REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

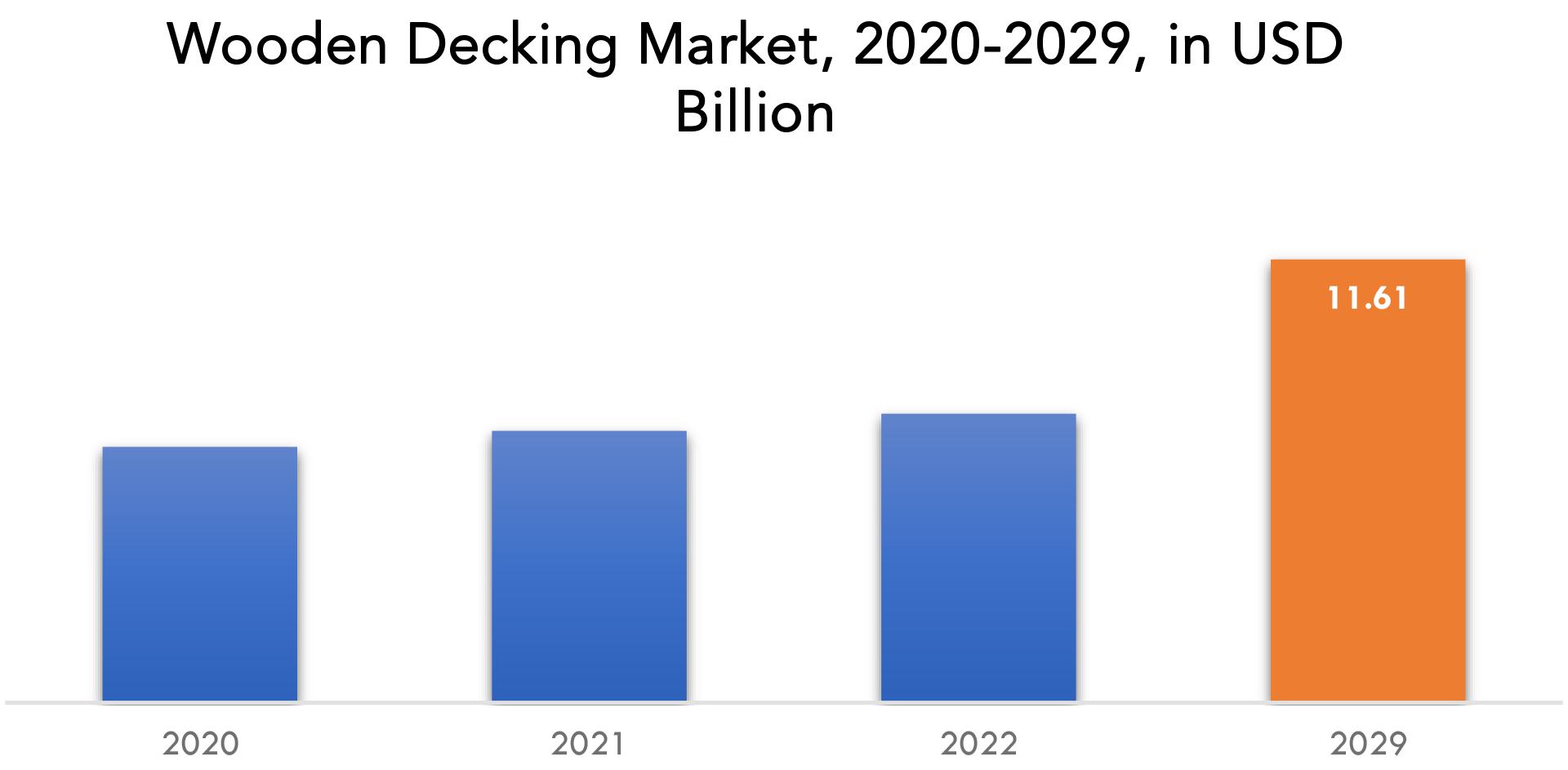

| USD 11.61 Billion by 2029 | 6.30% | North America |

| by Type | by Application | by End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Wooden Decking Market Overview

The wooden decking market is expected to grow at 6.30% CAGR from 2022 to 2029. It is expected to reach above USD 11.61 Billion by 2029 from USD 6.70 Billion in 2020.

