Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

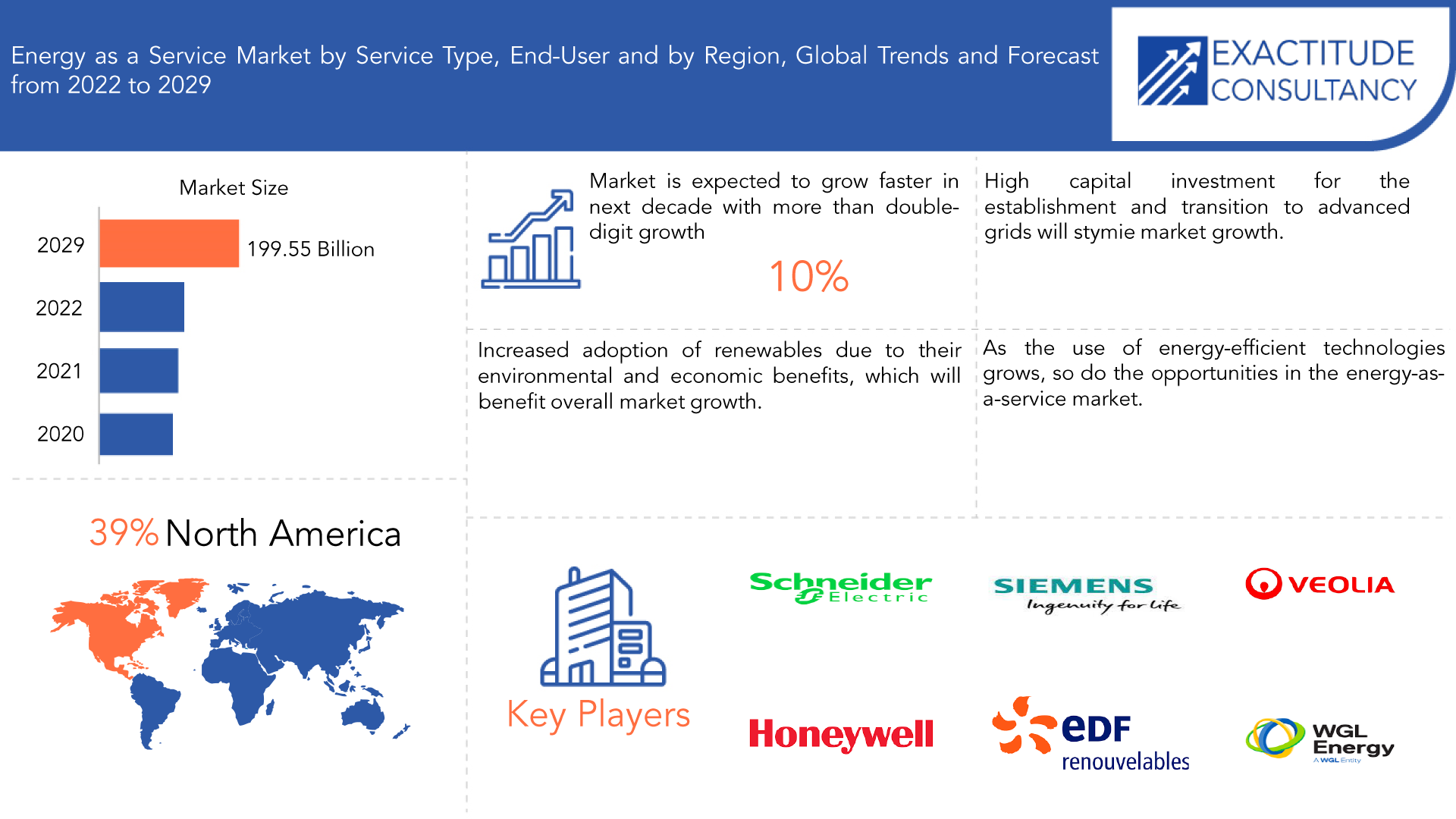

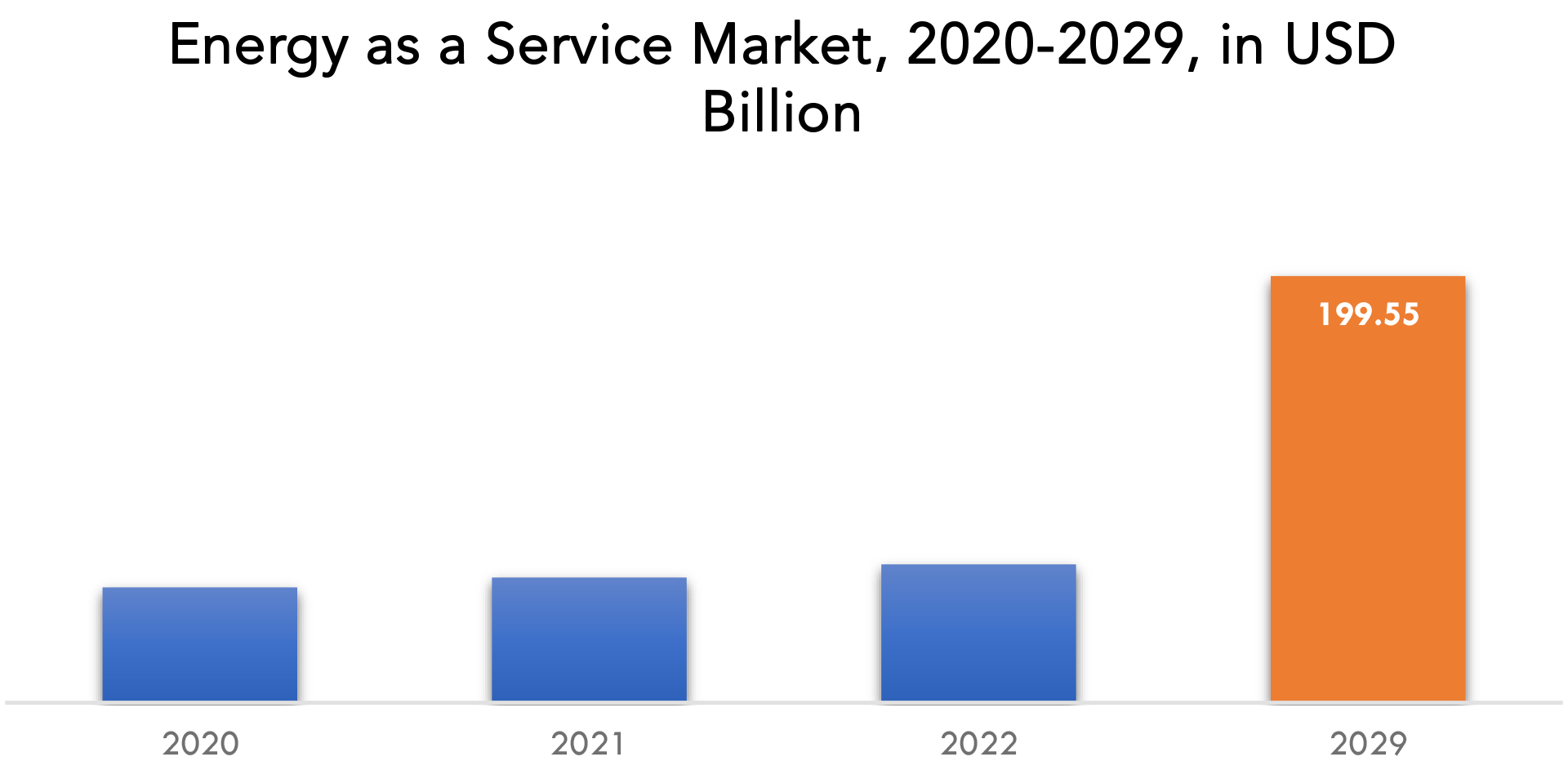

| USD 199.55 billion by 2029 | 10 % | North America |

| By Service Type | By End-User | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Energy As A Service Market Overview

The global energy as a service market is expected to grow at a 10 % CAGR from 2020 to 2029. It is expected to reach above USD 199.55 billion by 2029 from USD 53.4 billion in 2020.

