REPORT OUTLOOK

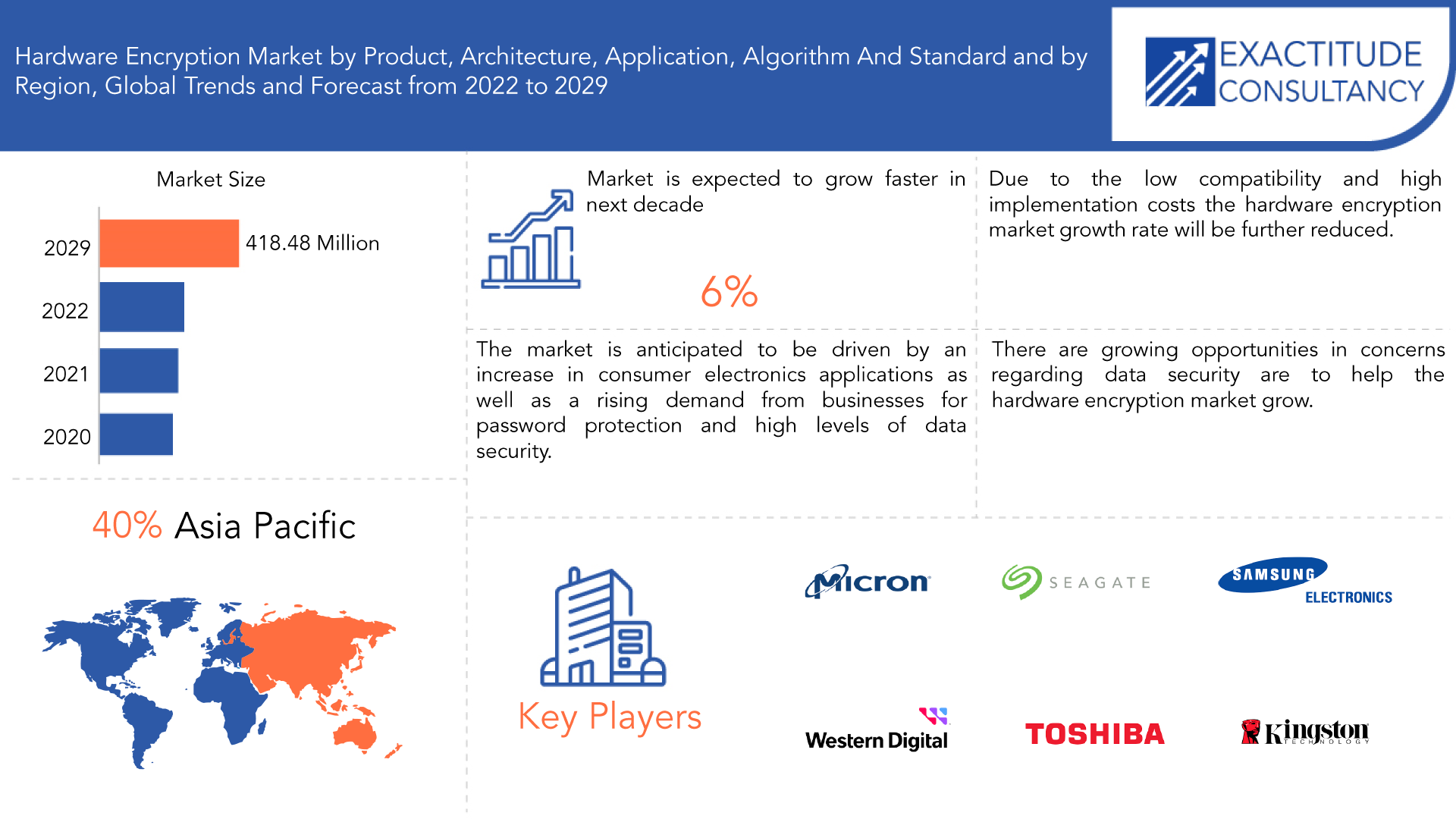

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 418.48 million by 2029 | 6% | Asia Pacific |

| By Product | By Architecture | By Application | By Algorithm And Standard |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Hardware Encryption Market Overview

