Report Outlook

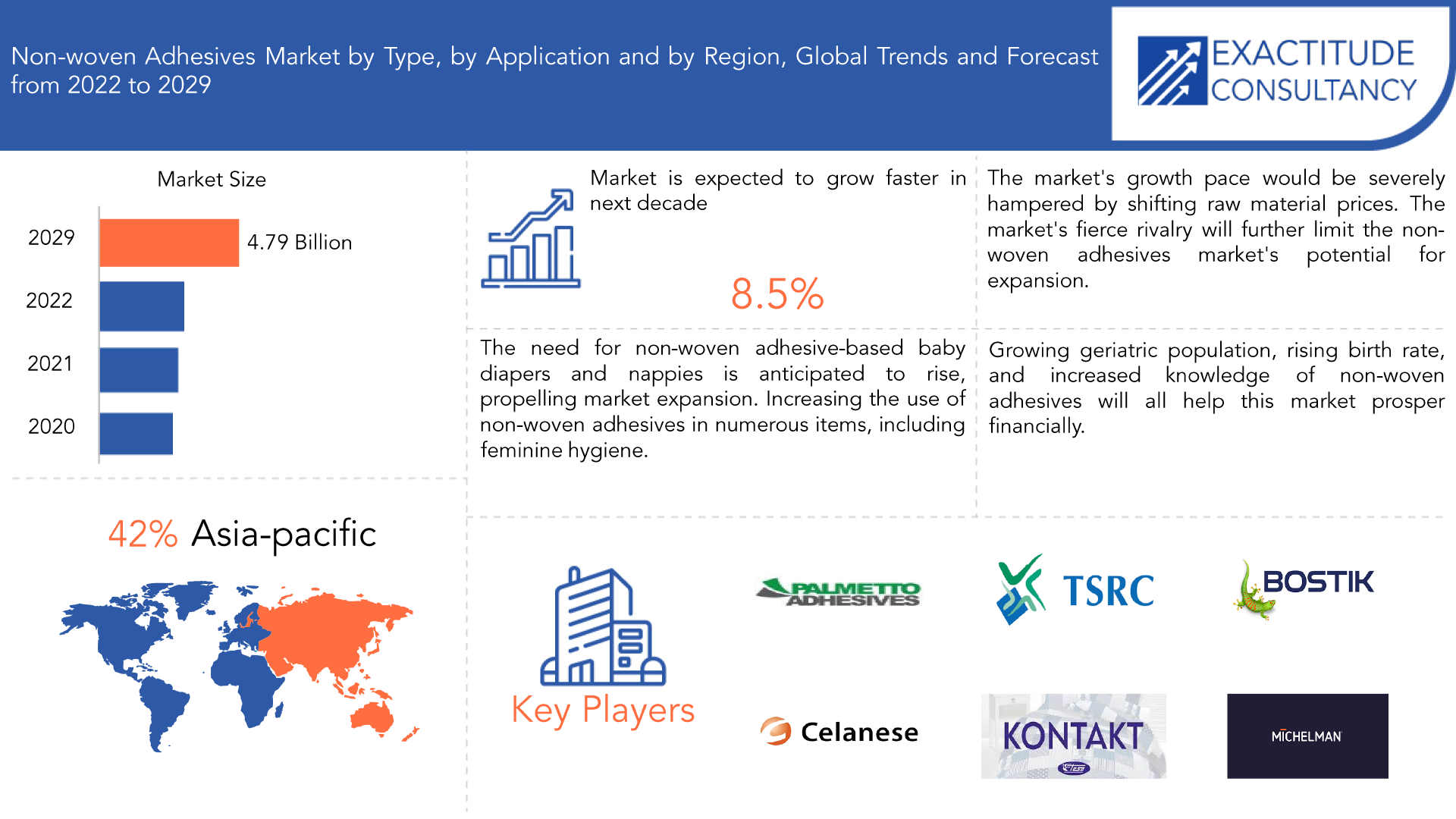

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 4.79 Billion by 2029 | 8.5% | Asia Pacific |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Non-woven Adhesives Market Overview

