Report Outlook

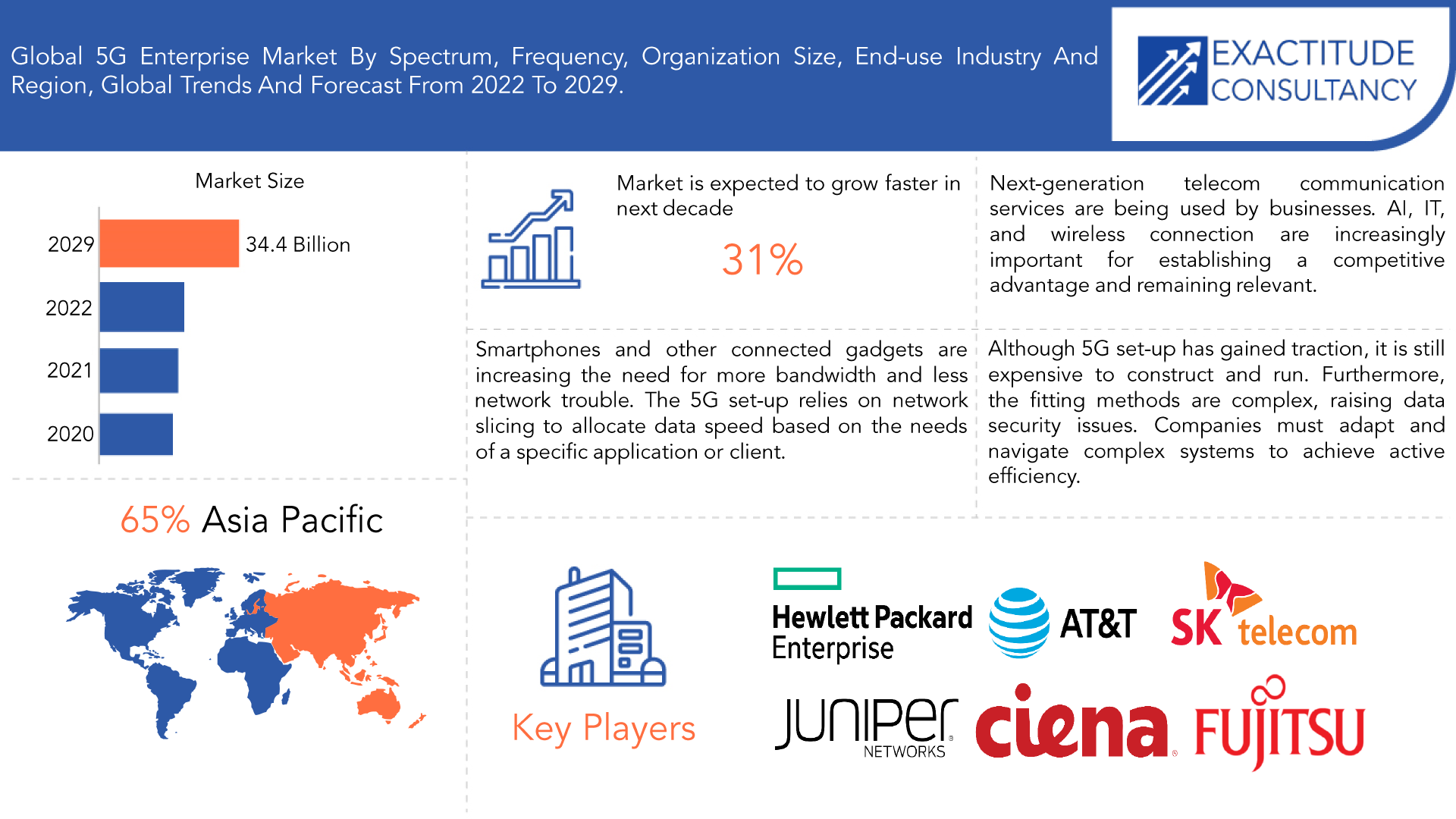

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 34.4 Billion by 2029 | 31 % | Asia Pacific |

| By Spectrum | By Frequency | By Organization Size |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Overview-5G Enterprise Market

