REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

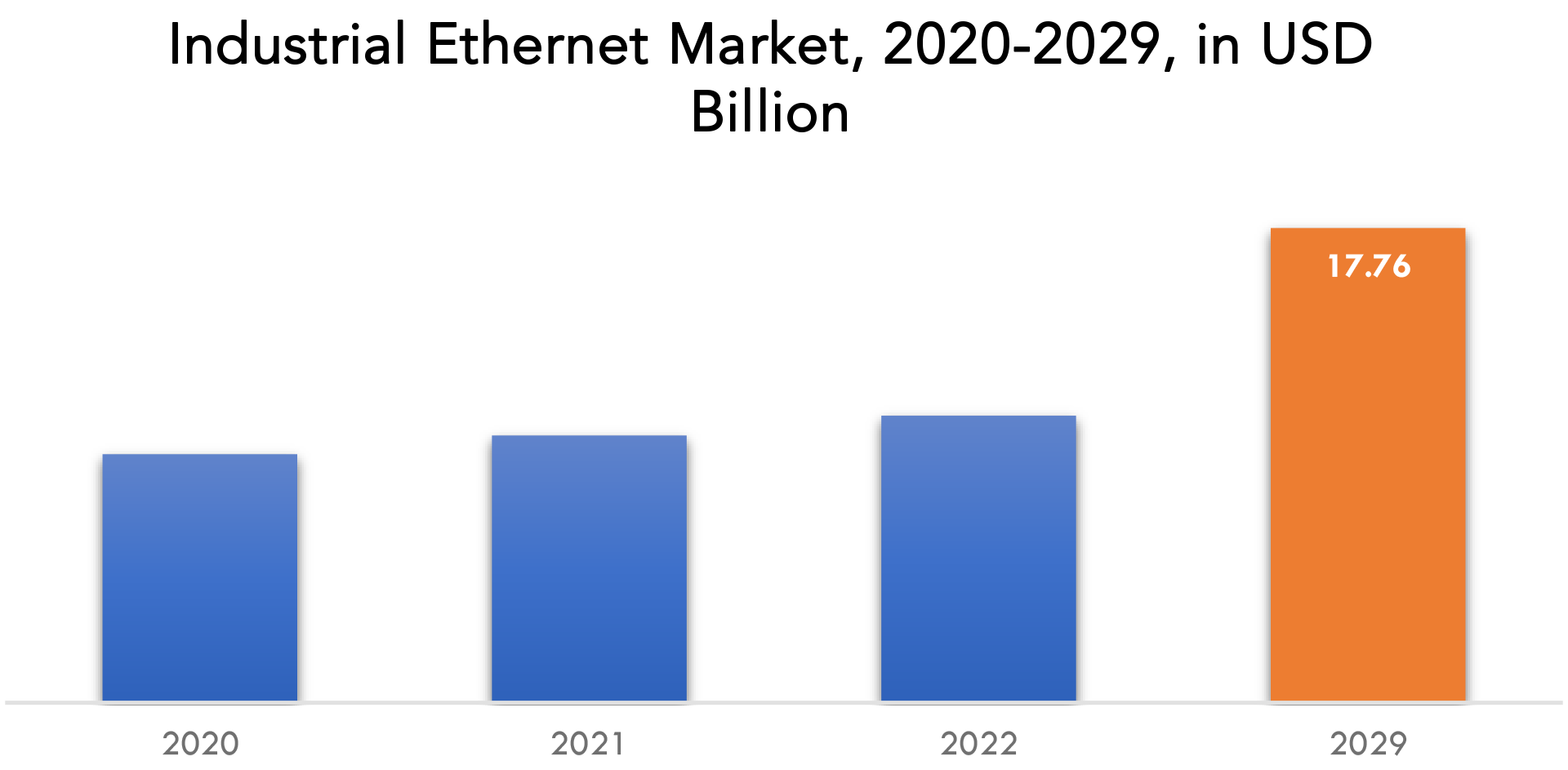

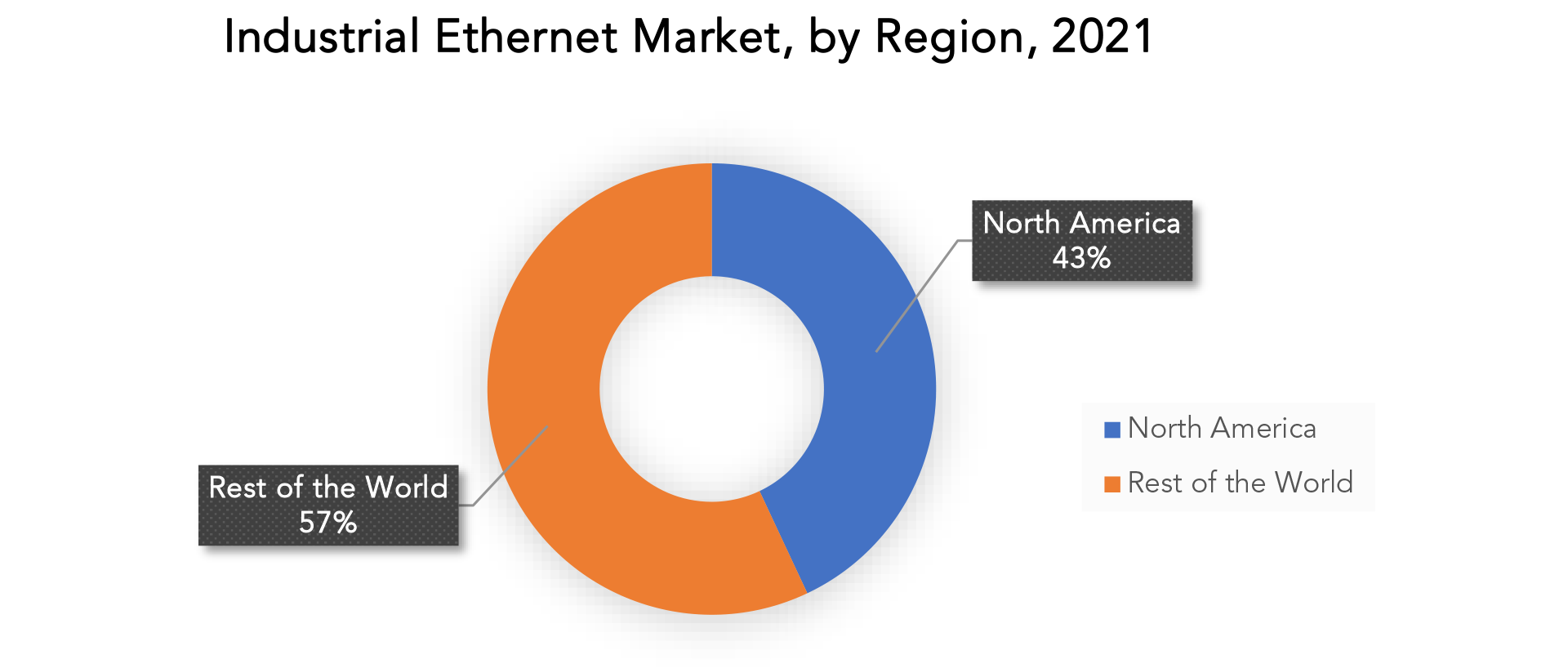

| USD 17.76 Billion by 2029 | 7.45 % CAGR | North America |

| by Offering | by Protocol | by End-Use |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Industrial Ethernet Market Overview

The industrial ethernet market is expected to grow at 7.45 % CAGR from 2022 to 2029. It is expected to reach above USD 17.76 Billion by 2029 from USD 10 Billion in 2021.

Ethernet is a LAN technology that connects network devices (such as computers and printers) via Ethernet switches and routers. Industrial Ethernet is an advanced version of Ethernet that is slightly more complicated. This technology applies Ethernet capabilities to industrial automation and control systems. It has recently surpassed traditional Fieldbus architectures to become the most widely used connection protocol in factories worldwide. In comparison to traditional Ethernet, industrial Ethernet typically employs advanced protocols such as EtherNet/IP, PROFINET, and Modbus TCP, which provide faster speeds, greater reliability, and enhanced security. Industrial Ethernet enables real-time communication between industrial equipment and systems, allowing for more efficient and flexible industrial process operation.

Industrial Ethernet has several advantages over other types of industrial networks, including increased data speed of up to 1 Gbit/s with Gigabit Ethernet, the ability to use standard networking hardware for wired and wireless communication, improved interoperability, and the option to use optical fibre for increased distance, among other benefits. Industrial Ethernet may also refer to the use of standard Ethernet protocols in an industrial setting, such as long-lasting connectors and thermal switches, for automated processes or control systems. Using fiber-optic Ethernet alternatives reduces electrical noise concerns and provides electrical isolation.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Value (Thousand units) |

| Segmentation | By offering, By protocol, By end-use, By Region |

| By offering |

|

| By protocol |

|

| By end-use |

|

| By Region |

|

Market services are recognized as critical when it comes to achieving complete transparency while working within the confines of an industrial plant. These also aid in the introduction and maintenance of efficiency within the plant, as well as the enterprise networks. The core of the Industry 4.0 concept is a dependable platform for communication networks, as the market is heavily reliant on real-time operational needs. As a result, there should be a system that is well-equipped and contains all of the features that aid in the better handling of information in a redundant manner. Furthermore, the networks should be scalable and belong to a piece of wide equipment and operational range for multiple standards with various types of interfaces.