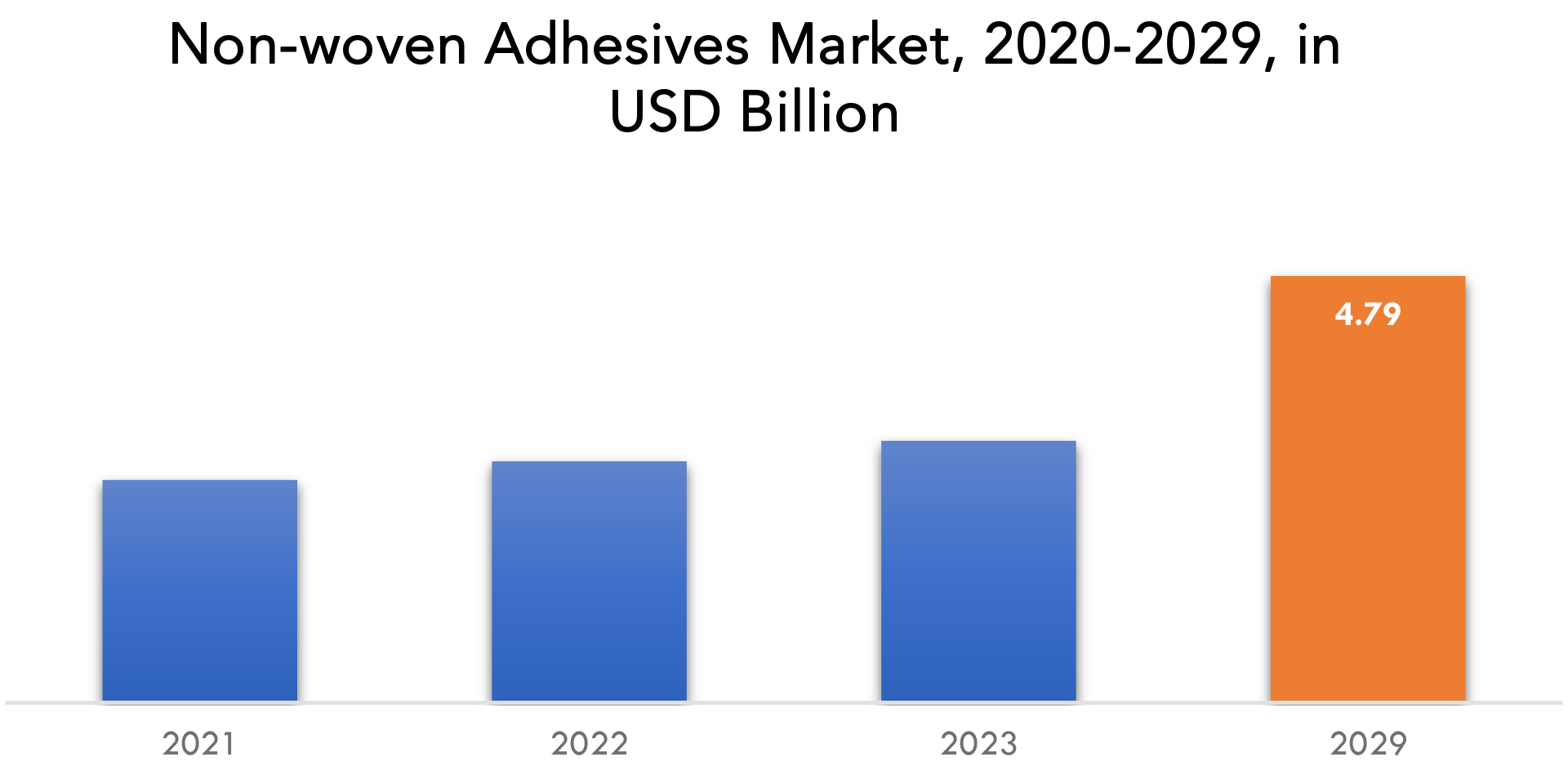

The non-woven adhesives market is expected to grow at 8.5% CAGR from 2022 to 2029. It is expected to reach above USD 4.79 Billion by 2029 from USD 2.3 Billion in 2020.

Fibers used in non-woven fabrics are held in place by non-woven adhesives. Base polymers, plasticizers, and antioxidants make up these adhesives. They have excellent processability, high elasticity, high cohesion strength, low odour, softness, and heat resistance. Baby diapers, training pants, sanitary napkins, adult incontinence products, medical wound care pads, surgical drapes, medical dressings, bed pads, and gowns are just a few examples of the health and hygiene items that frequently use non-woven adhesives. Also, they are utilized for internal engine compartment coverings, head and wall liners, and other vehicle liners and covers.

