REPORT OUTLOOK

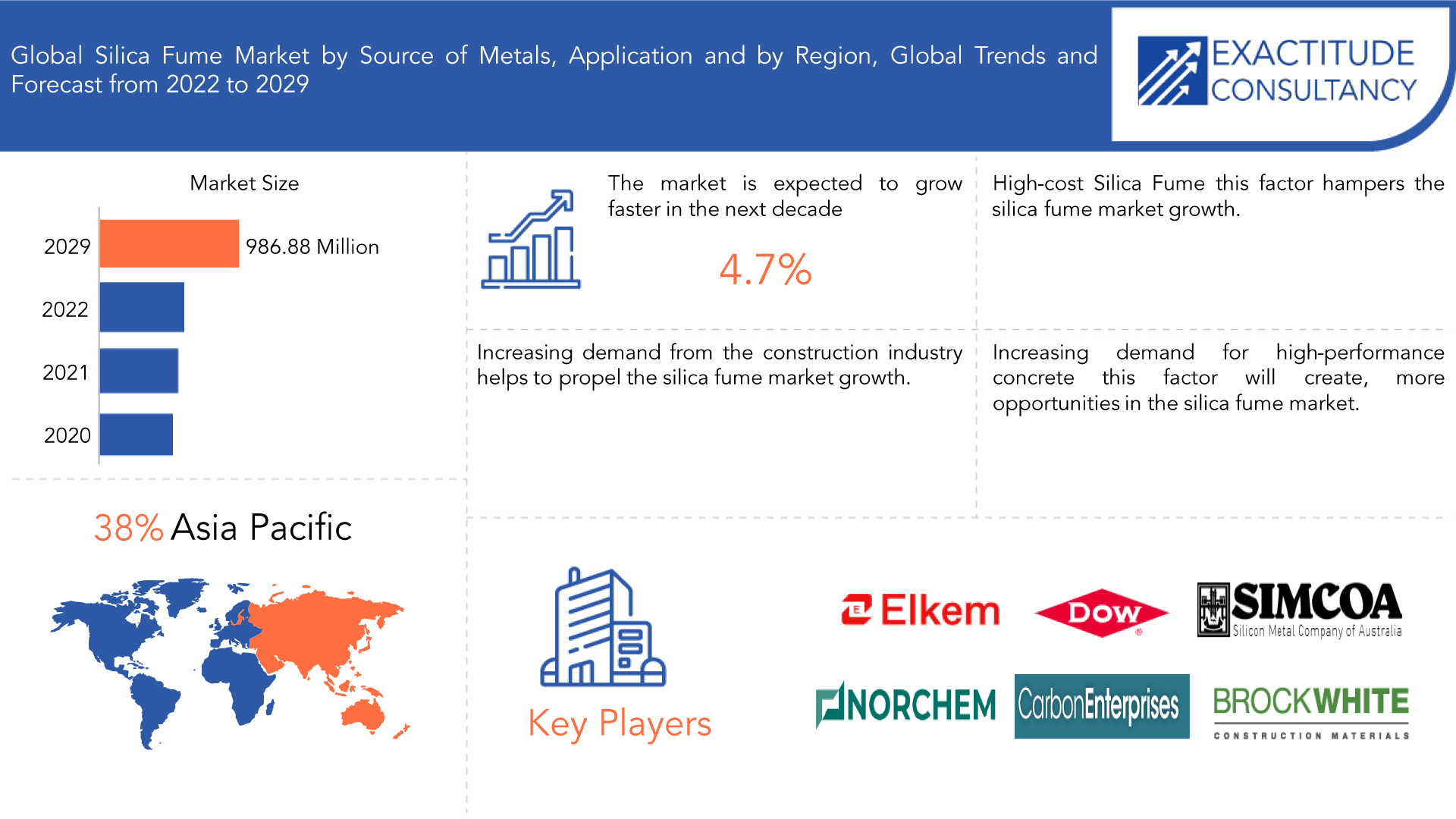

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 986.88 million by 2029 | 4.7 % | Asia Pacific |

| By Source of Metal | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Silica Fume Market Overview

