REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 42.23 billion by 2029 | 4.5% | North America |

| by Type | by Vehicle Type | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Steering Systems Sales Market Overview

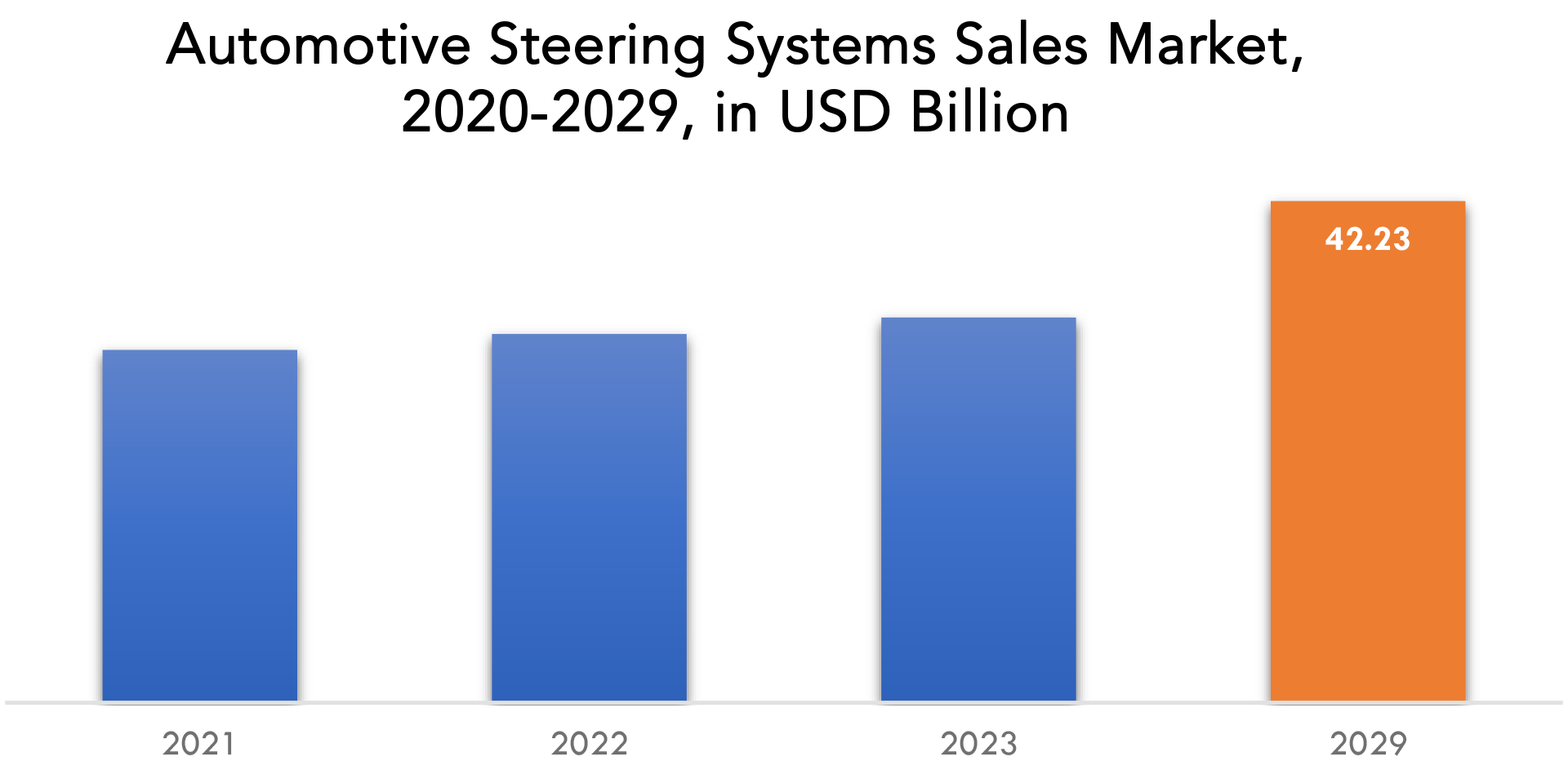

The automotive steering systems sales market is expected to grow at 4.5% CAGR from 2022 to 2029. It is expected to reach above USD 42.23 billion by 2029 from USD 28.42 billion in 2020.

