Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 164.12 billion by 2029 | 27.5 % | North America |

| By Technology | By End User | By Application | By Component |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

AI Infrastructure Market Overview

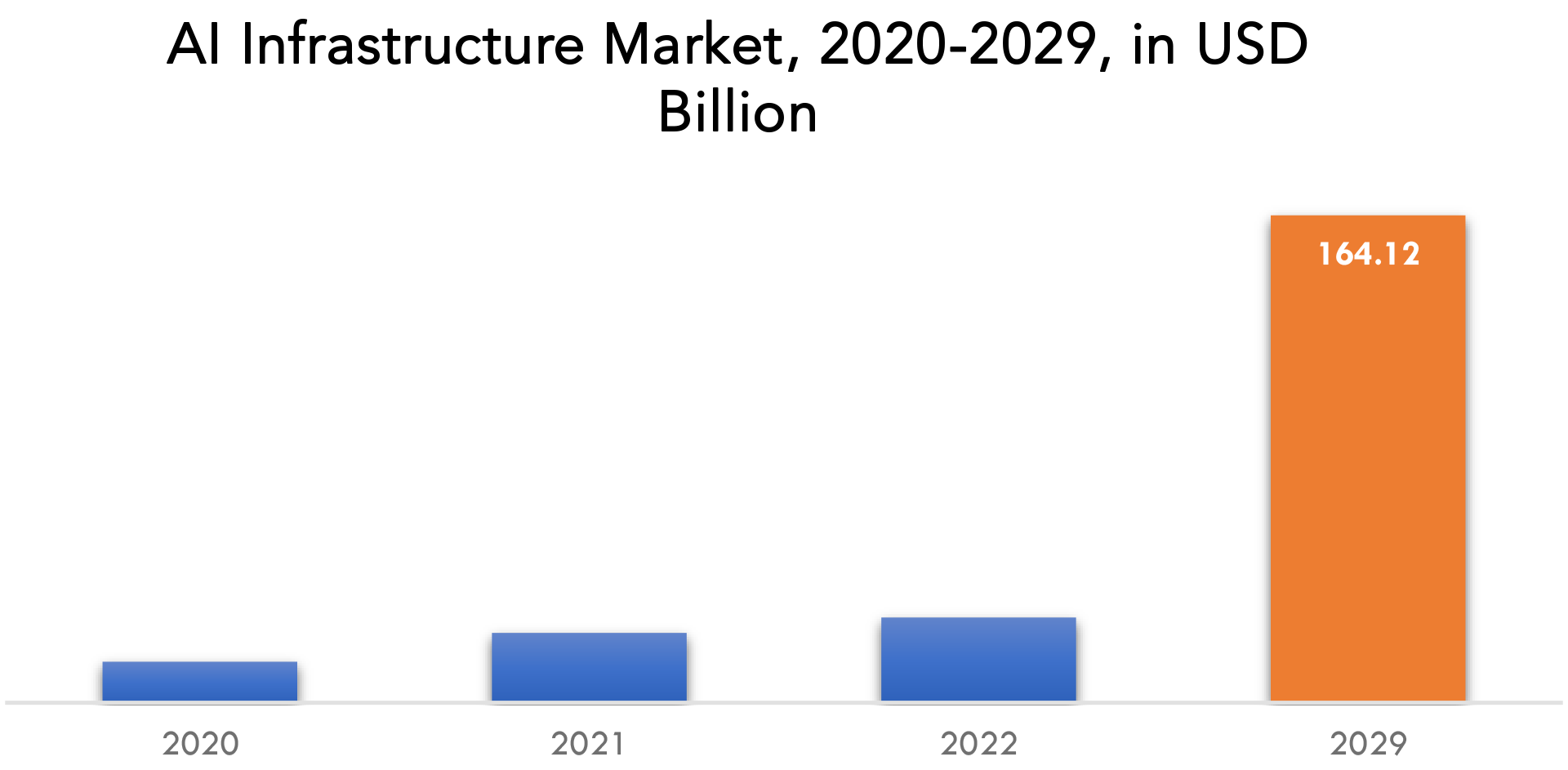

The AI infrastructure market is expected to grow at 27.5 % CAGR from 2022 to 2029. It is expected to reach above USD 164.12 billion by 2029 from USD 23.5 billion in 2021.