High initial setup costs, implementation complexities, and interoperability issues are major factors limiting overall market revenue growth. Industrial ethernet networks necessitate a significant upfront investment in infrastructure and equipment, which may deter some small and medium-sized businesses from deploying them. Furthermore, the implementation of industrial ethernet networks can be complex and require specialized knowledge and expertise, which can be difficult for businesses lacking the necessary resources.

The Industrial Ethernet Market offers numerous opportunities, including increased demand for advanced communication technology in industrial applications, increased adoption of Industry 4.0, and the requirement for reliable and secure communication in harsh environments. Other possibilities include expanding industrial automation in emerging economies and developing new Industrial Ethernet protocols and solutions.

During the COVID-19 pandemic, ethernet was rapidly implemented in the industrial sector. The virus’s appearance accelerated market dynamics and increased industrial IoT penetration. Similarly, in the post-pandemic era, manufacturing technology has shifted due to the introduction of improved technologies that allow for remote operations. Market acceptance has also grown as a result of the growing popularity of industry 4.0 technologies, which has aided market growth.

Industrial Ethernet Market Segment Analysis

The industrial ethernet market is segmented based on offering, protocol, end-use and region. By offering market is segmented into hardware, software, and services; by protocol market is segmented into PROFINET, EtherNet/ IP, EtherCAT, others; by end-use market is segmented into automotive & transportation, electrical & electronics, aerospace & defense, others.

In 2021, the hardware segment accounted for a significant revenue share. Rapid innovation in hardware products such as industrial switches, routers, and gateways, among others, is a key factor driving this segment’s revenue growth. Increasing demand for industrial ethernet components that provide improved performance in extreme temperatures, excessive humidity, robust vibrations, high dust levels, and other common factory floor conditions is also a major factor driving revenue growth in the segment.

With a revenue share of 26.5% over the forecast period, the EtherNet/IP segment dominates the market. It is one of the most important industrial protocols in the world, and it is widely used in a variety of industries, including factory, hybrid, and process. EtherNet/IP is an industrial network protocol that is based on Ethernet and extends the Common Industrial Protocol (CIP).

Between 2020 and 2029, the automotive and transportation applications will grow rapidly. The use of industrial ethernet for effective control and operation of various mechanical parts in automobiles is becoming more popular as the automotive industry advances. Ethernet solutions are widely used in gearbox sensors, oil tanker sensors, temperature sensors, and anti-brake systems for various cables in sensors that are applicable in a variety of environments and situations, driving up demand for ethernet technology.

Industrial Ethernet Market Players

The industrial ethernet market key players include Siemens, Rockwell Automation, Cisco Systems Inc., Omron Corporation, Dynalog India Ltd., Belden Inc., Huawei Technologies Co., Ltd., Schneider Electric, ABB, Honeywell International Inc., and Others.

Recent Developments:

- 08 March 2023: Rockwell Automation, Inc., the world’s largest company dedicated to industrial automation and digital transformation, announced a strategic investment in READY Robotics, a pioneering company in software-defined automation and a Rockwell Technology Partner.

- 01 March 2023: Rockwell Automation, Inc. (NYSE: ROK), the world’s largest company dedicated to industrial automation and digital transformation, announced that it acquired Knowledge Lens.

Who Should Buy? Or Key stakeholders

- Manufacturers

- Electricals & Electronics

- Traders and distributors

- End-users companies

- Government organizations

- Research organizations

- Investment research firms

- Others

Industrial Ethernet Market Regional Analysis

The industrial ethernet market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico, Rest of North America

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Russia, Spain, and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, Saudi Arabia, South Africa, and Rest of MEA

North America dominates the industrial ethernet market, accounting for 43% of market revenue in 2021. This is due to the rapid increase in industrial automation in the region. The rise of Industry 4.0 is further propelling the regional market. Furthermore, favorable government efforts and legislation encouraging industrial automation and adoption in the manufacturing and automotive industries would benefit the company. Many industrial automation businesses in the region contribute to regional growth as well. As industries invest heavily in automation, Canada’s economy is expected to be the most important industrial ethernet market. Many multinational corporations, including BMW and Mercedes, have manufacturing facilities in North American countries.

