Report Outlook

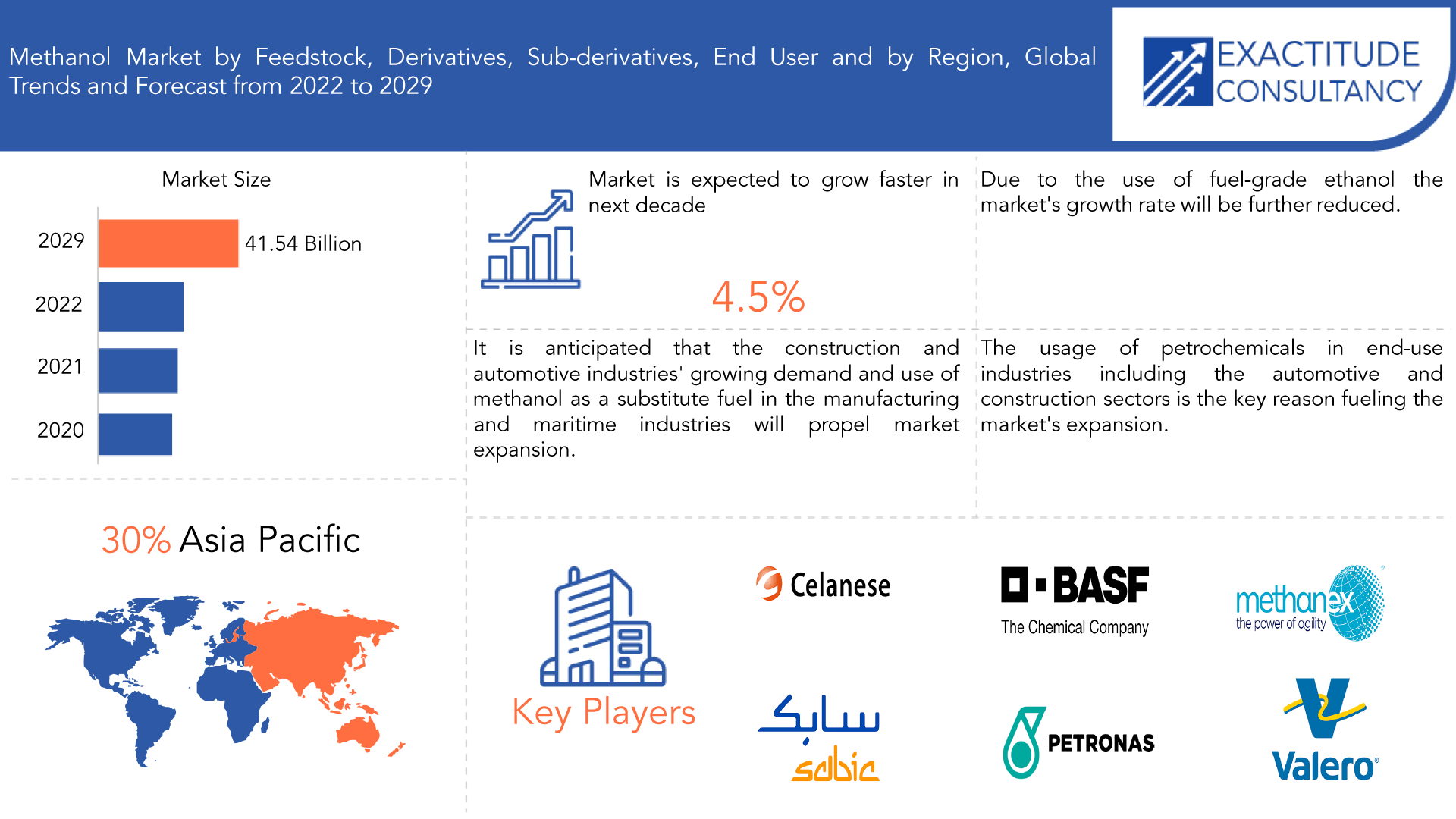

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 41.54 billion by 2029 | 4.5% | Asia Pacific |

| By Feedstock | By Derivative | By Sub-Derivative |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Methanol Market Overview