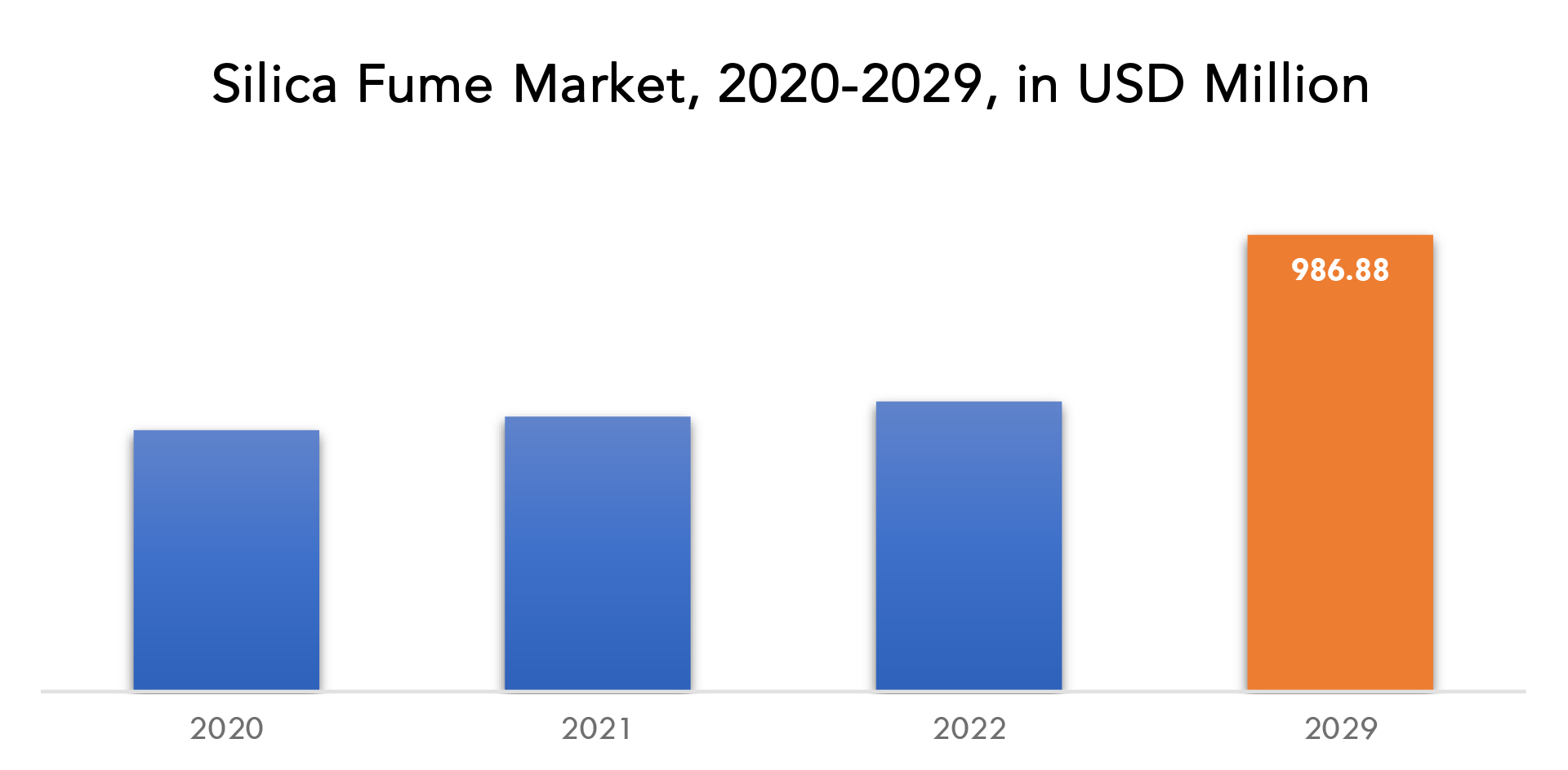

The global silica fume market is expected to grow at 4.7 % CAGR from 2020 to 2029. It is expected to reach above USD 986.88 million by 2029 from USD 564.8 million in 2020.

