Report Outlook

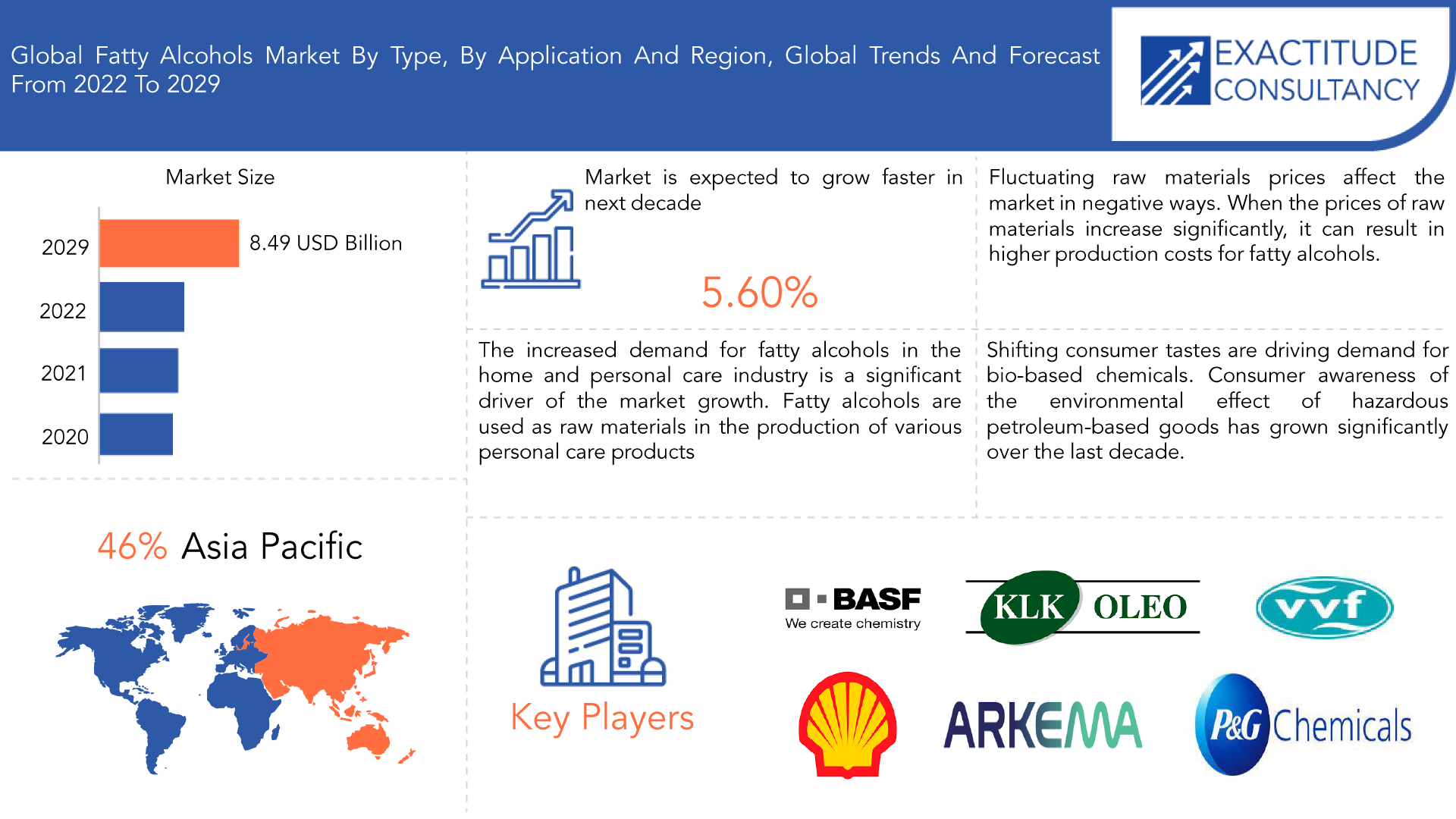

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 8.49 Billion by 2029 | 5.60% | Asia Pacific |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Fatty Alcohols Market Overview

