REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

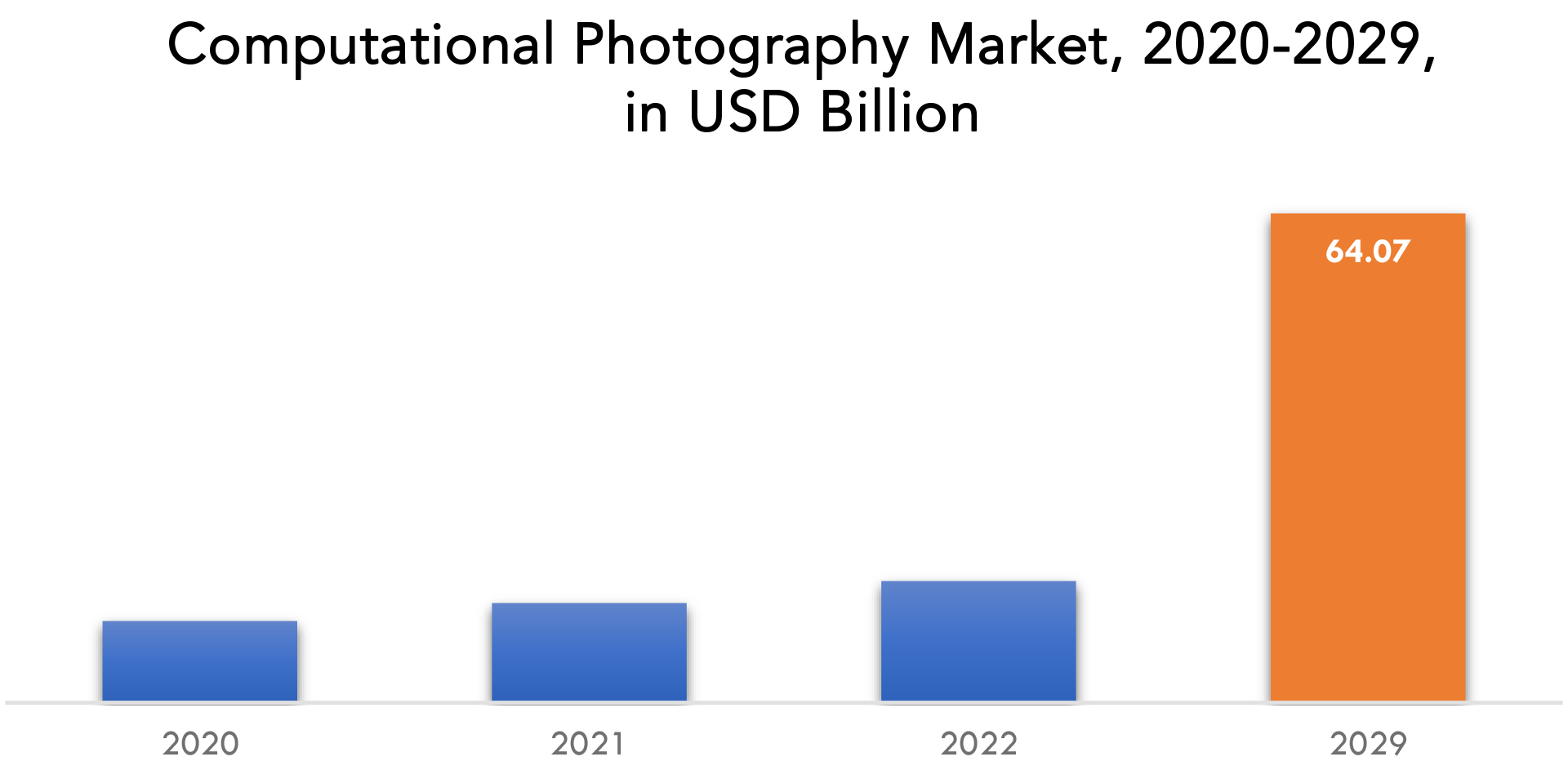

| USD 64.07 billion by 2029. | 22% CAGR | North America |

| by Product | by Type | by Offering | by Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Computational Photography Market Overview

Computational photography market is expected to grow at 22% CAGR from 2022 to 2029. It was valued 10.70 billion at 2020. It is expected to reach above USD 64.07 billion by 2029.

