Report Outlook

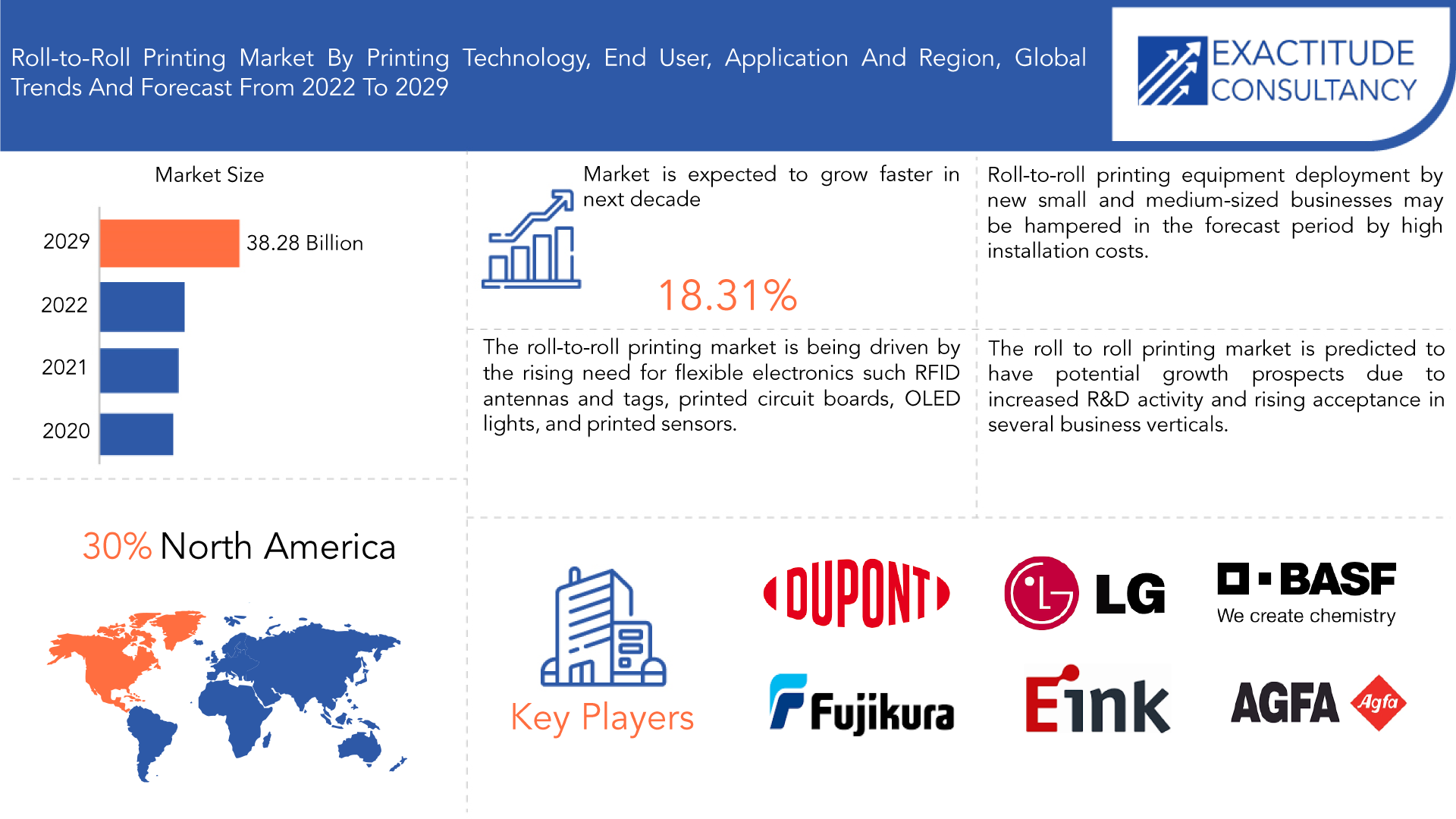

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 38.28 billion by 2029 | 18.31% | North America |

| By Printing Technology | By End User | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Global Roll-to-Roll Printing Market Overview

