REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 33.24 billion by 2029 | 7.3 % | Asia Pacific |

| By Product Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Silicone Market Overview

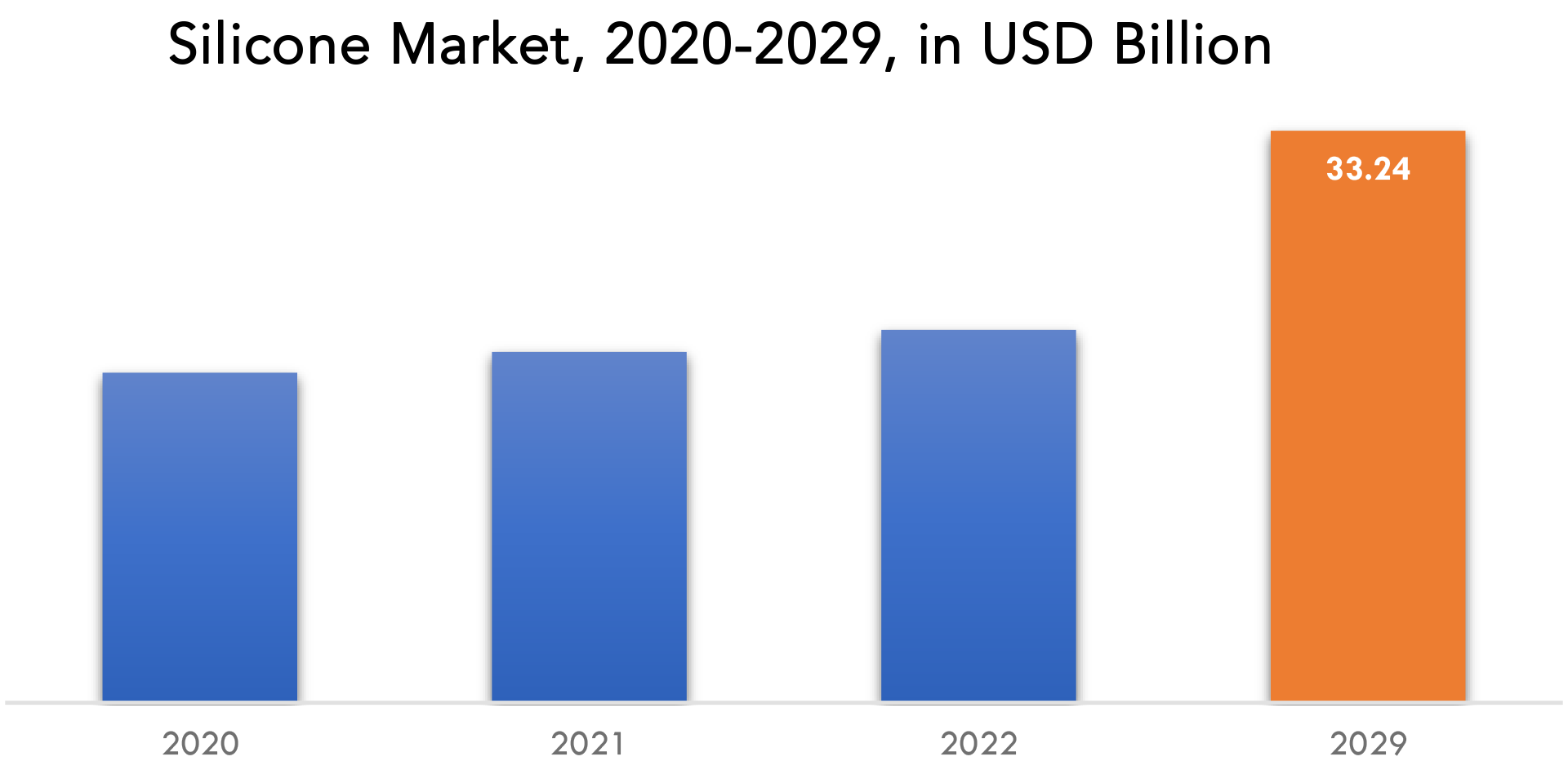

The global silicone market is projected to reach USD 33.24 billion by 2029 from USD 19.18 billion in 2020, at a CAGR of 7.3 % from 2022 to 2029.