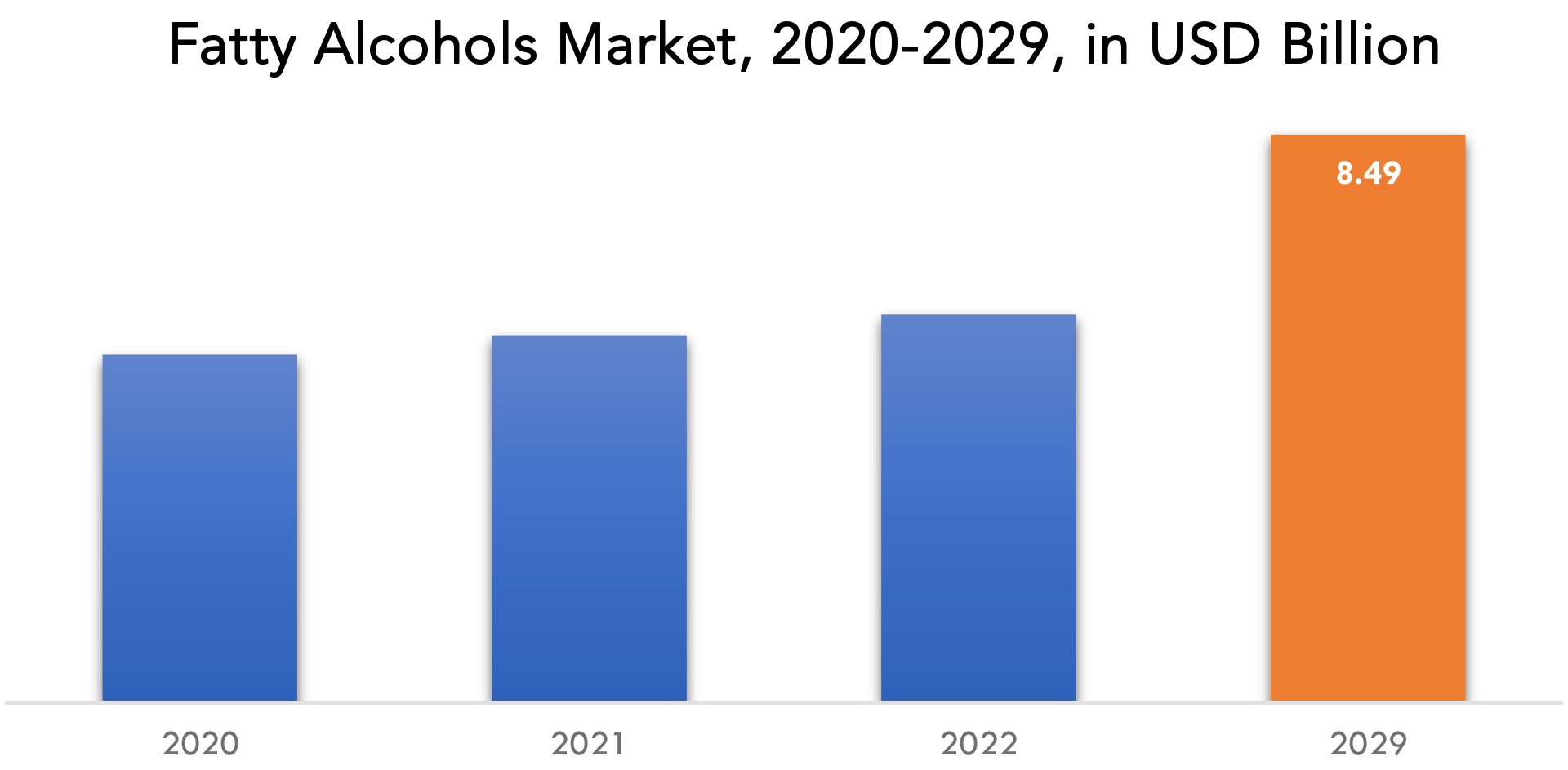

The global fatty alcohols market is expected to grow at 5.60 % CAGR from 2020 to 2029. It is expected to reach above USD 8.49 Billion by 2029 from USD 5.20 Billion in 2020.