A set of parts called an automotive steering system is used to steer the vehicle in the right direction and assist the driver in adjusting its course as needed. The steering column, universal joints, rack & pinion mechanism, and hand-operated steering wheel are all parts of the vehicle steering system. The move from a manual steering system to a power assist steering system was brought about by the advancement. The automotive steering system is regarded as an essential part of vehicles due it is not interchangeable and is responsible for safe and efficient handling of the vehicle. As a steering system is a need for all vehicles, the market for them is extremely competitive. The market’s expansion is primarily driven by an increase in demand for automobiles brought on by rising consumer disposable income.

A further factor driving this market’s expansion is the use of power steering systems in automobiles. Increased fuel efficiency of the vehicle is due to the steering system’s effectiveness. As a result, the demand for steering systems rises along with the desire for vehicles that are more fuel-efficient. The ease of driving and maneuverability of the vehicle are other factors that customers value when choosing a vehicle for themselves. Use of an efficient steering system, which increases demand for steering systems and propels this market’s expansion, results in more comfortable driving. Nonetheless, it is projected that the expensive price of a power steering system will restrain the market’s expansion. Drive-by-wire technology is anticipated to be used in upcoming vehicles, accelerating the market’s growth in the near term.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Type, By Vehicle type, By Region |

| By Type

|

|

| By Vehicle type

|

|

| By Region

|

|

If there is a market for vehicles, it is noted that the global automotive industry would continue to expand. The most demanding nations for the automotive industry include growing nations like Brazil, China, and India. The world’s largest auto market, China, is anticipated to expand over the next few years as a result of significant investments being made in this industry by most OEMs. Since every automobile requires a steering system to manage vehicle direction, the rising demand for vehicles in the automotive industry directly causes a rise in demand for steering systems. Furthermore, the change in the steering system or a component as a result of the accident may raise demand for steering systems in the aftermarket.

The vehicle steering system industry has been significantly impacted by the COVID-19 outbreak, which has resulted in the closure of numerous manufacturing facilities throughout the world. The pandemic consequently caused the global vehicle sector to suffer enormous financial losses. Also, it compelled the suspension of the production of several components and essential natural resources, raising the price of vehicle steering systems. On the other hand, the lockdown restrictions are progressively being relaxed, which is helping the vehicle steering system industry pick up speed. Creative industry leaders have started to actively look for new uses for the increasingly common vehicle steering systems.

Automotive Steering Systems Sales Market Segment Analysis

Automotive steering systems sales market is segmented based on type, vehicle type, and region.

Based on type, Due to the rising adoption of electric power steering by automakers across all vehicle types, the electric power steering category is predicted to dominate the market over the forecast period. This is due to the growing use of EPS systems in cars and light trucks, as well as to their improved performance and efficiency as compared to hydraulic power steering (HPS) systems.

While HPS systems use hydraulic pressure, EPS systems use an electric motor to assist with steering. Since EPS systems use less engine power than HPS systems, they are more effective and offer superior fuel economy. Additionally, especially at higher speeds, they offer better control and response. Due to of these benefits, they have been widely used in both passenger cars and light trucks, which has fueled the expansion of the market for automotive steering systems. Additionally, EPS systems provide a few other advantages, including decreased emissions, enhanced vehicle safety features, and improved driver comfort. Incorporating them with other car systems, such as driver assistance and automated driving systems, is also simpler. Overall, it is anticipated that the EPS category would continue to dominate the market for vehicle steering systems in the years to come.

Based on vehicle type, Due to rising sales and production in Asia-Pacific developing nations, the passenger vehicle category is anticipated to dominate the market during the upcoming period. Power steering systems are often necessary for passenger vehicles, such as cars and SUVs, to facilitate easy steering and increase driver comfort. Power steering systems aid in lowering the amount of effort needed to turn the steering wheel, simplifying vehicle maneuvering for drivers. This resulted in their widespread use in passenger cars, which in turn fueled the expansion of the market for automotive steering systems.

Additionally, the demand for steering systems is being fueled by the growing use of cutting-edge steering technologies in the passenger vehicle market, such as electric power steering (EPS) and steer-by-wire systems. Numerous advantages are provided by these cutting-edge systems, including increased vehicle safety features, decreased emissions, and better fuel efficiency. This has helped the market for automotive steering systems in the passenger car category to grow even further.

