REPORT OUTLOOK

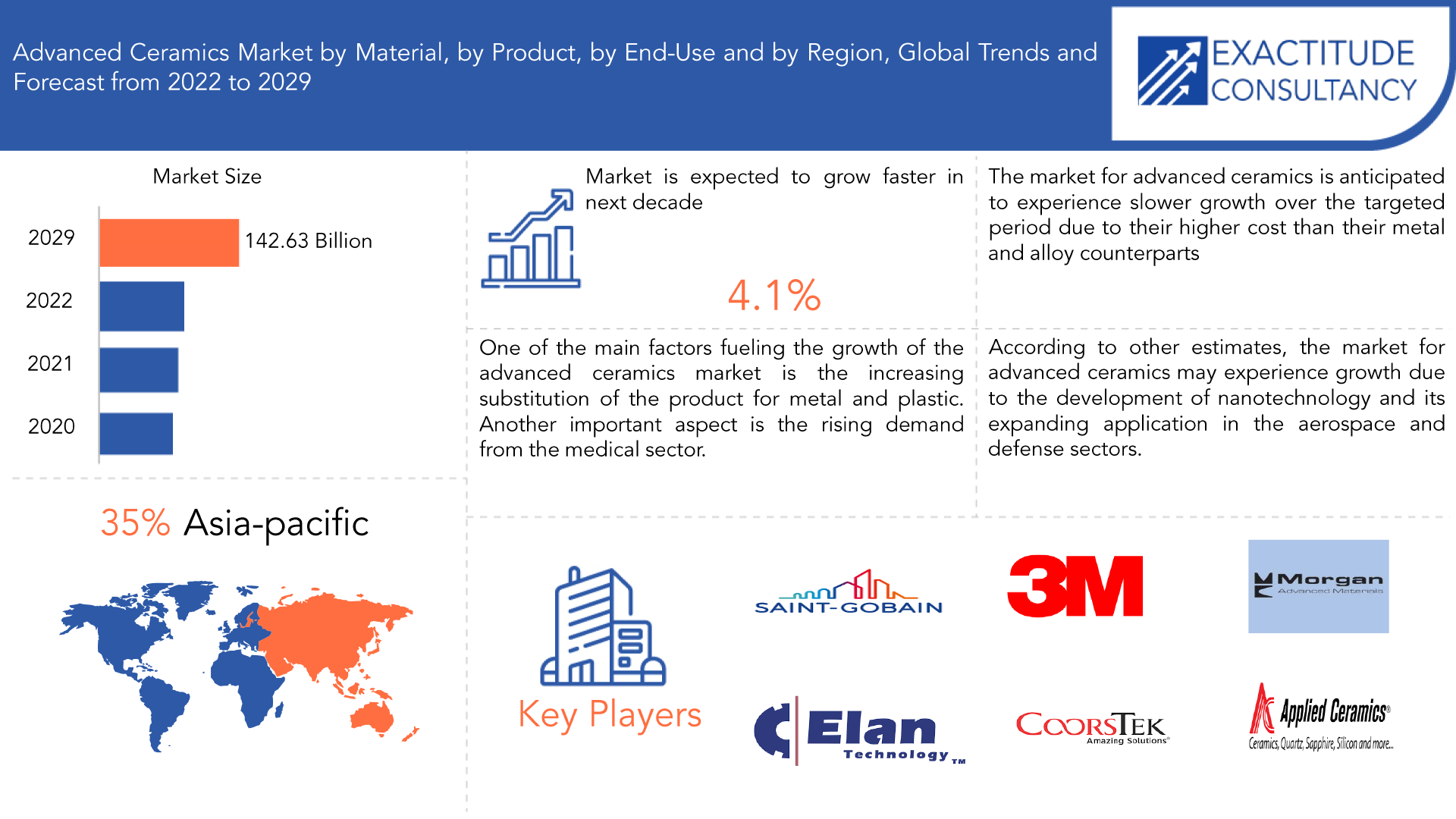

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 142.63 Billion by 2029 | 4.1% | Asia Pacific |

| By Material | By Product | By End-Use |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Advanced Ceramics Market Overview

