REPORT OUTLOOK

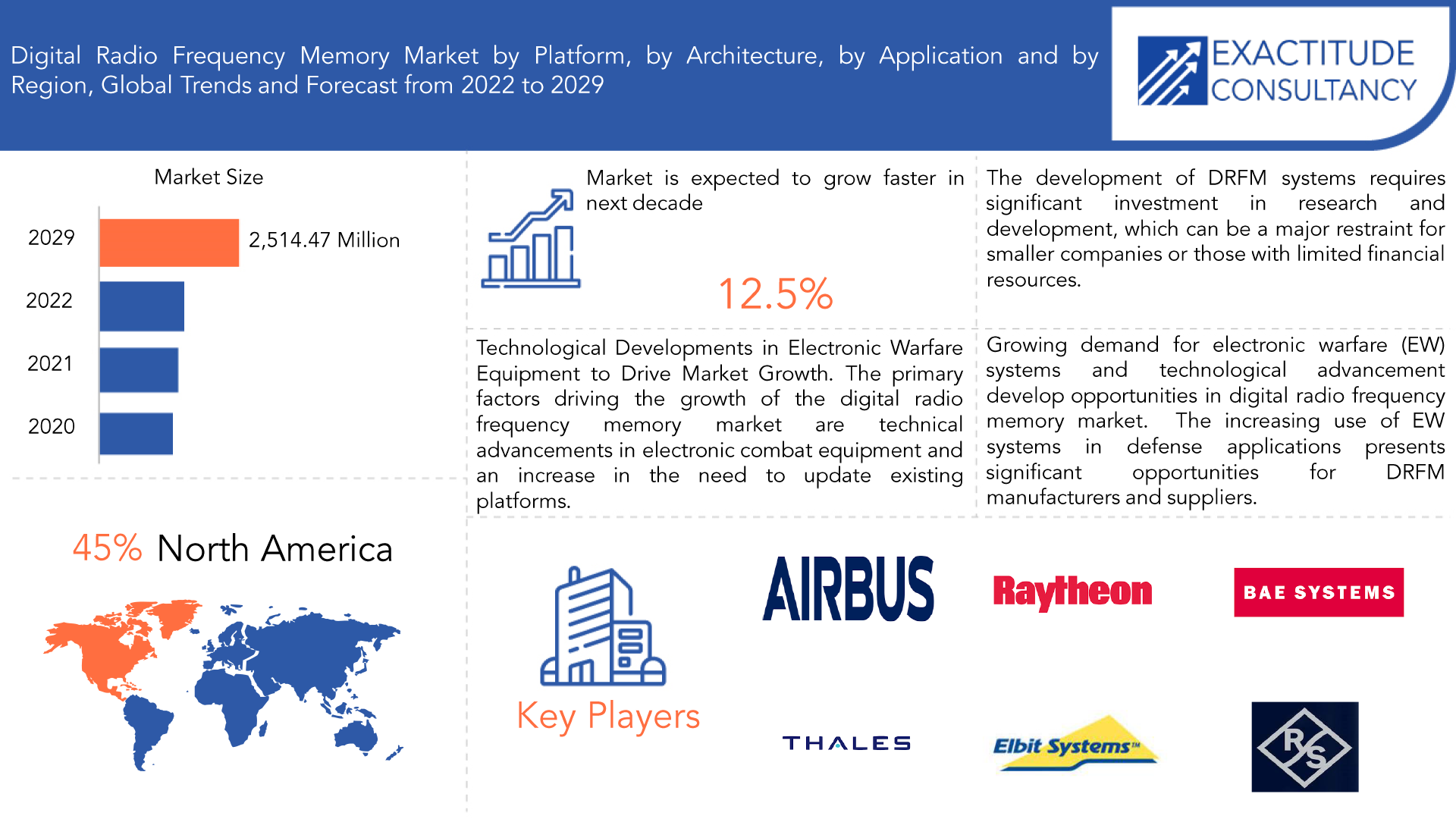

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2514.47 million by 2029 | 12.5% | North America |

| By Platform | By Architecture | By Application | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Digital Radio Frequency Memory Market Overview

