Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

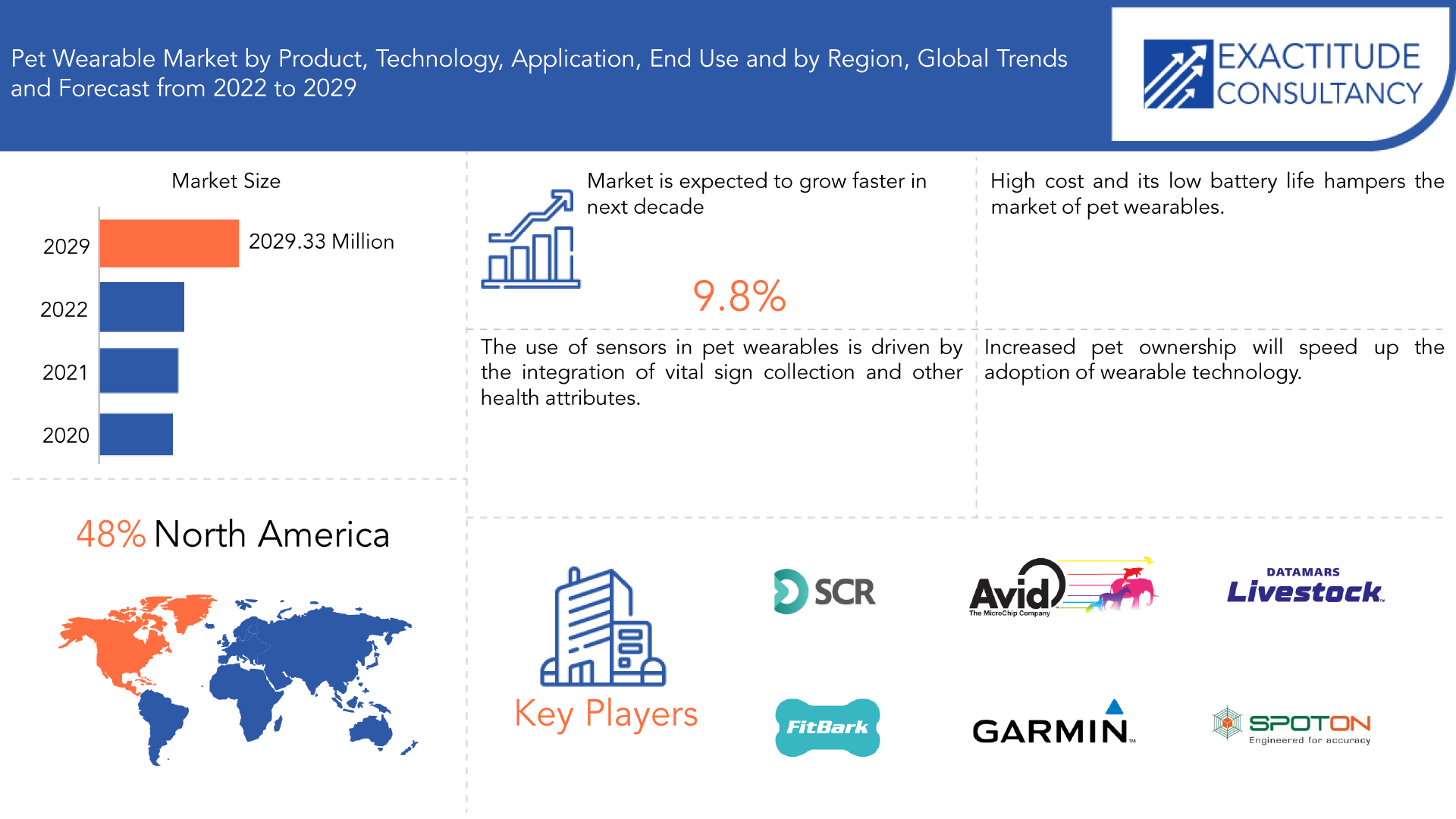

| USD 1848.20 million by 2028 | 9.8% | North American |

| By Product | By Technology | By Application | By End User |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Pet Wearables Market Overview