During the forecast period, Asia Pacific is expected to grow the fastest. The massive acceptance of industrial ethernet in the consumer electronics and automobile industries in countries such as China, Japan, South Korea, and India is the primary reason for the Asia Pacific industrial ethernet market’s dominance. During the forecast period, China is expected to have the highest CAGR in the Asia Pacific industrial ethernet market. Companies are increasingly adopting advanced automation systems to reduce production costs as labor costs in China rise year after year. Companies have implemented factory automation due to the high-quality standards, which necessitates a robust industrial communication network. These factors are expected to boost the growth of China’s industrial ethernet market during the forecast period.

Key Market Segments: Industrial Ethernet Market

Industrial Ethernet Market by Offering, 2020-2029, (USD Billion, Thousand Units)

- Hardware

- Software

- Services

Industrial Ethernet Market by Protocol, 2020-2029, (USD Billion, Thousand Units)

- PROFINET

- Ethernet/ IP

- EtherCAT

- Others

Industrial Ethernet Market by End-Use, 2020-2029, (USD Billion, Thousand Units)

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defense

- Others

Industrial Ethernet Market by Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

IMPORTANT COUNTRIES IN ALL REGIONS ARE COVERED.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the industrial ethernet market over the next 7 years?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the industrial ethernet market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the industrial ethernet market?

- What is the current and forecasted size and growth rate of the global industrial ethernet market?

- What are the key drivers of growth in the industrial ethernet market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the industrial ethernet market?

- What are the technological advancements and innovations in the industrial ethernet market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the industrial ethernet market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the industrial ethernet market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of industrial ethernet in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL INDUSTRIAL ETHERNET MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON INDUSTRIAL ETHERNET MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL INDUSTRIAL ETHERNET MARKET OUTLOOK

- GLOBAL INDUSTRIAL ETHERNET MARKET BY OFFERING(USD BILLION, THOUSAND UNITS), 2020-2029

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION, THOUSAND UNITS),2020-2029

- PROFINET

- ETHERNET/ IP

- ETHERCAT

- OTHERS

- GLOBAL INDUSTRIAL ETHERNET MARKET BY END-USE (USD BILLION, THOUSAND UNITS),2020-2029

- AUTOMOTIVE & TRANSPORTATION

- ELECTRICAL & ELECTRONICS

- AEROSPACE & DEFENSE

- OTHERS

- GLOBAL INDUSTRIAL ETHERNET MARKET BY REGION (USD BILLION, THOUSAND UNITS),2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SIEMENS

- ROCKWELL AUTOMATION

- CISCO SYSTEMS, INC.

- OMRON CORPORATION

- DYNALOG INDIA LTD.

- BELDEN INC.

- HUAWEI TECHNOLOGIES CO., LTD.

- SCHNEIDER ELECTRIC

- ABB

- HONEYWELL INTERNATIONAL INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 2 GLOBAL INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 4 GLOBAL INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 6 GLOBAL INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL INDUSTRIAL ETHERNET MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL INDUSTRIAL ETHERNET MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 17 US INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 18 US INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 19 US INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 20 US INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 21 US INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 22 US INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA INDUSTRIAL ETHERNET MARKET BY OFFERING (BILLION), 2020-2029

TABLE 24 CANADA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 26 CANADA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 CANADA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 30 MEXICO INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 32 MEXICO INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 MEXICO INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 REST OF NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 36 REST OF NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 37 REST OF NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 38 REST OF NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 39 REST OF NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATIONN (USD BILLION), 2020-2029

TABLE 40 REST OF NORTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATIONN (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 43 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 44 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 45 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 48 SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 49 BRAZIL INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 50 BRAZIL INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 51 BRAZIL INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 52 BRAZIL INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 53 BRAZIL INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 BRAZIL INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 ARGENTINA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 56 ARGENTINA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 57 ARGENTINA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 58 ARGENTINA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 59 ARGENTINA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 ARGENTINA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 COLOMBIA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 62 COLOMBIA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 63 COLOMBIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 64 COLOMBIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 65 COLOMBIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 66 COLOMBIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 68 REST OF SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 69 REST OF SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 70 REST OF SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 71 REST OF SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATIONN (USD BILLION), 2020-2029