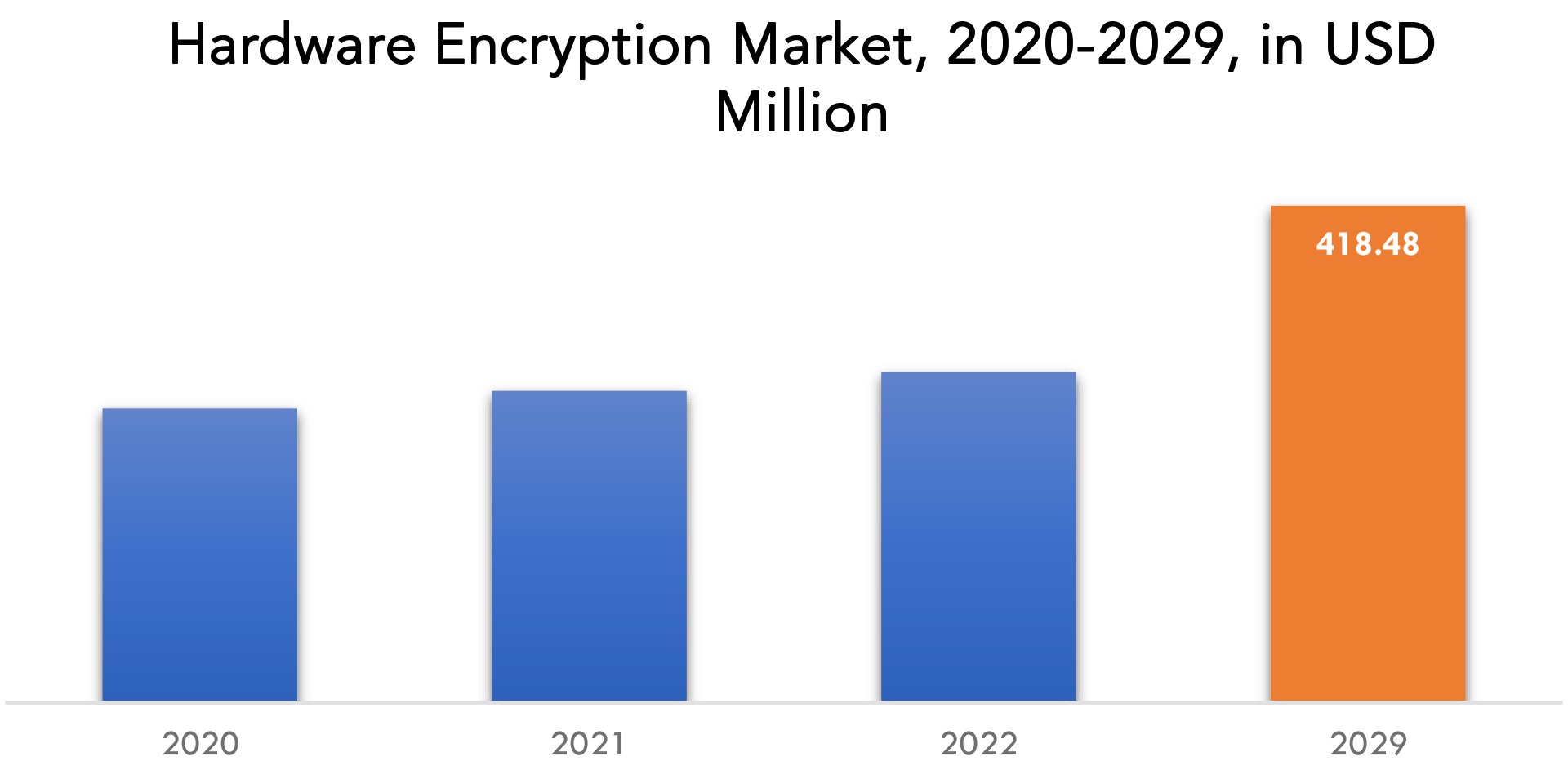

Hardware encryption market is expected to grow at 6% CAGR from 2022 to 2029. It was valued 247.70 million at 2020. It is expected to reach above USD 418.48 million by 2029. The market is anticipated to be driven by an increase in consumer electronics applications as well as a rising demand from businesses for password protection and high levels of data security.