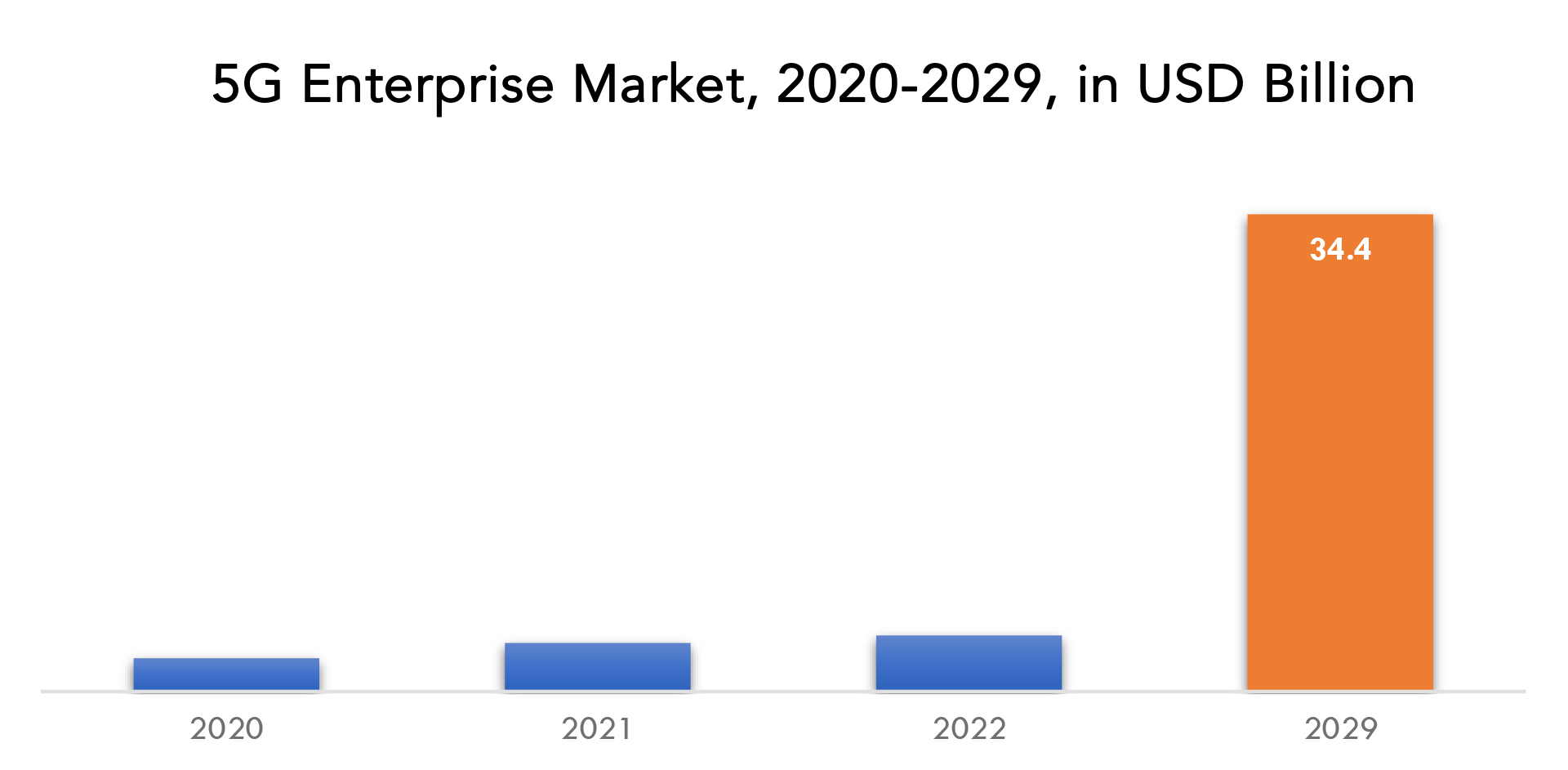

The global 5G Enterprise market is designed to grow at 31 % CAGR from 2022 to 2029. It is expected to reach above USD 34.4 Billion by 2029 from USD 4.04 Billion in 2022.

