REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

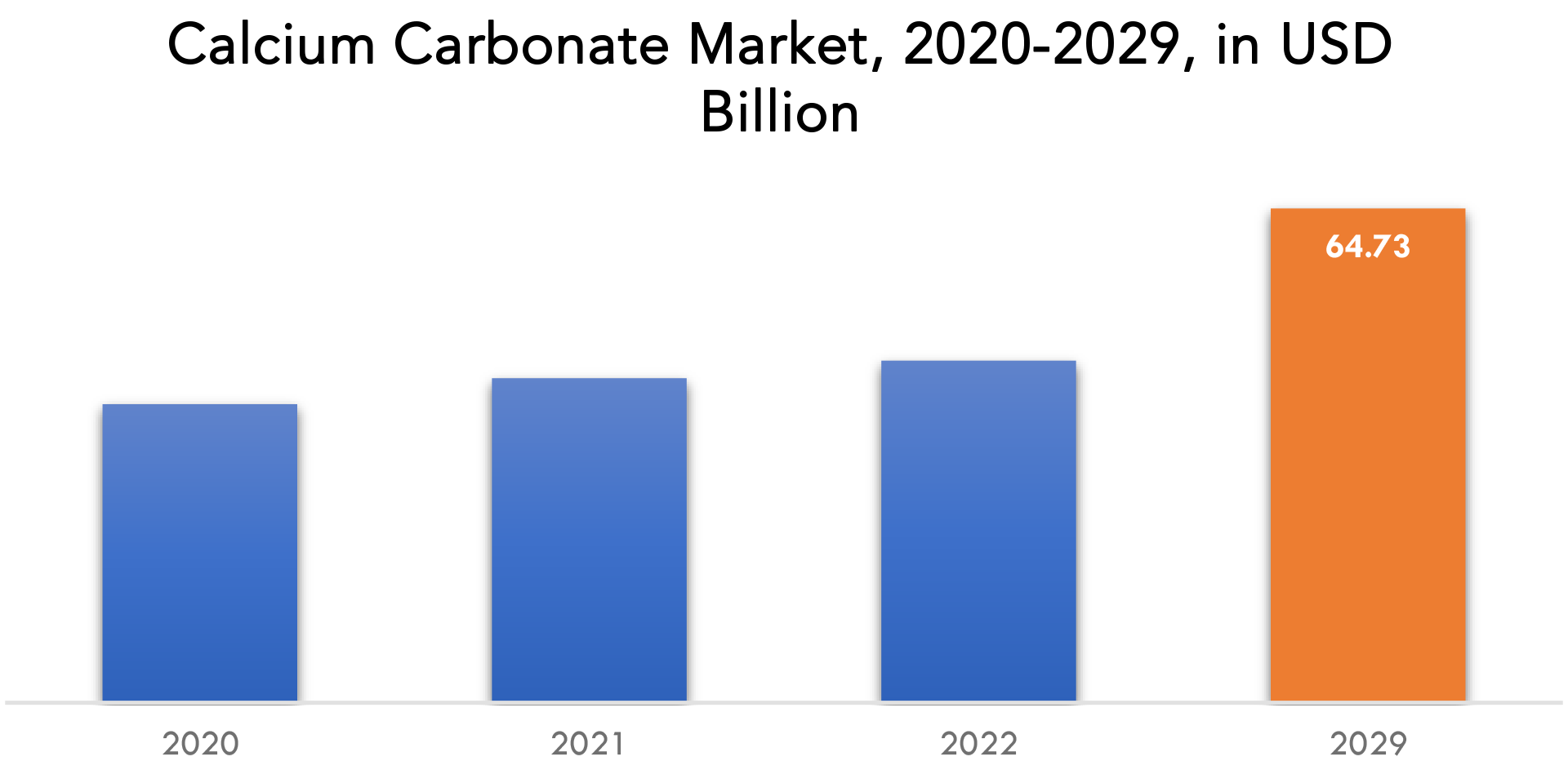

| USD 64.73 billion | 5.4 % | Asia Pacific |

| By Type | By Application | By End user |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Calcium Carbonate Market Overview

The calcium carbonate market is expected to grow at 5.4 % CAGR from 2022 to 2029. It is expected to reach above USD 64.73 billion by 2029 from USD 39.1 billion in 2020.