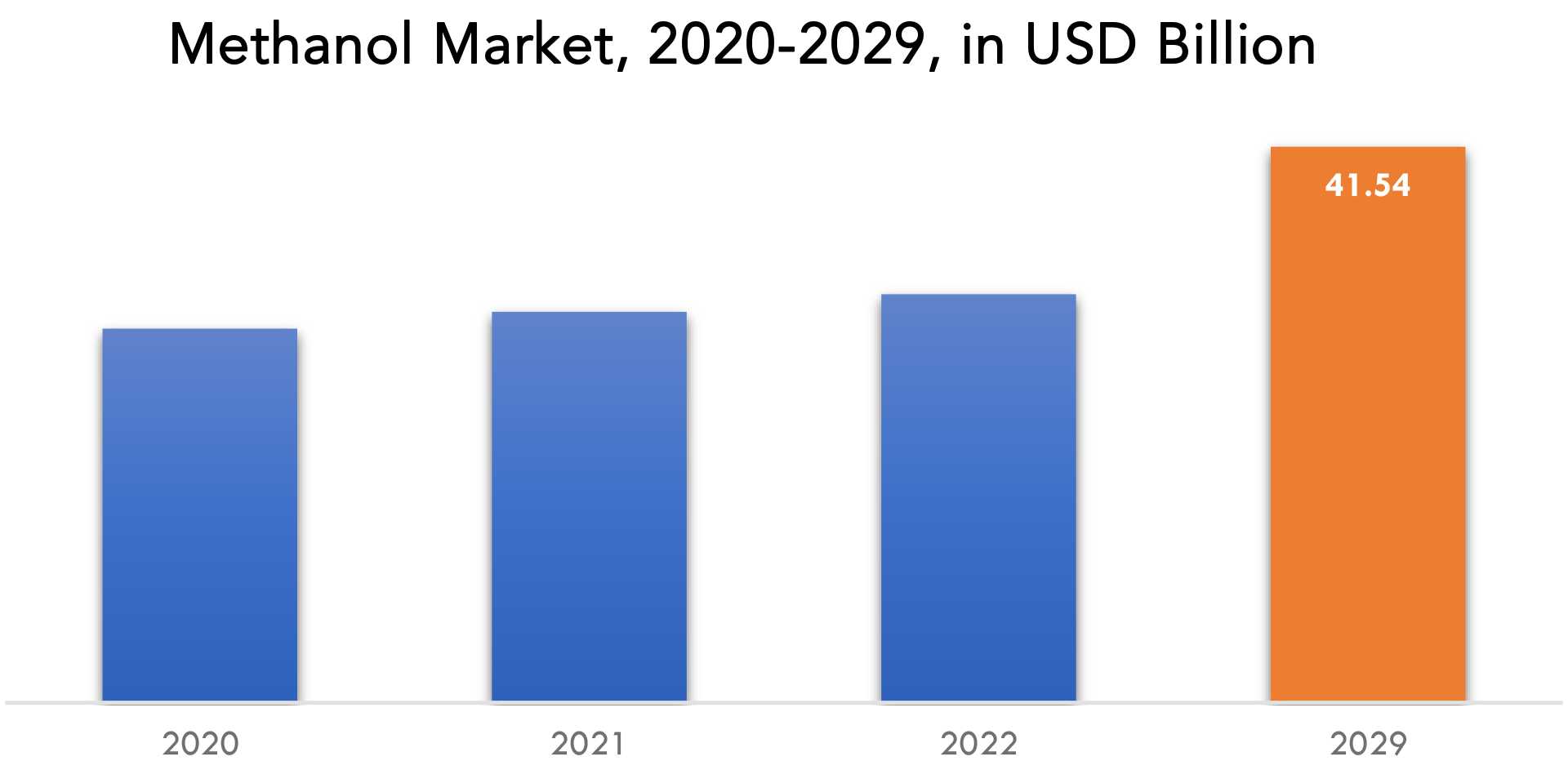

Methanol market is expected to grow at 4.5% CAGR from 2022 to 2029. It was valued 27.95 billion at 2020. It is expected to reach above USD 41.54 billion by 2029.