Fatty alcohols are a class of organic compounds that are derived from natural fats and oils. They are characterized by having a long carbon chain with a hydroxyl group (-OH) at one end, and are typically produced by the hydrogenation of natural fats and oils. Fatty alcohols have a wide range of applications, including as emollients and emulsifiers in personal care products, as surfactants in detergents, and as raw materials for the production of other chemicals. They are generally considered to be environmentally friendly and sustainable, as they are derived from renewable resources and are biodegradable.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Product, End User and region. |

| By Type |

|

| By Application |

|

| By Region |

|

The increased demand for fatty alcohols in the home and personal care industry is a significant driver of the market growth. Fatty alcohols are used as raw materials in the production of various personal care products, such as shampoos, conditioners, moisturizers, and other products. They offer several benefits such as emulsification, thickening, moisturizing, and mildness, making them suitable for use in different types of products. Another important driver of the market growth is the increasing demand for natural and sustainable personal care products. Consumers are becoming more conscious about the products they use, and they are looking for products that are eco-friendly, sustainable, and derived from natural sources. Fatty alcohols are derived from natural sources such as vegetable oils, and they offer several benefits such as biodegradability, low toxicity, and renewability, making them an ideal choice for natural and sustainable personal care products.

When the prices of raw materials increase significantly, it can result in higher production costs for fatty alcohols, which can lead to higher prices for end-users, such as manufacturers of personal care products. This can negatively impact the demand for fatty alcohols and restrain the growth of the market. Moreover, the supply of raw materials can also be affected by fluctuations in prices. If the price of a particular raw material increases, it can lead to a shift in demand towards other raw materials, which can result in a shortage of the affected raw material. This can result in a decline in the supply of fatty alcohols, which can also restrain the growth of the market.

Shifting consumer tastes are driving demand for bio-based chemicals. Consumer awareness of the environmental effect of hazardous petroleum-based goods has grown significantly over the last decade. Increasing environmental concerns are driving customers to purchase environmentally friendly items. Such incentives are compelling chemical firms to adopt bio-based raw materials in the production of their goods.

The COVID-19 pandemic is expected to have a substantial influence on the market due to the slump in the manufacturing sectors. Due to the coronavirus’s unexpected repercussions, big corporations were obliged to temporarily suspend production in order to limit its spread. The shutdown of these plants would have a significant impact on the company’s revenue output and market share. Many countries’ output levels have been substantially lowered as a result of lockdowns. There are limitations in the market’s supply chain due to material transportation difficulties. The aforementioned causes are expected to reduce demand.

Fatty Alcohols Market Segment Analysis

The market is divided into four types: pure and mid cut, long chain, and short chain, higher chain. The market is dominated by the Long Chain sector. The increased need for fatty alcohols in the manufacturing of detergents, soaps, and emollients is due to the rise of the long-chain sector. In the detergent business, fatty alcohols are utilized as emulsifiers, emollients, and surfactants. They are also utilized in the manufacture of soaps and cosmetics.

In terms of application, the market is divided into soaps and detergents, personal care, lubricants, amines. Throughout the projected period, the soaps and detergents category are likely to command a major share of the market. Increases in the level of life in developing nations, as well as increased attention to personal cleanliness, are expected to support the expansion of this category. Additionally, increased demand for home and industrial cleaners to maintain a sanitary environment is likely to drive the industry. Personal care is expected to be the second-largest category over the projection period. Personal care items such as shampoos, lotions, and essential oils are in high demand from Asia Pacific due to increased consumer spending power.

Fatty Alcohols Market Key Players

The fatty alcohols market key players include BASF, Univar Inc, KLK Oleo, VVF LLC, P & G Chemicals, Ecogreen Oleochemicals, Kao Corporation, Sasol Limited, Royal Dutch Shell Plc, Arkema SA

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Industry Development:

March 2021 – KLK OLEO just expanded its business footprint to the Americas with a new sales office at Woodbury, NY, USA. KLK OLEO Americas (KLKOA) will oversee the sales and marketing in the United States, Canada and South America. And continuously maintain and build customer relationships for the KLK OLEO group product portfolio.

November 2022 – Kao Corporation have developed a decoration processing technology that can design products according to the consumers’ needs and a dynamic cell production technology that enables efficient high-mix low-volume manufacturing by optimization of floating linear technology*1 in collaboration with B&R K.K. and Kyoto Seisakusho Co., Ltd. The new never-before-seen production system will begin operation in 2023.