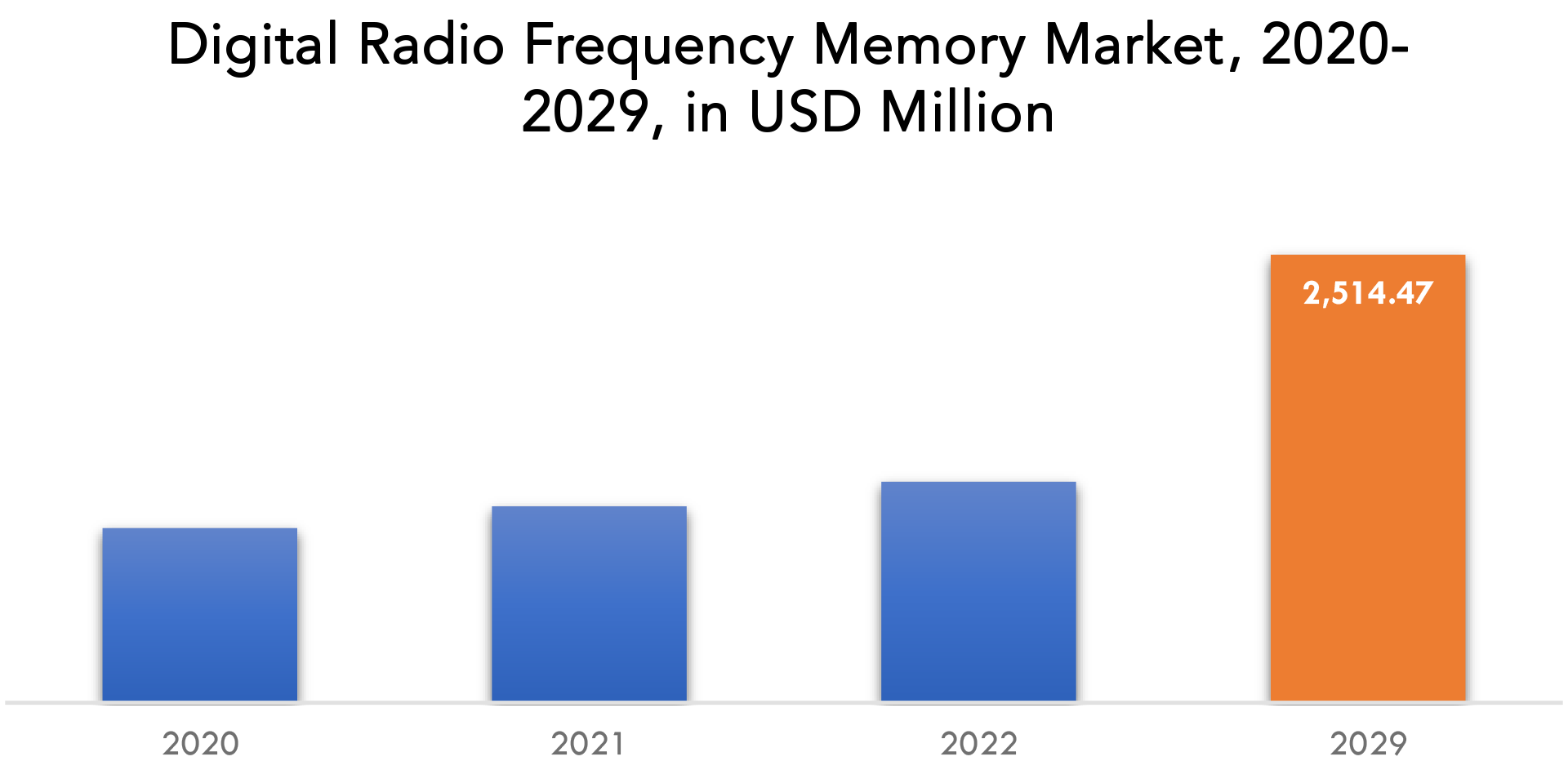

The digital radio frequency memory market is expected to grow at 12.5% CAGR from 2023 to 2029. It is expected to reach above USD 2514.47 million by 2029 from USD 980.0 million in 2022.

In the digital radio frequency memory (DRFM) approach, radio frequency, and microwave signals are stored using high-speed sampling and digital memory. The use of it to implement false-target ECM systems is growing in popularity. Digital radio frequency memory offers several functions, including coherent time delaying of RF signals and coherent deception jamming of a radar system by replaying a captured radar pulse with a slight delay, which gives the impression that the target is moving. DRFM can additionally modify the amplitude, frequency, and phase of collected pulse data to provide additional effects. The DRFM is a device with storage mechanisms in which the actual radar signal is saved, modulated with jamming signals, and then retransmitted to the danger.