The process of encrypting sensitive data so that only the intended receiver can read it is called encryption. Most encryption is done by hardware or software devices, which use a series of algorithms or mathematical operations to create the ciphertext or encrypted data. An electronic key is required by the recipient of an encrypted message in order to use a similar device to decrypt the data, which subsequently transforms it back into clear text, the original readable form. In order to use this hardware encryption technique, a file must be written to the hard drive and then automatically encrypted by specialized software.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million, Thousand Units) |

| Segmentation | By Product, By Architecture, By Application, By Algorithm And Standard |

| By Product |

|

| By Architecture |

|

| By Application |

|

| By Algorithm And Standard |

|

| By Region |

|

The file is then automatically decrypted by specialized software as it is read from the device, making it comprehensible to the receiver and enabling it to function like any other standard computer. Hardware encryption as a method adds an extra degree of security against hackers and internet threats by preventing data access by unauthorized users. Consumer electronics, healthcare, IT & telecom, and aerospace & defence are the main application sectors for the hardware encryption market globally.

The supply function has aided in the expansion of hardware encryption as hardware-enabled devices are built alongside cellphones, laptops, and computers. Consumer electronics applications are expanding as more products are required to use encryption to store sensitive data. The Hardware Encryption Market is primarily driven by the growing demand for data security. Data breaches are happening more frequently and faster. Large corporations are now able to use the hardware encryption solution. Users can only gain access to hardware encryption with the right security key and password.

Data centres are becoming more and more in demand as hardware encryption technology advances. A significant commercial restraint is the limited availability of reputable data centres in some areas to use this technology. The adoption of hardware encryption by users could be impeded by a decline in the number of data centres. Another difficulty is how long it will take to implement the hardware encryption technology. The switch from software encryption to hardware encryption is gradual. These technical restrictions act as barriers. These limitations can hurt the market during the forecasted time. The absence of standardization is another difficulty the providers encounter.

Hardware Encryption Market Segment Analysis

By product the market is segmented into external hard disk drives, inline network encryptors, internal hard disk drives, solid state drives, USB flash drives. During the projected period, the solid-state drives (SSD) segment is anticipated to increase. The increase of digital content and the rise in data breaches are two variables that are anticipated to fuel market expansion. The demand for solid-state drives is anticipated to be driven by a rise in the uptake of high-end cloud computing, the usage of SSDs in data centres, and the benefits of SSDs over HDDs. With the emergence of new cloud platforms, including personal clouds in homes and classic corporate private and public clouds, the need for solid-state drives is rising quickly. This trend is also anticipated to increase demand for hardware encryption.

By architecture the market is segmented into application specific integrated circuits, field programmable gate arrays. For specialized applications, ASICs provide high performance and low power consumption, while FPGAs offer flexibility for designing and testing new designs. In the upcoming years, both technologies are anticipated to fuel market expansion.

By application the market is segmented into consumer electronics, it & telecom, healthcare, aerospace and defense, transportation, others. The consumer electronics sector was in the lead in 2021, and it is anticipated that it would remain in the lead throughout the forecast period. Consumer demand for new features to adjust to shifting reality is driving the consumer electronics industry’s rapid evolution. The hardware encryption technology advances along with the increase in the demand for data centres. The hardware-enabled devices were used in the assembly line manufacturing of smartphones, laptops, and computers. The growth of hardware encryption has been aided by the supply function of hardware devices. The demand for hardware encryption consumer electronics applications is anticipated to rise as encryption for the storage of secret data becomes required.

By algorithm and standard the market is segmented into rivest-shamir-adleman, advanced encryption standard, secure hash algorithm, digital signature algorithm, data encryption standard, elliptic curve cryptography. These are the main cryptographic technologies used in e-commerce, cloud computing, and cybersecurity applications. The market for these technologies is anticipated to develop as a result of the rising demand for data security and privacy and the evolution of digital technologies. The market growth for these cryptographic technologies is also anticipated to be further boosted by the growing implementation of blockchain and Internet of Things (IoT) technologies.

Hardware Encryption Market Key Players

Hardware encryption market key players include Micron Technology Inc., Seagate Technology PLC, Kingston Technology Corp., Samsung Electronics, Toshiba Corporation, Western Digital Corporation, Kanguru Solutions, Maxim Integrated Products, Inc., NetApp, Win Magic Inc., Thales e-security, Gemalto NV., IBM Corporation, McAfee, LLC.

Industry Developments:

January 09, 2023: Micron Technology, Inc. announced the Micron 9400 NVMe™ SSD is in volume production and immediately available from channel partners and to global OEM customers for use in servers requiring the highest levels of storage performance.

October 12, 2022: Seagate® Technology Holdings plc announced the launch of Lyve™ Cloud Analytics platform, a complete cloud-based analytics solution that includes storage, compute, and analytics, to help Lyve Cloud customers lower the total cost of ownership (TCO) and accelerate time to value with their DataOps and MLOps (machine learning operations).