It is anticipated that the construction and automotive industries’ growing demand will propel market expansion. The usage of petrochemicals in end-use industries including the automotive and construction sectors is the key reason fueling the market’s expansion.

Methanol, sometimes referred to as methyl hydrate or methyl alcohol, is a colorless, flammable substance with a strong alcoholic odor. Methanol finds extensive use in a variety of industries, including insulation, paints and coatings, packaging, pharmaceuticals, paints & coatings, and automotive. Additionally, it is employed in the production of medical supplies such hooded caps, aprons, masks, medical gowns, gloves, disinfectants, pharmaceuticals, and others. Methanol is additionally employed in wastewater treatment plants to disinfect water. The conversion of extra nitrate from wastewater into nitrogen gas and atmospheric emission is a process known as denitrification.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Kilotons) |

| Segmentation | By Feedstock, By Derivative, By Sub-derivative, By End User |

| By Feedstock |

|

| By Derivative |

|

| By Sub-Derivative |

|

| By End User |

|

| By Region |

|

Methanol is becoming increasingly used as a transportation fuel and in the maritime industry. In contrast to gasoline-based fuel, methanol is a more inexpensive and adaptable form of transportation fuel. Methanol can replace gasoline-based fuels like diesel due to these characteristics. Acetic acid, olefins, methyl methacrylate, silicone, formaldehyde, and other chemicals are made in the chemical industry using methanol. Adhesives, plastics, paints, sealants, medical equipment, automobile production, lubricants, and other products are only a few of the end uses for these substances.

Methanol consumption will rise as a result of increased demand from sectors including the automobile and construction industries. Methyl alcohol is used to make insulating materials, fabrics, plastics, and adhesives. Polymers play a crucial function in automobiles by lowering the weight of the vehicle, which improves fuel efficiency and gives the appearance of metal. Throughout the forecast period, the increase will be fueled by the usage of plastics in the construction sector. Throughout the projection period, the market’s expansion will be supported by the demand for dresses in the consumer goods and furniture industries.

Another motivating aspect is the rising use of methanol in applications that involve fuel blending. Methanol is a colorless, flammable liquid that is often combined with ethyl alcohol for use in a variety of industrial applications. As end users turn to sustainable fuels, the methanol market is presented with enormous prospects. Due to its adaptable character and applications in a variety of industries, this alcohol will meet the needs of an expanding global population.

Methanol Market Dynamics

Growth Drivers:

On a worldwide scale, the growing need from sectors like automotive and construction is predicted to boost its usage. Methyl alcohol serves as a starting point for different chemicals and compounds, including adhesives, plastics, textiles, insulation materials, and more. Plastics are crucial in cars as they lower the vehicle’s weight, providing qualities like metals and enhancing fuel efficiency. Plastics are utilized in various applications in construction, from piping to crane ropes. Additionally, the market will be driven by the need for adhesives in the furniture and consumer goods sectors. Moreover, the anticipated rise in methanol consumption for fuel blending purposes is projected to drive the market’s advancement in the forecast period.

Worldwide, the rapidly expanding electronics sector, driven by rising demand for electronics components and devices, is pushing the growth of the methanol market. Methyl alcohol plays a vital role in the production of different electronic materials, such as printed circuit boards, semiconductors, and display screens. Moreover, the demand for the product is further increased by its role as a solvent in the production process of electronic items.

Restraints:

Methyl alcohol is primarily utilized as a solvent, alternative fuel, and pesticide. In addition to being produced commercially, it can be found naturally in foods, fruits, and the human body. Consuming contaminated alcohol may lead to poisoning from the product. Breathing in or ingesting it may result in loss of vision, buildup of acid in the blood, and fatality. Additional health consequences as a result of exposure consist of nausea, vomiting, heart and respiratory failure, seizures, and kidney failure. These factors are anticipated to impede the expansion of the methyl alcohol market.

