Report Outlook

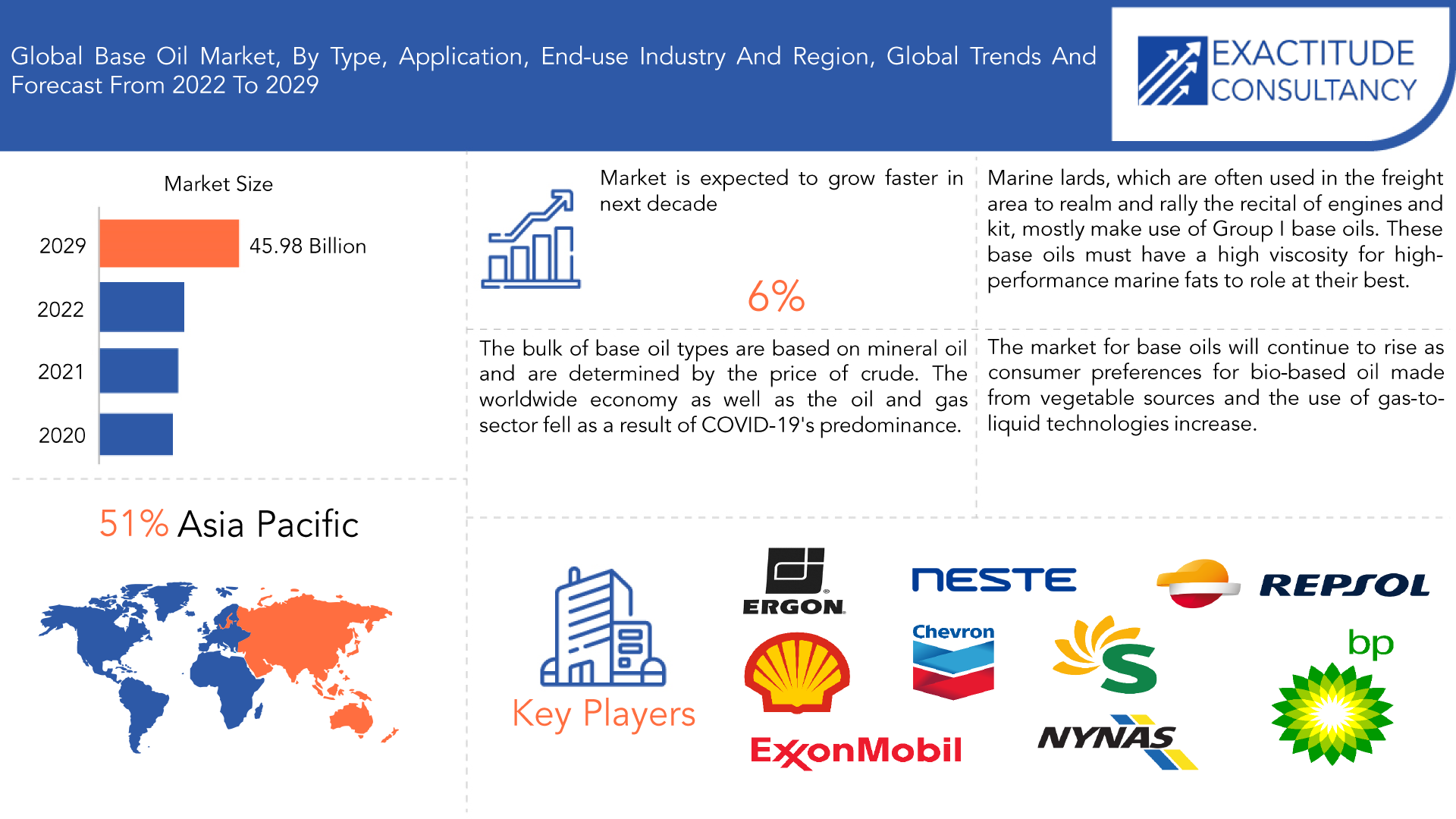

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 45.98 billion by 2029 | 6% | Asia Pacific |

| By Type | By Application | By End-User Industry |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Base Oil Market Overview