Calcium carbonate, having the chemical formula CaCO3, is a chemical substance. It is a typical substance found in rocks as the minerals calcite and aragonite, most notably as limestone, a form of sedimentary rock composed primarily of calcite. It also serves as the primary building block for pearls, gastropod shells, and eggshells. Calcareous refers to substances with high levels of calcium carbonate or substances that resemble it. The main component of agricultural lime is calcium carbonate, which is produced when calcium ions in hard water combine with carbonate ions to form limescale. It can be used medicinally as an antacid or calcium supplement, but excessive ingestion can be dangerous and lead to hypercalcemia and digestive problems.

Both as a standalone building material (such as marble) and as a component of cement, calcium carbonate is essential to the construction sector. It aids in the production of mortar, which is a binding agent for tiles, roofing shingles, rubber compounds, and concrete blocks. Lime, a crucial component in the production of steel, glass, and paper, is produced during the breakdown of calcium carbonate. In industrial settings, calcium carbonate is utilized to neutralize acidic conditions in both soil and water due to its antacid qualities. It is used as a cheap filler to create bright, opaque paper and is highly values by the paper industry for its excellent brightness and light scattering properties. Calcium carbonate filler, which is employed at the wet end of paper-making machinery, enables the paper to be brilliant and smooth.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By type, by application, by end user, by region |

| By Type |

|

| By Application |

|

| By End user |

|

| By Region |

|

Calcium carbonate is even used to control viscosity or heat expansion coefficient. In the production of pesticides, it is used as an additive as it is ecofriendly and suitable for the environment. It is frequently used as an efficient antacid, phosphate binder, dietary calcium supplement, and foundation for pharmaceutical tablets. Moreover, it can be found in a variety of grocery store products, including baking powder, toothpaste, dry dessert mix, bread, and wine.

Calcium carbonate is widely used by the paper industry worldwide. As technology in the paper industry transitioned from acid to neutral sizing, the use of calcium carbonate increased considerably. Calcium carbonate, both ground and precipitated, is used as a filler and coating pigment to create papers with high whiteness, gloss, and good printing qualities. The increased desire for brighter and heavier paper is, however, the main factor in the choice of calcium carbonate in papermaking. The market for calcium carbonate in the paper industry is expected to grow in the coming years, as demand for paper products continues to rise globally. The use of calcium carbonate in paper production is also becoming more widespread, as paper manufacturers look for ways to improve the quality of their products while also reducing costs.

Calcium carbonate is frequently used in the construction industry for a variety of applications which is further expanding the market growth. Calcium carbonate is often used as a filler material in concrete, as it improves the strength and durability of the concrete. It also helps to reduce the cost of concrete production. It is used as a coating material for buildings to improve their appearance and protect them from environmental damage. It is often used in the production of stucco, which is a popular exterior coating for buildings. Thus, calcium carbonate is a versatile material that is widely used in the construction industry for a variety of applications. Its properties of strength, durability, and cost-effectiveness make it a popular choice for many construction projects.

The production of calcium carbonate can have negative environmental impacts, such as the emission of greenhouse gases and the depletion of natural resources. This has led to increased scrutiny and regulations on the industry, which can limit growth. The market for office paper and newspaper paper is witnessing a 5% annual decline due to the growing use of digital media, which is progressively replacing paper. The growing digitalization functions as a test for the market because calcium carbonate is widely used as a filler in hard copy and printing paper, newspaper, and continuous paper bundling applications.

The use of calcium carbonate in the plastic industry will expand the market in the forecast period. Calcium carbonate is widely used in the production of plastic packaging materials such as bottles, containers, and films. The addition of calcium carbonate to these products improves their stiffness, impact resistance, and heat stability. It is used in the production of plastic parts for automobiles, such as dashboards, door panels, and trim. The addition of calcium carbonate to these products helps to reduce weight and improve the mechanical properties of the plastic parts. It is used in the production of plastic building materials such as pipes, roofing sheets, and wall panels. The products improve their durability and stiffness due to the addition. The biodegradable and biocompatible properties of calcium carbonate will help the market to grow in the coming years.