To faithfully simulate the RADAR return from a genuine (complex) target, a DRFM can also produce a multidimensional signal. Electronic systems built on the DRFM are widely incorporated into a variety of defense platforms, including naval ships, ground-based military forces, and others. Due to advancements in military radar technology and the introduction of cognitive electronic warfare, the market for digital radio frequency memory is anticipated to rise more rapidly over the forecast period. The demand for worldwide digital radio frequency memory has expanded due to ongoing technological advancements. The global market for digital radio frequency memory, however, is not growing because of the limited defense spending in developing nations. Moreover, throughout the projected period, the market is anticipated to benefit from the development of DRFM-based jammers for UAV applications.

The development of electronic combat technology and the growing demand for platform updates are the main drivers propelling the market for digital radio frequency memory. The increasing use of DRFM jammers in the military and on airplanes as a form of radar-based enemy tracking defense is another element promoting market expansion. The market for digital radio frequency memory is being driven by the defense industry’s increased spending in numerous countries to develop their defense systems as transnational disputes become more frequent.

The need to replace outdated platforms and technological advancements in electronic warfare equipment are two major factors boosting the DRFM industry. In addition, the increasing use of DRFM jammers in the military, aviation, and other organizations as a form of defense against enemy radar-based surveillance is one of the factors driving the growth of the DRFM market. In addition, the DRFM market is being driven ahead by increasing defense system spending in developing countries like China, India, and others, as well as by an uptick in transnational conflicts that result in a greater need for military combat equipment.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD MILLION) |

| Segmentation | By Platform, By Architecture, By Application, By Region |

| By Platform

|

|

| By Architecture

|

|

| By Application

|

|

| By Region

|

|

The main market restraints are expensive development and maintenance costs and sophisticated technology. The enormous expenditure in research and development needed to establish DRFM systems might be a major barrier for smaller businesses or those with limited financial means. The use of DRFM systems in some applications may be constrained by the high costs associated with maintenance and repair. The complexity of DRFM systems necessitates knowledge in a variety of fields, such as software development, digital electronics, and signal processing. Manufacturers may find it challenging to design and integrate DRFM systems that satisfy customers’ needs for performance and reliability a result. A further obstacle to the market’s expansion is the lack of skilled labor. To efficiently run and maintain DRFM systems, qualified staff is needed. The adoption and expansion of the DRFM industry, however, may be constrained by a lack of competent employees with the required technical skills.

The market for digital radio frequency memory has opportunities due to rising electronic warfare (EW) system demand and technical development. Manufacturers and producers of DRFM have a lot of potential due to the growing use of EW systems in defense applications. Advanced DRFM systems that may offer better signal processing and ECM capabilities are becoming more and more in demand as the complexity and sophistication of EW systems keep expanding. As software-defined radio (SDR) technology is used more frequently, digital signal processing techniques are enhanced, and digital-to-analog converters (DACs) and analog-to-digital converters progress, the DRFM market is seeing quick technological improvements (ADCs). As a result of these developments, manufacturers now have more opportunities to create cutting-edge DRFM systems that can satisfy consumers’ changing needs. Rising defense spending also creates opportunities for market expansion. Opportunities for DRFM producers and suppliers to grow their market share are being created by the increasing defense budgets of various nations. The demand for DRFM systems that can boost the effectiveness of EW systems is rising as nations engage in cutting-edge defense technologies to increase their military prowess. Manufacturers and suppliers increase their market share and create cutting-edge solutions that can cater to the specific requirements of clients.

