Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

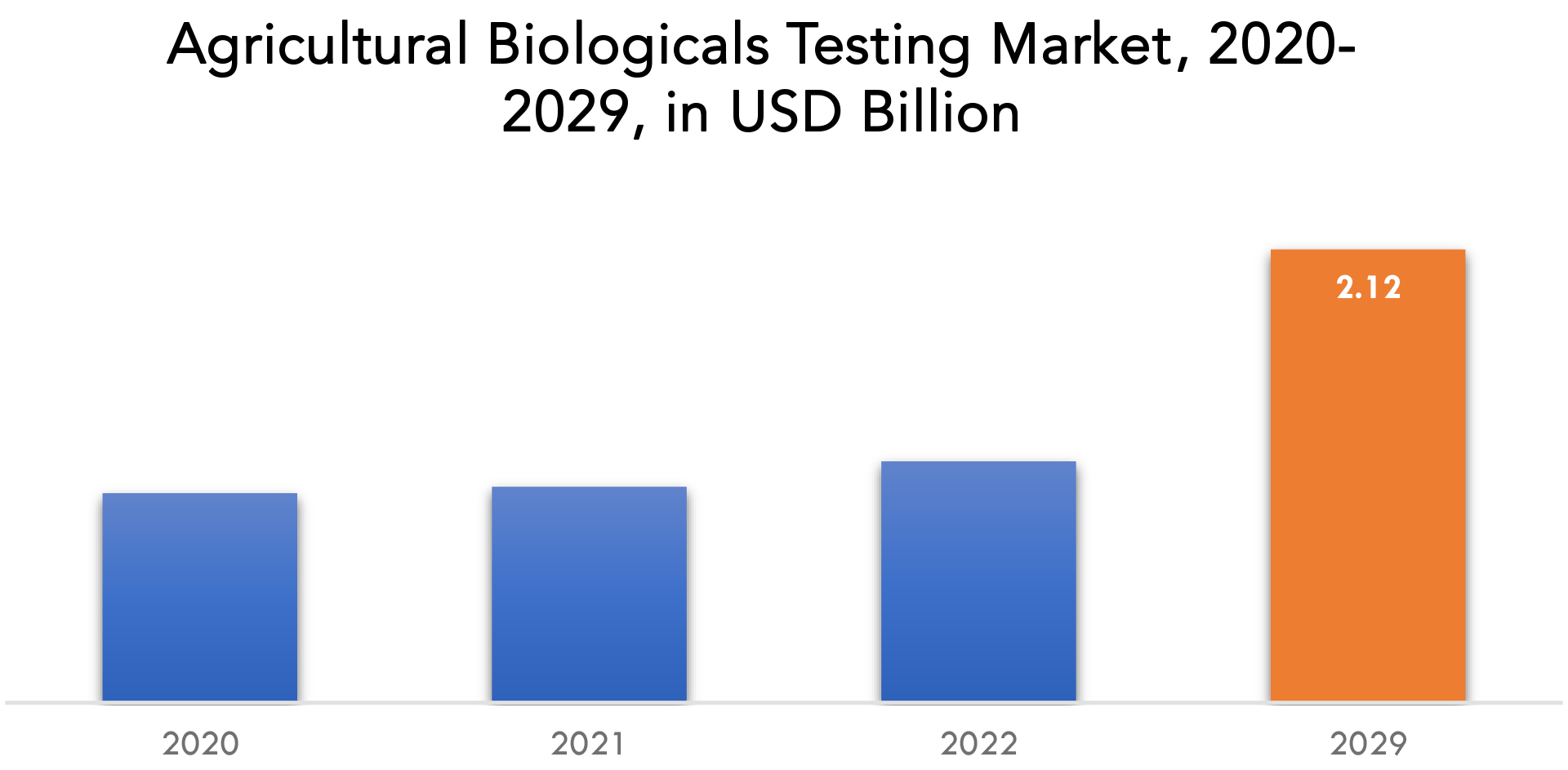

| USD 2.12 billion by 2029 | 9.7% | North America |

| By Product Type | By Application | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Agricultural Biologicals Testing Market Overview

The agricultural biologicals testing market is expected to grow at 9.7% CAGR from 2022 to 2029. It is expected to reach above USD 2.12 billion by 2029 from USD 0.98 billion in 2020.

The process of assessing the security, effectiveness, and functionality of biological products used in agriculture, such as biopesticides, biofertilizers, and biostimulants, is known as agricultural biologicals testing. Various analytical and biological assays, such as chemical and biological characterization, toxicity investigations, and field trials, are frequently used during the testing procedure. The purpose of testing agricultural biologicals is to make sure that these products are environmentally sustainable, safe to use, and successful at increasing crop yields and quality. In order to register and approve a product, regulatory standards must be met, which calls for testing.

