REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

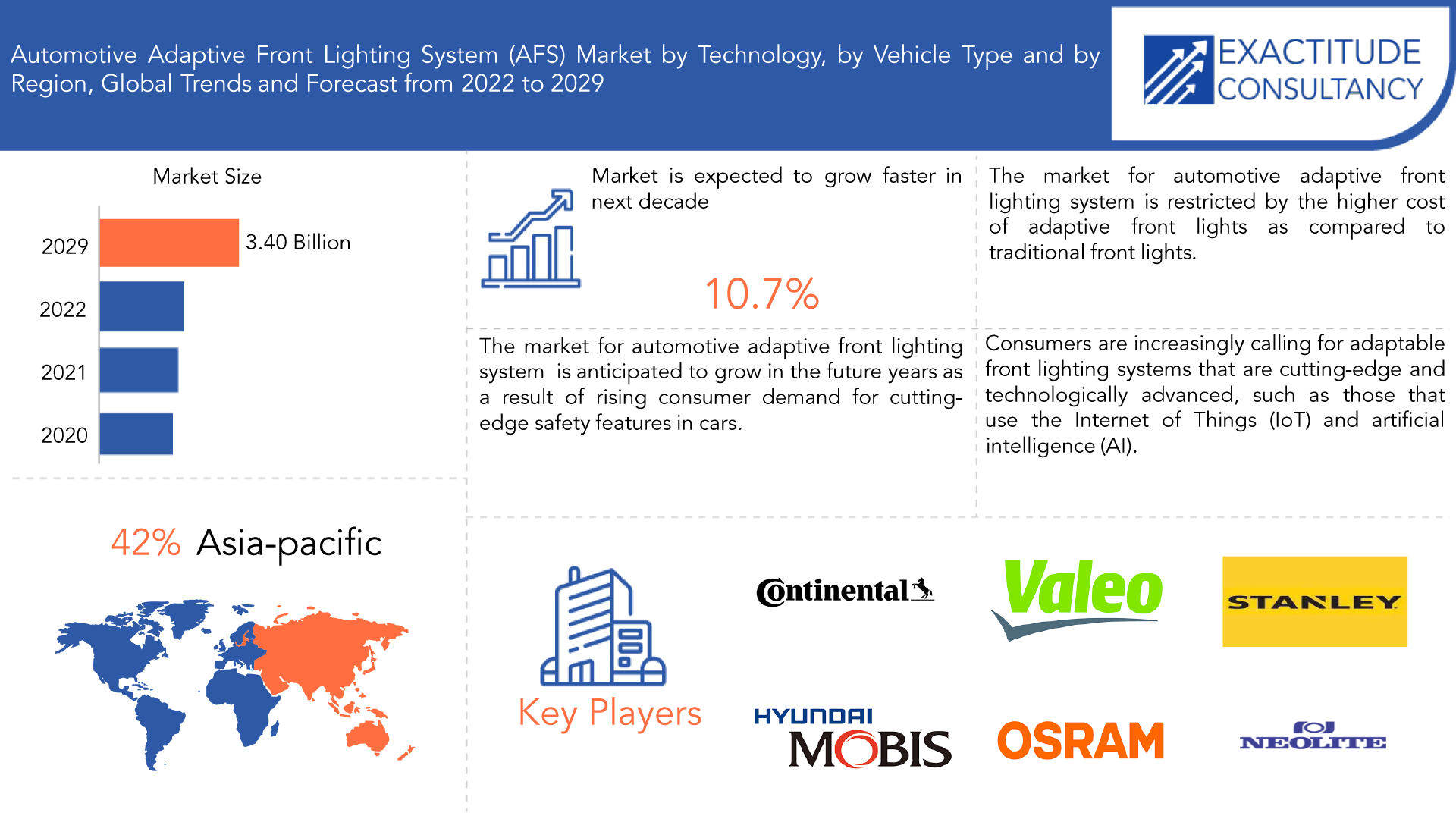

| USD 3.40 billion by 2029 | 10.7% | Asia Pacific |

| By Technology | By Vehicle Type | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Adaptive Front Lighting System (AFS) Market Overview