Silicone is a high performance polymer that comprises of siloxanes. It is prepared by hydrolysis of dimethyl dichlorosilane. Silicone exhibits various properties like low chemical reactivity, low toxicity, low thermal conductivity, and thermal stability. It can be formulated to be electrically conductive or insulative thus making it suitable for electrical applications. It contains a wide range of chemical and physical properties. They are resistant to moisture, cold, ultraviolet radiation, heat, and several chemicals.

Silicone is widely used in various end-use industries such as construction, electronics, transportation, healthcare, personal care & consumer goods, energy, and industrial process, among others. Fluids, gels, resins, elastomers, adhesives, and emulsions are the significant silicone types used in various end-use industries. Increasing demand for elastomers from various applications, such as electric vehicles, architectural elements, energy, and electronics, owing to their favorable properties such as excellent thermal resistance, chemical resistance, water repellence, and dielectric properties are anticipated to substantially fuel the demand for silicone elastomers over the forecast period.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) Volume (Kilotons) |

| Segmentation | By Product Type, By Application, By Region. |

| By Product Type

|

|

| By Application

|

|

| By Region

|

|

Silicone is a material that is used in the automotive business to make a variety of parts, including hoses, seals, and gaskets. The silicone market in the automotive sector is anticipated to expand as a result of the rising demand for lightweight, fuel-efficient vehicles. Another significant user of silicone is the building sector, where it is found in coatings, sealants, and adhesives. The development of the silicone market in the construction sector is anticipated to be fueled by the rising demand for eco-friendly structures and materials.

The production of various components like wires and cables, seals, and adhesives uses silicone, which is a major consumer in the electronics industry. The electronics industry’s silicone market is anticipated to expand as a result of the rising demand for electronics products.

Many personal care and cosmetic items, including creams, shampoos, foundations, eyeshadows, and blushers, contain silicones. This is one of the main factors spurring market development along with people’s growing awareness of their physical appearance. It can also be credited to the advantages of the goods themselves, such as lengthening their useful lives and shielding the skin from environmental harm and chemical exposure through the formation of a barrier.

The demand for silicones is also being fueled by the increasing popularity of photovoltaic panels and equipment because they are less expensive and increase performance, durability, and efficiency. A favourable outlook for the market is also being created by the rising prevalence of chronic illnesses like osteoporosis, cardiovascular disease, and Alzheimer’s.

Furthermore, during the forecast period, the increase in demand might be hampered by strict regulatory policies regarding the use of silicones. The development of the silicone market is anticipated to be constrained by increasing costs for raw materials, which raise the price of manufacturing. The low supply of raw silicone as a consequence of the closure of the manufacturing facilities is thought to be a significant factor influencing silicone material costs.

Silicone Market Segment Analysis

The global silicone market is segmented by product type, application and region.

Based on product type, the silicone market is classified into elastomers, fluids, resins, gels, other. The silicone market is expected to be led by the elastomers sector, which will account for the greatest revenue share (41.56%) in 2021. These elastomers, which have the properties of viscosity and elasticity and are employed in the production of lightweight components, are composed of a mixture of linear polymers, cross linkers, reinforcing agents, and catalysts. The demand for lightweight automotive components has increased recently, which helps to boost fuel efficiency and lower carbon emissions, and this is projected to fuel the expansion of the silicone market.

A result of its physiological inertness quality, silicones have seen a dramatic increase in demand in the healthcare sector. Prosthetics, synthetic heart valves, and blood transformation bags are just a few of the medicinal uses for them. The elastomer segment is predicted to rise significantly over the forecast period as a result of these numerous uses and ongoing increases in demand from end-use industries.

The market share held by the fluid segment was the greatest, and it is anticipated that during the projected period, it would expand at a CAGR of 4.2%. Silicone fluids are colorless, odorless, and clear liquids that exhibit good thermos-oxidative resistance in operations between -60 degrees and +300 degrees.

Based on application, the silicone market is segmented into industrial process, building & construction, transportation, personal care & consumer products, medical & healthcare, electronics, energy, others. In 2021, the industrial process sector dominated the market and generated more than 25.8% of total revenue. Silicones are widely employed in many industrial processes for a variety of purposes, including lubricants, antifoaming agents, paper manufacture, industrial coatings, and paint additives. By providing various components with improved durability, thermal resistance, and resistance to corrosion and chemicals, silicone is utilized in paints and coatings to raise performance and lower maintenance costs for industrial infrastructure and machinery.

Due to the widespread usage of silicones in building construction due to their high strength and moisture resistance features, the construction industry is also anticipated to rise at a 4.2% CAGR in the future years. Moreover, silicones are employed in the production of polymers, glass, marble, steel, and aluminum. Many of these characteristics are anticipated to fuel the silicone market’s expansion.

