REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 13.16 USD billion by 2029 | 13.87% | Asia Pacific |

| by Battery Type | by Material Type | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Battery Separators Market Overview

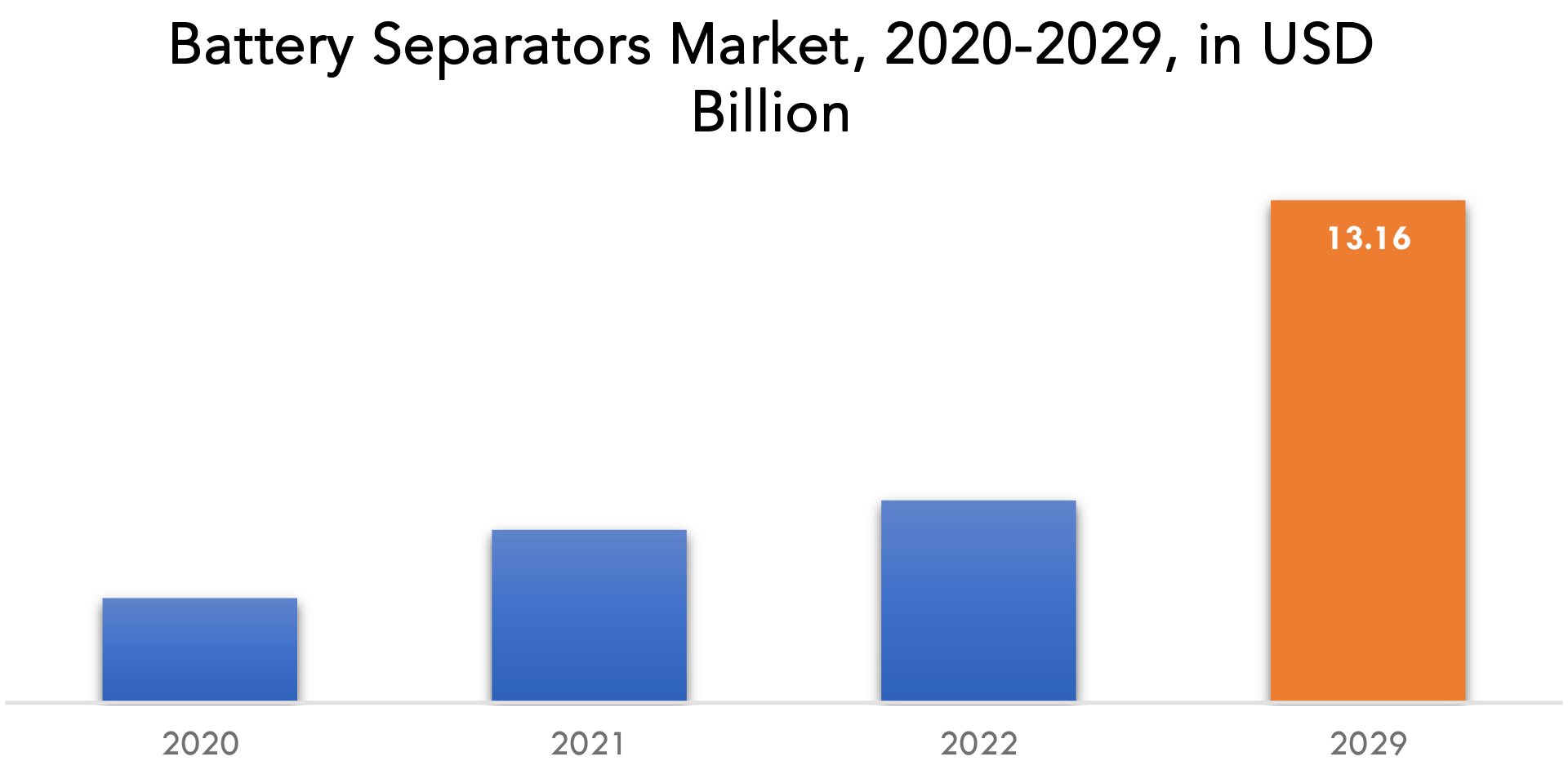

The battery separators Market is expected to grow at 13.87% CAGR from 2022 to 2029. It is expected to reach above USD 13.16 USD billion by 2029 from USD 4.53 billion in 2021.

