REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

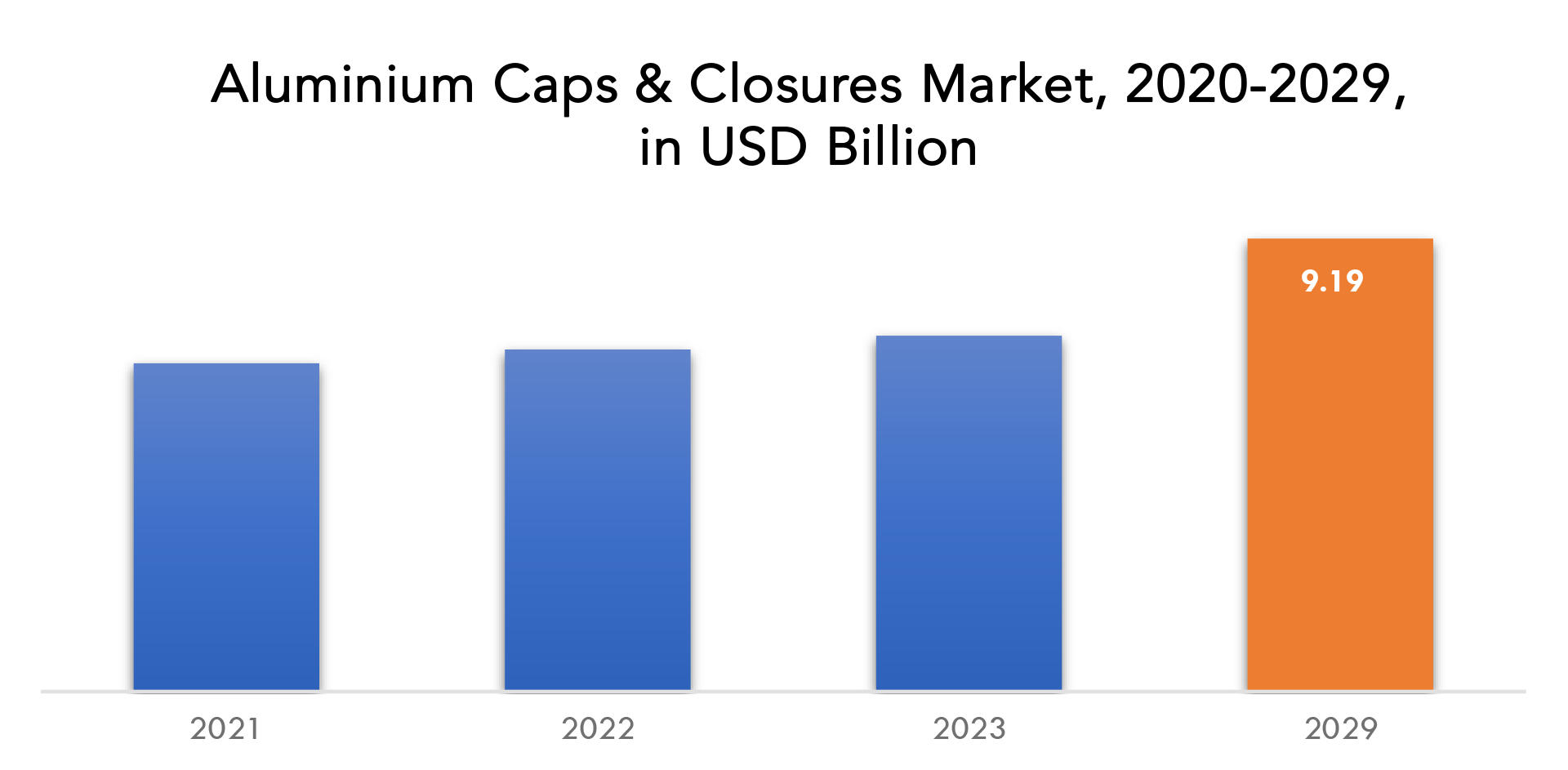

| USD 9.19 billion by 2029 | 4.1% | Asia Pacific |

| by Product Type | by End-Use Industry | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Aluminum Caps & Closures Market Overview

The aluminum caps & closures market is expected to grow at 4.1% CAGR from 2022 to 2029. It is expected to reach above USD 9.19 billion by 2029 from USD 6.4 billion in 2020.