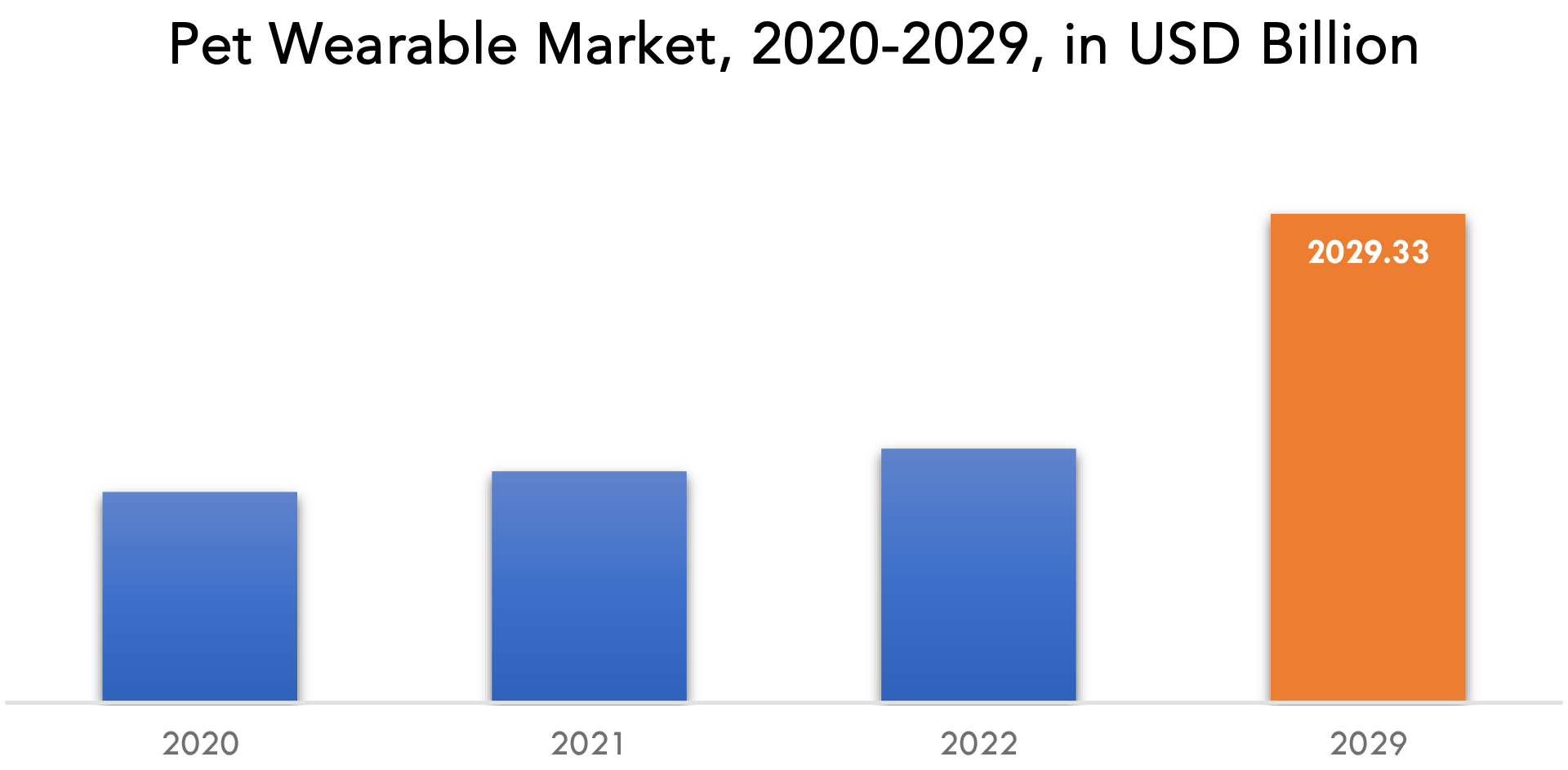

The global Pet wearables market are estimated to increase at a 9.8% CAGR from 2021 to 2028. It is predicted to exceed USD 1848.20 million by 2028, up from USD 960.58 million in 2021.

Pet wearables are defined as electronic wearable devices that enable users to remotely communicate with and keep track of their companion animals, pets, and other loved ones. These devices assist owners in monitoring their pets’ areas, providing unique identification for their animals, and keeping a constant eye on their behaviour and developmental activities.

The market is expanding as dog owners become more aware of how their dogs are doing. Additionally, the pet wearable market has received a lot of funding recently for a range of tech-enhanced products for dogs, including cameras and wearables. The sector is still developing, in its early stages. Nonetheless, it is characterised by heightened competition among important players and the threat of new entrants. OEM will focus on developing tools that can gather health data in an efficient manner.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) |

| Segmentation | By Product, By Technology, By Application, By End User, By Region. |

| By Product |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

The growing trend of keeping pets for entertainment, companionship, and personal interests has fueled the growth of the pet wearable market in recent years. The Internet of Things is significantly increasing the use of these devices. In addition, the pet wearable industry is integrating with technologies such as data analytics and mobile applications to provide more efficient service. Agricultural activities have increased significantly in recent years, and there is a growing need to monitor farm animals, which is expected to boost pet wearable market sales. These devices are widely used in a variety of fields, including medicine, tracking and identification, security, and safety.