Silicone Market Players

The global silicone market key players include Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Illinois Tool Works Inc., Evonik Industries AG, Hutchinson, Kemira Oyj, Dow Inc., AbbVie Inc., KCC Corporation, Elkem ASA, Ashland, Momentive, Kemira, Wacker Chemie, Amul Polymers, Specialty Silicone Products, Inc., Supreme Silicones, Silchem Inc., BASF SE, and others.

Recent developments:

- 30 March 2022: A new vulcanization type of liquid silicone rubber with one component, the KCP Series, has been created by Shin-Etsu Chemical Co., Ltd. At room temperature, one-component liquid silicone rubber hardens by responding to humidity in the air. It is used as adhesive/sealing materials and coating materials in products like component parts for electric vehicles (EV), semiconductors, and electric/electronics

- 14 October 2022: Yasuhiko Saitoh, President of Shin-Etsu Chemical Co., Ltd., has developed the first silicone film-forming emulsion for fiber-treatment applications that is available on the market. In response to customer requests, this product—which has never been produced before—was made.

- 12 August 2020: Wacker Chemie AG cooperated with H.M. Royal, a specialty chemical distributor, to sell SILPURAN, a liquid silicone rubber (LSR) and high consistency rubber (HCR) specifically created for medical applications.

Who Should Buy? Or Key stakeholders

- Regional agencies and research organizations

- Investment research firm

- Automobile Industry

- Construction Industry

- Electrical Industry

- Paints & Coating Industry

- Research Organizations

- End-Use Industry

Silicone Market Regional Analysis

The silicone market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

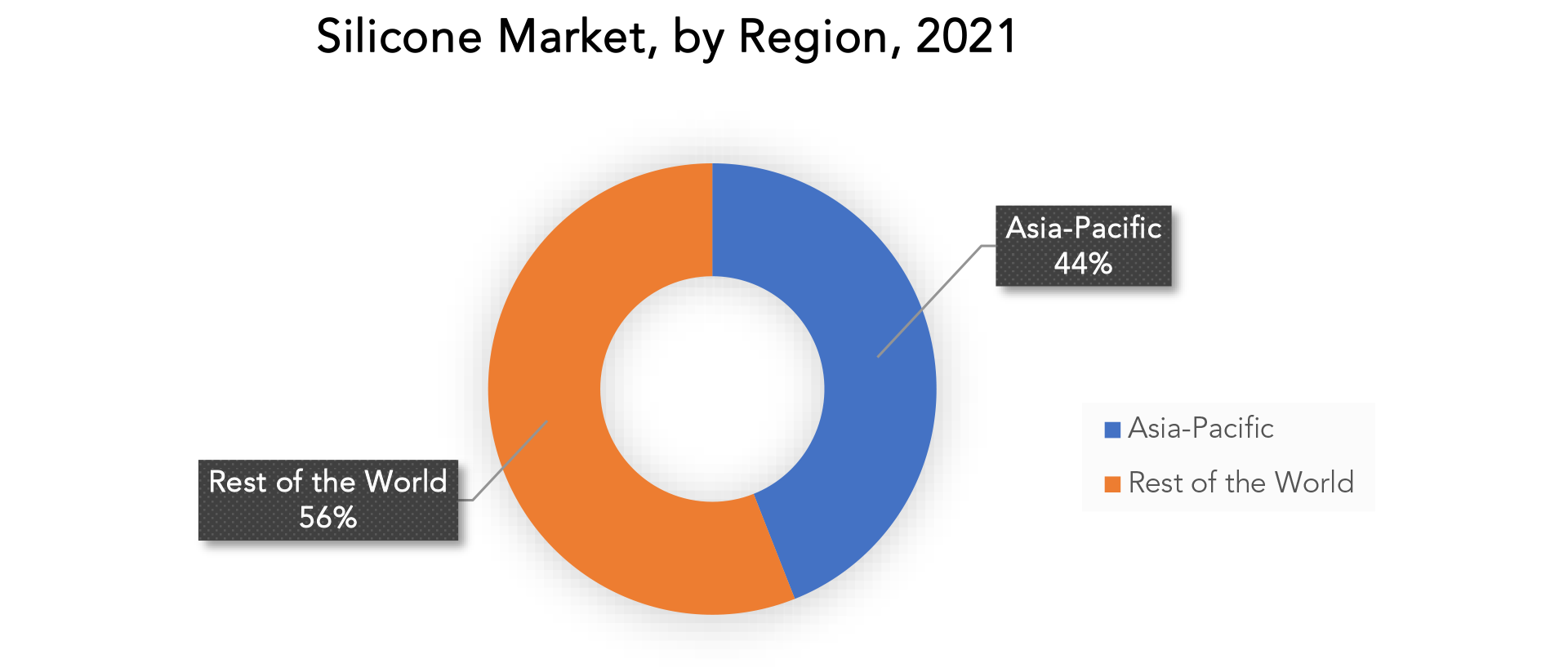

The Asia Pacific region has emerged as the world’s biggest Silicone market, with an estimated 7.0 billion in market revenue in 2021 and a market share of over 44%. The growth of the Silicone market in the Asia Pacific region is due to the development of medical healthcare facilities by various small and medium-sized businesses. Market players are anticipated to relocate their manufacturing operations from Europe and North America to Asia over the course of the forecast period due to factors like improved raw material availability, low labor costs, and increased market penetration opportunities in end-use industries like transportation, construction, industrial process, personal care and consumer products, electronics, healthcare, and energy.

Europe is the second-largest area. It is anticipated to achieve an expected USD 5220 million by 2029, with a CAGR of 3.9%. The major factor driving the silicone market in Europe is the expanding demand for lightweight silicones in construction and transit. It is expected that during the projected period, product demand will increase because countries like the United Kingdom, Germany, Spain, and France are experiencing growth in the building industry. The expansion of the building industry in the area is anticipated to be aided by a combination of increased EU funding and advantageous policies (such as tax breaks, incentives, and subsidies) created by numerous governments.