Silica fume is a by-product of the production of silicon metal and ferrosilicon alloys. It is a fine, amorphous, and highly reactive powder consisting of spherical particles that are approximately 100 times smaller than the average cement particle. Silica fume is also known as micro silica or condensed silica fume. Silica fume is used as a mineral admixture in concrete and cement-based products. When added to concrete, silica fume improves its strength, durability, and resistance to chemical attacks, abrasion, and freeze-thaw cycles. It also reduces the permeability of concrete, making it less susceptible to water penetration and chloride ion ingress, which can cause corrosion of reinforcing steel. Silica fume is also used in refractory materials, such as high-temperature cement and castable, due to its high melting point and low thermal expansion. It is also used in the production of advanced ceramics, such as silicon nitride and silicon carbide, due to its high purity and chemical stability.

Due to its advantages and benefits, silica fume is in high demand in the building industry. It offers concrete with increased strength, better construction structures, high performance, and extends the lifespan of structures. Silica fume increases electrical properties and prevents corrosion of the steel reinforcement in concrete. Moreover, it is utilized in situations when concrete needs to be more impermeable. Furthermore, the expansion of the global market is significantly aided by the increase in demand for silica fume in nuclear power development. In the anticipated future, an increase in construction activity is anticipated to increase market share.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD MILLION), (Kilotons) |

| Segmentation | By Source of Metals, By Application, By Region |

| By Source of Metal |

|

| By Application |

|

| By Region |

|

The global silica fume market is expected to grow significantly in the coming years, driven by the increasing demand for high-strength and durable concrete in construction and infrastructure projects. The Asia-Pacific region is the largest market for silica fume, followed by North America and Europe. The key players in the silica fume market include Elkem ASA, Norchem Inc., Dow Corning Corporation, and Wacker Chemie AG.

The global silica fume market is expected to grow significantly in the coming years, driven by the increasing demand for high-strength and durable concrete in construction and infrastructure projects. The Asia-Pacific region is the largest market for silica fume, followed by North America and Europe. Silica fume is used as an admixture in concrete to improve its strength, durability, and resistance to chemical attacks, abrasion, and freeze-thaw cycles. The growing demand for high-strength and durable concrete in construction and infrastructure projects is driving the demand for silica fume. The growth of the construction and infrastructure sector in emerging economies, such as China, India, and Southeast Asia, is driving the demand for silica fume. As silica fume helps in producing concrete with higher strength and durability, which is essential for large-scale construction projects.

Silica fume is a byproduct of the production of silicon metal and ferrosilicon alloys, making it an environmentally friendly material. With the growing focus on sustainable construction practices, the demand for silica fume is expected to grow further. Silica fume is also used in the production of advanced ceramics, such as silicon nitride and silicon carbide, due to its high purity and chemical stability. The growing demand for advanced ceramics in the electronics and aerospace industries is driving the demand for silica fume. Overall, the Silica Fume market is growing due to its unique properties and its increasing usage in a wide range of applications, including construction, infrastructure, and advanced ceramics.

Silica Fume Market Segment Analysis

The global Silica Fume market is segmented based on the source of metal, application, and region. By source of metal, the market is bifurcated into Silicon Metal, Ferrosilicon. By application the market is bifurcated into Building Construction, Marine Structure Construction, Chemical Production Facilities Construction, Oil & Gas Well Grouting, Nuclear Power Plant Construction, and others.

Based on the source of metal silicone metal segment is dominating the silica fume market. It is a high-purity form of silicon that contains about 98-99% silicon, with small amounts of iron, aluminum, and calcium. Silicon metal has several important properties that make it useful in a wide range of applications. It is a good conductor of electricity and heat, has a low thermal expansion coefficient, and is highly resistant to corrosion and oxidation. These properties make silicon metal suitable for use in a variety of industries, including the electronics, solar energy, and chemical industries.