The demand for calcium carbonate in some sectors such as construction, paper, and packaging has been relatively stable during the pandemic. However, the pandemic has had a negative impact on other sectors, such as the automotive and aerospace industries, which have seen a significant decline in demand due to reduced production and decreased consumer spending. In addition, the supply chain for calcium carbonate has also been affected by the pandemic, as transportation and logistics have been disrupted by border closures and reduced air travel. This has led to delays in shipping and increased costs for manufacturers and distributors.

Overall, while the impact of the pandemic on the calcium carbonate market has been mixed, the industry is expected to recover as economies reopen and demand for products in various sectors returns to pre-pandemic levels.

Calcium Carbonate Market Segment Analysis

The calcium carbonate market is segmented based on type, application, end user and region.

Based on the type, calcium carbonate market is divided into ground calcium carbonate (GCC), precipitated calcium carbonate (PCC). GCC accounts for a higher share of the market revenue. Typically, ground calcium carbonate is used as a common mineral. It is used as a filler in plastic, paper, and paints & coatings. GCC can also be converted into calcium oxide and calcium hydroxide and is used in concrete as well. It can be used to reduce ignition fumes and raise the pH in soils or water.

Based on the application, market is segmented into fillers, neutralizing agents, construction materials, dietary supplements, desulfurization, additive. The demand for fillers is significant in the building and construction, automotive, electronics, and packaging industries, which has boosted calcium carbonate sales all over the world. The inorganic substance is a filler used in cement, ceramics, plastics, rubber, paints, paper, and pulp. The market for calcium carbonate is being driven by an increase in demand for these materials from the building industry and other end uses.

Among the various end users of calcium carbonate, paper industry generates the largest revenue. The paper pulp is filled with calcium carbonate, which is also used as a coating pigment. Its inclusion improves the paper’s brightness and opacity. The demand for paper in other sectors, such as packaging and tissue paper, was unaffected by the internet, despite the fact that it did have an impact on the print media market. Calcium carbonate is a cost-effective filler compared to other alternatives such as kaolin or titanium dioxide. Calcium carbonate is a natural mineral that is abundant in nature, making it a more sustainable option than synthetic fillers. Additionally, it has a low carbon footprint compared to other fillers.

Calcium Carbonate Market Players

The calcium carbonate market key players include AGSCO Corp., Carmeuse, Blue Mountain Minerals, GCCP Resources, GLC Minerals, LLC, Greer Limestone Company, Gulshan Polyols Ltd., ILC Resources, Imerys, J.M. Huber Corp., LafargeHolcim, Midwest Calcium Carbonates, Mineral Technologies, Mississippi Lime.

September 20, 2022: Mississippi Lime Company, an HBM company headquartered in St. Louis, and a leading global supplier of high-calcium lime products, announced it has completed its acquisition of Valley Minerals, a single-site dolomitic quicklime producer based in Bonne Terre, Missouri. The acquisition will enable Mississippi Lime to expand on its commitment to better serve the growing next-generation steel production base in the Central U.S.

January 1, 2023: Mississippi Lime Company (“MLC”) will increase prices for Quicklime, Hydrated Lime, Dolomitic Lime, Specialty, and Calcium Carbonate products up to 35%, subject to contractual obligations. The significant cost drivers that impacted MLC during 2022 continue to add upward pressure on operating costs as we move into 2023. Energy, labor, freight, and materials are creating significant cost pressures in the market and to MLC directly, despite strong measures taken by MLC to mitigate the impact of these increases.

