REPORT OUTLOOK

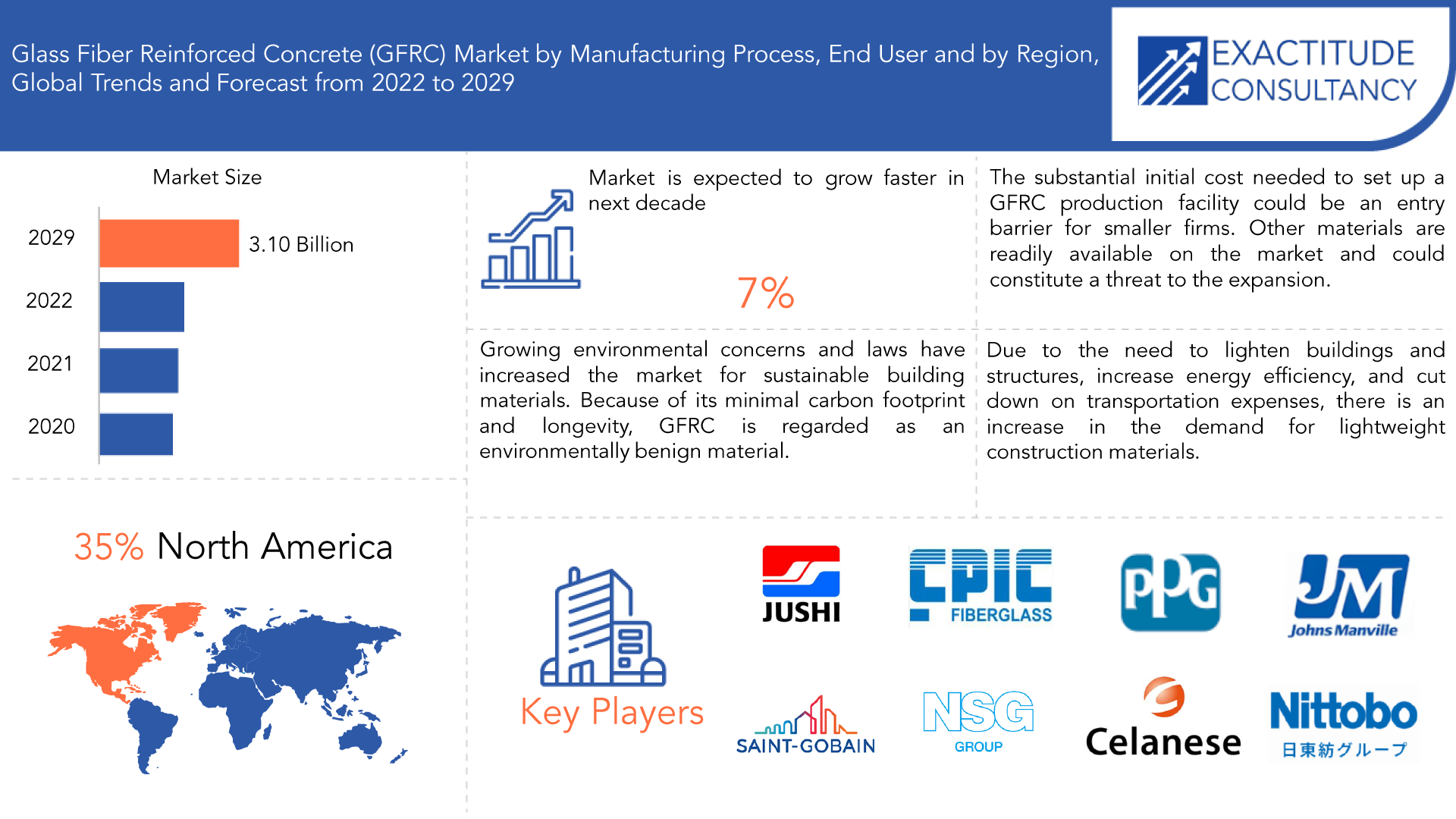

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.10 Billion by 2029 | 7% | North America |

| by Manufacturing Process | by End User | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Glass Fiber Reinforced Concrete (GFRC) Market Overview