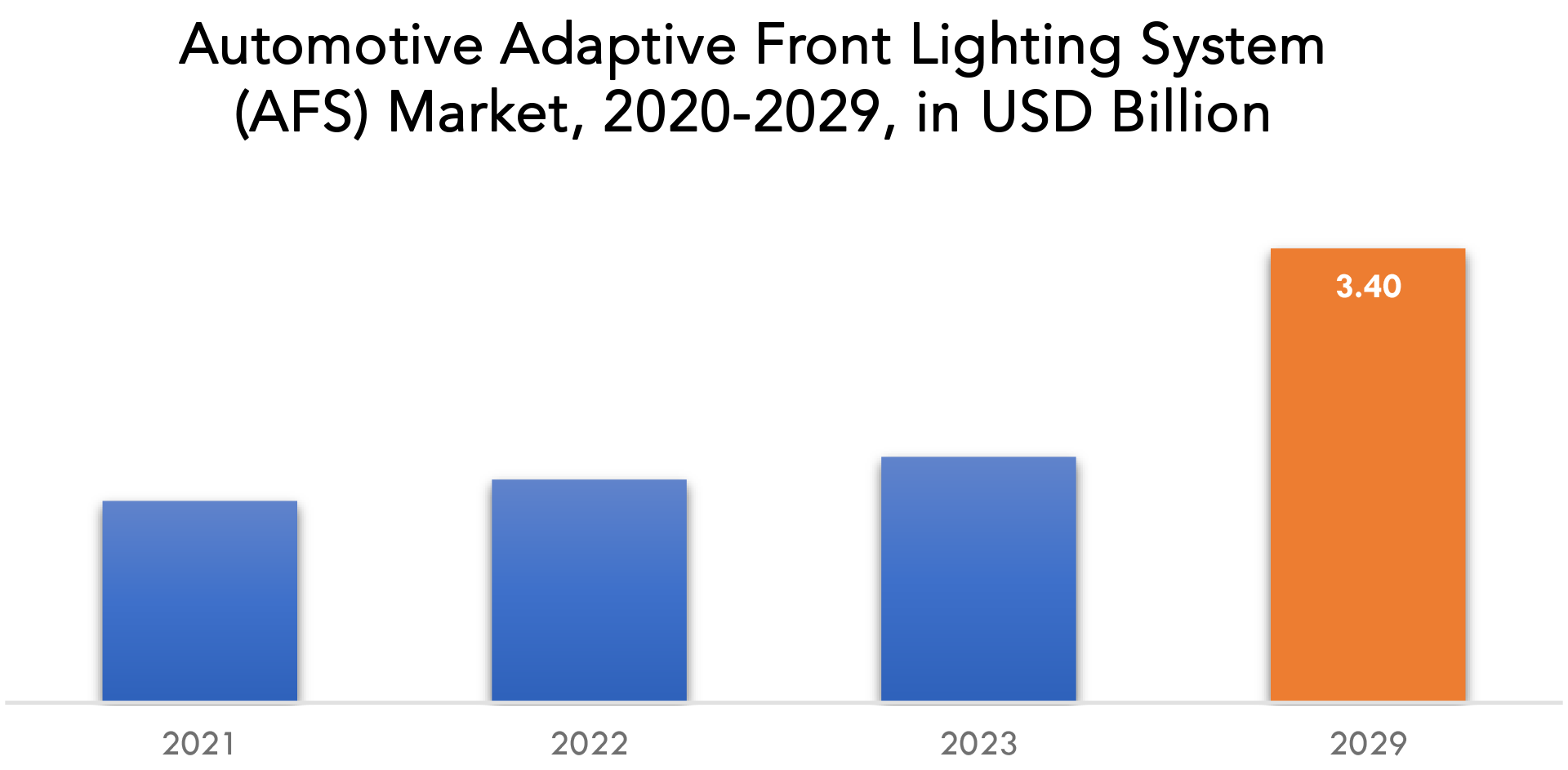

The automotive adaptive front lighting system (AFS) market is expected to grow at 10.7% CAGR from 2022 to 2029. It is expected to reach above USD 3.40 billion by 2029 from USD 1.36 billion in 2020.