Agricultural biologicals testing is a crucial part of the biotechnology sector, which is dedicated to creating novel approaches for sustainable agriculture. Growing public and governmental concern over the environmental effects of conventional chemical pesticides and fertilizers has increased the use of biological products in agriculture. Generally speaking, testing of agricultural biologicals is essential to ensuring that the biological products used in agriculture are secure, efficient, and environmentally sound, hence supporting sustainable farming methods.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By product type, by application, by end user, by region |

| By Product Type |

|

| By Application |

|

| By End user |

|

| By Region |

|

Agricultural biological testing is certainly influenced by high organic agricultural production. Instead of using synthetic chemicals to manage pests and fertilize crops, organic farming uses natural processes and products. This means that in order to support the growth and health of their crops, organic farmers must rely extensively on biological products like biopesticides, biofertilizers, and biostimulants. Determining the safety and effectiveness of these goods requires agricultural biological testing, which is being driven by the rise in demand for biological products in organic agriculture. Agricultural biological testing is required to assess how biological products work in organic agriculture and to confirm that they adhere to the rules and specifications established by organic certification agencies.

The covid-19 pandemic’s effects on the agricultural biologicals testing market have been conflicting. On one hand, the pandemic hampered the international supply chains, decreased economic activity, and slowed down regulatory procedures, which had a detrimental effect on the market. However, the pandemic has also led to a rise in the demand for sustainable farming, which has opened up new business prospects. The interruption of international supply chains has been one of the biggest issues the agricultural biologicals testing sector has had to deal with throughout the pandemic. Companies have experienced delays and higher expenses as a result of their inability to access the goods and equipment required for testing due to travel limitations, quarantine regulations, and social distance limits.

Agricultural Biologicals Testing Market Segment Analysis

The agricultural biologicals testing market is segmented based on product type, application and end user.

Based on product type the agricultural biopesticides are the largest segment of the agricultural biologicals testing market and are expected to continue to grow due to increased demand for sustainable agriculture practices. Bio stimulants are a growing segment of the agricultural biologicals testing market as farmers look for ways to improve crop yields and reduce environmental impact.

Based on the application, the largest market share for agricultural biologicals testing services is likely to be in the analytical category. For ensuring the quality and safety of agricultural biologicals products, analytical services, which include laboratory testing for product quality, efficacy, and safety, are crucial. The usage and performance of agricultural biologicals products depend on field support services like crop monitoring, soil sampling, and field trials. However, given that the demand for field support services may be more regional and reliant on certain crops and growing conditions, it is possible that its market share will be lower than that of the analytical category.

On the basis of end user, biological products manufacturers have the highest growth of the market. Since chemical pesticides are harmful to both human and environmental health, there is a growing demand for biological pesticide alternatives. They are less expensive and easier to record than chemical molecules. When utilized in integrated pest management (IPM) procedures along with a modest amount of chemical pesticides, these biological product manufacturers are also economically advantageous.

Agricultural Biologicals Testing Market Players

The agricultural biologicals testing market key players include SGS SA, Eurofins Scientific SE, Syntech Research, Anadiag Group, BiotecnologieBT Sr, RJ Hill Laboratories Ltd, Apal Agricultural Laboratory, Laus GmbH, Bionema Limited, Kwizda Agro.

Industry News:

- January 16, 2023: The Colombian Institute of Agriculture (ICA) has granted SynTech Research Group the registration as Agronomic Evaluation Unit to be performed anywhere in the country. With this new achievement, SynTech Research Colombia can carry out seed development and registration testing services throughout the country and support the growth strategies of our clients.

- January 26, 2022: Syngenta Crop Protection AG has acquired two next generation bioinsecticides, NemaTrident and UniSpore, from leading biocontrol technology developer, Bionema Limited. NemaTrident and UniSpore will provide customers with additional and complementary technologies to manage insect pests and resistance effectively and sustainably.

Who Should Buy? Or Key Stakeholders

- Agricultural Biologicals Testing Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Agricultural Biologicals Testing Market Regional Analysis