Social networking on a worldwide scale inside the ecosystem of smartphones and multimedia tablets is significantly impacted by the trend of sharing photographs and videos utilizing cutting-edge media sharing technologies. The market is being driven by technological breakthroughs in camera modules, components, and design as well as improvements in sensor picture resolution. Throughout the anticipated period, the growing need for better vision technology in the computer vision sector is anticipated to create new growth opportunities for the industry.

The main driver of the expanding market for computational photography is the combination of increased disposable incomes and quick technological breakthroughs that have produced amazing achievements. All restrictions that people once experienced with conventional photography techniques have been eliminated by the evolution of photography.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Thousand Units) |

| Segmentation | By Product, By Type, By Offering |

| By Product |

|

| By Type |

|

| By Offering |

|

| By Region |

|

In the past, photography simply meant capturing what was visible to the naked eye. Computational photography is the use of advanced hardware, such as high-quality sensors to capture images with high resolution and then process them using a variety of software that applies a variety of algorithms to create an image with high dynamic range and improved picture quality using de-blurring algorithms, tone mapping algorithms, matting algorithms, and many more. The market for computational photography is consequently expected to develop at a healthy double-digit CAGR in the foreseeable future since computational photography has such great growth potential.

The primary reason propelling the growth of the computational photography market is the rising trends of sharing videos and photographs along with the expansion of social media networking. Nowadays, people prefer to maintain a global connection using social media apps like Facebook and WhatsApp. Due to all of this, smartphones now include high-end cameras. Also, the popularity of high-end smartphones with advanced cameras has been encouraged by the global surge in smartphone penetration.

Also, due to the technology’s quick breakthroughs, it has enabled people to record and create high-quality photographs, modify them using a variety of apps, and share them at their convenience. In the near future, it is predicted that the market for computational photography will grow exponentially due to rising disposable incomes and an improved standard of living.

The market for computational photography is expanding quickly due to a number of causes, including technological improvements, an increase in the demand for high-quality photographs, and a rise in the use of smartphones and other mobile devices with sophisticated cameras. Major firms engage in research and development to stay on top of the game in this fiercely competitive market. Additionally, the industry is being further stimulated for innovation and expansion by the growing application of AI and machine learning in computational photography. However, the market also has to deal with issues including the requirement for powerful processing, a lack of standards, and worries about data security and privacy. Overall, the computational photography market offers a dynamic environment with opportunities and challenges that market participants must carefully examine.

Computational Photography Market Segment Analysis

By product the market is segmented into standalone camera, smartphone camera, machine vision. In the global market for computational photography, smartphone cameras were the most popular application sector, accounting for more than 60% of total sales in 2019. Over the past few years, smartphone cameras have greatly improved. Smartphones are getting smarter and better at shooting pictures thanks to technology breakthroughs like AI-based image enhancing tools. In the global market for computational photography, standalone cameras were the second-largest application sector, accounting for more than 30% of total revenue in 2019.

By type the market is segmented into 16-lens cameras, single-and dual-lens cameras. Images from a certain angle are captured using single- or dual-lens cameras. Two or more lenses are used by single- and dual-lens cameras to take pictures. For photographic purposes, such as shooting images of people or things, this kind of camera is frequently utilized.

By offering the market is segmented into software, camera module. In the market for computational photography, software and camera modules are essential for providing cutting-edge imaging capabilities including depth sensing, image stabilization, and low-light performance. Innovation is being fueled by these technologies in sectors including cellphones, automobiles, healthcare, and entertainment.

Computational Photography Market Players

Computational photography market key players include Google, Samsung Electronics, Qualcomm Technologies, Lytro, Nvidia, Canon, Nikon, Sony, On Semiconductors, Pelican Imaging, Almalence, Movidius, Algolux, Corephotonics, Dxo Labs, and Affinity Media.

Industry Developments

October 06, 2022: Google Introduced their new Pixel portfolio of products.

March 21, 2023: Samsung announced ultra-wideband chipset with centimeter-level accuracy for mobile and automotive devices.