The fifth-generation (5G) wireless network, also known as the 5G enterprise, is an advancement over the fourth-generation (4G) wireless network. It is performed by using the high-frequency and short-range bands of the radio spectrum. 5G Enterprise provides low latency and high internet rates. It has a network performance of more than 1Gbps, which is 10 times faster than the 4G network. Enterprises will be able to offer a variety of services and develop their private wireless platform with a wide range of operational capabilities with the support of 5G enterprise technologies. Furthermore, it enables the high-tech Internet of Things platform, which is essential for the implementation of Industry 4.0 and industrial automation.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION) |

| Segmentation | By Spectrum, Frequency, organization size, End-user industry, and region. |

| By Spectrum |

|

| By Frequency |

|

| By organization size |

|

| By End-user industry |

|

| By Region |

|

The global 5G enterprise market is growing as a result of a variety of causes, including greater use of network slicing to provide various 5G services and an increase in smartphone and wearable device usage across all age groups. Furthermore, the global growth of smart telecommunications infrastructure supports the market. The high start-up and construction costs of 5G corporate solutions, as well as security challenges in 5G core networks, are impeding the market growth.

Cell phone use in developing countries has consistently increased over the last ten years due to a range of factors such as increased per capita income, cost affordability, the availability of various low-cost options with substantial capabilities, and others. Cell phones are increasingly being utilized for social purposes as a result of the COVID-19 epidemic and the rising adoption of the work-from-home policy by many businesses. Numerous companies and educational institutions are using smartphones, tablets, and other smart devices to communicate with their employees and students.

The private 5G network will be wirelessly connected to the assembly line equipment, enabling connected manufacturing with M2M apps, IIT, and robotics, among other things. Wireless technology control applications are still in their infancy. Offshore oil platforms are expected to lead the way in yet another significant adoption. It is difficult to run a cable from the platform to the beach to enable connectivity on these platforms. As a result, oil rigs have long been hampered by poor speeds and intermittent connectivity.

Segment Analysis-5G Enterprise Market

Based on the spectrum, the licensed sector accounted for the vast majority of the 5G enterprise market share in 2021, and this trend is expected to continue for the foreseeable future. The segment’s growth is attributed to the several benefits provided by this spectrum type, such as great connection quality that saves costs when adding new resources, robust security, and others. Nonetheless, the unlicensed/shared market is expected to grow at the quickest rate in the coming years.

The mmWave frequency range, on the other hand, is expected to grow the fastest since it allows a high number of users to connect to a single access point, which is helpful in densely populated areas of major cities. The use of this technology speeds up the start-up of new firms, increases the value of current mobile and wearable resources, and lowers data costs, all of which contribute to the market’s continuous growth.

In terms of organization size, large-scale companies presently dominate the 5G enterprise market, and this trend is expected to continue during the projection period. The market is developing as a result of both large-scale businesses’ major expenditures in 5G networks and increased demand for high-speed internet among these enterprises. Nonetheless, small and medium-sized firms grew the most in the market in 2022. This growth is due to a shift in small and medium-sized enterprises towards digitization and the usage of the Internet of Things in normal operations that demand high-speed and reasonably priced Internet, which drives the global 5G enterprise market.