Wooden decking is a wooden platform that is often constructed outside to offer a smooth and level surface for leisure activities such as relaxing, entertaining, and dining. Wooden decking may be created from a range of wood species, each having its own distinct aesthetic, durability, and weather resistance. Hardwood decking can be placed in a variety of ways, including floating, nailed, screwed, or secretly clipped. It may also be treated or polished with a variety of coatings to improve its natural beauty, protect it from moisture and UV radiation, and increase its longevity.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (KILOTONS). |

| Segmentation | By Type, By Application, By End User, By Region |

| By Type |

|

| By Applications |

|

| By End User |

|

| By Region |

|

Growth in the construction industry refers to an increase in construction activity, which can be driven by various factors such as population growth, urbanization, economic growth, and government investments in infrastructure. The construction industry is a major consumer of wooden decking materials, as decking is often an essential component of outdoor living spaces. The growth in the construction industry has a direct impact on the wooden decking market, as it creates demand for decking materials. As new homes, commercial buildings, and public spaces are built, there is a need for outdoor living spaces, which creates opportunities for the use of wooden decking materials. In addition to new construction, the renovation and remodeling of existing buildings also drives demand for wooden decking materials. As homeowners and property managers seek to update their outdoor living spaces, they may opt for wooden decking as a cost-effective and customizable option.

One of the key restraints of the wooden decking market is the limited availability of natural wood resources and sustainability concerns related to its production. The demand for wooden decking can lead to deforestation, illegal logging, and unsustainable sourcing practices, which can have negative impacts on the environment and communities. There is increasing awareness among consumers about the environmental and social impacts of their purchasing decisions, and this can affect their preferences for wooden decking materials. Consumers may prefer eco-friendly and sustainable decking materials, which can create challenges for the wooden decking market.

Increased demand for outdoor living areas. With individuals spending more time at home and looking for ways to improve their quality of life, there is a rising trend for developing outdoor living areas such as decks, patios, and outdoor kitchens. Many factors are driving this trend, including the need for a pleasant and practical outdoor space, the need for greater space for social separation, and a rising awareness of the health advantages of spending time in nature. The increased demand for outdoor living areas has provided possibilities for the wooden decking industry, since decks and patios are vital components of these spaces. Hardwood decking materials are popular due to their natural appearance and feel, adaptability, and customizability.

The COVID-19 pandemic has also caused disruptions in the supply chain, which can affect the availability and pricing of wooden decking materials. The pandemic has led to shutdowns and reduced production at sawmills and manufacturing facilities, which can lead to shortages and higher prices for wooden decking materials. In addition, transportation disruptions and border closures can affect the import and export of wooden decking materials, which can further affect availability and pricing. Furthermore, the pandemic has also led to uncertainty and financial challenges for consumers, which can affect their willingness to invest in outdoor living spaces and decking projects. Homeowners may be more cautious with their spending and delay or cancel decking projects due to economic uncertainty.

Wooden Decking Market Segment Analysis

The market is classified into three types pressure-treated wood, redwood, and cedar. Cedar and Redwood are having highest market share in this segment of the Global Wooden Decking Market. Cedar is one of the least expensive decking materials. It is also resistant to rot, termites, and weathering. Moreover, redwood is long-lasting, suitable for painting or staining, and does not warp readily. Redwood is stronger than cedar, yet both perform brilliantly in the Wooden Decking Market.

The market is divided into two segments based on end-user residential and non-residential. Residential is biggest end user of the Global Wooden Decking Market. Increasing energy prices and growing knowledge of the benefits of energy-efficient buildings are driving market expansion in residential construction. Furthermore, increased new development in some emerging nations is expected to enhance the usage of hardwood decking.

On the basis of application wooden decking market is segmented in two parts building materials and rails & infrastructure. Here rails & infrastructure is widely used application. The rails & infrastructure segment includes wooden decking used for infrastructure projects, such as bridges, walkways, and docks. This segment is driven by the versatility and durability of wooden decking materials, which can withstand harsh weather conditions and heavy traffic.

Wooden Decking Market Players

The wooden decking market key players include AZEK Company LLC, Trex Company Inc., DuraLife Decking and Railing Systems, Fiberon, Metsa Wood, James Latham Plc, Long Fence, Setra Group Ab, UFP Industries, Vetedy Group.

Recent News

Sept 2021 – The AZEK Company an industry-leading manufacturer of low-maintenance and sustainable residential and commercial building products, announced innovative new products from its TimberTech brand, a leader in premium decking and railing. Available this spring, the products include the TimberTech® AZEK® Landmark Collection™ and new railing options.

Sept 2022- A German element manufacturer Brüninghoff favored prefabricated wooden wall elements made of Kerto® LVL for its new concrete element plant. Due to the high level of prefabrication, assembly times were optimized. At the same time the material is impressively sustainable and material-efficient, fitting in with the overall concept of the new plant.

