REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

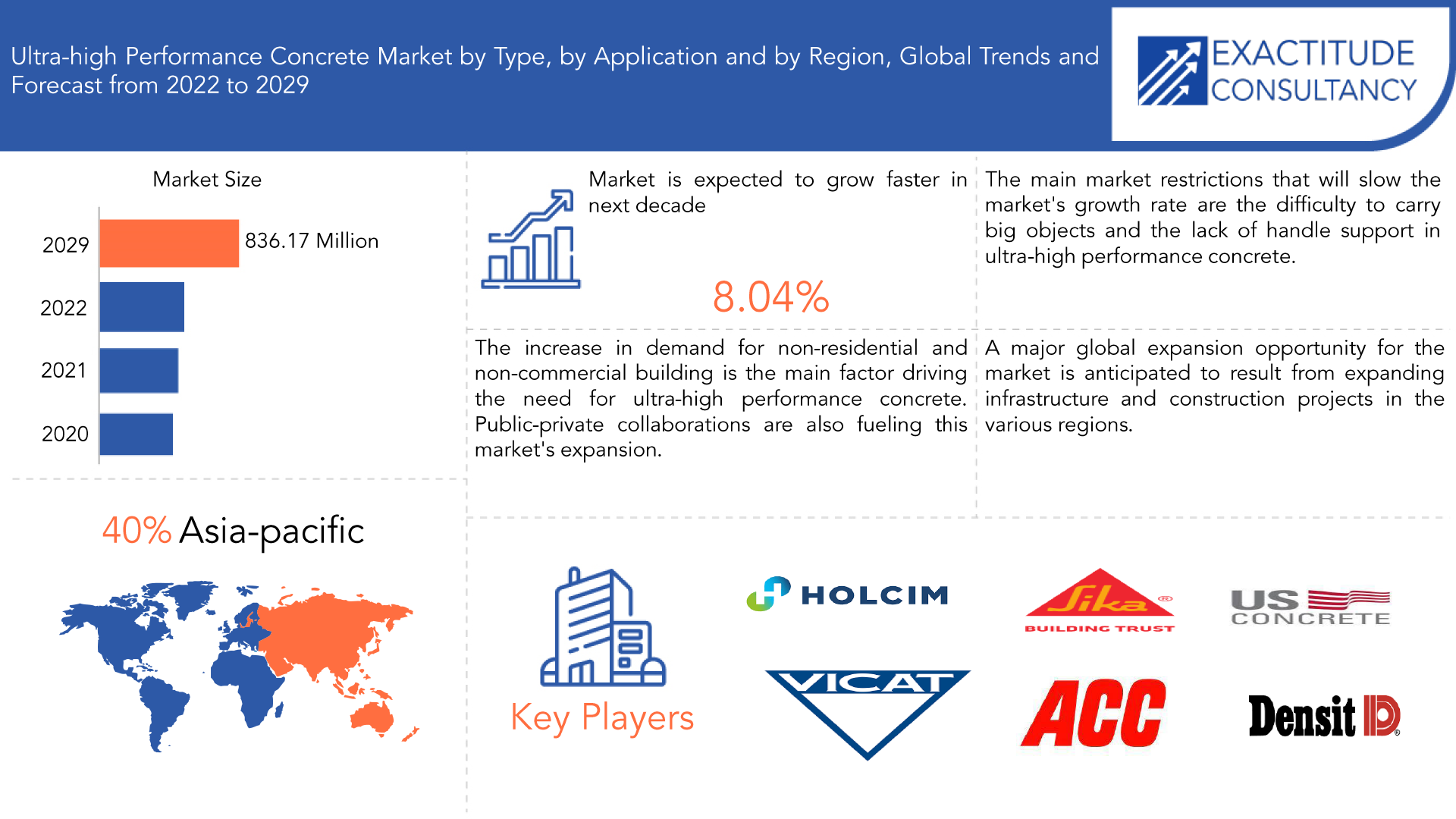

| USD 836.17 Million by 2029 | 8.04% | Asia Pacific |

| by Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Ultra-high-Performance Concrete Market Overview