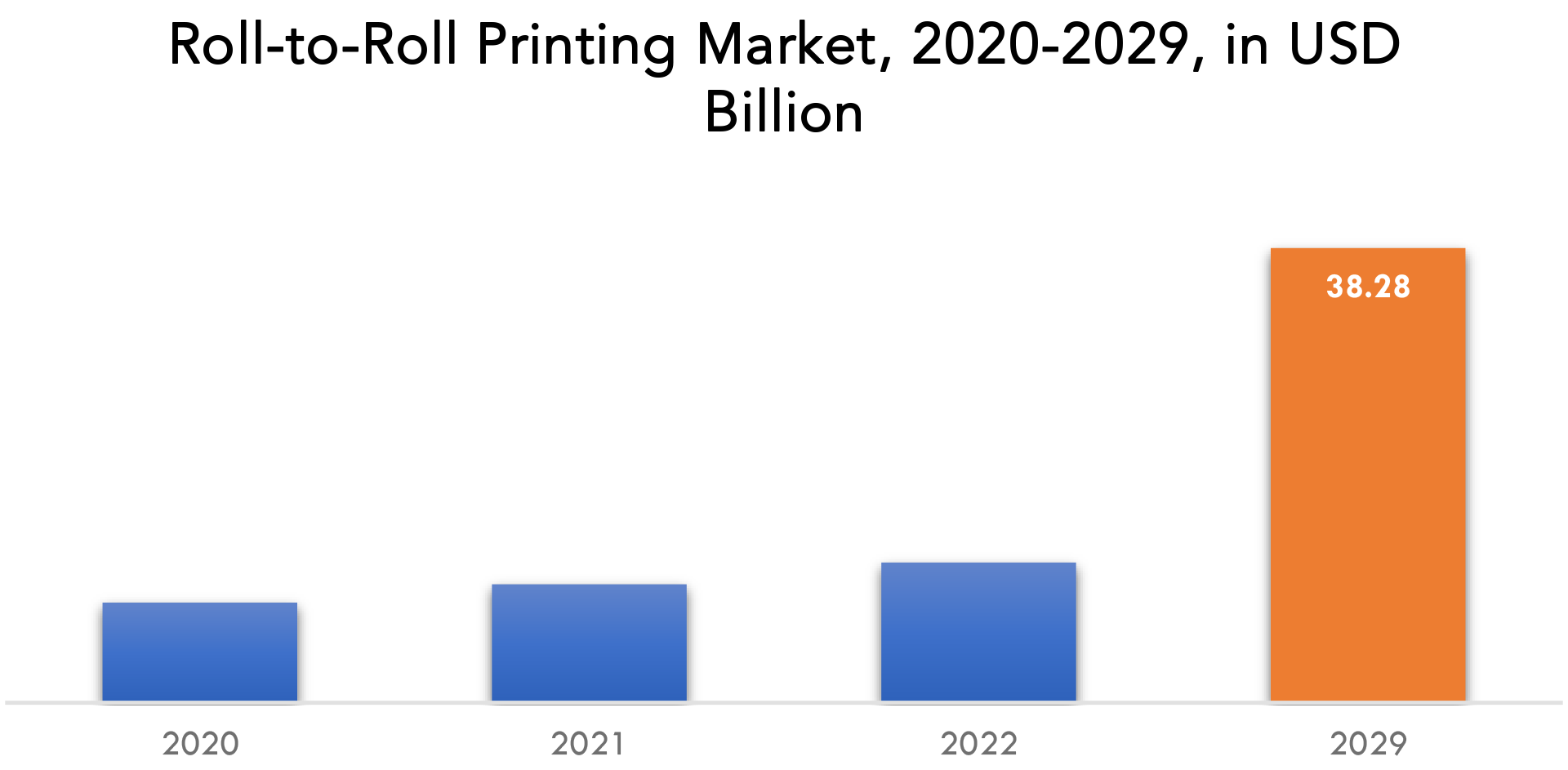

The global roll-to-roll printing market size is expected to grow at more than 18.31% CAGR from 2020 to 2029. It is expected to reach above USD 38.28 billion by 2029 from a little above USD 8.43 billion in 2020.