Pet wearables are more readily accepted in developed nations than they are in developing nations. These gadgets are also employed for general monitoring, heart rate monitoring, and the study of sleep patterns. The main obstacles to the market share expansion of pet wearables, however, are their high electricity consumption and short battery lives. The growth of the pet wearable market may soon be constrained by the high cost of these devices. Future sales of these devices will soar due to a growing global acceptance of them as pet owners become more concerned with the welfare and safety of their animals.

The growing adoption of the Internet of Things (IoT) will drive market expansion. A smart pet wearable powered by IoT monitors heart rate and breathing patterns remotely. The data is synced via Wi-Fi and accessible via mobile and web apps. By utilizing management and monitoring principles such as Key Performance Indicators (KPIs) and Threshold Crossing Alerts, the integration of IoT and cloud enables robust functionality (TCAs). Integration with social media is also an intriguing feature of IoT pet tracking, as pet owners often form communities.

PET WEARABLES MARKET SEGMENT ANALYSIS

The GPS-enabled pet wearables market is anticipated to expand globally at a CAGR of nearly 19%. GPS technology is very accurate at pinpointing a pet’s current location. For instance, using Findster Pets, a GPS tracker, pet owners can use precise GPS technology to track their pet’s location in real-time. The pet module and its parent module can effectively communicate with each other thanks to these GPS-enabled pet wearables. Additionally, it offers advantages like free monthly monitoring.

Radio-frequency identification (RFID) technology’s market for pet wearables is anticipated to expand at a CAGR of more than 15.2%. The market is expanding due to the growing popularity of using pet RFID tags for pet tracking. Pinning RFID chips with a distinctive identification number to a pet’s skin enables pet parents to locate lost animals on a national database.

The market for pet wearables using alternative technologies is anticipated to expand at a CAGR of more than 14.2%. Other technologies include using temperature sensors to detect a pet’s body temperature (Bio-sense technology). These technologies can track a pet’s location and activity and alert pet parents via SMS or voice call if the pet barks or leaves a predefined perimeter.

The pet wearable market’s identification and tracking application segment will expand significantly through 2026. The adoption of sophisticated tracking devices has been prompted by the rise in lost pet incidents. Around two million pets are stolen each year around the world, according to Pet Found by Internet (FBI). The implantation of a microchip under the pet’s skin enables the identification of pets thanks to the integration of RFID technology in pet wearables.

The emergence of modern farming will result in significant growth for the pet wearable market from the commercial end-user sector. The tools are widely used to track and monitor livestock in order to spot potential health issues early on. Animal training benefits from the ability to monitor health by enhancing performance and lowering injury risks. To assist farm owners in monitoring health indicators like blood pressure, heart rate, temperature, and respiratory rate, several manufacturers are developing devices.

Pet Wearables Market Players

The global pet wearables companies profiled in the report include SCR Engineers LTD, Avid Identification Systems, Inc., Datamars, FitBark Inc., Garmin Ltd., Spoton Logistics, Invisible Fence, Whistle, Link My Pet., Loc8tor Ltd., Motorola Mobility LLC, Tractive, Trovan Ltd., Voyce, Cybortra technology co., Ltd., KYON, DOGTRA, PetPace LTD., PawTrax, Pod Trackers Pty Ltd, DAIRYMASTER, Gibi Technologies Inc., IceRobotics Ltd, and INUPATHY Inc. Mergers and acquisitions, joint ventures, capacity expansions, significant distribution, and branding decisions by established industry players to improve market share and regional presence. They are also engaged in ongoing R&D activities to develop new products and are focused on expanding the product portfolio. This is expected to increase competition and pose a threat to new entrants into the market.

Industry Developments:

MAY 31, 2023- Datamars Acquires Kippy — Advanced Tracking Technology Offers Pet Owners Peace of Mind Datamars, a leading Swiss global supplier of high-performance identification and data-based management solutions for the companion animal, livestock and textile markets, has acquired Kippy S.r.l., the successful GPS tracker and activity monitoring solution for pets, as a natural expansion of its existing offering to pet owners globally.