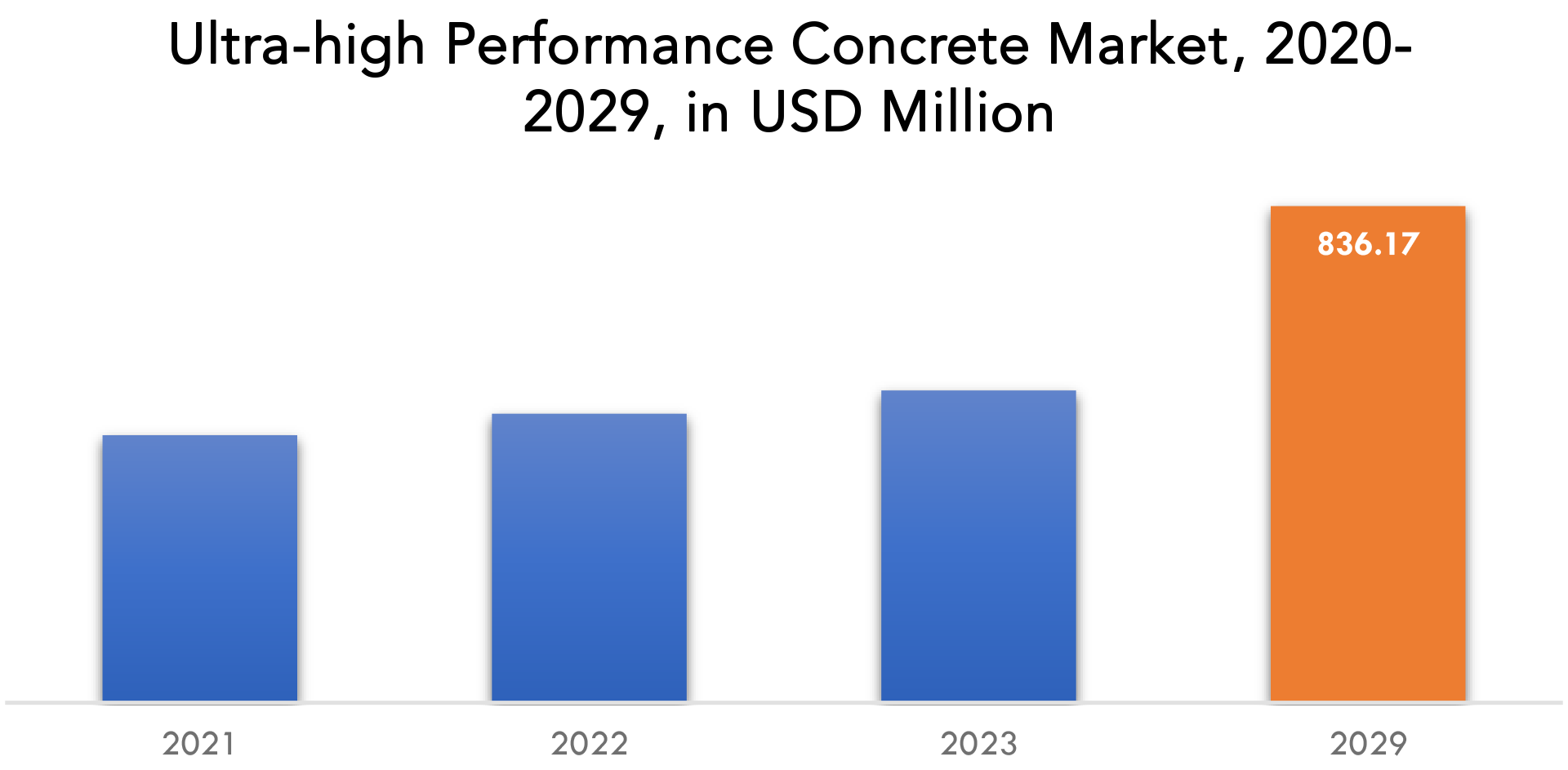

The ultra-high-Performance concrete market is expected to grow at 8.04% CAGR from 2022 to 2029. It is expected to reach above USD 836.17 Million by 2029 from USD 416.90 Million in 2020.