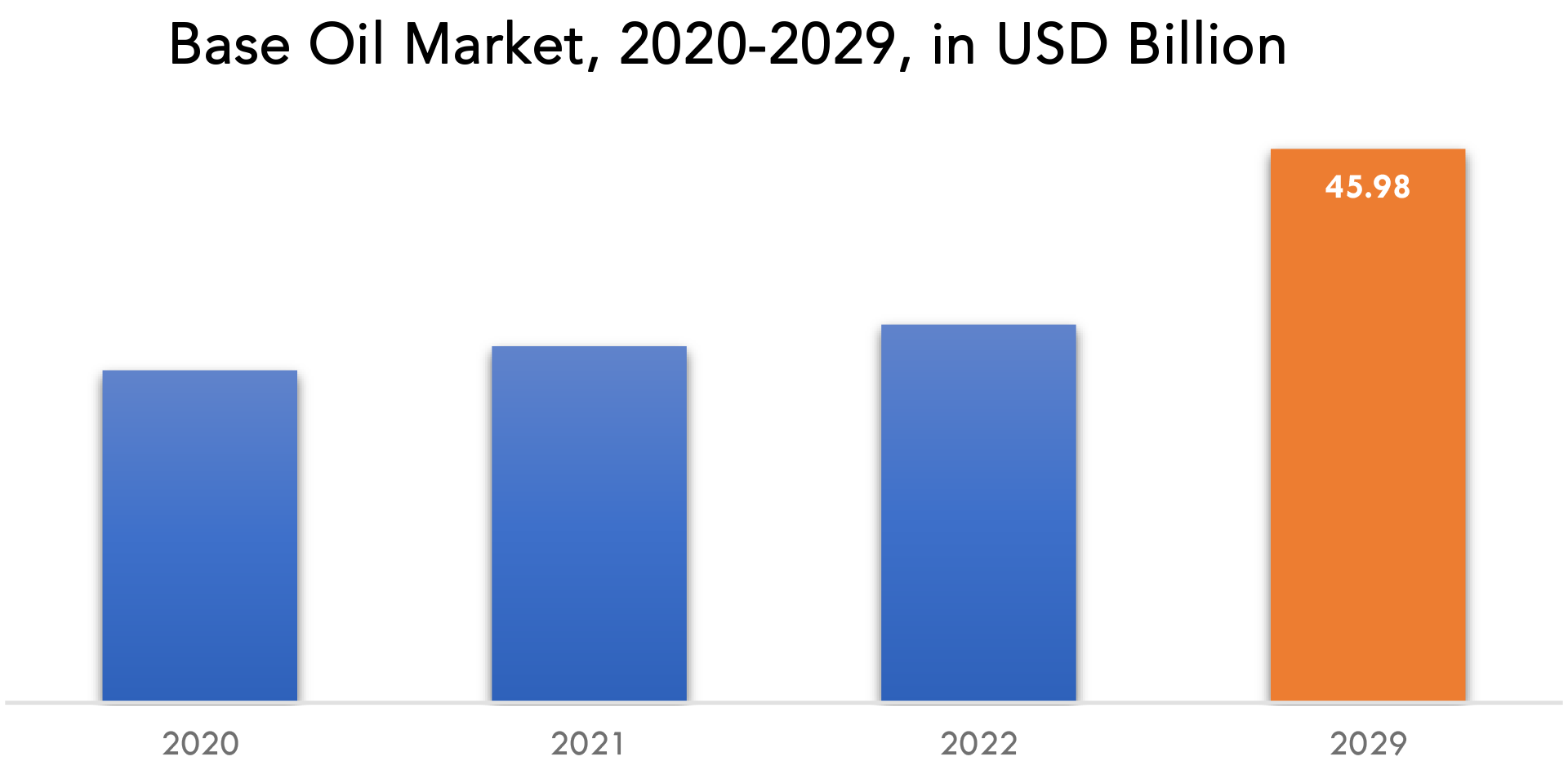

The global base oil market is expected to grow at 6 % CAGR from 2022 to 2029. It is expected to reach above USD 45.98 billion by 2029 from USD 31.39 billion in 2022.

The increase in engine oil used in sectors including metallurgy, automotive, chemicals, heavy equipment, and power generation is blamed for the surge. Due to the existence of several very inventive firms, the market is extremely fragmented. Competition is fierce as participants work to keep their clientele to get a competitive advantage over one another. Businesses are implementing cooperative business tactics to boost output, offer consumers well-regarded goods, and broaden their geographical reach.