The rise in the number of urban dwellers and the consumption of hygiene goods is to blame for the non-woven adhesives market’s rapid expansion. The key important players are investing more in new product development, which will open up attractive growth chances for the non-woven adhesives market. Demand for non-woven adhesives will further rise as a result of rising industrialization, cheap production costs, and waste minimization features. Increased demand for non-woven adhesives as medical products and equipment, along with rising healthcare industry innovations, will drive market value growth. Due to the rising need for disposable hygiene items including infant diapers, feminine hygiene products, and training trousers, the demand for high-performance non-woven adhesives has increased. Non-woven adhesives are a crucial component of the goods offered in the hygiene sector. The hygiene industry is primarily driven by various product breakthroughs. It is suggested to choose products with better absorption, less waste, smaller cores, and an appropriate and comfortable fit. Non-woven adhesives satisfy these requirements. The growth rate of the non-woven adhesives market will be significantly hampered by fluctuating raw material prices. This can limit the market’s potential for expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Type, By Application, By Region |

| By Type |

|

| By Application |

|

| By Region |

|

Global players have chances to invest in emerging economies where rules are more flexible due to strict government controls regarding the emission of volatile organic compounds and the production of chemical-based products in industrialized nations. Many stringent regulations put in place by Europe have boosted the use and manufacture of biodegradable chemicals in the area. The Non-Woven Adhesives Market will be driven by improvements in medical practices and healthcare-related technologies in the upcoming years. Non-woven adhesives will likely be used in numerous adult care items, including adult diapers, as a result of the population’s increasing ageing. Additionally, it is anticipated that the global non-woven adhesives market would expand during the forecasted period due to rising consumer awareness of safe and hygienic products.

Since the pandemic has affected a number of industries, including the automotive, construction, and textile industries, the demand for non-woven adhesives has decreased. Reduced consumer spending, brief plant shutdowns, and supply chain disruptions are the causes of the decline in demand. The supply chain for non-woven adhesives has been significantly disrupted by the COVID-19 outbreak. The supply of raw materials and the shipping of completed goods have been impacted by the travel bans and lockdowns that several nations have enacted. The pandemic has caused price volatility in the non-woven adhesives industry as a result of changes in demand patterns and supply chain interruptions. Accurate planning and forecasting have become more difficult for producers because to the uncertainties brought on by the pandemic. Despite the fact that the pandemic has had a detrimental impact on many industries, it has raised demand for hygiene supplies including masks, wipes, and hospital gowns. The demand for non-woven adhesives utilized in the manufacture of these items has increased as a result of this. The epidemic has also sparked product development advances to meet the shifting wants of clients. Manufacturers are putting their efforts into creating non-woven adhesives that attach various materials more successfully, are more environmentally friendly, and offer greater antibacterial qualities.

Non-woven Adhesives Market Segment Analysis

Non-woven Adhesives Market is segmented based on Type, Application and Region.

Based on type, a significant portion of the market was made up of styrenic block copolymers. Due to their superior bonding abilities, flexibility, and durability, styrenic block copolymers are frequently utilized in the manufacture of non-woven adhesives. They are utilized in a number of items, including those for babies, medical equipment, and automobile interiors. The styrenic block copolymer market is expanding due to the rising demand for non-woven adhesives in various sectors. Styrenic block copolymers with higher environmental performance are also being developed by manufacturers in response to the rising demand for environmentally friendly and sustainable products. Styrenic block copolymers are anticipated to increase at a faster rate as a result in the non-woven adhesives industry.

Based on application, a significant portion of the market was made up of baby care. Due to rising disposable income and awareness of infant cleanliness, there has been an increase in the market for baby care goods. As they give the non-woven fabrics a firm hold, non-woven adhesives are crucial ingredients in the manufacturing of infant care goods like diapers and wipes. To address the rising demand in this industry, producers are creating more effective and affordable non-woven adhesives, which is boosting market growth.

Non-woven Adhesives Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Palmetto Adhesives Company, LLC, Celanese Corporation, TSRC Corporation, tesa SC, Bostik, Moresco Corporation, Michelman Inc., H.B. Fuller, Sika Ireland Ltd., Arkema.

Industry Developement:

- In January 2023, Palmetto Adhesives Company, LLC, today announced a strategic investment by a consortium led by Sidereal Capital Group, LLC, a private equity firm focused on growth oriented, middle market companies in the manufacturing and industrial services sectors.

- In February 2023, Celanese Corporation (NYSE: CE), a global specialty materials and chemical company, announced the availability of more sustainable versions of multiple Acetyl Chain materials with mass balance bio-content. These offerings will be designated as ECO-B, consistent with the innovative bio-based offerings introduced for Engineered Materials customers in previous years. While many Acetyl Chain solutions already help customers to improve sustainability by reducing waste and materials usage, this expanded product portfolio provides an opportunity to take an additional step with an offering that is chemically identical to the standard products.