Who Should Buy? Or Key stakeholders

- Working professionals

- Gamers

- Fitness enthusiast

- Travelers

- Environmentalists

- Small business owners

- Manufacturing companies

- Retailers

- Government agencies

- Investors

- Others

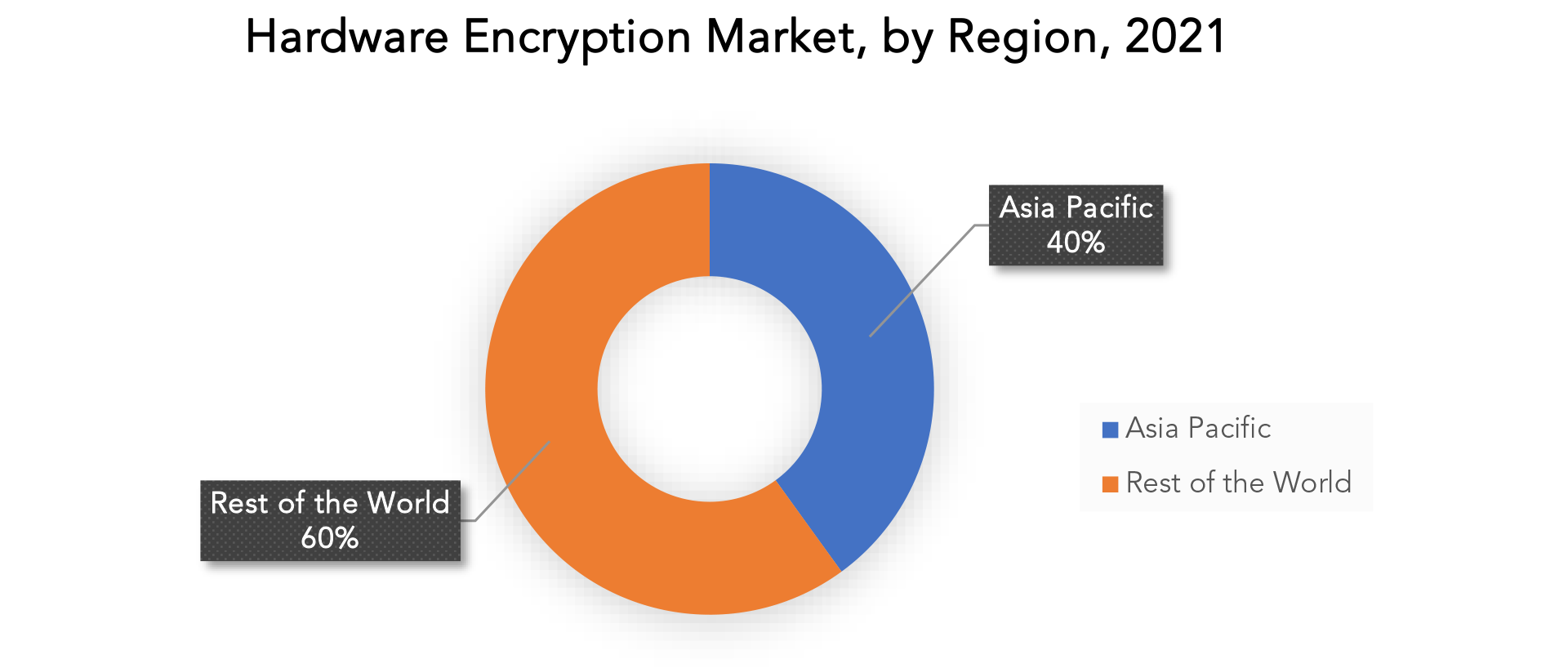

Hardware Encryption Market Regional Analysis

Hardware encryption market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Based on forecasts, the Asia-Pacific region will dominate the industry. Some of the key drivers of the market growth include the existence of well-established hardware encryption manufacturing companies, the sheer volume of automation projects, smart city projects, high defence spending, cutting-edge healthcare facilities, connected living environments, and growing reliance on e-commerce. Growth in the regional market is anticipated to be fueled by the expansion of the IT and telecommunications networks in developing nations like China, Thailand, Malaysia, South Korea, and India as well as the widespread use of smartphones and consumer electronics. Because of the enormous population in emerging countries, the Asia-Pacific area is one of the regions that consumes the most consumer electronics items.