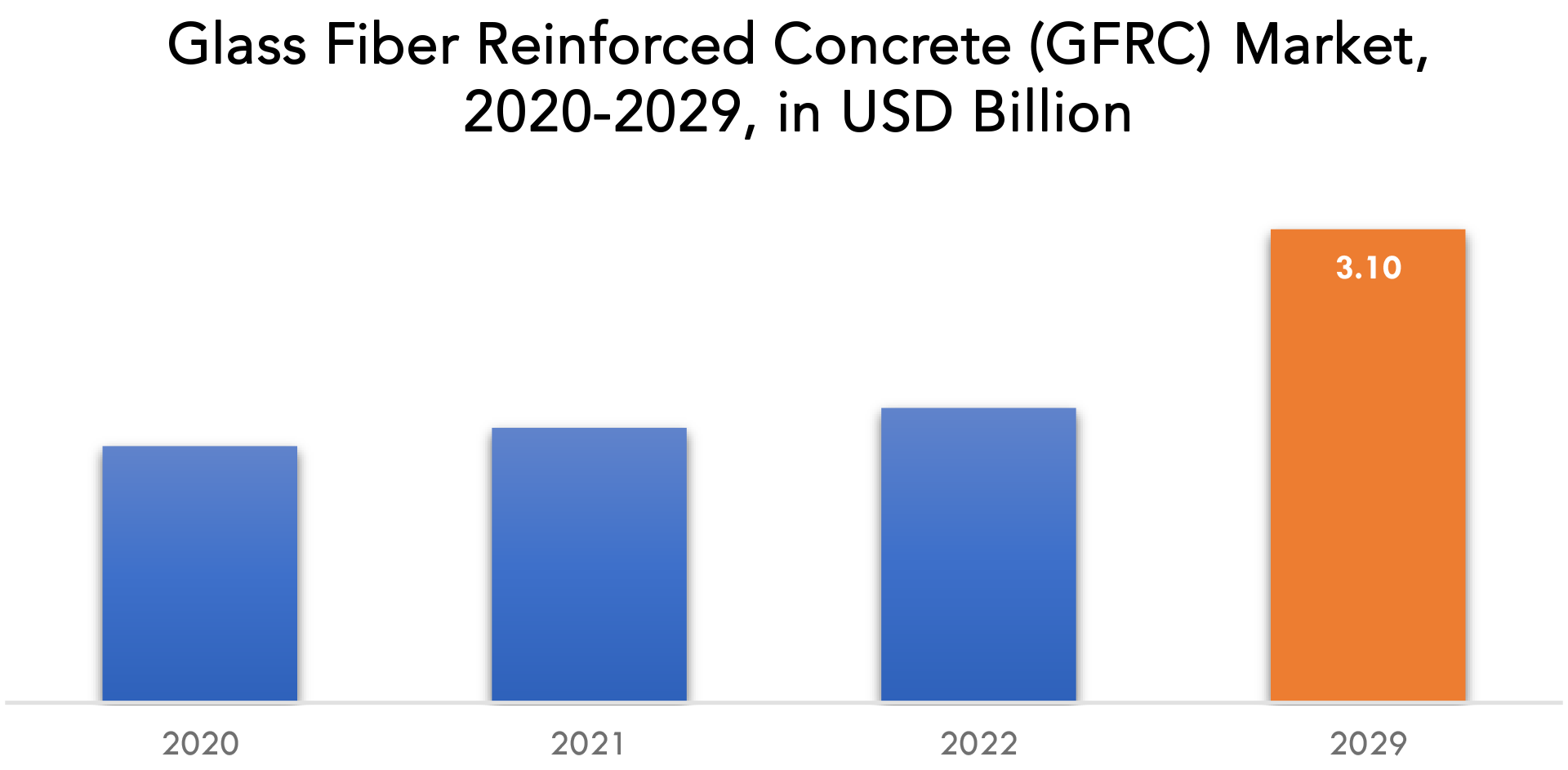

The glass fiber reinforced concrete (GFRC) market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above USD 3.10 Billion by 2029 from USD 1.68 Billion in 2020.

