REPORT OUTLOOK

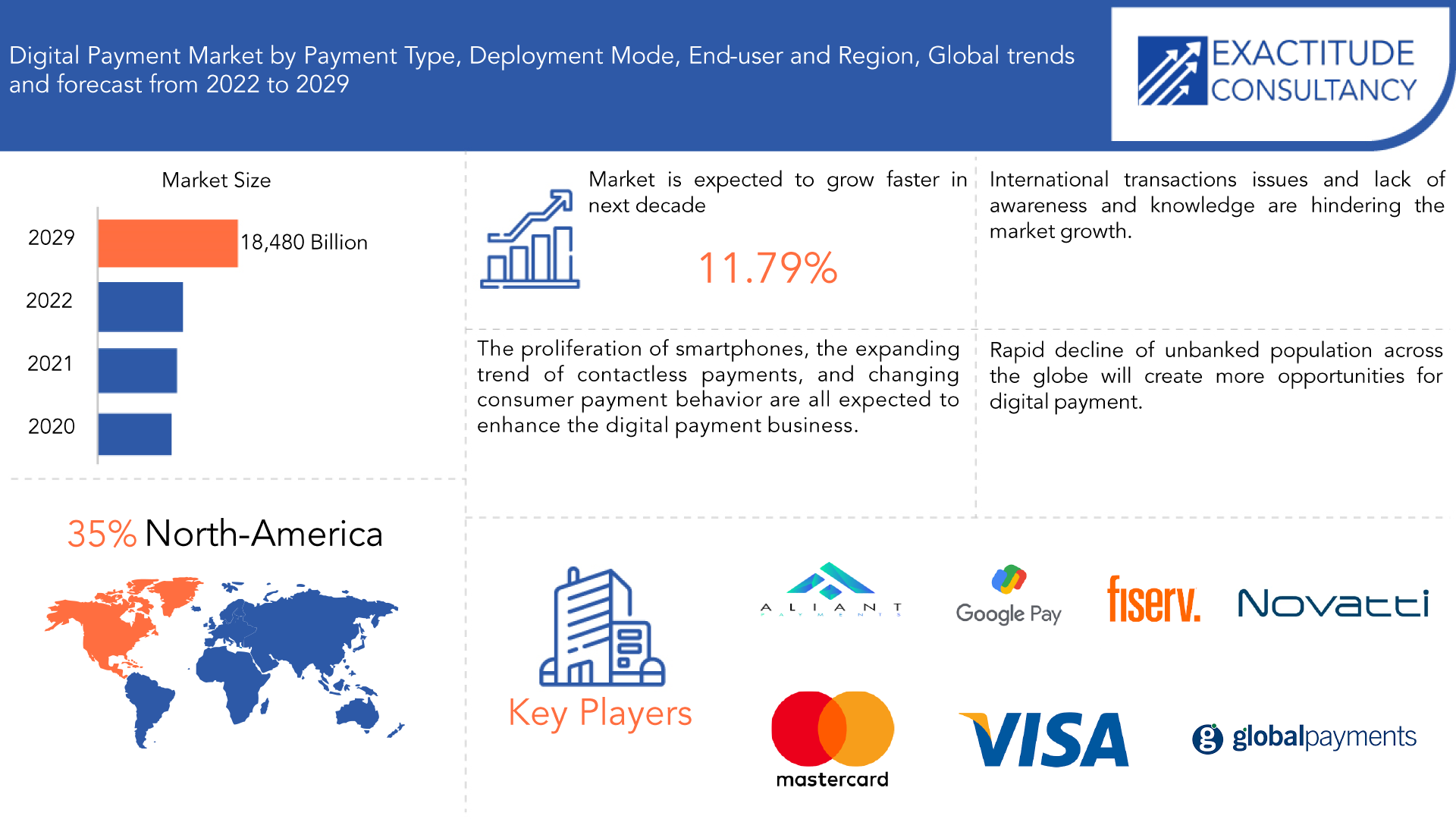

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 18480 billion by 2029 | 11.79% | North America |

| By Payment Type | By deployment mode | By End-user |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Digital Payment Market Overview