Based on application building and construction segment is dominating the silica fume market. Silica fume is used as an admixture in concrete to improve its strength, durability, and resistance to chemical attacks, abrasion, and freeze-thaw cycles. The growing demand for high-strength and durable concrete in construction and infrastructure projects is driving the demand for silica fume. The growth of the construction and infrastructure sector in emerging economies, such as China, India, and Southeast Asia, is driving the demand for silica fume. Governments around the world are implementing stringent regulations for the construction industry, such as building codes and environmental regulations, which are driving the demand for high-performance concrete. Silica fume is an important component in producing high-performance concrete that meets these regulations.

Overall, the building and construction segment is dominating the silica fume market due to the growing demand for high-strength and durable concrete, rising construction and infrastructure activities, increasing focus on sustainable construction, and stringent government regulations.

Silica Fume Market Players

The Silica Fume market key players include Globe Specialty Metals/ Norchem, Inc., NORCHEM, Elkem, CEMENTE Industries Inc, DOW Corning, Krypton, ELKON Products Inc, Brock White Company LLC, SIMCOA Operations Pty Ltd, Carbon Enterprises, ECOTECH, Bisley, ROCKFIT, SILPOZZ, Uhan NEWREACH MICROSILICA Co., Ltd, Shenzhen BEMSUN Industry Co., Ltd, Shanghai TOPKEN Silica Fume Co., Ltd.

Elkem ASA: Elkem is a leading supplier of silica fume and had invested in expanding its production capacity.

In 2021, Elkem announced plans to build a new silica fume production plant in Quebec, Canada, which was expected to start production in the second half of 2022.

WACKER CHEMIE is a chemical company that produces and sells silica fume under the brand name HDK.

In 2020, the company announced that it was expanding its HDK production capacity by building a new plant in the United States.

CEMENTA is a Swedish cement company that produces and sells silica fume under the brand name MICROSILICA. In 2020, the company announced that it had invested in a new facility to produce MICROSILICA in SLITE, Sweden, which is expected to increase its production capacity.

Who Should Buy? Or Key stakeholders

- Building Construction

- Nuclear Power Plant Construction Industry

- Investors

- Government Organizations

- Marine Structure Construction Industry

- Research Organization

- Chemical Production Facilities Construction

- Oil and Gas Industry

- Others

Silica Fume Market Regional Analysis

The Silica Fume market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, the and Rest of Europe