Base Oil is widely used across a wide range of sectors and plays a crucial role in the formulation of lubricating oils on a worldwide scale. Marine lubricants, which are frequently used in the shipping sector to preserve and improve the performance of engines and equipment, primarily make use of Group I base oils. These base oils must have a high viscosity for high-performance marine lubricants to function at their best.

Nowadays, one of the key global contributors to base oils is the automobile industry. Although the trend toward electric cars has slowed the rise of some lubricants after sales, the demand for lubricants in the production of vehicles is anticipated to continue. Manufacturers of lubricants engage in innovative product advancements, particularly for the automobile sector, as consumers seek for standard and customized goods to meet specific needs. Throughout the projection period, it is predicted that the demand for base oils would increase due to lubricant makers’ rising usage.

Shifting consumer preferences in the context of an anticipated economic downturn, changes to industrial regulations to reflect escalating environmental concerns, significant swings in raw material prices brought on by current geopolitical tensions, and anticipated economic turbulences are noted as key challenges that the Base Oil industry players will need to address over the short and medium-term forecast.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Type, Application, End-user industry, and region. |

| By Type |

|

| By Application |

|

| By End-user industry |

|

| By Region |

|

Players in the base oil market will focus their expenditures on acquiring innovative technologies, obtaining raw materials, effective procurement and inventory management, improving product portfolios, and utilizing skills to sustain growth in difficult economic times. Base Oil producers and related actors are concentrating on country-specific strategies as a result of the documented significant differences in the economic and social issues faced by various markets and nations.

The need for participants in the base oil business to be more watchful and forward-thinking is pressing due to worries about the global economic downturn, the Effect of the Ukrainian conflict, lockdowns in China with resurgent COVID cases, and the Hazards of stagflation envisaging various market situations. Companies are being forced to adapt their strategy because of the significant changes brought about by the COVID-19 epidemic in the base oil supply chain and the growing movement for a cleaner, more sustainable environment.

Base Oil Market Segmentation

Basic oils are divided into five categories, or Group 1 through Group 4 and others. The first three groupings come from facilities that refine petroleum downstream. Group 4 base oils are polyalphaolefin-based synthetic oils. The base oil market is divided into three categories: type, application, and region. Group I, Group II, Group III, Group IV, and other categories are used to segment the market. Engine oils, transmission and gear oils, metalworking fluids, hydraulic fluids, greases, and other applications make up the market’s application-based segments. The market size and predictions for base oil in 15 countries across significant regions are also included in the paper. The market size and forecasting for each segment have been done using volume.

Due to the increasing demand for engine oil from industries such as automotive, power, heavy equipment, metallurgy, chemicals, and others, the engine oil sector leads the market for base oil. Internal combustion engines are frequently lubricated using engine oils, which are typically composed of 75–90% basic oils and 10–25% additives. They are often used to protect the engine internals from corrosion, reduce wear, and ensure smooth operation. To improve heat transmission and lessen stress during component contact, they produce a thin coating between the moving parts.

In 2021, the group I product category dominated the market and accounted for 42.0% of total sales. Due to their accessibility, ease of processing, low volatility, high viscosity index, and lubrication properties, lubricants are becoming more and more popular in the automotive, marine, and rail industries. More than 0.03% sulfur, less than 90% saturates, and viscosities between 80 and 120 are all considered to be characteristics of Group I goods. This category is distinguished by its lack of aromatic compounds and paraffinic composition. The temperature range is 32 to 150 degrees Fahrenheit. Group I is the least refined and has a variety of irregular hydrocarbon chains when compared to the other groups.

Base Oil Market Players

Chevron Corporation, Exxon Mobil Corporation, Royal Dutch Shell PLC, Ergon Inc., Neste Oyj, Nynas AB, S-OIL CORPORATION, Sepahan Oil, Repsol S.A., Sinopec Limited, BP PLC, Evonik Industries AG, H&R Group, Saudi Aramco, and SK Lubricants Co. Ltd. are significant market participants in the base oil.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Industry Development:

-

In March 2024, Chevron began the U.S. commercial production of NEXBASE 3043, a Group III base oil, at its Richmond, California plant. This product is characterized by a high viscosity index and low volatility, making it suitable for formulating high-quality engine oils and other lubricants. The Richmond facility is now the third plant to produce NEXBASE 3043, complementing existing production in Europe and Asia, and enhancing Chevron’s capacity to meet the growing demand for premium base oils in North America.