A continuous roll of substrate material is fed through a printer during roll-to-roll printing, which is essentially a web-fed printing technology. The substrate, which is becoming increasingly used in a variety of industries, including healthcare, consumer electronics, retail, and packaging, is often rolled into giant spools or cores and is composed of a variety of materials, including paper, plastic film, metal foil, and fabric.

Roll to roll printing technology is radically changing the manufacturing paradigm and assisting in overcoming the constraints of earlier technologies through decreased processing time, resource savings, and increased industrial production efficiency. It can be used to make a variety of things, including flexible circuits, membrane switch assemblies, RFID antennae, and other electrical components. One of the major reasons expected to propel the growth of the global roll to roll printing market is the rising need for flexible devices such as RFID antennas & tags, printed circuits, OLED lights, and printed sensors across the globe. In the upcoming years, it is anticipated that the rise of the manufacturing process would accelerate the growth of the total market. Roll-to-roll printing can be used to create flexible electronics, which are revolutionizing several businesses and opening up a ton of opportunities for the auto industry. As cars continue to get smarter and more electronically advanced, new challenges are faced throughout the production process. Additionally, during the forecast period, factors including rising purchasing power and booming industrialization would hasten the rise of the market as a whole. The market is anticipated to benefit from elements like consumer choice considerations, rising safety regulations, and the demand for more rapid and effective ways to produce these flexible electronics.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Printing Technology, By End User, By Application, By Region |

| By Printing Technology |

|

| By End User |

|

| By Application |

|

| By Region |

|

Additionally, it costs lot of money to deploy new roll-to-roll printing technology. The fact that many small and medium-sized firms are reluctant to use roll to roll printers owing to a lack of capital is one of the major barriers preventing the market’s development.

According to estimates, the market will see beneficial possibilities as a result of the integration of flexible batteries for roll-to-roll printing, further accelerating the market’s rate of expansion. Additionally, the introduction of Industry 4.0 and other technologies presents a number of additional industry expansion potential. The elements pushing digitalization include new IoT-enabled devices, as well as developments in AI, cloud computing, and web 3.0.

The COVID-19 outbreak had a significant impact on the roll-to-roll printing industry. Although there has been a worldwide decline in the number of new projects, roll-to-roll printing is still in high demand. Companies all around the world have struggled to develop and assemble new equipment since workers have stayed at home, and even the items that are already in different warehouses can’t be transferred due to current standards and regulations. This has disrupted global supply chains. Only the manufacturing and supply chain are affected by COVID-19 temporarily in the roll-to-roll printing industry. Once things start to look up, so will production, supply networks, and demand for these products.

Global Roll-to-Roll Printing Market Segment Analysis

Based on the printing technology, market is segmented into flexography, inkjet printing, gravure printing, screen printing. The roll-to-roll printing industry’s inkjet segment holds the biggest market share. A variety of substrates, including paper, plastic films, fabrics, and metal foils, can be printed on using the non-contact printing technique known as inkjet printing. The technique supports a wide range of applications, including packaging, labels, textiles, and ornamental laminates. It also delivers high printing speeds, great resolution, and minimal material waste.

Based on the end user, market is segmented into manufacturing, automotive, food & beverages, healthcare, retail and aerospace & defense. Due to their lightweight, low complexity, and high reliability characteristics, printed electronics are widely used in the aerospace and defense sectors of the economy. This is due to the fact that they require less maintenance. Furthermore, roll to roll printed electronics technology minimizes wiring in a variety of aircraft systems, such as in-flight entertainment systems and structural health monitoring systems.