Opportunities:

Bunkering in marine settings is easy with methanol since it remains in liquid form at room temperature, eliminating the need for cryogenic storage or specialized materials in tanks and pipes. The rising demand for environmentally-friendly fuels and changes in regulations are becoming more influential in promoting new uses for methanol as a marine fuel because of its reduced emissions.

Methanol Market Segment Analysis

Methanol market is segmented based on feedstock, derivative, sub-derivative, end user and region.

By feedstock the market is segmented into coal, natural gas, and others. Over the projection period, the natural gas segment will command a large market share. This market sector is anticipated to expand because to the low cost of production that results in a considerable output. Together with an increase in the use of coal to generate methyl alcohol in many nations with substantial coal output, the coal section is also anticipated to pass the end of the line successfully.

By derivative the market is segmented into gasoline, MTO/MTP, formaldehyde, methyl tertiary butyl ether, acetic acid, dimethyl ether, methyl methacrylate, biodiesel, others. Throughout the projected period, it is anticipated that the MTO/MTP category will increase at the fastest rate. These thermoplastics—polypropylene, polyolefins, and polyethylene—are made from methyl alcohol and are widely used in a variety of sectors of the economy.

Due to their adaptability and advantageous characteristics, plastics are utilised more than other materials in the construction, furnishing, and automobile industries. Polyolefins are increasingly in demand across a wide range of end user industries. We will also have a bigger volume share for the formaldehyde category. It is crucial for the production of adhesives, insecticides, and molding materials. In various industries, formaldehyde is in high demand. The expansion of the formaldehyde market is being driven by the textile, construction, and mobile industries.

By sub-derivative the market is segmented into gasoline additives, olefins, UF/PF resins, VAM, polyacetals, MDI, PTA, acetate esters, acetic anhydride, fuels, and others. Regulations aiming at lowering car emissions and enhancing fuel efficiency are a big factor in the need for gasoline additives. Olefins market dynamics, price, and technological improvements all have an impact on the broader petrochemical industry, which is closely related to it.

Although these resins are used to create a range of wood-based products, the building and furniture industries dominate the market for UF/PF resins. The demand for adhesives, coatings, and other goods in the construction, automotive, and packaging industries is what drives the VAM market. Engineering plastics are in high demand in the consumer goods, electronics, and automotive sectors, which drives the market for polyacetals.

By end user the market is segmented into construction, automotive, electronics, appliances, paints & coatings, insulation, pharmaceuticals, packaging, solvents, others. Across the projection period, it is anticipated that the construction sector would account for the greatest market share in methanol. This is because methanol is used to make a wide range of goods, including foams, adhesives, plywood subfloors, and plastics. Large uses for these items exist in the construction sector, and rising demand is anticipated to drive up consumption. The increased usage of plastics and methanol-blend fuels is predicted to cause the automotive market to see significant growth by the end of the projection period.

Methanol Market Key Players

Methanol market key players include Celanese Corporation, BASF SE, Methanex Corporation, SABIC, Petroliam Nasional Berhad (PETRONAS), Mitsubishi Gas Chemical Company, Inc., Valero, Mitsui & Co., Ltd., Methanol Holdings (Trinidad) Limited., Zagros Petrochemical Co.

Industry Development:

January 2024 – Celanese Corporation announced, that Fairyway Methanol company, a joint venture between the company and Mitsui & Co., has began carbon capture and utilization at its plant located in Clear Lake, Texas. The plant is producing 130,000 metric tons of methanol from 180,000 metric tons of the greenhouse gas carbon dioxide per year.

March 01, 2023: Celanese Corporation, a global specialty materials and chemical company, and Alessa Therapeutics announced their collaboration for developing a new oncology drug product leveraging Alessa’s expertise on sustained localized drug delivery and the Celanese VitalDose® EVA drug delivery platform.

December 02, 2022: Methanex Corporation, the world’s largest producer and supplier of methanol, is pleased to announced it has made a NZ USD 2 million investment to support the building of the new neonatal unit at Taranaki Base Hospital in New Zealand. The 10-year partnership provides funding for state-of-the-art treatment to care for the most vulnerable newborns and their families. As part of this investment, the new unit will be called The Methanex Neonatal Unit and is expected to be completed in 2025.