Who Should Buy? Or Key stakeholders

- Smartphone manufacturers

- Digital camera manufacturers

- Automotive manufacturers

- Healthcare providers

- Entertainment companies

- Content creator

- Drone manufacturers

- Security and surveillance companies

- Research institutions

- Others

Computational Photography Market Regional Analysis

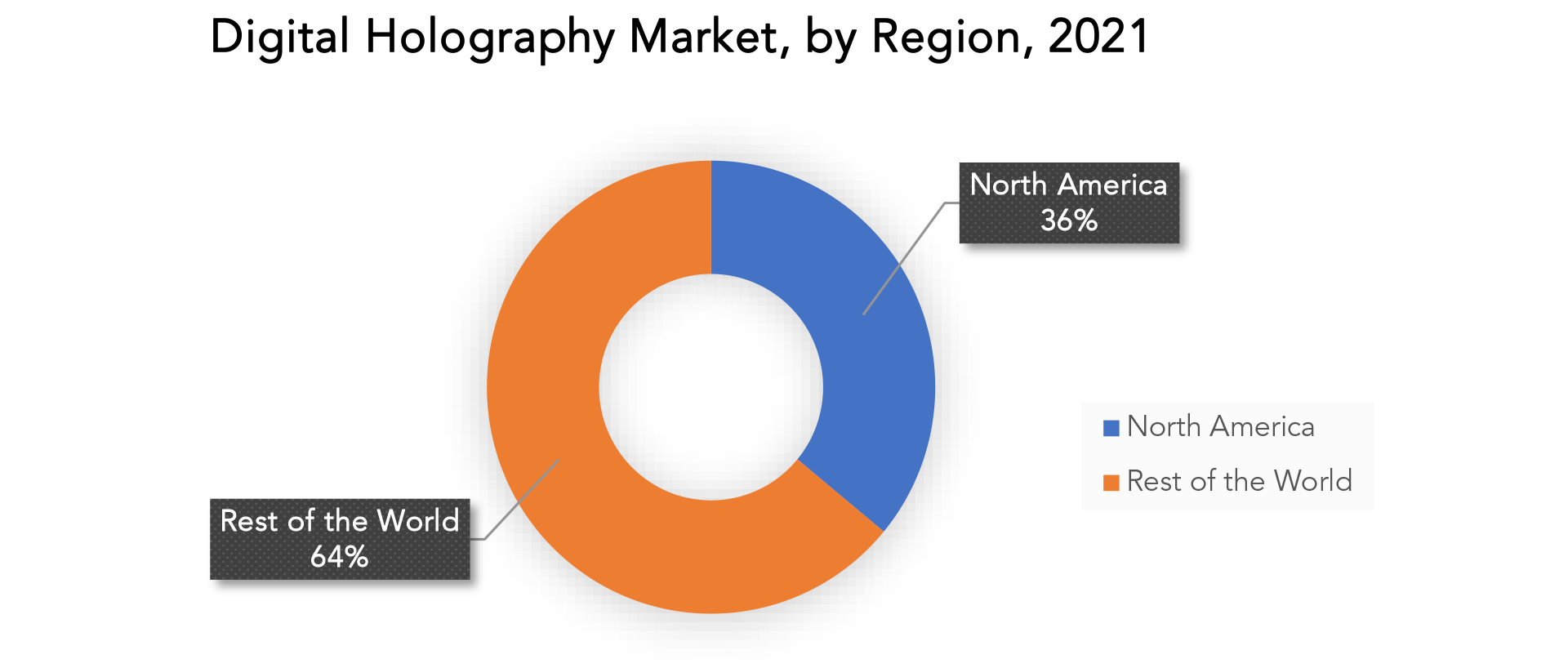

Computational photography market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

-

North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Computational photography has a significant market in North America, which is fueled by the presence of major firms there and the increasing demand for cutting-edge imaging solutions across a range of industries. Leading businesses that are making significant investments in the research and development of computational photography include Apple, Google, Qualcomm, and Intel. Computational photography is increasingly being employed in sectors including entertainment, healthcare, and transportation for functions like virtual reality, autonomous driving, and medical imaging. Consumer demand for high-quality photography solutions is also being fueled by the rising popularity of social media and digital content development. Yet the market also has to contend with concerns like fierce competition, shifting consumer tastes, and regulatory problems.

In the upcoming years, there will likely be a noticeable increase in the market for computational photography in the Asia-Pacific region. The demand for high-quality photos in sectors like healthcare, the automotive industry, and retail, as well as the rising popularity of smartphones and other mobile devices with superior camera features, should be credited for this growth. The region’s sizable and expanding population of tech-savvy consumers is another factor fueling market innovation and expansion. Additionally, it is anticipated that the region will continue to grow and expand as a result of the growing usage of AI and machine learning in computational photography. Overall, the Asia Pacific computational photography market is anticipated to grow significantly and offers industry players a lucrative opportunity.

