Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 33.26 billion by 2029 | 6.02% | Asia Pacific |

| By Resin Type | By Manufacturing Process | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Global Composite Resin Market Overview

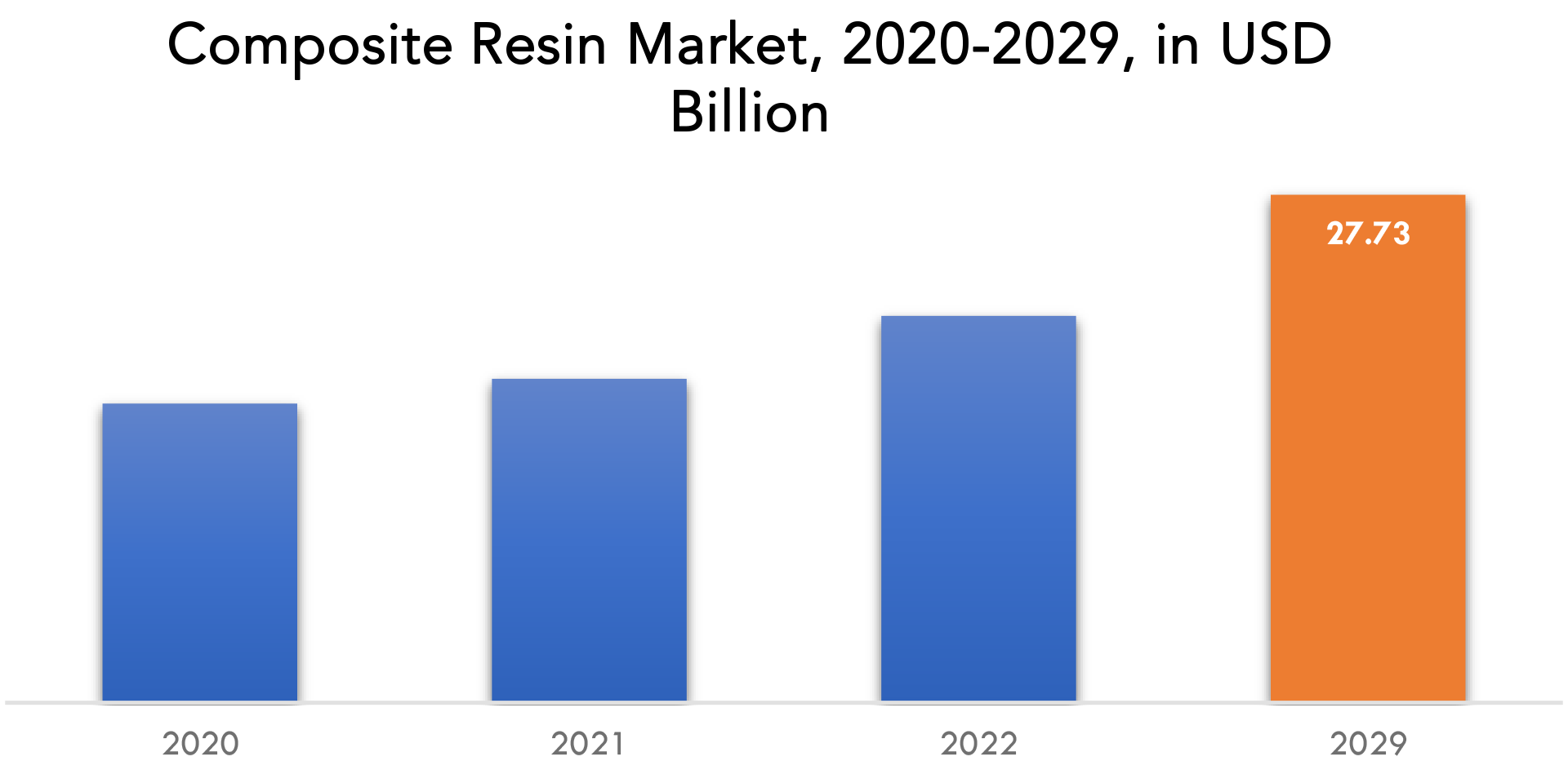

The global composite resin market size is expected to grow at more than 6.02 % CAGR from 2021 to 2029. It is expected to reach above USD 33.26 billion by 2029 from a little above USD 19.59 billion in 2020.