North America is the third-largest area due to the region’s expanding use of silicone in numerous industries, such as transportation, construction, industrial processes, personal care, consumer goods, and energy. North America is one of the top markets for silicone compounds because of its high demand in the production of chemicals, paints and coatings, food and beverages, and composites. The region’s high growth potential for medical-grade silicones is also influenced by a substantial amount of significant regional manufacturers and a high level of demand from the healthcare industry. Positive growth is expected throughout the projection period as a result of rising demand for minimally invasive procedures, the availability of cutting-edge implant devices, and the sophistication of the healthcare infrastructure in the United States.

Key Market Segments: Silicone Market

Silicone Market By Product Type, 2020-2029, (Usd Billion) (Kilotons)

- Elastomers

- Fluids

- Resins

- Gels

- Other

Silicone Market By Application, 2020-2029, (Usd Billion) (Kilotons)

- Industrial Process

- Building & Construction

- Transportation

- Personal Care & Consumer Products

- Medical & Healthcare

- Electronics

- Energy

- Others

Silicone Market By Region, 2020-2029, (Usd Billion) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the silicone market over the next 7 years?

- Who are the major players in the silicone market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the silicone market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the silicone market?

- What is the current and forecasted size and growth rate of the global silicone market?

- What are the key drivers of growth in the silicone market?

- What are the distribution channels and supply chain dynamics in the silicone market?

- What are the technological advancements and innovations in the silicone market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the silicone market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the silicone market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of silicone in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SILICONE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SILICONE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SILICONE MARKET OUTLOOK

- GLOBAL SILICONE MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION) (KILOTONS)

- ELASTOMERS

- FLUIDS

- RESINS

- GELS

- OTHER

- GLOBAL SILICONE MARKET BY APPLICATION, 2020-2029, (USD BILLION) (KILOTONS)

- INDUSTRIAL PROCESS

- BUILDING & CONSTRUCTION

- TRANSPORTATION

- PERSONAL CARE & CONSUMER PRODUCTS

- MEDICAL & HEALTHCARE

- ELECTRONICS

- ENERGY

- OTHERS

- GLOBAL SILICONE MARKET BY REGION, 2020-2029, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