Who Should Buy? Or Key stakeholders

- Suppliers and Distributor

- Construction Companies

- Wood Manufacturer

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Wooden Decking Market Regional Analysis

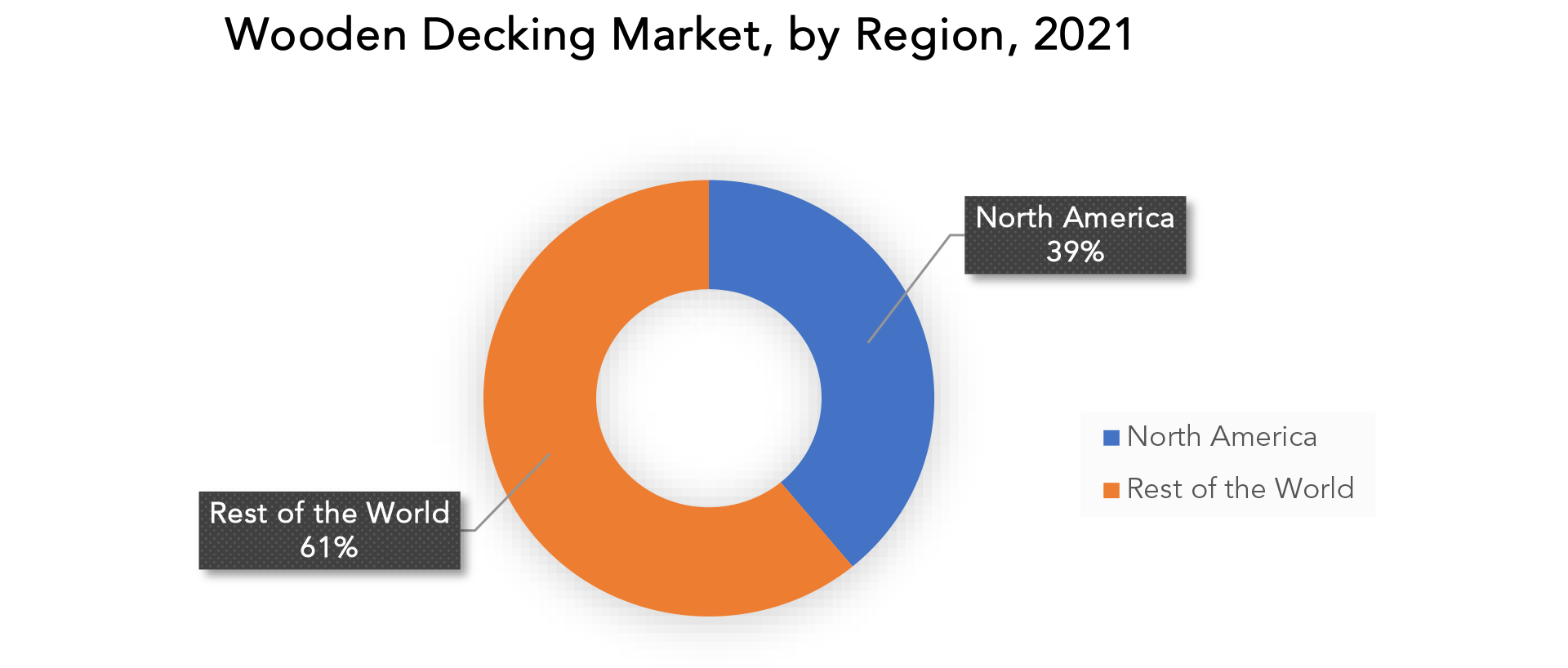

The Wooden Decking Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North American wooden decking market has highest market share for wooden decking, driven by the growing trend for outdoor living spaces and the preference for natural and sustainable building materials. The market is dominated by the United States, which has a large construction industry and a high demand for residential and commercial building projects that require functional and aesthetically pleasing decking materials. Additionally, there is an increasing focus on sustainability and eco-friendliness in the region, which can drive the demand for certified and sustainable wooden decking materials. The market is highly competitive, with several key players operating in the region, including manufacturers, distributors, and retailers.

The Asia wooden decking market is a growing market, driven by the increasing demand for residential and commercial building projects in the region. The market is particularly strong in countries such as China, Japan, and India, which have a large population and growing urbanization. The demand for functional and aesthetically pleasing decking materials is also increasing, driven by the growing trend for outdoor living spaces in the region. The market is highly competitive, with several key players operating in the region, as well as a growing number of local manufacturers. Overall, the Asia wooden decking market is expected to continue growing in the coming years, driven by the increasing demand for sustainable and eco-friendly building materials.

Key Market Segments: Wooden Decking Market

Wooden Decking Market by Type, 2020-2029, (USD Billion), (Kilotons).

- Pressure- Treated Wood

- Redwood

- Cedar

Wooden Decking Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Building Materials

- Rails & Infrastructure

Wooden Decking Market by End User, 2020-2029, (USD Billion), (Kilotons).

