REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

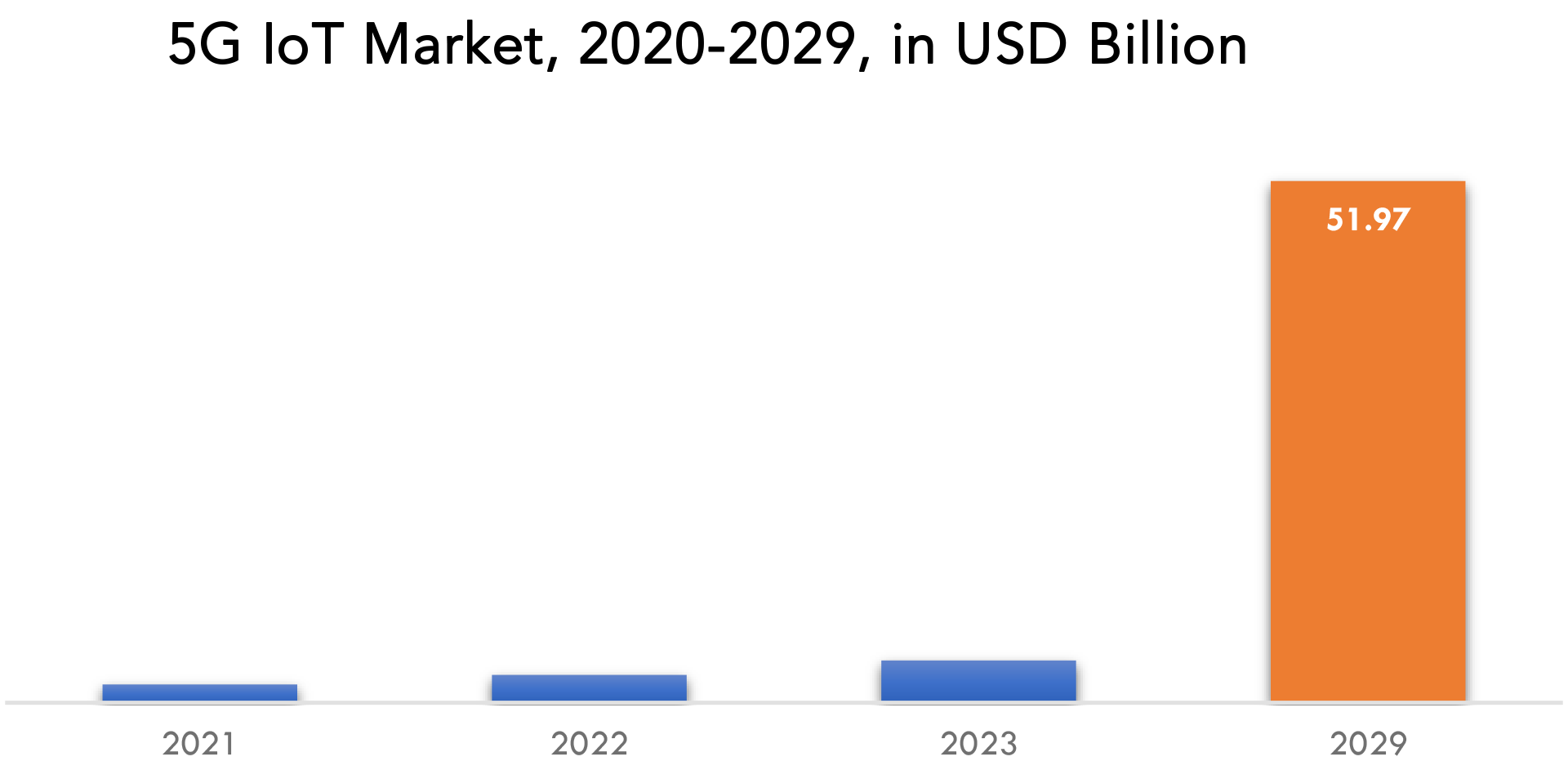

| USD 51.97 Billion by 2029 | 52% CAGR | North America |

| By Radio Technology | By Range | By Vertical |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

5G IOT Market Overview

The 5G IOT market is expected to grow at 52% CAGR from 2022 to 2029. It is expected to reach above USD 51.97 Billion by 2029 from USD 1.2 Billion in 2020.

