Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

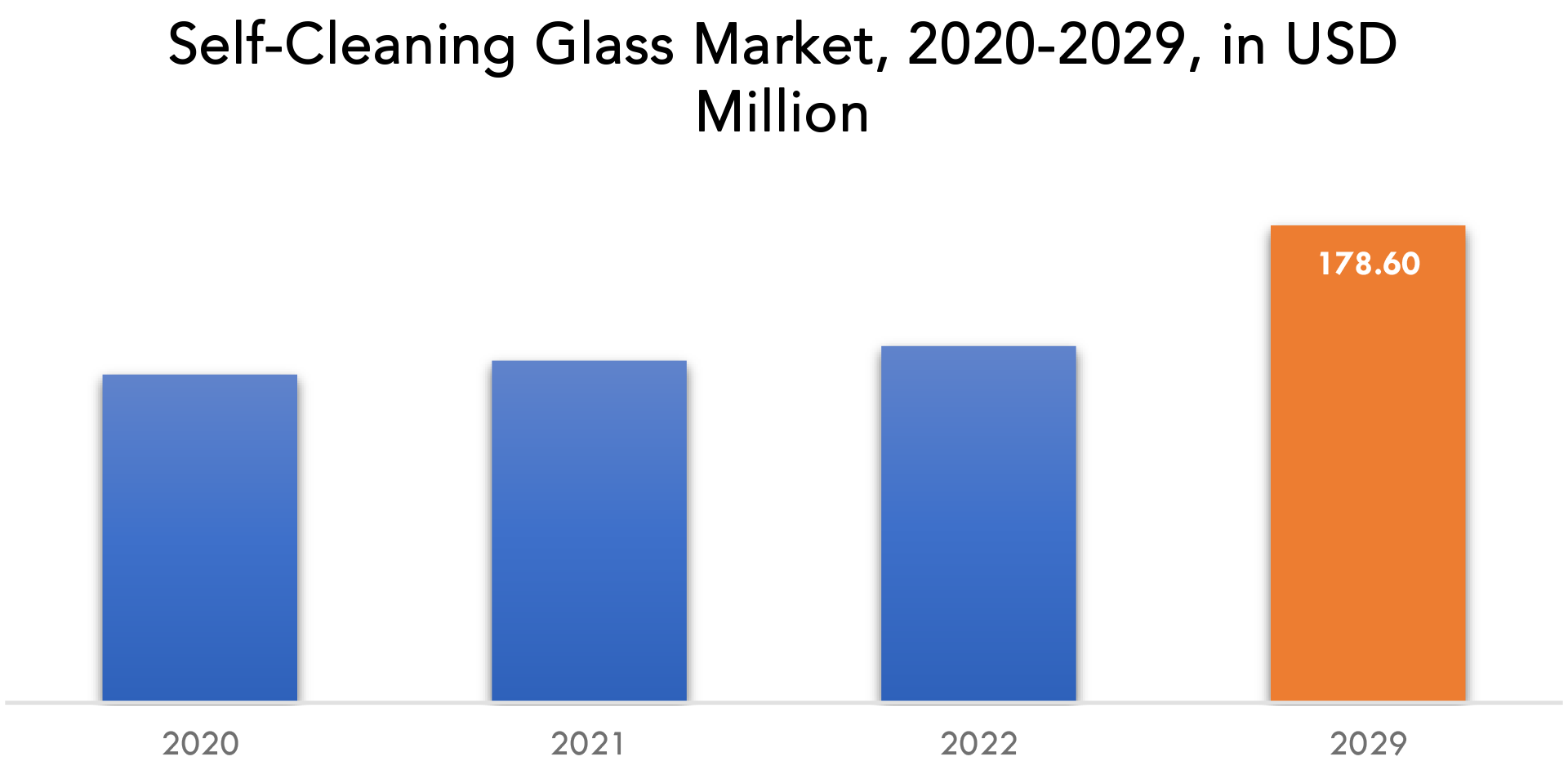

| USD 122.8 million by 2029 | 4.25% | Europe |

| By Coating Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Self-Cleaning Glass Market Overview

The self-cleaning glass market is expected to grow at 4.25% CAGR from 2022 to 2029. It is expected to reach above USD 122.8 million by 2029 from USD 178.60 million in 2020.