By application, market is segmented into packaging, textiles and electronics. Roll-to-roll (R2R) printed flexible circuits can minimize the conformability and space limitations of rigid circuits. R2R flexible circuits are used in a variety of industries since they can be bent and twisted and are constructed on flexible substrates, which are becoming more and more important in the design of electronic devices due to space restrictions. Electronic device manufacturers have been compelled to create tiny devices as a result of the rising demand for these circuits for usage in consumer electronics. The need for underlying R2R printed flexible circuits has consequently surged. R2R printed flexible circuits make it simple to assemble components on flexible substrates for the healthcare end-use market.

Global Roll-to-Roll Printing Market Players

Key competitors from both domestic and international markets compete fiercely in the worldwide global roll-to-roll printing industry include E Ink Holdings Inc., Fujikura Ltd., LG, Multek Corporation, Nippon Mektron Ltd., 3M Company, GSI Technologies LLC, Agfa-Gavaert, BASF, DuPont.

Recent News:

1st June 2022: The Agfa-Gevaert Group announced that it had closed the acquisition of Inca Digital Printers.

23rd September 2020: DuPont Image Solutions introduced Artistri® Xite P2700 inks for roll-to-roll printers.

Who Should Buy? Or Key stakeholders

- OEM

- Electronics Manufacturers

- Manufacturing Companies

- Regulatory Bodies

- Research and Development Organization

- Government

- Others

Global Roll-to-Roll Printing Market Regional Analysis

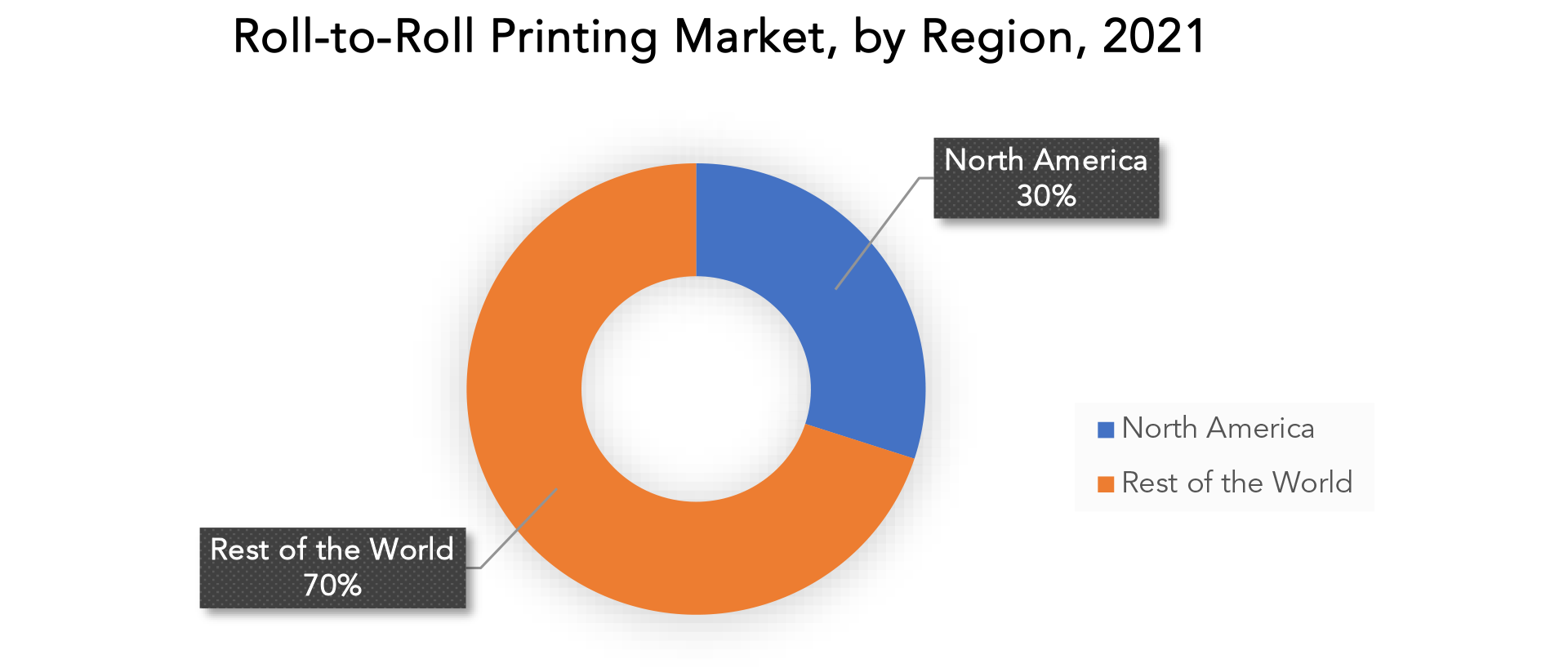

The global roll-to-roll printing market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Due to the increasing use of graphene ink for cost-effective development in the region over the forecast period of 2022 to 2029, North America is expected to lead the roll to roll printing market. Furthermore, it is anticipated that the expansion would pick up speed over the projection period due to the rising need for flexible devices. Due to the region’s extensive production of electronic components, Asia-Pacific is predicted to experience significant growth between 2022 and 2029. Additionally, there are other variables like the expansion of regional investments in printed electronics-related research and development. High electronic component manufacturing rates and investments in printed electronics-related R&D activities are projected to contribute to the market’s growth. One of the main manufacturers of electronics components is the area. The implementation of roll-to-roll printing technology is anticipated to increase in the near future as thin-film PV cell installations rise.