Who Should Buy? Or Key stakeholders

- Calcium Carbonate Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Calcium Carbonate Market Regional Analysis

The calcium carbonate market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

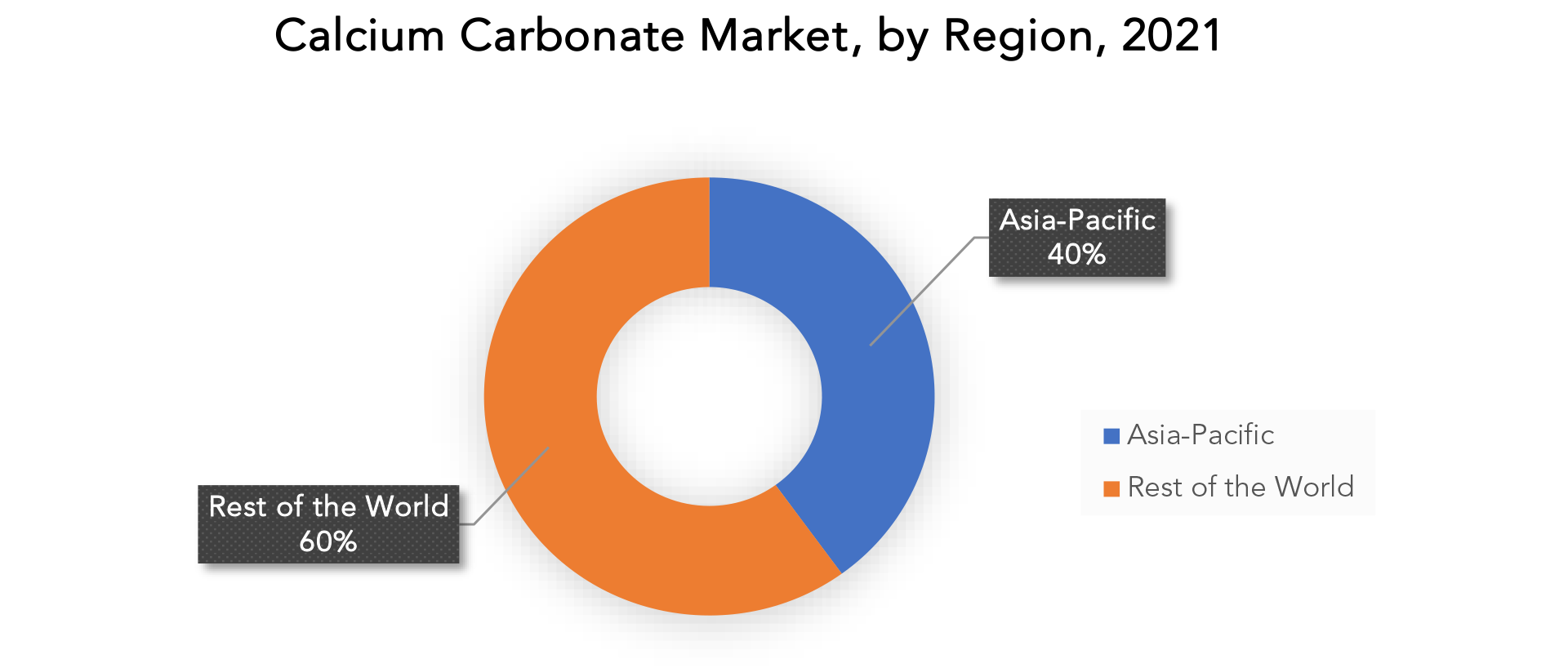

The demand for calcium carbonate from a variety of end-use sectors, including paper, plastics, paints and coatings, and construction, has led to a sizeable and quickly expanding market in the Asia Pacific region. The Asia Pacific region is home to a number of nations, including China, India, Japan, Australia, and South Korea. The pandemic has, in any event, had a terrible impact on the manufacturing network and the duties involved in assembly. The construction sector, one of the biggest consumers of the mineral in China, which is the country with the highest consumption of calcium carbonate worldwide, is what drives the country’s need for the mineral. Calcium carbonate is also widely consumed in China’s paper and plastics industries. India is a large calcium carbonate user as well, because to the expansion of the paper and construction industries. In the upcoming years, it is anticipated that the country’s growing urbanization and population will further increase calcium carbonate consumption.

