REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 15.2 billion | 7% | North America |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Polymer Tubes Market Overview

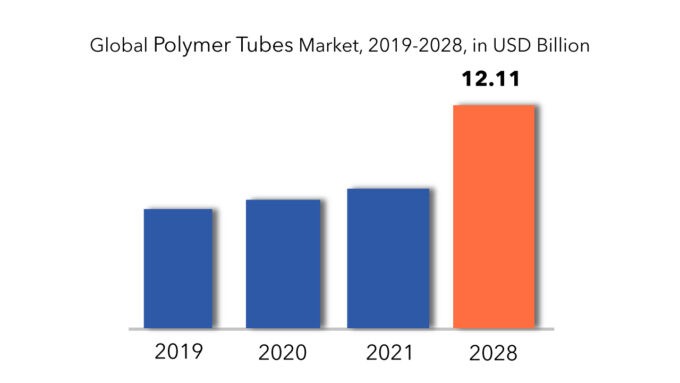

The global polymer tubes market is expected to grow at more than 7% CAGR from 2019 to 2028. It is expected to reach above USD 15.2 billion by 2028 from a little above USD 8.12 billion in 2019.

Polymeric tubes constitute cylindrical structures fabricated from diverse synthetic or semi-synthetic polymers, finding widespread application across various sectors including manufacturing, construction, healthcare, and automotive. They present numerous advantages over conventional materials such as metal or glass, notably encompassing lightweight characteristics, resistance to corrosion, flexibility, and cost efficiency. Customizable in terms of size, shape, and color, polymer tubes cater to specific application needs.

The burgeoning flexible packaging industry worldwide emerges as a significant catalyst propelling the growth of the plastic tubes market. The escalating preference for flexible and semi-flexible packaging solutions in sectors like personal care and cosmetics accelerates market expansion. The surge in flexible packaging adoption, owing to its lightweight nature and the growing demand for packaging solutions with superior barrier properties, further steers market dynamics. Additionally, heightened investments, urbanization, industrialization, and the quest for innovative and convenient packaging, coupled with advancements in packaging technology, positively impact the plastic tubes market. Moreover, the advent of bio plastic-based packaging and paper-based tube packaging extends lucrative opportunities for market participants.

Polymer tubes are witnessing noteworthy trends shaping their market dynamics, including heightened demand across diverse sectors due to their flexibility, chemical resistance, and lightweight attributes. A discernible shift toward sustainability prompts the development of eco-friendly polymer tubes crafted from recycled materials or biodegradable polymers. Innovations in polymer technology lead to the creation of specialized tubes tailored to specific industry requisites, while digitalization and automation revolutionize manufacturing processes, enhancing efficiency and customization capabilities. The COVID-19 pandemic underscores the pivotal role of polymer tubes in medical applications, further bolstering demand in the healthcare domain. These trends collectively signify a dynamic and evolving landscape for polymer tubes, fostering innovation and growth opportunities across sectors.

Polymer Tubes Market Segment Analysis

Based on type, the global polymer tubes market has been segmented into laminated, aluminum and plastic. Laminated polymer tubes are a hybrid of aluminum tubes and plastic tubes. They efficiently protect contents due to many overlaid layers, one of which is the barrier layer. Both longitudinal edges of the laminate tube are welded together and constitute the body which is then sealed to the tube shoulder.

An aluminum polymer composite (APC) material used for tubes combines aluminum with a polymer to create materials with interesting characteristics. It is stronger than regular polymer and provides good estimation for thermal conductivity.

Based on application, market can be classified as oral care, cosmetics, pharmaceuticals, food & beverage, cleaning products. Oral hygiene related products, such as toothpaste are packaged using polymer tubes. Collapsible squeeze tubes for creams, gels, and lotions are usually made from a type of plastic called polypropylene, or PP. Polymers are also present in a wide range of seawater applications, such as mooring systems that protect ships when docking in harbor.

Governments in various countries have imposed stringent regulations to minimize the impact of waste and its harmful by-products, for the safety of the environment, flora, and fauna. They have also enforced strict laws for the management of consumer and industrial plastic waste to reduce solid waste accumulating in landfills. But biopolymer-based tube products present a huge opportunity for the tube packaging market to grow in the forecast period.

Polymer Tubes Market Key Players

The global polymer tubes market includes major suppliers like as Amcor, Albea Group, Essel Propack Limited, Hoffman Neopack AG, and Huhtamaki Oyj. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and Rest of the World.