The market for computational photography in Europe is anticipated to expand dramatically during the next several years. The demand for high-quality photos in sectors like healthcare, automotive, and retail is one of the factors causing this growth. Another is the expanding use of smartphones and other mobile devices with sophisticated camera features. Additionally, the region’s emphasis on research and development, along with the presence of significant market participants, is fostering innovation and expansion. Further growth and market expansion are anticipated to be fueled by the growing usage of AI and machine learning in computational photography. Overall, the market for computational photography in Europe offers lucrative opportunities for firms to capitalize on and is expected to grow rapidly over the next few years.

Key Market Segments: Computational Photography Market

Computational Photography Market by Product, 2020-2029, (USD Billion, Thousand Units)

- Standalone Camera

- Smartphone Camera

- Machine Vision

Computational Photography Market by Type, 2020-2029, (USD Billion, Thousand Units)

- 16-Lens Cameras

- Single-And Dual-Lens Cameras

Computational Photography Market by Offering, 2020-2029, (USD Billion, Thousand Units)

- Software

- Camera Module

Computational Photography Market by Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the expected growth rate of the computational photography market over the next 7 years?

- Who are the major players in the computational photography market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the computational photography market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the computational photography market?

- What is the current and forecasted size and growth rate of the global computational photography market?

- What are the key drivers of growth in the computational photography market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the computational photography market?

- What are the technological advancements and innovations in the computational photography market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the computational photography market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the computational photography market?

- What are the product offerings and specifications of leading players in the market?

What is the pricing trend of computational photography market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON COMPUTATIONAL PHOTOGRAPHY MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET OUTLOOK

- GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION, THOUSAND UNITS), 2020-2029

- STANDALONE CAMERA

- SMARTPHONE CAMERA

- MACHINE VISION

- GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- 16-LENS CAMERAS

- SINGLE-AND DUAL-LENS CAMERAS

- GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION, THOUSAND UNITS), 2020-2029

- SOFTWARE

- CAMERA MODULE

- GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SAMSUNG ELECTRONICS

- QUALCOMM TECHNOLOGIES

- LYTRO

- NVIDIA

- CANON

- NIKON

- SONY

- ON SEMICONDUCTORS

- PELICAN IMAGING

- ALMALENCE

- MOVIDIUS

- ALGOLUX

- COREPHOTONICS

- DXO LABS

- AFFINITY MEDIA

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 2 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 6 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY BY COUNTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 18 US COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 19 US COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 20 US COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 US COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 22 US COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 24 CANADA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 CANADA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 28 CANADA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 30 MEXICO COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 MEXICO COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 34 MEXICO COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 44 BRAZIL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 46 BRAZIL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 48 BRAZIL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 50 ARGENTINA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 52 ARGENTINA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 54 ARGENTINA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 56 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 57 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 58 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 59 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 60 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 61 COLOMBIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 62 REST OF SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 63 REST OF SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 64 REST OF SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 65 REST OF SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 66 REST OF SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 67 REST OF SOUTH AMERICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 68 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 69 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 70 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 71 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 72 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 73 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 74 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 75 ASIA-PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 76 INDIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 77 INDIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 78 INDIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 79 INDIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 80 INDIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 81 INDIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 82 CHINA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 83 CHINA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 84 CHINA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 85 CHINA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 86 CHINA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 87 CHINA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 88 JAPAN COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 89 JAPAN COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 90 JAPAN COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 91 JAPAN COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 92 JAPAN COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 93 JAPAN COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 94 SOUTH KOREA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 95 SOUTH KOREA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 96 SOUTH KOREA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 97 SOUTH KOREA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 98 SOUTH KOREA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 99 SOUTH KOREA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 100 AUSTRALIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 101 AUSTRALIA COMPUTATIONAL PHOTOGRAPHY BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 102 AUSTRALIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 103 AUSTRALIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 104 AUSTRALIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 105 AUSTRALIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 106 SOUTH EAST ASIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD MI LLION), 2020-2029