An innovative variety of cement, ultra-high-Performance concrete has advantages including outstanding durability and great strength. It is used to increase the structural or building’s sustainability as well as the sustainability of other infrastructure elements. In a variety of applications, including repair and rehabilitation, architectural elements, bridges, and construction components, ultra-high-Performance concrete is used. Moreover, it is utilized in windmill towers, offshore buildings, and hydraulic structures. The construction of highways and bridges is where ultra-high-Performance concrete is most frequently used among these uses. Reactive powder concrete is another name for ultra-high-Performance concrete. Water, high-range eater reducers, fine sand, quartz flour, limestone flour, reactive powders, and auxiliary components are used to create ultra-high-Performance concrete. In order to create ultra-high-Performance concrete with a high compressive strength of up to 200 Mpa, these components are blended. For the concrete’s aesthetics, fine materials give a smooth, dense surface. These fine materials can also be changed to become harder. Moreover, structures constructed in marine environments make advantage of the ultra-high-Performance concrete. Chloride-induced corrosion is a concern for reinforced concrete buildings in coastal environments. Due to its great durability, which guards the structure against chloride corrosion, ultra-high-Performance concrete has proven to be a successful option. Ultra-high-Performance concrete makes up most of the bridges that are constructed over water. Because these bridges are lightweight, less maintenance is necessary. Because it can be utilized in a variety of applications, the demand for ultra-high-Performance concrete is anticipated to increase throughout the projected period. Ultra-high-Performance concrete has substantially more strength than regular concrete. The development of this market may also be constrained by factors like the high cost of establishing manufacturing facilities.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) (Kilotons) |

| Segmentation | By Type, By Application, By Region |

| By Type |

|

| By Application |

|

| By Region |

|

One of the top industries in the world for generating revenue has always been the building sector. Despite its scale and extent, the sector is always evolving and adjusting to the political, social, and economic climate. The global construction market will develop quickly, according to the most recent statistics. Although the post-recession construction boom is currently beginning to wane, the sector is by no means in a standstill. The need for commercial development projects is increasing as a result of the metropolises’ quick growth. With ultra-high-Performance concrete, repair work is possible. Due to its exceptional qualities, UHPC has been frequently used as an overlay to repair old concrete structures, improving its mechanical and durability attributes for less frequent maintenance.

Due to low demand from a variety of industries, including construction, as a result of the lockdown enforced by governments of several nations, it is anticipated that demand for ultra-high-Performance concrete will decline. Construction material imports and exports have been impacted by the coronavirus. The world’s top exporter of building supplies is China. The global import and export of ultra-high-Performance concrete are expected to decrease due to negative economic trends in China. Manufacturers and investors are anticipating an excessively slowing economic growth, which has caused a significant decline in the demand for new construction materials. International travel restrictions have an impact on the commerce in building materials. As a result, there is no longer any supply or demand for building materials anywhere in the world. The trade of construction materials has been impacted by travel restrictions all around the world. As a result, there is no longer any global supply or demand for building materials. Because to the lockdown and lack of logistics in the area, construction material production enterprises in China are the outbreak’s main victims. The government-ordered house quarantines that resulted in the suspension of building material manufacturing are the main obstacle for the worldwide market for construction materials. Over the course of the current economic year, decreased consumer demand and spending resulted in a decrease and slowdown in the sales of construction materials globally.

As a result, it is anticipated that the market for ultra-high-Performance concrete will suffer.

Ultra-high-Performance Concrete Market Segment Analysis

Ultra-high-Performance concrete market is segmented based on type, application, and region.

