REPORT OUTLOOK

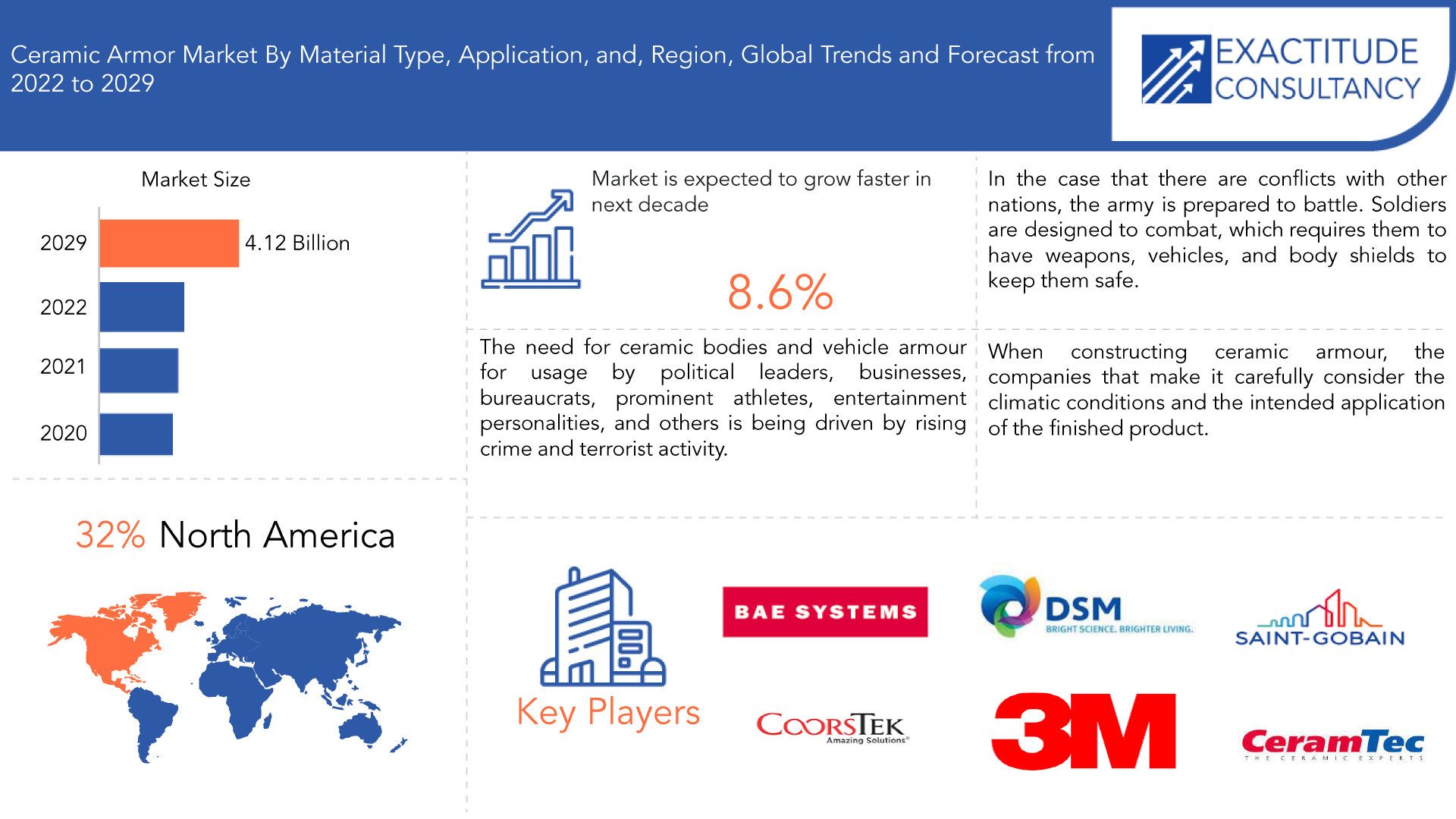

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 4.12 billion by 2029 | 8.6% | North America |

| By Material Type | By Application | |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Ceramic Armor Market Overview:

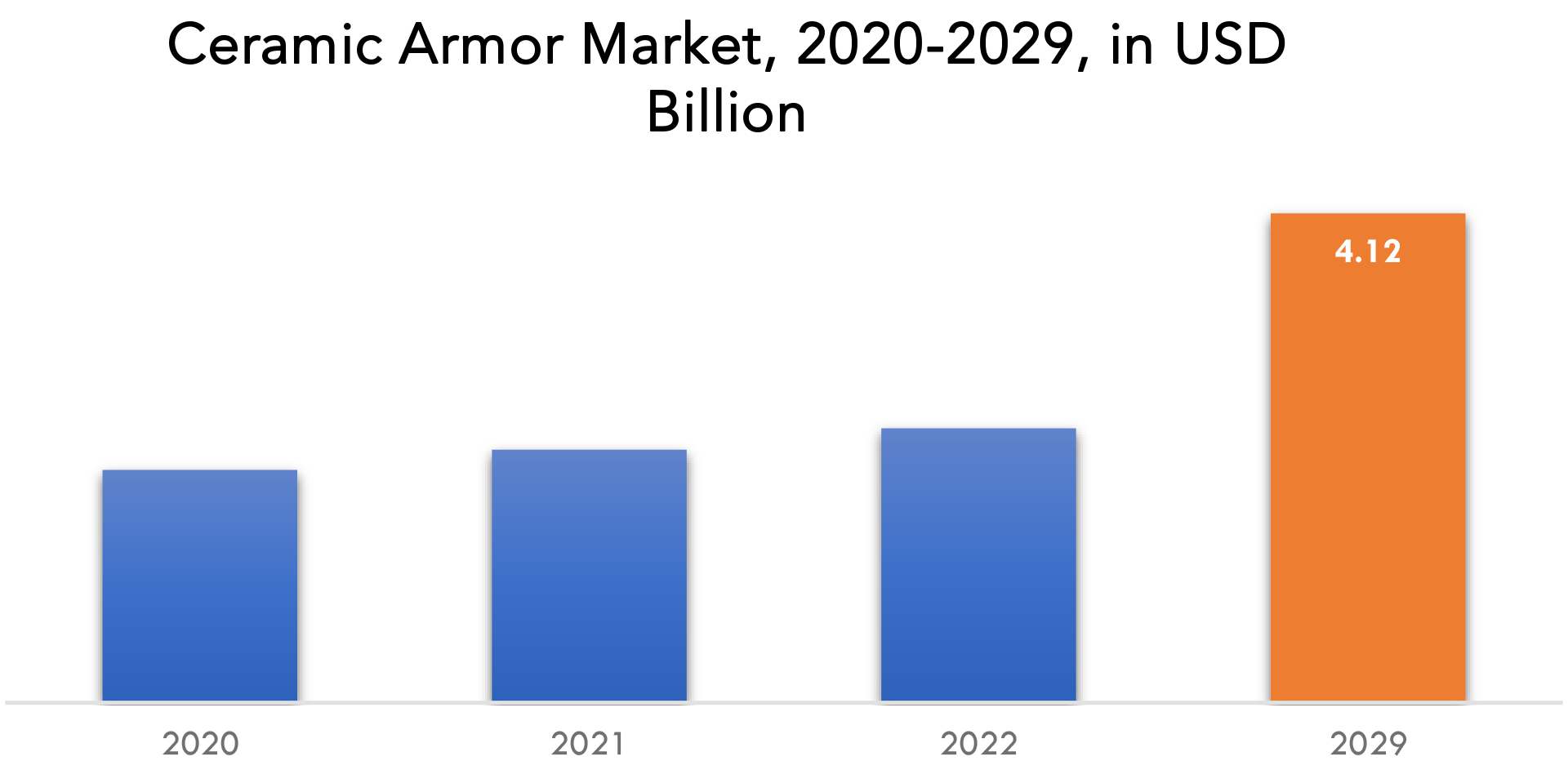

The global ceramic armor market was valued at 2.31 billion in 2022 and is projected to reach 4.12 billion by 2029, growing at a CAGR of 8.6% from 2022 to 2029

Ceramic armor is frequently used in body armor, aircraft, marine, and vehicle armor, among other applications. One of the main aspects influencing their popularity has been their lightweight and great degree of flexibility. Another factor driving the growth of the ceramic armor market globally is the rising amount of money that various nations are spending to secure their armed forces.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Material Type, By Application, By Region. |

| By Material Type |

|

| By Application |

|

| By Region |

|

Demand for ceramic body and vehicle armor from politicians, businesses, bureaucrats, prominent athletes, entertainment celebrities, and others is being driven by an increase in crime and terrorism. As political unrest and instability have increased, as have terrorist attacks across the globe, military, law enforcement, and the materials science community have been forced to come up with practical security solutions. Upgrading armor is currently more necessary than ever because to political crises in Syria, Egypt, Libya, Iraq, Afghanistan, Russia-Ukraine, India-Pakistan, India-China, Russia-Turkey, and Columbia-Peru.

Ceramic Armor Market Segment Analysis

Based on material type, application, and region, the global market for professional ceramic armor is divided into these categories.