Who Should Buy? Or Key stakeholders

- Research and development

- Agriculture

- End Use industries

- Aquaculture

- E-Commerce and Retail

- Horticulture & Floriculture

PET WEARABLES MARKET REGIONAL ANALYSIS

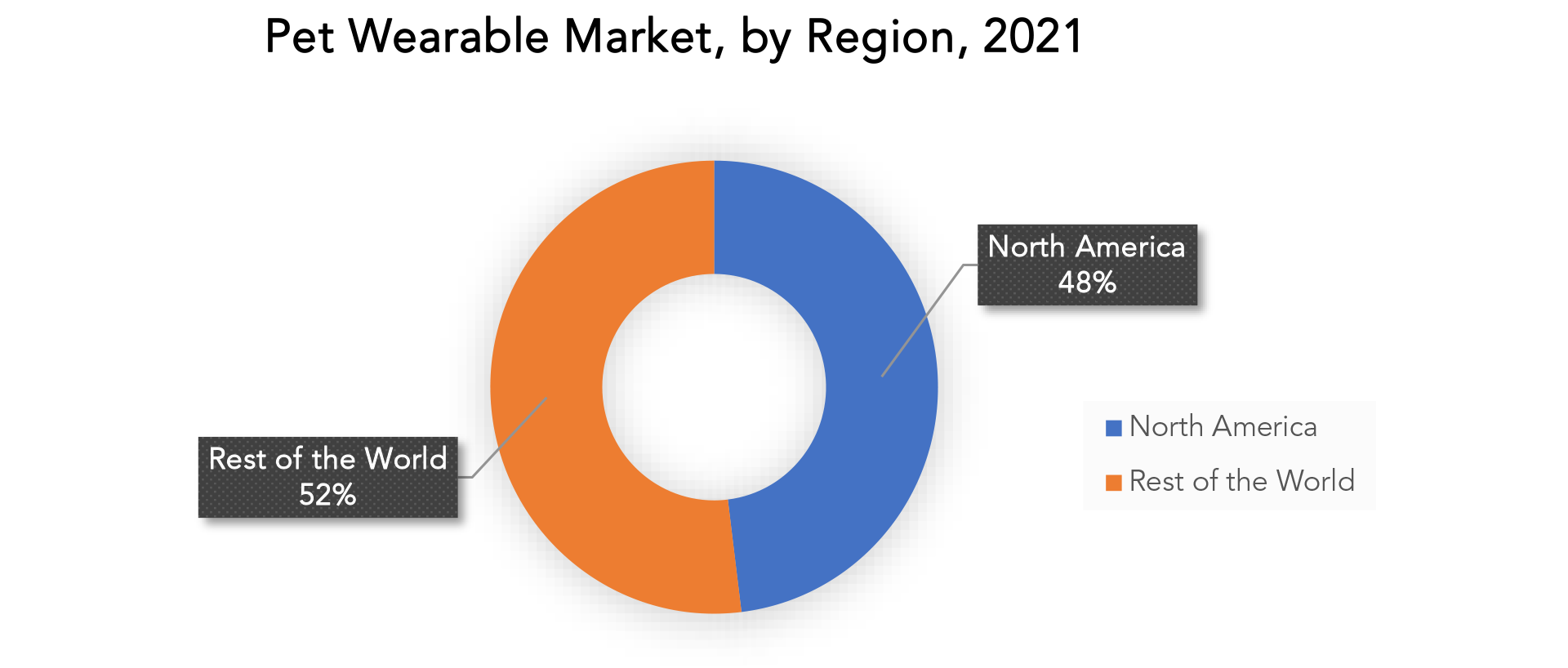

Geographically, the Pet Wearables market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North American region made a significant contribution in 2021. Ten million pets are thought to go missing in the US each year, according to estimates in the pet wearable market research report. As a result of the growing need to track the pet’s daily activities and the region’s increasing urbanization, the use of pet wearables has skyrocketed. During the forecast period, this region is expected to grow at the fastest rate. Increased investments in the overall development of advanced technology, the Asia Pacific region is contributing significantly to market growth.

The size of the European pet wearable market exceeded USD 656.15 million in 2021 and is expected to increase by more than 19.3% between 2021 and 2027. Latin American pet owners’ priorities the security and safety of their animals. The demand for these gadgets with GPS tracking and live positioning functionality is anticipated to increase as a result. As a result of an increase in pet abandonment cases in the area, strict regulations on pet safety have been implemented.