Who Should Buy? Or Key stakeholders

- Manufactures of non-woven adhesives

- Traders and distributors of non-woven adhesives

- Research and development institutes

- Raw material suppliers

- Nationalized laboratories

- Potential investors

- Others

Non-woven Adhesives Market Regional Analysis

The Non-woven Adhesives Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

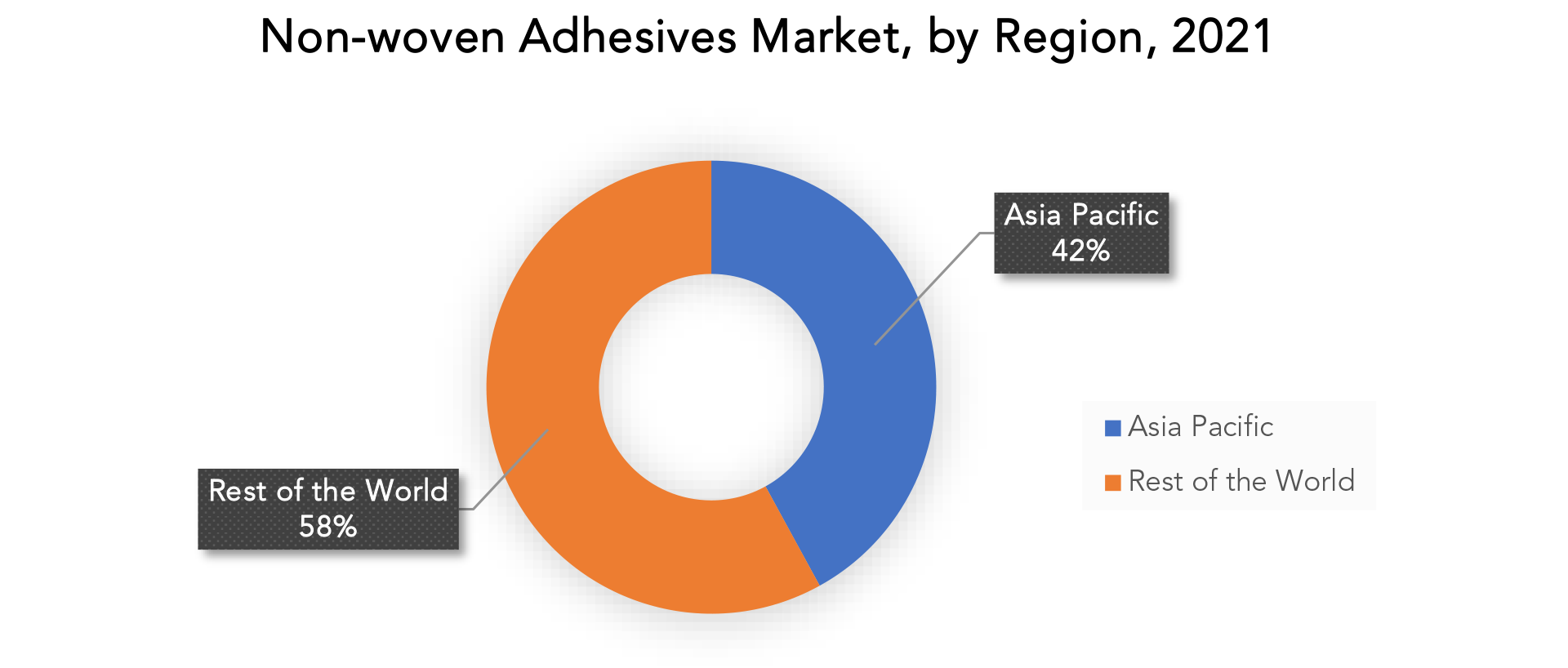

The greatest revenue share in 2021 over 42% was accounted for by Asia Pacific. To take advantage of the low production and labour costs, numerous non-woven and hygiene product manufacturers are establishing or growing their manufacturing facilities in this region. It has become a powerful industrial hub due to innovations and advances in the end-use sectors, growing population, and increasing uses for superior hygiene goods. Throughout the projection period, there is anticipated to be an increase in demand for non-woven hygiene adhesives in a variety of non-woven hygiene and medical applications.

The middle-class and upper-class people in India has increased their spending as a result of their increased disposable income, which has increased the demand for baby diapers and feminine hygiene products. The baby care and feminine hygiene sectors in India have grown as a result of the constant rise in the number of working women. The market for non-woven hygiene adhesives is anticipated to be driven by a number of specialised applications like medical, pet care, and bath tissues that are anticipated to expand in the area during the forecast period. Due to the region’s rapid economic expansion and significant expenditures in the adhesives sector, the non-woven hygiene adhesives market is expanding in the APAC region. The potential to better serve regional emerging markets and the low cost of production are benefits of moving production facilities to the APAC area.