In order to improve perceptual safety and reduce driver stress, the automobile adaptive front lighting adjusts the vehicle lights to suit the available light, the state of the road, and the surrounding weather. Furthermore, adaptive headlights are clever headlamps that can automatically change to the driving environment. In order to improve road illumination, active curve lights turn the headlamps into the bend. Moreover, auto adaptive front lighting minimizes the likelihood of traffic accidents by enabling drivers and pedestrians to assess the size, position, and speed of the vehicle in low visibility areas. Automobile adaptive front lighting has a few advantages over conventional lighting systems, including enhanced visibility and dependability, maximum energy efficiency, improved operational efficiency, and upright aesthetics.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Technology, By Vehicle Type, By Region |

| By Technology |

|

| By Vehicle Type |

|

| By Region |

|

Demand for luxury and premium automobiles is rising, awareness of road safety is rising, and government requirements for vehicle safety are becoming stricter, all of which are important drivers of market growth. The cornering light, high beam assist, and low beam assist functional segments make up the car adaptive front lighting market. The adoption of ADAS and growing concern for road safety are factors that support the growth of the global market for vehicle adaptive front lighting. Moreover, the market’s expansion is hampered by expensive and sophisticated configurations, as well as poorly structured aftermarket services in emerging nations. Yet, factors including the increased use of modern technology in vehicles and the rapid uptake of autonomous vehicles offer several prospects for the expansion of the global market over the course of the projection period.

The rapid growth of the global auto industry, an increase in the number of fatal crashes, and strict government laws requiring the installation of these lighting systems in new cars are some of the primary reasons driving the market for automotive adaptive front lighting globally. The market is also growing as a result of rising customer knowledge of technologically sophisticated vehicle systems and rising luxury automobile adoption that includes adaptive lighting as a standard feature. The market participants are predicted to benefit financially from the attractive chances that the rising demand for advanced driver-assistance system (ADAS) features in automobiles would bring about for expanding their client bases and product lines.

Due to commuting limits, logistical difficulties, and supply chain interruptions caused by the COVID-19 pandemic, the market for automobile adaptive front lighting has been significantly impacted. This has caused a delay in product development. Supply chain execution, regulatory and policy changes, reliance on labour, working capital management, and liquidity and solvency management are the main risk considerations for market participants. Due to commuter limitations, a lack of labour, and a shortage of raw materials as a result of supply chain disruption, many manufacturing facilities for intelligent lighting products have been shut down during the epidemic. Global vehicle production and sales activities are directly related to the selling of adaptive front lighting.

Automotive Adaptive Front Lighting System (AFS) Market Segment Analysis

Automotive adaptive front lighting system (AFS) market is segmented based on technology, vehicle type, and region.

Based on technology, a significant portion of the market was made up of xenon. An electric light that creates light by passing electricity through ionized xenon gas at high pressure is called a xenon arc lamp, which is a specific kind of gas discharge lamp. It emits a pure white light that nearly mimics sunlight.

Based on vehicle type, a significant portion of the market was made up of passenger vehicles. The primary driver of automobile adaptive front lighting system growth is the steadily rising output of passenger cars with cutting-edge safety features. Increasing use of commercial vehicles for commuting as a result of the expanding logistics sector, frequent family vacations taken by the passengers, expanding hub-spoke design, and the demand for night driving, together with other factors, are projected to lengthen overall commute times.

Automotive Adaptive Front Lighting System (AFS) Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Continental AG, Hyundai Mobis Co., Ltd, Valeo SA, OSRAM, STANLEY, NEOLITE, Toyota, HELLA, KOITO, Texas Instruments Incorporated

Industry Development:

- On April 2023, New IVECO commercial vehicles will use Continental’s eHorizon platform and HERE data to support compliance with the EU’s Intelligent Speed Assistance requirement and to enable Advanced Driver Assistance Systems functions

- On January 2023, the new, all-electric 2023 Hyundai IONIQ 6 has completed final EPA testing with the IONIQ 6 SE Long Range RWD trim receiving an EPA-estimated range of 361 miles. The IONIQ 6 SE AWD achieved an EPA-estimated range of 316 miles

Who Should Buy? Or Key stakeholders

- Research and Development Institutes

- Regulatory Authorities

- End-use Companies

- Industrial

- Potential Investors

- Automotive Industry

- Others

Automotive Adaptive Front Lighting System (AFS) Market Regional Analysis

The automotive adaptive front lighting system (AFS) market by region includes North America, Asia-Pacific (APAC), Europe, South America, And Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