Anode (the positive electrode) and cathode (the negative electrode) components of a cell are mechanically separated by battery separators. These barriers allow for optimal ionic conductivity during charging or discharging while also preventing short-circuits between the battery’s interior parts. Separators are chemically and electrochemically stable to the electrolyte and electrode materials of a battery and have a porous structure. In the event of an overheat or short circuit, the separator is intended to turn off the batteries. The battery separator, an isolator with no electrical conductivity, permits particles to flow freely between the anodes. Current separators, whether in commercial use or development, have not yet met the high stability and lifespan performance standards required to sustain the efficacy and dependability of battery technology. Compounds such as battery separators emit controlled volatile organic chemicals that aid in the formation of low-level ozone.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (THOUSAND UNITS) |

| Segmentation | By battery type, by material type, by end user, by region |

| By Battery Type |

|

| By Material Type |

|

| By End User |

|

| By Region |

|

Battery separators are used in the pesticide, adhesive and sealant, photographic reproduction, and textile industries. The majority of battery separators are used for metal degreasing, dry cleaning, rubber and polymer, fuel additives, and oil refining and recovery. With around half of the market, the majority of solvents are used as dissolve agents in a variety of industries, followed by washing, degreasing, and purifying. Battery separators are frequently used as ingredients in product formulations or as production process aids. The best way to utilize a solution’s physical and chemical properties is to use the proper solvents, which makes them suitable for usage in a variety of industrial systems and processes.

A rise in the demand for electric cars to reduce carbon footprint is the main factor fueling the market growth of battery separators market. The primary market drivers are the quick increase in automobile revenue and the rising demand for smart electronic gadgets. Additionally, the development of lithium-ion batteries has accelerated market expansion. Global need for battery separators is being driven by rising population and industrialization, as well as rising demand for electrically powered vehicles and other battery technological advancements.

Throughout the projection period, battery separator demand will rise across a number of industries, including consumer electronics and transportation. Additionally, the increased use of wet separators and micro grids in the automotive sector is anticipated to boost the market share for battery separators throughout the forecast period. A major factor supporting the growth of the battery separator market over the forecast period is the rising demand for lithium-ion batteries, which will increase with the use of battery separators. This is due to the rising popularity of electric vehicles. Additionally, the market for battery separators is expanding due to the quickly rising need for highly effective batteries across a variety of end-use sectors.

Handling batteries of any kind entails potential dangers. Whether they are in use, charging, or just being kept, if the right safety measures are not taken, they could be dangerous to people and buildings around. Battery chargers that burn, explode, or overheat could be one of the issues, which could result in heat burns and electrical shock. Accidents, fatalities, and property loss can occur as a result of these. A number of industrial injuries occur each year as a result of improper handling of lithium-ion batteries. Traditional lead acid batteries and even 9-volt dry cell batteries bought at the grocery store can drastically jeopardize the health and safety of anyone. Thus, proper storage and transportation of batteries can be a restraint on the market growth.

Battery energy storage systems are among the technologies in the fast-growing sustainable energy industry. The effectiveness of energy storage systems is now acknowledged as techniques that have been developed to reduce the dependency on fossil fuels and frequently unstable energy sources. One of the most common battery types used in energy storage devices are lithium-ion batteries. Approximately 90% of the grid battery storage business is made up of lithium-ion batteries. Additionally, because they are a more cost-effective battery option and are recyclable, lead-acid batteries are a great choice for a battery storage system, according to the ESA(European Space agency) . Due to the fact that their active components are not Rammable, they are also safer than some other chemistries. These batteries are created for high power and outstanding performance. This usage of battery in the energy storage devices will create immense opportunities for the battery separator market.

The market for battery separators suffered as a result of the recent coronavirus outbreak. Numerous industry sectors have been severely harmed by the pandemic’s lockdown. Logistics, supply chain disruption, diminishing demand from the manufacturing, electronics, and other prospective end-user industries, as well as problems with the oil and gas industry, are a few of the significant problems that have impeded the overall expansion of the battery separator industry. The majority of the batteries used in electric vehicles are purchased by the automobile sector. Automakers stopped manufacturing as a result of COVID-19’s appearance due to the regulations. Battery separator usage had declined as a result of the decline in battery consumption. Additionally, due to logistical challenges, finished goods were not delivered to manufacturing facilities and raw materials.