Key Market Segments: Non-woven Adhesives Market

Non-Woven Adhesives Market By Type, 2020-2029, (USD Billion), (Kilotons)

- Amorphous Poly Alpha Olefin

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

Non-Woven Adhesives Market By Application, 2020-2029, (USD Billion), (Kilotons)

- Feminine Hygiene

- Baby Care

- Medical

- Adult Incontinence

Non-Woven Adhesives Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and Market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the non-woven adhesives market over the next 7 years?

- Who are the major players in the non-woven adhesives market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the non-woven adhesives market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the non-woven adhesives market?

- What is the current and forecasted size and growth rate of the global non-woven adhesives market?

- What are the key drivers of growth in the non-woven adhesives market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the non-woven adhesives market?

- What are the technological advancements and innovations in the non-woven adhesives market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the non-woven adhesives market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the non-woven adhesives market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NON-WOVEN ADHESIVES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NON-WOVEN ADHESIVES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NON-WOVEN ADHESIVES MARKET OUTLOOK

- GLOBAL NON-WOVEN ADHESIVES MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- AMORPHOUS POLY ALPHA OLEFIN

- ETHYLENE VINYL ACETATE

- STYRENIC BLOCK COPOLYMERS

- GLOBAL NON-WOVEN ADHESIVES MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- FEMININE HYGIENE

- BABY CARE

- MEDICAL

- ADULT INCONTINENCE

- GLOBAL NON-WOVEN ADHESIVES MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- PALMETTO ADHESIVES COMPANY, LLC

- CELANESE CORPORATION

- TSRC CORPORATION

- TESA SC

- BOSTIK

- MORESCO CORPORATION

- MICHELMAN INC.

- B. FULLER

- SIKA IRELAND LTD.

- ARKEMA

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL NON-WOVEN ADHESIVES MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL NON-WOVEN ADHESIVES MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA NON-WOVEN ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA NON-WOVEN ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 31 BRAZIL NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC NON-WOVEN ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC NON-WOVEN ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE NON-WOVEN ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE NON-WOVEN ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA NON-WOVEN ADHESIVES MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NON-WOVEN ADHESIVES MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL NON-WOVEN ADHESIVES MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL NON-WOVEN ADHESIVES MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL NON-WOVEN ADHESIVES MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL NON-WOVEN ADHESIVES MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL NON-WOVEN ADHESIVES MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 PALMETTO ADHESIVES COMPANY, LLC: COMPANY SNAPSHOT

FIGURE 17 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 18 TSRC CORPORATION: COMPANY SNAPSHOT

FIGURE 19 TESA SC: COMPANY SNAPSHOT

FIGURE 20 BOSTIK: COMPANY SNAPSHOT

FIGURE 21 MORESCO CORPORATION: COMPANY SNAPSHOT

FIGURE 22 MICHELMAN INC.: COMPANY SNAPSHOT

FIGURE 23 H.B. FULLER: COMPANY SNAPSHOT

FIGURE 24 SIKA IRELAND LTD.: COMPANY SNAPSHOT

FIGURE 25 ARKEMA: COMPANY SNAPSHOT

FAQ

The Non-woven Adhesives Market is expected to grow at 8.5% CAGR from 2022 to 2029. It is expected to reach above USD 4.79 Billion by 2029 from USD 2.3 Billion in 2020.

Asia Pacific held more than 42% of the Non-woven Adhesives Market revenue share in 2021 and will witness expansion in the forecast period.

The accelerated growth of the non-woven adhesives market can be attributed to the increase in urban population and the consumption of hygiene products. The major market players are investing more in the creation of new products, which will present exciting growth opportunities for the non-woven adhesives market. Because of increased industrialization, low production costs, and waste reduction features, demand for non-woven adhesives will continue to develop. Non-woven adhesives will see increased demand as medical equipment and supplies, and expanding healthcare industry innovations will fuel market value growth.

The greatest revenue share was accounted for by Asia Pacific. Several non-woven and hygiene product manufacturers are setting up or expanding their manufacturing plants in this area to take advantage of the low production and labour expenses. The higher disposable incomes, India’s middle and upper classes have boosted their spending, which has raised the demand for newborn diapers and feminine hygiene products. The steady increase in the number of working women in India has led to an expansion of the baby care and feminine hygiene industries. Over the forecast period, a variety of specialised applications, including those for medical, pet care, and bath tissues, are predicted to grow in popularity and drive the market for non-woven hygiene adhesives. The market for non-woven hygienic adhesives is growing in the APAC region as a result of the country’s quick economic growth and large spending in the adhesives industry.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.