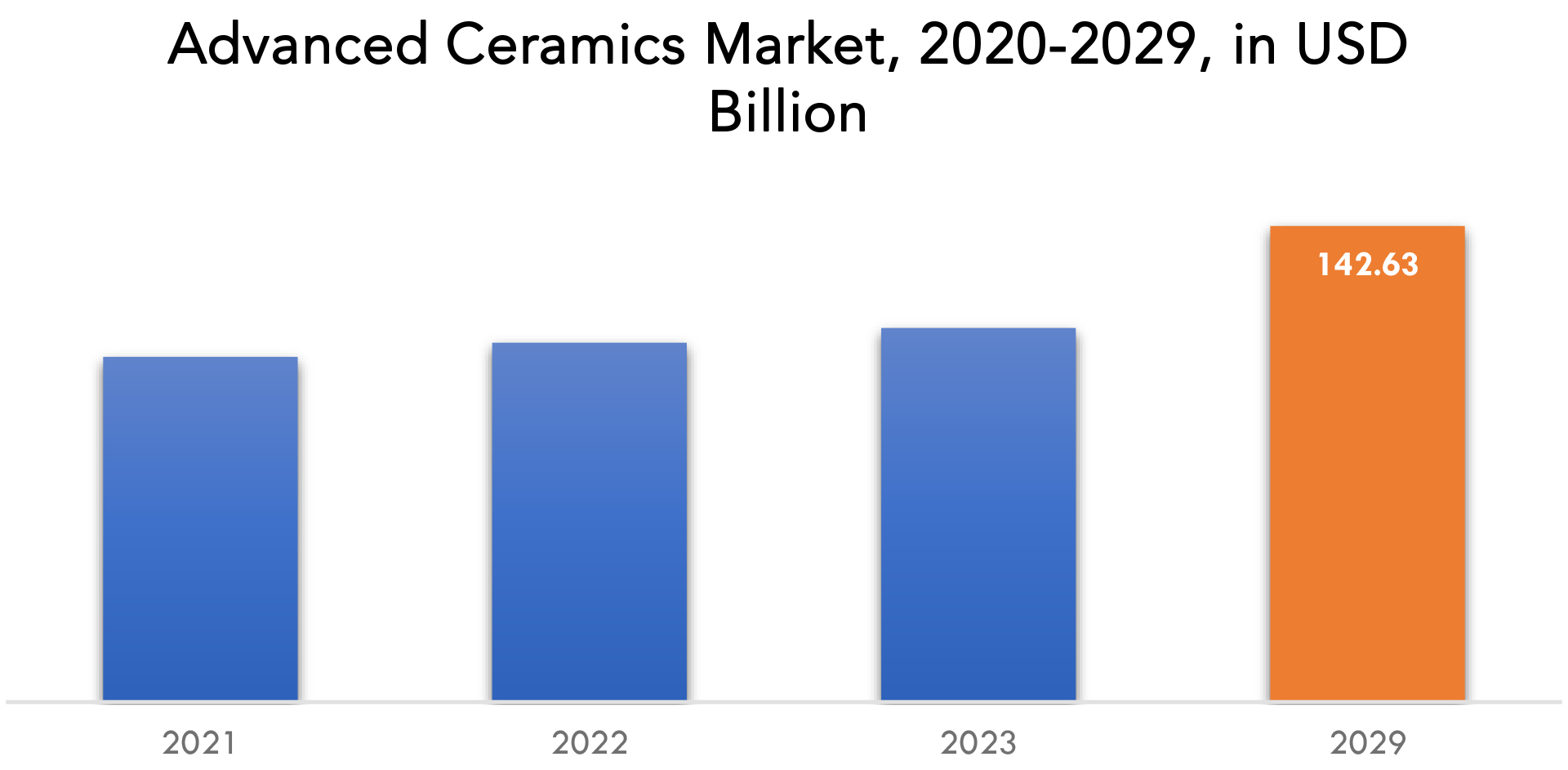

The advanced ceramics market is expected to grow at 4.1% CAGR from 2022 to 2029. It is expected to reach above USD 142.63 Billion by 2029 from USD 99.35 Billion in 2020.