Market Players-5G Enterprise Market

The 5G enterprise market includes some top key players and that are; Ciena Corporation, Affirmed Network, Hewlett Packard Enterprise Development LP, AT&T Intellectual Property, Juniper Networks INC, Samsung, Fujitsu, SK Telecom Co, LTD, ZTE, Verizon, Cradle point, INC. Mavenir, Nokia, and CommScope, Amongst Others.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Industry Developments:

- March 2022 – Sierra Wireless Introduces a New Private APN Solution for Managed Connectivity Solutions with Strong Security and Faster Application Development.

- April 2023 – More first responders select FirstNet to communicate reliably. They have introduced the new Mini Compact Rapid Deployable for FirstNet to further mark the anniversary of FirstNet’s founding. These agency-owned assets, which are now available for purchase by public safety agencies, are 80% smaller and less expensive than the CRDTM for FirstNet, which has proved crucial in first responders’ emergency response during wildfires and Hurricane Ian last year.

Who Should Buy? Or Key stakeholders

- Investors

- Technology Companies

- Research Organizations

- Automotive industries

- Regulatory Authorities

- Institutional & retail players

- Others

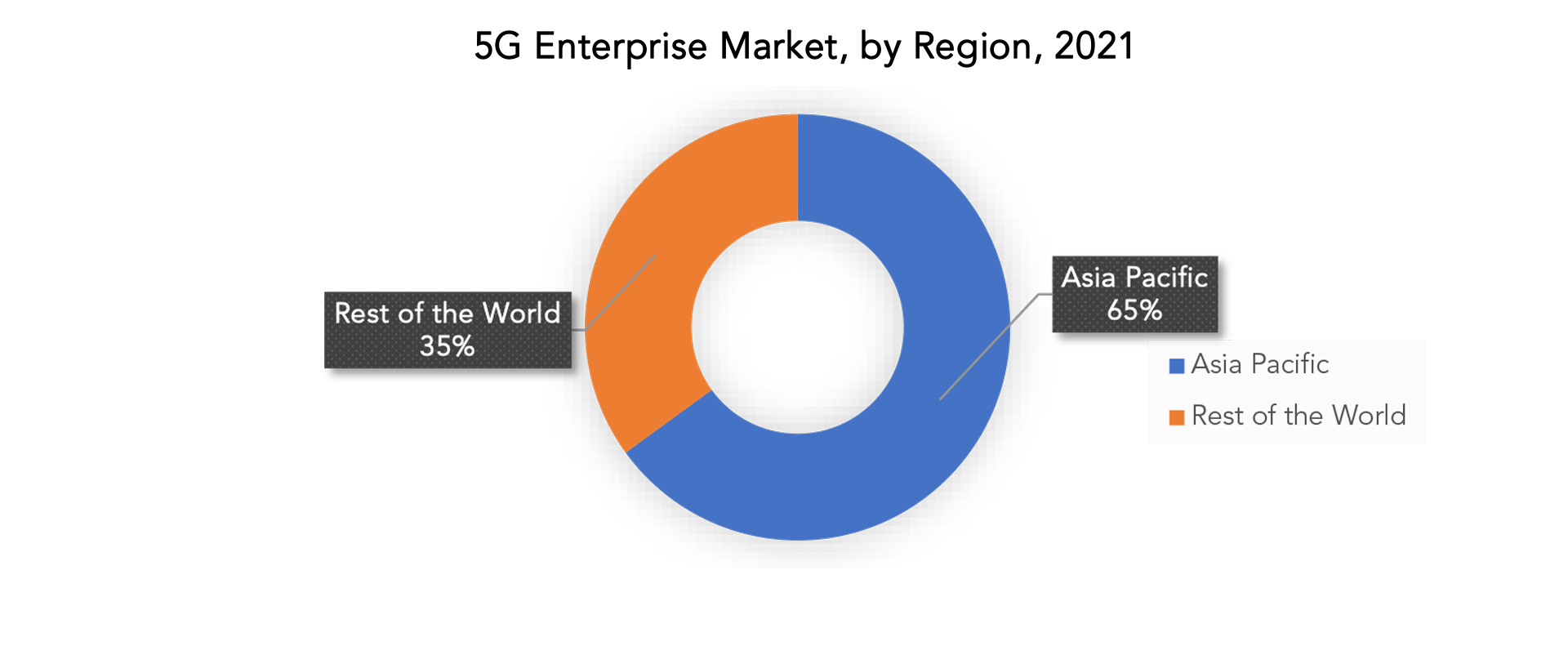

Regional Analysis-5G Enterprise Market

The 5G enterprise market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Over the projected period for the 5G business market, Asia-Pacific is expected to develop the fastest. This is due to the region’s rising nations’ rapid economic expansion and the telecom industry’s continued development, which motivates companies to focus on the deployment and implementation of 5G enterprises to sustain growth and enhance productivity. Since low latency communication is becoming important for onboard computers in autonomous cars to transmit their presence as well as observe and respond to barriers, traffic signals, and neighboring vehicles, 5G-operated connected autos provide a new opportunity for mobile carriers.

Cloud-based enterprise apps are pretty popular in North America. As 5G provides substantially faster internet connections, it may boost connectivity even more. To function in a hosted environment, cloud-based technologies require an internet connection. In comparison to other regions, the region is seeing the greatest increase in demand for cutting-edge technology such as machine-to-machine communication, connected vehicles, and artificial intelligence. As a result, it is expected to create considerable growth opportunities for the 5G corporate market.