Strong growth for glass fibre is predicted to boost market expansion in a variety of commercial, residential, and industrial construction. High tensile, flexural, and compressive strength of the product are projected to boost demand for it as a reinforcement material in concrete. This assists in rendering concrete stronger, which raises demand for it when building things like countertops and fireplace surrounds. The market in the U.S. is anticipated to grow rapidly soon as a result of an increase in residential construction sector remodeling and renovation activities. In addition, more residential house development is probably going to become one of the main drivers of demand for glass fibre reinforced concrete (GFRC), which will support the expansion of the market in the nation.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By Manufacturing process, By End User, By Region |

| By Resin End User |

|

| By End User |

|

| By Region |

|

The precast concrete market is expanding as a result of the rapidly expanding construction industry, significant technological improvements in the industry, and advantages offered by precast concrete such as rapid construction and lower costs. Glass fibers are used in precast concrete to aid halt or delay crack formation.

In order to meet the growing need for infrastructure, governments are projected to raise their construction spending because of growing populations, fast urbanization, and industrialization in emerging economies. The demand for glass fibre reinforced concrete in a variety of construction applications is hence anticipated to increase.

Manufacturers of commodities are actively participating in research and development relating to the manufacturing of glass fibres for reinforcing purposes and are placing a greater emphasis on the production of advanced reinforcing glass fibre with a range of sizes and qualities. This should increase product penetration throughout the construction sector.

The virus COVID-19 is hazardous. It caused more than only deathly illness in a few persons. The infection may lead to complications and long-term health complications. The scenario is rendered worse by the possibility of COVID-19 reactivation a few months after a full recovery. COVID-19 is among the deadliest viruses in the post-modern world because of these and other factors.

Governments became alerted of this early in 2020. They decided to set up lockdowns and quarantines because of this. They did not have much of an impact on halting the virus’s transmission. They were transient due to this. In any case, the ramifications on many enterprises in the majority of industries worldwide were not transient. Due to lockdowns and quarantines, several businesses were required to either temporarily halt production or radically scale back operations.

It turned out, however, that businesses in the glass fiber-reinforced concrete sector had the absolute reverse outcome. Most of these businesses were successful. There was a justification for this. Individuals were focusing on remodeling and restoration projects for their residential properties all throughout the world, but mainly in Western countries. Astounding demand for glass fibre reinforced concrete resulted from this.

Glass fiber reinforced concrete (GFRC) Market Segment Analysis

The glass fiber reinforced concrete (GFRC) market is segmented based on manufacturing process, end user, and region.

Since manufacturing process, the market is segmented into spray, premix, hybrid. The leading market share for fibre reinforced concrete is forecasted to belong to the spray market subsegment. It performs great and lasts longer when installed in various residential and commercial units around the world since it is of superior quality. Moreover, spray glass fibre reinforced concrete has many more uses than regular concrete.

This kind of fiber-reinforced concrete is made by mixing fibre into a matrix and using a spray gun to apply the mixture to a specific surface. Moreover, this kind of concrete is significantly more flexible. It adapts far more readily to nature’s erratic and harsh surroundings. This prolongs the life of the buildings it covers.

Based on end user, the market is segmented into residential construction, commercial construction, infrastructure construction. The largest market share for fibre reinforced concrete is forecasted to belong to the commercial construction subsegment. It is well recognized for its capacity to absorb moisture, its ability to withstand the environment, its lack of cracking, and its resistance to fire damage. Its extensive use in the building sector is credited with giving rise to all these traits. Also, it explains why the construction sector is expanding so quickly.

Glass fiber reinforced concrete (GFRC) Market Players

Owens Corning, Jushi Group Co., Ltd., Chongqing Polycomp International Corporation, PPG Industries, Inc., Johns Manville Corporation, Saint-Gobain Corporation, Nippon Sheet Glass Co., Ltd., Taishan Fiberglass Inc., AGY Holding Corp., Asahi Fiber Glass Co., Ltd., Binani Industries Limited, Celanese Corporation, SAERTEX GmbH & Co. KG, NITTOBO ASIA Glass Fiber Co. Ltd., and BGF Industries, Inc. are the major Glass fiber reinforced concrete (GFRC) market players.