Energy as a service is a rapidly expanding and newly developed model that offers a wide range of energy-related services and energy-optimization solutions to small, medium, and large businesses. It also raises awareness about better management and the increased use of distributed generation sources. Energy as a service is used in various service types, and the market study provides a detailed overview of these segments. The EAAS market provides detailed information on the commercial and industrial end-use segments.

Commercial and industrial building sector consumers are heavily investing in energy efficiency and energy procurement from more sustainable sources to reduce their total energy footprint. The increasing adoption of these services has been driven primarily by the desire to reduce energy costs and carbon emissions to maintain ecological balance. Customers can now finance energy-efficient building technologies and measures thanks to new business models. Pay-for-performance contracts, energy savings performance contracts, power purchase agreements, and on-bill financing are examples of these.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Service Type, By End-user, and By Region |

| By Service Type |

|

| By End-User |

|

| By Region |

|

Energy as a Service (EaaS) refers to the sale of technology, energy, analytics, grid access, and customized services. The issue of carbon emissions is a serious threat to the environment. The growing use of renewable energy sources has resulted in decentralized energy distribution. Rapid industrialization in developing countries raises energy demand and contributes to the global depletion of fossil fuels. The growing need to reduce reliance on fossil fuels and reduce carbon emissions from their combustion has increased demand for renewable energy sources, which is expected to drive the EaaS market’s progress over the analyzed timeframe.

Due to the prolonged lockdown in major countries such as the United States, China, Japan, India, and Germany, the outbreak of the COVID-19 pandemic has resulted in the partial or complete shutdown of production facilities that do not fall under essential goods. During the lockdown, electricity demand fell to lower levels, with dramatic drops in the services and IT industries partially offset by an increased residential use. In most countries, except India, electricity demand fell by 10% and 5% in June and July, respectively, from the same month in 2019.

EaaS projects provide both energy efficiency and long-term cost savings. However, high initial capital investments have caused many companies to reduce such investments. Companies are already struggling to keep up with fixed costs and survive the impact of COVID-19, so any commitment to such massive capital investment is either postponed, canceled, or delayed. As a result, the impact on the EaaS market is significant.

Energy as a Service Market Segment Analysis

The global energy as a service market is segmented based on service type, and end-user. Based on service type, Energy optimization and efficiency services, operational and maintenance services, and energy supply services comprise the market. With a 58.55% market share in 2021, the energy supply service segment will dominate the market. The segment’s expansion is attributed to the rising population, which results in an increase in the number of customers in each region. Energy optimization and efficiency-as-a-service is a pay-for-performance, off-balance-sheet financing solution that enables customers to implement energy and water efficiency projects with no initial capital outlay. Implementing these services is cost-effective in the long run because the customer pays for services based on actual energy savings or other equipment performance metrics, resulting in immediate lower operating expenses. These factors are expected to fuel the segment’s expansion.

Based on end-user, The global energy as a service market is divided into two segments: industrial and commercial. With a large number of commercial spaces available and high electricity consumption in 2021, the commercial segment is expected to dominate the market during the forecast period. Services provided by an EaaS company to conserve energy or electricity for multiple uses are included in the commercial sector. EaaS providers provide a variety of technical and software solutions that help the company understand the pattern of electricity consumption. The industrial sector accounts for a sizable portion of the global market. The industrial sector includes manufacturing plants and production plants that require a constant electricity supply and cannot afford interruptions in energy storage and supply. It impedes their production lines, causing business disruption. As a result, such factors are expected to propel market growth in this sector.

Energy as a Service Market Key Players

The energy as a service market key players includes Schneider Electric, Siemens, Veolia, Honeywell, Enel X, EDF Renewables, General Electric Company, ENGIE, WGL Energy, Edison Energy, Smart Watt, Inc,

These key leaders are implementing strategic formulations for corporate expansion, such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, fueling revenue generation.