-

February 2023 – Russian base oil shipments in 2022 were behind 2021 levels for every month of the year and are unlikely to rebound this year, trading company DYM Resources said at the Argus Global Base Oils Conference today.

-

March 2023 – Reuters, March 12, 2019 – Amin Nasser, the chief executive of Aramco, stated on Sunday that he was cautiously optimistic and believed the oil market will stay tightly balanced in the short to medium term.

Who Should Buy? Or Key Stakeholders

- Investors

- Food and Beverage industry

- Medical Technology Companies

- Healthcare and personal care firms

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

Base Oil Market Regional Analysis

The base oil market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

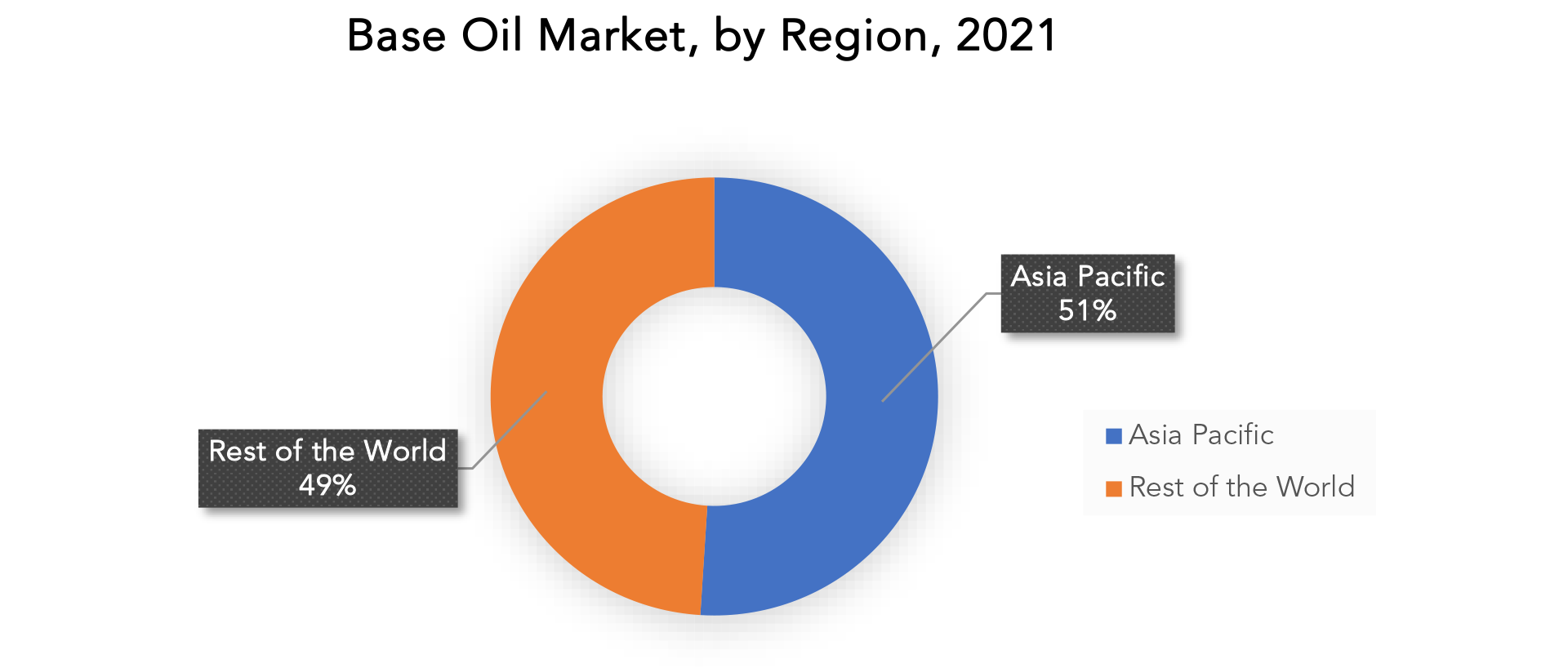

In 2021, Asia Pacific led the market and accounted for 50.6% of total revenue. This is explained by the fact that the area is a desirable market for lubricant makers due to the existence of expanding economies and the rising level of disposable income in the population. China dominates the Asia Pacific area, which is one of the world’s major markets for base oil. Throughout the forecast period, China is anticipated to dominate the Asia Pacific base oil market. The supremacy is attributable to the country’s booming industrial sector and greater usage of vehicles. The availability of raw supplies, greater foreign investment, fast industrialization, and a rising population all boost the Chinese market.