Recent News

22 September, 2022: Saint-Gobain Corporation announced that it got approval from all relevant competition authorities and thus acquired GCP Applied Technologies. GCP Applied Technologies is a major global player in construction chemical.

17 March, 2021: Nippon Sheet Glass successfully developed a new antibacterial and antiviral coating for glass substrates. The Coating is based on the proprietary sol-gel technology.

Who Should Buy? Or Key stakeholders

- Glass fiber reinforced concrete (GFRC) Manufacturers

- Raw Materials and Components Suppliers

- Distributors And Resellers

- Research and Development (R&D) Companies

- Government Research Institute

- Academic Institutes and Universities

- Investors

- Regulatory Authorities

Glass fiber reinforced concrete (GFRC) Market Regional Analysis

The Glass fiber reinforced concrete (GFRC) market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

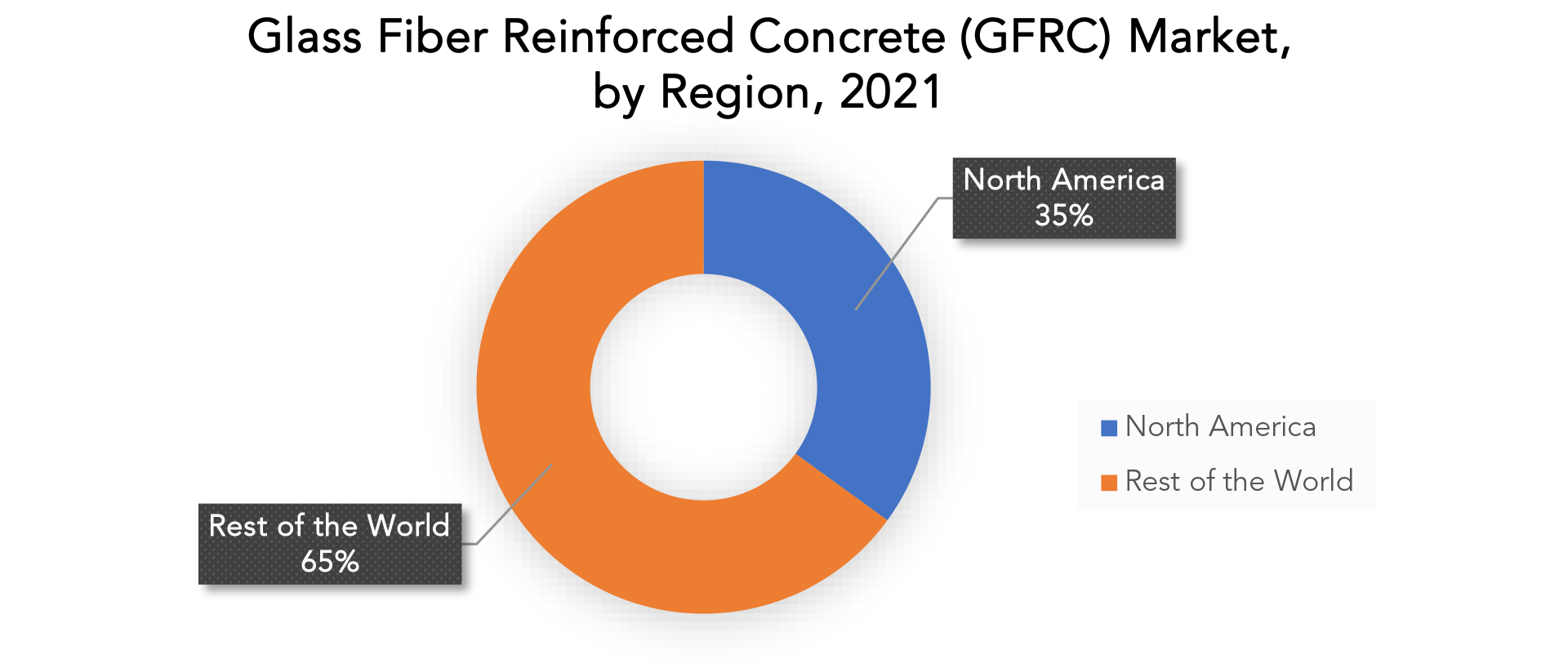

In 2021, North America dominated the Glass Fiber Reinforced Concrete (GFRC) market. With the increasing acceptance of green building techniques and rising demand for sustainable construction materials, the region held the highest share of the global market.