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

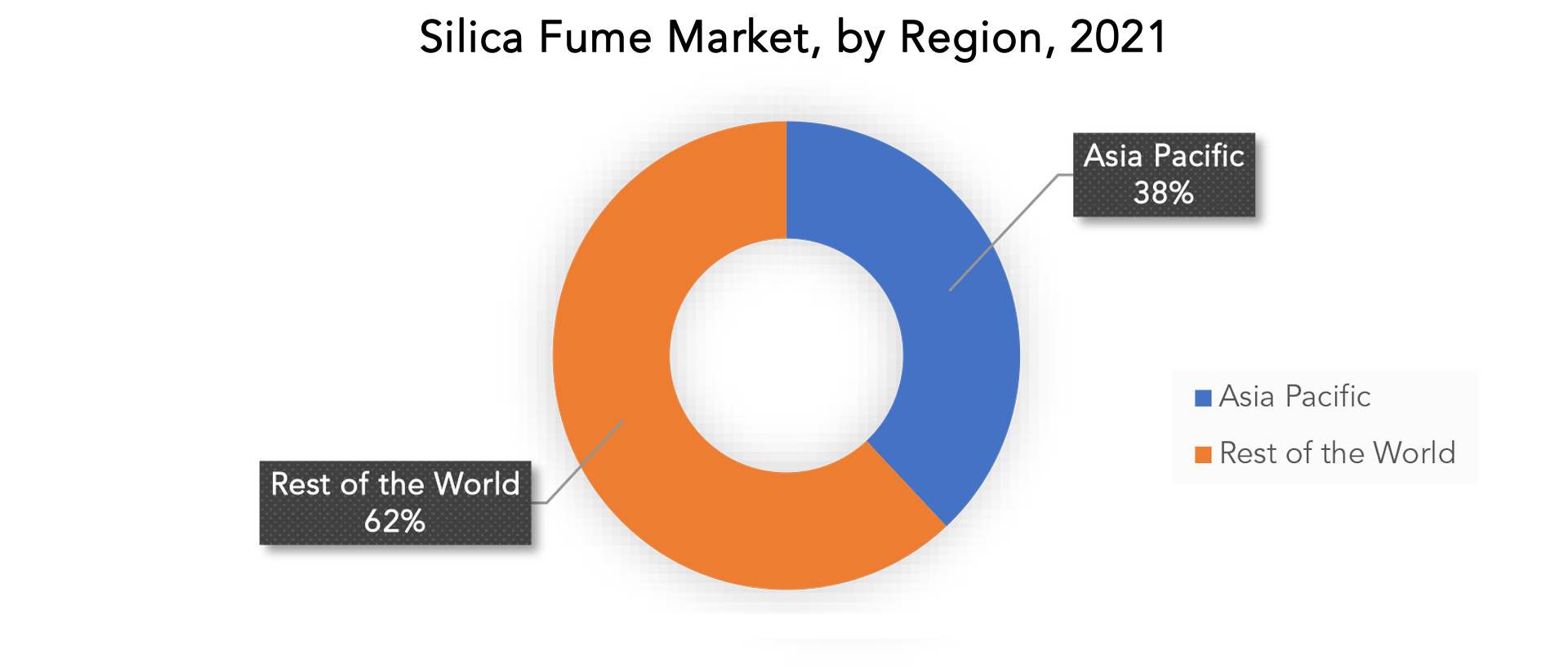

Asia Pacific accounted for the largest market in the silica fume market. Due to the high demand in China and India, followed and account for 38% of the global silica fume market. The construction market in APAC will likely remain one of the biggest and fastest-growing in the world. Large and more developed markets such as China, India, and Japan are expected to grow more in the coming years because of the governmental infrastructure projects in these countries. China leads the Asia-Pacific region in terms of silica fume market demand, followed by India and Japan.

Governments in the Asia Pacific are promoting infrastructure development through investments in large-scale construction projects, such as highways, airports, and urban housing. These projects require high-performance concrete, which is driving the demand for silica fume. Additionally, governments are implementing regulations to promote sustainable construction practices, which is also driving the demand for silica fume. Overall, Asia Pacific is dominating the silica fume market due to the growing construction and infrastructure activities, the presence of major producers, favorable government policies, and the growing demand for advanced ceramics in the region.

Key Market Segments: Silica Fume Market

Silica Fume Market By Source Of Metals, 2020-2029, (Usd Million), (Kilotons)

- Silicon Metal

- Ferrosilicon

Silica Fume Market By Application, 2020-2029, (Usd Million), (Kilotons)

- Building Construction

- Marine Structure Construction

- Chemical Production Facilities Construction

- Oil & Gas Well Grouting

- Nuclear Power Plant Construction

- Others

Silica Fume Market By Region, 2020-2029, (Usd Million), (Kilotons)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the current size of the silica fume market?

- What is the expected growth rate of the silica fume market over the next 7 years?

- Who are the major players in the silica fume market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as the Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the high strength of the steel market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the military-embedded system market?

- What is the current and forecasted size and growth rate of the global silica fume market?

- What are the key drivers of growth in the silica fume market?

- Who are the major players in the market and what is their market share?

- What are the silica fume market’s distribution channels and supply chain dynamics?

- What are the technological advancements and innovations in the silica fume market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the silica fume market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the silica fume market?

- What are the product offerings specifications of leading players in the market?