Aluminum caps and closures are the aluminum-based coverings or lids that are used to cover the open ending mouth of bottles, jars, containers, and other items to avoid leakage. This is obvious from the term itself. The aluminium closures and caps provide further protection against external contamination. The packaging industry is expanding and growing, particularly in developing economies. There is a growing demand for creative packaging solutions that are created using cutting-edge and innovative manufacturing techniques. The consumption of both alcoholic and non-alcoholic beverages is rising, and there is a rise in personal disposable income. These are the factors that are fueling the growth of the aluminium cap industry. The value of the aluminium caps and closures market is expanding due to rising urbanization, modernization, and globalization.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product Type, By End-Use Industry, By Region |

| By Product Type |

|

| By End-Use Industry |

|

| By Region |

|

The value of the aluminium caps and closures market will increase as a result of rising customer desire for practical parking solutions and rising consumer awareness of food safety. Other factors driving the growth of the aluminium caps and closures market include increasing research and development capabilities, strict government guidelines for food security, technological advancements in packaging equipment and technology, increased e-commerce industry proliferation, and growing environmental concerns. Increased production costs for aluminium alloys and fluctuating raw material prices may further slow the market’s expansion for aluminium caps and closures. The growth rate of the market for aluminium caps and closures will be hampered by the availability of low-cost alternatives and the rising use of plastic, rubber, and other substitute materials

Comparatively speaking to other materials, aluminium caps and closures offer higher rigidity and stability for packing. There are many different types and diameters of these caps and closures. In the coming years, the market for aluminium caps and closers is projected to grow as a result of the recent trend towards including processed and preserved foods in everyday diets. The market for aluminium caps and closures is anticipated to be driven by worries about food safety, product security, and safety, as well as product differentiation and branding. The aluminum caps & closures Market is anticipated to be driven in the next years by the growth in demand for convenience and smaller pack sizes.

The market for aluminium caps and closures has been significantly impacted by the COVID-19 outbreak in several different industries. Global supply chains have been hampered by the pandemic, leading to delays and shortages of raw materials and final goods. Due to difficulties locating the supplies and parts required to make these goods, this has had an impact on the market for aluminium caps and closures. As a result of the pandemic, more people are choosing to stay at home and prepare and enjoy their meals there. As a result, there is now a greater market for packaged foods and drinks, which in turn has raised demand for aluminium caps and closures. In order to comply with new health and safety standards and recommendations, several producers in the market for aluminium caps and closures have had to modify their production processes. The output and capacity of production have changed as a result, and the price of putting new safety measures into place has gone up. The market for aluminium caps and closures has been impacted, as with many other industries, by the pandemic’s substantial economic uncertainties. Businesses have had to adjust to shifts in supply and demand, which has required them to make challenging choices on hiring, investing, and other business endeavors.

Aluminum Caps & Closures Market Segment Analysis

Aluminum caps & closures market is segmented based on product type, end-use industry, and region.

Based on product type, a significant portion of the market was made up of roll-on pilfer-proof. A roll-on pilfer-proof may be a well-engineered product that is screwed on and off on a container. These closures contain either continuous threads or lugs. It must be engineered and designed to be cost-effective, compatible with contents, easy to open; provide an efficient seal; and suit the merchandise, package, and environmental laws and regulations. In the beverages industry, aluminum caps & closures are tamper-resistant, which further helps tackle the issues of counterfeiting. A major factor in this expansion is supported by the fact that roll-on pilfer-proof caps combine the traditional decorating role of tamper-proof sealing and help retain the properties of packaged products.

Based on end-use industry, a significant portion of the market was made up of pharmaceutical. During the production process, it is crucial to maintain the quality of pharmaceutical products. Airborne particles, dust, and microbes frequently contaminate pharmaceutical products. In the pharmaceutical sector, aluminium caps and closures are used to seal the medications in order to prevent contamination. To protect the contents from air, dust, and moisture, the packaging of healthcare supplies is of highest importance. The demand for healthcare items, which in turn drives the need for aluminium caps & closures, is driven by an increase in chronic illnesses, an increase in the ageing population, and an increase in income in developing countries.

Aluminum Caps & Closures Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Crown Holdings, Guala Closures, Torrent Closures, Alameda Packaging, Amcor Plc, Silgan Holdings, Alutop, Alcopack Group, EMA Pharmaceuticals, Aluminum Closures Limited.

Recent News

- On February 2023, on the transition of MENA’s food and beverage sector to a Circular Economy, we explored metal packaging’s green credentials and how the format can help regional producers implement steps toward a more sustainable future.

