REPORT OUTLOOK

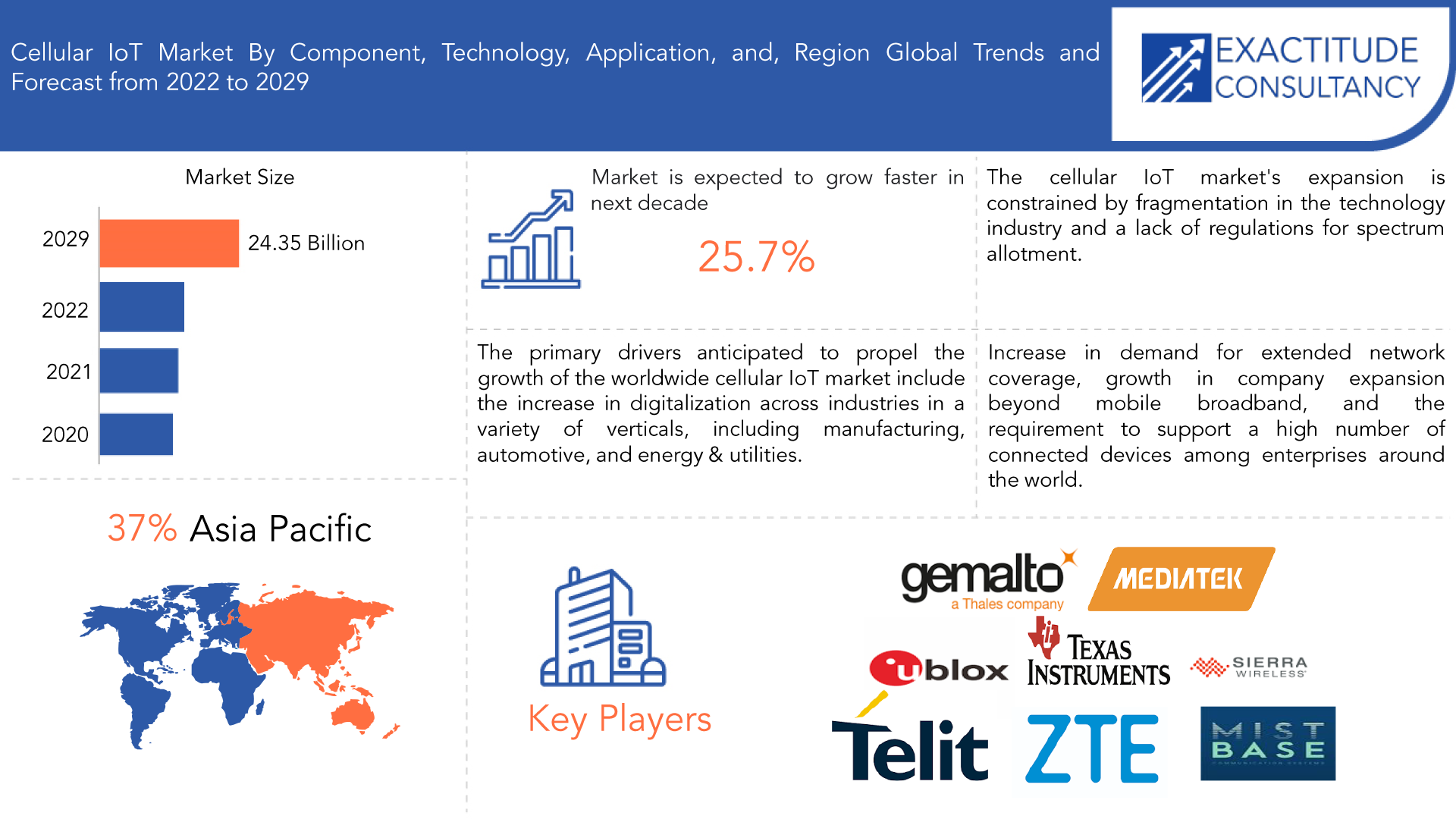

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 24.35 Billion By 2029 | 25.7% | Asia Pacific |

| By Component | By Technology | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Cellular IoT Market Overview