Who Should Buy? Or Key Stakeholders

- Methanol producers

- Methanol distributors and traders

- Financial institutions

- Investors

- Manufacturing companies

- Raw Material Suppliers

- End Users

- Government & Regional Agencies

- Research Organizations

- Others

Methanol Market Regional Analysis

Methanol market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

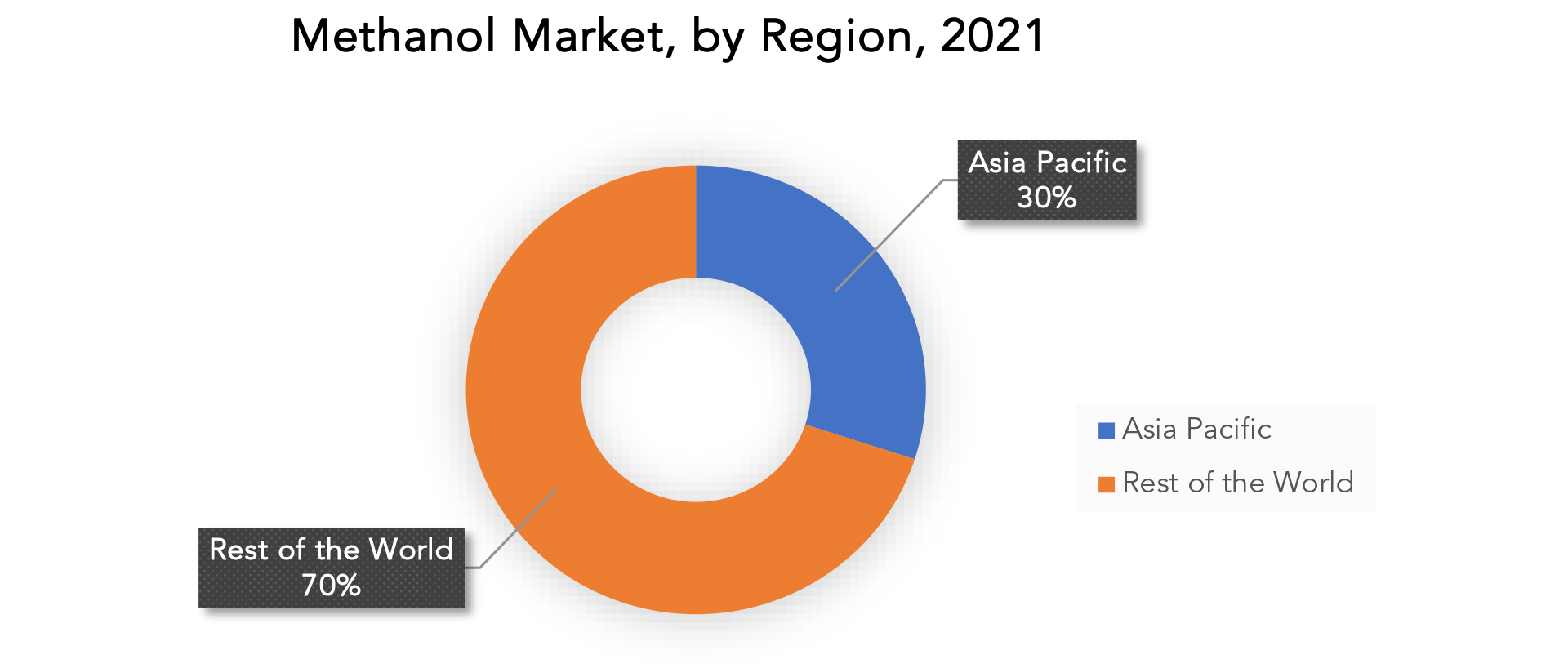

The market’s growth is primarily attributed to the Asia Pacific region. The market is anticipated to expand along with the development of the building and automotive sectors in China and India. A significant contributor to the market’s expansion is the fact that China is a significant producer and consumer of derivative. The Asia Pacific region has a sizable and expanding population, which is driving demand for a variety of chemical products used in consumer goods, electronics, construction, and other end-use industries.