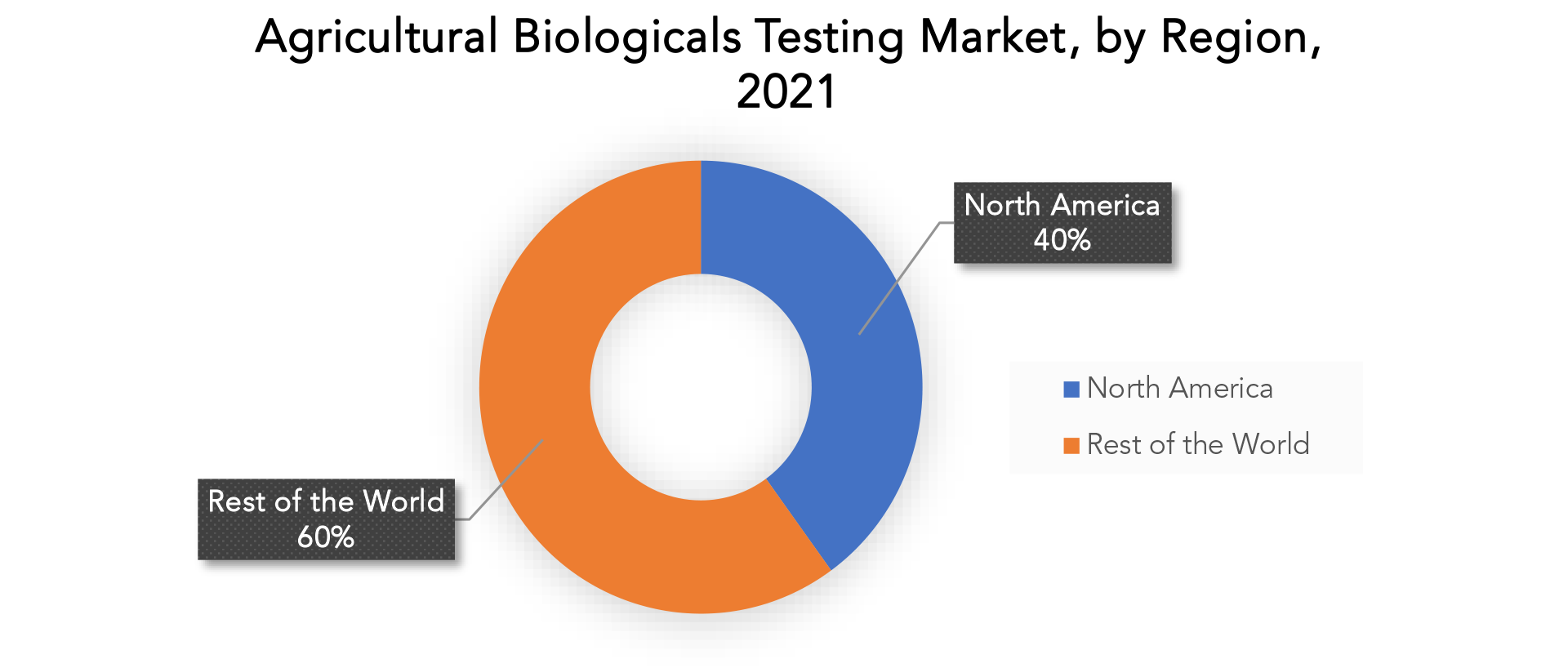

The agricultural biologicals testing market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The market for testing agricultural biologicals in North America is significant, and testing services for agricultural biologicals are in great demand. In terms of using contemporary farming techniques and advancing sustainable agriculture, North America has taken the lead. As a result, agricultural biologicals are now being used more frequently to boost soil health, decrease the use of chemicals, and raise crop yields. To assure the security and effectiveness of these products, testing services are becoming increasingly necessary. Additionally, the area has a well-established regulatory framework for agricultural products that includes standards for testing agricultural inputs. This has increased the region’s need for testing services. Numerous top market participants, including Eurofins Scientific, SGS SA, and Intertek Group plc, among others, are present in the North American agricultural biologicals testing market. These players provide a variety of testing services for agricultural biologicals, including, among others, residue, efficacy, and safety testing.

Europe has been a leader in adopting sustainable agriculture practices and promoting organic farming. This has resulted in increased adoption of agricultural biologicals as a means to improve crop yields, reduce chemical inputs, and promote soil health. As a result, there is a growing need for testing services to ensure the safety and efficacy of these products. Moreover, the region has a well-developed regulatory framework for agricultural products, which includes testing requirements for agricultural inputs.

Key Market Segments: Agricultural Biologicals Testing Market

Agricultural Biologicals Testing Market By Product Type, 2020-2029, (USD Billion), (Kilotons)

- Bio Pesticides

- Bio Fertilizers

- Bio Stimulants

Agricultural Biologicals Testing Market By Application, 2020-2029, (USD Billion), (Kilotons)

- Field Support

- Analytical

- Regulatory

Agricultural Biologicals Testing Market By End User, 2020-2029, (USD Billion), (Kilotons)

- Biological Product Manufacturers

- Government Agencies

- Plant Breeders

- Outsourced Contract Research Organization

Agricultural Biologicals Testing Market By Region, 2020-2029, (USD Billion), (Kilo Tons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered: –

- What is the expected growth rate of the agricultural biologicals testing market over the next 7 years?