The Digital Radio Frequency Memory (DRFM) sector, like many other industries, has been significantly impacted by the Covid-19 pandemic. Delays in product releases, decreased demand, supply chain disruptions, remote work, and a rise in the use of unmanned systems are only a few of the major effects. Global supply chains have been hampered by the epidemic, which has impacted the supply of basic components, finished goods, and raw materials. As a result, there have been delays in the production, shipping, and delivery of DRFM systems. Particularly in business applications like aviation and telecommunications, the pandemic has caused a decline in demand for DRFM systems. Manufacturers and suppliers have consequently seen their sales and incomes decline. As a result of supply chain interruptions and decreased demand brought on by the pandemic, manufacturers were forced to delay or postpone the release of new DRFM systems. Due to the epidemic, many businesses have been compelled to implement remote working practices, which has hampered manufacturers’ capacity for effective teamwork and communication. Development and integration of products have been delayed as a result. Unmanned technology, like drones and unmanned ground vehicles, has become more popular as a result of the epidemic for surveillance and monitoring tasks. As a result, there are now more opportunities for DRFM providers and manufacturers since these systems need sophisticated EW capabilities. The Covid-19 epidemic has generally had a mixed effect on the DRFM market, with supply chain interruptions and decreased demand posing problems for producers and suppliers. Yet, the rising use of unmanned systems opens up new prospects for commercial expansion and expansion.

Digital Radio Frequency Memory Market Segment Analysis

The digital radio frequency memory market is segmented based on platform, architecture, application, and region.

By platform into (Defense, Commercial, and civil). By architecture into (Processors, Modulators, Converters, Memory, and Others). By Application into (Electronic warfare, Radar test and evaluation, electronic warfare training, Radio, and cellular network jamming) and region.

The market is divided into defense and commercial & civil segments based on the kind of platform. Air, naval, ground, and unmanned systems are included in the military sector. Electronic Support Measures are the main used for Naval DRFM systems (ESM). A wide variety of Naval Laser Warning (NLW) systems, as well as ESM and ELINT systems for submarine and surface vessels, are delivered by major participants in the naval DRFM system industry. The capabilities of these naval DRFM systems include early detection, analysis, threat warning, and anti-ship cruise missile defense (ASCMs).

The market is divided into four categories based on the kind of application electronic warfare, radar test and evaluation, electronic warfare training, and radio and cellular network jamming. The market’s main application sector is thought to be electronic warfare. In both airborne and maritime platforms, electronic warfare systems are mounted. Electronic warfare issues electromagnetic spectrum commands to interfere with hostile electronic systems. Electronic warfare technologies now have more potential thanks to the use of DRFM devices in jammers. The DRFM devices can store and alter signals before sending them to the adversary’s radar. These systems use a variety of deception strategies to trick the adversary radar, including multiple false target creation, range gate pull-off, and velocity gate pull-off. Other applications for DRFM-based systems include Communications Intelligence (COMINT) and Signals Intelligence (SIGINT) operations to intercept the electromagnetic signatures of adversarial aircraft, ships, and other units. These electromagnetic signatures provide information regarding the capabilities of adversary ships and the types of electronic systems in use.

Processors, modulators, converters, memory, and other devices are the market segments based on architecture type. The inbound radar signal’s digital waveform is stored in the memory. To send this signal back to the target radar for deception jamming, DRFM analyses it. In 2021, the processor segment had the highest market share based on architecture type.

Digital Radio Frequency Memory Market Player

The digital radio frequency memory market key players include Airbus, Raytheon Company, BAE Systems, ROHDE & SCHWARZ, Elbit Systems Ltd., Thales Group, Curtiss-Wright Corporation, Israel Aerospace Industries Ltd., Northrop Grumman Corporation, and Leonardo – Societ per azioni.

02 March 2023: Airbus Helicopters has partnered with International SOS to launch a next-generation emergency medical system improvement program, LifeSaver, which enhances healthcare systems to improve patient outcomes. Estonia is the first country to work with International SOS and Airbus Helicopters to launch a national innovation program dedicated to improving their emergency medical system (EMS) through LifeSaver. Estonia is at the forefront of technological innovation, including in the medical sector. By being the first to implement the LifeSaver solution, the country is taking a medium to long-term view on enhancing its EMS response capabilities.

01 February 2023: Qatar Airways and Airbus are pleased to have reached an amicable and mutually agreeable settlement about their legal dispute over A350 surface degradation and the grounding of A350 aircraft. A repair project is now underway and both parties look forward to getting these aircraft safely back in the air.