The hardware and software elements required to support the creation, training, and implementation of AI models and applications are referred to as AI infrastructure. Strong computers or servers with specialized processing units, such as graphics processing units (GPUs) or tensor processing units (TPUs), that are optimized for machine learning tasks often make up the infrastructure. AI models are able to carry out complex calculations much more quickly thanks to these processing units than they could before.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Technology, by end user, by application, by component, by deployment mode |

| By Technology |

|

| By End user |

|

| By Application |

|

| By Component |

|

| By Deployment Mode |

|

| By Region |

|

The software tools and frameworks TensorFlow, PyTorch, and Keras, among others, allow programmers to create and train machine learning models. AI infrastructure also includes hardware. These frameworks offer a variety of features, such as model training, model optimization, and data preprocessing. Systems for data management and storage, which are essential for handling the enormous datasets that are frequently employed in machine learning, are additional elements of the AI infrastructure. To make sure the models are working properly in production settings, AI infrastructure also includes deployment and monitoring tools.

The creation and implementation of AI models and applications require a complex ecosystem of hardware and software, collectively known as the “AI infrastructure.” The need for sophisticated and scalable AI infrastructure will increase as AI develops and becomes more pervasive.

AI Infrastructure Market Segment Analysis

The AI infrastructure market is segmented based on technology, end users, application, component and deployment mode.

Deep learning is currently accounting for the largest portion of the technology-based AI infrastructure, followed by machine learning. This is due to the fact that deep learning algorithms comprise multiple layers of interconnected nodes that process and analyses data, requiring substantially more processing power than typical machine learning methods.

Cloud service providers (CSPs) currently hold the largest end-user market for AI infrastructure, followed by businesses and governments are making significant investments in AI infrastructure to meet the rising demand for AI applications on the cloud, including Amazon Web Services, Microsoft Azure, and Google Cloud. To help its clients develop and deploy AI applications at scale, these suppliers offer specialized AI infrastructure services, including GPUs, TPUs, pre-trained models, and machine learning and deep learning frameworks.

Based on application, AI training currently holds the biggest market share for AI infrastructure, followed by inferencing. Machine learning and deep learning models must be trained using vast volumes of data. This procedure needs a lot of processing power, storage, and specialized gear like GPUs and TPUs. The growing usage of AI in fields including image and speech recognition, natural language processing, and autonomous vehicles is fueling a demand for infrastructure for AI training.

Specialized processors like GPUs, TPUs, and FPGAs as well as servers, storage units, and networking hardware that is tailored for AI workloads are examples of hardware components. The necessity for high-performance computation and storage to serve AI training and inferencing workloads is the factor that is driving the need for AI hardware.

The benefits of cloud installations include scalability, flexibility, and lower infrastructure expenses. In order to meet the rising demand for AI applications in the cloud, cloud service providers are making significant investments in AI infrastructure. To help their customers develop and deploy AI applications at scale, they provide specialized AI infrastructure services like machine learning and deep learning frameworks, GPUs and TPUs, and pre-trained models.

AI Infrastructure Market Players

The AI infrastructure market key players include NVIDIA Corporation, Microsoft Corporation, Alphabet Inc., Intel Corporation, Toshiba Corporation, Micron Technology, Inc., Amazon.com, Inc., Oracle Corporation, Samsung Electronics Co., Ltd., IBM Corporation.

Industry News:

September 24, 2018: Microsoft announced Azure Digital Twins to create digital replicas of spaces and infrastructure using cloud, AI and IoT.

November 15 , 2022 : Micron Technology, Inc. (Nasdaq: MU) announced that it is expanded its portfolio for its silicon root-of-trust solution, Authenta™, made its cloud-based internet of things (IoT) security offerings more widely accessible.