Based on type, a significant portion of the market was made up of slurry infiltrated fibrous concrete (SIFCON), Construction of both commercial and residential constructions regularly makes use of this kind of ultra-high-Performance concrete. SIFCON is appropriate for building applications requiring high tensile strength because of its high fibre content. These infrastructural structures include precast bridge decking and prestressed girders used in bridge building. SIFCON offers increased stability under dynamic, fatigue, and repetitive loading regimes because of its high strength and ductility. Due to its high fibre concentration, this type of ultra-high-Performance concrete mix is relatively pricey. Yet, it is a helpful replacement for standard concrete mixes in situations where consumers require certain qualities like high strength and ductility or when standard concrete mixes are insufficient to meet their needs.

Based on application, a significant portion of the market was made up of road & bridge construction. Construction of compact and light-weight structural components is made possible by ultra-high-Performance concrete without compromising the bridge’s capacity to carry its own weight. If setting times are shorter and maintenance costs are lower, countries can raise infrastructure growth rates more swiftly to keep up with economic development. UHPC increases durability by reducing the rate strength ratio. These advancements have increased the usage of ultra-high-Performance concrete in the construction of roads and bridges in recent years, and it is projected that this trend will continue during the projection period. In turn, this is projected to be advantageous and stimulate market growth.

Ultra-high-Performance Concrete Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Holcim, Sika AG, Vicat, ACC Limited, Gulf Precast Concrete, U.S. Concrete, Inc, Densit, TAKTL, Ceentek, ELO KG

Recent News

- On March 2023, Holcim Launched World’s First Cement Plant Digital Twin

- On January 2023, Sika Exceeded Sales Of CHF 10 Million for The First Time – Strong Growth Of 15.8% In Local Currencies

Who Should Buy? Or Key stakeholders

- Investors

- Construction Industry

- End user companies

- Research and Development

- Chemical Laboratories

- Environment, Health, and Safety Professionals

- Regulatory Authorities

- Others

Ultra-high-Performance Concrete Market Regional Analysis

The ultra-high-Performance concrete market by region includes north america, asia-pacific (APAC), europe, south america, and middle east & africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