8.1. SHIN-ETSU CHEMICAL CO. LTD.

8.2. WACKER CHEMIE AG

8.3. ILLINOIS TOOL WORKS INC.

8.4. EVONIK INDUSTRIES AG

8.5. HUTCHINSON

8.6. KEMIRA OYJ

8.7. DOW INC.

8.8. ABBVIE INC.

8.9. KCC CORPORATION

8.10. ELKEM ASA

8.11. ASHLAND

8.12. MOMENTIVE

8.13. KEMIRA

8.14. WACKER CHEMIE

8.15. AMUL POLYMERS

8.16. SPECIALTY SILICONE PRODUCTS INC.

8.17. SUPREME SILICONES

8.18. SILCHEM INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 GLOBAL SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 NORTH AMERICA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA SILICONE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA SILICONE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 13 US SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 14 US SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 15 US SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 US SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 US SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 18 US SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 19 CANADA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 20 CANADA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 21 CANADA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 22 CANADA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 CANADA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 24 CANADA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 25 MEXICO SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 26 MEXICO SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 27 MEXICO SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 MEXICO SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 29 MEXICO SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 30 MEXICO SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 31 SOUTH AMERICA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 32 SOUTH AMERICA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 33 SOUTH AMERICA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 SOUTH AMERICA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA SILICONE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA SILICONE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 BRAZIL SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 38 BRAZIL SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 39 BRAZIL SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 BRAZIL SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 BRAZIL SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 42 BRAZIL SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 43 ARGENTINA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 44 ARGENTINA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 45 ARGENTINA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 ARGENTINA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 ARGENTINA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 48 ARGENTINA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 49 COLOMBIA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 50 COLOMBIA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 51 COLOMBIA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 COLOMBIA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 COLOMBIA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 54 COLOMBIA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 55 REST OF SOUTH AMERICA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 56 REST OF SOUTH AMERICA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 57 REST OF SOUTH AMERICA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 REST OF SOUTH AMERICA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 REST OF SOUTH AMERICA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 60 REST OF SOUTH AMERICA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 61 ASIA-PACIFIC SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 62 ASIA-PACIFIC SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 63 ASIA-PACIFIC SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 ASIA-PACIFIC SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 ASIA-PACIFIC SILICONE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 66 ASIA-PACIFIC SILICONE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 67 INDIA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 68 INDIA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 69 INDIA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 70 INDIA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 INDIA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 72 INDIA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 73 CHINA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 74 CHINA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 75 CHINA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 CHINA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 77 CHINA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 78 CHINA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 79 JAPAN SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 80 JAPAN SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 81 JAPAN SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 82 JAPAN SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 JAPAN SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 84 JAPAN SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 85 SOUTH KOREA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 86 SOUTH KOREA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 87 SOUTH KOREA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 88 SOUTH KOREA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 89 SOUTH KOREA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 90 SOUTH KOREA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 91 AUSTRALIA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 92 AUSTRALIA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 93 AUSTRALIA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 AUSTRALIA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 AUSTRALIA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 96 AUSTRALIA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 97 SOUTH-EAST ASIA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 98 SOUTH-EAST ASIA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 99 SOUTH-EAST ASIA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 100 SOUTH-EAST ASIA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 101 SOUTH-EAST ASIA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 102 SOUTH-EAST ASIA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 103 REST OF ASIA PACIFIC SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 104 REST OF ASIA PACIFIC SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 105 REST OF ASIA PACIFIC SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 106 REST OF ASIA PACIFIC SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 107 REST OF ASIA PACIFIC SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 108 REST OF ASIA PACIFIC SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 109 ASIA-PACIFIC SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 110 ASIA-PACIFIC SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 111 ASIA-PACIFIC SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 112 ASIA-PACIFIC SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 113 EUROPE SILICONE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 114 EUROPE SILICONE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 115 GERMANY SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 116 GERMANY SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 117 GERMANY SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 GERMANY SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 119 GERMANY SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 120 GERMANY SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 121 UK SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 122 UK SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 123 UK SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 UK SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 UK SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 126 UK SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 127 FRANCE SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 128 FRANCE SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 129 FRANCE SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 130 FRANCE SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 131 FRANCE SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 132 FRANCE SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 133 ITALY SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 134 ITALY SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 135 ITALY SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 136 ITALY SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 137 ITALY SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 138 ITALY SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 139 SPAIN SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 140 SPAIN SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 141 SPAIN SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 SPAIN SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 143 SPAIN SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 144 SPAIN SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 145 RUSSIA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 146 RUSSIA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 147 RUSSIA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 148 RUSSIA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 149 RUSSIA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 150 RUSSIA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 151 REST OF EUROPE SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 152 REST OF EUROPE SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 153 REST OF EUROPE SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 154 REST OF EUROPE SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 155 REST OF EUROPE SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 156 REST OF EUROPE SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 157 MIDDLE EAST AND AFRICA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 158 MIDDLE EAST AND AFRICA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 159 MIDDLE EAST AND AFRICA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 MIDDLE EAST AND AFRICA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 161 MIDDLE EAST AND AFRICA SILICONE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 162 MIDDLE EAST AND AFRICA SILICONE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 163 UAE SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 164 UAE SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 165 UAE SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 166 UAE SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 167 UAE SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 168 UAE SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 169 SAUDI ARABIA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 170 SAUDI ARABIA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 171 SAUDI ARABIA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 SAUDI ARABIA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 173 SAUDI ARABIA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 174 SAUDI ARABIA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 175 SOUTH AFRICA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 176 SOUTH AFRICA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 177 SOUTH AFRICA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 SOUTH AFRICA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 SOUTH AFRICA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 180 SOUTH AFRICA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 181 REST OF MIDDLE EAST AND AFRICA SILICONE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 182 REST OF MIDDLE EAST AND AFRICA SILICONE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 183 REST OF MIDDLE EAST AND AFRICA SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 REST OF MIDDLE EAST AND AFRICA SILICONE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 REST OF MIDDLE EAST AND AFRICA SILICONE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 186 REST OF MIDDLE EAST AND AFRICA SILICONE MARKET BY REGION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SILICONE MARKET BY TYPE (USD BILLION) 2020-2029

