REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 52.42 Billion by 2029 | 9.80 % | North America |

| by Fiber | by Aircraft | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Aerospace Composites Market Overview

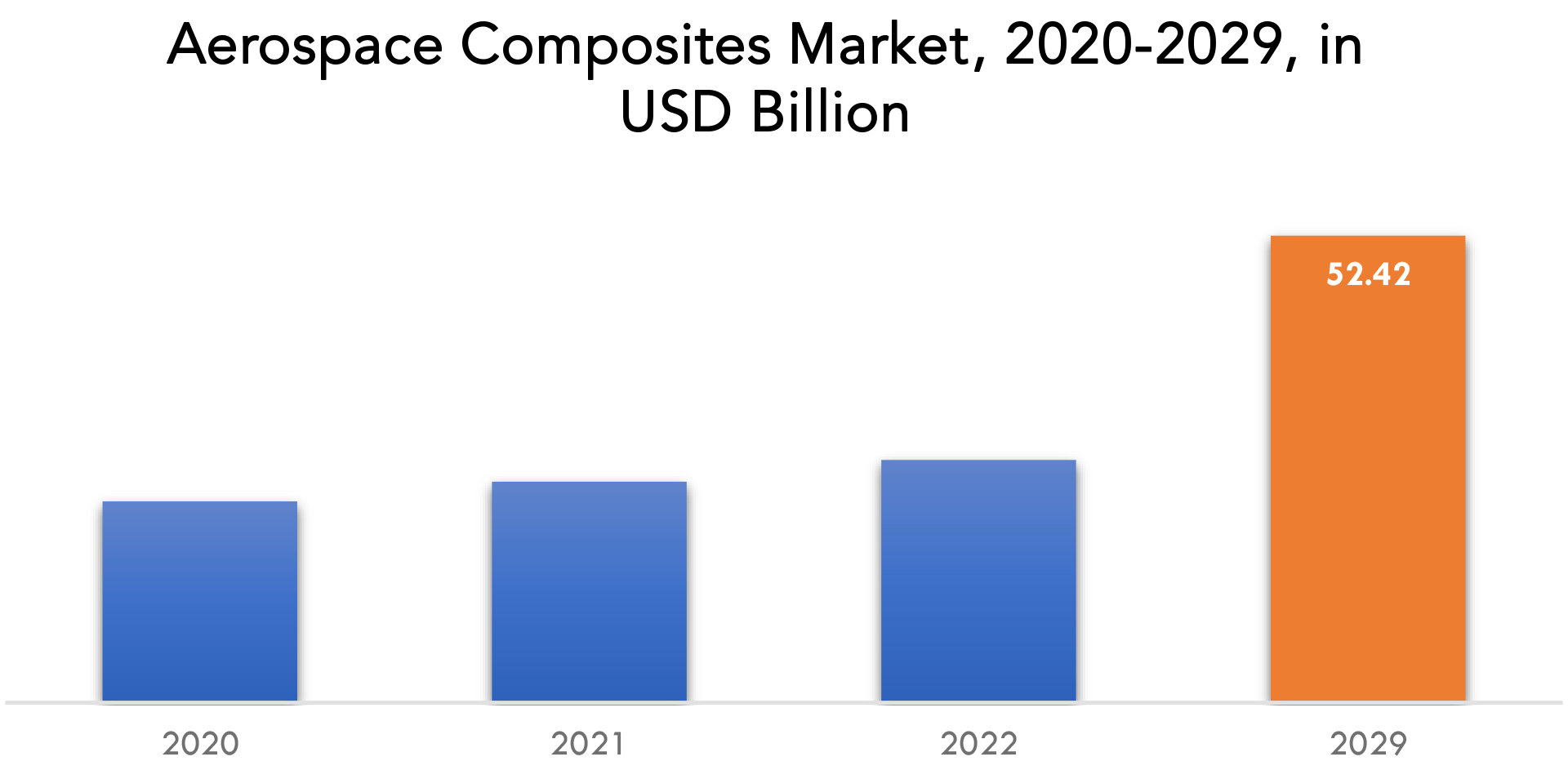

The global aerospace composites market is expected to grow at 9.80 % CAGR from 2020 to 2029. It is expected to reach above USD 52.42 Billion by 2029 from USD 22.60 Billion in 2020.

Innovative materials called aerospace composites are employed in the creation of aircraft parts that are lightweight, strong, and fuel-efficient. The use of modern techniques and procedures is required to ascertain whether the use of composite materials introduces new structural or performance problems in the design, despite the fact that composites offer a number of advantages over conventional materials like metal. Without these cutting-edge technologies, engineers find it difficult to address hazards associated with design and production, as well as high prices and longer cycle times when creating aerospace composite components.