- Who are the major players in the agricultural biologicals testing market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the agricultural biologicals testing market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the agricultural biologicals testing market?

- What is the current and forecasted size and growth rate of the global agricultural biologicals testing market?

- What are the key drivers of growth in the agricultural biologicals testing market?

- What are the distribution channels and supply chain dynamics in the agricultural biologicals testing market?

- What are the technological advancements and innovations in the agricultural biologicals testing market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the agricultural biologicals testing market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the agricultural biologicals testing market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of agricultural biologicals testing in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AGRICULTURAL BIOLOGICALS TESTING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET OUTLOOK

- GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- BIO PESTICIDES

- BIO FERTILIZERS

- BIO STIMULANTS

- GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- FIELD SUPPORT

- ANALYTICAL

- REGULATORY

- GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER, 2020-2029, (USD BILLION), (KILOTONS)

- BIOLOGICAL PRODUCT MANUFACTURERS

- GOVERNMENT AGENCIES

- PLANT BREEDERS

- OUTSOURCED CONTRACT RESEARCH ORGANIZATION

- GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- SGS SA

- EUROFINS SCIENTIFIC SE

- SYNTECH RESEARCH

- ANADIAG GROUP

- BIOTECNOLOGIEBT SR

- RJ HILL LABORATORIES LTD

- APAL AGRICULTURAL LABORATORY

- LAUS GMBH

- BIONEMA LIMITED

- KWIZDA AGRO. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 US AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 18 US AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 19 US AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 US AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 US AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 23 CANADA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 CANADA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 CANADA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 29 MEXICO AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 MEXICO AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 BRAZIL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 49 ARGENTINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 55 COLOMBIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 INDIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 INDIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 INDIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 CHINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 CHINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 CHINA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 JAPAN AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 JAPAN AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 JAPAN AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 123 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 GERMANY AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 GERMANY AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 131 UK AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 132 UK AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 133 UK AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 UK AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 137 FRANCE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 FRANCE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 FRANCE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 143 ITALY AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 147 ITALY AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 ITALY AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 149 SPAIN AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 SPAIN AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 154 SPAIN AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 155 RUSSIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 175 UAE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 176 UAE AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 177 UAE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 UAE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 180 UAE AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY REGION, USD BILLION, 2021

FIGURE 14 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY PRODUCT TYPE, USD BILLION, 2021

FIGURE 16 GLOBAL AGRICULTURAL BIOLOGICALS TESTING MARKET BY END USER, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 KWIZDA AGRO: COMPANY SNAPSHOT

FIGURE 19 SGS SA: COMPANY SNAPSHOT

FIGURE 20 EUROFINS SCIENTIFIC SE: COMPANY SNAPSHOT

FIGURE 21 SYNTECH RESEARCH: COMPANY SNAPSHOT

FIGURE 22 ANADIAG GROUP: COMPANY SNAPSHOT

FIGURE 23 BIOTECNOLOGIEBT SR.: COMPANY SNAPSHOT

FIGURE 24 RJ HILL LABORATORIES LTD: COMPANY SNAPSHOT

FIGURE 25 APAL AGRICULTURAL LABORATORY: COMPANY SNAPSHOT

FIGURE 26 LAUS GMBH: COMPANY SNAPSHOT

FIGURE 27 BIONEMA LIMITED: COMPANY SNAPSHOT

FAQ

The agricultural biologicals testing market is expected to grow at 9.7% CAGR from 2022 to 2029. It is expected to reach above USD 2.12 billion by 2029 from USD 0.98 billion in 2020.

North America held more than 40% of the agricultural biologicals testing market revenue share in 2021 and will witness expansion in the forecast period.

Agricultural biological testing is certainly influenced by high organic agricultural production. Instead of using synthetic chemicals to manage pests and fertilize crops, organic farming uses natural processes and products. This means that in order to support the growth and health of their crops, organic farmers must rely extensively on biological products like biopesticides, biofertilizers, and biostimulants.

On the basis of end user, biological products manufacturers have the highest growth of the market. Since chemical pesticides are harmful to both human and environmental health, there is a growing demand for biological pesticide alternatives. They are less expensive and easier to record than chemical molecules. When utilized in integrated pest management (IPM) procedures along with a modest amount of chemical pesticides, these biological product manufacturers are also economically advantageous.

The market for testing agricultural biologicals in North America is significant, and testing services for agricultural biologicals are in great demand. In terms of using contemporary farming techniques and advancing sustainable agriculture, North America has taken the lead. As a result, agricultural biologicals are now being used more frequently to boost soil health, decrease the use of chemicals, and raise crop yields. To assure the security and effectiveness of these products, testing services are becoming increasingly necessary.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.