Who Should Buy? Or Key Stakeholders

- Armed Forces (Air Force, Army, and Navy)

- Defense Research Institutes

- Government Telecommunication Authorities

- Manufacturers of Electronic Jammers

- Original Equipment Manufacturers (OEMs)

- System-on-Chip Electronic Component Suppliers

- Investors

- Regulatory Authorities

- Others

Digital Radio Frequency Memory Market Regional Analysis

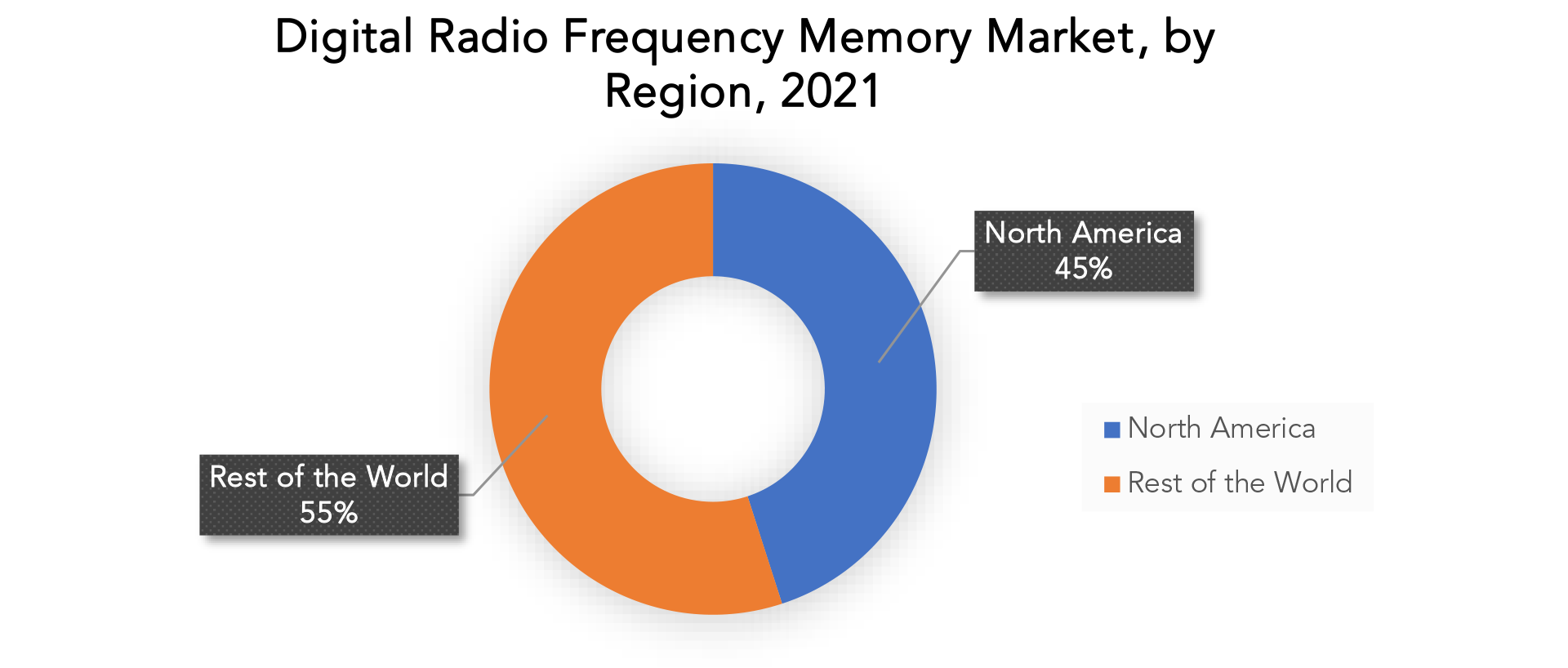

The digital radio frequency memory market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North America held more than 45% of the Digital radio frequency memory market revenue share in 2021 and will witness expansion in the forecast period. North America has the biggest market share for DRFM throughout the preceding ten years. Defense organizations in North America are making growing investments in the creation of cutting-edge DRFM systems. Among the most well-known and significant DRFM producers in the area is Northrop Grumman Corporation (US). In 2021, the US market for Digital Radio Frequency Memory (DRFM) is expected to be worth 285 million dollars. Canada is one of the other important geographic markets, and it is anticipated to expand at a 9.7% annual pace during the study period. A well-known and significant producer of DRFM in the area is Northrop Grumman Corporation (U.S.). By 2021, the US market for Digital Radio Frequency Memory (DRFM) is anticipated to be worth $285 million. One of the other important regional markets, Canada, is anticipated to grow at an annual rate of 9.7% during the studied period. A worldwide defense firm that offers cybersecurity, civil government, and defense-related solutions is the Raytheon Firm (US). In 2015, the company had 13.5% of the global market for digital radio frequency memory (DRFM). The company has a significant number of government contracts, and as part of its main strategy, it is developing new products.