- Residential

- Non-Residential

Wooden Decking Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the wooden decking market over the next 7 years?

- Who are the major players in the wooden decking market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the wooden decking market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the wooden decking market?

- What is the current and forecasted size and growth rate of the global wooden decking market?

- What are the key drivers of growth in the wooden decking market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the wooden decking market?

- What are the technological advancements and innovations in the wooden decking market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the wooden decking market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the wooden decking market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL WOODEN DECKING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON WOODEN DECKING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL WOODEN DECKING MARKET OUTLOOK

- GLOBAL WOODEN DECKING MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- PRESSURE- TREATED WOOD

- REDWOOD

- CEDAR

- GLOBAL WOODEN DECKING MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- BUILDING MATERIALS

- RAILS & INFRASTRUCTURE

- GLOBAL WOODEN DECKING MARKET BY END USER, 2020-2029, (USD BILLION), (KILOTONS)

- RESIDENTIAL

- NON-RESIDENTIAL

- GLOBAL WOODEN DECKING MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AZEK COMPANY LLC

- TREX COMPANY INC.

- DURALIFE DECKING AND RAILING SYSTEMS

- FIBERON

- METSA WOOD

- JAMES LATHAM PLC

- LONG FENCE

- SETRA GROUP AB

- UFP INDUSTRIES

- VETEDY GROUP *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL WOODEN DECKING MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL WOODEN DECKING MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA WOODEN DECKING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA WOODEN DECKING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 US WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 US WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 US WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 US WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 23 CANADA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 CANADA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 CANADA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 29 MEXICO WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 MEXICO WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA WOODEN DECKING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA WOODEN DECKING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 BRAZIL WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 49 ARGENTINA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 55 COLOMBIA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC WOODEN DECKING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC WOODEN DECKING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 INDIA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 INDIA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 INDIA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 CHINA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 CHINA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 CHINA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 JAPAN WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 JAPAN WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 JAPAN WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 EUROPE WOODEN DECKING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE WOODEN DECKING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 ASIA-PACIFIC WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 ASIA-PACIFIC WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 121 ASIA-PACIFIC WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 ASIA-PACIFIC WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 123 ASIA-PACIFIC WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 ASIA-PACIFIC WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 GERMANY WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 GERMANY WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 131 UK WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 UK WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 UK WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 137 FRANCE WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 FRANCE WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 FRANCE WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 143 ITALY WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 147 ITALY WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 ITALY WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 149 SPAIN WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 SPAIN WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 154 SPAIN WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 155 RUSSIA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 175 UAE WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 177 UAE WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 UAE WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 180 UAE WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA WOODEN DECKING MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL WOODEN DECKING MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL WOODEN DECKING MARKET BY SYSTEM TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL WOODEN DECKING MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL WOODEN DECKING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL WOODEN DECKING MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL WOODEN DECKING MARKET BY SYSTEM TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL WOODEN DECKING MARKET BY END USER, USD BILLION, 2021

FIGURE 16 GLOBAL WOODEN DECKING MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA WOODEN DECKING MARKET SNAPSHOT

FIGURE 18 EUROPE WOODEN DECKING MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA WOODEN DECKING MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC WOODEN DECKING MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA WOODEN DECKING MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 AZEK COMPANY LLC: COMPANY SNAPSHOT

FIGURE 24 TREX COMPANY INC.: COMPANY SNAPSHOT

FIGURE 25 DURALIFE DECKING AND RAILING SYSTEMS: COMPANY SNAPSHOT

FIGURE 26 FIBERON: COMPANY SNAPSHOT

FIGURE 27 METSA WOOD: COMPANY SNAPSHOT

FIGURE 28 JAMES LATHAM PLC: COMPANY SNAPSHOT

FIGURE 29 LONG FENCE: COMPANY SNAPSHOT

FIGURE 30 SETRA GROUP AB: COMPANY SNAPSHOT

FIGURE 31 UFP INDUSTRIES: COMPANY SNAPSHOT

FIGURE 32 VETEDY GROUP: COMPANY SNAPSHOT

FAQ

The wooden decking market is expected to grow at 6.30% CAGR from 2022 to 2029. It is expected to reach above USD 11.61 Billion by 2029 from USD 6.70 Billion in 2020.

North America held more than 39% of the wooden decking market revenue share in 2021 and will witness expansion in the forecast period.

The construction industry is a key driver of the wooden decking market. As new homes are built and existing ones are remodeled, there is a need for outdoor living spaces, which creates demand for wooden decking.

Wooden decking has leading application in construction sector.

North America region dominated the market with highest revenue share.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.