The two largest markets in North America are the US and Canada, where a large percentage of construction projects call for GFRC materials. The market in the region is expanding due to the usage of GFRC in architectural and ornamental applications such cladding panels, balustrades, and columns.

In addition, the growing infrastructure and urbanization in nations like China, India, and Japan are likely to drive significant growth in the GFRC market in the Asia-Pacific region. Long-term demand for GFRC products is anticipated to be driven by the increased need for lightweight construction materials and environmentally friendly building techniques in the area.

Globally, it is anticipated that the GFRC market would expand significantly, propelled by rising infrastructure development projects and rising demand for environmentally friendly and sustainable building materials.

Key Market Segments: Glass Fiber Reinforced Concrete (GFRC) Market

Glass Fiber Reinforced Concrete (GFRC) Market by Manufacturing Process, 2020-2029, (USD Billion) (Kilotons)

- Spray

- Premix

- Hybrid

Glass Fiber Reinforced Concrete (GFRC) Market by End User, 2020-2029, (USD Billion) (Kilotons)

- Residential Construction

- Commercial Construction

- Infrastructure Construction

Glass Fiber Reinforced Concrete (GFRC) Market by Region, 2020-2029, (USD Billion) (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new End User

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the glass fiber reinforced concrete (GFRC) market over the next 7 years?

- Who are the major players in the glass fiber reinforced concrete (GFRC) market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the glass fiber reinforced concrete (GFRC) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the glass fiber reinforced concrete (GFRC) market?

- What is the current and forecasted size and growth rate of the global glass fiber reinforced concrete (GFRC) market?

- What are the key drivers of growth in the glass fiber reinforced concrete (GFRC) market?

- What are the distribution channels and supply chain dynamics in the glass fiber reinforced concrete (GFRC) market?

- What are the technological advancements and innovations in the glass fiber reinforced concrete (GFRC) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the glass fiber reinforced concrete (GFRC) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the glass fiber reinforced concrete (GFRC) market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of glass fiber reinforced concrete (GFRC) in the market and what is the impact of raw End User prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET OUTLOOK

- GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION, KILOTONS), 2020-2029

- SPRAY

- PREMIX

- HYBRID

- GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION, KILOTONS), 2020-2029

- RESIDENTIAL CONSTRUCTION

- COMMERCIAL CONSTRUCTION

- INFRASTRUCTURE CONSTRUCTION

- GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY REGION (USD BILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- OWENS CORNING,

- JUSHI GROUP CO., LTD.

- CHONGQING POLYCOMP INTERNATIONAL CORPORATION

- PPG INDUSTRIES, INC.

- JOHNS MANVILLE CORPORATION

- SAINT-GOBAIN CORPORATION

- NIPPON SHEET GLASS CO., LTD.

- TAISHAN FIBERGLASS INC.

- AGY HOLDING CORP.

- ASAHI FIBER GLASS CO., LTD.

- BINANI INDUSTRIES LIMITED

- CELANESE CORPORATION

- SAERTEX GMBH & CO. KG

- NITTOBO ASIA GLASS FIBER CO. LTD.