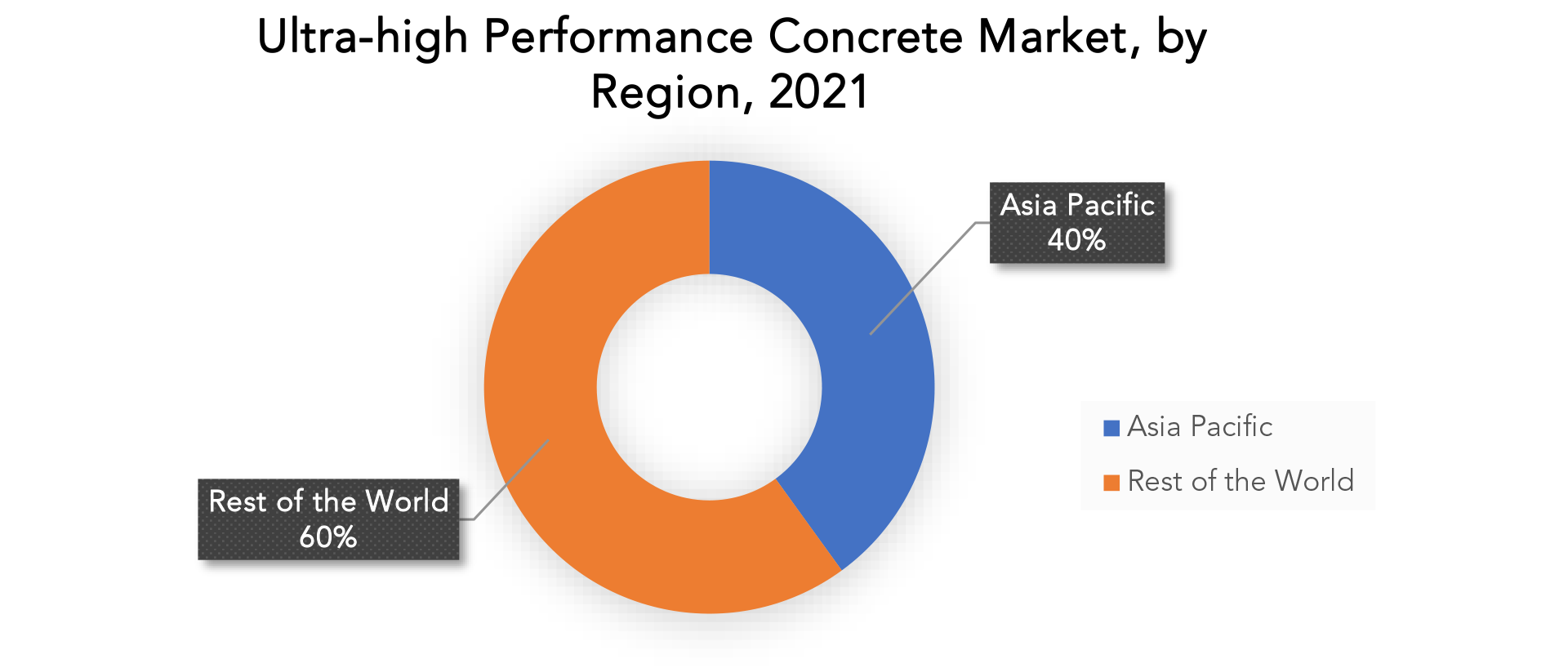

The greatest revenue share in 2021 over 40% was accounted for by Asia Pacific. This situation is anticipated to be influenced by growing opportunities in nations like China and strong demand from nations like Japan, China, and South Korea. The area is noted for its growing understanding of the use of ultra-high-Performance concrete. Rapid urbanisation, greater infrastructure spending as a result of numerous government programmes, and rising disposable income are just a few of the key factors that have fueled the expansion of the construction industry in the area. Public-Private Partnerships (PPP) have been established by governments to build projects including highways, dams, and railway networks. The government’s concerted efforts to create affordable housing are also propelling the construction sector. The region’s expanding building market should be able to meet growing regional demand.

Key Market Segments: Ultra-high-Performance Concrete Market

Ultra-High-Performance Concrete Market by Type, 2020-2029, (USD Million), (Kilotons)

- Slurry Infiltrated Fibrous Concrete (SIFC)

- Reactive Powder Concrete (RPC)

- Compact Reinforced Concrete (CRC)

Ultra-High-Performance Concrete Market by Application, 2020-2029, (USD Million), (Kilotons)

- Road & Bridge Construction

- Building Construction

- Military Construction

- Others

Ultra-High-Performance Concrete Market by Region, 2020-2029, (USD Million), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and Market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the ultra-high-performance concrete market over the next 7 years?

- Who are the major players in the ultra-high-performance concrete market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, middle east, and Africa?

- How is the economic environment affecting the ultra-high-performance concrete market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the ultra-high-Performance concrete market?

- What is the current and forecasted size and growth rate of the global ultra-high-performance concrete market?

- What are the key drivers of growth in the ultra-high-performance concrete market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the ultra-high-performance concrete market?