Key Market Segments: 5G Enterprise Market

5g Enterprise Market By Spectrum, 2022-2029, (USD Billion)

- Licensed

- Unlicensed

- Shared

5g Enterprise Market By Frequency, 2022-2029, (USD Billion)

- Sub-6ghz

- Mmwave

5g Enterprise Market By Organization Size, 2022-2029, (USD Billion)

- Small & Medium Enterprises

- Large Enterprises

5g Enterprise Market By End-User Industry, 2022-2029, (USD Billion)

- Bfsi

- Manufacturing

- Retail

- Healthcare

- Energy & Utilities

- Transportation And Logistics

- Aerospace

5g Enterprise Market By Region, 2022-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the 5G Enterprise market over the next 7 years?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the 5G Enterprise market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the 5G Enterprise market?

- What are the key drivers of growth in the 5G Enterprise market?

- Who are the market’s major players, and what is their market share?

- What are the 5G Enterprise market’s distribution channels and supply chain dynamics?

- What are the technological advancements and innovations in the 5G Enterprise market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the 5G Enterprise market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the 5G Enterprise market?

- What is the pricing trend of 5G Enterprise in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL 5G ENTERPRISE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE 5G ENTERPRISE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL 5G ENTERPRISE MARKET OUTLOOK

- GLOBAL 5G ENTERPRISE MARKET BY SPECTRUM, 2022-2029, (USD BILLION)

- LICENSED

- UNLICENSED

- SHARED

- GLOBAL 5G ENTERPRISE MARKET BY FREQUENCY, 2022-2029, (USD BILLION)

- SUB-6GHZ

- MMWAVE

- 5G ENTERPRISE MARKET BY ORGANIZATION SIZE, 2022-2029, (USD BILLION)

- SMALL & MEDIUM ENTERPRISES

- LARGE ENTERPRISES

- GLOBAL 5G ENTERPRISE MARKET BY END-USER INDUSTRY, 2022-2029, (USD BILLION)

- BFSI

- MANUFACTURING

- RETAIL

- HEALTHCARE

- ENERGY & UTILITIES

- TRANSPORTATION AND LOGISTICS

- AEROSPACE

- GLOBAL 5G ENTERPRISE MARKET BY REGION, 2022-2029, (USD BILLION)

- NORTH AMERICA

- ASIA PACIFIC

- EUROPE

- SOUTH AMERICA

- MIDDLE EAST AND AFRICA

- GLOBAL 5G ENTERPRISE MARKET BY REGION, 2022-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- CIENA CORPORATION

- AFFIRMED NETWORK

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT

- AT&T INTELLECTUAL PROPERTY

- JUNIPER NETWORKS INC

- SAMSUNG FUJITSU

- SK TELECOM CO

- LTD

- ZTE

- VERIZON

- CRADLE POINT INC.