Self-cleaning glass is referred to be a particular kind of glass having a surface that maintains its cleanliness in the presence of hostile environmental elements. It is a low-maintenance glass that is created by coating the surface with a thin layer of a chemical that exhibits photolytic and hydrophilic qualities. This makes it simpler to clean the glass.

Glass that cleans itself is resistant to fog and glare. The material added to the glass does not alter its acoustic, thermal, or mechanical characteristics. Self-cleaning glass is utilized in places where human cleaning is difficult to reach, such as facades and higher elevations. It features a layer of titanium oxide on the surface, which when exposed to water or rain, undergoes a chemical reaction to break down debris and other substances into smaller bits that may be readily washed off. In contrast to regular glass, which is hydrophobic and repels water, the layer is hydrophilic, or it attracts water. Water therefore flows evenly across the glass and quickly removes the grime. Self-cleaning glass reduces the time and labor required for maintenance.

The rapidly expanding demand from the building sector and the rising demand from the energy sector are the main drivers of the market under study. It is anticipated that a high price barrier and a lack of customer awareness will impede the development of the industry under study. Buildings & construction industry led the market and is predicted to expand throughout the forecast period owing to the less maintenance expenses.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD MILLION) |

| Segmentation | By Coating Type, By Application, By Region |

| By Coating Type |

|

| By Application |

|

| By Region |

|

The rising demand for environmentally friendly and energy-efficient building materials is one of the main factors. Glass that cleans itself can lessen the need for manual maintenance and cleaning, which can save money and energy. The growing number of applications for self-cleaning glass outside of conventional building windows is another motivator. The technique can be utilized to increase visibility and lower maintenance costs in many different industries, including automotive, aerospace, and marine. The market is also being driven by developments in self-cleaning technologies, such as the creation of more effective coatings and the incorporation of smart sensors. These innovations improve the effectiveness and efficiency of glass’s inherent ability to self-clean. The benefits of self-cleaning glass are also becoming more widely known and understood, which is increasing demand and implementation. Customers and building owners are more likely to invest in this technology as they become more aware of its benefits. The market for self-cleaning glass is anticipated to grow and expand over the next several years as a result of these driving factors.

The high cost of production and installation is a significant determining factor. Self-cleaning glass requires specific coatings and cutting-edge production processes, which raises the price. It might be more expensive as a result, which could prevent it from being used in some applications. The efficiency of self-cleaning technology in specific situations is another consideration. While self-cleaning glass performs admirably in locations with lots of sunlight, it might not perform as well in locations with little access to natural light. The glass’s ability to clean itself may also deteriorate over time, necessitating maintenance or replacement. Also, not all types of structures or buildings can use self-cleaning glass. Last but not least, there is little knowledge and education regarding the advantages and uses of self-cleaning glass. In some markets, this can reduce adoption and demand. Ultimately, self-cleaning glass has potential, but these barriers to growth must be removed in order to realize that potential.

The rising demand for eco-friendly and energy-efficient building materials are one significant opportunity. Self-cleaning glass is an appealing choice for building owners and operators since it can assist decrease the need for manual cleaning and maintenance. The growth of self-cleaning glass uses outside of conventional building windows represents another possibility. Self-cleaning glass can be employed in different industries, such as automotive, aerospace, and marine. Self-cleaning technological developments, such as the creation of more efficient coatings and the incorporation of smart sensors, present greater chances for creativity and distinctiveness. Ultimately, there is a chance that self-cleaning glass will become more popular in developing nations. Overall, there are numerous potential for growth and expansion in the self-cleaning glass sector.

Solar energy projects were somewhat impacted by COVID-19 because they rely on natural resources like wind and sunlight, but rooftop solar projects were most negatively impacted because the majority of them are small businesses. Due to the fact that the majority of solar cells and modules are imported from China, supply chain disruption has had an impact on company. Moreover, businesses have slowed down manufacturing. Due to decreased customer traffic in showrooms and a drop in vehicle sales, the pandemic has had a significant impact on the automotive industry, leading to the closure of factories that make cars and their components around the world. Construction projects are significantly impacted by COVID-19 because the majority of the work is halted.

Self-Cleaning Glass Market Segment Analysis

The self-cleaning glass market is segmented based on coating type, application and region.

Based on coating type market is segmented into hydrophilic and hydrophobic; by Application market is segmented into residential construction, non-residential construction, solar panels, automotive, and others; and region.