As the economies of the region expand and consumer preferences change, this trend is anticipated to last for the foreseeable future. The demand for consumer goods and personal care products is being driven by the region’s huge and expanding population as well as rising wages. Surfactants, polymers, and speciality chemicals are all experiencing growth as a result of this. The US is one of the top producers of chemicals in the world and the biggest in North America. The nation boasts a thriving chemical sector with a broad range of goods and uses. Due to regulatory pressure and consumer demand, the North American chemical sector is placing an increasing amount of emphasis on sustainability and environmental responsibility. This is encouraging more money to be spent on recycling, green chemistry, and other sustainable initiatives.

Key Market Segments: Methanol Market

Methanol Market By Feedstock, 2020-2029, (USD Billion, Kilotons)

- Coal

- Natural Gas

- Others

Methanol Market By Derivative, 2020-2029, (USD Billion, Kilotons)

- Gasoline

- MTO/MTP

- Formaldehyde

- Methyl Tertiary Butyl Ether

- Acetic Acid

- Dimethyl Ether

- Methyl Methacrylate

- Biodiesel

- Others

Methanol Market By Sub-Derivative, 2020-2029, (USD Billion, Kilotons)

- Gasoline Additives

- Olefins

- UF/PF Resins

- VAM

- Polyacetals

- MDI

- PTA

- Acetate Esters

- Acetic Anhydride

- Fuels

- Others

Methanol Market By End User, 2020-2029, (USD Billion, Kilotons)

- Construction

- Automotive

- Electronics

- Appliances

- Paints & Coatings

- Insulation

- Pharmaceuticals

- Packaging

- Solvents

- Others

Methanol Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the methanol market over the next 7 years?

- Who are the major players in the methanol market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the methanol market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the methanol market?

- What is the current and forecasted size and growth rate of the global methanol market?

- What are the key drivers of growth in the methanol market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the methanol market?

- What are the technological advancements and innovations in the methanol market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the methanol market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the methanol market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of methanol market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL METHANOL MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON METHANOL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL METHANOL MARKET OUTLOOK

- GLOBAL METHANOL MARKET BY FEEDSTOCK (USD BILLION, KILOTONS), 2020-2029

- COAL

- NATURAL GAS

- OTHERS

- GLOBAL METHANOL MARKET BY DERIVATIVE (USD BILLION, KILOTONS), 2020-2029

- GASOLINE

- MTO/MTP

- FORMALDEHYDE

- METHYL TERTIARY BUTYL ETHER

- ACETIC ACID

- DIMETHYL ETHER

- METHYL METHACRYLATE

- BIODIESEL

- OTHERS

- GLOBAL METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION, KILOTONS), 2020-2029

- GASOLINE ADDITIVES

- OLEFINS

- UF/PF RESINS

- VAM

- POLYACETALS

- MDI

- PTA

- ACETATE ESTERS

- ACETIC ANHYDRIDE

- FUELS

- OTHERS

- GLOBAL METHANOL MARKET BY END USER (USD BILLION, KILOTONS), 2020-2029

- CONSTRUCTION

- AUTOMOTIVE

- ELECTRONICS

- APPLIANCES

- PAINTS & COATINGS

- INSULATION

- PHARMACEUTICALS

- PACKAGING

- SOLVENTS

- OTHERS

- GLOBAL METHANOL MARKET BY REGION (USD BILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- CELANESE CORPORATION

- BASF SE

- METHANEX CORPORATION

- SABIC

- PETROLIAM NASIONAL BERHAD (PETRONAS)

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- VALERO

- MITSUI & CO., LTD.

- METHANOL HOLDINGS (TRINIDAD) LIMITED.

