REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.76 billion by 2029 | 6.53% | North America |

| by Type | by Technique | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Chromatography Resin Market Overview

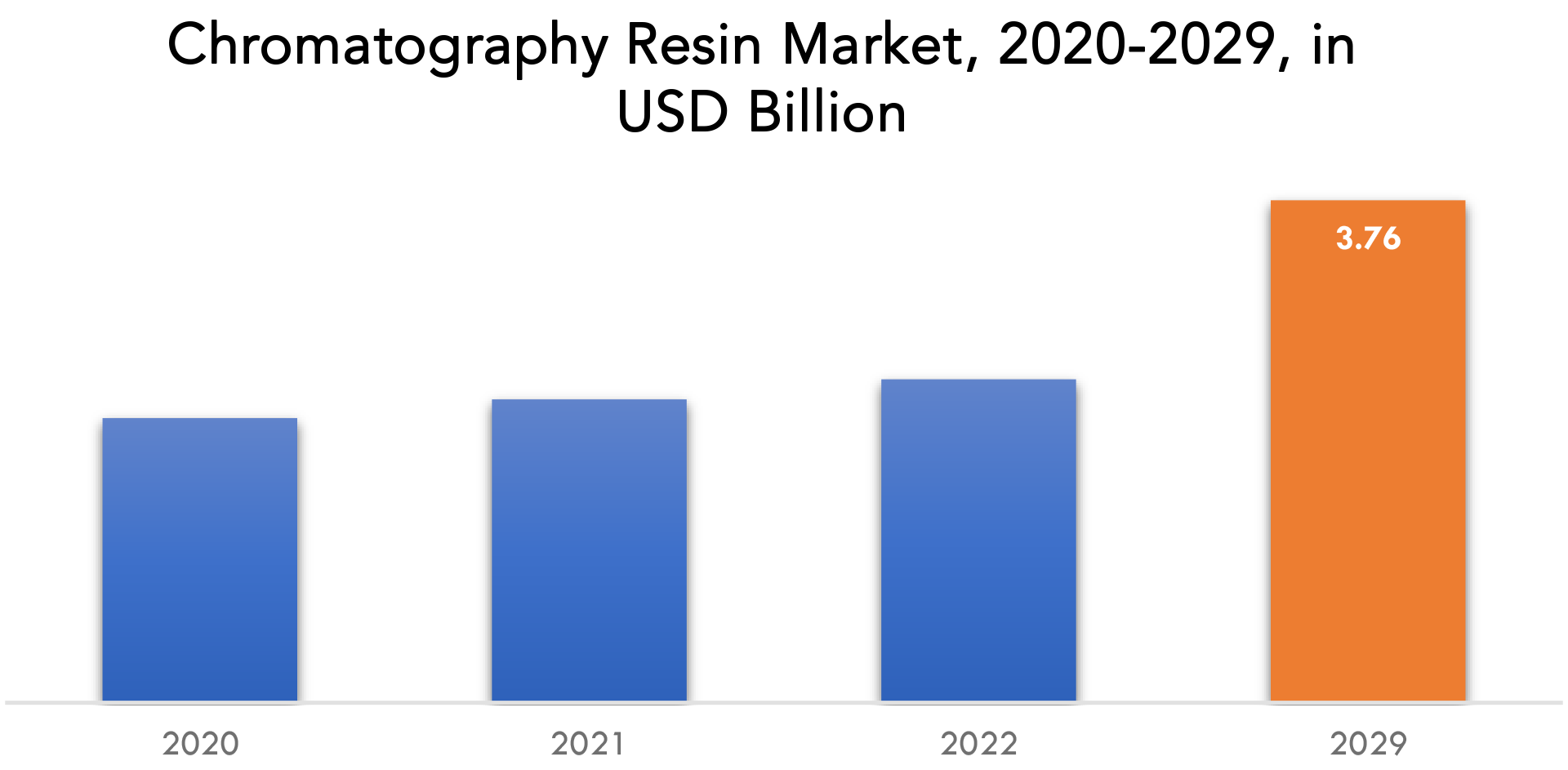

The global chromatography resin market size was valued at USD 2.13 billion in 2020, and projected to reach USD 3.76 billion by 2029, with a CAGR of 6.53% from 2022 to 2029.

Chromatography is a method of isolating substances based on their color. Resins are essential in the separation process. They are widely used for separating and purifying the desired substrate from a mixture, such as proteins. Water sample analysis in various industries is one of the major industrial applications of chromatography in which resins play an important role.