Who Should Buy? Or Key Stakeholders

- Investors

- Environment, Health and Safety Professionals

- Research Organizations

- Polymer Industry

- Healthcare

- Chemical manufacturing industry

- Regulatory Authorities

- Others

Polymer Tubes Market Regional Analysis

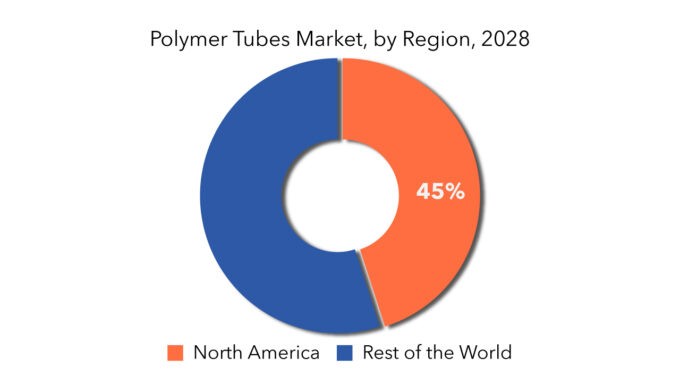

Geographically, the global polymer tubes market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Key Market Segments: Polymer Tubes Market

Polymer Tubes Market By Type 2019-2028, (In USD Million)

- Laminated

- Aluminum

- Plastic

Polymer Tubes Market By Application, 2019-2028, (In USD Million)

- Oral Care

- Cosmetics

- Pharmaceuticals

- Food & Beverage

- Cleaning Products

Polymer Tubes Market By Region, 2019-2028, (In USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important countries in all regions are covered (Total country profiles 25)

Objectives of the Study

- To provide an overall view of the market.

- To detail out key pointers such as growth, market size, trends, drivers, restraints, challenges and opportunities in quantitative and qualitative terms

- To provide a holistic view of market players and their activities to get an understanding of key growth strategies adopted

Key Question Answered

- What is the current market size of this high growth market?

- What is the overall growth rate?

- What are the key growth areas, applications, end uses and types?

- Key reasons for growth

- Challenges for growth

- What technological developments are happening in this area?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polymer tubes Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Polymer Tubes Market

- Global Polymer tubes Market Outlook

- Global Polymer tubes Market by Type, (USD Million)

- Laminated Tube

- Aluminum Tube

- Plastic Tube

- Global Polymer tubes Market by Application, (USD Million)

- Oral Care

- Cosmetics

- Food & Beverages

- Cleaning Product

- Pharmaceuticals

- Other

- Global Polymer tubes Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Amcor

- Albea Group

- Essel Propack Limited

- Hoffman Neopack AG

- Huhtamaki Oyj

- Hoffmann Neopac AG

- Pirlo Holding GmbH

- CTL-TH Packaging SL

- Tubapack A.S.

- Antilla Propack Inc.

- Alltub SAS

- Others

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 2 GLOBAL POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 3 GLOBAL POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 4 GLOBAL POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 5 GLOBAL POLYMER TUBES MARKET BY REGION (USD MILLIONS), 2019-2028

TABLE 6 GLOBAL POLYMER TUBES MARKET BY REGION (KILOTONS), 2019-2028

TABLE 7 NORTH AMERICA POLYMER TUBES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 8 NORTH AMERICA POLYMER TUBES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 9 US POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 10 US POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 11 US POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 12 US POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 13 Canada POLYMER TUBES MARKET BY type (CanadaD MILLIONS), 2019-2028