Key Market Segments: Pet Wearables Market

Pet Wearables Market By Product, 2020-2029, (USD Million)

- Smart Collar

- Smart Camera

- Smart Harness & Vest

- Tags

- Monitors

- Trackers

- Translators

Pet Wearables Market By Technology, 2020-2029, (USD Million)

- RFID

- GPS

- Sensors

- Others

Pet Wearables Market By Application, 2020-2029, (USD Million)

- Identification & Tracking

- Behavior Monitoring & Control

- Facilitation, Safety & Security

- Medical Diagnosis & Treatment

Pet Wearables Market By End User, 2020-2029, (USD Million)

- Commercial

- Household

Pet Wearables Market By Regions, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Key Question Answered

- What is the expected growth rate of the Pet wearables market over the next 7 years?

- Who are the major players in the Pet wearables market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the Pet wearables market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on Pet wearables market?

- What is the current and forecasted size and growth rate of the global Pet wearables market?

- What are the key drivers of growth in the Pet wearables market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Pet wearables market?

- What are the technological advancements and innovations in the Pet wearables market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Pet wearables market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Pet wearables market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of toluene in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PET WEARABLE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PET WEARABLE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PET WEARABLE MARKET OUTLOOK

- GLOBAL PET WEARABLE MARKET BY PRODUCT, 2020-2029, (USD MILLION)

- SMART COLLAR

- SMART CAMERA

- SMART HARNESS & VEST

- TAGS

- MONITORS

- TRACKERS

- TRANSLATORS

- GLOBAL PET WEARABLE MARKET BY TECHNOLOGY, 2020-2029, (USD MILLION)

- RFID

- GPS

- SENSORS

- OTHERS

- GLOBAL PET WEARABLE MARKET BY APPLICATION, 2020-2029, (USD MILLION)

- IDENTIFICATION & TRACKING

- BEHAVIOR MONITORING & CONTROL

- FACILITATION, SAFETY & SECURITY

- MEDICAL DIAGNOSIS & TREATMENT

- GLOBAL PET WEARABLE MARKET BY END USE, 2020-2029, (USD MILLION)

- COMMERCIAL

- HOUSEHOLD

- GLOBAL PET WEARABLE MARKET BY REGION, 2020-2029, (USD MILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

10.1. SCR ENGINEERS LTD

10.2. AVID IDENTIFICATION SYSTEMS, INC.

10.3. DATAMARS

10.4. FITBARK INC.

10.5. GARMIN LTD.

10.6. SPOTON LOGISTICS

10.7. INVISIBLE FENCE

10.8. LOC8TOR LTD.

10.9. MOTOROLA MOBILITY LLC

10.10. TROVAN LTD. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 2 GLOBAL PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 3 GLOBAL PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 4 GLOBAL PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 5 GLOBAL PET WEARABLE MARKET BY REGION (USD MILLION) 2020-2029