The usage of sophisticated ceramics in medical equipment has increased recently. Low friction, excellent compression strength, and superior thermal conductivity are just a few of the characteristics that these ceramics display. They are used in a wide variety of medical devices, such as therapeutic devices, implants, and diagnostic imaging equipment. For instance, alumina ceramics are utilized in the components of automobile engines. They are additionally employed in backing materials, mounting brackets, and insulators. These materials are becoming more crucial to the high-tech sector, the restructuring of traditional industries, and national security.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Kilotons) |

| Segmentation | By Material, By Product, By End-Use, By Region |

| By Material |

|

| By Product |

|

| By End-Use |

|

| By Region |

|

They can be created to have the same purposes as metals and have special qualities like strength and high temperature resistance. One of the main factors fueling the growth of the advanced ceramics market is the increasing substitution of the product for metal and plastic. High hardness, high wear resistance, high compressive strength, huge electrical resistance, and strong corrosion resistance are only a few of the material traits and features that advanced ceramics enhance. Certain ceramics, like silicon carbide made by CVD, provide extra benefits by allowing for both some electrical conductivity and relatively strong heat conductivity. Another important aspect driving the market’s growth is the rising demand from the medical sector. Advanced ceramics are utilized in dental implants, feedthrough insulators, precision ceramic components, casings for neurostimulators, and insulators for endoscopic instruments. Moreover, advanced ceramics are used in a variety of medical tools and equipment, including ultrasonic instruments, infusion pumps, dialysis machines, and diagnostic tools. On the other hand, the market for advanced ceramics is anticipated to experience slower growth over the targeted period due to their higher cost than their metal and alloy counterparts.

The market for advanced ceramics on a global scale is one that is both intensely competitive and changing quickly. Advanced ceramics, often referred to as technical ceramics or engineered ceramics, are high-performance materials with distinctive features that make them appropriate for a variety of applications, from aerospace and defense to electronics and medical devices. The market for medical ceramics is expanding significantly as a result of the rising demand for ceramic implants and other medical devices for orthopaedic, dental, and other uses. Many governments are launching campaigns to encourage the use of advanced ceramics in a range of applications, which is anticipated to fuel market expansion.

The COVID-19 epidemic had a conflicting effect on the world market for innovative ceramics. The market first faced a drop because of supply chain problems and a slowdown in demand from important end-use industries like the automotive and aerospace sectors, but later witnessed a recovery as the pandemic raised demand for medical ceramics. Several advanced ceramics manufacturing plants were forced to close during the early phases of the pandemic as a result of lockdowns and limitations on the movement of people and commodities. This caused supply chain interruptions, which had an impact on the availability of both raw materials and completed goods. In addition, the pandemic’s effect on demand in the aerospace and automobile sectors had an effect on the market. As ceramics are commonly used in medical devices including ventilators, oxygen concentrators, and other respiratory equipment, the demand for medical ceramics increased significantly during the pandemic. Likewise, as the necessity for surgeries and other medical treatments grew, so did the need for ceramic implants.

Advanced Ceramics Market Segment Analysis

Advanced ceramics market is segmented based on material, product, end-use and region.

Based on material, a significant portion of the market was made up of alumina. The most affordable advanced ceramic on the market today, alumina ceramic performs admirably. In demanding applications where wear resistance and thermostability are needed, they are built on aluminium. A few examples of applications include ballistic armor, high-voltage separators, mechanical seals, and semiconductor parts. It is consequently produced in massive amounts. In cast iron finishing and roughing applications, alumina advanced ceramic is frequently employed.

Based on product, a significant portion of the market was made up of ceramic matrix composites. These composites contain a ceramic matrix as well as reinforcement components. They have improved qualities as a result of the blending of several components. Because of this, ceramic matrix composites are compact, robust, and have good thermal shock properties. The segmental growth is also being fueled by the key companies’ focus on the introduction of ceramic matrix composite materials that offer a variety of advantages for numerous industries.

Based on end-use, a significant portion of the market was made up of electrical & electronics. High demand for power electronics and electronic sensors, along with significant technological breakthroughs, will drive the segment’s growth. Transportation includes the industries of aerospace, military, and security, as well as the automotive sector. Examples of notable product adoption in these sectors are electric water pumps and aircraft engines.

Advanced Ceramics Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Saint-Gobain, Elan Technology, 3M, CoorsTek Inc., Morgan Advanced Materials, Ceradyne Inc., Ceramtec, AGC Inc., Vesuvius, Applied ceramics

Recent News

- In March 2021, Saint-Gobain Germany has recently acquired a majority stake in Brüggemann, a company specializing in the production of prefabricated wood-based solutions. This strategic investment provides access to a complete range of sustainable solutions.