The rising performance requirements in the aircraft industry is indeed driving the growth of composites. The aerospace industry is facing increased pressure to design and manufacture more efficient, lighter, and stronger aircraft. This is driven by several factors, including the need to reduce fuel consumption and emissions, improve safety, and increase passenger comfort. Composites are a key material in meeting these performance requirements, as they offer several advantages over traditional materials such as aluminum. Composites are lighter and stronger, which reduces the weight of the aircraft and improves fuel efficiency. They are also more durable and resistant to corrosion, which reduces maintenance costs and increases the lifespan of the aircraft. In addition, composites can be formed into complex shapes, which allows for greater design flexibility and the creation of more aerodynamic structures.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kiloton) |

| Segmentation | By Fiber, Aircraft and region. |

| By Fiber |

|

| By Application |

|

| By Region |

|

Composites are generally more expensive than traditional materials such as aluminum, which can make them less attractive to some manufacturers, especially those with cost-sensitive business models. Additionally, the manufacturing processes for composites can be more complex and require specialized equipment, which can add to the cost. Safety concerns are also a significant factor in the use of composites in the aerospace industry. While composites are generally stronger and more durable than traditional materials, there are some concerns about their long-term safety and reliability. This is because composites can be susceptible to damage from impacts or environmental factors, such as moisture or ultraviolet radiation, which can compromise their structural integrity. As a result, the use of composites in critical aircraft components, such as wings and fuselages, requires rigorous testing and certification to ensure their safety and reliability.

The reduction of the cost of carbon fiber is an excellent opportunity for the aerospace composite market. Carbon fiber composites offer high strength and stiffness-to-weight ratios, making them a preferred material for many aerospace applications. However, the cost of carbon fiber has traditionally been high, which has limited its use in some applications. As the cost of carbon fiber decreases, it will become more competitive with traditional materials such as aluminum and steel. This will enable manufacturers to create lighter, more efficient aircraft that are better suited to meet the performance requirements of the industry.

The COVID-19 epidemic has had a significant negative influence on the global market for aircraft composite materials. The COVID-19 outbreak’s impact on the aircraft industry’s activity is projected to have an even greater impact on market expansion. Many commercial sectors have been compelled by the epidemic to all but cease operations in order to adhere to laws like social segregation. In addition, there won’t be much air travel because of the worldwide lockdown and prohibition on domestic and foreign travel. The manufacturing rate and supply chain of the aerospace composite system market would also be hampered by the lack of raw materials. Consequently, the worldwide market for aircraft composite materials has become unstable.

Aerospace Composites Market Segment Analysis

The global aerospace composites market is segmented based on fiber type into carbon fiber, glass fiber, aramid fiber. This category is now dominated by carbon fiber, and it is anticipated that other categories will follow suit. Since carbon fiber is approximately twice as rigid as aramid and glass fibers, it is favored for use in airplanes and spacecraft. Additionally, the lightweighting effects of the high-strength carbon fiber contribute to improved engine performance and decreased fuel consumption. Glass fiber follows carbon fiber in the order. Additionally, the advantages of glass fiber include its lower cost, high strength-to-weight ratio, and resistance to moisture and the elements.

The Global Aerospace Composites Market is segmented based on type of aircraft into helicopters, fixed-wing military aircraft, commercial aircraft. The market for aircraft composites worldwide is dominated by the commercial aerospace industry. Due to major advancements in the civilian aircraft industry and the replacement of the fleet that is getting older, it is anticipated to continue its supremacy.

Aerospace Composites Market Players

The Aerospace Composites Market key players include Solvay S.A, Hexcel Corporation, Royal Tencate N.V., Teijin Limited, Toray Industries Inc., SGL Group—The Carbon Company, Owens Corning, Materion Corporation, Mitsubishi Rayon Co. Ltd., Renegade Materials Corporation.

Recent Developments

January 2020 – Mitsubishi Chemical Corporation, a manufacturer of a variety of chemicals & materials headquartered in Japan, announced its plans to acquire c-m-p GmbH, a Germany based manufacturer of Carbon Fiber Prepreg. This is expected to strengthen the company’s position in the carbon fiber composites market

March 2021, Ericsson-controlled 5G releases Spot the robot for Airport Terminal review. The robot was associated with TDC NET’s Ericsson-controlled 5G. The 5G use-case trial was a partnership with the Danish Technological Institute.