On the basis of material types ceramic armor is divided into Alumina, Boron Carbide, Silicon Carbide, Ceramic Matrix Composite, Titanium Boride, and Aluminium Nitride. The greatest share of the global ceramic armor market was held by silicon carbide. Due to its exceptional strength and hardness, silicon carbide ceramic material is ideal for protecting rifle projectiles. The market for silicon carbide ceramic armor has increased due to the excessive demand for body armor offering greater defense and less weight.

One of the essential ceramic components for making ceramic armor is silicon carbide. For defense against heavier projectiles, armor frequently contains silicon carbide. The global market for silicon carbide has grown due to the growing demand for body armor that offers more defense and lighter weight. Due to its tremendous strength and hardness, silicon carbide ceramic material is the most suitable material for resisting rifle projectiles.

On the basis of application ceramic armor is divided into Body Armor, Aircraft Armor, Marine Armor, Vehicle Armor. Ceramic armor is used to create body armor because it is lightweight and corrosion-resistant, which improves maneuverability and assembly simplicity. The effectiveness of threats has increased as a result of weapon modernization, which has boosted the demand for better body armor. Ballistic strikes are deflected away from the body by armor by lowering their kinetic energy. The most lucrative markets are the US, China, and Russia.

Ceramic Armor Market Players

The major players operating in the global ceramic armor industry include BAE Systems plc, Koninklijke, DSM N.V., Morgan Advanced Materials, Saint-Gobain, CoorsTek, Inc., 3M Company, CeramTec, Ceradyne, SAAB AB, ArmorWorks and others

Recent developments:

- 15 February 2023: BAE Systems and Leonardo collaborate on interoperable aircraft survivability solutions. BAE Systems, Inc. and Leonardo UK recently received U.S. government approval to develop an interoperable aircraft survivability suite consisting of BAE Systems’ AN/AAR-57 Common Missile Warning System (CMWS) and Leonardo’s Miysis Directed Infrared Countermeasure (DIRCM) System.

- 12 December 2022: U.S. Navy awards BAE Systems $295 million contract for USS Kearsarge modernization. BAE Systems has received a $294.7 million contract from the U.S. Navy to drydock and perform more than 19 months* of maintenance and modernization work on the amphibious assault ship USS Kearsarge (LHD 3).