As cognitive electronic warfare technologies advance, Europe offers promising development opportunities in the digital radio frequency memory sector. Germany’s growth within Europe is anticipated to develop at a CAGR of 8.3%. The most renowned and significant DRFM manufacturer in this area is BAE Systems plc. The Army is giving its European units access to cutting-edge electronic warfare equipment. Just before the Coronavirus outbreak, the US military was done delivering intermediate equipment to its troops in Europe. In the fiscal year 2021, similar efforts were made. The European DRFM Market is being helped by all of these factors. Since current sophisticated technology is linked with industry demands, Europe is anticipated to lead the digital radio frequency memory (DRFM) market. According to estimates, Europe will have 25.6% of the market in 2022.

Key Market Segments: Digital Radio Frequency Memory Market

Digital Radio Frequency Memory Market By Platform, 2020-2029, (USD Million).

- Defense

- Commercial And Civil

Digital Radio Frequency Memory Market By Architecture, 2020-2029, (USD Million).

- Processors

- Modulators

- Converters

- Memory

- Others

Digital Radio Frequency Memory Market By Application, 2020-2029, (USD Million).

- Electronic Warfare

- Radar Test And Evaluation

- Electronic Warfare Training

- Radio And Cellular Network Jamming

Digital Radio Frequency Memory Market By Region, 2020-2029, (USD Million).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the digital radio frequency memory market over the next 7 years?

- Who are the major players in the digital radio frequency memory market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the digital radio frequency memory market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the digital radio frequency memory market?

- What is the current and forecasted size and growth rate of the global digital radio frequency memory market?

- What are the key drivers of growth in the digital radio frequency memory market?

- What are the distribution channels and supply chain dynamics in the digital radio frequency memory market?

- What are the technological advancements and innovations in the digital radio frequency memory market and their impact on form development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the digital radio frequency memory market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the digital radio frequency memory market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global digital radio frequency memory market outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact Of Covid-19 On the Digital Radio Frequency Memory Market

- Porter’s Five Forces Model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry Value Chain Analysis

- Global digital radio frequency memory market outlook

- Global Digital Radio Frequency Memory Market By Platform (USD Million), 2020-2029

- Defense

- Commercial and Civil

- Global Digital Radio Frequency Memory Market By Architecture (USD Million),2020-2029

- Processors

- Modulators

- Converters

- Memory

- Others

- Global Digital Radio Frequency Memory Market By Application (USD Million),2020-2029

- Electronic warfare

- Radar test and evaluation

- Electronic warfare training

- Radio and cellular network jamming

- Global Digital Radio Frequency Memory Market By Region (USD Million),2020-2029

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Airbus

- Raytheon Company

- BAE Systems

- ROHDE & SCHWARZ

- Elbit Systems Ltd.

- Thales Group

- Curtiss-Wright Corporation

- Israel Aerospace Industries Ltd.

- Northrop Grumman Corporation

- Leonardo – Societ per azioni.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 2 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 3 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 4 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY REGION (USD MILLION) 2020-2029