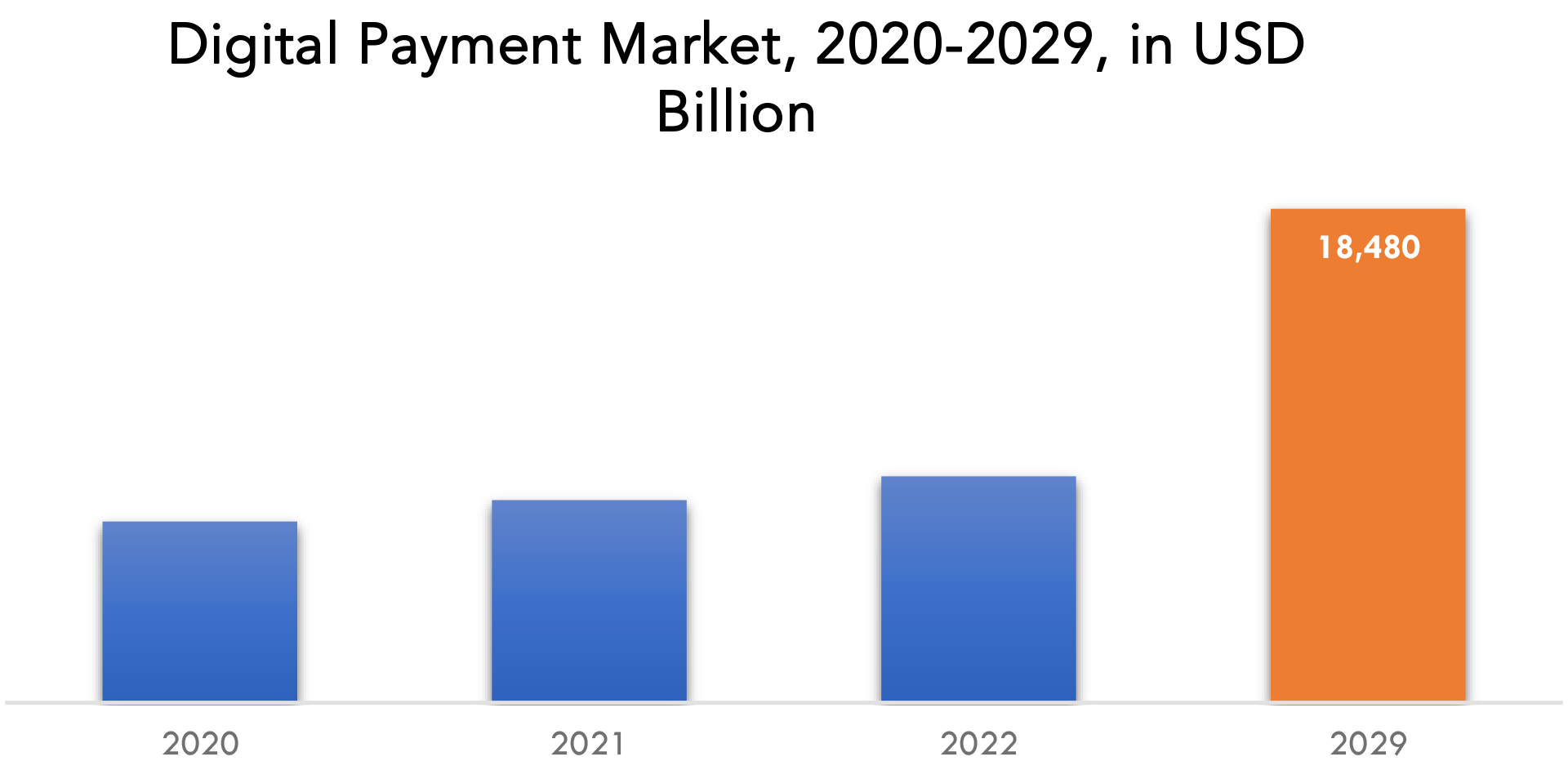

The Digital Payment Market is expected to grow at 11.79% CAGR from 2022 to 2029. It is expected to reach above USD 18480 billion by 2029 from USD 6780 billion in 2020.