The hydrophilic segment dominated the self-cleaning glass market in terms of coating type. The hydrophilic self-cleaning glass is covered in a titanium dioxide coating. This coating self-cleans glass in two stages: the photo catalytic stage and the hydrophilic sheathing stage. In the photo catalytic stage, ultraviolet light from the sun degrades the organic dirt on the glass. In the hydrophilic sheathing process, rain washes away the dirt, leaving no streaks behind because hydrophilic glass spreads the water evenly over the surface. This glass works better when it is frequently washed off with water or in locations with heavy rainfall.

Residential Construction is anticipated to hold the greatest market share for self-cleaning glass during the period of forecasting. In residential constructions, self-cleaning glass is utilized in roof windows, bay windows, conservatories, roofs, patio doors, and glazed facades. Typically, a hydrophilic coating is applied to solar control glass to provide superior energy efficiency and self-cleaning properties. Rapid urbanization in developing nations and the expansion of building codes in developed nations have raised the need for self-cleaning glass in residential buildings.

Self-Cleaning Glass Market Key Players

The Self-Cleaning Glass Market key players include Pilkington Group Limited, Saint Gobain Glass (SGG), Vitro Architectural Glass, Morley Glass & Glazing Ltd, Balcony Systems Solutions Ltd, Cyndan Chemicals, Tuff-X Processed Glass Ltd, Guardian Industries Corp, Australian Insulated Glass, Roof-Maker Limited, and others.

Industry Development:

06 February 2023: AGC and Saint-Gobain, worldwide flat glass manufacturers leading in sustainability, announced that they collaborated on the design of a pilot breakthrough flat glass line which reduce very significantly its direct CO2 emissions.

28 June 2022: Vitro Glass (formerly PPG Glass), the largest glass manufacturer in the Americas, joined VueReal, a leader in micro printing technology, to advance the interactivity and functionality of glass.

Who Should Buy? Or Key stakeholders

- Construction Industry

- Automotive Industry

- Government Organizations

- Investors

- Research and development

- Regulatory Authorities

- End-users Companies

- Others

Self-Cleaning Glass Market Regional Analysis

The Self-Cleaning Glass Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico, Rest of North America

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes UAE, South Africa, and Rest of MEA