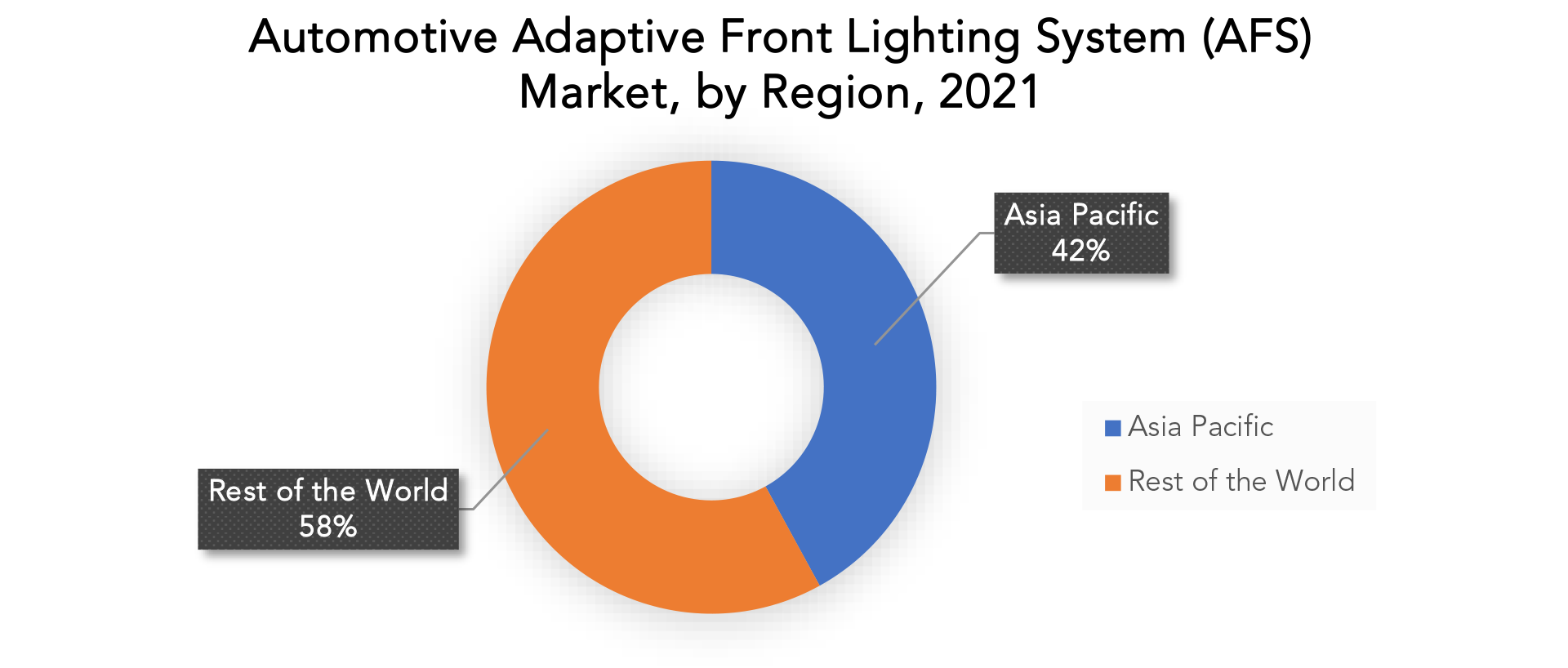

The greatest revenue share in 2021 over 42% was accounted for by Asia Pacific. One of the main driving factors in this region is the rapidly increasing automotive production. The automobile sector has benefited from improvements in living conditions and infrastructure in this area. It is also anticipated that rising rates of vehicle electrification in the Asia Pacific area will favourably affect the market for automotive adaptive front lights. The market for automobile adaptive front lights has been significantly influenced by the affordable labour that is readily available in this area.

The other two top regions are North America and Europe, largely due to the developed automobile sector. The presence of significant manufacturers in this area is another important factor supporting the Automobile Adaptive Front Light market.