Industry Development

February 8, 2023: Schneider Electric announced that it has been onboarded as the official Sustainability Partner for ELECRAMA 2023, the flagship exhibition of the Indian Electrical and Electronics Manufacturers Association (IEEMA) and the largest congregation of power sector ecosystem in the country. As part of this association, Schneider Electric reinforces its commitment towards a More Electric and More Digital world, which will be the key enabler to a sustainable and resilient future.

September 22, 2022: Veolia announced the unprecedented plan to make its water and waste services in France energy self-sufficient within five years, with 2 TWh (terawatt-hours) of locally produced energy to cover the equivalent of its entire current consumption. This is equivalent to the consumption of 430,000 French households. This energy will be 100% local and 100% renewable.

Who Should Buy? Or Key stakeholders

- Energy as a Service Supplier

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Energy as a Service Market Regional Analysis

The Energy as a Service market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

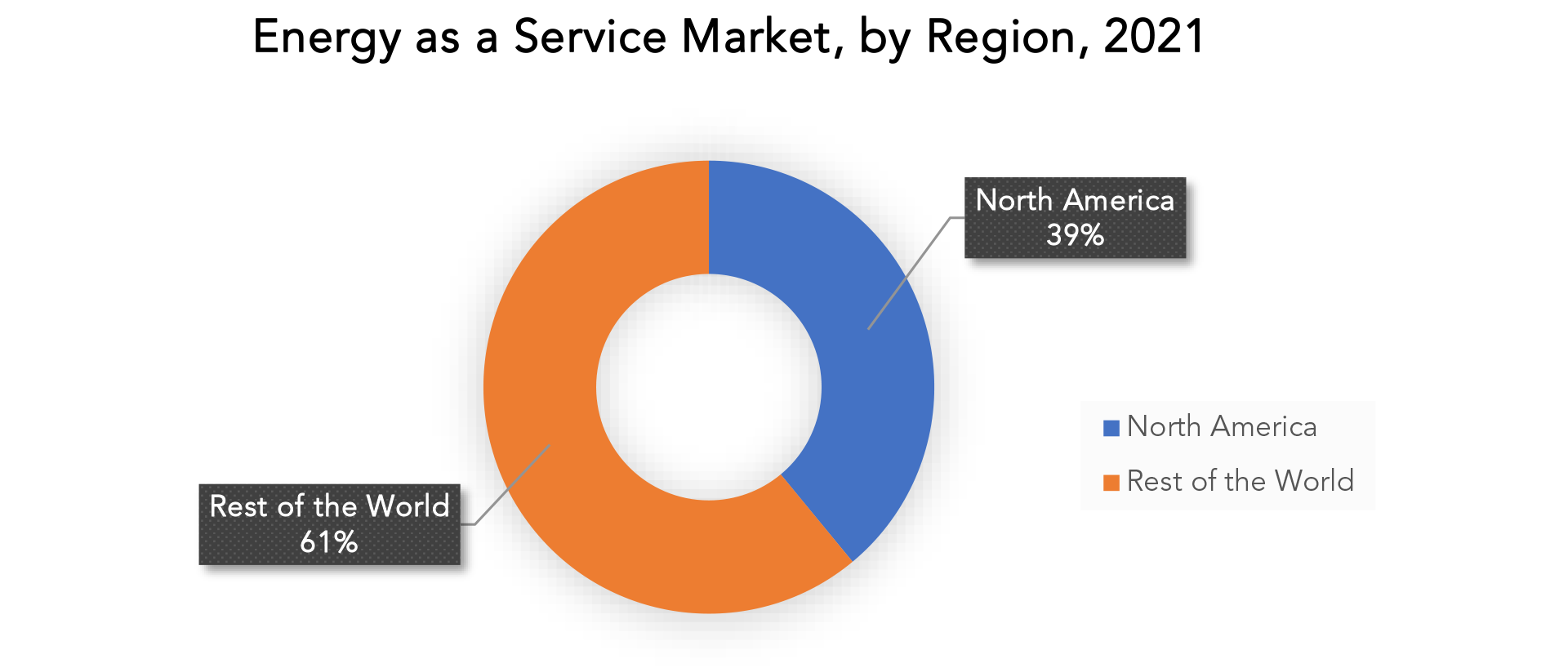

The market has been divided into four major regions: Europe, Asia Pacific, North America, and the Rest of the World. During the forecast period, North America is expected to dominate the energy as a service market share, with the United States accounting for the majority of demand. The country is well-known for having implemented EaaS in a variety of sectors. The region has implemented several projects, particularly in the commercial sector, that are expected to improve energy storage efficiency and reduce operating costs. Furthermore, the region has seen significant investment in the refining, production, and exploration sectors, which is expected to increase demand for energy as a service model in the coming years.