Pharmaceutical and biotechnology industries extensively use chromatography resins (in chromatography) for a spectrum of uses, including the production of high purity drugs, reviewing and analyzing trace contaminants, and detecting molecular matter such as vitamins, proteins, fats, and others. To maintain the high quality of products competent to the standards prescribed by the relevant authorities, the choice of chromatographic resins is of high importance to ensure accurate results. Thus, the expansion of the pharmaceutical and biotechnology industries is expected to generate healthy growth opportunities over the forecast period. Given the growing number of critical diseases, there has been an increase in demand for monoclonal antibodies around the world in recent years. These healthcare issues have resulted in increased sales of monoclonal antibodies, which has increased the industry’s demand for chromatography resins.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Type, By Technique, By Application, By Region. |

| By Type |

|

| By Technique |

|

| By Application |

|

| By Region |

|

The growing demand for chromatography in drug development and omics research represents a fantastic opportunity for the market. Chromatography is the most adaptable separation technique and is widely available. Many closely related compounds are synthesized and must be separated during the early stages of drug discovery. Their identification and purity testing are extremely important. Chromatography techniques are commonly used for these applications. Chromatography instruments are used to separate, purify, and analyze raw materials, Active Pharmaceutical Ingredients (APIs), and excipients. Thus, rising demand for high-quality drugs and the implementation of stringent government initiatives are heading up demand for chromatography resin in a number of countries.

Strict regulatory standards for new products such as chromatography resins and columns for analysis and diagnostic purposes are likely to stymie market growth.

The high cost of the adoption and use of chromatography resin technologies is another factor hampering the market growth. Higher selling prices and the repeated use of chromatography to reduce manufacturing costs are affecting quality, stifling growth. Furthermore, many manufacturing companies prefer to use smaller protein A columns rather than larger protein A columns to reduce manufacturing costs by repeating cycles for a single batch of monoclonal antibodies. This is expected to have a negative impact on demand.

Some of the prominent techniques available as alternatives to chromatography include precipitation, high-resolution ultrafiltration, crystallization, high-pressure refolding, charged ultra-filtration membranes, protein crystallization, capillary electrophoresis, aqueous two-phase extraction, three-phase partitioning, monoliths, and membrane chromatography. Alternative techniques’ advantages are likely to put a damper on the growth of the chromatography resin market.

Chromatography Resin Market Segment Analysis

The market is divided into techniques: ion exchange, affinity, hydrophobic interaction, size exclusion, and others. In 2021, the ion exchange segment is expected to account for a larger market share. Rising demand for high purity products in a variety of end-use industries, including food and beverage and water treatment, is expected to drive segment growth during the forecast period. The affinity chromatography segment is also expected to grow significantly due to increased demand from the pharmaceutical industry.

During the forecast period, natural polymers are expected to lead the global chromatography resin market. Natural polymers such as agarose, dextran, and others were classified. Its availability at a lower cost was the primary driver of its expansion. As a result, the product was most likely used in the end-use industries for size exclusion and paper chromatography.

The chromatography resin market is segmented by application into Food & Beverage, Academic & Research, Pharmaceutical & Biotechnology, and Others. In food analysis, chromatography resin is an important analytical technique. It is primarily used for three purposes: determining food nutritional quality, detecting spoilage, and detecting food additives. Rapid advances in science and technology, rising healthcare costs, increased demand for natural food products, changing lifestyles and eating preferences, and increased awareness about health and wellness through diets are the major factors driving demand for beverages and dairy products, as well as natural ingredients such as food colors and flavors, flavonoids, and carotenoids. All of these factors contribute to an increase in chromatography resin demand in food and beverage applications.

Chromatography Resin Market Players

The global market is fragmented in nature with the presence of various key players such Bio-Rad Laboratories Inc., Tosoh Corporation, Mitsubishi Chemical Corporation, Purolite Corporation, Repligen Corporation, Kaneka Corporation, Sartorius AG, JSR Life Sciences, Thermo Fisher Scientific Inc, Avantor Performance Materials, Generon, Life Technologies Corporation along with medium and small-scale regional players operating in different parts of the world. Major companies in the market compete in terms of application development capability, product launches, and development of new technologies for product formulation.

Recent Developments

February 8, 2023 – RWE, LOTTE CHEMICAL Corporation (LOTTE), and Mitsubishi Corporation (MC) formed a strategic alliance to develop stable and large-scale clean ammonia supply chains in Asia, Europe, and the United States.

In March 2021, Purolite announced the availability of its Praesto Protein A and Ion Exchange chromatography resins in South Korea and Singapore. Purolite will distribute these items through an expanded strategic partnership with PharmNXT Biotech, a provider of solutions for the Pharmaceutical and Life Sciences industries.