Who Should Buy? Or Key stakeholders

- Investors

- Raw Materials Manufactures

- Logistic Companies

- Military Organization

- Aviation Companies

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

Aerospace Composites Market Regional Analysis

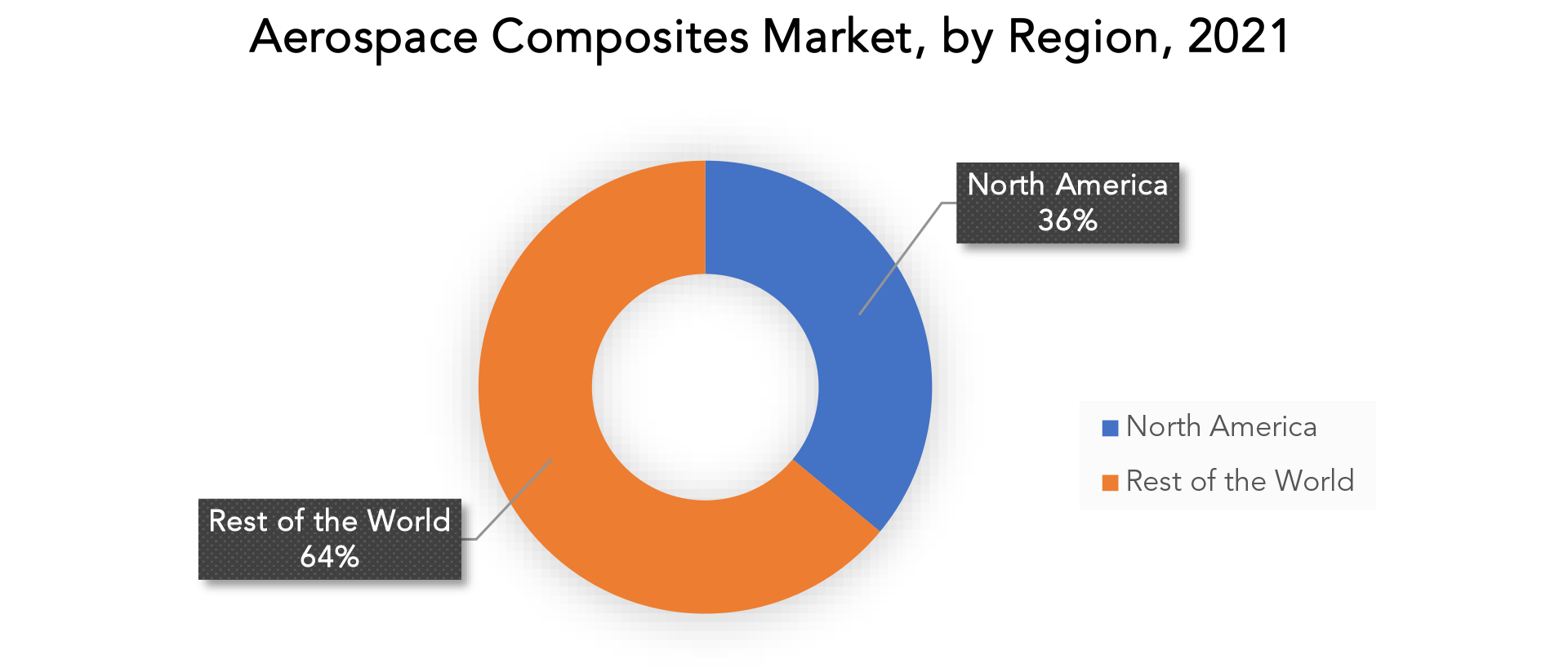

The Aerospace Composites Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

The North America aerospace composite market is one of the largest in the world, driven by the presence of major aircraft manufacturers, such as Boeing and Airbus, as well as a large number of suppliers and service providers. The aerospace composite market in North America is driven by several factors, including the region’s significant investment in research and development, the presence of leading aerospace companies, and a strong focus on innovation and technology. One of the key growth drivers in the North America aerospace composite market is the demand for lighter and more fuel-efficient aircraft.

As the aircraft sector in the area expands quickly, Asia-Pacific is expected to experience tremendous growth in the next years. As the aerospace sector expands in rising nations like China and India, there is a major increase in demand for mid-sized commercial aircraft. Additionally, it is anticipated that the market’s players would benefit greatly from the expanding military budget and fighter jet spending in nations like India.

Key Market Segments: Aerospace Composites Market

Aerospace Composites Market by Fiber, 2020-2029, (Usd Billion), (Kiloton)

- Carbon Fiber

- Glass Fiber

- Aramid Fiber

Aerospace Composites Market by Aircraft, 2020-2029, (Usd Billion), (Kiloton)

- Commercial Aircraft

- Military Fixed Wings

- Helicopter

Aerospace Composites Market by Region, 2020-2029, (Usd Billion), (Kiloton)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the aerospace composites market over the next 7 years?

- Who are the major players in the aerospace composites market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and Africa?

- How is the economic environment affecting the aerospace composites market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the aerospace composites market?

- What is the current and forecasted size and growth rate of the global aerospace composites market?

- What are the key drivers of growth in the aerospace composites market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the aerospace composites market?