Who Should Buy? Or Key stakeholders

- AI Infrastructure service providers

- IT Industries

- Research Organizations

- Investors

- Regulatory Authorities

- Others

AI Infrastructure Market Regional Analysis

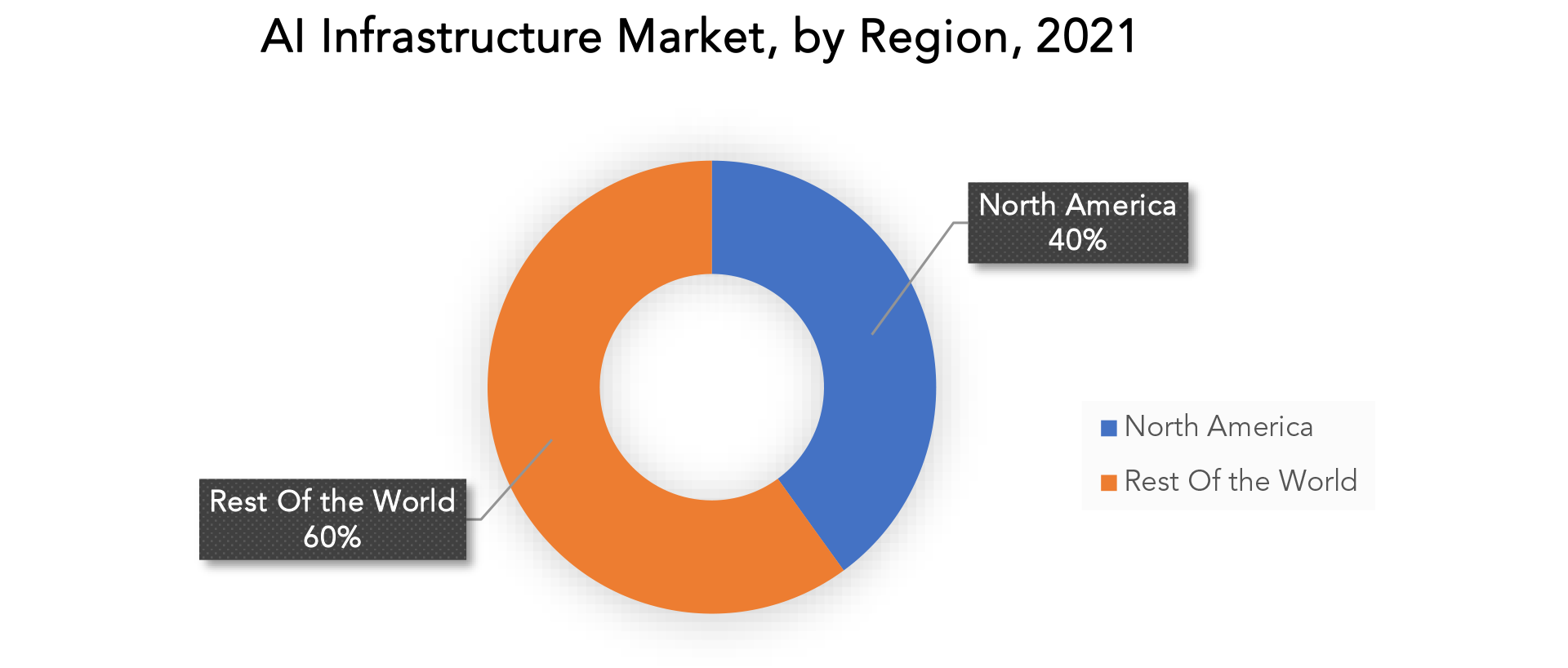

The AI infrastructure market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Due to the region’s excellent IT infrastructure, high rates of technology adoption, and considerable investments in AI research and development, North America is a prominent market for AI infrastructure. NVIDIA, Intel, IBM, and Google are just a few of the key players in the sector that have their headquarters in the United States, which is the biggest market for AI infrastructure in North America. MIT, Stanford, and Carnegie Mellon are just a few of the top colleges and research centers in the area that are fueling advancements in AI technology. The demand for AI infrastructure in North America is being driven by several factors, including the growing adoption of AI technology across various industries, the increasing availability of data for training AI models, and the need for advanced computing power and storage to support complex AI workloads. Additionally, the COVID-19 pandemic has accelerated the adoption of AI in healthcare, finance, and other industries, further driving the demand for AI infrastructure.

The AI infrastructure market in Asia Pacific is rapidly growing due to the increasing adoption of artificial intelligence (AI) technologies in various industries, such as healthcare, finance, retail, and manufacturing. The MEA region is witnessing a surge in the adoption of AI technologies, particularly in countries such as the United Arab Emirates, Saudi Arabia, and Israel, due to the government’s initiatives to promote the adoption of emerging technologies, such as AI, blockchain, and IoT, to diversify the economy and improve the quality of life.

Key Market Segments: AI Infrastructure Market

AI Infrastructure Market by Technology, 2020-2029, (USD Billion)

- Machine Learning

- Deep Learning

AI Infrastructure Market by End User, 2020-2029, (USD Billion)

- Enterprises

- Governments

- Cloud Service Providers (CSPS)

AI Infrastructure Market by Application, 2020-2029, (USD Billion)

- Ai Training

- Inferencing

AI Infrastructure Market by Component ,2020-2029, (USD Billion)

- Hardware

- Software

- Services

AI Infrastructure Market by Deployment Mode, 2020-2029, (USD Billion)

- On-Premise

- Cloud

- Hybrid

AI Infrastructure Market by Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Questions Answered:

- What is the expected growth rate of the ai infrastructure market over the next 7 years?