Due to the requirement for a speedier network with more capacity that can meet connectivity needs, 5G is essential for the Internet of Things (IOT). The frequencies on which cellular technologies will carry data will increase thanks to the 5G spectrum. The fifth-generation (5G) cellular broadband technology standard. It is designed to increase wireless service speed, reduce latency, and increase flexibility. The theoretical maximum speed of 5G technology is 20 Gbps, compared to the maximum speed of 4G which is only 1 Gbps. Through automation enabled by machine learning, 5G also improves the digital experience. The software-defined platform of 5G architecture will be used to govern network functionality rather than hardware.

The growth of the 5G Technology Market is being driven by increasing demand for IOT linked devices, increased usage of mobile broadband, an increase in device-to-device communication, and quick innovation virtualization in the networking space. In order to create networks tailored to each individual consumer, 5G offers methods like network function virtualization and network slicing. Additionally, the market’s expansion may be hampered by high spectrum costs and the risk of cyberattacks. With the advent of 5G technology, the likelihood of cyberattacks is anticipated to rise. Attackers may take advantage of this security gap to increase security vulnerabilities as connected devices and machines proliferate, which could have a negative impact on the market’s ability to grow.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION) |

| Segmentation | By Radio Technology, By Range, By Vertical, Region |

| By Radio Technology |

|

| By Range |

|

| By Vertical |

|

| By Region |

|

Industry 4.0, for instance, completely relies on robotics and moving robots to raise the productivity of the plant. The 5g network can provide tailored infrastructure for IOT applications to boost industry efficiency. The adoption of 5g allows for the use of a network line with a high wireless data transfer that provides real-time information by connected devices. In addition, the market is seeing development prospects due to rising demand for high reliability and low latency networks, technical improvements, and 5G Technology in the logistic sector. For instance, the idea of communication between a vehicle and anything else has made it possible for connected cars and autonomous driving. One of the keys uses for telemedicine, where hospitals and healthcare professionals may instantly access real-time data, is increasing demand for 5g due to its low latency characteristics.

The primary driver propelling the expansion of the global market is the abrupt emergence of COVID-19. People all around the world are being harmed by COVID-19, which is causing a rise in demand for advanced and digitalized technologies with robust networks. All industry sectors have been asked by WHO to handle the effects of social isolation and manage consumer demand during the pandemic emergency. However, the international market is expanding exponentially and is anticipated to recover significantly in a post-pandemic world.

5G IOT Market Segment Analysis

The 5G IOT Market is segmented based on Radio Technology, Range, Vertical and Region, Global trends and forecast.

by Radio Technology (5G NR Standalone Architecture and 5G NR Non- Standalone Architecture), by Range (Short Range IOT Devices and Wide Range IOT Devices), by Vertical (Manufacturing, Energy & Utilities, Government, Healthcare, Transportation & Logistics, Mining) and Region

The global market is divided into 5G NR standalone architecture and 5G NR non-standalone architecture based on radio technology. Due to its cutting-edge features and extensive variety of functionalities, the stand-alone architecture sector is predicted to have the greatest market share globally in 2020. Additionally, it offers a number of built-in features like virtualization, ultra-low latency, network slicing, support for multiple Gbps, and control and user plane separation (CUPS)

The global market is divided into short-range and wide-range Internet of Things devices based on range. During the forecast period compared to the study period, it is anticipated that the short-range IOT device category will see the greatest CAGR. Due to the emergence of new application industries including healthcare, energy, and manufacturing, among others, short-range IOT devices require various sorts of connectivity solutions.

The market is divided into segments based on end user, including manufacturing, healthcare, energy and utilities, automotive and transportation, supply chain and logistics, government and public safety, agriculture, and others. The Manufacturing sector dominates the market. Manufacturers are embracing digitalization as a way to reduce costs and boost ROI, and 5G IOT guarantees new process efficiencies and cutting-edge technological breakthroughs, increasing profitability and shop floor efficiency.