- In April 2021, Elan 46 LAS Glass Ceramic for Modern Glass-To-Metal Sealing Advanced Hybrid Glass Ceramic Technology

Who Should Buy? Or Key stakeholders

- Government Organizations

- Transportation Industries

- Research and Development

- Construction Industries

- Raw material suppliers

Advanced Ceramics Market Regional Analysis

The Advanced Ceramics Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

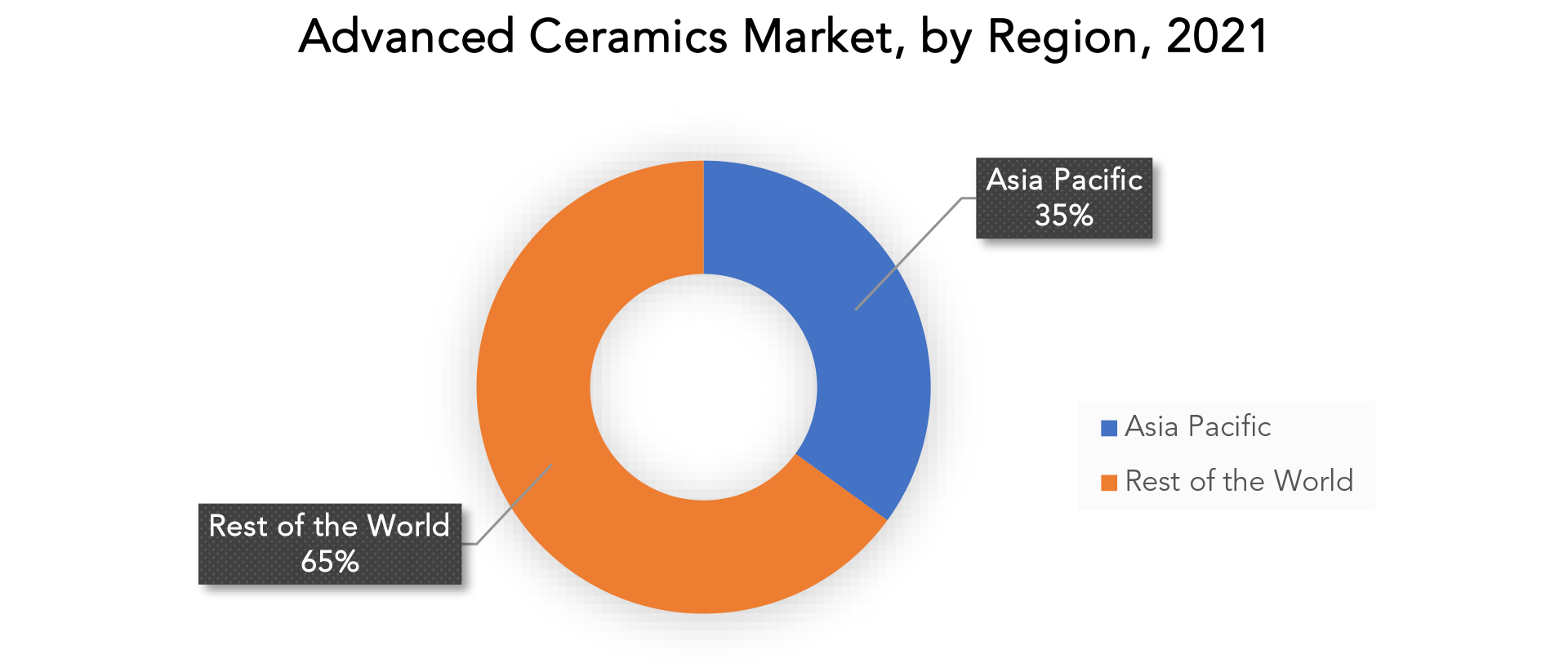

The greatest revenue share in 2021 over 35% was accounted for by Asia Pacific. Increased demand for better electronics products, an escalating population, and shifting lifestyles are driving the Asia-Pacific advanced ceramics market. Modern ceramics are primarily sold in China in this region. Rising product demand in the medical industry is the likely cause of the increase. Rapid technological progress and stepped-up research and development initiatives will also move the industry ahead. The largest market share in this area belongs to China as a result of the expanding use of titanium oxide in the automobile industry. Demand for advanced ceramics in the region is anticipated to increase as a result of the rollout of 5G technology and developments in medical electronics. A combination of factors, including a growing population, urbanisation, technology advancements like 5G and IoT, and favourable government regulations, are expected to make India and China the country’s fastest-growing markets.