- Who are the major players in the ai infrastructure market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the ai infrastructure market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the ai infrastructure market?

- What is the current and forecasted size and growth rate of the global ai infrastructure market?

- What are the key drivers of growth in the ai infrastructure market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the ai infrastructure market?

- What are the technological advancements and innovations in the ai infrastructure market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the ai infrastructure market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the ai infrastructure market?

- What are the service offerings and specifications of leading players in the market?

Exactitude Consultancy Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AI INFRASTRUCTURE OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AI INFRASTRUCTURE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- DEPLOYMENT MODE VALUE CHAIN ANALYSIS

- GLOBAL AI INFRASTRUCTURE OUTLOOK

- GLOBAL AI INFRASTRUCTURE MARKET BY TECHNOLOGY, 2020-2029,(USD BILLION)

- MACHINE LEARNING

- DEEP LEARNING

- GLOBAL AI INFRASTRUCTURE MARKET BY END USER, 2020-2029,(USD BILLION)

- ENTERPRISES

- GOVERNMENTS

- CLOUD SERVICE PROVIDERS (CSPS)

- GLOBAL AI INFRASTRUCTURE MARKET BY APPLICATION, 2020-2029,(USD BILLION)

- AI TRAINING

- INFERENCING

- GLOBAL AI INFRASTRUCTURE MARKET BY COMPONENT, 2020-2029,(USD BILLION)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE,2020-2029,(USD BILLION)

- ON-PREMISE

- CLOUD

- HYBRID

- GLOBAL AI INFRASTRUCTURE MARKET BY REGION,2020-2029,(USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- NVIDIA CORPORATION

- MICROSOFT CORPORATION

- ALPHABET INC.

- INTEL CORPORATION

- TOSHIBA CORPORATION

- MICRON TECHNOLOGY, INC.

- COM, INC.

- ORACLE CORPORATION

- SAMSUNG ELECTRONICS CO., LTD.

- IBM CORPORATION. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 2 GLOBAL AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 3 GLOBAL AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 5 GLOBAL AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 6 GLOBAL AI INFRASTRUCTURE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 9 NORTH AMERICA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 11 NORTH AMERICA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AI INFRASTRUCTURE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 13 US AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 14 US AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 15 US AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 17 US AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 18 CANADA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(BILLION), 2020-2029