The organic and inorganic components of the composite resin are combined to create a highly viscous, sticky substance that is utilized to create composite materials. These composite materials, including vinyl ester, polypropylene, and polyethylene, demonstrate a great capacity for bonding the variety of fibers present in the materials with the strength and stiffness of the materials. The automobile, aerospace and military, building and construction, as well as other industries, heavily utilize composite resins. A composite material’s two basic ingredients are fibers and resin. The fibers, which are often made of glass or carbon fiber, provide stiffness and strength, but they are unable to be shaped into a shape or form where these qualities are applicable when employed alone.

Composite resin is consumed most frequently by the automotive and transportation sectors. This is due to composite resin’s application in the production of vehicle parts. Improving energy efficiency, lowering vehicle emissions, and boosting durability are just a few of the problems the automobile industry must overcome. In the automotive and transportation industry, composites are seen as alternatives to aluminum and steel that can reduce the weight of the vehicle by 30% to 60%. Composites offer superior mechanical qualities and increased durability in addition to producing lightweight constructions. The increased performance characteristics of thermoset and thermoplastic composite resins, which are utilized as a matrix in composites, make the composites practical in these applications. The need for composites in the automotive and transportation sectors is being driven by their quicker curing times, improved finishing quality, and resilience to heat, temperature, and corrosion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Resin Type, By Manufacturing Process, By Application, By Region |

| By Resin Type |

|

| By Manufacturing Process |

|

| By Application |

|

| By Region |

|

One of the practical means of producing electricity from renewable sources is wind energy. According to the Global Wind Energy Council (GWEC), the world’s two largest wind power markets, China and the US, installed a record amount of new installations in 2020, accounting for more than half of the world’s total wind power capacity. This record growth was reportedly fueled by a surge in installations in these two countries. As a result, the demand for composite resin has recently increased further. Over the next five years, it is anticipated that growing economies like Indonesia, Brazil, and India would host more of these types of events. These nations are making use of their wind energy potential and boosting wind energy output to lessen their reliance on non-renewable sources, which will increase demand for composite resin materials.

The COVID-19 pandemic is expected to reduce demand for composite resin in 2020. The consequences of this terrible disease are being felt all around the world, but Asia-Pacific and Europe have been particularly heavily struck. To curb the virus’s spread, businesses have shut down their operations and production facilities, and the government has prohibited new building. Because of this, composite resin is frequently not as necessary. Demand for composite resin has decreased as a result of COVID-19 and other regulatory concerns that have hampered manufacturing in end-use industries, such as protracted permitting processes. However, it is anticipated that demand for composite resin would increase once more in forecasted period due to increasing demand in transportation industry

Global Composite Resin Market Segment Analysis

The market is split between Thermoset and Thermoplastic according to Type. During the anticipated period, thermoplastic resin type is expected to hold the biggest market share. The composites created using thermoplastic resin as a matrix material have the essential benefit of being moldable and reshapable, unlike composites created using thermoset resin. The thermoplastic resin market is more lucrative than the thermoset resin industry thanks to factors like strong impact strength, superior surface quality, lower product rejection, high stiffness at high and low temperatures, creep resistance in challenging environments, and consistent load. The demand for thermoplastic composite resins will increase over the projection period as a result of their widespread application in the transportation, electrical and electronic, aerospace and defense, and other sectors of the economy.