TABLE 5 NORTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 6 NORTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 7 NORTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 8 NORTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 9 US DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 10 US DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 11 US DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 12 CANADA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 13 CANADA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 14 CANADA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 15 MEXICO DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 16 MEXICO DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 17 MEXICO DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 18 SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 19 SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 20 SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 21 SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 22 BRAZIL DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 23 BRAZIL DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 24 BRAZIL DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 25 ARGENTINA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 26 ARGENTINA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 27 ARGENTINA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 28 COLOMBIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 29 COLOMBIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 30 COLOMBIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 31 REST OF THE SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 34 ASIA-PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 35 ASIA-PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 36 ASIA-PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 37 ASIA-PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 38 INDIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 39 INDIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 40 INDIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 41 CHINA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 42 CHINA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 43 CHINA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 44 JAPAN DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 45 JAPAN DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 46 JAPAN DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 47 SOUTH KOREA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 48 SOUTH KOREA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 49 SOUTH KOREA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 50 AUSTRALIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 51 AUSTRALIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 52 AUSTRALIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 53 SOUTH-EAST ASIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 54 SOUTH-EAST ASIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 55 SOUTH-EAST ASIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 59 EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 60 EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 61 EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 62 EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 63 GERMANY DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 64 GERMANY DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 65 GERMANY DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 66 UK DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 67 UK DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 68 UK DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 69 FRANCE DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 70 FRANCE DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 71 FRANCE DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 72 ITALY DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 73 ITALY DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 74 ITALY DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 75 SPAIN DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 76 SPAIN DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 77 SPAIN DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 78 RUSSIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 79 RUSSIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 80 RUSSIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 81 REST OF EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 82 REST OF EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 83 REST OF EUROPE DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 88 UAE DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 89 UAE DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 90 UAE DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 91 SAUDI ARABIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 92 SAUDI ARABIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 93 SAUDI ARABIA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 94 SOUTH AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 95 SOUTH AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 96 SOUTH AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 97 REST OF THE MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM (USD MILLION), 2020-2029

TABLE 98 REST OF THE MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE (USD MILLION), 2020-2029

TABLE 99 REST OF THE MIDDLE EAST AND AFRICA DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION (USD MILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL DIGITAL RADIO FREQUENCY BY PLATFORM, USD MILLION, 2020-2029

FIGURE 9 GLOBAL DIGITAL RADIO FREQUENCY BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL DIGITAL RADIO FREQUENCY BY ARCHITECTURE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL DIGITAL RADIO FREQUENCY BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY PLATFORM, USD MILLION, 2021

FIGURE 14 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 15 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY ARCHITECTURE, USD MILLION, 2021

FIGURE 16 GLOBAL DIGITAL RADIO FREQUENCY MEMORY MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AIRBUS: COMPANY SNAPSHOT

FIGURE 19 RAYTHEON COMPANY: COMPANY SNAPSHOT

FIGURE 20 BAE SYSTEMS: COMPANY SNAPSHOT

FIGURE 21 ROHDE & SCHWARZ: COMPANY SNAPSHOT

FIGURE 22 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 23 THALES GROUP: COMPANY SNAPSHOT

FIGURE 24 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

FIGURE 25 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 26 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 27 LEONARDO – SOCIET PER AZIONI: COMPANY SNAPSHOT

FAQ

The digital radio frequency memory market is expected to grow at 12.5% CAGR from 2022 to 2029. It is expected to reach above USD 2514.47 Million by 2029 from USD 980.0 Million in 2020.

North America held more than 45% of the Digital radio frequency memory market revenue share in 2021 and will witness expansion in the forecast period.

The development of electronic combat technology and the growing demand for platform updates are the main drivers propelling the market for digital radio frequency memory. The increasing use of DRFM jammers in the military and on airplanes as a form of radar-based enemy tracking defense is another element promoting market expansion. The market for digital radio frequency memory is being driven by the defense industry’s increased spending in numerous countries to develop their defense systems as transnational disputes become more frequent.

To faithfully simulate the RADAR return from a genuine (complex) target, a DRFM can also produce a multidimensional signal. Electronic systems built on the DRFM are widely incorporated into a variety of defense platforms, including naval ships, ground-based military forces, and others. Due to advancements in military radar technology and the introduction of cognitive electronic warfare, the market for digital radio frequency memory is anticipated to rise more rapidly over the forecast period. The demand for worldwide digital radio frequency memory has expanded due to ongoing technological advancements. The global market for digital radio frequency memory, however, is not growing due to limited defense spending in developing nations. Moreover, throughout the projected period, the market is anticipated to benefit from the development of DRFM-based jammers for UAV applications.

North America held more than 45% of the Digital radio frequency memory market revenue share in 2021 and will witness expansion in the forecast period. North America has the biggest market share for DRFM throughout the preceding ten years. Defense organizations in North America are making growing investments in the creation of cutting-edge DRFM systems. Among the most well-known and significant DRFM producers in the area is Northrop Grumman Corporation (U.S.). In 2021, the US market for Digital Radio Frequency Memory (DRFM) is expected to be worth 285 million dollars.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.