- MAVENIR

- NOKIA

- COMMSCOPE

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 2 GLOBAL 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 3 GLOBAL 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 4 GLOBAL 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 5 GLOBAL 5G ENTERPRISE MARKET BY REGION (USD BILLION) 2022-2029

TABLE 6 NORTH AMERICA 5G ENTERPRISE MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 7 NORTH AMERICA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 8 NORTH AMERICA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 9 NORTH AMERICA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 10 NORTH AMERICA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 11 US 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 12 US 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 13 US 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 14 US 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 15 CANADA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 16 CANADA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 17 CANADA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 18 CANADA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 19 MEXICO 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 20 MEXICO 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 21 MEXICO 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 22 MEXICO 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 23 SOUTH AMERICA 5G ENTERPRISE MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 24 SOUTH AMERICA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 25 SOUTH AMERICA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 26 SOUTH AMERICA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 27 SOUTH AMERICA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 28 BRAZIL 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 29 BRAZIL 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 30 BRAZIL 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 31 BRAZIL 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 32 ARGENTINA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 33 ARGENTINA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 34 ARGENTINA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 35 ARGENTINA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 36 COLOMBIA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 37 COLOMBIA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 38 COLOMBIA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 39 COLOMBIA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 40 REST OF THE SOUTH AMERICA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 41 REST OF THE SOUTH AMERICA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 42 REST OF SOUTH AMERICA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 43 REST OF SOUTH AMERICA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 44 ASIA-PACIFIC 5G ENTERPRISE MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 45 ASIA-PACIFIC 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 46 ASIA-PACIFIC 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 47 ASIA-PACIFIC 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 48 ASIA-PACIFIC 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 49 INDIA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 50 INDIA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 51 INDIA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 52 INDIA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 53 CHINA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 54 CHINA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 55 CHINA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 56 CHINA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 57 JAPAN 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 58 JAPAN 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 59 JAPAN 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 60 JAPAN 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 61 SOUTH KOREA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 62 SOUTH KOREA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 63 SOUTH KOREA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 64 SOUTH KOREA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 65 AUSTRALIA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 66 AUSTRALIA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 67 AUSTRALIA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 68 AUSTRALIA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 69 SOUTH-EAST ASIA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 70 SOUTH-EAST ASIA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 71 SOUTH-EAST ASIA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 72 SOUTH-EAST ASIA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 73 REST OF ASIA PACIFIC 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 74 REST OF ASIA PACIFIC 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 75 REST OF ASIA PACIFIC 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 76 REST OF ASIA PACIFIC 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 77 EUROPE 5G ENTERPRISE MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 78 EUROPE 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 79 EUROPE 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 80 EUROPE 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 81 EUROPE 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 82 GERMANY 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 83 GERMANY 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 84 GERMANY 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 85 GERMANY 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 86 UK 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 87 UK 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 88 UK 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 89 UK 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 90 FRANCE 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 91 FRANCE 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 92 FRANCE 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 93 FRANCE 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 94 ITALY 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 95 ITALY 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 96 ITALY 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 97 ITALY 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 98 SPAIN 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 99 SPAIN 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 100 SPAIN 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 101 SPAIN 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 102 RUSSIA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 103 RUSSIA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 104 RUSSIA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 105 RUSSIA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 106 REST OF EUROPE 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 107 REST OF EUROPE 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 108 REST OF EUROPE 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 109 REST OF EUROPE 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 110 MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY COUNTRY (USD BILLION) 2022-2029