Based on manufacturing process, market is segmented into compression molding, filament winding, injection molding, layup, pultrusion, resin transfer molding. It is anticipated that demand for the compression molding process would increase. The method requires little upkeep and is inexpensive to execute; it might even survive for decades. For high-volume production, it is essential that the product sets it produces be more uniform. The thermoset resins polyester, epoxy, and phenolic are primarily used in compression molding. Due to the vast range of applications for GFRP and CFRP products in sectors like transportation, infrastructure, and construction, as well as aerospace and defense, demand is rising.

Based on the application, market is segmented into construction, transportation, automotive, electrical & electronics, wind energy, defense. Because composite resin is used extensively in the production of composites for the transportation industry, this sector is expanding at the quickest rate. In comparison to steel and aluminum, most composite materials have a wider strength-to-weight ratio. Due to the weight reduction for a specific degree of strength, composites play a significant role in transportation. Composites are used in body panels, floor panels, and other components of contemporary light rail and passenger rail cars to lighten them up and increase efficiency.

Global Composite Resin Market Players

Key competitors from both domestic and international markets compete fiercely in the worldwide global composite resin industry are Kukdo Chemical Co. Ltd., Alpha Owens-Corning, Reichhold Inc., Huntsman Corporation, The Dow Chemical Company, BASF SE, Polynt SpA, Hexion Inc., Sumitomo Bakelite Company Ltd., SABIC.

Recent News:

- 27th September 2021: BASF SE and Sanyo Chemical came to an agreement to work together on the development of polyurethane dispersions by signing a memorandum of understanding.

- 15th January 2021: Huntsman International LLC has acquired Gabriel Performance Products a North American specialty chemical manufacturer a specialty additives and epoxy curing agents for the coatings, adhesives, sealants and composite end-markets, from Audax Private Equity.