Who Should Buy? Or Key stakeholders

- Chromatography resin Manufacturers, Distributors, and Suppliers

- End-use Markets such as Pharmaceutical & Biotechnology, Food & Beverage, and Water & Environmental Analysis

- Government and Research Organizations

- Raw Material and Equipment Suppliers

- Associations and Industry Bodies, etc.

Chromatography Resin Market Regional Analysis

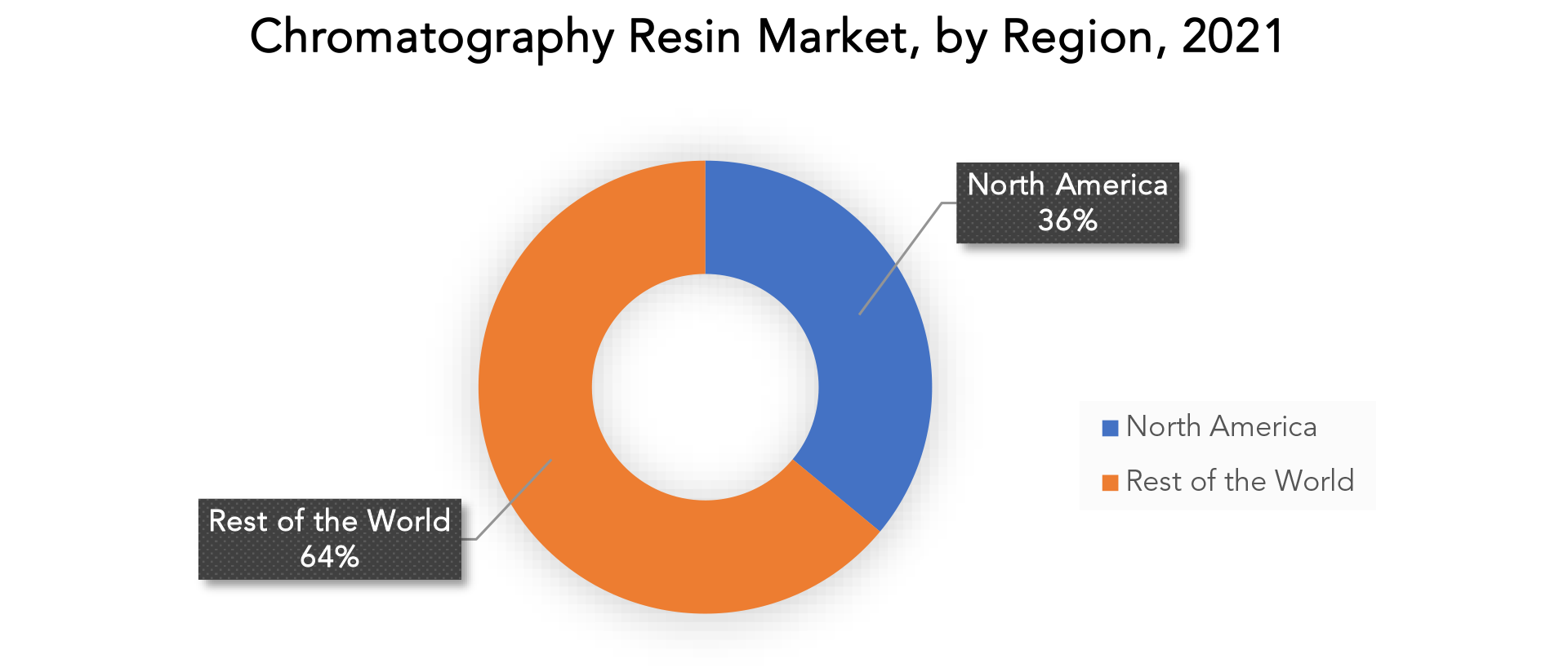

Geographically, the chromatography resin market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

In 2022, the US Chromatography Resin market is expected to be worth USD 573.9 million. China, the world’s second largest economy, is expected to reach a projected market size of USD 677.4 million by 2029 growing at an 8.6% CAGR from 2022 to 2029. Other notable geographic markets include Japan and Canada, which are expected to grow at 1.8% and 5.5%, respectively, between 2022 and 2029. Germany is expected to grow at a CAGR of around 2.9% in Europe.