Battery Separators Market Segment Analysis

The Battery Separators market is segmented based on Battery Type, Material Type and End User.

By Battery Type, the market is bifurcated into lithium-Ion and lead Acid. The lithium-ion segment is expected to grow due to increased production of the battery required for electric vehicles. Governments across the world are encouraging the adoption of electric vehicles which is further fueling the segment growth.

Based on the material, market is further segmented into polyethylene, polypropylene and others. The polyethylene segments accounts for the largest market share. The ability of the product to cut off the battery if the core temperature rises above 130°C, eliminating short circuits and thermal runaway, is one of its features that can be contributed to the segment’s growth. One of the most widely used polyolefin battery separators is polypropylene, which is also utilized in the consumer electronics and automobile industries.

Between the various end users for the battery separators market, automotive sector dominated the market in the year 2020. The biggest end-user of battery separators is the automotive sector. The demand for lithium-ion batteries in the automotive industry is rising. Also, the penetration of electric vehicles is expected to generate substantial revenue in the forecast period.

Battery Separators Market Players

The Battery Separators market key players include Toray Industry, SK Innovation, Asahi Kasei , Freudenberg , W-Scope Industries , Entek International, Ube Industries , Dreamweaver International , Sumitomo Chemical , and Bernard Dumas .

Recent Developments

January 31, 2023: – Toray Industries, Inc., announced that it has verified the high durability of its all-carbon carbon dioxide (CO2) separation membrane in harsh environments. These are notably under high partial CO2 pressures and in the presence of impurities in natural gas production refining processes.

January 26, 2023: Toray Industries, Inc., announced that it has developed recycled nylon 66 recovered from silicone-coated airbag fabric scrap cuttings. This material achieves the same flowability and mechanical properties as injection molding grades from virgin nylon 66.

Who Should Buy? Or Key stakeholders

- Battery Separator Suppliers

- Raw Materials Manufacturers

- Automotive organizations

- Battery manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Battery Separators Market Regional Analysis

The Battery Separators market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