TABLE 14 Canada POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 15 CanadaPOLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 16 CanadaPOLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 17 MEXICO POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 18 MEXICO POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 19 MEXICO POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 20 MEXICO POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 21 SOUTH AMERICA POLYMER TUBES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 22 SOUTH AMERICA POLYMER TUBES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 23 BRAZIL POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 24 BRAZIL POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 25 BRAZIL POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 26 BRAZIL POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 27 ARGENTINA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 28 ARGENTINA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 29 ARGENTINA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 30 ARGENTINA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 31 COLOMBIA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 32 COLOMBIA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 33 COLOMBIA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 34 COLOMBIA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 35 REST OF SOUTH AMERICA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 36 REST OF SOUTH AMERICA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 37 REST OF SOUTH AMERICA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 38 REST OF SOUTH AMERICA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 39 ASIA-PACIFIC POLYMER TUBES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 40 ASIA-PACIFIC POLYMER TUBES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 41 INDIA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 42 INDIA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 43 INDIA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 44 INDIA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 45 CHINA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 46 CHINA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 47 CHINA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 48 CHINA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 49 JAPAN POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 50 JAPAN POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 51 JAPAN POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 52 JAPAN POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 53 SOUTH KOREA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 54 SOUTH KOREA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 55 SOUTH KOREA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 56 SOUTH KOREA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 57 AUSTRALIA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 58 AUSTRALIA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 59 AUSTRALIA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 60 AUSTRALIA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 61 SOUTH EAST ASIA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 62 SOUTH EAST ASIA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 63 SOUTH EAST ASIA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 64 SOUTH EAST ASIA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 65 REST OF ASIA PACIFIC POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 66 REST OF ASIA PACIFIC POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 67 REST OF ASIA PACIFIC POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 68 REST OF ASIA PACIFIC POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 69 EUROPE POLYMER TUBES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 70 EUROPE POLYMER TUBES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 71 GERMANY POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 72 GERMANY POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 73 GERMANY POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 74 GERMANY POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 75 UK POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 76 UK POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 77 UK POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 78 UK POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 79 FRANCE POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 80 FRANCE POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 81 FRANCE POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 82 FRANCE POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 83 ITALY POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 84 ITALY POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 85 ITALY POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 86 ITALY POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 87 SPAIN POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 88 SPAIN POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 89 SPAIN POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 90 SPAIN POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 91 RUSSIA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 92 RUSSIA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 93 RUSSIA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 94 RUSSIA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 95 REST OF EUROPE POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 96 REST OF EUROPE POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 97 REST OF EUROPE POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 98 REST OF EUROPE POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 99 MIDDLE EAST AND AFRICA POLYMER TUBES MARKET BY COUNTRY (USD MILLIONS), 2019-2028

TABLE 100 MIDDLE EAST AND AFRICA POLYMER TUBES MARKET BY COUNTRY (KILOTONS), 2019-2028

TABLE 101 UAE POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 102 UAE POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 103 UAE POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 104 UAE POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 105 SAUDI ARABIA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 106 SAUDI ARABIA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 107 SAUDI ARABIA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 108 SAUDI ARABIA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 109 SOUTH AFRICA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 110 SOUTH AFRICA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 111 SOUTH AFRICA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 112 SOUTH AFRICA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

TABLE 113 REST OF MIDDLE EAST AND AFRICA POLYMER TUBES MARKET BY type (USD MILLIONS), 2019-2028

TABLE 114 REST OF MIDDLE EAST AND AFRICA POLYMER TUBES MARKET BY type (KILOTONS), 2019-2028

TABLE 115 REST OF MIDDLE EAST AND AFRICA POLYMER TUBES MARKET BY APPLICATION (USD MILLIONS), 2019-2028

TABLE 116 REST OF MIDDLE EAST AND AFRICA POLYMER TUBES MARKET BY APPLICATION (KILOTONS), 2019-2028

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYMER TUBES MARKET BY TYPE, USD MILLION, 2019-2028

FIGURE 9 GLOBAL POLYMER TUBES MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 10 GLOBAL POLYMER TUBES MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL POLYMER TUBES MARKET BY TYPE, USD MILLION, 2019-2028

FIGURE 13 GLOBAL POLYMER TUBES MARKET BY APPLICATION, USD MILLION, 2019-2028

FIGURE 14 GLOBAL POLYMER TUBES MARKET BY REGION, USD MILLION, 2019-2028

FIGURE 15 POLYMER TUBES MARKET BY REGION 2020

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 Amcor : COMPANY SNAPSHOT

FIGURE 18 Albea Group : COMPANY SNAPSHOT

FIGURE 19 Essel Propack Limited : COMPANY SNAPSHOT

FIGURE 20 Hoffman Neopack AG : COMPANY SNAPSHOT

FIGURE 21 Huhtamaki Oyj : COMPANY SNAPSHOT

FIGURE 22 Hoffmann Neopac AG : COMPANY SNAPSHOT

FIGURE 23 Pirlo Holding GmbH : COMPANY SNAPSHOT

FIGURE 24 CTL-TH Packaging SL : COMPANY SNAPSHOT

FIGURE 25 Tubapack A.S. : COMPANY SNAPSHOT

FIGURE 26 Antilla Propack Inc.: COMPANY SNAPSHOT

FIGURE 27 Alltub SAS: COMPANY SNAPSHOT

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.