TABLE 72 REST OF SOUTH AMERICA INDUSTRIAL ETHERNET MARKET BY APPLICATIONN (THOUSAND UNITS), 2020-2029

TABLE 73 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 74 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 75 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 76 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 77 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 78 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 80 ASIA -PACIFIC INDUSTRIAL ETHERNET MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 81 INDIA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 82 INDIA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 83 INDIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 84 INDIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 85 INDIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 86 INDIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 87 CHINA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 88 CHINA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 89 CHINA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 90 CHINA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 91 CHINA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 92 CHINA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 93 JAPAN INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 94 JAPAN INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 95 JAPAN INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 96 JAPAN INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 97 JAPAN INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 JAPAN INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 SOUTH KOREA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 100 SOUTH KOREA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 101 SOUTH KOREA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 102 SOUTH KOREA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH KOREA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 104 SOUTH KOREA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 105 AUSTRALIA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 106 AUSTRALIA INDUSTRIAL ETHERNET MARKET BY PROTOCOLBY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 107 AUSTRALIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 108 AUSTRALIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 109 AUSTRALIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 AUSTRALIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC INDUSTRIAL ETHERNET MARKET BY PROTOCOLBY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 118 EUROPE INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 120 EUROPE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 122 EUROPE INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 123 EUROPE INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE INDUSTRIAL ETHERNET MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 126 GERMANY INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 128 GERMANY INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 129 GERMANY INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 130 GERMANY INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 131 UK INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 132 UK INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 133 UK INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 134 UK INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 135 UK INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 UK INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 137 FRANCE INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 138 FRANCE INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 140 FRANCE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 141 FRANCE INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 142 FRANCE INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 144 ITALY INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 146 ITALY INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 147 ITALY INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 148 ITALY INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 150 SPAIN INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 152 SPAIN INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 153 SPAIN INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 154 SPAIN INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 156 RUSSIA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 158 RUSSIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 159 RUSSIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 160 RUSSIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF EUROPE INDUSTRIAL ETHERNET MARKET BY APPLICATIONN (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE INDUSTRIAL ETHERNET MARKET BY APPLICATIONN (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 173 MIDDLE EAST ABD AFRICA INDUSTRIAL ETHERNET MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST ABD AFRICA INDUSTRIAL ETHERNET MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 175 UAE INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 176 UAE INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 177 UAE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 178 UAE INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 179 UAE INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 180 UAE INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 185 SAUDI ARABIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 191 SOUTH AFRICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY OFFERING (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY OFFERING (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY PROTOCOL (THOUSAND UNITS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL ETHERNET MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL INDUSTRIAL ETHERNET MARKET BY OFFERING, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 9 GLOBAL INDUSTRIAL ETHERNET MARKET BY FUNCTION, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 10 GLOBAL INDUSTRIAL ETHERNET MARKET BY APPLICATION, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 11 GLOBAL INDUSTRIAL ETHERNET MARKET BY REGION, USD BILLION, THOUSAND UNITS, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL INDUSTRIAL ETHERNET MARKET BY OFFERING, USD BILLION, 2021

FIGURE 14 GLOBAL INDUSTRIAL ETHERNET MARKET BY FUNCTION, USD BILLION, 2021

FIGURE 15 GLOBAL INDUSTRIAL ETHERNET MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL INDUSTRIAL ETHERNET MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 SIEMENS: COMPANY SNAPSHOT

FIGURE 19 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

FIGURE 20 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 21 OMRON CORPORATION: COMPANY SNAPSHOT

FIGURE 22 DYNALOG INDIA LTD.: COMPANY SNAPSHOT

FIGURE 23 BELDEN INC.: COMPANY SNAPSHOT

FIGURE 24 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

FIGURE 25 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

FIGURE 26 ABB: COMPANY SNAPSHOT

FIGURE 27 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FAQ

Industrial ethernet market was valued at USD 10.74 Billion in 2022 and is projected to reach USD 17.76 Billion by 2029, growing at a CAGR of 7.45% from 2022 to 2029.

The growing adoption of the Industrial Internet of Things (IIoT) in the manufacturing and process verticals is one of the major factors accountable for the global industrial Ethernet market growth.

The major players are Siemens, Rockwell Automation, Cisco Systems Inc., Omron Corporation, Dynalog India Ltd., Belden Inc., Huawei Technologies Co., Ltd., Schneider Electric, ABB, Honeywell International Inc.

The global industrial ethernet market is segmented on the basis of offering, protocol, end-use, and geography.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.