Who Should Buy? Or Key stakeholders

- Investors

- Raw Materials Manufacturer

- Healthcare Companies

- Cosmetics Companies

- Supplier & Distributors

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

Fatty Alcohols Market Regional Analysis

The Fatty Alcohols Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

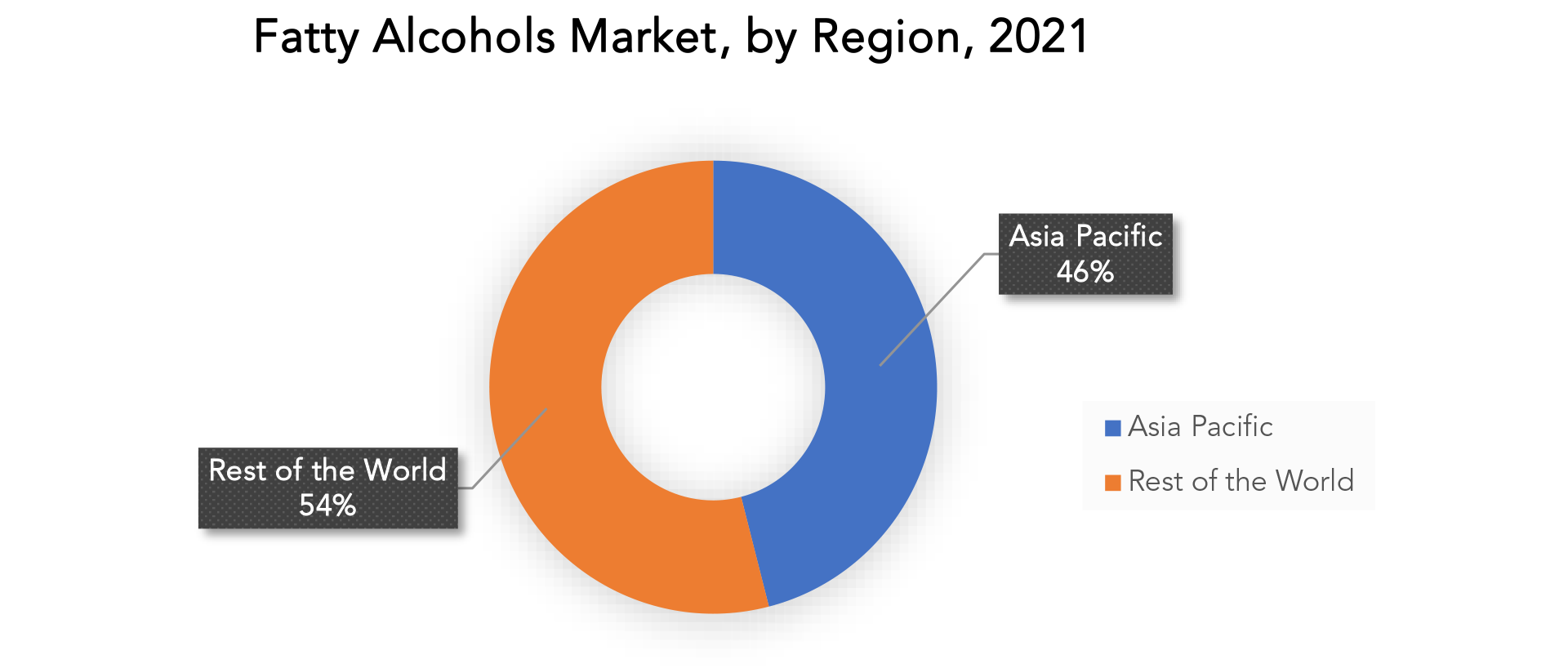

The Asia Pacific area consumes and produces the most of fatty alcohols, accounting for the majority of the worldwide market. Increased demand from end-use sectors such as personal care, home care, and industrial goods, as well as large-scale manufacturing by prominent manufacturers, are driving market expansion. The region’s embrace of natural and sustainable products, as well as favorable government regulations encouraging the use of renewable resources, have all contributed to the market’s expansion. China, India, Japan, and South Korea are key consumers in the Asia Pacific fatty alcohols market because to their big population, developing economy, and increasing need for personal care and home care products.