Key Market Segments: Global Roll-to-Roll Printing Market

Global Roll-To-Roll Printing Market By Printing Technology, 2020-2029, (USD Billion)

- Flexography

- Inkjet Printing

- Gravure Printing

- Screen Printing

Global Roll-To-Roll Printing Market By End User, 2020-2029, (USD Billion)

- Manufacturing

- Automotive

- Food & Beverages

- Healthcare

- Retail

- Aerospace & Defense

Global Roll-To-Roll Printing Market By Application, 2020-2029, (USD Billion)

- Packaging

- Textiles

- Electronics

Global Roll-To-Roll Printing Market By Region, 2020-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

IMPORTANT COUNTRIES IN ALL REGIONS ARE COVERED

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new market

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the roll-to-roll printing market over the next 7 years?

- Who are the major players in the roll-to-roll printing market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the roll-to-roll printing market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the roll-to-roll printing market?

- What is the current and forecasted size and growth rate of the global roll-to-roll printing market?

- What are the key drivers of growth in the roll-to-roll printing market?

- What are the distribution channels and supply chain dynamics in the roll-to-roll printing market?

- What are the technological advancements and innovations in the roll-to-roll printing market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the roll-to-roll printing market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the roll-to-roll printing market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of roll-to-roll printing in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ROLL-TO-ROLL PRINTING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ROLL-TO-ROLL PRINTING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ROLL-TO-ROLL PRINTING MARKET OUTLOOK

- GLOBAL ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY, 2020-2029, (USD BILLION)

- FLEXOGRAPHY

- INKJET PRINTING

- GRAVURE PRINTING

- SCREEN PRINTING

- GLOBAL ROLL-TO-ROLL PRINTING MARKET BY END-USER, 2020-2029, (USD BILLION)

- MANUFACTURING

- AUTOMOTIVE

- FOOD & BEVERAGE

- HEALTHCARE

- RETAIL

- AEROSPACE & DEFENSE

- GLOBAL ROLL-TO-ROLL PRINTING MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- PACKAGING

- TEXTILES

- ELECTRONICS

- GLOBAL ROLL-TO-ROLL PRINTING MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- E INK HOLDINGS INC.

- FUJIKURA LTD.

- LG

- MULTEK CORPORATION

- NIPPON MEKTRON LTD.