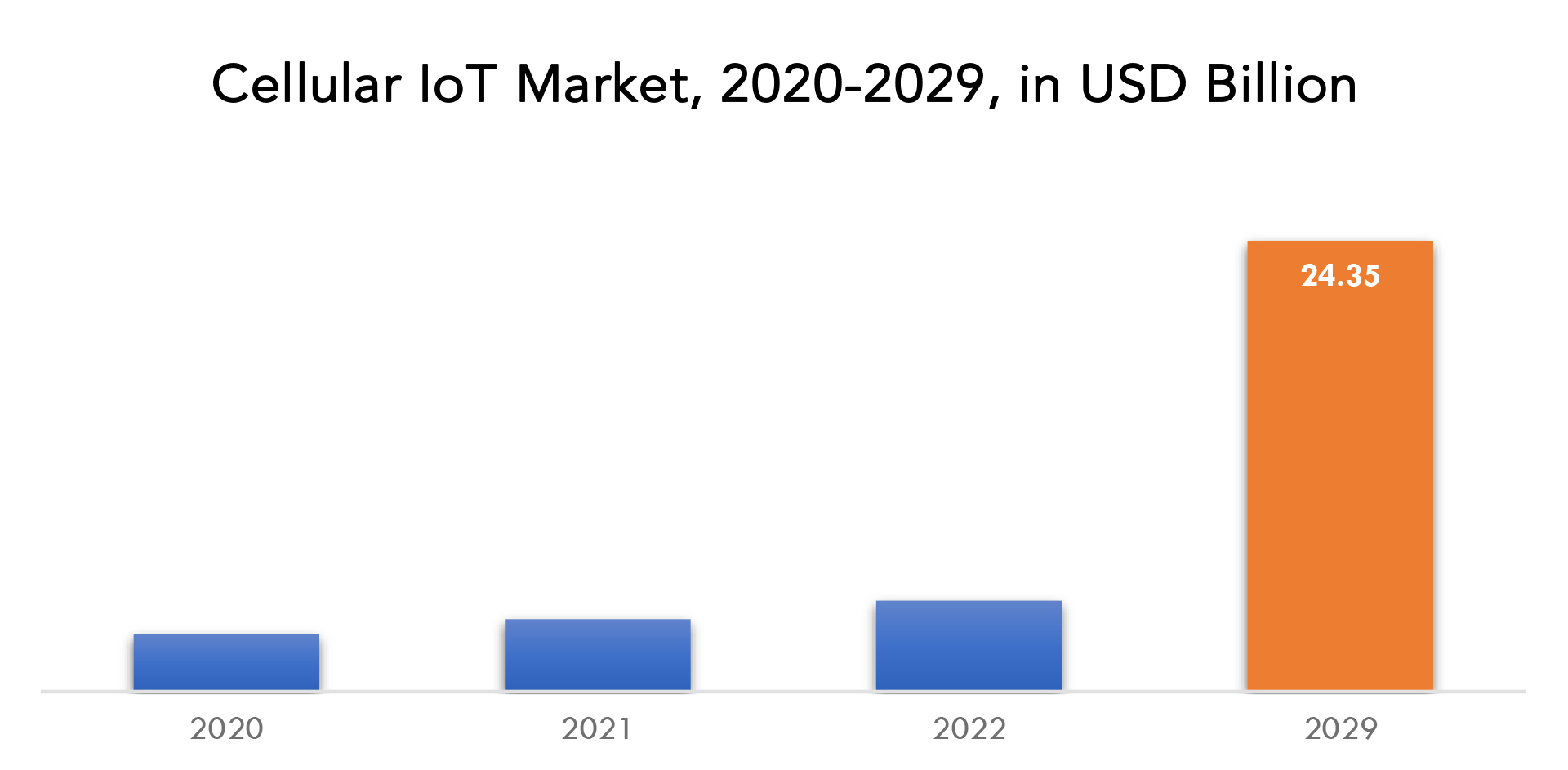

The Global Cellular Iot Market Was Valued At 4.91 Billion In 2022 And Is Projected To Reach 24.35 Billion By 2029, Growing At A CAGR Of 25.7% From 2022 To 2029

Cellular IoT refers to the method of connecting physical objects to the internet from any location on Earth. The most recent cellular technologies are LPWA (Low Power Wide Area), LTE-M, 3G, 4G, and 5G, as well as NB-IoT and LTE-M. Benefits including ubiquitous coverage, dependable IoT device connectivity, and cost-effective hardware are all provided—all of which are essential for cellular IoT characteristics. Built-in connectivity in smartphones and other IoT gadgets makes using them easier, lowers infrastructure costs, and improves the quality of long-distance talks. Smartphones, sensors, scanners, and other IoT devices are a few examples.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION) |

| Segmentation | By component, technology, application, platform, and By Region. |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Region |

|

Increase in demand for extended network coverage, growth in company expansion beyond mobile broadband, and the requirement to support a high number of connected devices among enterprises around the world. The primary drivers anticipated to propel the growth of the worldwide cellular IoT market include the increase in digitalization across industries in a variety of verticals, including manufacturing, automotive, and energy & utilities.