Digital payments are payments made through digital or online channels that do not entail the exchange of actual currency. This type of payment, also known as an electronic payment (e-payment), is the transfer of value from one payment account to another in which both the payer and the payee utilize a digital device such as a mobile phone, computer, or credit, debit, or prepaid card. The merchant, the customer, the payment network, and the bank are all engaged in the processing of digital payment transactions. Individuals, governments, businesses, and international development organizations may all benefit from it in terms of cost savings, transparency, and security. The ability to migrate to digital payments and receipts has greatly aided small businesses all over the world in making faster and more secure payments with no risk or penalties.

One of the most significant benefits of digital payment is the seamless experience it offers clients. Traditional payment methods such as cash and checks add significant risk, steps, and physical presence. You may send and receive cash from anywhere in the globe with the touch of a button using digital payment. Handling and dealing in cash is a difficult and time-consuming activity. With digital payments, one may easily keep their cash secure in an online manner. Thanks to UPI, net banking, and mobile wallets, your cell phone is now sufficient to make and receive payments. Furthermore, most digital payment channels give regular updates, notifications, and statements to allow customers to track their cash.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION) |

| Segmentation | By Payment Type, By Deployment Mode, By End-user, By Region |

| By Payment Type

|

|

| By deployment mode

|

|

| By End-user

|

|

| By Region

|

|

The global digital payment market has grown as a result of factors such as a shift away from cash and increased smartphone usage. Furthermore, the widespread use of the Internet has boosted the global e-commerce sector. E-commerce is also driving the evolution of non-financial companies’ point-of-sale services such as digital payments, insurance, and credit. In addition, e-commerce platforms such as Alibaba, Jumia, Mercado Libre, and Amazon have recently begun to integrate payment processing into their platforms. This is known as the embedding finance trend, and it is expected to accelerate digital payment transactions even further. This increase in e-commerce has contributed to an increase in digital financial services associated with small businesses and consumers, thereby boosting the global digital payment market’s growth. On the other hand, an expanding digital payments industry has grown in recent years across emerging economies around the world as a result of the availability of low-cost smartphones and increasing Internet penetration. In addition, governments and regulators in emerging markets have been working on a digital transformation roadmap to encourage citizens to go cashless. For example, the Indian government established the National Payments Corporation of India (NPCI) as a separate entity to promote retail payments. Such government initiatives focusing on the evolution of digital payments are advantageous for global market growth.

Despite the fact that the global digital payment sector is expanding significantly, there are still no standards in place for international transfers. Further limiting the usage of digital channels for international transactions are issues including hidden costs, exchange rates, payment tracking, and payment identification. Because of this, businesses, particularly small and medium-sized ones (SMEs), are hesitant to enter global markets. For instance, only around 50% of businesses and SMEs, according to a survey by Visa Inc., have a competent payment processing infrastructure for cross-border payments. During the projected period, these factors are anticipated to limit market growth to some level. The rate of growth will also be slowed down by people’s hesitation and anxiety about the security and safety of such interfaces in poor regions around the world. Additionally, a combination of poor banking infrastructure in these areas and a lack of awareness and knowledge among the populace will limit the potential for growth.

Rapid decline of unbanked population across the globe will create more opportunities for digital payment. The majority of people on earth reside in rural and isolated regions. Digital literacy and connectivity are lacking among this group. Governments, aid agencies, and business actors now acknowledge the significance of financial services for a sizable population residing in rural and distant areas. More people are utilizing financial services as a result. Governments launch a number of programs to connect these people in order to promote financial inclusion. Due to the payment bank facility’s ability to open and manage bank accounts using mobile phones even in remote locations, digital payments are crucial in growing the number of individuals with bank accounts. The introduction of digital wallets has had a big influence and is aiding in financial inclusion. Also, rising trend of e-commerce and adoption of internet will create lucrative opportunities for digital payment market.