5G IOT Market Players

Telefonica, SK Telecom, Deutsche Telekom, Ericsson, China Mobile, AT&T, Verizon, T-Mobile, Vodafone, and Orange S.A. are the key market participants. Key development strategies, market share analysis, and market positioning analysis of the aforementioned competitors internationally are also included in the competitive landscape section.

Recent Developments

- February 8, 2023 SK Telecom ends 2022 with 13.4 million 5G subscribers

SK Telecom, South Korea’s largest telecom operator, ended the fourth quarter of the year with a total of 13.4 million subscribers in the 5G segment, up from 12.5 million in the previous quarter, the carrier said in its earnings statement.

During last year, SK Telecom recorded a net addition of 3.5 million 5G customers.

- 25/02/2023 Telefónica to connect IOT devices via satellite with 5G technology

- The company, through its Telefónica Tech and Telefónica Global Solutions (TGS) divisions, is testing SatelIOT’s solution to develop an innovative dual 5G NB-IOT connectivity service that integrates the satellite network with existing terrestrial networks to provide IOT connectivity wherever the customer needs it.

- The new service would extend the coverage of current terrestrial NB-IOT networks to remote areas providing connectivity over 100% of the territory and would be compatible with current NB-IOT devices available on the market.

- The first pre-commercial customer pilots are planned for the end of the year.

- In January 2021, AT&T launched its 5G+ services in certain popular areas and venues across Tampa, such as Raymond James Stadium, Channel District, and Tampa International Airport in the US

- In November 2021, CMIOT is a subsidiary of China Mobile Communications Group, introduced IOT OS called OneOS that supports 5G network standards. It has features such as low energy consumption, cross-platform, scalable, and high safety.

- In February 2021, Verizon partnered with Zyter, one of the leading digital health and IOT-enablement platform providers, to aid sports and entertainment venues with 5G experiences.

- In November 2020, Ericsson finished the acquisition of Cradlepoint, one of the prime vendors in WLAN, edge, and IOT solutions. Cradlepoint helps businesses to connect mobile sites, workforce, edge devices, vehicles, and IOT devices.