TABLE 19 CANADA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 20 CANADA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 21 CANADA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 22 CANADA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 23 MEXICO AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 24 MEXICO AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 25 MEXICO AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 26 MEXICO AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 27 MEXICO AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 29 SOUTH AMERICA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 31 SOUTH AMERICA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 33 SOUTH AMERICA AI INFRASTRUCTURE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 BRAZIL AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 35 BRAZIL AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 36 BRAZIL AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 37 BRAZIL AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 38 BRAZIL AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 39 ARGENTINA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 40 ARGENTINA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 41 ARGENTINA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 AREGENTINA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 43 AREGENTINA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 44 COLOMBIA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 45 COLOMBIA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 46 COLOMBIA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 47 COLOMBIA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 48 COLOMBIA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 49 REST OF SOUTH AMERICA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 51 REST OF SOUTH AMERICA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 52 REST OF SOUTH AMERICA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 53 REST OF SOUTH AMERICA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 54 ASIA-PACIFIC AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 55 ASIA-PACIFIC AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 56 ASIA-PACIFIC AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 57 ASIA-PACIFIC AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 58 ASIA-PACIFIC AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 59 ASIA-PACIFIC AI INFRASTRUCTURE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 60 INDIA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 61 INDIA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 62 INDIA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 63 INDIA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 64 INDIA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 65 CHINA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 66 CHINA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 67 CHINA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 CHINA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 69 CHINA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 70 JAPAN AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 71 JAPAN AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 JAPAN AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 73 JAPAN AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 74 JAPAN AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 75 SOUTH KOREA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 76 SOUTH KOREA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 77 SOUTH KOREA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 SOUTH KOREA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 79 SOUTH KOREA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 80 AUSTRALIA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 81 AUSTRALIA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 82 AUSTRALIA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 83 AUSTRALIA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 84 AUSTRALIA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 85 SOUTH EAST ASIA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 86 SOUTH EAST ASIA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 87 SOUTH EAST ASIA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 88 SOUTH EAST ASIA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 89 SOUTH EAST ASIA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 90 REST OF ASIA PACIFIC AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 91 REST OF ASIA PACIFIC AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 REST OF ASIA PACIFIC AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 93 REST OF ASIA PACIFIC AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 94 REST OF ASIA PACIFIC AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 95 EUROPE AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 96 EUROPE AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 97 EUROPE AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 EUROPE AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 99 EUROPE AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 100 EUROPE AI INFRASTRUCTURE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 101 GERMANY AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 102 GERMANY AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 103 GERMANY AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 104 GERMANY AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 105 GERMANY AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 106 UK AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 107 UK AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 108 UK AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 109 UK AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 110 UK AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 111 FRANCE AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 112 FRANCE AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 113 FRANCE AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 FRANCE AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 115 FRANCE AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 116 ITALY AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 117 ITALY AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 118 ITALY AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 119 ITALY AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 120 ITALY AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 121 SPAIN AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 122 SPAIN AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 123 SPAIN AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 SPAIN AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 125 SPAIN AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 126 RUSSIA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 127 RUSSIA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 128 RUSSIA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 129 RUSSIA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 130 RUSSIA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 131 REST OF EUROPE AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 132 REST OF EUROPE AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 133 REST OF EUROPE AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 134 REST OF EUROPE AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 135 REST OF EUROPE AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 136 MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 137 MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 138 MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 139 MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 140 MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 141 MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 142 UAE AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 143 UAE AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 144 UAE AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 145 UAE AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 146 UAE AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 147 SAUDI ARABIA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 148 SAUDI ARABIA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 149 SAUDI ARABIA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 150 SAUDI ARABIA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 151 SAUDI ARABIA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 152 SOUTH AFRICA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 153 SOUTH AFRICA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SOUTH AFRICA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 155 SOUTH AFRICA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 156 SOUTH AFRICA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY TECHNOLOGY(USD BILLION), 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 159 REST OF MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 160 REST OF MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 161 REST OF MIDDLE EAST AND AFRICA AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AI INFRASTRUCTURE MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AI INFRASTRUCTURE MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AI INFRASTRUCTURE MARKET BY APPLICATION , USD BILLION, 2020-2029

FIGURE 11 GLOBAL AI INFRASTRUCTURE MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 12 GLOBAL AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE , USD BILLION, 2020-2029

FIGURE 13 GLOBAL AI INFRASTRUCTURE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 GLOBAL AI INFRASTRUCTURE MARKET BY TECHNOLOGY , USD BILLION, 2021

FIGURE 16 GLOBAL AI INFRASTRUCTURE MARKET BY END USER , USD BILLION, 2021

FIGURE 17 GLOBAL AI INFRASTRUCTURE MARKET BY APPLICATION , USD BILLION, 2021

FIGURE 18 GLOBAL AI INFRASTRUCTURE MARKET BY COMPONENT , USD BILLION, 2021

FIGURE 19 GLOBAL AI INFRASTRUCTURE MARKET BY DEPLOYMENT MODE , USD BILLION, 2021

FIGURE 20 GLOBAL AI INFRASTRUCTURE MARKET BY REGION, USD BILLION, 2021

FIGURE 21 MARKET SHARE ANALYSIS

FIGURE 22 NVIDIA CORPORATION: COMPANY SNAPSHOT

FIGURE 23 MICROSOFT CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ALPHABET INC: COMPANY SNAPSHOT

FIGURE 25 INTEL CORPORATION: COMPANY SNAPSHOT

FIGURE 26 TOSHIBA CORPORATION: COMPANY SNAPSHOT

FIGURE 27 MICRON TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 28 AMAZON.COM: COMPANY SNAPSHOT

FIGURE 29 ORACLE CORPORATION.: COMPANY SNAPSHOT

FIGURE 30 SAMSUNG ELECTRONICS CO., LTD: COMPANY SNAPSHOT

FIGURE 31 IBM CORPORATION: COMPANY SNAPSHOT

FAQ

The AI infrastructure market was USD 23.5 Billion in the year 2021.

North America held more than 40 % of the AI Infrastructure market revenue share in 2021 and will witness expansion in the forecast period

The increased demand for artificial intelligence is primarily driving the market for AI Infrastructure.

Based on application, AI training currently holds the biggest market share for AI infrastructure, followed by inferencing.

Due to the region’s excellent IT infrastructure, high rates of technology adoption, and considerable investments in AI research and development, North America is a prominent market for AI infrastructure.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.