The COVID-19 epidemic has boosted financial inclusion, resulting in a significant surge in digital payments with the worldwide expansion of formal financial services. This growth offered new economic possibilities, narrowed the gender gap in account ownership, and increased household resilience to better manage financial shocks. On the other side, the COVID-19 epidemic has compelled governments, educators, corporations, and individuals to adjust to a “new normal” for carrying out their regular tasks. This has resulted in a shift in customer preferences and purchasing behavior, allowing individuals to perform retail, corporate, financial, and government transactions through digital methods. The epidemic period has resulted in increased use of contactless payment technologies, notably e-wallets. Despite the fact that the manufacturing industry was severely impacted, the market for digital payments experienced an increase in bill payments, peer-to-peer (P2P) transfers, and customer-to-business (C2B) payments during the shutdown.

Digital Payment Market Segment Analysis

The digital payment market is segmented based on payment type, deployment mode, end-user and region, global trends and forecast.

By Payment Type the market is bifurcated into mobile payment, online banking, point of sale, digital wallet; by Deployment Mode market is bifurcated into Cloud and On-premise, by End-user market is bifurcated into retail, entertainment, healthcare, BFSI, transportation, and others; and Region.

In 2022, the point of sales industry led the market and generated more than 51.0% of total revenue. Retail establishments employ point-of-sale systems to handle transactions. These systems provide advantages like quick checkout alternatives, a personalized client experience, and several payment methods. To boost productivity and enhance customer satisfaction, retailers all over the world are implementing cloud-based point-of-sale systems. Over the course of the forecast period, the internet banking segment is anticipated to increase at a high rate. One of the main elements influencing the segment’s growth is the advantages provided by online banking, such as increased time efficiency, simplicity of banking, and activity tracking. As a result, more people are using online banking in many different nations around the globe.

In 2022, the market was dominated by the on-premise segment, which brought in more than 64.0% of worldwide revenue. Digital payment deployment on-premises gives businesses total control over their systems and apps, which their IT team can simply manage. Furthermore, one of the main causes influencing the demand for on-premise solutions among enterprises is the rise in financial scams in the COVID-19 epidemic. Over the forecast period, the cloud segment is expected to grow at the fastest CAGR. One of the major factors driving the segment’s growth is the continued rollout of smart city projects, combined with an increase in the number of unmanned retail stores. Furthermore, payment companies’ efforts to integrate artificial intelligence features into their payment systems are expected to boost segment growth.

The Banking, Financial Services, and Insurance (BFSI) industry is the dominant in terms of end-user and is expected to have the greatest impact on the digital payment market. The way insurance, financial services, and stockbroking companies disburse and receive funds has changed dramatically in recent years. As a result, an increase in demand for digital payment for domestic and cross-border transactions primarily drives growth in the BFSI sector. Furthermore, the BFSI sector is witnessing an increase in consumer preferences for digital payments as a result of increased internet usage and the rapid adoption of smartphones. Banks, on the other hand, are improving their digital payment offerings in order to compete with other solution providers such as Google, Facebook, and Amazon. However, the retail & e-commerce segment is expected to grow at the fastest rate during the forecast period due to a significant increase in consumer use of mobile-based payment solutions for retail payments. Furthermore, the ongoing trend of unmanned convenience stores is expected to create lucrative growth opportunities for this segment.

Digital Payment Market Key Players

The Digital Payment Market key players include Aliant Payments, Google LLC, Aurus Inc., Adyen, Mastercard Inc., Financial Software & Systems Pvt. Ltd., Global Payments Inc., PayPal Holdings Inc., ACI Worldwide Inc., Novatti Group, Fiserv Inc., Sage Pay Europe Ltd., Visa Inc., and others.

Recent development:

- 29 November 2022: Visa announced a seven-year global partnership with GoHenry, the prepaid card and financial education app for 6-to 18-year-olds. Visa will provide support as the exclusive global network partner for GoHenry’s prepaid cards for kids and teens in the US, UK, and Europe.

- 11 October 2022: PayPal Holdings, Inc. announced the rollout of the PayPal Zettle Terminal to small businesses in the US following its launch in European markets last year. Terminal is an all-in-one point-of-sale solution that offers increased mobility in-store for small businesses.