Key Market Segments: Automotive Adaptive Front Lighting System (AFS) Market

Automotive Adaptive Front Lighting System (Afs) Market By Technology, 2020-2029, (USD Billion), (Thousand Units)

- Xenon

- Led

- Laser

- Oled

Automotive Adaptive Front Lighting System (Afs) Market By Vehicle Type, 2020-2029, (USD Billion), (Thousand Units)

- Passenger Vehicles

- Commercial Vehicles

Automotive Adaptive Front Lighting System (Afs) Market By Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and Market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the automotive adaptive front lighting system (AFS) market over the next 7 years?

- Who are the major players in the automotive adaptive front lighting system (AFS) market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the automotive adaptive front lighting system (AFS) market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive adaptive front lighting system (AFS) market?

- What is the current and forecasted size and growth rate of the global automotive adaptive front lighting system (AFS) market?

- What are the key drivers of growth in the automotive adaptive front lighting system (AFS) market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the automotive adaptive front lighting system (AFS) market?

- What are the technological advancements and innovations in the automotive adaptive front lighting system (AFS) market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive adaptive front lighting system (AFS) market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive adaptive front lighting system (AFS) market?

- What are the products offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET OUTLOOK

- GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- XENON

- LED

- LASER

- OLED

- GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- PASSENGER VEHICLES

- COMMERCIAL VEHICLES

- GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- CONTINENTAL AG

- HYUNDAI MOBIS CO., LTD

- VALEO SA

- OSRAM

- STANLEY

- NEOLITE

- TOYOTA

- HELLA

- KOITO

- TEXAS INSTRUMENTS INCORPORATED

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 14 US AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 15 US AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 16 US AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 18 CANADA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 20 CANADA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 22 MEXICO AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 24 MEXICO AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 32 BRAZIL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 34 BRAZIL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 36 ARGENTINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 38 ARGENTINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 40 COLOMBIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 42 COLOMBIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 54 INDIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 56 INDIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 58 CHINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 60 CHINA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 62 JAPAN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 64 JAPAN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 82 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 84 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 88 GERMANY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 90 GERMANY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 91 UK AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 92 UK AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 93 UK AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 94 UK AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 96 FRANCE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 98 FRANCE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 100 ITALY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 102 ITALY AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 104 SPAIN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 106 SPAIN AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 108 RUSSIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 110 RUSSIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 122 UAE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 123 UAE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 124 UAE AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY TECHNOLOGY, USD BILLION, 2021

FIGURE 13 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY VEHICLE TYPE INDUSTRY, USD BILLION, 2021

FIGURE 14 GLOBAL AUTOMOTIVE ADAPTIVE FRONT LIGHTING SYSTEM (AFS) MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 17 HYUNDAI MOBIS CO., LTD: COMPANY SNAPSHOT

FIGURE 18 VALEO SA: COMPANY SNAPSHOT

FIGURE 19 OSRAM: COMPANY SNAPSHOT

FIGURE 20 STANLEY: COMPANY SNAPSHOT

FIGURE 21 NEOLITE: COMPANY SNAPSHOT

FIGURE 22 TOYOTA: COMPANY SNAPSHOT

FIGURE 23 HELLA: COMPANY SNAPSHOT

FIGURE 24 KOITO: COMPANY SNAPSHOT

FIGURE 25 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

FAQ

The automotive adaptive front lighting system (AFS) market is expected to grow at 10.7% CAGR from 2022 to 2029. It is expected to reach above USD 3.40 billion by 2029 from USD 1.36 billion in 2020.

Asia Pacific held more than 42% of the automotive adaptive front lighting system (AFS) market revenue share in 2021 and will witness expansion in the forecast period.

Vehicles’ front lighting systems are used to enhance drivers’ field of vision and direct them while driving. For drivers, nighttime visibility on the road is very poor. Owing to reduced vision, drivers are unable to notice curves, corners, bends, slopes, and other roadside obstructions. Road accidents are more likely as a result. The market for adaptive front lighting is anticipated to grow in the future years as a result of rising consumer demand for cutting-edge safety features in cars.

The growing nations of the Asia-Pacific, including China, India, and Japan, are anticipated to see the highest rates of growth during the projection period. The market for automotive adaptive front lighting in this region is anticipated to be driven by rising passenger vehicle production as a result of several reasons, including decreased production costs, increased productivity, and increased safety in vehicle operation.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.