- What are the technological advancements and innovations in the aerospace composites market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the aerospace composites market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the aerospace composites market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AEROSPACE COMPOSITES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AEROSPACE COMPOSITES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AEROSPACE COMPOSITES MARKET OUTLOOK

- GLOBAL AEROSPACE COMPOSITES MARKET BY FIBER, 2020-2029, (USD BILLION), (KILOTONS)

- CARBON FIBER

- GLASS FIBER

- ARAMID FIBER

- GLOBAL AEROSPACE COMPOSITES MARKET BY AIRCRAFT, 2020-2029, (USD BILLION), (KILOTONS)

- COMMERCIAL AIRCRAFT

- MILITARY FIXED WINGS

- HELICOPTER

- GLOBAL AEROSPACE COMPOSITES MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SOLVAY S.A.

- HEXCEL CORPORATION

- ROYAL TENCATE N.V.

- TEIJIN LIMITED

- TORAY INDUSTRIES INC.

- SGL GROUP – THE CARBON COMPANY

- OWEN CORNING

- MATERION CORPORATION

- MITSUBISHI RAYON CO. LTD.

- RENEGADE MATERIALS CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 2 GLOBAL AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 3 GLOBAL AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 4 GLOBAL AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 5 GLOBAL AEROSPACE COMPOSITES MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL AEROSPACE COMPOSITES MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA AEROSPACE COMPOSITES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AEROSPACE COMPOSITES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 14 US AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 15 US AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 16 US AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 17 CANADA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 18 CANADA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 19 CANADA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 20 CANADA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 21 MEXICO AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 22 MEXICO AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 23 MEXICO AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 24 MEXICO AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 31 BRAZIL AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 32 BRAZIL AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 33 BRAZIL AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 BRAZIL AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 35 ARGENTINA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 36 ARGENTINA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 37 ARGENTINA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 38 ARGENTINA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 39 COLOMBIA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 40 COLOMBIA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 41 COLOMBIA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 42 COLOMBIA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC AEROSPACE COMPOSITES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC AEROSPACE COMPOSITES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 54 INDIA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 55 INDIA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 56 INDIA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 57 CHINA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 58 CHINA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 59 CHINA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 CHINA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 61 JAPAN AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 62 JAPAN AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 63 JAPAN AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 64 JAPAN AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 81 EUROPE AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 82 EUROPE AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 83 EUROPE AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 84 EUROPE AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 85 EUROPE AEROSPACE COMPOSITES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE AEROSPACE COMPOSITES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 88 GERMANY AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 89 GERMANY AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 90 GERMANY AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 91 UK AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 92 UK AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 93 UK AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 94 UK AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 95 FRANCE AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 96 FRANCE AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 97 FRANCE AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 FRANCE AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 99 ITALY AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 100 ITALY AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 101 ITALY AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 102 ITALY AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 103 SPAIN AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 104 SPAIN AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 105 SPAIN AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 106 SPAIN AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 107 RUSSIA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 108 RUSSIA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 109 RUSSIA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 RUSSIA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 122 UAE AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 123 UAE AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 124 UAE AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AEROSPACE COMPOSITES MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AEROSPACE COMPOSITES BY FIBER, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AEROSPACE COMPOSITES BY AIRCRAFT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AEROSPACE COMPOSITES BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AEROSPACE COMPOSITES BY FIBER, USD BILLION, 2021

FIGURE 13 GLOBAL AEROSPACE COMPOSITES BY AIRCRAFT, USD BILLION, 2021

FIGURE 14 GLOBAL AEROSPACE COMPOSITES BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 SOLVAY S.A.: COMPANY SNAPSHOT

FIGURE 17 HEXCEL CORPORATION: COMPANY SNAPSHOT

FIGURE 18 ROYAL TENCATE N.V.: COMPANY SNAPSHOT

FIGURE 19 TEIJIN LIMITED: COMPANY SNAPSHOT

FIGURE 20 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 21 SGL GROUP – THE CARBON COMPANY: COMPANY SNAPSHOT

FIGURE 22 OWEN CORNING: COMPANY SNAPSHOT

FIGURE 23 MATERION CORPORATION: COMPANY SNAPSHOT

FIGURE 24 MITSUBISHI RAYON CO. LTD.: COMPANY SNAPSHOT

FIGURE 25 RENEGADE MATERIALS CORPORATION: COMPANY SNAPSHOT

FAQ

The global Aerospace Composites Market is expected to grow at 9.80% CAGR from 2020 to 2029. It is expected to reach above USD 52.42 Billion by 2029 from USD 22.60 Billion in 2020.

North America held more than 36% of the Aerospace Composites Market revenue share in 2020 and will witness tremendous expansion during the forecast period.

The rising performance requirements in the aircraft industry is indeed driving the growth of composites. The aerospace industry is facing increased pressure to design and manufacture more efficient, lighter, and stronger aircraft.

The aviation sector is major sector where the application of Aerospace Composites has seen more.

The Markets largest share is in the North America region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.