- What is the pricing trend of silica fumes in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SILICA FUME MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE SILICA FUME MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SILICA FUME MARKET OUTLOOK

- GLOBAL SILICA FUME MARKET BY SOURCE OF METAL 2020-2029, (USD MILLION), (KILOTONS)

- SILICON METAL

- FERROSILICON

- GLOBAL SILICA FUME MARKET BY APPLICATION, 2020-2029, (USD MILLION), (KILOTONS)

- BUILDING & CONSTRUCTION

- MARINE STRUCTURE CONSTRICTION

- CHEMICAL PRODUCTION FACILITIES AND CONSTRUCTION

- OIL & GAS WELL GROUTING

- NUCLEAR POWER PLANT CONSTRUCTION

- OTHERS

- GLOBAL SILICA FUME MARKET BY REGION, 2020-2029, (USD MILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

8.1. INEOS ENTERPRISE

8.2. BUFA COMPOSITE SYSTEMS GMBH

8.3. HK RESEARCH CORPORATION

8.4. ALLNEX

8.5. SCOTT BADER COMPANY

8.6. SIKA ADVANCED RESINS

8.7. GRM SYSTEMS S.R.O.

8.8. SATYEN POLYMERS

8.9. VIKRAM RESINS AND POLYMERS

8.10. MADER GROUP *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 2 GLOBAL SILICA FUME MARKET BY SOURCE OF METAL (USD KILOTONS) 2020-2029

TABLE 3 GLOBAL SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 4 GLOBAL SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 5 GLOBAL SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 6 GLOBAL SILICA FUME MARKET BY REGION (USD MILLION) 2020-2029

TABLE 7 GLOBAL SILICA FUME MARKET BY REGION (KILOTONS) 2020-2029

TABLE 8 NORTH AMERICA SILICA FUME MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 9 NORTH AMERICA SILICA FUME MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 10 NORTH AMERICA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 11 NORTH AMERICA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 12 NORTH AMERICA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 13 NORTH AMERICA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 14 US SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 15 US SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 16 US SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 17 US SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 18 CANADA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 19 CANADA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 20 CANADA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 21 CANADA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 22 MEXICO SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 23 MEXICO SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 24 MEXICO SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 25 MEXICO SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 26 SOUTH AMERICA SILICA FUME MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 27 SOUTH AMERICA SILICA FUME MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 28 SOUTH AMERICA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 29 SOUTH AMERICA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 30 SOUTH AMERICA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 31 SOUTH AMERICA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 32 BRAZIL SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 33 BRAZIL SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 34 BRAZIL SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 35 BRAZIL SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 36 ARGENTINA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 37 ARGENTINA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 38 ARGENTINA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 39 ARGENTINA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 40 COLOMBIA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 41 COLOMBIA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 42 COLOMBIA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 43 COLOMBIA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 44 REST OF SOUTH AMERICA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 45 REST OF THE SOUTH AMERICA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 46 REST OF THE SOUTH AMERICA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 47 REST OF SOUTH AMERICA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 48 ASIA-PACIFIC SILICA FUME MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 49 ASIA-PACIFIC SILICA FUME MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 50 ASIA-PACIFIC SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 51 ASIA-PACIFIC SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 52 ASIA-PACIFIC SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 53 ASIA-PACIFIC SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 54 INDIA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 55 INDIA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 56 INDIA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 57 INDIA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 58 CHINA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 59 CHINA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 60 CHINA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 61 CHINA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 62 JAPAN SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 63 JAPAN SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 64 JAPAN SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 65 JAPAN SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 66 SOUTH KOREA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 67 SOUTH KOREAN SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 68 SOUTH KOREA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 69 SOUTH KOREA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 70 AUSTRALIA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 71 AUSTRALIA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 72 AUSTRALIA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 73 AUSTRALIA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 74 SOUTH-EAST ASIA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 75 SOUTH-EAST ASIA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 76 SOUTH-EAST ASIA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 77 SOUTH-EAST ASIA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 78 REST OF ASIA PACIFIC SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 79 REST OF THE ASIA PACIFIC SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 80 REST OF ASIA PACIFIC SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 81 REST OF ASIA PACIFIC SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 82 EUROPE SILICA FUME MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 83 EUROPE SILICA FUME MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 84 EUROPE SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 85 EUROPE SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 86 EUROPE SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 87 EUROPE SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 88 GERMANY SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 89 GERMANY SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 90 GERMANY SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 91 GERMANY SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 92 UK SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 93 UK SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 94 UK SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 95 UK SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 96 FRANCE SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 97 FRANCE SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 98 FRANCE SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 99 FRANCE SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 100 ITALY SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 101 ITALY SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 102 ITALY SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 103 ITALY SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 104 SPAIN SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 105 SPAIN SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 106 SPAIN SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 107 SPAIN SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 108 RUSSIA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 109 RUSSIA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 110 RUSSIA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 111 RUSSIA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 112 REST OF EUROPE SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 113 REST OF EUROPE SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 114 REST OF EUROPE SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 115 REST OF EUROPE SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA SILICA FUME MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA SILICA FUME MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 121 MIDDLE EAST AND AFRICA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 122 UAE SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 123 UAE SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 124 UAE SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 125 UAE SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 126 SAUDI ARABIA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 127 SAUDI ARABIA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 128 SAUDI ARABIA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 129 SAUDI ARABIA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 130 SOUTH AFRICA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 131 SOUTH AFRICA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 132 SOUTH AFRICA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 133 SOUTH AFRICA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 134 REST OF THE MIDDLE EAST AND AFRICA SILICA FUME MARKET BY SOURCE OF METAL (USD MILLION) 2020-2029