Key Market Segments: Chromatography Resin Market

Chromatography Resin Market by Type, 2020-2029, (USD Billion) (Kilotons)

- Natural Polymer

- Inorganic Media

- Synthetic Polymer

Chromatography Resin Market by Technique, 2020-2029, (USD Billion) (Kilotons)

- Ion Exchange

- Affinity

- Hydrophobic Interaction

- Size Exclusion

- Others

Chromatography Resin Market by Application, 2020-2029, (USD Billion) (Kilotons)

- Food & Beverage

- Academic & Research

- Pharmaceutical & Biotechnology

- Others

Chromatography Resin Market by Regions, 2020-2029, (USD Billion) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the chromatography resin market over the next 7 years?

- Who are the major players in the chromatography resin market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the chromatography resin market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the chromatography resin market?

- What is the current and forecasted size and growth rate of the global chromatography resin market?

- What are the key drivers of growth in the chromatography resin market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the chromatography resin market?

- What are the technological advancements and innovations in the chromatography resin market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the chromatography resin market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the chromatography resin market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of chromatography resin in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- CHROMATOGRAPHY RESIN MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CHROMATOGRAPHY RESIN MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- CHROMATOGRAPHY RESIN MARKET OUTLOOK

- GLOBAL CHROMATOGRAPHY RESIN MARKET BY TYPE, 2020-2029, (USD BILLION) (KILOTONS)

- NATURAL POLYMER

- INORGANIC MEDIA

- SYNTHETIC POLYMER

- GLOBAL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE, 2020-2029, (USD BILLION) (KILOTONS)

- ION EXCHANGE

- AFFINITY

- HYDROPHOBIC INTERACTION

- SIZE EXCLUSION

- OTHERS

- GLOBAL CHROMATOGRAPHY RESIN MARKET BY APPLICATION, 2020-2029, (USD BILLION) (KILOTONS)

- FOOD & BEVERAGE

- ACADEMIC & RESEARCH

- PHARMACEUTICAL & BIOTECHNOLOGY

- OTHERS

- GLOBAL CHROMATOGRAPHY RESIN MARKET BY REGION, 2020-2029, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

9. COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BIO-RAD LABORATORIES INC.

- TOSOH CORPORATION

- MITSUBISHI CHEMICAL CORPORATION

- PUROLITE CORPORATION

- REPLIGEN CORPORATION

- KANEKA CORPORATION

- SARTORIUS AG

- JSR LIFE SCIENCES

- THERMO FISHER SCIENTIFIC INC

- AVANTOR PERFORMANCE MATERIALS

- GENERON

- 9.12 LIFE TECHNOLOGIES CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 2 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 3 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 4 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 5 GLOBAL CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 6 GLOBAL CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 7 GLOBAL CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 8 GLOBAL CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 9 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 10 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 11 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 12 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 13 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 14 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 15 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 16 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 17 US CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 18 US CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 19 US CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 20 US CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 21 US CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 22 US CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 23 US CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 24 US CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 25 CANADA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 26 CANADA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 27 CANADA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 28 CANADA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 29 CANADA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 30 CANADA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 31 CANADA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 32 CANADA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 33 MEXICO CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 34 MEXICO CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 35 MEXICO CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 36 MEXICO CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 37 MEXICO CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 38 MEXICO CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 39 MEXICO CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 40 MEXICO CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 41 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 42 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 43 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 44 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 45 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 46 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 47 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 48 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 49 BRAZIL CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 50 BRAZIL CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 51 BRAZIL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 52 BRAZIL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 53 BRAZIL CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 54 BRAZIL CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 55 BRAZIL CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 56 BRAZIL CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 57 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 58 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 59 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 60 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 61 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 62 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 63 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 64 ARGENTINA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 65 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 66 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 67 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 68 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 69 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 70 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 71 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 72 COLOMBIA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 73 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 74 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 75 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 76 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 77 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 78 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 79 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 80 REST OF SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 81 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 82 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 83 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 84 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 85 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 86 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 87 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 88 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 89 INDIA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 90 INDIA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 91 INDIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 92 INDIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 93 INDIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 94 INDIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 95 INDIA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 96 INDIA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 97 CHINA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 98 CHINA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 99 CHINA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 100 CHINA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 101 CHINA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 102 CHINA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 103 CHINA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 104 CHINA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 105 JAPAN CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 106 JAPAN CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 107 JAPAN CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 108 JAPAN CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 109 JAPAN CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 110 JAPAN CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 111 JAPAN CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 112 JAPAN CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 113 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 114 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 115 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 116 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 117 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 118 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 119 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 120 SOUTH KOREA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 121 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 122 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 123 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 124 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 125 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 126 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 127 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 128 AUSTRALIA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 129 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 130 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 131 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 132 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 133 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 134 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 135 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 136 SOUTH-EAST ASIA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 137 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 138 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 139 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 140 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 141 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 142 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 143 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 144 REST OF ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 145 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 146 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 147 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 148 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 149 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 150 ASIA-PACIFIC CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 151 EUROPE CHROMATOGRAPHY RESIN MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 152 EUROPE CHROMATOGRAPHY RESIN MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 153 GERMANY CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 154 GERMANY CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 155 GERMANY CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 156 GERMANY CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 157 GERMANY CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 158 GERMANY CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 159 GERMANY CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 160 GERMANY CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 161 UK CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 162 UK CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 163 UK CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 164 UK CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 165 UK CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 166 UK CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 167 UK CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 168 UK CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 169 FRANCE CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 170 FRANCE CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 171 FRANCE CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 172 FRANCE CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 173 FRANCE CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 174 FRANCE CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 175 FRANCE CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 176 FRANCE CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 177 ITALY CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 178 ITALY CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 179 ITALY CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 180 ITALY CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 181 ITALY CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 182 ITALY CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 183 ITALY CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 184 ITALY CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 185 SPAIN CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 186 SPAIN CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 187 SPAIN CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 188 SPAIN CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 189 SPAIN CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 190 SPAIN CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 191 SPAIN CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 192 SPAIN CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 193 RUSSIA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 194 RUSSIA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 195 RUSSIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 196 RUSSIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 197 RUSSIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 198 RUSSIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 199 RUSSIA CHROMATOGRAPHY RESIN MARKET BY REGION USD BILLION) 2022-2029