Automotive Steering Systems Sales Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Nexteer, NSK, Ltd., Showa Corporation, Thyssenkrupp AG, JTEKT Corporation, Hyundai Mobis, Robert Bosch GmbH, Hitachi Automotive System, Mando Corporation, Magna International

Industry Developments

- On October 2021, Nexteer Automotive expands its Electric Power Steering (EPS) portfolio with its new Modular Column-Assist EPS System (mCEPS). This innovative system offers a cost-efficient, modular platform design achieving scalability for Nexteer and flexibility to meet a wide range of OEMs’ requirements.

- On May 2022, NSK, Ltd. and thyssenkrupp AG have signed a memorandum of understanding to explore a joint venture between NSK Steering and thyssenkrupp Automotive. The steering businesses of both companies are highly complementary and synergetic in terms of product competencies, geographic footprints, and customer groups.

Who Should Buy? Or Key stakeholders

- Research and Development Institutes

- Regulatory Authorities

- End-use Companies

- Industrial

- Potential Investors

- Automotive Industry

- Others

Automotive Steering Systems Sales Market Regional Analysis

The automotive steering systems sales market by region includes North America, Asia-Pacific (APAC), Europe, South America, And Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

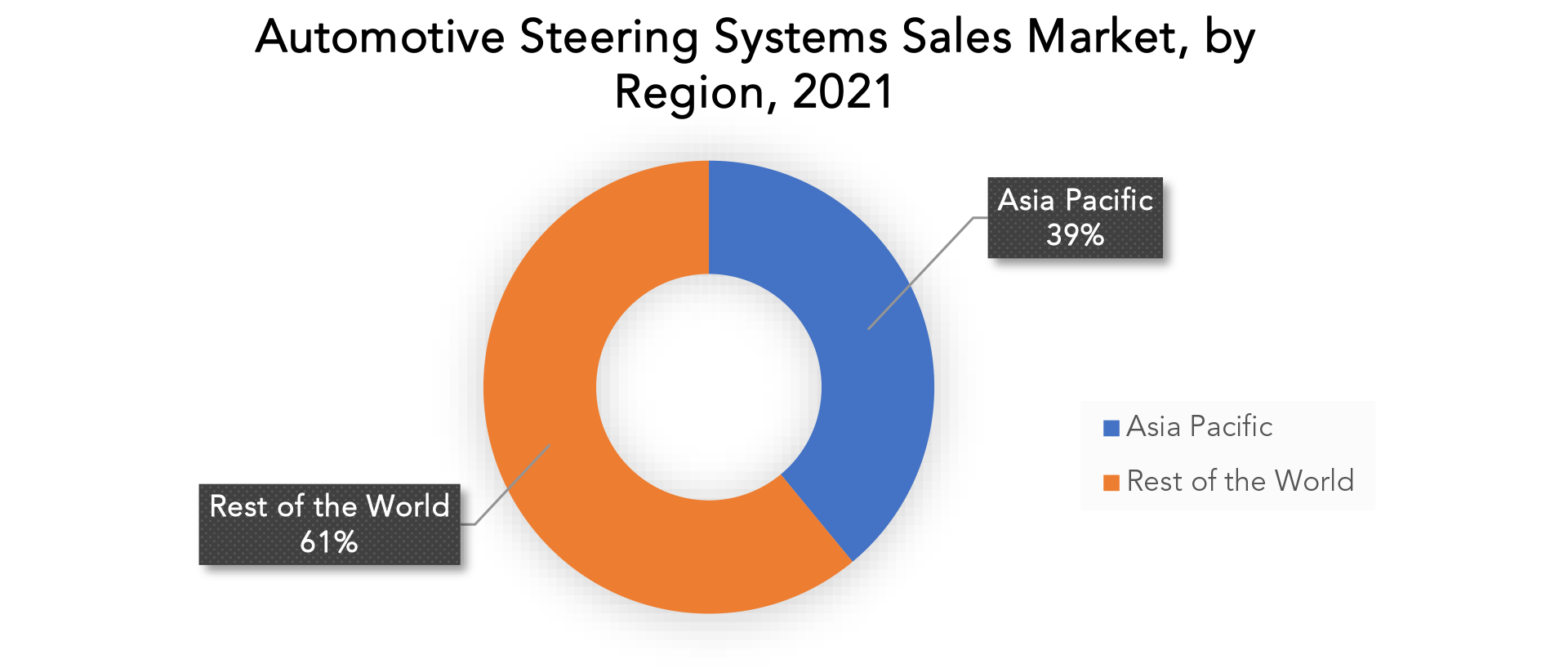

The greatest revenue share in 2021 over 39% was accounted for by Asia Pacific. Asia Pacific is experiencing rapid growth in the global market for automobile steering systems. Market leaders in the automotive steering system market, like Bosch, are investing heavily in electric mobility solutions, which is a key development driver. Also, as a result of increased per capita income and improved road infrastructure in China and India, the market for vehicle steering systems is also expanding.