- ZAGROS PETROCHEMICAL CO. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 2 GLOBAL METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 3 GLOBAL METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 5 GLOBAL METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 6 GLOBAL METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 7 GLOBAL METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 9 GLOBAL METHANOL MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL METHANOL MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA METHANOL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA METHANOL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 16 NORTH AMERICA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 17 NORTH AMERICA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 19 NORTH AMERICA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 NORTH AMERICA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 21 US METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 22 US METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 23 US METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 24 US METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 25 US METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 26 US METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 27 US METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 28 US METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 29 CANADA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 30 CANADA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 31 CANADA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 32 CANADA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 33 CANADA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 34 CANADA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 35 CANADA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 36 CANADA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 37 MEXICO METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 38 MEXICO METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 39 MEXICO METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 40 MEXICO METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 41 MEXICO METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 42 MEXICO METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 43 MEXICO METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 MEXICO METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 45 SOUTH AMERICA METHANOL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA METHANOL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 47 SOUTH AMERICA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 49 SOUTH AMERICA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 50 SOUTH AMERICA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 51 SOUTH AMERICA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 53 SOUTH AMERICA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 54 SOUTH AMERICA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 55 BRAZIL METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 56 BRAZIL METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 57 BRAZIL METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 58 BRAZIL METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 59 BRAZIL METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 60 BRAZIL METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 61 BRAZIL METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 BRAZIL METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 63 ARGENTINA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 64 ARGENTINA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 65 ARGENTINA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 66 ARGENTINA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 67 ARGENTINA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 68 ARGENTINA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 69 ARGENTINA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 70 ARGENTINA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 71 COLOMBIA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 72 COLOMBIA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 73 COLOMBIA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 74 COLOMBIA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 75 COLOMBIA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 76 COLOMBIA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 77 COLOMBIA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 78 COLOMBIA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 82 REST OF SOUTH AMERICA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 REST OF SOUTH AMERICA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 ASIA-PACIFIC METHANOL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC METHANOL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 89 ASIA-PACIFIC METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 91 ASIA-PACIFIC METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 92 ASIA-PACIFIC METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 93 ASIA-PACIFIC METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 95 ASIA-PACIFIC METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 96 ASIA-PACIFIC METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 97 INDIA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 98 INDIA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 99 INDIA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 100 INDIA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 101 INDIA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 102 INDIA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 103 INDIA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 INDIA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 CHINA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 106 CHINA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 107 CHINA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 108 CHINA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 109 CHINA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 110 CHINA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 111 CHINA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 112 CHINA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 113 JAPAN METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 114 JAPAN METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 115 JAPAN METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 116 JAPAN METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 117 JAPAN METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 118 JAPAN METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 119 JAPAN METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 120 JAPAN METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 121 SOUTH KOREA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 123 SOUTH KOREA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 124 SOUTH KOREA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 125 SOUTH KOREA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 127 SOUTH KOREA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 SOUTH KOREA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 129 AUSTRALIA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 131 AUSTRALIA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 132 AUSTRALIA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 133 AUSTRALIA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 135 AUSTRALIA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 136 AUSTRALIA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 137 SOUTH-EAST ASIA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 139 SOUTH-EAST ASIA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 140 SOUTH-EAST ASIA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 141 SOUTH-EAST ASIA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 143 SOUTH-EAST ASIA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 144 SOUTH-EAST ASIA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 148 REST OF ASIA PACIFIC METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 REST OF ASIA PACIFIC METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 153 EUROPE METHANOL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE METHANOL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 155 EUROPE METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 156 EUROPE METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 157 EUROPE METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 158 EUROPE METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 159 EUROPE METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 160 EUROPE METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 161 EUROPE METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 162 EUROPE METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 163 GERMANY METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 164 GERMANY METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 165 GERMANY METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 166 GERMANY METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 167 GERMANY METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 168 GERMANY METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 169 GERMANY METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 170 GERMANY METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 171 UK METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 172 UK METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 173 UK METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 174 UK METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 175 UK METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 176 UK METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 177 UK METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 178 UK METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 179 FRANCE METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 180 FRANCE METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 181 FRANCE METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 182 FRANCE METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 183 FRANCE METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 184 FRANCE METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 185 FRANCE METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 186 FRANCE METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 187 ITALY METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 188 ITALY METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 189 ITALY METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 190 ITALY METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 191 ITALY METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 192 ITALY METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 193 ITALY METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 194 ITALY METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 195 SPAIN METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 196 SPAIN METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 197 SPAIN METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 198 SPAIN METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 199 SPAIN METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 200 SPAIN METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 201 SPAIN METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 202 SPAIN METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 203 RUSSIA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 204 RUSSIA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 205 RUSSIA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 206 RUSSIA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 207 RUSSIA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 208 RUSSIA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 209 RUSSIA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 210 RUSSIA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 211 REST OF EUROPE METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 213 REST OF EUROPE METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 214 REST OF EUROPE METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 215 REST OF EUROPE METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 217 REST OF EUROPE METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 218 REST OF EUROPE METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA METHANOL MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA METHANOL MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 229 UAE METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 230 UAE METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 231 UAE METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 232 UAE METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 233 UAE METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 234 UAE METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 235 UAE METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 236 UAE METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 237 SAUDI ARABIA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 239 SAUDI ARABIA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 240 SAUDI ARABIA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 241 SAUDI ARABIA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 243 SAUDI ARABIA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 244 SAUDI ARABIA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 245 SOUTH AFRICA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 247 SOUTH AFRICA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 248 SOUTH AFRICA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 249 SOUTH AFRICA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 251 SOUTH AFRICA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 252 SOUTH AFRICA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY FEEDSTOCK (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY FEEDSTOCK (KILOTONS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY DERIVATIVE (USD MILLIONS) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY DERIVATIVE (KILOTONS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY SUB-DERIVATIVE (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY SUB-DERIVATIVE (KILOTONS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA METHANOL MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL METHANOL MARKET BY FEEDSTOCK, USD BILLION, 2020-2029