Who Should Buy? Or Key stakeholders

- Manufacturing

- End Use industries

- Automotive Industries

- Industrial Vehicles

- Aviation

- Regulatory Authorities

- Research Organizations

- Metal Processing Industries

- Construction

Ceramic Armor Market Regional Analysis

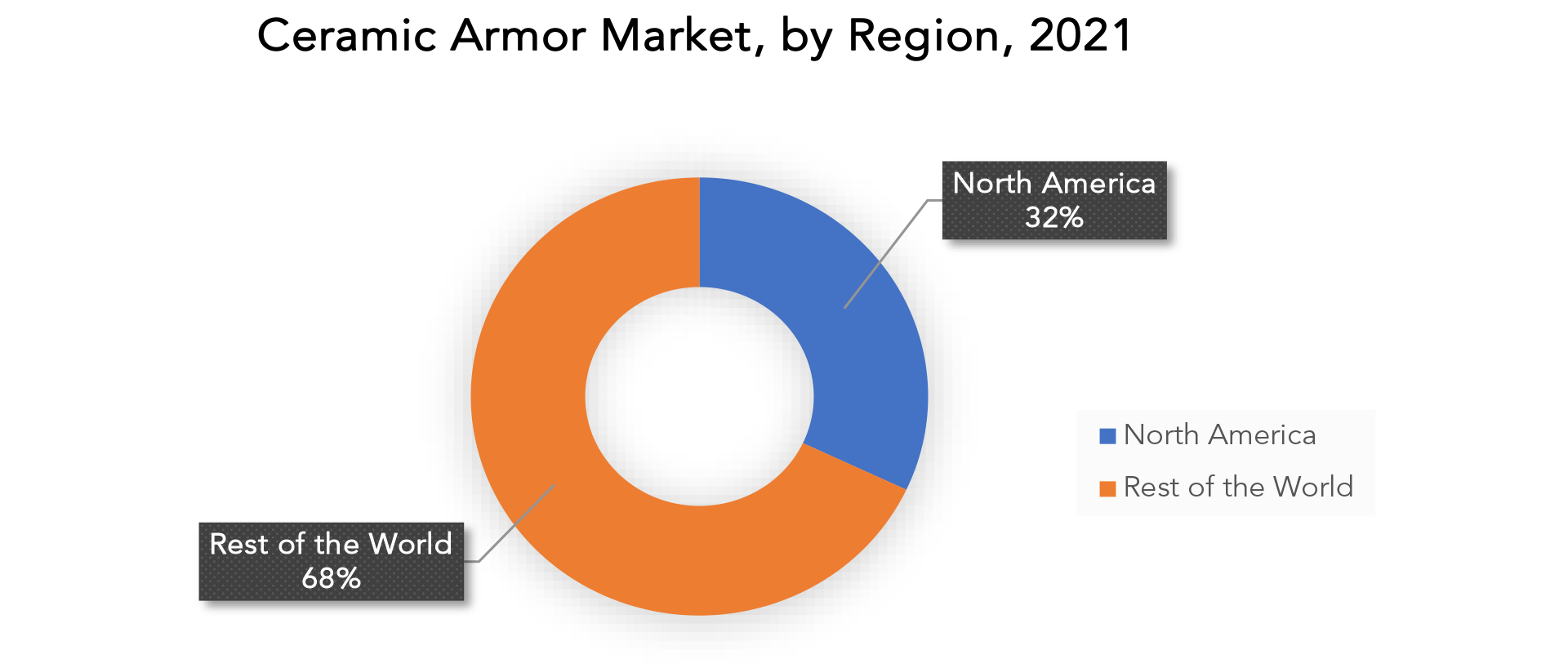

Geographically, the ceramic armor market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Due to the huge demand from the US and other nations, North America is the region that consumes the most ceramic armor. The US military spends a lot of money maintaining security in this area, there are established companies, and there are strict regulations surrounding the safety of defense personnel, which all contribute to the market growth for ceramic armor in this area. It is anticipated that there would be a lot of investment prospects for ceramic armor producers as a result of increased research and development expenditures by the US government and private businesses as well as the replacement of outdated combat vehicles with high-performance, lightweight materials.

Key Market Segments: Ceramic Armor Market

Ceramic Armor Market By Material Type, 2020-2029, (Usd Billion) (Thousand Units)

- Alumina

- Boron Carbide

- Silicon Carbide

- Ceramic Matrix Composite

- Titanium Boride

- Aluminium Nitride

Ceramic Armor Market By Application, 2020-2029, (Usd Billion) (Thousand Units)

- Body Armor

- Aircraft Armor

- Marine Armor

- Vehicle Armor

Ceramic Armor Market By Region, 2022-2029, (Usd Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the ceramic armor market over the next 7 years?

- Who are the major players in the ceramic armor market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the ceramic armor market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the ceramic armor market?

- What is the current and forecasted size and growth rate of the global ceramic armor market?

- What are the key drivers of growth in the ceramic armor market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the ceramic armor market?

- What are the technological advancements and innovations in the ceramic armor market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the ceramic armor market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the ceramic armor market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of ceramic armor in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CERAMIC ARMOR MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE CERAMIC ARMOR MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CERAMIC ARMOR MARKET OUTLOOK

- GLOBAL CERAMIC ARMOR MARKET BY TYPE, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- ALUMINA

- BORON CARBIDE

- SILICON CARBIDE

- CERAMIC MATRIX COMPOSITE

- TITANIUM BORIDE

- ALUMINIUM NITRIDE

- GLOBAL CERAMIC ARMOR MARKET BY APPLICATION, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- BODY ARMOR

- AIRCRAFT ARMOR

- MARINE ARMOR

- VEHICLE ARMOR

- GLOBAL CERAMIC ARMOR MARKET BY REGION, 2020-2029, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BAE SYSTEMS PLC.

- KONINKLIJKE DSM N.V.

- MORGAN ADVANCED MATERIALS.

- SAINT-GOBAIN

- COORSTEK, INC.