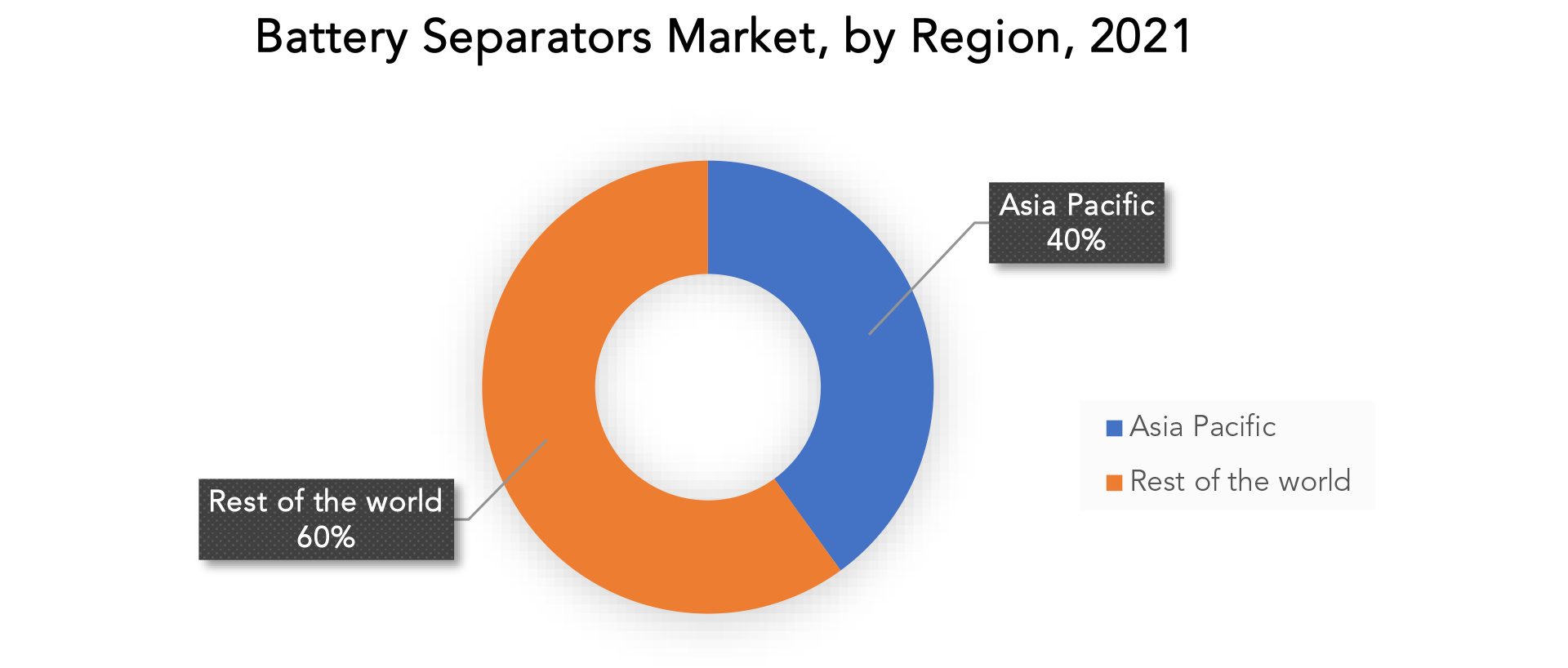

The largest solvent exporter in the world as well as the sector’s growth engine is Asia-Pacific. As a result of the majority of Asia Pacific countries having gone through a prolonged period of rapid economic expansion, which was reflected in rising earnings and the recent rise of a middle class in those markets, the region retains the greatest market share, or around 44%. One of the key reasons supporting the Battery Separator Market expansion in APAC over the projected period is the rising propensity for R&D to improve the technologies already in use to support EV sales. China being the largest market for automotive industry is also one of the factors affecting the market growth of battery separators market. Also, there is an increase in the penetration of consumer electronics which will support the growth of the market in the region.

Europe has some of the largest battery manufacturers. Batteries are used as sustainable and compact sources of power in automotive and consumer electronics. As the consumer electronics market is growing in the region, there is a rising demand for battery separators. The region is expected to witness the highest growth in the forecast period. In North America the rapid adoption of electric vehicle will boost the market growth of battery separators market. Due to the expanding of the automotive industry in Brazil and Mexico , South America market is also expected to grow.

Key Market Segments: Battery Separators market

Battery Separators Market by Battery Type, 2020-2029, (USD Billion), (Thousand Units)

- Lithium-Ion

- Lead Acid

Battery Separators Market by Material Type, 2020-2029, (USD Billion), (Thousand Units)

- Polypropylene

- Polyethylene

Battery Separators Market by End User, 2020-2029, (USD Billion), (Thousand Units)

- Automotive

- Industrial

- Consumer Electronics

Battery Separators Market by Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the battery separators market over the next 7 years?

- Who are the major players in the battery separators market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the battery separators market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the battery separators market?

- What is the current and forecasted size and growth rate of the global battery separators market?

- What are the key drivers of growth in the battery separators market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the battery separators market?

- What are the technological advancements and innovations in the battery separators market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the battery separators market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the battery separators market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of battery separators in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BATTERY SEPARATORS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BATTERY SEPARATORS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BATTERY SEPARATORS MARKET OUTLOOK

- GLOBAL BATTERY SEPARATORS MARKET BY BATTERY TYPE, (USD BILLION, THOUSAND UNITS)

- LI-ION

- LEAD ACID

- GLOBAL BATTERY SEPARATORS MARKET BY MATERIAL TYPE, (USD BILLION, THOUSAND UNITS)

- POLYPROPYLENE

- POLYETHYLENE

- GLOBAL BATTERY SEPARATORS MARKET BY END USER, (USD BILLION, THOUSAND UNITS)

- AUTOMOTIVE

- INDUSTRIAL

- CONSUMER ELECTRONICS

- GLOBAL BATTERY SEPARATORS MARKET BY REGION, (USD BILLION, THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- TORAY INDUSTRY

- SK INNOVATION

- ASAHI KASEI

- FREUDENBERG

- W-SCOPE INDUSTRIES

- ENTEK INTERNATIONAL

- UBE INDUSTRIES

- DREAMWEAVER INTERNATIONAL

- SUMITOMO CHEMICAL

- BERNARD DUMAS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL BATTERY SEPARATORS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL BATTERY SEPARATORS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA BATTERY SEPARATORS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA BATTERY SEPARATORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 18 US BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 US BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 20 US BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 US BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA BATTERY SEPARATORS MARKET BY BATTERY TYPE (BILLION), 2020-2029