TABLE 135 REST OF THE MIDDLE EAST AND AFRICA SILICA FUME MARKET BY SOURCE OF METAL (KILOTONS) 2020-2029

TABLE 136 REST OF THE MIDDLE EAST AND AFRICA SILICA FUME MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 137 REST OF THE MIDDLE EAST AND AFRICA SILICA FUME MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SILICA FUME MARKET BY METAL, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SILICA FUME MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SILICA FUME MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SILICA FUME MARKET BY METALS, USD MILLION, 2021

FIGURE 12 GLOBAL SILICA FUME MARKET BY APPLICATIONS, USD MILLION, 2021

FIGURE 12 GLOBAL SILICA FUME MARKET BY REGION, USD MILLION, 2021

FIGURE 12 NORTH AMERICA SILICA FUME MARKET SNAPSHOT

FIGURE 13 EUROPE SILICA FUME MARKET SNAPSHOT

FIGURE 14 SOUTH AMERICA SILICA FUME MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC SILICA FUME MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST ASIA AND AFRICA SILICA FUME MARKET SNAPSHOT

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 GLOBE SPECIALTY METAL: COMPANY SNAPSHOT

FIGURE 19 NORCHEM: COMPANY SNAPSHOT

FIGURE 20 ELKEM: COMPANY SNAPSHOT

FIGURE 21 CEMENTE INDUSTRIES INC: COMPANY SNAPSHOT

FIGURE 22 DOW CORNING: COMPANY SNAPSHOT

FIGURE 23 KRYPTON: COMPANY SNAPSHOT

FIGURE 24 ELKON PRODUCTS INC.: COMPANY SNAPSHOT

FIGURE 25 BROCK WHITE COMPANY LLC: COMPANY SNAPSHOT

FIGURE 26 SIMCOA OPERATIONS PTY LTD: COMPANY SNAPSHOT

FIGURE 27 CARBON ENTERPRISES: COMPANY SNAPSHOT

FAQ

The global silica fume market is expected to grow at 4.7 % CAGR from 2020 to 2029. It is expected to reach above USD 986.88 million by 2029 from USD 564.8 million in 2020.

Asia Pacific accounted for the largest market in the silica fume market. Due to the high demand in China and India, followed by North America, the Asia Pacific region is expected to experience the fastest growth rate during the forecast period and account for 38% of the global silica fume market.

The increase in demand for silica fume in nuclear power construction, and growing demand from the construction industry in Asia pacific are the factors that help to propel the silica fume market growth.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.