Who Should Buy? Or Key stakeholders

- Service Provider

- Research and development

- IT and telecommunication companies

- Healthcare sector

- Manufacture

- Networking Companies

- Investors

5G IOT Market Regional Analysis

The 5G IOT Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

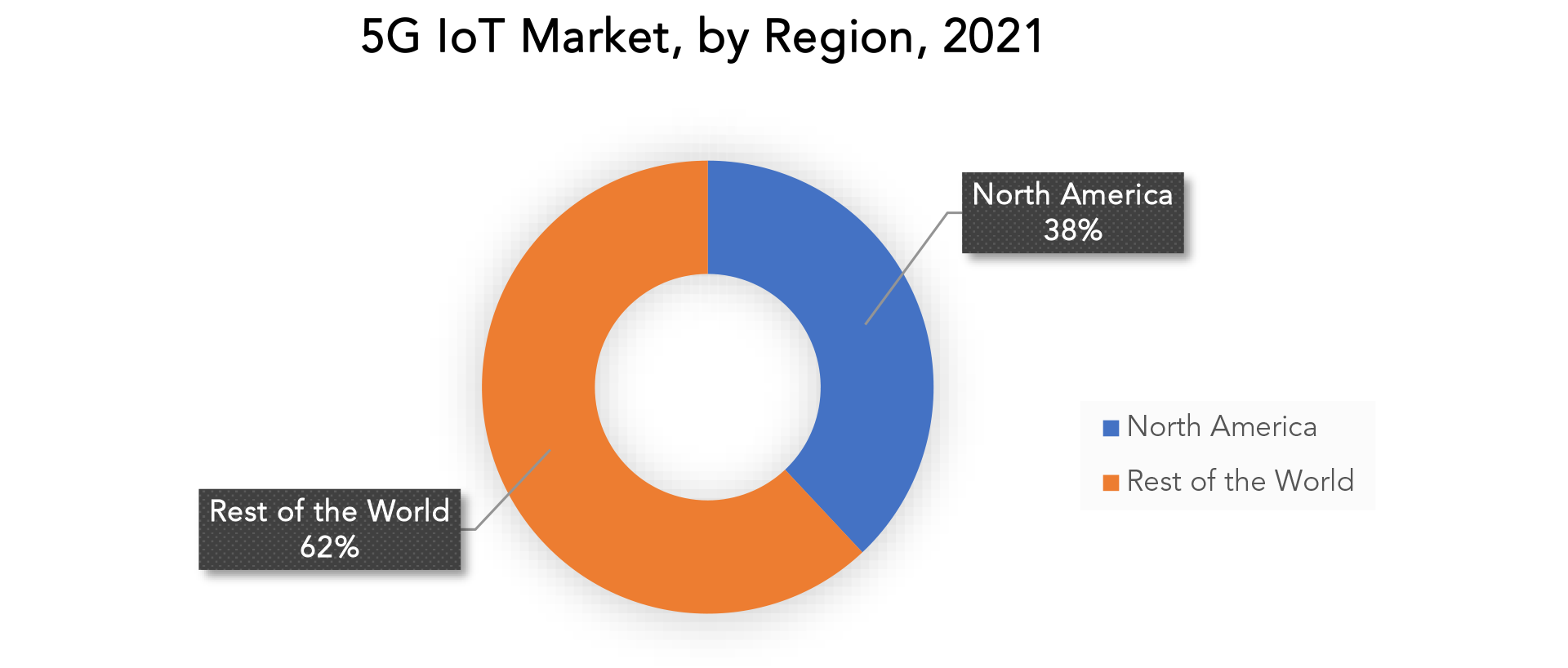

Geographically speaking, North America dominated the global market. The increase in linked devices, wireless connection, and IOT-enabled device use in the area has outpaced demand for this new technology. Additionally, wealthy nations like the United States and Canada have numerous significant digital service providers. Furthermore, over the course of the forecast, the 5G IOT market is anticipated to expand significantly in Asia Pacific. because more people are adopting digitalized offerings, more people are aware of emerging technology, and more people in the region are using smartphones. In addition, economies like those of India, China, and Japan are expected to propel regional growth due to the region’s immense diversity and sizeable population. The growing number of internet users, numerous government initiatives, and linked devices are some of the other key variables influencing the local industry.

Key Market Segments: 5G IOT Market

5g IOT Market by Radio Technology, 2020-2029, (USD Billion)

- 5g NR Standalone Architecture

- 5g NR Non-Standalone Architecture

5g IOT Market by Range, 2020-2029, (USD Billion)

- Short Range IOT Devices

- Wide Range IOT Devices

5g IOT Market by Vertical, 2020-2029, (USD Billion)

- Manufacturing

- Energy And Utilities

- Government

- Healthcare

- Transportation and Logistics

- Mining

5g IOT Market by Region, 2020-2029, (USD Billion),

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the 5G IOT market over the next 7 years?

- Who are the major players in the 5G IOT market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the 5G IOT market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 5G IOT market?

- What is the current and forecasted size and growth rate of the global 5G IOT market?

- What are the key drivers of growth in the 5G IOT market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the 5G IOT market?

- What are the technological advancements and innovations in the 5G IOT market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the 5G IOT market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the 5G IOT market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL 5G IOT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON 5G IOT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL 5G IOT MARKET OUTLOOK

- GLOBAL 5G IOT MARKET BY RADIO TECHNOLOGY, 2020-2029, (USD BILLION)

- 5G NR STANDALONE ARCHITECTURE

- 5G NR NON-STANDALONE ARCHITECTURE

- GLOBAL 5G IOT MARKET BY RANGE, 2020-2029, (USD BILLION)

- SHORT RANGE IOT DEVICES

- WIDE RANGE IOT DEVICES

- GLOBAL 5G IOT MARKET BY VERTICAL, 2020-2029, (USD BILLION)

- MANUFACTURING

- ENERGY AND UTILITIES

- GOVERNMENT

- HEALTHCARE

- TRANSPORTATION AND LOGISTICS

- MINING

- GLOBAL 5G IOT MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, RANGES OFFERED, RECENT DEVELOPMENTS)