Many factors, such as the rising need for paper and plastics products, rising building activity, and the developing pharmaceutical and personal care industries, are responsible for the increase in calcium carbonate demand in North America. The paper and plastics sectors, which are among the biggest consumers of calcium carbonate worldwide, are what fuel demand for the mineral in the United States, which is the major consumer of calcium carbonate in North America. Due to its use in the creation of cement, concrete, and other building materials, the construction industry in the United States is also a big user of calcium carbonate. Canada is also a significant consumer of calcium carbonate, with the paper industry being the largest consumer of the mineral. In addition, the construction industry in Canada is also a major consumer of calcium carbonate.

Key Market Segments: Calcium Carbonate Market

Calcium Carbonate Market By Type, 2020-2029, (Usd Billion), (Kilotons)

- Ground Calcium Carbonate (Gcc)

- Precipitated Calcium Carbonate (Pcc)

Calcium Carbonate Market By Application, 2020-2029, (Usd Billion), (Kilotons)

- Fillers

- Neutralizing Agents

- Construction Materials

- Dietary Supplements

- Desulfurization

- Additive

Calcium Carbonate Market By End User, 2020-2029, (Usd Billion), (Kilotons)

- Paper

- Plastic And Rubber

- Paints And Coatings

- Adhesives And Sealants

- Cement And Ceramics

- Agriculture

- Pharmaceuticals

Calcium Carbonate Market By Region, 2020-2029, (Usd Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the calcium carbonate market over the next 7 years?

- Who are the major players in the calcium carbonate market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the calcium carbonate market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the calcium carbonate market?

- What is the current and forecasted size and growth rate of the global calcium carbonate market?

- What are the key drivers of growth in the calcium carbonate market?

- What are the distribution channels and supply chain dynamics in the calcium carbonate market?

- What are the technological advancements and innovations in the calcium carbonate market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the calcium carbonate market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the calcium carbonate market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of calcium carbonate in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CALCIUM CARBONATE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CALCIUM CARBONATE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CALCIUM CARBONATE MARKET OUTLOOK

- GLOBAL CALCIUM CARBONATE MARKET BY TYPE,2020-2029, (USD BILLION, KILOTONS)

- GROUND CALCIUM CARBONATE (GCC)

- PRECIPITATED CALCIUM CARBONATE (PCC)

- GLOBAL CALCIUM CARBONATE MARKET BY APPLICATION, 2020-2029, (USD BILLION, KILOTONS)

- FILLERS

- NEUTRALIZING AGENTS

- CONSTRUCTION MATERIALS

- DIETARY SUPPLEMENTS

- DESULFURIZATION

- ADDITIVE

- GLOBAL CALCIUM CARBONATE MARKET BY END USER, 2020-2029, (USD BILLION, KILOTONS)

- PAPER

- PLASTIC AND RUBBER

- PAINTS AND COATINGS

- ADHESIVES AND SEALANTS

- CEMENT AND CERAMICS

- AGRICULTURE

- PHARMACEUTICALS

- GLOBAL CALCIUM CARBONATE MARKET BY REGION, 2020-2029, (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AGSCO CORP.

- CARMEUSE

- BLUE MOUNTAIN MINERALS

- GCCP RESOURCES

- GLC MINERALS

- GREER LIMESTONE COMPANY

- GULSHAN POLYOLS LTD.

- ILC RESOURCES

- IMERYS

- M. HUBER CORP.

- LAFARGEHOLCIM

- MIDWEST CALCIUM CARBONATES

- MINERAL TECHNOLOGIES

- MISSISSIPPI LIME. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 7 GLOBAL CALCIUM CARBONATE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL CALCIUM CARBONATE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA CALCIUM CARBONATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA CALCIUM CARBONATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 17 US CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 US CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 US CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 US CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 US CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 23 CANADA CALCIUM CARBONATE MARKET BY TYPE (BILLION), 2020-2029