TABLE 200 RUSSIA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 201 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 202 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 203 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 204 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 205 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 206 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 207 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 208 REST OF EUROPE CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 209 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 210 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 211 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 212 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 213 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 214 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 215 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 216 MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 217 UAE CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 218 UAE CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 219 UAE CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 220 UAE CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 221 UAE CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 222 UAE CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 223 UAE CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 224 UAE CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 225 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 226 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 227 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 228 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 229 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 230 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 231 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 232 SAUDI ARABIA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 233 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 234 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 235 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 236 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 237 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 238 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 239 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 240 SOUTH AFRICA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

TABLE 241 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 242 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 243 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2022-2029

TABLE 244 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (KILOTONS) 2022-2029

TABLE 245 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 246 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 247 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2022-2029

TABLE 248 REST OF MIDDLE EAST AND AFRICA CHROMATOGRAPHY RESIN MARKET BY REGION (KILOTONS) 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2020-2029

FIGURE 9 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2020-2029

FIGURE 10 GLOBAL CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

FIGURE 11 GLOBAL CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TYPE (USD BILLION) 2021

FIGURE 14 GLOBAL CHROMATOGRAPHY RESIN MARKET BY TECHNIQUE (USD BILLION) 2021

FIGURE 15 GLOBAL CHROMATOGRAPHY RESIN MARKET BY APPLICATION (USD BILLION) 2021

FIGURE 16 GLOBAL CHROMATOGRAPHY RESIN MARKET BY REGION (USD BILLION) 2021

FIGURE 17 NORTH AMERICA CHROMATOGRAPHY RESIN MARKET SNAPSHOT

FIGURE 18 EUROPE CHROMATOGRAPHY RESIN MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA CHROMATOGRAPHY RESIN MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC CHROMATOGRAPHY RESIN MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA CHROMATOGRAPHY RESIN MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 BIO-RAD LABORATORIES INC.: COMPANY SNAPSHOT

FIGURE 24 TOSOH CORPORATION: COMPANY SNAPSHOT

FIGURE 25 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 26 PUROLITE CORPORATION: COMPANY SNAPSHOT

FIGURE 27 REPLIGEN CORPORATION: COMPANY SNAPSHOT

FIGURE 28 KANEKA CORPORATION: COMPANY SNAPSHOT

FIGURE 29 SARTORIUS AG: COMPANY SNAPSHOT

FIGURE 30 JSR LIFE SCIENCES: COMPANY SNAPSHOT

FIGURE 31 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT

FIGURE 32 AVANTOR PERFORMANCE MATERIALS: COMPANY SNAPSHOT

FIGURE 33 GENERON: COMPANY SNAPSHOT

FIGURE 34 LIFE TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FAQ

The wireless network security market is expected to reach USD 2.58 billion by the end of 2023.

Upcoming trends of chromatography resin market is mix-mode chromatography.

The global chromatography resin market size was valued at USD 2.13 billion in 2020, and projected to reach USD 3.76 billion by 2029, with a CAGR of 6.53% from 2021 to 2029.

The North America dominated the global industry in 2021 and accounted for the maximum share of more than 36% of the overall revenue.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.