In the upcoming years, the base oil market is anticipated to develop due to the expanding automotive sector. The need for motor oils and lubricating greases that offer compatibility with fast-moving components and high temperatures is being driven by advanced engine technology. Additionally, superior base oils and additive technologies are used to create engine oils that maintain their viscosity, minimize engine wear, and assist ensure reliability. Automotive base oil is fuel for internal combustion engines, which power a range of machines, including lawnmowers, motorcycles, generators, and cars.

Similar to other markets, the Indian industry is anticipated to grow quickly because of the country’s government’s aggressive infrastructure development plans and the significant presence of multiple base oil producers. During the year 2021, Europe is expected to account for the second-largest revenue share internationally. Given that base oil makes up the majority of lubricants, the market’s expansion in Europe is thought to be significantly influenced by the region’s high lubricant consumption. The expansion of the transportation and industrial sectors is directly correlated with the increased base oil consumption.

Key Market Segments: Base Oil Market

Base Oil Market By Type, 2022-2029, (USD Billion), (Kilotons)

- Group I

- Group II

- Group III

- Group IV

- Others

Base Oil Market By Application, 2022-2029, (USD Billion), (Kilotons)

- Automotive Oil

- Industrial Oil

- Hydraulic Oil

- Grease

- Metalworking Fluid

Base Oil Market By End-User Industry, 2022-2029, (USD Billion), (Kilotons)

- Food & Beverages

- Agriculture

- Healthcare

- Automotive

- Electrical & Electronics

Base Oil Market By Region, 2022-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the base oil market over the next 7 years?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the base oil market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the base oil market?

- What are the key drivers of growth in the base oil market?

- Who are the market’s major players, and what is their market share?

- What are the base oil market’s distribution channels and supply chain dynamics?

- What are the technological advancements and innovations in the base oil market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the base oil market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the base oil market?

- What are the market’s product offerings/ service offerings and specifications of leading players?

- What is the pricing trend of base oil in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SOLAR BASE OIL MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BASE OIL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SOLAR BASE OIL MARKET OUTLOOK

- GLOBAL BASE OIL MARKET BY TYPE, 2022-2029, (USD BILLION), (KILOTONS)

- GROUP 1

- GROUP 2

- GROUP 3

- GROUP 4

- OTHERS

- GLOBAL BASE OIL MARKET BY APPLICATION, 2022-2029, (USD BILLION), (KILOTONS)

- AUTOMOTIVE OIL

- INDUSTRIAL OIL

- HYDRAULIC OIL

- GREASE

- METALWORKING FLUID

- GLOBAL BASE OIL MARKET BY END-USER INDUSTRY, 2022-2029, (USD BILLION), (KILOTONS)

- FOOD & BEVERAGES

- AGRICULTURE

- HEALTHCARE

- AUTOMOTIVE

- ELECTRICAL & ELECTRONICS

- GLOBAL BASE OIL MARKET BY REGION, 2022-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- CHEVRON CORPORATION

- EXXON MOBIL CORPORATION

- ROYAL DUTCH SHELL PLC

- ERGON INC

- NESTE OYJ

- NYNAS AB

- S-OIL CORPORATION

- SEPAHAN OIL

- REPSOL S.A.