Key Market Segments: Advanced Ceramics Market

Advanced Ceramics Market by Material, 2020-2029, (USD Billion), (Kilotons)

- Alumina

- Titanate

- Zirconia

- Silicon Carbide

Advanced Ceramics Market by Product, 2020-2029, (USD Billion), (Kilotons)

- Monolithic Ceramic

- Ceramic Coatings

- Ceramic Matrix Composites

- Ceramic Filters

Advanced Ceramics Market by End-Use, 2020-2029, (USD Billion), (Kilotons)

- Electrical & Electronics

- Transportation

- Medical

- Defense & Security

- Others

Advanced Ceramics Market by Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and Market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the advanced ceramics market over the next 7 years?

- Who are the major players in the advanced ceramics market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the advanced ceramics market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the advanced ceramics market?

- What is the current and forecasted size and growth rate of the global advanced ceramics market?

- What are the key drivers of growth in the advanced ceramics market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the advanced ceramics market?

- What are the technological advancements and innovations in the advanced ceramics market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the advanced ceramics market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the advanced ceramics market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ADVANCED CERAMICS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ADVANCED CERAMICS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ADVANCED CERAMICS MARKET OUTLOOK

- GLOBAL ADVANCED CERAMICS MARKET BY MATERIAL, 2020-2029, (USD BILLION), (KILOTONS)

- ALUMINA

- TITANATE

- ZIRCONIA

- SILICON CARBIDE

- GLOBAL ADVANCED CERAMICS MARKET BY PRODUCT, 2020-2029, (USD BILLION), (KILOTONS)

- MONOLITHIC CERAMIC

- CERAMIC COATINGS

- CERAMIC MATRIX COMPOSITES

- CERAMIC FILTERS

- GLOBAL ADVANCED CERAMICS MARKET BY END-USE, 2020-2029, (USD BILLION), (KILOTONS)

- ELECTRICAL & ELECTRONICS

- TRANSPORTATION

- MEDICAL

- DEFENSE & SECURITY

- OTHERS

- GLOBAL ADVANCED CERAMICS MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SAINT-GOBAIN

- ELAN TECHNOLOGY

- 3M

- COORSTEK INC.

- MORGAN ADVANCED MATERIALS

- CERADYNE INC.

- CERAMTEC

- AGC INC.

- VESUVIUS

- APPLIED CERAMICS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 2 GLOBAL ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 3 GLOBAL ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 4 GLOBAL ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 5 GLOBAL ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 6 GLOBAL ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 7 GLOBAL ADVANCED CERAMICS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL ADVANCED CERAMICS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA ADVANCED CERAMICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA ADVANCED CERAMICS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 17 US ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 18 US ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 19 US ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 20 US ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 21 US ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 22 US ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 23 CANADA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 24 CANADA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 25 CANADA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 26 CANADA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 27 CANADA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 28 CANADA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 29 MEXICO ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 30 MEXICO ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 31 MEXICO ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 32 MEXICO ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 33 MEXICO ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 34 MEXICO ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA ADVANCED CERAMICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA ADVANCED CERAMICS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 43 BRAZIL ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 44 BRAZIL ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 45 BRAZIL ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 46 BRAZIL ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 47 BRAZIL ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 48 BRAZIL ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 49 ARGENTINA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 50 ARGENTINA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 51 ARGENTINA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 52 ARGENTINA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 53 ARGENTINA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 54 ARGENTINA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 55 COLOMBIA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 56 COLOMBIA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 57 COLOMBIA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 58 COLOMBIA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 59 COLOMBIA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 60 COLOMBIA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 75 INDIA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 76 INDIA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 77 INDIA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 78 INDIA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 79 INDIA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 80 INDIA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 81 CHINA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 82 CHINA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 83 CHINA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 84 CHINA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 85 CHINA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 86 CHINA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 87 JAPAN ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 88 JAPAN ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 89 JAPAN ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 90 JAPAN ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 91 JAPAN ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 92 JAPAN ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 117 EUROPE ADVANCED CERAMICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE ADVANCED CERAMICS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 120 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 121 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 122 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 123 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 124 ASIA-PACIFIC ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 125 GERMANY ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 126 GERMANY ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 127 GERMANY ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 128 GERMANY ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 129 GERMANY ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 130 GERMANY ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 131 UK ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 132 UK ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 133 UK ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 134 UK ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 135 UK ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 136 UK ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 137 FRANCE ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 138 FRANCE ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 139 FRANCE ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 140 FRANCE ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 141 FRANCE ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 142 FRANCE ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 143 ITALY ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 144 ITALY ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 145 ITALY ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 146 ITALY ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 147 ITALY ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 148 ITALY ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 149 SPAIN ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 150 SPAIN ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 151 SPAIN ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 152 SPAIN ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 153 SPAIN ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 154 SPAIN ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 155 RUSSIA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 156 RUSSIA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 157 RUSSIA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 158 RUSSIA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 159 RUSSIA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 160 RUSSIA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 175 UAE ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 176 UAE ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 177 UAE ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 178 UAE ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 179 UAE ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 180 UAE ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY MATERIAL (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY MATERIAL (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY END-USE (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ADVANCED CERAMICS MARKET BY END-USE (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ADVANCED CERAMICS MARKET BY MATERIAL, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ADVANCED CERAMICS MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ADVANCED CERAMICS MARKET BY END-USE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL ADVANCED CERAMICS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ADVANCED CERAMICS MARKET BY MATERIAL, USD BILLION, 2021