FIGURE 9 GLOBAL SILICONE MARKET BY APPLICATION (USD BILLION) 2020-2029

FIGURE 10 GLOBAL SILICONE MARKET BY REGION (USD BILLION) 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SILICONE MARKET BY TYPE 2021

FIGURE 13 GLOBAL SILICONE MARKET BY APPLICATION 2021

FIGURE 14 GLOBAL SILICONE MARKET BY REGION 2021

FIGURE 15 NORTH AMERICA SILICONE MARKET SNAPSHOT

FIGURE 16 EUROPE SILICONE MARKET SNAPSHOT

FIGURE 17 SOUTH AMERICA SILICONE MARKET SNAPSHOT

FIGURE 18 ASIA PACIFIC SILICONE MARKET SNAPSHOT

FIGURE 19 MIDDLE EAST ASIA AND AFRICA SILICONE MARKET SNAPSHOT

FIGURE 20 MARKET SHARE ANALYSIS

FIGURE 21 SHIN-ETSU CHEMICAL CO. LTD.: COMPANY SNAPSHOT

FIGURE 22 WACKER CHEMIE AG: COMPANY SNAPSHOT

FIGURE 23 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

FIGURE 24 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 25 HUTCHINSON: COMPANY SNAPSHOT

FIGURE 26 KEMIRA OYJ: COMPANY SNAPSHOT

FIGURE 27 DOW INC.: COMPANY SNAPSHOT

FIGURE 28 ABBVIE INC.: COMPANY SNAPSHOT

FIGURE 29 KCC CORPORATION: COMPANY SNAPSHOT

FIGURE 30 ELKEM ASA: COMPANY SNAPSHOT

FIGURE 31 ASHLAND: COMPANY SNAPSHOT

FIGURE 32 MOMENTIVE: COMPANY SNAPSHOT

FIGURE 33 KEMIRA: COMPANY SNAPSHOT

FIGURE 34 WACKER CHEMIE: COMPANY SNAPSHOT

FIGURE 35 AMUL POLYMERS: COMPANY SNAPSHOT

FIGURE 36 SPECIALTY SILICONE PRODUCTS INC.: COMPANY SNAPSHOT

FIGURE 37 SUPREME SILICONES: COMPANY SNAPSHOT

FIGURE 38 SILCHEM INC.: COMPANY SNAPSHOT

FIGURE 39 BASF SE: COMPANY SNAPSHOT

FAQ

The global silicone market is projected to reach USD 33.24 billion by 2029 from USD 19.18 billion in 2020, at a CAGR of 7.3 % from 2022 to 2029.

Silicones are more in demand in the paper and pulp manufacturing sector because they improve production efficiency and reduce foam formation. Since the largest nations producing paper and pulp are the U.S., Canada, Japan, and South Korea, the need for silicones in these nations is rising rapidly.

The global Silicone market registered a CAGR of 7.3 % from 2022 to 2029

In 2021, the Asia Pacific region dominated the silicone market, using the most silicone globally. Due to its enormous user base, China had the largest market among the Asian countries. At the same time, North America and Europe chased Asia Pacific. The market for silicone is also anticipated to grow somewhat in the coming years in the U.S. and Europe due to silicone’s significant contribution to its development.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.