Who Should Buy? Or Key Stakeholders

- Investors

- Environment, Health and Safety Professionals

- Computer Hardware Industry

- Research Organizations

- Banking and Financial Organizations

- Regulatory Authorities

- Electronics and Telecommunication Industry

- E- Commerce Industries

- Others

Digital Payment Market Regional Analysis

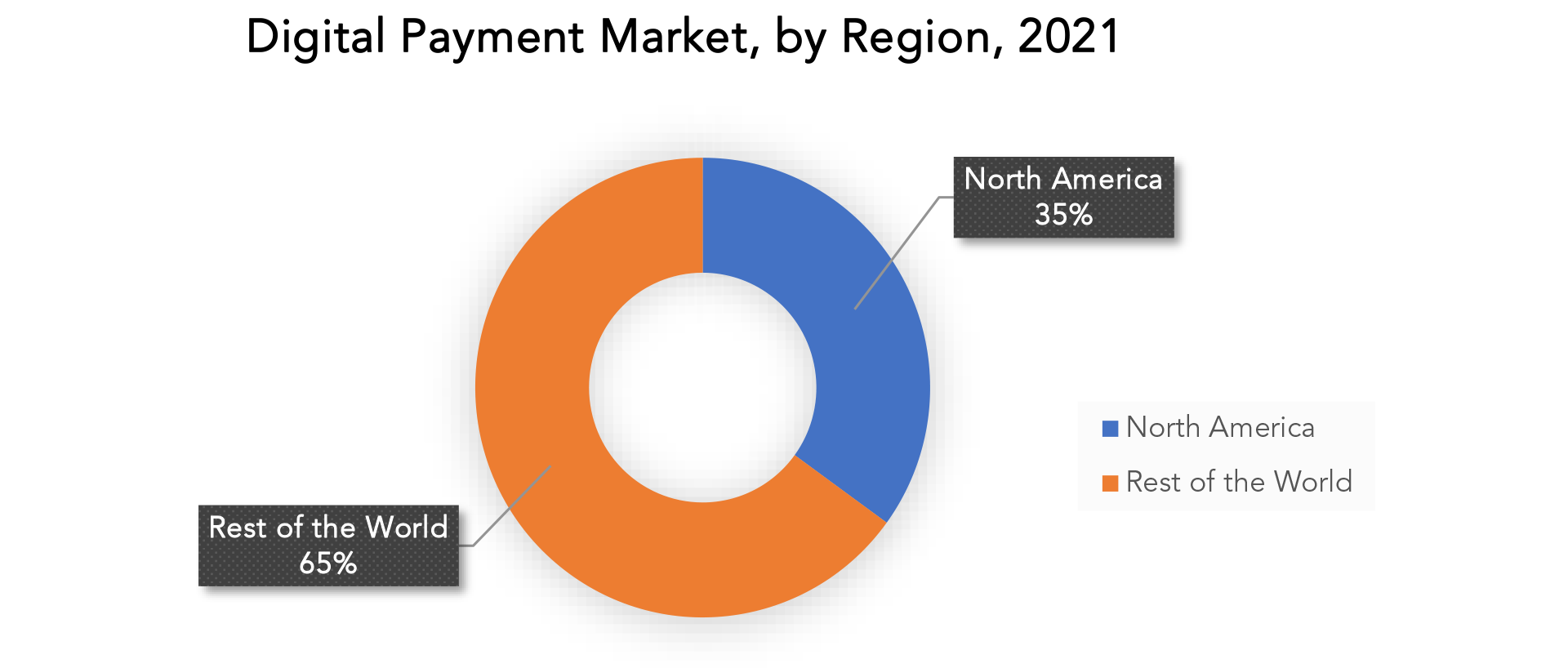

The Digital Payment Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

In terms of revenue share, the North American region dominated the market in 2021. US and Canada are included in this region. The US consumer population’s ongoing use of digital wallets and mobile payments is largely responsible for the market’s expansion in this area. It is anticipated that technological developments in the North American digital payment sector would open up attractive new market prospects. This platform provides the option to split payments for online purchases using different credit and debit cards without incurring interest or other fees. In this way, it is anticipated that the platform would assist users in lowering the cost load on individual cards, enhancing financial privacy, and raising credit scores.