TABLE 24 CANADA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 26 CANADA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 32 MEXICO BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA BATTERY SEPARATORS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA BATTERY SEPARATORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 46 BRAZIL BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 52 ARGENTINA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 56 COLOMBIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 57 COLOMBIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 58 COLOMBIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 COLOMBIA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 67 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 73 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC BATTERY SEPARATORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 75 INDIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 76 INDIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 INDIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 78 INDIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 INDIA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 81 CHINA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 82 CHINA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 CHINA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 84 CHINA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 CHINA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 87 JAPAN BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 88 JAPAN BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 JAPAN BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 90 JAPAN BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 91 JAPAN BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 93 SOUTH KOREA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 SOUTH KOREA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 SOUTH KOREA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 99 AUSTRALIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA BATTERY SEPARATORSBY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 AUSTRALIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 AUSTRALIA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 105 SOUTH EAST ASIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA BATTERY SEPARATORSBY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 SOUTH EAST ASIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 SOUTH EAST ASIA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC BATTERY SEPARATORSBY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 118 EUROPE BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 120 EUROPE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 123 EUROPE BATTERY SEPARATORS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE BATTERY SEPARATORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 128 GERMANY BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 GERMANY BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 131 UK BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 132 UK BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 133 UK BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 134 UK BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 UK BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 137 FRANCE BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 140 FRANCE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 141 FRANCE BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 146 ITALY BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 147 ITALY BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 152 SPAIN BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 153 SPAIN BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 158 RUSSIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 159 RUSSIA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF EUROPE BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 175 UAE BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 176 UAE BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 177 UAE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 178 UAE BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 179 UAE BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 185 SAUDI ARABIA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 191 SOUTH AFRICA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY BATTERY TYPE (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY MATERIAL TYPE (THOUSAND UNITS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA BATTERY SEPARATORS MARKET BY END USER (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BATTERY SEPARATORS BY BATTERY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL BATTERY SEPARATORS BY MATERIAL TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL BATTERY SEPARATORS BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL BATTERY SEPARATORS BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 BATTERY SEPARATORS MARKET BY REGION 2021

FIGURE 14 BATTERY SEPARATORS MARKET BY MATERIAL TYPE 2021

FIGURE 15 BATTERY SEPARATORS MARKET BY BATTERY TYPE 2021

FIGURE 16 BATTERY SEPARATORS MARKET BY END USER 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 TORAY INDUSTRY: COMPANY SNAPSHOT

FIGURE 19 SK INNOVATION: COMPANY SNAPSHOT

FIGURE 20 ASAHI KASEI: COMPANY SNAPSHOT

FIGURE 21 FREUDENBERG: COMPANY SNAPSHOT

FIGURE 22 W-SCOPE INDUSTRIES: COMPANY SNAPSHOT

FIGURE 23 ENTEK INTERNATIONAL.: COMPANY SNAPSHOT

FIGURE 24 UBE INDUSTRIES: COMPANY SNAPSHOT

FIGURE 25 DREAMWEAVER INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 26 SUMITOMO CHEMICAL: COMPANY SNAPSHOT

FIGURE 27 BERNARD DUMAS: COMPANY SNAPSHOT

FAQ

The Battery Separators market size was 4.53 USD Billion in the year 2021 and expected to grow at a rate of 13.87 CAGR to 13.16 USD Billion in 2029.

Asia Pacific held more than 44% of the Battery Separators market revenue share in 2021 and will witness expansion in the forecast period.

A rise in the demand for electric cars to reduce carbon footprint are the factors fueling the market growth of battery separators market.

Between the various end users for the battery separators market, automotive sector dominated the market in the year 2020. The biggest end-user of battery separators is the automotive sector. The demand for lithium-ion batteries in the automotive industry is rising. Also, the penetration of electric vehicles is expected to generate substantial revenue in the forecast period.

The largest solvent exporter in the world as well as the sector’s growth engine is Asia-Pacific. As a result of the majority of Asia Pacific countries having gone through a prolonged period of rapid economic expansion, which was reflected in rising earnings and the recent rise of a middle class in those markets, the region retains the greatest market share, or around 44%.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.