Who Should Buy? Or Key stakeholders

- Global Composite Resin Suppliers

- Investors

- Regulatory Authorities

- Consultancy firms/advisory films

- Composite Resin Vendors

- Research and Development Organizations

- Energy Providers

- Others

Global Composite Resin Market Regional Analysis

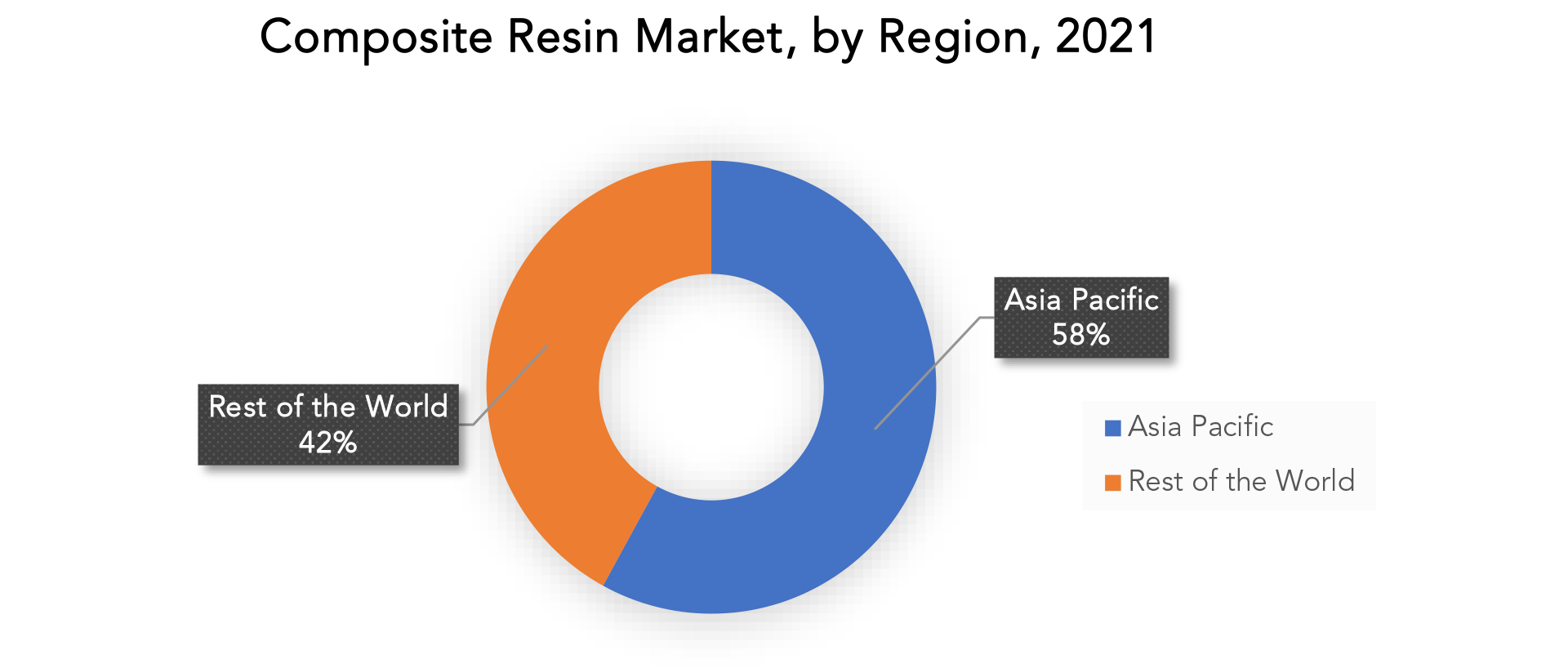

The global composite resin market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The largest market share was given by Asia Pacific. And during the anticipated period, it is anticipated to increase quickly. Asia Pacific is a potential market for composite resin due to the rising demand for it. The area has the most potential as a market for composite resin since it contains growing economies like China, India, and Japan. Over the next five years, the market will be driven by rising demand for tanks, pipelines, wind energy, and the electrical and electronic sectors.

Key Market Segments: Global Composite Resin Market

Global Composite Resin Market By Resin Type, 2020-2029, (USD Billion), (Kilotons)

- Thermoset

- Thermoplastic

Global Composite Resin Market By Manufacturing Process, 2020-2029, (USD Billion), (Kilotons)

- Compression Molding

- Filament Winding

- Injection Molding

- Layup

- Pultrusion

- Resin Transfer Molding

Global Composite Resin Market By Application, 2020-2029, (USD Billion), (Kilotons)

- Construction

- Transportation

- Automotive

- Electrical & Electronics

- Wind Energy

- Defense

Global Composite Resin Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the composite resin market over the next 7 years?

- Who are the major players in the composite resin market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the composite resin market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the composite resin market?

- What is the current and forecasted size and growth rate of the global composite resin market?

- What are the key drivers of growth in the composite resin market?

- What are the distribution channels and supply chain dynamics in the composite resin market?

- What are the technological advancements and innovations in the composite resin market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the composite resin market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the composite resin market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of composite resin’s in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL COMPOSITE RESIN MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GLOBAL COMPOSITE RESIN MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL COMPOSITE RESIN MARKET OUTLOOK

- GLOBAL COMPOSITE RESIN MARKET BY RESIN TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- THERMOSET

- THERMOPLASTIC

- GLOBAL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS, 2020-2029, (USD BILLION), (KILOTONS)

- COMPRESSION MOLDING

- FILAMENT WINDING

- INJECTION MOLDING

- LAYUP

- PULTRUSION

- RESIN TRANSFER MOLDING

- GLOBAL COMPOSITE RESIN MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- CONSTRUCTION

- TRANSPORTATION

- AUTOMOTIVE

- ELECTRICAL & ELECTRONICS

- WIND ENERGY

- DEFENSE

- GLOBAL COMPOSITE RESIN MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- KUKDO CHEMICAL CO. LTD.

- ALPHA OWENS-CORNING,

- REICHHOLD INC.

- HUNTSMAN CORPORATION

- THE DOW CHEMICAL COMPANY

- BASF SE

- POLYNT SPA

- HEXION INC.

- SUMITOMO BAKELITE COMPANY LTD.