Key Market Segments: Automotive Steering Systems Sales Market

Automotive Steering Systems Sales Market by Type, 2020-2029, (USD Billion), (Thousand Units)

- Electric Power Steering (Eps)

- Hydraulic Power Steering (HPS)

- Electro-Hydraulic Power Steering (EHPS)

- Manual Steering

Automotive Steering Systems Sales Market by Vehicle Type, 2020-2029, (USD Billion), (Thousand Units)

- Passenger Vehicles

- Light Commercial Vehicles (LCVS)

- Heavy Commercial Vehicles (HCVS)

- Others

Automotive Steering Systems Sales Market by Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the expected growth rate of the automotive steering systems sales market over the next 7 years?

- Who are the major players in the automotive steering systems sales market and what is their market share?

- What is the vehicle type industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the automotive steering systems sales market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive steering systems sales market?

- What is the current and forecasted size and growth rate of the global automotive steering systems sales market?

- What are the key drivers of growth in the automotive steering systems sales market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the automotive steering systems sales market?

- What are the technological advancements and innovations in the automotive steering systems sales market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive steering systems sales market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive steering systems sales market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE STEERING SYSTEMS SALES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET OUTLOOK

- GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- ELECTRIC POWER STEERING (EPS)

- HYDRAULIC POWER STEERING (HPS)

- ELECTRO-HYDRAULIC POWER STEERING (EHPS)

- MANUAL STEERING

- GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- PASSENGER VEHICLES

- LIGHT COMMERCIAL VEHICLES (LCVS)

- HEAVY COMMERCIAL VEHICLES (HCVS)

- OTHERS

- GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AKEBONO BRAKE CORPORATION

- CONTINENTAL AG

- EBC BRAKES

- KNORR-BREMSE AG

- BREMBO SPA

- WABCO

- HALDEX

- TRW AUTOMOTIVE

- HYUNDAI MOBIS

- MANDO CORPORATION

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 16 US AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 20 CANADA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 24 MEXICO AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 34 BRAZIL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 38 ARGENTINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 42 COLOMBIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 56 INDIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 60 CHINA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 64 JAPAN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 84 EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 90 GERMANY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 91 UK AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 94 UK AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 98 FRANCE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 102 ITALY AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 106 SPAIN AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 110 RUSSIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 124 UAE AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY VEHICLE TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL AUTOMOTIVE STEERING SYSTEMS SALES MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AKEBONO BRAKE CORPORATION: COMPANY SNAPSHOT

FIGURE 17 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 18 EBC BRAKES: COMPANY SNAPSHOT

FIGURE 19 KNORR-BREMSE AG: COMPANY SNAPSHOT

FIGURE 20 BREMBO SPA: COMPANY SNAPSHOT

FIGURE 21 WABCO: COMPANY SNAPSHOT

FIGURE 22 HALDEX: COMPANY SNAPSHOT

FIGURE 23 TRW AUTOMOTIVE: COMPANY SNAPSHOT

FIGURE 24 HYUNDAI MOBIS: COMPANY SNAPSHOT

FIGURE 25 MANDO CORPORATION: COMPANY SNAPSHOT

FAQ

The automotive steering systems sales market is expected to grow at 4.5% CAGR from 2022 to 2029. It is expected to reach above USD 42.23 billion by 2029 from USD 28.42 billion in 2020.

Asia Pacific held more than 39% of the automotive steering systems sales market revenue share in 2021 and will witness expansion in the forecast period.

The market for automotive steering systems is expected to grow as consumers want more fuel-efficient vehicles with good steering systems. The global market for automotive steering systems is projected to grow as a result of an increase in mergers and acquisitions among automobile manufacturers working to provide high-quality goods.

Over the course of the forecast, Asia Pacific is anticipated to rule the automobile steering system market. The automobile steering system market is anticipated to increase in this area due to the rising sales and production of automakers from developing nations. This region’s market is expected to rise as a result of customer demand for high-end luxury vehicles and rising disposable income in developing nations.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.