Furthermore, encouraging government and organizational policy frameworks to deploy green energy solutions and significant installation of power generation technologies in various areas benefits Europe’s market. Currently, Germany, the United Kingdom, and Italy, among others, are the key countries contributing significantly to the region’s EaaS market. Furthermore, increased investments and plans to expand and fortify grid infrastructure networks to support the growing renewable energy installation are expected to propel the industry even further.

Key Market Segments: Energy As A Service Market

Energy As A Service Market By Service Type, 2020-2029, (USD Billion)

- Energy Supply Service

- Operational & Maintenance Service

- Energy Optimization & Efficiency Service

Energy As A Service Market By End-User, 2020-2029, (USD Billion)

- Commercial

- Industrial

Energy As A Service Market By Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the carbon nanotubes market over the next 7 years?

- Who are the major players in the carbon nanotubes market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the carbon nanotubes market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the carbon nanotubes market?

- What is the current and forecasted size and growth rate of the global carbon nanotubes market?

- What are the key drivers of growth in the carbon nanotubes market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the carbon nanotubes market?

- What are the technological advancements and innovations in the carbon nanotubes market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the carbon nanotubes market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the carbon nanotubes market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of carbon nanotubes market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ENERGY AS A SERVICE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ENERGY AS A SERVICE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ENERGY AS A SERVICE MARKET OUTLOOK

- GLOBAL ENERGY AS A SERVICE MARKET BY SERVICE TYPE, 2020-2029, (USD BILLION)

- ENERGY SUPPLY SERVICE

- OPERATIONAL & MAINTENANCE SERVICE

- ENERGY OPTIMIZATION & EFFICIENCY SERVICE

- GLOBAL ENERGY AS A SERVICE MARKET BY END-USER, 2020-2029, (USD BILLION)