The North American fatty alcohols market is the second-largest in the world, driven by the increasing demand for personal care products and the growing trend towards natural and sustainable products. The United States is the largest consumer and producer of fatty alcohols in the region, with several leading manufacturers. The region’s favorable government policies and the presence of key end-use industries have enabled the growth of the market. Additionally, the development of new and innovative applications of fatty alcohols in the industrial sector is expected to drive the market’s growth further.

Key Market Segments: Fatty Alcohols Market

Fatty Alcohols Market By Type, 2020-2029, (USD Billion), (Kilotons)

- Short Chain

- Pure And Mid Cut

- Long Chain

- Higher Chain

Fatty Alcohols Market By Application, 2020-2029, (USD Billion), (Kilotons)

- Soaps & Detergents

- Personal Care

- Lubricants

- Amines

Fatty Alcohols Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the fatty alcohols market over the next 7 years?

- Who are the major players in the fatty alcohols market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the fatty alcohols market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the fatty alcohols market?

- What is the current and forecasted size and growth rate of the global fatty alcohols market?

- What are the key drivers of growth in the fatty alcohols market?

- What are the distribution channels and supply chain dynamics in the fatty alcohols market?

- What are the technological advancements and innovations in the fatty alcohols market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the fatty alcohols market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the fatty alcohols market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of fatty alcohols in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL FATTY ALCOHOLS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON FATTY ALCOHOLS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL FATTY ALCOHOLS MARKET OUTLOOK

- GLOBAL FATTY ALCOHOLS MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- SHORT CHAIN

- PURE AND MID CUT

- LONG CHAIN

- HIGHER CHAIN

- GLOBAL FATTY ALCOHOLS MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- SOAP & DETERGENTS

- PERSONAL CARE

- LUBRICANTS

- AMINES

- GLOBAL FATTY ALCOHOLS MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF

- UNIVAR INC.

- KLK OLEO

- VVF LLC

- P & G CHEMICALS

- ECOGREEN OLEOCHEMICALS

- KAO CORPORATION

- SASOL LIMITED

- ROYAL DUTCH SHELL PLC

- ARKEMA SA

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL FATTY ALCOHOLS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL FATTY ALCOHOLS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA FATTY ALCOHOLS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA FATTY ALCOHOLS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA FATTY ALCOHOLS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA FATTY ALCOHOLS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 BRAZIL FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC FATTY ALCOHOLS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC FATTY ALCOHOLS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE FATTY ALCOHOLS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE FATTY ALCOHOLS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA FATTY ALCOHOLS MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FATTY ALCOHOLS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL FATTY ALCOHOLS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL FATTY ALCOHOLS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL FATTY ALCOHOLS MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL FATTY ALCOHOLS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL FATTY ALCOHOLS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BASF: COMPANY SNAPSHOT

FIGURE 17 UNIVAR INC.: COMPANY SNAPSHOT

FIGURE 18 KLK OLEO: COMPANY SNAPSHOT

FIGURE 19 VVF LLC: COMPANY SNAPSHOT

FIGURE 20 P & G CHEMICALS: COMPANY SNAPSHOT

FIGURE 21 ECOGREEN OLEOCHEMICALS: COMPANY SNAPSHOT

FIGURE 22 KAO CORPORATION: COMPANY SNAPSHOT

FIGURE 23 SASOL LIMITED: COMPANY SNAPSHOT

FIGURE 24 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

FIGURE 25 ARKEMA SA: COMPANY SNAPSHOT

FAQ

The Global Fatty Alcohols Market is expected to grow at 5.60% CAGR from 2020 to 2029. It is expected to reach above USD 8.49 Billion by 2029 from USD 5.20 Billion in 2020.

North America held more than 46% of the Fatty Alcohols Market revenue share in 2020 and will witness tremendous expansion during the forecast period.

The increased demand for fatty alcohols in the home and personal care industry is a significant driver of the market growth. Fatty alcohols are used as raw materials in the production of various personal care products, such as shampoos, conditioners, moisturizers, and other products. They offer several benefits such as emulsification, thickening, moisturizing, and mildness, making them suitable for use in different types of products.

The manufacturing sector is major sector where the application of Fatty Alcohols has seen more.

The Markets largest share is in the Asia Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.