Key Market Segments: Hardware Encryption Market

Hardware Encryption Market By Product, 2020-2029, (USD Million, Thousand Units)

- External Hard Disk Drives

- Inline Network Encryptors

- Internal Hard Disk Drives

- Solid State Drives

- USB Flash Drives

Hardware Encryption Market By Architecture, 2020-2029, (USD Million, Thousand Units)

- Application Specific Integrated Circuits (ASIC)

- Field Programmable Gate Arrays (FPGA)

Hardware Encryption Market By Application, 2020-2029, (USD Million, Thousand Units)

- Consumer Electronics

- It & Telecom

- Healthcare

- Aerospace And Defense

- Transportation

- Others

Hardware Encryption Market By Algorithm And Standard, 2020-2029, (USD Million, Thousand Units)

- Rivest-Shamir-Adleman (RSA)

- Advanced Encryption Standard (AES)

- Secure Hash Algorithm (SHA)

- Digital Signature Algorithm (DSA)

- Data Encryption Standard (DES)

- Elliptic Curve Cryptography (ECC)

Hardware Encryption Market By Region, 2020-2029, (USD Million, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the hardware encryption market over the next 7 years?

- Who are the major players in the hardware encryption market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the hardware encryption market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the hardware encryption market?

- What is the current and forecasted size and growth rate of the global hardware encryption market?

- What are the key drivers of growth in the hardware encryption market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the hardware encryption market?

- What are the technological advancements and innovations in the hardware encryption market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the hardware encryption market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the hardware encryption market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of hardware encryption market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL HARDWARE ENCRYPTION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON HARDWARE ENCRYPTION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL HARDWARE ENCRYPTION MARKET OUTLOOK

- GLOBAL HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION, THOUSAND UNITS), 2020-2029

- EXTERNAL HARD DISK DRIVES

- INLINE NETWORK ENCRYPTORS

- INTERNAL HARD DISK DRIVES

- SOLID STATE DRIVES

- USB FLASH DRIVES

- GLOBAL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION, THOUSAND UNITS), 2020-2029

- APPLICATION SPECIFIC INTEGRATED CIRCUITS (ASIC)

- FIELD PROGRAMMABLE GATE ARRAYS (FPGA)

- GLOBAL HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION, THOUSAND UNITS), 2020-2029

- CONSUMER ELECTRONICS

- IT & TELECOM

- HEALTHCARE

- AEROSPACE AND DEFENSE

- TRANSPORTATION

- OTHERS

- GLOBAL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION, THOUSAND UNITS), 2020-2029

- RIVEST-SHAMIR-ADLEMAN (RSA)

- ADVANCED ENCRYPTION STANDARD (AES)

- SECURE HASH ALGORITHM (SHA)

- DIGITAL SIGNATURE ALGORITHM (DSA)

- DATA ENCRYPTION STANDARD (DES)

- ELLIPTIC CURVE CRYPTOGRAPHY (ECC)

- GLOBAL HARDWARE ENCRYPTION MARKET BY REGION (USD MILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- MICRON TECHNOLOGY INC.

- SEAGATE TECHNOLOGY PLC

- KINGSTON TECHNOLOGY CORP.

- SAMSUNG ELECTRONICS

- TOSHIBA CORPORATION

- WESTERN DIGITAL CORPORATION

- KANGURU SOLUTIONS

- MAXIM INTEGRATED PRODUCTS, INC.

- NETAPP

- WIN MAGIC INC.

- THALES E-SECURITY

- GEMALTO NV.

- IBM CORPORATION

- MCAFEE, LLC

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 2 GLOBAL HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 4 GLOBAL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 6 GLOBAL HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 8 GLOBAL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL HARDWARE ENCRYPTION MARKET BY REGION (USD MILLION) 2020-2029