TABLE 24 CANADA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 25 CANADA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 CANADA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 27 CANADA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 29 MEXICO CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 31 MEXICO CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 MEXICO CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 MEXICO CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA CALCIUM CARBONATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA CALCIUM CARBONATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 BRAZIL CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 BRAZIL CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 BRAZIL CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 49 ARGENTINA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 51 ARGENTINA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 ARGENTINA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 53 ARGENTINA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 55 COLOMBIA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 56 COLOMBIA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 57 COLOMBIA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 58 COLOMBIA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 59 COLOMBIA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC CALCIUM CARBONATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 75 INDIA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 76 INDIA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 77 INDIA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 INDIA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 INDIA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 81 CHINA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 CHINA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 CHINA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 CHINA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 CHINA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 87 JAPAN CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 JAPAN CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 JAPAN CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 JAPAN CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 JAPAN CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA FERTILIZER ADDITIVESBY TYPE (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA FERTILIZER ADDITIVESBY TYPE (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC FERTILIZER ADDITIVESBY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 117 EUROPE CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 118 EUROPE CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 119 EUROPE CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 120 EUROPE CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 121 EUROPE CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 123 EUROPE CALCIUM CARBONATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE CALCIUM CARBONATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 GERMANY CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 GERMANY CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 GERMANY CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 GERMANY CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 131 UK CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 132 UK CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 133 UK CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 134 UK CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 135 UK CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 137 FRANCE CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 138 FRANCE CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 139 FRANCE CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 140 FRANCE CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 141 FRANCE CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 143 ITALY CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 144 ITALY CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 145 ITALY CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 146 ITALY CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 147 ITALY CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 149 SPAIN CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 150 SPAIN CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 151 SPAIN CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 152 SPAIN CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 153 SPAIN CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 155 RUSSIA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 156 RUSSIA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 157 RUSSIA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 158 RUSSIA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 159 RUSSIA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 175 UAE CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 176 UAE CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 177 UAE CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 178 UAE CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 179 UAE CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA CALCIUM CARBONATE MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CALCIUM CARBONATEBY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CALCIUM CARBONATEBY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CALCIUM CARBONATEBY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CALCIUM CARBONATEBY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CALCIUM CARBONATE MARKET BY REGION 2021

FIGURE 14 GLOBAL CALCIUM CARBONATE MARKET BY APPLICATION 2021

FIGURE 15 GLOBAL CALCIUM CARBONATE MARKET BY TYPE 2021

FIGURE 16 GLOBAL CALCIUM CARBONATE MARKET BY END USER 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AGSCO CORP.: COMPANY SNAPSHOT

FIGURE 19 CARMEUSE : COMPANY SNAPSHOT

FIGURE 20 BLUE MOUNTAIN MINERALS: COMPANY SNAPSHOT

FIGURE 21 GCCP RESOURCES : COMPANY SNAPSHOT

FIGURE 22 GLC MINERALS LLC: COMPANY SNAPSHOT

FIGURE 23 GREER LIMESTONE COMPANY .: COMPANY SNAPSHOT

FIGURE 24 GULSHAN POLYOLS LTD: COMPANY SNAPSHOT

FIGURE 25 ILC RESOURCES: COMPANY SNAPSHOT

FIGURE 26 IMERYS : COMPANY SNAPSHOT

FIGURE 28 J.M. HUBER CORP: COMPANY SNAPSHOT

FIGURE 29 LAFARGEHOLCIM: COMPANY SNAPSHOT

FIGURE 30 MIDWEST CALCIUM CARBONATES: COMPANY SNAPSHOT

FIGURE 31 MINERAL TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 32 MISSISSIPPI LIME: COMPANY SNAPSHOT

FAQ

The Calcium Carbonate market size is expected to reach above USD 64.73 billion by 2029 from USD 39.1 billion in 2020.

Asia Pacific held more than 39.7 % of the Calcium Carbonate market revenue share in 2021 and will witness expansion in the forecast period.

Factors such aa rising demand from the paper industry is driving the market growth of Calcium Carbonate market.

Among the various end users of calcium carbonate, paper industry generates the largest revenue. The paper pulp is filled with calcium carbonate, which is also used as a coating pigment. Its inclusion improves the paper’s brightness and opacity. The demand for paper in other sectors, such as packaging and tissue paper, was unaffected by the internet, despite the fact that it did have an impact on the print media market.

The largest regional market for Calcium Carbonate market is Asia Pacific region. The demand for calcium carbonate from a variety of end-use sectors, including paper, plastics, paints and coatings, and construction, has led to a sizeable and quickly expanding market in the Asia Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.