In the market for digital payments, Asia-Pacific is regarded as having the fastest growth. China, India, Japan, South Korea, and the rest of the world are all included in this region. One of the key reasons propelling market expansion is the major countries in this region’s initiatives to improve the digital payment industry. For instance, the Indian government is actively pursuing its plan to digitise the financial and economic sectors. Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), which was recently introduced, has become one of the preferred payment methods for Indian citizens. The Asia-Pacific area is expanding due to China’s rapid growth in the digital payment sector. The two most popular digital payment systems in the nation, WeChat Pay and Alipay, are used by more than 90% of urban Chinese consumers.

Europe has a developed banking and mobile sector. Since the majority of people in Europe have bank accounts, the rise of digital wallets is expected to peak around 2026. The technology is anticipated to increase market size in the region as numerous companies, like Telefonica and Vodafone, invest in NFC services through phones and cards, mainly in the UK and Germany.

Key Market Segments: Digital Payment Market

Digital Payment Market By Payment Type, 2020-2029, (Usd Billion)

- Mobile Payment

- Online Banking

- Point Of Sale

- Digital Wallet

Digital Payment Market By Deployment Mode, 2020-2029, (Usd Billion)

- Cloud

- On-Premise

Digital Payment Market By End-User, 2020-2029, (Usd Billion)

- Retail

- Entertainment

- Healthcare

- Bfsi

- Transportation

- Others

Digital Payment Market By Region, 2020-2029, (Usd Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the Digital Payment Market over the next 7 years?

- Who are the major players in the Digital Payment Market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the Digital Payment Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Digital Payment Market?

- What is the current and forecasted size and growth rate of the global Digital Payment Market?

- What are the key drivers of growth in the Digital Payment Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Digital Payment Market?

- What are the technological advancements and innovations in the Digital Payment Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Digital Payment Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Digital Payment Market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL DIGITAL PAYMENT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON DIGITAL PAYMENT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL DIGITAL PAYMENT MARKET OUTLOOK

- GLOBAL DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

- MOBILE PAYMENT

- ONLINE BANKING

- POINT OF SALE

- DIGITAL WALLET

- GLOBAL DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

- CLOUD

- ON-PREMISE

- GLOBAL DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

- RETAIL

- ENTERTAINMENT

- HEALTHCARE

- BFSI

- TRANSPORTATION

- OTHERS

- GLOBAL DIGITAL PAYMENT MARKET BY REGION (USD BILLION), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ALIANT PAYMENTS

- GOOGLE LLC

- AURUS INC.

- ADYEN

- MASTERCARD INC.

- FINANCIAL SOFTWARE & SYSTEMS PVT. LTD.

- GLOBAL PAYMENTS INC.

- PAYPAL HOLDINGS INC.

- ACI WORLDWIDE INC.

- NOVATTI GROUP

- FISERV INC.

- SAGE PAY EUROPE LTD.

- VISA INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 3 GLOBAL DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 4 GLOBAL DIGITAL PAYMENT MARKET BY REGION (USD BILLION), 2020-2029

TABLE 5 NORTH AMERICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 6 NORTH AMERICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA DIGITAL PAYMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 9 US DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 10 US DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 11 US DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 12 CANADA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (BILLION), 2020-2029