TABLE 107 SOUTH EAST ASIA COMPUTATIONAL PHOTOGRAPHY BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 108 SOUTH EAST ASIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 109 SOUTH EAST ASIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 110 SOUTH EAST ASIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 111 SOUTH EAST ASIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 112 REST OF ASIA PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 113 REST OF ASIA PACIFIC COMPUTATIONAL PHOTOGRAPHY BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 114 REST OF ASIA PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 115 REST OF ASIA PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 116 REST OF ASIA PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 117 REST OF ASIA PACIFIC COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 118 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 119 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 120 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 121 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 122 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 123 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 124 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 125 EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 126 GERMANY COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 127 GERMANY COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 128 GERMANY COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 129 GERMANY COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 130 GERMANY COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 131 GERMANY COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 132 UK COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 133 UK COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 134 UK COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 135 UK COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 136 UK COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 137 UK COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 138 FRANCE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 139 FRANCE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 140 FRANCE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 141 FRANCE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 142 FRANCE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 143 FRANCE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 144 ITALY COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 145 ITALY COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 146 ITALY COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 147 ITALY COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 148 ITALY COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 149 ITALY COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 150 SPAIN COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 151 SPAIN COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 152 SPAIN COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 153 SPAIN COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 154 SPAIN COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 155 SPAIN COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 156 RUSSIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 157 RUSSIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 158 RUSSIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 159 RUSSIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 160 RUSSIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 161 RUSSIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 162 REST OF EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 163 REST OF EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 164 REST OF EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 165 REST OF EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 166 REST OF EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 167 REST OF EUROPE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 175 MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 176 UAE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 177 UAE COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 178 UAE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 179 UAE COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 180 UAE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 181 UAE COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 182 SAUDI ARABIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 183 SAUDI ARABIA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 184 SAUDI ARABIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 185 SAUDI ARABIA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 186 SAUDI ARABIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 187 SAUDI ARABIA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 188 SOUTH AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 189 SOUTH AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 190 SOUTH AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 191 SOUTH AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 192 SOUTH AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 193 SOUTH AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 199 REST OF MIDDLE EAST AND AFRICA COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING, USD BILLION, 2020-2029

FIGURE 11 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 14 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY OFFERING, USD BILLION, 2021

FIGURE 16 GLOBAL COMPUTATIONAL PHOTOGRAPHY MARKET BY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 GOOGLE: COMPANY SNAPSHOT

FIGURE 19 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 20 QUALCOMM TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 21 LYTRO: COMPANY SNAPSHOT

FIGURE 22 NVIDIA: COMPANY SNAPSHOT

FIGURE 23 CANON: COMPANY SNAPSHOT

FIGURE 24 NIKON: COMPANY SNAPSHOT

FIGURE 25 SONY: COMPANY SNAPSHOT

FIGURE 26 ON SEMICONDUCTORS: COMPANY SNAPSHOT

FIGURE 27 PELICAN IMAGING: COMPANY SNAPSHOT

FIGURE 28 ALMALENCE: COMPANY SNAPSHOT

FIGURE 29 MOVIDIUS: COMPANY SNAPSHOT

FIGURE 30 ALGOLUX: COMPANY SNAPSHOT

FIGURE 31 COREPHOTONICS: COMPANY SNAPSHOT

FIGURE 32 DXO LABS: COMPANY SNAPSHOT

FIGURE 33 AFFINITY MEDIA: COMPANY SNAPSHOT

FAQ

North America held more than 50% of computational photography market revenue share in 2021 and will witness expansion in the forecast period.

Social networking on a worldwide scale inside the ecosystem of smartphones and multimedia tablets is significantly impacted by the trend of sharing photographs and videos utilizing cutting-edge media sharing technologies. The market is being driven by technological breakthroughs in camera modules, components, and design as well as improvements in sensor picture resolution. Throughout the anticipated period, the growing need for better vision technology in the computer vision sector is anticipated to create new growth opportunities for the industry.

In the global market for computational photography, smartphone cameras were the most popular application sector, accounting for more than 60% of total sales in 2019. Over the past few years, smartphone cameras have greatly improved. Smartphones are getting smarter and better at shooting pictures thanks to technology breakthroughs like AI-based image enhancing tools. In the global market for computational photography, standalone cameras were the second-largest application sector, accounting for more than 30% of total revenue in 2019.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.