- SINOPEC LIMITED

- BP PLC

- EVONIK INDUSTRIES AG

- H&R GROUP

- SAUDI ARMACO

- SK LUBRICANTS CO. LTD

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 2 GLOBAL BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 3 GLOBAL BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 4 GLOBAL BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 5 GLOBAL BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 6 GLOBAL BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 7 GLOBAL BASE OIL MARKET BY REGION (USD BILLION) 2022-2029

TABLE 8 GLOBAL BASE OIL MARKET BY REGION (KILOTONS) 2022-2029

TABLE 9 NORTH AMERICA BASE OIL MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 10 NORTH AMERICA BASE OIL MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 11 NORTH AMERICA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 12 NORTH AMERICA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 13 NORTH AMERICA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 14 NORTH AMERICA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 15 NORTH AMERICA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 16 NORTH AMERICA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 17 US BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 18 US BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 19 US BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 20 US BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 21 US BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 22 US BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 23 CANADA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 24 CANADA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 25 CANADA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 26 CANADA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 27 CANADA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 28 CANADA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 29 MEXICO BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 30 MEXICO BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 31 MEXICO BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 32 MEXICO BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 33 MEXICO BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 34 MEXICO BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 35 SOUTH AMERICA BASE OIL MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 36 SOUTH AMERICA BASE OIL MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 37 SOUTH AMERICA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 38 SOUTH AMERICA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 39 SOUTH AMERICA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 40 SOUTH AMERICA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 41 SOUTH AMERICA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 42 SOUTH AMERICA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 43 BRAZIL BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 44 BRAZIL BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 45 BRAZIL BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 46 BRAZIL BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 47 BRAZIL BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 48 BRAZIL BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 49 ARGENTINA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 50 ARGENTINA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 51 ARGENTINA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 52 ARGENTINA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 53 ARGENTINA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 54 ARGENTINA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 55 COLOMBIA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 56 COLOMBIA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 57 COLOMBIA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 58 COLOMBIA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 59 COLOMBIA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 60 COLOMBIA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 61 REST OF SOUTH AMERICA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 62 REST OF SOUTH AMERICA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 63 REST OF SOUTH AMERICA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 64 REST OF SOUTH AMERICA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 65 REST OF SOUTH AMERICA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 66 REST OF SOUTH AMERICA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 67 ASIA-PACIFIC BASE OIL MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 68 ASIA-PACIFIC BASE OIL MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 69 ASIA-PACIFIC BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 70 ASIA-PACIFIC BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 71 ASIA-PACIFIC BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 72 ASIA-PACIFIC BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 73 ASIA-PACIFIC BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 74 ASIA-PACIFIC BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 75 INDIA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 76 INDIA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 77 INDIA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 78 INDIA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 79 INDIA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 80 INDIA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 81 CHINA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 82 CHINA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 83 CHINA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 84 CHINA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 85 CHINA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 86 CHINA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 87 JAPAN BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 88 JAPAN BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 89 JAPAN BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 90 JAPAN BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 91 JAPAN BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 92 JAPAN BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 93 SOUTH KOREA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 94 SOUTH KOREA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 95 SOUTH KOREA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 96 SOUTH KOREA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 97 SOUTH KOREA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 98 SOUTH KOREA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 99 AUSTRALIA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 100 AUSTRALIA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 101 AUSTRALIA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 102 AUSTRALIA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 103 AUSTRALIA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 104 AUSTRALIA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 105 SOUTH-EAST ASIA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 106 SOUTH-EAST ASIA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 107 SOUTH-EAST ASIA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 108 SOUTH-EAST ASIA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 109 SOUTH-EAST ASIA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 110 SOUTH-EAST ASIA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 111 REST OF ASIA PACIFIC BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 112 REST OF ASIA PACIFIC BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 113 REST OF ASIA PACIFIC BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 114 REST OF ASIA PACIFIC BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 115 REST OF ASIA PACIFIC BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 116 REST OF ASIA PACIFIC BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 117 EUROPE BASE OIL MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 118 EUROPE BASE OIL MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 119 ASIA-PACIFIC BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 120 ASIA-PACIFIC BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 121 ASIA-PACIFIC BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 122 ASIA-PACIFIC BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 123 ASIA-PACIFIC BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 124 ASIA-PACIFIC BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 125 GERMANY BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 126 GERMANY BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 127 GERMANY BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 128 GERMANY BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 129 GERMANY BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 130 GERMANY BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 131 UK BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 132 UK BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 133 UK BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 134 UK BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 135 UK BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 136 UK BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 137 FRANCE BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 138 FRANCE BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 139 FRANCE BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 140 FRANCE BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 141 FRANCE BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 142 FRANCE BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 143 ITALY BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 144 ITALY BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 145 ITALY BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 146 ITALY BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 147 ITALY BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 148 ITALY BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 149 SPAIN BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 150 SPAIN BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 151 SPAIN BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 152 SPAIN BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 153 SPAIN BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 154 SPAIN BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 155 RUSSIA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 156 RUSSIA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 157 RUSSIA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 158 RUSSIA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 159 RUSSIA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 160 RUSSIA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 161 REST OF EUROPE BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 162 REST OF EUROPE BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 163 REST OF EUROPE BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 164 REST OF EUROPE BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 165 REST OF EUROPE BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 166 REST OF EUROPE BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 167 MIDDLE EAST AND AFRICA BASE OIL MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 168 MIDDLE EAST AND AFRICA BASE OIL MARKET BY COUNTRY (KILOTONS) 2022-2029