TABLE 13 CANADA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 14 CANADA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 15 MEXICO DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 16 MEXICO DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 17 MEXICO DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 18 REST OF NORTH AMERICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 19 REST OF NORTH AMERICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 20 REST OF NORTH AMERICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 21 SOUTH AMERICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 22 SOUTH AMERICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 23 SOUTH AMERICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 24 SOUTH AMERICA DIGITAL PAYMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 25 BRAZIL DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 26 BRAZIL DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 27 BRAZIL DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 28 ARGENTINA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 29 ARGENTINA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 30 ARGENTINA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 31 COLOMBIA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 32 COLOMBIA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 33 COLOMBIA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 34 REST OF SOUTH AMERICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 35 REST OF SOUTH AMERICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 36 REST OF SOUTH AMERICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 37 ASIA-PACIFIC DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 38 ASIA-PACIFIC DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 39 ASIA-PACIFIC DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 40 ASIA-PACIFIC DIGITAL PAYMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 41 INDIA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 42 INDIA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 43 INDIA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 44 CHINA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 45 CHINA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 46 CHINA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 47 JAPAN DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 48 JAPAN DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 49 JAPAN DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 50 SOUTH KOREA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 51 SOUTH KOREA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 52 SOUTH KOREA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 53 AUSTRALIA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 54 AUSTRALIA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 55 AUSTRALIA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 56 REST OF ASIA PACIFIC DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 57 REST OF ASIA PACIFIC DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 58 REST OF ASIA PACIFIC DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 59 EUROPE DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 60 EUROPE DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 61 EUROPE DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 62 EUROPE DIGITAL PAYMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 63 GERMANY DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 64 GERMANY DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 65 GERMANY DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 66 UK DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 67 UK DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 68 UK DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 69 FRANCE DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 70 FRANCE DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 71 FRANCE DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 72 ITALY DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 73 ITALY DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 74 ITALY DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 75 SPAIN DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 76 SPAIN DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 77 SPAIN DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 78 RUSSIA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 79 RUSSIA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 80 RUSSIA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 81 REST OF EUROPE DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 82 REST OF EUROPE DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 83 REST OF EUROPE DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 88 UAE DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 89 UAE DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 90 UAE DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 91 SAUDI ARABIA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 92 SAUDI ARABIA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 93 SAUDI ARABIA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 94 SOUTH AFRICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 95 SOUTH AFRICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 96 SOUTH AFRICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY PAYMENT TYPE (USD BILLION), 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA DIGITAL PAYMENT MARKET BY END-USER (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DIGITAL PAYMENT MARKET BY PAYMENT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL DIGITAL PAYMENT MARKET BY END-USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL DIGITAL PAYMENT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL DIGITAL PAYMENT MARKET BY REGION 2021

FIGURE 14 GLOBAL DIGITAL PAYMENT MARKET BY PAYMENT TYPE 2021

FIGURE 15 GLOBAL DIGITAL PAYMENT MARKET BY DEPLOYMENT MODE 2021

FIGURE 16 GLOBAL DIGITAL PAYMENT MARKET BY END-USER 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ALIANT PAYMENTS: COMPANY SNAPSHOT

FIGURE 19 GOOGLE LLC.: COMPANY SNAPSHOT

FIGURE 20 AURUS INC: COMPANY SNAPSHOT

FIGURE 21 ADYEN: COMPANY SNAPSHOT

FIGURE 22 MASTERCARD INC.: COMPANY SNAPSHOT

FIGURE 23 FINANCIAL SOFTWARE & SYSTEMS PVT. LTD.: COMPANY SNAPSHOT

FIGURE 24 GLOBAL PAYMENTS INC.: COMPANY SNAPSHOT

FIGURE 25 PAYPAL HOLDINGS INC.: COMPANY SNAPSHOT

FIGURE 26 ACI WORLDWIDE INC.: COMPANY SNAPSHOT

FIGURE 27 NOVATTI GROUP: COMPANY SNAPSHOT

FIGURE 28 FISERV INC.: COMPANY SNAPSHOT

FIGURE 29 SAGE PAY EUROPE LTD.: COMPANY SNAPSHOT

FIGURE 30 VISA INC.: COMPANY SNAPSHOT

FAQ

The global Digital Payment Market revenue is projected to expand at a CAGR of 11.79% during the forecast period.

The global Digital Payment Market was valued at USD 6780 Billion in 2020.

Some key players operating in the Digital Payment Market include Aliant Payments, Total System Services Inc, Aurus Inc., Adyen, Wirecard, Financial Software & Systems Pvt. Ltd., Global Payments Inc., PayPal Holdings Inc., ACI Worldwide Inc., Novatti Group, Fiserv Inc., Sage Pay Europe Ltd., WEX Inc.

The North America market dominated the Global Software Defined Security Market by Region in 2020, and would continue to be a dominant market till 2029.

Availability of various payment options and increased government support are driving the market growth.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.