Cellular IoT Market Segment Analysis

Based on component, technology, application, and region, the global market for cellular IoT is divided into these categories.

Based on component types, the global cellular IoT market is divided into two main classes: hardware and software. The foundation of the entire cellular IoT ecosystem is made up of hardware elements like chipsets and cellular IoT modules. The expansion of the hardware market is anticipated to be fueled by the expanding use of cellular IoT modules in wearables, linked healthcare devices, smart city infrastructure, and building automation projects.

The market has been divided into 2G, 3 G, 4G, LTE-M, NB-LTE-M, NB-IoT, and 5G segments depending on technology. As it offers low-cost certificates and modem alternatives and has the most users worldwide, 2G held the greatest market share in terms of revenue among these in 2016. Though standards and technologies for machine-to-machine and IoT connections are rapidly expanding and providing cutting-edge and effective cellular services, 2G is anticipated to lose ground shortly. While 5G technology is still being developed, it is predicted to grow the fastest since it will support a wide range of applications and provide a lot of bandwidth for high-speed ones.

Cellular IoT Market Players

The major players operating in the global Cellular IoT industry include the major market players Commsolid GmbH, Gemalto NV, Mediatek Inc., Mistbase Communication System, Qualcomm Incorporated, Sequans Communication, Sierra Wireless, Telit Communications PLC, Texas Instruments, U–Blox Holding AG, ZTE Corporation and others.

Recent Developments:

21 August 2022: MediaTek launched a 5G chip aimed at gaining US market share. This new modem chip, called the M80, will also support millimeter-wave technology, which is being used by U.S. carriers such as Verizon Communications Inc.

8 November 2022: For Incredible Performance and Unmatched Power Savings MediaTek Launched Flagship Dimensity 9200 Chipset. It is the latest 5G chipset powering the next era of flagship smartphones.