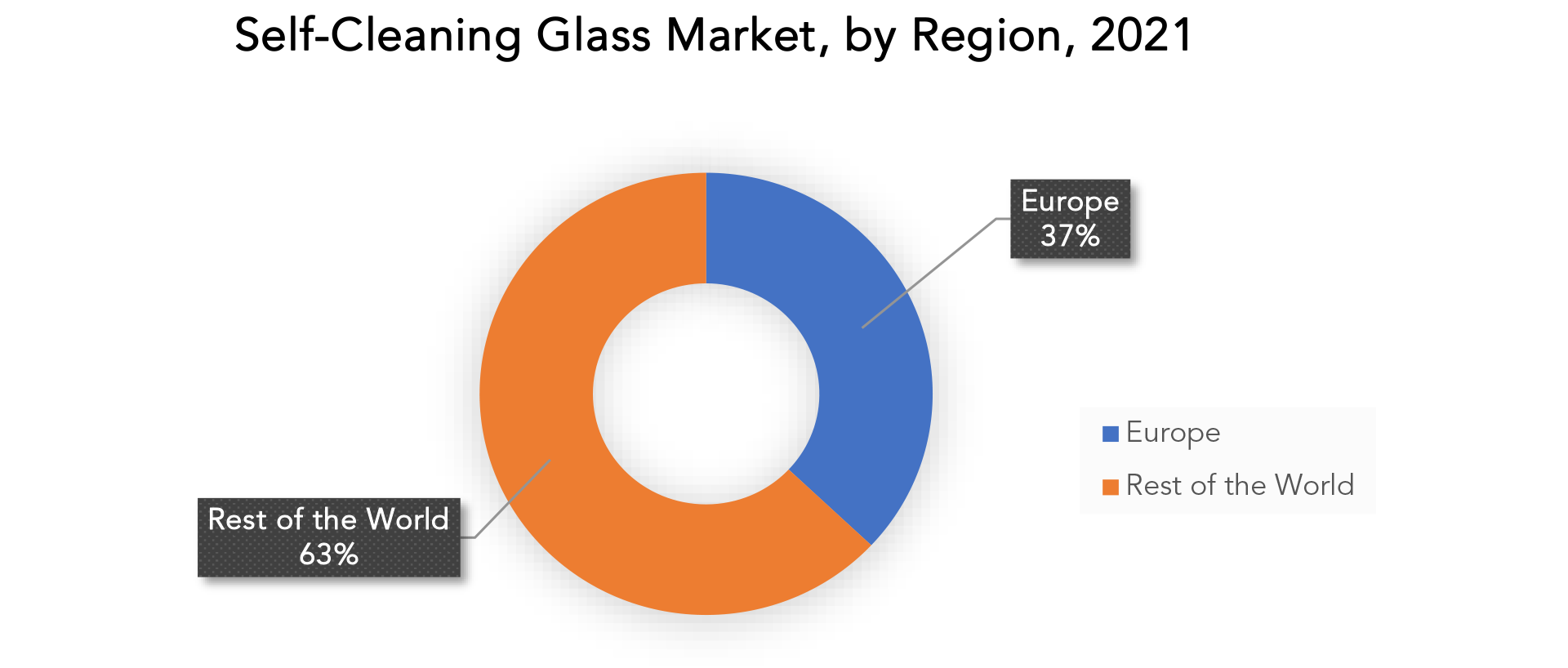

For the next five years, Europe is anticipated to continue to be the largest market by geographic region. The region’s three largest markets are Germany, France, and the United Kingdom. Compared to other regions, like Asia-Pacific, the market in Western Europe is still relatively young. Self-cleaning glass has been used for more than 15 years in several important European nations. Self-cleaning glass manufacturers include Pilkington, Saint-Gobain Limited, Tuffx Glass, and Morley Glass & Glazing Ltd. in Europe. One of the world’s biggest producers of self-cleaning glasses is the United Kingdom. The European Commission reports that around 570 projects have applied for funding totaling USD 63.19 million to be used for their construction. These glasses are frequently utilized to replace the glasses that are currently used to make solar panels because of their capacity to self-clean. Hence, this has led to a rise in solar panels’ efficiency. In all the aforementioned areas, the demand for self-cleaning glasses is expected to increase throughout the projected period due to the aforementioned causes as well as government backing.

The self-cleaning glass market is expected to grow significantly in the Asia Pacific region over the next years. The self-cleaning glass market in this area is being driven by the expanding middle-class population with high disposable income and the expanding need for environmentally friendly buildings throughout the growth phase.

Key Market Segments: Self-Cleaning Glass Market

Self-Cleaning Glass Market By Coating Type, 2020-2029, (USD Million)

- Hydrophilic

- Hydrophobic

Self-Cleaning Glass Market By Application, 2020-2029, (USD Million)

- Residential Construction

- Non Residential Construction

- Solar Panels

- Automotive

- Others

Self-Cleaning Glass Market By Region, 2020-2029, (USD Million)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the self-cleaning glass market over the next 7 years?

- Who are the major players in the self-cleaning glass market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the self-cleaning glass market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the self-cleaning glass market?

- What is the current and forecasted size and growth rate of the global self-cleaning glass market?

- What are the key drivers of growth in the self-cleaning glass market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the self-cleaning glass market?

- What are the technological advancements and innovations in the self-cleaning glass market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the self-cleaning glass market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the self-cleaning glass market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SELF-CLEANING GLASS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SELF-CLEANING GLASS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SELF-CLEANING GLASS MARKET OUTLOOK

- GLOBAL SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

- HYDROPHILIC

- HYDROPHOBIC

- GLOBAL SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

- RESIDENTIAL CONSTRUCTION

- NON RESIDENTIAL CONSTRUCTION

- SOLAR PANELS

- AUTOMOTIVE

- OTHERS

- GLOBAL SELF-CLEANING GLASS MARKET BY REGION (USD MILLION), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- PILKINGTON GROUP LIMITED

- SAINT GOBAIN GLASS (SGG)

- VITRO ARCHITECTURAL GLASS

- MORLEY GLASS & GLAZING LTD

- BALCONY SYSTEMS SOLUTIONS LTD

- CYNDAN CHEMICALS

- TUFF-X PROCESSED GLASS LTD

- GUARDIAN INDUSTRIES CORPORATION

- AUSTRALIAN INSULATED GLASS

- ROOF-MAKER LIMITED

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 3 GLOBAL SELF-CLEANING GLASS MARKET BY REGION (USD MILLION), 2020-2029

TABLE 4 NORTH AMERICA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 5 NORTH AMERICA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 6 NORTH AMERICA SELF-CLEANING GLASS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 7 US SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 8 US SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 9 CANADA SELF-CLEANING GLASS MARKET BY COATING TYPE (MILLION), 2020-2029