FIGURE 14 GLOBAL ADVANCED CERAMICS MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 15 GLOBAL ADVANCED CERAMICS MARKET BY END-USE, USD BILLION, 2021

FIGURE 16 GLOBAL ADVANCED CERAMICS MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA ADVANCED CERAMICS MARKETSNAPSHOT

FIGURE 18 EUROPE ADVANCED CERAMICS MARKETSNAPSHOT

FIGURE 19 SOUTH AMERICA ADVANCED CERAMICS MARKETSNAPSHOT

FIGURE 20 ASIA PACIFIC ADVANCED CERAMICS MARKETSNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA ADVANCED CERAMICS MARKETSNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 SAINT-GOBAIN: COMPANY SNAPSHOT

FIGURE 24 ELAN TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 25 3M: COMPANY SNAPSHOT

FIGURE 26 COORSTEK INC.: COMPANY SNAPSHOT

FIGURE 27 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

FIGURE 28 CERADYNE INC.: COMPANY SNAPSHOT

FIGURE 29 CERAMTEC: COMPANY SNAPSHOT

FIGURE 30 AGC INC.: COMPANY SNAPSHOT

FIGURE 31 VESUVIUS: COMPANY SNAPSHOT

FIGURE 32 APPLIED CERAMICS: COMPANY SNAPSHOT

FAQ

The Advanced Ceramics Market is expected to grow at 4.1% CAGR from 2022 to 2029. It is expected to reach above USD 142.63 Billion by 2029 from USD 99.35 Billion in 2020.

Asia Pacific held more than 35% of the Advanced Ceramics Market revenue share in 2021 and will witness expansion in the forecast period.

The rising use of sophisticated ceramics in place of metal and plastic is one of the major drivers of the market’s expansion. Only a few of the material characteristics and properties that advanced ceramics enhance include great hardness, high wear resistance, high compressive strength, enormous electrical resistance, and strong corrosion resistance. By allowing for both some electrical conductivity and moderately high thermal conductivity, some ceramics, such as silicon carbide produced by CVD, offer added advantages. The increasing demand from the medical industry is another significant factor propelling the market’s expansion.

The greatest revenue share was accounted for by Asia Pacific. The Asia-Pacific advanced ceramics market is being driven by rising population levels, changing lifestyles, and increased need for improved electronics products. In this region, China is the main market for contemporary ceramics. Increased product demand in the medical sector is most likely to blame. The sector will also advance due to quick technological development and intensified research and development efforts. Due to the rising use of titanium oxide in the automotive sector, China now holds the biggest market share in this sector. It is projected that the region’s demand for advanced ceramics would rise as a result of the deployment of 5G technology and advancements in medical electronics.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.