- COMMERCIAL

- INDUSTRIAL

- GLOBAL ENERGY AS A SERVICE MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SCHNEIDER ELECTRIC

- SIEMENS

- VEOLIA

- HONEYWELL

- ENEL X

- EDF RENEWABLES

- GENERAL ELECTRIC COMPANY

- ENGIE

- WGL ENERGY

- SMART WATT, INC

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 3 GLOBAL ENERGY AS A SERVICE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 4 NORTH AMERICA ENERGY AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 7 US ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 8 US ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 9 CANADA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 10 CANADA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 11 MEXICO ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 12 MEXICO ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 13 SOUTH AMERICA ENERGY AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 14 SOUTH AMERICA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 15 SOUTH AMERICA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 16 BRAZIL ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 17 BRAZIL ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 18 ARGENTINA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 19 ARGENTINA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 20 COLOMBIA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 21 COLOMBIA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 22 REST OF SOUTH AMERICA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 23 REST OF SOUTH AMERICA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 24 ASIA-PACIFIC ENERGY AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 25 ASIA-PACIFIC ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 26 ASIA-PACIFIC ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 27 INDIA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 28 INDIA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 29 CHINA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 30 CHINA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 31 JAPAN ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 32 JAPAN ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 33 SOUTH KOREA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 34 SOUTH KOREA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 35 AUSTRALIA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 36 AUSTRALIA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 37 SOUTH-EAST ASIA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH-EAST ASIA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 39 REST OF ASIA PACIFIC ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 40 REST OF ASIA PACIFIC ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 41 EUROPE ENERGY AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 42 ASIA-PACIFIC ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 43 ASIA-PACIFIC ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 44 GERMANY ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 45 GERMANY ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 46 UK ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 47 UK ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 48 FRANCE ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 49 FRANCE ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 50 ITALY ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 51 ITALY ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 52 SPAIN ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 53 SPAIN ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 54 RUSSIA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 55 RUSSIA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 56 REST OF EUROPE ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 57 REST OF EUROPE ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 58 MIDDLE EAST AND AFRICA ENERGY AS A SERVICE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 59 MIDDLE EAST AND AFRICA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 60 MIDDLE EAST AND AFRICA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 61 UAE ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 62 UAE ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 63 SAUDI ARABIA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 64 SAUDI ARABIA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 65 SOUTH AFRICA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 66 SOUTH AFRICA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 67 REST OF MIDDLE EAST AND AFRICA ENERGY AS A SERVICE MARKET BY SERVICE TYPE (USD BILLION) 2020-2029

TABLE 68 REST OF MIDDLE EAST AND AFRICA ENERGY AS A SERVICE MARKET BY END-USER (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ENERGY AS A SERVICE MARKET BY SERVICE TYPE, USD (BILLION), 2020-2029

FIGURE 9 GLOBAL ENERGY AS A SERVICE MARKET BY END-USER, USD (BILLION), 2020-2029

FIGURE 10 GLOBAL ENERGY AS A SERVICE MARKET BY REGION, USD (BILLION), 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ENERGY AS A SERVICE MARKET BY SERVICE TYPE, USD (BILLION), 2021

FIGURE 13 GLOBAL ENERGY AS A SERVICE MARKET BY END-USER, USD (BILLION), 2020-2021

FIGURE 14 GLOBAL ENERGY AS A SERVICE MARKET BY REGION, USD (BILLION), 2021

FIGURE 15 NORTH AMERICA ENERGY AS A SERVICE MARKET SNAPSHOT

FIGURE 16 EUROPE ENERGY AS A SERVICE MARKET SNAPSHOT

FIGURE 17 SOUTH AMERICA ENERGY AS A SERVICE MARKET SNAPSHOT

FIGURE 18 ASIA PACIFIC ENERGY AS A SERVICE MARKET SNAPSHOT

FIGURE 19 MIDDLE EAST ASIA AND AFRICA ENERGY AS A SERVICE MARKET SNAPSHOT

FIGURE 20 MARKET SHARE ANALYSIS

FIGURE 21 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

FIGURE 22 SIEMENS: COMPANY SNAPSHOT

FIGURE 23 VEOLIA: COMPANY SNAPSHOT

FIGURE 24 ENEL X.: COMPANY SNAPSHOT

FIGURE 25 EDF RENEWABLES: COMPANY SNAPSHOT

FIGURE 26 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 27 ENGINE: COMPANY SNAPSHOT

FIGURE 28 WGL ENERGY: COMPANY SNAPSHOT

FIGURE 29 EDISON ENERGY: COMPANY SNAPSHOT

FIGURE 30 SMART WATT, INC: COMPANY SNAPSHOT

FAQ

The global energy as a service market is expected to grow at a 10 % CAGR from 2020 to 2029. It is expected to reach above USD 199.55 billion by 2029 from USD 53.4 billion in 2020.

Increasing renewables adoption due to their environmental and economic benefits, rising energy demand in various end-user sectors, and rising peak energy demand, combined with a favorable policy framework, are some of the major factors driving the market growth.

Energy as a service is used in various service types, and the market study provides a detailed overview of these segments. The EAAS market provides detailed information on the commercial and industrial end-use segments.

The region’s largest share is in North America. North America is expected to dominate the energy as a service market share, with the United States accounting for the majority of demand. The country is well-known for having implemented EaaS in a variety of sectors.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.