Who Should Buy? Or Key stakeholders

- Manufacturing

- End-Use Industries

- BFSI

- Mining & Metal

- Manufacturing & Construction

- Regulatory Authorities

- Research Organizations

- Metal Processing Industries

- Telecommunication

Cellular IoT Market Regional Analysis

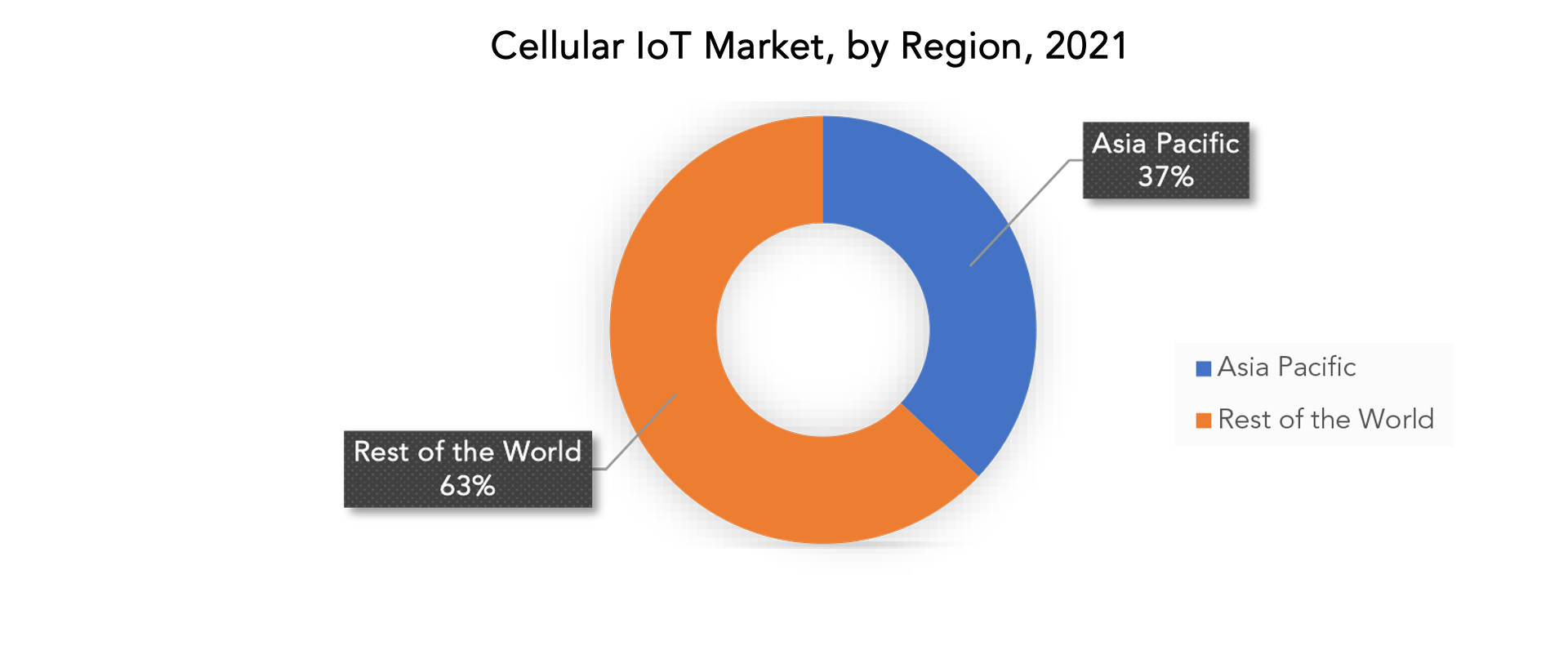

Geographically, the Cellular IoT market is segmented into North America, South America, Europe, APAC, and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

As a result of the vast number of semiconductor dealers in nations like China and India, the Asia Pacific region is predicted to have the greatest rate of growth for the cellular IoT market. Also, the increased investment in IoT technology in the region together with the growing entry of technology businesses is anticipated to accelerate market expansion.

Governments in Asian nations like India are starting several smart infrastructure projects and showing interest in the cellular IOT industry. Governments in India, Japan, China, Korea, Malaysia, and Singapore have supported national cellular IoT plans, which are anticipated to further support the expansion of the cellular IoT market in these nations.

Key Market Segments: Cellular IoT Market

Cellular Iot Market By Component, 2020-2029, (USD Billion)

- Hardware

- Software

- Services

Cellular Iot Market By Technology, 2022-2029, (USD Billion)

- 2g

- 3g

- 4g

- Lte-M

- Nb-Lte-M

- Nb-Iot

- 5g

Cellular Iot Market By Application, 2022-2029, (USD Billion)

- Alarms & Detectors

- Smart Appliances

- Smart Metering

- Smart Parking

- Smart Street Light

- Surveillance & Monitoring

- Trackers

- Wearable Devices

Cellular Iot Market By Platform, 2022-2029, (USD Billion)

- Space

- Land

- Naval

- Airborne

Cellular Iot Market By Region 2022-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the cellular IoT market over the next 7 years?

- Who are the major players in the cellular IoT market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the cellular IoT market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the cellular IoT market?

- What is the current and forecasted size and growth rate of the global cellular IoT market?

- What are the key drivers of growth in the cellular IoT market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the cellular IoT market?

- What are the technological advancements and innovations in the cellular IoT market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the cellular IoT market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the cellular IoT market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CELLULAR IOT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE CELLULAR IOT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CELLULAR IOT MARKET OUTLOOK

- GLOBAL CELLULAR IOT MARKET BY COMPONENT, 2020-2029, (USD BILLION)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL CELLULAR IOT MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION)

- 2G

- 3G

- 4G

- LTE-M

- NB-LTE-M

- NB-IOT

- 5G

- GLOBAL CELLULAR IOT MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- ALARMS & DETECTORS

- SMART APPLIANCES

- SMART METERING

- SMART PARKING

- SMART STREET LIGHT

- SURVEILLANCE & MONITORING

- TRACKERS

- WEARABLE DEVICES

- GLOBAL CELLULAR IOT MARKET BY REGION, 2020-2029, (USD BILLION) (THOUSAND UNIT)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- COMMSOLID GMBH

- GEMALTO NV

- MEDIATEK INC.