TABLE 169 MIDDLE EAST AND AFRICA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 170 MIDDLE EAST AND AFRICA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 171 MIDDLE EAST AND AFRICA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 172 MIDDLE EAST AND AFRICA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 173 MIDDLE EAST AND AFRICA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 174 MIDDLE EAST AND AFRICA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 175 UAE BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 176 UAE BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 177 UAE BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 178 UAE BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 179 UAE BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 180 UAE BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 181 SAUDI ARABIA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 182 SAUDI ARABIA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 183 SAUDI ARABIA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 184 SAUDI ARABIA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 185 SAUDI ARABIA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 186 SAUDI ARABIA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 187 SOUTH AFRICA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 188 SOUTH AFRICA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 189 SOUTH AFRICA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 190 SOUTH AFRICA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 191 SOUTH AFRICA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 192 SOUTH AFRICA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA BASE OIL MARKET BY TYPE (USD BILLION) 2022-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA BASE OIL MARKET BY TYPE (KILOTONS) 2022-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA BASE OIL MARKET BY APPLICATION (USD BILLION) 2022-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA BASE OIL MARKET BY APPLICATION (KILOTONS) 2022-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA BASE OIL MARKET BY END USER (USD BILLION) 2022-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA BASE OIL MARKET BY END USER (KILOTONS) 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BASE OIL MARKET BY TYPE, USD BILLION, 2022-2029

FIGURE 9 GLOBAL BASE OIL MARKET BY APPLICATION, USD BILLION, 2022-2029

FIGURE 10 GLOBAL BASE OIL MARKET BY END USER, USD BILLION, 2022-2029

FIGURE 11 GLOBAL BASE OIL MARKET BY REGION, USD BILLION, 2022-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL BASE OIL MARKET BY TYPE, 2021

FIGURE 14 GLOBAL BASE OIL MARKET BY APPLICATION 2021

FIGURE 15 GLOBAL BASE OIL MARKET BY END USER 2021

FIGURE 16 BASE OIL MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 CHEVRON CORPORATION: COMPANY SNAPSHOT

FIGURE 19 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

FIGURE 20 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

FIGURE 21 ERGON INC: COMPANY SNAPSHOT

FIGURE 22 NESTE OYJ: COMPANY SNAPSHOT

FIGURE 23 NYNAS AB: COMPANY SNAPSHOT

FIGURE 24 S-OIL CORPORATION: COMPANY SNAPSHOT

FIGURE 25 SEPAHAN OIL: COMPANY SNAPSHOT

FIGURE 26 REPSOL S.A: COMPANY SNAPSHOT

FAQ

The global base oil market is expected to grow at 6 % CAGR from 2022 to 2029. It is expected to reach above USD 45.98 billion by 2029 from USD 31.39 billion in 2022.

The increase in engine oil used in sectors including metallurgy, automotive, chemicals, heavy equipment, and power generation is blamed for the surge. Due to the existence of several very inventive firms, the market is extremely fragmented. Competition is fierce as participants work to keep their clientele to get a competitive advantage over one another. Businesses are implementing cooperative business tactics to boost output, offer consumers well-regarded goods, and broaden their geographical reach.

Due to the increasing demand for engine oil from industries such as automotive, power, heavy equipment, metallurgy, chemicals, and others, the engine oil sector leads the market for base oil. Internal combustion engines are frequently lubricated using engine oils, which are typically composed of 75–90% basic oils and 10–25% additives. They are often used to protect the engine internals from corrosion, reduce wear, and ensure smooth operation. To improve heat transmission and lessen stress during component contact, they produce a thin coating between the moving parts.

The Market’s largest share is in the Asia Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.