- On July 2022, the acquisition of the Vicenza-based company specialized in high-end closures has a strategic relevance for Guala Closures. For the Group, the deal represents an important step towards becoming a world leader also in the luxury segment

Who Should Buy? Or Key stakeholders

- Research and Development Institutes

- Regulatory Authorities

- End-use Companies

- Industrial

- Potential Investors

- Material Industry

- Chemical Industry

- Others

Aluminum Caps & Closures Market Regional Analysis

The aluminum caps & closures market by region includes north america, asia-pacific (APAC), europe, south america, and middle east & africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

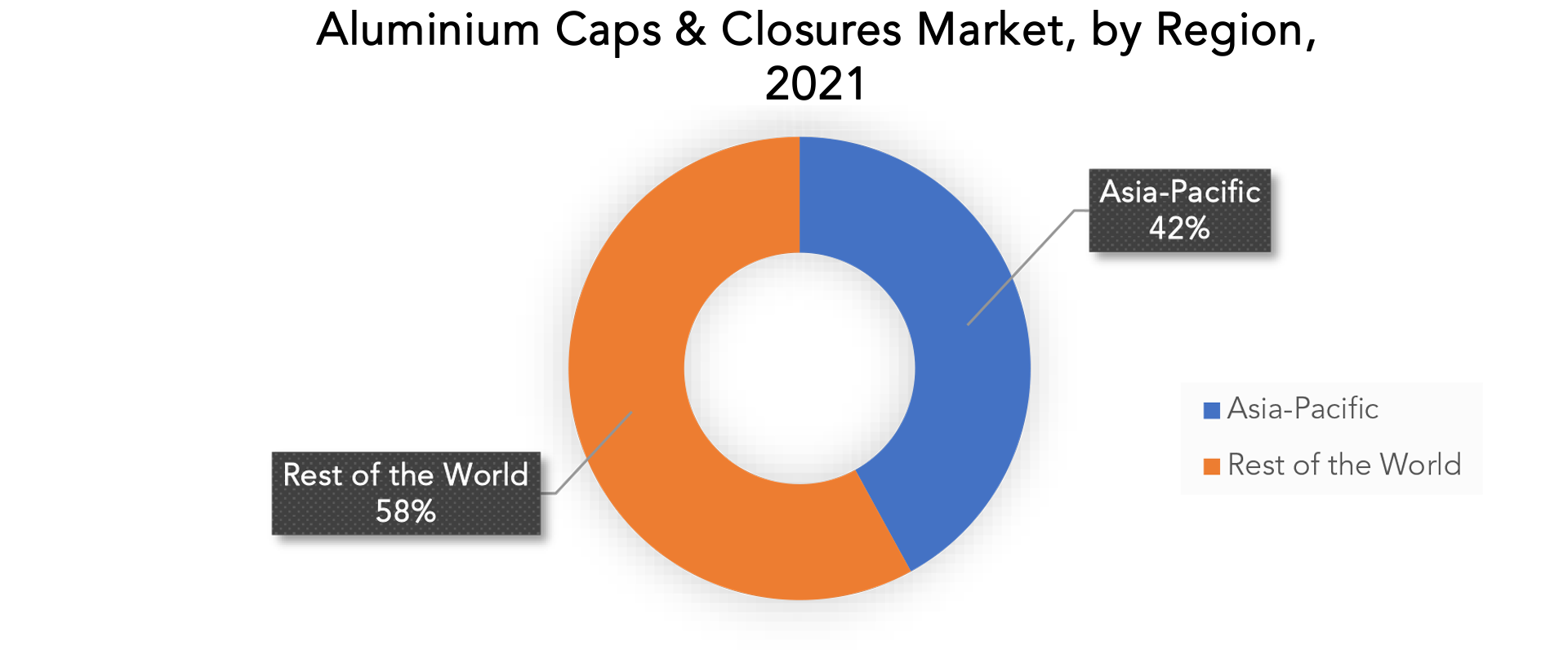

The greatest revenue share in 2021 over 42% was accounted for by Asia Pacific. The expansion of the beverage industry and better economic conditions are key drivers of regional growth. Government restrictions and the region’s expanding healthcare sector are anticipated to boost regional growth during the projection period. Other variables that are projected to assist regional growth over the forecast period include an increase in per capita income, population expansion, and a favourable outlook for the economy. In the coming years, China and India are expected to contribute significantly to the expansion of the Asia Pacific. As a result, Asia Pacific is estimated to have the highest CAGR and to maintain its supremacy for the duration of the forecast period.