TABLE 10 CANADA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 11 MEXICO SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 12 MEXICO SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 13 SOUTH AMERICA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 14 SOUTH AMERICA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 15 SOUTH AMERICA SELF-CLEANING GLASS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 16 BRAZIL SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 17 BRAZIL SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 18 ARGENTINA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 19 ARGENTINA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 20 REST OF SOUTH AMERICA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 21 REST OF SOUTH AMERICA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 22 ASIA -PACIFIC SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 23 ASIA -PACIFIC SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 24 ASIA -PACIFIC SELF-CLEANING GLASS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 25 INDIA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 26 INDIA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 27 CHINA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 28 CHINA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 29 JAPAN SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 30 JAPAN SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 31 SOUTH KOREA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 32 SOUTH KOREA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 33 AUSTRALIA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 34 AUSTRALIA HYBRID FUNCTIONBY APPLICATION (USD MILLION), 2020-2029

TABLE 35 AUSTRALIA SELF-CLEANING GLASS MARKET BY FUNCTION (USD MILLION), 2020-2029

TABLE 36 AUSTRALIA SELF-CLEANING GLASS MARKET BY ORGANIZATION SIZE (USD MILLION), 2020-2029

TABLE 37 REST OF ASIA PACIFIC SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 38 REST OF ASIA PACIFIC HYBRID FUNCTIONBY APPLICATION (USD MILLION), 2020-2029

TABLE 39 EUROPE SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 40 EUROPE SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 41 EUROPE SELF-CLEANING GLASS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 42 GERMANY SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 43 GERMANY SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 44 UK SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 45 UK SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 46 FRANCE SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 47 FRANCE SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 48 ITALY SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 49 ITALY SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 50 SPAIN SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 51 SPAIN SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 52 REST OF EUROPE SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 53 REST OF EUROPE SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 54 MIDDLE EAST AND AFRICA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 55 MIDDLE EAST AND AFRICA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 56 MIDDLE EAST AND AFRICA SELF-CLEANING GLASS MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 57 UAE SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 58 UAE SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 59 SOUTH AFRICA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 60 SOUTH AFRICA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 61 REST OF MIDDLE EAST AND AFRICA SELF-CLEANING GLASS MARKET BY COATING TYPE (USD MILLION), 2020-2029

TABLE 62 REST OF MIDDLE EAST AND AFRICA SELF-CLEANING GLASS MARKET BY APPLICATION (USD MILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SELF-CLEANING GLASS MARKET BY COATING TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SELF-CLEANING GLASS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SELF-CLEANING GLASS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SELF-CLEANING GLASS MARKET BY COATING TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL SELF-CLEANING GLASS MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 14 GLOBAL SELF-CLEANING GLASS MARKET BY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 PILKINGTON GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 17 SAINT GOBAIN GLASS (SGG): COMPANY SNAPSHOT

FIGURE 18 VITRO ARCHITECTURAL GLASS: COMPANY SNAPSHOT

FIGURE 19 MORLEY GLASS & GLAZING LTD: COMPANY SNAPSHOT

FIGURE 20 BALCONY SYSTEMS SOLUTIONS LTD: COMPANY SNAPSHOT

FIGURE 21 CYNDAN CHEMICALS: COMPANY SNAPSHOT

FIGURE 22 TUFF-X PROCESSED GLASS LTD: COMPANY SNAPSHOT

FIGURE 23 GUARDIAN INDUSTRIES CORPORATION: COMPANY SNAPSHOT

FIGURE 24 AUSTRALIAN INSULATED GLASS: COMPANY SNAPSHOT

FIGURE 25 ROOF-MAKER LIMITED: COMPANY SNAPSHOT

FAQ

The global self-cleaning glass market size was valued at 122.8 million in 2020.

The self-cleaning glass Market key players include Pilkington Group Limited, Saint Gobain Glass(SGG), Vitro Architectural Glass, Morley Glass & Glazing Ltd, Balcony Systems Solutions Ltd, Cyndan Chemicals, Tuff-X Processed Glass Ltd, Guardian Industries Corp, Australian Insulated Glass, Roof-Maker Limited.

Europe is the largest regional market for self-cleaning glass.

The Self-Cleaning Glass Market is growing at a CAGR of 4.25% over the next 7 years.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.