- What are the technological advancements and innovations in the ultra-high-performance concrete market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the ultra-high-performance concrete market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the ultra-high-performance concrete market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ULTRA-HIGH PERFORMANCE CONCRETE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET OUTLOOK

- GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE, 2020-2029, (USD MILLION), (KILOTONS)

- SLURRY INFILTRATED FIBROUS CONCRETE (SIFCON)

- REACTIVE POWDER CONCRETE (RPC)

- COMPACT REINFORCED CONCRETE (CRC)

- GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION, 2020-2029, (USD MILLION), (KILOTONS)

- ROAD & BRIDGE CONSTRUCTION

- BUILDING CONSTRUCTION

- MILITARY CONSTRUCTION

- OTHERS

- GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY REGION, 2020-2029, (USD MILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- HOLCIM

- SIKA AG

- VICAT

- ACC LIMITED

- GULF PRECAST CONCRETE

- U.S. CONCRETE, INC

- DENSIT

- TAKTL

- CEENTEK

- ELO KG *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY REGION (USD MILLION), 2020-2029

TABLE 6 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 14 US ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 16 US ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 18 CANADA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 20 CANADA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 22 MEXICO ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 24 MEXICO ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 26 SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 28 SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 30 SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 31 BRAZIL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 32 BRAZIL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 34 BRAZIL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 36 ARGENTINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 38 ARGENTINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 40 COLOMBIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 42 COLOMBIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 48 ASIA-PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 50 ASIA-PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 52 ASIA-PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 54 INDIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 56 INDIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 58 CHINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 60 CHINA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 62 JAPAN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 64 JAPAN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 66 SOUTH KOREA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 68 SOUTH KOREA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 70 AUSTRALIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 72 AUSTRALIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 82 EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 84 EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 86 EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 88 GERMANY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 90 GERMANY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 92 UK ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 94 UK ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 96 FRANCE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 98 FRANCE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 100 ITALY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 102 ITALY ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 104 SPAIN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 106 SPAIN ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 108 RUSSIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 110 RUSSIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 112 REST OF EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 114 REST OF EUROPE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 122 UAE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 124 UAE ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 126 SAUDI ARABIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 128 SAUDI ARABIA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 130 SOUTH AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 132 SOUTH AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 14 GLOBAL ULTRA-HIGH PERFORMANCE CONCRETE MARKET BY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 HOLCIM: COMPANY SNAPSHOT

FIGURE 17 SIKA AG: COMPANY SNAPSHOT

FIGURE 18 VICAT: COMPANY SNAPSHOT

FIGURE 19 ACC LIMITED: COMPANY SNAPSHOT

FIGURE 20 GULF PRECAST CONCRETE: COMPANY SNAPSHOT

FIGURE 21 U.S. CONCRETE, INC: COMPANY SNAPSHOT

FIGURE 22 DENSIT: COMPANY SNAPSHOT

FIGURE 23 TAKTL: COMPANY SNAPSHOT

FIGURE 24 CEENTEK: COMPANY SNAPSHOT

FIGURE 25 ELO KG: COMPANY SNAPSHOT

FAQ

The ultra-high-Performance concrete market is expected to grow at 8.04% CAGR from 2022 to 2029. It is expected to reach above USD 836.17 Million by 2029 from USD 416.90 Million in 2020.

Asia Pacific held more than 40% of the ultra-high-performance concrete market revenue share in 2021 and will witness expansion in the forecast period.

Global demand for new construction projects is rising as macroeconomic conditions improve. New residential construction and housing developments have both experienced significant increases. Also, it is projected that the need for concrete with superior quality, increased compressive strength, and decreased weight will fuel the expansion of the ultra-high-Performance concrete market. Increased demand for non-residential and non-commercial construction is the key factor driving the need for ultra-high-Performance concrete. The expansion of this sector and the demand for various grades of ultra-high-Performance concrete in infrastructure projects are both driven by public-private partnerships (PPPs).

The greatest revenue share was accounted for by asia pacific. A growing number of the newest housing units and significant investments in the infrastructure sector are to blame. The APAC real estate market has been rapidly growing over the last few decades. The industry is under intense pressure to meet this demand at competitive prices and shorten turnaround times because the demand for housing and industrial assets is increasing in proportion to the rapidly growing population and economy. These changes have likely increased demand in the ultra-high-Performance concrete marketplace. As a result, it can be said that throughout the course of the projected period, the area is expected to have a considerable growth rate in the market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.