- TELEFONICA

- SK TELECOM

- DEUTSCHE TELEKOM

- ERICSSON

- CHINA MOBILE

- AT&T

- VERIZON

- T-MOBILE

- VODAFONE

- ORANGE S.A. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 2 GLOBAL 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 3 GLOBAL 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 4 GLOBAL 5G IOT MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA 5G IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 9 US 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 10 US 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 11 US 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 12 CANADA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 13 CANADA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 14 CANADA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 15 MEXICO 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 16 MEXICO 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 17 MEXICO 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA 5G IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 22 BRAZIL 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 23 BRAZIL 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 24 BRAZIL 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 25 ARGENTINA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 26 ARGENTINA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 27 ARGENTINA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 28 COLOMBIA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 29 COLOMBIA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 30 COLOMBIA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 34 ASIA-PACIFIC 5G IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 35 ASIA-PACIFIC 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 36 ASIA-PACIFIC 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 37 ASIA-PACIFIC 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 38 INDIA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 39 INDIA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 40 INDIA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 41 CHINA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 42 CHINA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 43 CHINA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 44 JAPAN 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 45 JAPAN 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 46 JAPAN 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 53 SOUTH-EAST ASIA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 54 SOUTH-EAST ASIA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 55 SOUTH-EAST ASIA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 59 EUROPE 5G IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 60 ASIA-PACIFIC 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 61 ASIA-PACIFIC 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 62 ASIA-PACIFIC 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 63 GERMANY 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 64 GERMANY 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 65 GERMANY 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 66 UK 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 67 UK 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 68 UK 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 69 FRANCE 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 70 FRANCE 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 71 FRANCE 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 72 ITALY 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 73 ITALY 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 74 ITALY 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 75 SPAIN 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 76 SPAIN 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 77 SPAIN 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 78 RUSSIA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 79 RUSSIA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 80 RUSSIA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA 5G IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 88 UAE 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 89 UAE 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 90 UAE 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA 5G IOT MARKET BY RADIO TECHNOLOGY (USD BILLION) 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA 5G IOT MARKET BY RANGE (USD BILLION) 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA 5G IOT MARKET BY VERTICAL (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL 5G IOT MARKET BY RADIO TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL 5G IOT MARKET BY RANGE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL 5G IOT MARKET BY VERTICAL, USD BILLION, 2020-2029

FIGURE 11 GLOBAL 5G IOT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL 5G IOT MARKET BY RADIO TECHNOLOGY, USD BILLION, 2021

FIGURE 14 GLOBAL 5G IOT MARKET BY RANGE, USD BILLION, 2021

FIGURE 15 GLOBAL 5G IOT MARKET BY VERTICAL, USD BILLION, 2021

FIGURE 16 GLOBAL 5G IOT MARKET BY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TELEFONICA: COMPANY SNAPSHOT

FIGURE 19 SK TELECOM: COMPANY SNAPSHOT

FIGURE 20 DEUTSCHE TELEKOM: COMPANY SNAPSHOT

FIGURE 21 ERICSSON: COMPANY SNAPSHOT

FIGURE 22 CHINA MOBILE: COMPANY SNAPSHOT

FIGURE 23 AT&T: COMPANY SNAPSHOT

FIGURE 24 VERIZON: COMPANY SNAPSHOT

FIGURE 25 T-MOBILE: COMPANY SNAPSHOT

FIGURE 26 VODAFONE: COMPANY SNAPSHOT

FIGURE 27 ORANGE S.A.: COMPANY SNAPSHOT

FAQ

The 5G IOT Market is expected to grow at 52% CAGR from 2022 to 2029. It is expected to reach above USD 51.97 Billion by 2029 from USD 1.2 Billion in 2020.

North America held more than 38% of the 5G IOT Market revenue share in 2021 and will witness expansion in the forecast period.

Growing technical developments, rising need for 5G Technology, and rising demand for high dependability and low latency networks are creating growth prospects in the market. One of the keys uses for telemedicine, where hospitals and healthcare professionals may instantly access real-time data, is increasing demand for 5g due to its low latency characteristics.

North America dominated the global market. The increase in linked devices, wireless connection, and IOT-enabled device use in the area has outpaced demand for this new technology. Additionally, wealthy nations like the United States and Canada have numerous significant digital service providers.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.