- 3M COMPANY

- GSI TECHNOLOGIES LLC

- AGFA-GEVAERT

- BASF

- DUPONT*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 2 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 3 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 9 US ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 10 US ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 11 US ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 12 CANADA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 13 CANADA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 14 CANADA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 15 MEXICO ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 16 MEXICO ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 17 MEXICO ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 22 BRAZIL ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 23 BRAZIL ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 24 BRAZIL ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 25 ARGENTINA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 26 ARGENTINA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 27 ARGENTINA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 COLOMBIA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 29 COLOMBIA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 30 COLOMBIA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 ASIA-PACIFIC ROLL-TO-ROLL PRINTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 35 ASIA-PACIFIC ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 36 ASIA-PACIFIC ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 37 ASIA-PACIFIC ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 38 INDIA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 39 INDIA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 40 INDIA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 41 CHINA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 42 CHINA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 43 CHINA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 44 JAPAN ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 45 JAPAN ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 46 JAPAN ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 53 SOUTH-EAST ASIA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 54 SOUTH-EAST ASIA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 55 SOUTH-EAST ASIA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 59 EUROPE ROLL-TO-ROLL PRINTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 60 EUROPE ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 61 EUROPE ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 62 EUROPE ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 63 GERMANY ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 64 GERMANY ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 65 GERMANY ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 UK ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 67 UK ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 68 UK ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 69 FRANCE ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 70 FRANCE ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 71 FRANCE ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ITALY ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 73 ITALY ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ITALY ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 75 SPAIN ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 76 SPAIN ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 77 SPAIN ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 RUSSIA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 79 RUSSIA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 RUSSIA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 88 UAE ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 89 UAE ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 90 UAE ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY (USD BILLION) 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY END USER (USD BILLION) 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA ROLL-TO-ROLL PRINTING MARKET BY APPLICATION (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY END-USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY PRINTING TECHNOLOGY, USD BILLION, 2021

FIGURE 14 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY END-USER, USD BILLION, 2021

FIGURE 15 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL ROLL-TO-ROLL PRINTING MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA ROLL-TO-ROLL PRINTING MARKET SNAPSHOT

FIGURE 18 EUROPE ROLL-TO-ROLL PRINTING MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA ROLL-TO-ROLL PRINTING MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC ROLL-TO-ROLL PRINTING MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA ROLL-TO-ROLL PRINTING MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 E INK HOLDINGS INC.: COMPANY SNAPSHOT

FIGURE 24 FUJIKURA LTD.: COMPANY SNAPSHOT

FIGURE 25 LG: COMPANY SNAPSHOT

FIGURE 26 MULTEK CORPORATION: COMPANY SNAPSHOT S

FIGURE 27 NIPPON MEKTRON LTD.: COMPANY SNAPSHOT

FIGURE 28 3M COMPANY: COMPANY SNAPSHOT

FIGURE 29 GSI TECHNOLOGIES LLC: COMPANY SNAPSHOT

FIGURE 30 AGFA-GEVAERT: COMPANY SNAPSHOT

FIGURE 31 BASF: COMPANY SNAPSHOT

FIGURE 32 DUPONT: COMPANY SNAPSHOT

FAQ

Some key players operating in the global roll-to-roll printing market include E Ink Holdings Inc., Fujikura Ltd., LG, Multek Corporation, Nippon Mektron Ltd., 3M Company, GSI Technologies LLC, Agfa-Gavaert, BASF, DuPont.

The roll-to-roll printing market is being driven by the rising need for flexible electronics such RFID antennas and tags, printed circuit boards, OLED lights, and printed sensors.

The global roll-to-roll printing market size was estimated at USD 9.97 billion in 2021 and is expected to reach USD 38.28 billion in 2029.

The global roll-to-roll printing market is expected to grow at a compound annual growth rate of 18.31% from 2022 to 2029 to reach USD 38.28 billion by 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.