- SABIC

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 6 GLOBAL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 7 GLOBAL COMPOSITE RESIN MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL COMPOSITE RESIN MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA COMPOSITE RESIN MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA COMPOSITE RESIN MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 17 US COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 18 US COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 19 US COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 US COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 22 US COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 23 CANADA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 CANADA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 28 CANADA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 29 MEXICO COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 34 MEXICO COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA COMPOSITE RESIN MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA COMPOSITE RESIN MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 43 BRAZIL COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 48 BRAZIL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 49 ARGENTINA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 54 ARGENTINA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 55 COLOMBIA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 60 COLOMBIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC COMPOSITE RESIN MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC COMPOSITE RESIN MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 75 INDIA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 INDIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 80 INDIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 81 CHINA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 CHINA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 86 CHINA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 87 JAPAN COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 JAPAN COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 92 JAPAN COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 117 EUROPE COMPOSITE RESIN MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE COMPOSITE RESIN MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 ASIA-PACIFIC COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 120 ASIA-PACIFIC COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 121 ASIA-PACIFIC COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 ASIA-PACIFIC COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 123 ASIA-PACIFIC COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 124 ASIA-PACIFIC COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 125 GERMANY COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 130 GERMANY COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 131 UK COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 132 UK COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 133 UK COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 136 UK COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 137 FRANCE COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 FRANCE COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 142 FRANCE COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 143 ITALY COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 147 ITALY COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 148 ITALY COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 149 SPAIN COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 SPAIN COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 154 SPAIN COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 155 RUSSIA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 160 RUSSIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 175 UAE COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 176 UAE COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 177 UAE COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 UAE COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 180 UAE COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COMPOSITE RESIN MARKET BY RESIN TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS, USD BILLION, 2020-2029

FIGURE 10 GLOBAL COMPOSITE RESIN MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL COMPOSITE RESIN MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL COMPOSITE RESIN MARKET BY RESIN TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL COMPOSITE RESIN MARKET BY MANUFACTURING PROCESS, USD BILLION, 2021

FIGURE 15 GLOBAL COMPOSITE RESIN MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL COMPOSITE RESIN MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA COMPOSITE RESIN MARKET SNAPSHOT

FIGURE 18 EUROPE COMPOSITE RESIN MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA COMPOSITE RESIN MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC COMPOSITE RESIN MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA COMPOSITE RESIN MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 KUKDO CHEMICAL CO. LTD.: COMPANY SNAPSHOT

FIGURE 24 ALPHA OWENS-CORNING: COMPANY SNAPSHOT

FIGURE 25 REICHHOLD INC.: COMPANY SNAPSHOT

FIGURE 26 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 27 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 28 BASF SE: COMPANY SNAPSHOT

FIGURE 29 POLYNT SPA: COMPANY SNAPSHOT

FIGURE 30 HEXICON INC.: COMPANY SNAPSHOT

FIGURE 31 SUMITOMO BAKELITE COMMPANY LTD.: COMPANY SNAPSHOT

FIGURE 32 SABIC: COMPANY SNAPSHOT

FAQ

Some key players operating in the Global Composite Resin market include Kukdo Chemical Co. Ltd., Alpha Owens-Corning, Reichhold Inc., Huntsman Corporation, The Dow Chemical Company, BASF SE, Polynt SpA, Hexion Inc., Sumitomo Bakelite Company Ltd., SABIC.

One of the major drivers of the market’s expansion is the growing use of composite resin in the building and construction industry, as well as in aerospace and military applications. Additionally, another factor driving the market’s growth is the demand for light materials from transportation, which improves fuel economy as a result.

The global composite resin market size was estimated at USD 20.84 billion in 2021 and is expected to reach USD 33.26 billion in 2029.

The global composite resin market is expected to grow at a compound annual growth rate of 6.02 % from 2022 to 2029 to reach USD 33.26 billion by 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.