TABLE 10 GLOBAL HARDWARE ENCRYPTION MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 12 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 14 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 16 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 18 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 20 NORTH AMERICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 21 US HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 22 US HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 23 US HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 24 US HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 25 US HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 26 US HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 US HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 28 US HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 30 CANADA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 32 CANADA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 34 CANADA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 36 CANADA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 38 MEXICO HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 40 MEXICO HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 42 MEXICO HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 44 MEXICO HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 46 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 48 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 50 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 52 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 54 SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 56 BRAZIL HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 58 BRAZIL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 60 BRAZIL HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 62 BRAZIL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 64 ARGENTINA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 66 ARGENTINA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 68 ARGENTINA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 70 ARGENTINA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 72 COLOMBIA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 74 COLOMBIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 76 COLOMBIA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 78 COLOMBIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 88 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 90 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 92 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 94 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 96 ASIA-PACIFIC HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 98 INDIA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 100 INDIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 102 INDIA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 104 INDIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 106 CHINA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 108 CHINA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 110 CHINA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 112 CHINA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 114 JAPAN HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 116 JAPAN HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 118 JAPAN HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 120 JAPAN HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 122 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 124 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 126 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 128 SOUTH KOREA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 130 AUSTRALIA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 132 AUSTRALIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 134 AUSTRALIA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 136 AUSTRALIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE HARDWARE ENCRYPTION MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 154 EUROPE HARDWARE ENCRYPTION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 156 EUROPE HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 158 EUROPE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 160 EUROPE HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 162 EUROPE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 164 GERMANY HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 166 GERMANY HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 168 GERMANY HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 170 GERMANY HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 171 UK HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 172 UK HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 173 UK HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 174 UK HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 175 UK HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 176 UK HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 177 UK HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 178 UK HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 180 FRANCE HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 182 FRANCE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 184 FRANCE HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 186 FRANCE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 188 ITALY HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 190 ITALY HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 192 ITALY HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 194 ITALY HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 196 SPAIN HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 198 SPAIN HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 200 SPAIN HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 202 SPAIN HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 204 RUSSIA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 206 RUSSIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 208 RUSSIA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 210 RUSSIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 212 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 214 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 216 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 218 REST OF EUROPE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 229 UAE HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 230 UAE HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 231 UAE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 232 UAE HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 233 UAE HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 234 UAE HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 235 UAE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 236 UAE HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 238 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 240 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 242 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 244 SAUDI ARABIA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 246 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 248 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 250 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 252 SOUTH AFRICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY PRODUCT (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (USD MILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ARCHITECTURE (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (USD MILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HARDWARE ENCRYPTION MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL HARDWARE ENCRYPTION MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD, USD MILLION, 2020-2029

FIGURE 12 GLOBAL HARDWARE ENCRYPTION MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL HARDWARE ENCRYPTION MARKET BY PRODUCT, USD MILLION, 2021

FIGURE 15 GLOBAL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE, USD MILLION, 2021

FIGURE 16 GLOBAL HARDWARE ENCRYPTION MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 17 GLOBAL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD, USD MILLION, 2021

FIGURE 18 GLOBAL HARDWARE ENCRYPTION MARKET BY REGION, USD MILLION, 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 MICRON TECHNOLOGY INC: COMPANY SNAPSHOT

FIGURE 21 SEAGATE TECHNOLOGY PLC: COMPANY SNAPSHOT

FIGURE 22 KINGSTON TECHNOLOGY CORP: COMPANY SNAPSHOT

FIGURE 23 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 24 TOSHIBA CORPORATION: COMPANY SNAPSHOT

FIGURE 25 WESTERN DIGITAL CORPORATION: COMPANY SNAPSHOT

FIGURE 26 KANGURU SOLUTIONS: COMPANY SNAPSHOT

FIGURE 27 MAXIM INTEGRATED PRODUCTS, INC: COMPANY SNAPSHOT

FIGURE 28 NETAPP: COMPANY SNAPSHOT

FIGURE 29 WIN MAGIC INC: COMPANY SNAPSHOT

FIGURE 30 THALES E-SECURITY: COMPANY SNAPSHOT

FIGURE 31 GEMALTO NV: COMPANY SNAPSHOT

FIGURE 32 IBM CORPORATION: COMPANY SNAPSHOT

FIGURE 33 MCAFEE, LLC: COMPANY SNAPSHOT

FAQ

Hardware encryption market is expected to grow at 6% CAGR from 2022 to 2029. it is expected to reach above USD 418.48 million by 2029

Asia Pacific held more than 40% of hardware encryption market revenue share in 2021 and will witness expansion in the forecast period.

The market is anticipated to be driven by an increase in consumer electronics applications as well as a rising demand from businesses for password protection and high levels of data security.

During the projected period, the solid-state drives (SSD) segment is anticipated to increase. The increase of digital content and the rise in data breaches are two variables that are anticipated to fuel market expansion. The demand for solid-state drives is anticipated to be driven by a rise in the uptake of high-end cloud computing, the usage of SSDs in data centres, and the benefits of SSDs over HDDs. With the emergence of new cloud platforms, including personal clouds in homes and classic corporate private and public clouds, the need for solid-state drives is rising quickly.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.