- MISTBASE COMMUNICATION SYSTEM

- QUALCOMM INCORPORATED

- SEQUANS COMMUNICATION

- SIERRA WIRELESS

- TELIT COMMUNICATIONS PLC

- TEXAS INSTRUMENTS

- U–BLOX HOLDING AG

- ZTE CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 2 GLOBAL CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 3 GLOBAL CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL CELLULAR IOT MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA CELLULAR IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 9 US CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 10 US CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 11 US CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 12 CANADA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 13 CANADA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 14 CANADA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 15 MEXICO CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 16 MEXICO CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 17 MEXICO CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA CELLULAR IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 22 BRAZIL CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 23 BRAZIL CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 24 BRAZIL CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 25 ARGENTINA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 26 ARGENTINA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 27 ARGENTINA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 COLOMBIA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 29 COLOMBIA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 30 COLOMBIA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 ASIA-PACIFIC CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 35 ASIA-PACIFIC CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 36 ASIA-PACIFIC CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 37 ASIA-PACIFIC CELLULAR IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 38 INDIA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 39 INDIA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 40 INDIA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 41 CHINA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 42 CHINA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 43 CHINA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 44 JAPAN CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 45 JAPAN CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 46 JAPAN CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 53 SOUTH-EAST ASIA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 54 SOUTH-EAST ASIA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 55 SOUTH-EAST ASIA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 59 EUROPE CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 60 EUROPE CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 61 EUROPE CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 EUROPE CELLULAR IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 63 GERMANY CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 64 GERMANY CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 65 GERMANY CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 UK CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 67 UK CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 68 UK CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 69 FRANCE CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 70 FRANCE CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 71 FRANCE CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ITALY CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 73 ITALY CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 74 ITALY CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 75 SPAIN CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 76 SPAIN CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 77 SPAIN CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 RUSSIA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 79 RUSSIA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 80 RUSSIA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 UAE CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 89 UAE CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 90 UAE CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 97 REST OF THE MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 98 REST OF THE MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 99 REST OF THE MIDDLE EAST AND AFRICA CELLULAR IOT MARKET BY APPLICATION (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CELLULAR IOT MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CELLULAR IOT MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CELLULAR IOT MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CELLULAR IOT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CELLULAR IOT MARKET BY COMPONENT, USD BILLION, 2021

FIGURE 14 GLOBAL CELLULAR IOT MARKET BY TECHNOLOGY, USD BILLION, 2021

FIGURE 15 GLOBAL CELLULAR IOT MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL CELLULAR IOT MARKET BY REGION, USD BILLION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 COMMSOLID GMBH: COMPANY SNAPSHOT

FIGURE 19 GEMALTO NV: COMPANY SNAPSHOT

FIGURE 20 MEDIATEK INC.: COMPANY SNAPSHOT

FIGURE 21 MISTBASE COMMUNICATION SYSTEM: COMPANY SNAPSHOT

FIGURE 22 QUALCOMM INCORPORATED: COMPANY SNAPSHOT

FIGURE 23 SEQUANS COMMUNICATION: COMPANY SNAPSHOT

FIGURE 24 SIERRA WIRELESS: COMPANY SNAPSHOT

FIGURE 25 TELIT COMMUNICATIONS PLC: COMPANY SNAPSHOT

FIGURE 26 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 27 U–BLOX HOLDING AG: COMPANY SNAPSHOT

FIGURE 28 ZTE CORPORATION: COMPANY SNAPSHOT

FAQ

The global cellular IoT market was valued at 5.31 billion in 2022 and is projected to reach 18.59 billion by 2029, growing at a CAGR of 19.6% from 2022 to 2029

Based on product, technology, application, platform, and region the cellular IoT market reports divisions are broken down.

The global cellular IoT market registered a CAGR of 25.7% from 2022 to 2029. The industry segment was the highest revenue contributor to the market.

The Asia Pacific region is estimated to experience the highest rate of growth in the cellular IoT market. Due to a large number of semiconductor dealers in countries like China and India. Additionally, it is projected that the expanding entry of technology companies into the region along with the increased investment in IoT technology will hasten market progress.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.