- BGF INDUSTRIES, INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 2 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 3 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 4 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 5 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 NORTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 13 US GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 14 US GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 15 US GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 US GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 CANADA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 18 CANADA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 19 CANADA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 20 CANADA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 21 MEXICO GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 22 MEXICO GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 23 MEXICO GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 24 MEXICO GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 25 SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 26 SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 27 SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 28 SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 29 SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 30 SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 31 BRAZIL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 32 BRAZIL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 33 BRAZIL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 BRAZIL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 35 ARGENTINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 36 ARGENTINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 37 ARGENTINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 38 ARGENTINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 39 COLOMBIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 40 COLOMBIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 41 COLOMBIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 COLOMBIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 REST OF SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 44 REST OF SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 46 REST OF SOUTH AMERICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 47 ASIA-PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 48 ASIA-PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 49 ASIA-PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 50 ASIA-PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 51 ASIA-PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 52 ASIA-PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 53 INDIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 54 INDIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 55 INDIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 56 INDIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 57 CHINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 58 CHINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 59 CHINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 CHINA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 61 JAPAN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 62 JAPAN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 63 JAPAN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 64 JAPAN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 65 SOUTH KOREA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 66 SOUTH KOREA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 67 SOUTH KOREA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 68 SOUTH KOREA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 69 AUSTRALIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 70 AUSTRALIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 71 AUSTRALIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 72 AUSTRALIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 73 SOUTH-EAST ASIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 74 SOUTH-EAST ASIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 75 SOUTH-EAST ASIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 76 SOUTH-EAST ASIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 77 REST OF ASIA PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 78 REST OF ASIA PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 79 REST OF ASIA PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 REST OF ASIA PACIFIC GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 82 EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 83 EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 84 EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 85 EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 GERMANY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 88 GERMANY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 89 GERMANY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 90 GERMANY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 91 UK GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 92 UK GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 93 UK GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 94 UK GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 95 FRANCE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 96 FRANCE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 97 FRANCE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 FRANCE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 ITALY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 100 ITALY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 101 ITALY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 102 ITALY GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 103 SPAIN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 104 SPAIN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 105 SPAIN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 106 SPAIN GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 107 RUSSIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 108 RUSSIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 109 RUSSIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 RUSSIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 REST OF EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 112 REST OF EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 113 REST OF EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 114 REST OF EUROPE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 121 UAE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 122 UAE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 123 UAE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 UAE GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 SAUDI ARABIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 126 SAUDI ARABIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 127 SAUDI ARABIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 128 SAUDI ARABIA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 129 SOUTH AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 130 SOUTH AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 131 SOUTH AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 132 SOUTH AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (USD BILLION) 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS (KILOTONS) 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS, USD BILLION, 2020-2029

FIGURE 6 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 7 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 8 PORTER’S FIVE FORCES MODEL

FIGURE 9 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY MANUFACTURING PROCESS, USD BILLION, 2021

FIGURE 10 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY END USER, USD BILLION, 2021

FIGURE 11 GLOBAL GLASS FIBER REINFORCED CONCRETE (GFRC) MARKET BY REGION, USD BILLION, 2021

FIGURE 12 MARKET SHARE ANALYSIS

FIGURE 13 OWENS CORNING: COMPANY SNAPSHOT

FIGURE 14 JUSHI GROUP CO., LTD.: COMPANY SNAPSHOT

FIGURE 15 CHONGQING POLYCOMP INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

FIGURE 16 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 17 JOHNS MANVILLE CORPORATION: COMPANY SNAPSHOT

FIGURE 18 SAINT-GOBAIN CORPORATION: COMPANY SNAPSHOT

FIGURE 19 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

FIGURE 20 TAISHAN FIBERGLASS INC.: COMPANY SNAPSHOT

FIGURE 21 AGY HOLDING CORP.: COMPANY SNAPSHOT

FIGURE 22 ASAHI FIBER GLASS CO., LTD.: COMPANY SNAPSHOT

FIGURE 23 BINANI INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 24 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 25 SAERTEX GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 26 NITTOBO ASIA GLASS FIBER CO. LTD.: COMPANY SNAPSHOT

FIGURE 27 BGF INDUSTRIES, INC.: COMPANY SNAPSHOT

FAQ

The glass fiber reinforced concrete (GFRC) market size had crossed USD1.68 Billion in 2020 and will observe a CAGR of more than 7% up to 2029.

The key factors driving the market include the rapidly expanding construction sector in growing economies. Also, rising renovation activities in the residential and commercial sectors are estimated to further aid the market growth.

The region’s largest share is in North America. Manufacturing process that is manufactured in nations like US and Canada that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal. Also, the key players such as PPG Industries, Inc., Johns Manville Corporation play important roles.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.