FIGURE 9 GLOBAL METHANOL MARKET BY DERIVATIVE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL METHANOL MARKET BY SUB-DERIVATIVE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL METHANOL MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 12 GLOBAL METHANOL MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL METHANOL MARKET BY FEEDSTOCK, USD BILLION, 2021

FIGURE 15 GLOBAL METHANOL MARKET BY DERIVATIVE, USD BILLION, 2021

FIGURE 16 GLOBAL METHANOL MARKET BY SUB-DERIVATIVE, USD BILLION, 2021

FIGURE 17 GLOBAL METHANOL MARKET BY END USER, USD BILLION, 2021

FIGURE 18 GLOBAL METHANOL MARKET BY REGION, USD BILLION, 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 21 BASF SE: COMPANY SNAPSHOT

FIGURE 22 METHANEX CORPORATION: COMPANY SNAPSHOT

FIGURE 23 SABIC: COMPANY SNAPSHOT

FIGURE 24 PETROLIAM NASIONAL BERHAD (PETRONAS): COMPANY SNAPSHOT

FIGURE 25 MITSUBISHI GAS CHEMICAL COMPANY, INC: COMPANY SNAPSHOT

FIGURE 26 VALERO: COMPANY SNAPSHOT

FIGURE 27 MITSUI & CO., LTD: COMPANY SNAPSHOT

FIGURE 28 METHANOL HOLDINGS (TRINIDAD) LIMITED: COMPANY SNAPSHOT

FIGURE 29 ZAGROS PETROCHEMICAL CO: COMPANY SNAPSHOT

FAQ

Methanol market is expected to grow at 4.5% CAGR from 2022 to 2029. it is expected to reach above USD 41.95 billion by 2029.

Asia Pacific held more than 30% of methanol market revenue share in 2021 and will witness expansion in the forecast period.

It is anticipated that the construction and automotive industries’ growing demand will propel market expansion. The usage of petrochemicals in end-use industries including the automotive and construction sectors is the key reason fueling the market’s expansion.

Over the projection period, the natural gas segment will command a large market share. This market sector is anticipated to expand because to the low cost of production that results in a considerable output. Together with an increase in the use of coal to generate methyl alcohol in many nations with substantial coal output, the coal section is also anticipated to pass the end of the line successfully.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.