- 3M COMPANY

- CERAMTEC

- CERADYNE

- ARMORWORKS

- M CUBED TECHNOLOGIES

- OLBO & MEHLER

- SAFARILAND LLC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL CERAMIC ARMOR MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 GLOBAL CERAMIC ARMOR MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 7 NORTH AMERICA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 9 NORTH AMERICA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA CERAMIC ARMOR MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA CERAMIC ARMOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 US CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 14 US CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 US CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 US CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 17 CANADA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 CANADA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 19 CANADA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 CANADA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 21 MEXICO CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 22 MEXICO CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 MEXICO CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 24 MEXICO CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 25 SOUTH AMERICA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 26 SOUTH AMERICA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 27 SOUTH AMERICA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 SOUTH AMERICA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 29 SOUTH AMERICA CERAMIC ARMOR MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 30 SOUTH AMERICA CERAMIC ARMOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 31 BRAZIL CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 32 BRAZIL CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 33 BRAZIL CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 BRAZIL CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 ARGENTINA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 36 ARGENTINA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 37 ARGENTINA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 38 ARGENTINA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 39 COLOMBIA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 40 COLOMBIA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 41 COLOMBIA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 COLOMBIA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 REST OF SOUTH AMERICA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 REST OF SOUTH AMERICA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 REST OF SOUTH AMERICA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 47 ASIA-PACIFIC CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 48 ASIA-PACIFIC CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 ASIA-PACIFIC CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 ASIA-PACIFIC CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 51 ASIA-PACIFIC CERAMIC ARMOR MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 52 ASIA-PACIFIC CERAMIC ARMOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 53 INDIA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 54 INDIA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 55 INDIA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 56 INDIA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 57 CHINA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 58 CHINA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 59 CHINA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 CHINA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 JAPAN CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 JAPAN CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 63 JAPAN CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 JAPAN CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 65 SOUTH KOREA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 66 SOUTH KOREA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 67 SOUTH KOREA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 SOUTH KOREA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 AUSTRALIA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 AUSTRALIA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 71 AUSTRALIA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 AUSTRALIA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 73 SOUTH-EAST ASIA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 74 SOUTH-EAST ASIA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 75 SOUTH-EAST ASIA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 SOUTH-EAST ASIA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 REST OF ASIA PACIFIC CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 78 REST OF ASIA PACIFIC CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF ASIA PACIFIC CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 80 REST OF ASIA PACIFIC CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 81 EUROPE CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 EUROPE CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 83 EUROPE CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 EUROPE CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 EUROPE CERAMIC ARMOR MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 86 EUROPE CERAMIC ARMOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 87 GERMANY CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 GERMANY CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 GERMANY CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 GERMANY CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 91 UK CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 92 UK CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 93 UK CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 UK CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 FRANCE CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 96 FRANCE CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 97 FRANCE CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 98 FRANCE CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 99 ITALY CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 ITALY CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 ITALY CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 ITALY CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 SPAIN CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 104 SPAIN CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 105 SPAIN CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 106 SPAIN CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 107 RUSSIA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 108 RUSSIA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 109 RUSSIA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 RUSSIA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 REST OF EUROPE CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF EUROPE CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 113 REST OF EUROPE CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF EUROPE CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA CERAMIC ARMOR MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA CERAMIC ARMOR MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 117 UAE CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 118 UAE CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 119 UAE CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 120 UAE CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 121 SAUDI ARABIA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SAUDI ARABIA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 SAUDI ARABIA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 SAUDI ARABIA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH AFRICA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 SOUTH AFRICA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH AFRICA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 SOUTH AFRICA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA CERAMIC ARMOR MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA CERAMIC ARMOR MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 REST OF MIDDLE EAST AND AFRICA CERAMIC ARMOR MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 132 REST OF MIDDLE EAST AND AFRICA CERAMIC ARMOR MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CERAMIC ARMOR MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CERAMIC ARMOR MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CERAMIC ARMOR MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL CERAMIC ARMOR MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL CERAMIC ARMOR MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL CERAMIC ARMOR MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BAE SYSTEMS PLC: COMPANY SNAPSHOT

FIGURE 17 KONINKLIJKE DSM N.V: COMPANY SNAPSHOT

FIGURE 18 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

FIGURE 19 SAINT-GOBAIN: COMPANY SNAPSHOT

FIGURE 20 COORSTEK, INC.: COMPANY SNAPSHOT

FIGURE 21 3M COMPANY: COMPANY SNAPSHOT

FIGURE 22 CERAMTEC: COMPANY SNAPSHOT

FIGURE 23 CERADYNE: COMPANY SNAPSHOT

FIGURE 24 ARMORWORKS: COMPANY SNAPSHOT

FIGURE 25 M CUBED TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 26 OLBO & MEHLER: COMPANY SNAPSHOT

FIGURE 27 SAFARILAND LLC: COMPANY SNAPSHOT

FAQ

The global ceramic armor market was valued at 2.31 billion in 2022 and is projected to reach 4.15 billion by 2029, growing at a CAGR of 8.6% from 2022 to 2029

Based on material type, application, and region, the ceramic armor market report’s divisions are broken down.

The global Ceramic Armor market registered a CAGR of 8.6% from 2022 to 2029. The industry segment was the highest revenue contributor to the market.

Due to the huge demand from the US and other nations, North America is the region that consumes the most ceramic armor. The US military spends a lot of money maintaining security in this area, there are established companies, and there are strict regulations surrounding the safety of defense personnel, which all contribute to the market growth for ceramic armor in this area.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.