TABLE 111 MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 112 MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 113 MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 114 MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 115 UAE 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 116 UAE 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 117 UAE 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 118 UAE 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 119 SAUDI ARABIA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 120 SAUDI ARABIA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 121 SAUDI ARABIA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 122 SAUDI ARABIA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

TABLE 123 SOUTH AFRICA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 124 SOUTH AFRICA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 125 SOUTH AFRICA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 126 SOUTH AFRICA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-202

TABLE 127 REST OF MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY SPECTRUM (USD BILLION) 2022-2029

TABLE 128 REST OF THE MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY ORGANIZATION SIZE (USD BILLION) 2022-2029

TABLE 129 REST OF MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY END USER (USD BILLION) 2022-2029

TABLE 130 REST OF MIDDLE EAST AND AFRICA 5G ENTERPRISE MARKET BY FREQUENCY (USD BILLION) 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL 5G ENTERPRISE MARKET BY SPECTRUM, USD BILLION, 2022-2029

FIGURE 9 GLOBAL 5G ENTERPRISE MARKET BY ORGANIZATION SIZE, USD BILLION, 2022-2029

FIGURE 10 GLOBAL 5G ENTERPRISE MARKET BY END-USER, USD BILLION, 2022-2029

FIGURE 11 GLOBAL 5G ENTERPRISE MARKET BY FREQUENCY, USD BILLION, 2022-2029

FIGURE 12 GLOBAL 5G ENTERPRISE MARKET BY REGION, USD BILLION, 2022-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL 5G ENTERPRISE MARKET BY SPECTRUM, 2021

FIGURE 15 GLOBAL 5G ENTERPRISE MARKET BY ORGANIZATION SIZE 2021

FIGURE 16 GLOBAL 5G ENTERPRISE MARKET BY END USER 2021

FIGURE 17 GLOBAL 5G ENTERPRISE MARKET BY FREQUENCY 2021

FIGURE 18 ABC MARKET BY REGION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 CIENA CORPORATION: COMPANY SNAPSHOT

FIGURE 21 AFFIRMED NETWORK: COMPANY SNAPSHOT

FIGURE 22 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

FIGURE 23 AT&T INTELLECTUAL PROPERTY: COMPANY SNAPSHOT

FIGURE 24 JUNIPER NETWORK INC: COMPANY SNAPSHOT

FIGURE 25 SAMSUNG: COMPANY SNAPSHOT

FIGURE 26 FUJITSU: COMPANY SNAPSHOT

FIGURE 27 SK TELECOM: COMPANY SNAPSHOT

FIGURE 28 LTD: COMPANY SNAPSHOT

FAQ

The global 5G Enterprise market is designed to grow at 31 % CAGR from 2022 to 2029. It is expected to reach above USD 34.38 Billion by 2029 from USD 4.04 Billion in 2022.

The fifth-generation (5G) wireless network, also known as the 5G enterprise, is an advancement over the fourth-generation (4G) wireless network. It is performed by using the high-frequency and short-range bands of the radio spectrum. 5G Enterprise provides low latency and high internet rates. It has a network performance of more than 1Gbps, which is 10 times faster than the 4G network.

Enterprises will be able to offer a variety of services and develop their private wireless platform with a wide range of operational capabilities with the support of 5G enterprise technologies. Furthermore, it enables the high-tech Internet of Things platform, which is essential for implementing Industry 4.0 and industrial automation.

Cell phone use in developing countries has consistently increased over the last ten years due to a range of factors such as increased per capita income, cost affordability, the availability of various low-cost options with substantial capabilities, and others. Numerous companies and educational institutions are using smartphones, tablets, and other smart devices to communicate with their employees and students.

Asia-Pacific is expected to develop the fastest. This is due to the region’s rising nations’ rapid economic expansion and the telecom industry’s continued development, which motivates companies to focus on the deployment and implementation of 5G enterprises to sustain growth and enhance productivity.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.