Key Market Segments: Aluminum Caps & Closures Market

Aluminum Caps & Closures Market by Product Type, 2020-2029, (USD Billion), (Thousand Units)

- Roll-On-Pilfer-Proof

- Easy Open Ends

- Non-Refillable

- Others

Aluminum Caps & Closures Market by End-Use Industry, 2020-2029, (USD Billion), (Thousand Units)

- Beverage

- Pharmaceutical

- Food

- Home & Personal Care

- Others

Aluminum Caps & Closures Market by Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and Market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the aluminum caps & closures market over the next 7 years?

- Who are the major players in the aluminum caps & closures market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the aluminum caps & closures market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the aluminum caps & closures market?

- What is the current and forecasted size and growth rate of the global aluminum caps & closures market?

- What are the key drivers of growth in the aluminum caps & closures market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the aluminum caps & closures market?

- What are the technological advancements and innovations in the aluminum caps & closures market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the aluminum caps & closures market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the aluminum caps & closures market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ALUMINIUM CAPS & CLOSURES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ALUMINIUM CAPS & CLOSURES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ALUMINIUM CAPS & CLOSURES MARKET OUTLOOK

- GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- ROLL-ON-PILFER-PROOF

- EASY OPEN ENDS

- NON-REFILLABLE

- OTHERS

- GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- BEVERAGE

- PHARMACEUTICAL

- FOOD

- HOME & PERSONAL CARE

- OTHERS

- GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- CROWN HOLDINGS

- GUALA CLOSURES,

- TORRENT CLOSURES

- ALAMEDA PACKAGING

- AMCOR PLC

- SILGAN HOLDINGS

- ALUTOP

- ALCOPACK GROUP

- EMA PHARMACEUTICALS

- ALUMINUM CLOSURES LIMITED *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 4 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 14 US ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 16 US ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 20 CANADA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 24 MEXICO ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 34 BRAZIL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 38 ARGENTINA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 42 COLOMBIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 56 INDIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 60 CHINA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 64 JAPAN ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 84 EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 90 GERMANY ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 91 UK ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 92 UK ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 94 UK ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 98 FRANCE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 102 ITALY ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 106 SPAIN ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 110 RUSSIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 122 UAE ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 124 UAE ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY PRODUCT TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY END-USE INDUSTRY, USD BILLION, 2021

FIGURE 14 GLOBAL ALUMINIUM CAPS & CLOSURES MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 CROWN HOLDINGS: COMPANY SNAPSHOT

FIGURE 17 GUALA CLOSURES: COMPANY SNAPSHOT

FIGURE 18 TORRENT CLOSURES: COMPANY SNAPSHOT

FIGURE 19 ALAMEDA PACKAGING: COMPANY SNAPSHOT

FIGURE 20 AMCOR PLC: COMPANY SNAPSHOT

FIGURE 21 SILGAN HOLDINGS: COMPANY SNAPSHOT

FIGURE 22 ALUTOP: COMPANY SNAPSHOT

FIGURE 23 ALCOPACK GROUP: COMPANY SNAPSHOT

FIGURE 24 EMA PHARMACEUTICALS: COMPANY SNAPSHOT

FIGURE 25 ALUMINUM CLOSURES LIMITED: COMPANY SNAPSHOT

FAQ

The aluminum caps & closures market is expected to grow at 4.1% CAGR from 2022 to 2029. It is expected to reach above USD 9.19 billion by 2029 from USD 6.4 billion in 2020.

Asia Pacific held more than 42% of the aluminum caps & closures market revenue share in 2021 and will witness expansion in the forecast period.

Better operability and rising demand for convenience foods are two major factors influencing the use of aluminium caps and closures. The product must be protected from dust and other microorganisms and always kept fresh with a cap. Customers are searching for closures that are simple to use, quick to open, and handy. The market for aluminium caps and closures is expected to expand as a result of the growing acceptance of dispensing closures and pump closures in a variety of product categories, including beverages, liquid food products, body care, and skin care.

The greatest revenue share was accounted for by Asia Pacific. Urbanization, industrialisation, and rising population all contribute to the market’s expansion for aluminium caps and closures. The demand for aluminium caps and closures has expanded as a result of China’s growth as a major global manufacturing hub. The production of these goods in the area is boosted by the accessibility of raw materials and cheap labour.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.