TABLE 6 NORTH AMERICA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 7 NORTH AMERICA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 8 NORTH AMERICA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 9 NORTH AMERICA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 10 NORTH AMERICA PET WEARABLE MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 11 US PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 12 US PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 13 US PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 14 US PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 15 CANADA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 16 CANADA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 17 CANADA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 18 CANADA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 19 MEXICO PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 20 MEXICO PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 21 MEXICO PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 22 MEXICO PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 23 SOUTH AMERICA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 24 SOUTH AMERICA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 25 SOUTH AMERICA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 26 SOUTH AMERICA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 27 SOUTH AMERICA PET WEARABLE MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 28 BRAZIL PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 29 BRAZIL PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 30 BRAZIL PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 31 BRAZIL PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 32 ARGENTINA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 33 ARGENTINA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 34 ARGENTINA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 35 ARGENTINA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 36 COLUMBIA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 37 COLUMBIA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 38 COLUMBIA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 39 COLUMBIA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 41 REST OF SOUTH AMERICA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 42 REST OF SOUTH AMERICA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 43 REST OF SOUTH AMERICA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 44 ASIA PACIFIC PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 45 ASIA PACIFIC PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 46 ASIA PACIFIC PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 47 ASIA PACIFIC PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 48 ASIA PACIFIC PET WEARABLE MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 49 INDIA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 50 INDIA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 51 INDIA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 52 INDIA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 53 CHINA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 54 CHINA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 55 CHINA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 56 CHINA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 57 JAPAN PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 58 JAPAN PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 59 JAPAN PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 60 JAPAN PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 61 SOUTH KOREA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 62 SOUTH KOREA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 63 SOUTH KOREA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 64 SOUTH KOREA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 65 AUSTRALIA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 66 AUSTRALIA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 67 AUSTRALIA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 68 AUSTRALIA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 69 SOUTH EAST ASIA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 70 SOUTH EAST ASIA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 71 SOUTH EAST ASIA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 72 SOUTH EAST ASIA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 73 REST OF ASIA PACIFIC PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 74 REST OF ASIA PACIFIC PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 75 REST OF ASIA PACIFIC PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 76 REST OF ASIA PACIFIC PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 77 EUROPE PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 78 EUROPE PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 79 EUROPE PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 80 EUROPE PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 81 EUROPE PET WEARABLE MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 82 GERMANY PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 83 GERMANY PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 84 GERMANY PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 85 GERMANY PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 86 UK PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 87 UK PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 88 UK PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 89 UK PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 90 FRANCE PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 91 FRANCE PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 92 FRANCE PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 93 FRANCE PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 94 ITALY PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 95 ITALY PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 96 ITALY PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 97 ITALY PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 98 SPAIN PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 99 SPAIN PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 100 SPAIN PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 101 SPAIN PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 102 RUSSIA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 103 RUSSIA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 104 RUSSIA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 105 RUSSIA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 106 REST OF EUROPE PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 107 REST OF EUROPE PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 108 REST OF EUROPE PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 109 REST OF EUROPE PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 110 MIDDLE EAST & AFRICA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 111 MIDDLE EAST & AFRICA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 112 MIDDLE EAST & AFRICA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 113 MIDDLE EAST & AFRICA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 114 MIDDLE EAST & AFRICA PET WEARABLE MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 115 UAE PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 116 UAE PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 117 UAE PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 118 UAE PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 119 SAUDI ARABIA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 120 SAUDI ARABIA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 121 SAUDI ARABIA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 122 SAUDI ARABIA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 123 SOUTH AFRICA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 124 SOUTH AFRICA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 125 SOUTH AFRICA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 126 SOUTH AFRICA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

TABLE 127 REST OF MIDDLE EAST & AFRICA PET WEARABLE MARKET BY PRODUCT (USD MILLION) 2020-2029

TABLE 128 REST OF MIDDLE EAST & AFRICA PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 129 REST OF MIDDLE EAST & AFRICA PET WEARABLE MARKET BY APPLICATION (USD MILLION) 2020-2029

TABLE 130 REST OF MIDDLE EAST & AFRICA PET WEARABLE MARKET BY END USE (USD MILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PET WEARABLE MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL PET WEARABLE MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL PET WEARABLE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL PET WEARABLE MARKET BY END USE, USD MILLION, 2020-2029

FIGURE 12 GLOBAL PET WEARABLE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL PET WEARABLE MARKET BY PRODUCT (USD MILLION), 2021

FIGURE 15 GLOBAL PET WEARABLE MARKET BY TECHNOLOGY (USD MILLION), 2021

FIGURE 16 GLOBAL PET WEARABLE MARKET BY APPLICATION (USD MILLION), 2021

FIGURE 17 GLOBAL PET WEARABLE MARKET BY END USE (USD MILLION), 2021

FIGURE 18 GLOBAL PET WEARABLE MARKET BY REGION (USD MILLION), 2021

FIGURE 19 NORTH AMERICA PET WEARABLE MARKET SNAPSHOT

FIGURE 20 EUROPE PET WEARABLE MARKET SNAPSHOT

FIGURE 21 SOUTH AMERICA PET WEARABLE MARKET SNAPSHOT

FIGURE 22 ASIA PACIFIC PET WEARABLE MARKET SNAPSHOT

FIGURE 23 MIDDLE EAST ASIA AND AFRICA PET WEARABLE MARKET SNAPSHOT

FIGURE 24 MARKET SHARE ANALYSIS

FIGURE 25 SCR ENGINEERS LTD: COMPANY SNAPSHOT

FIGURE 26 AVID IDENTIFICATION SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 27 DATAMARS: COMPANY SNAPSHOT

FIGURE 28 FITBARK INC.: COMPANY SNAPSHOT

FIGURE 29 GARMIN LTD.: COMPANY SNAPSHOT

FIGURE 30 SPOTON LOGISTICS: COMPANY SNAPSHOT

FIGURE 31 INVISIBLE FENCE: COMPANY SNAPSHOT

FIGURE 32 LOC8TOR LTD.: COMPANY SNAPSHOT

FIGURE 33 MOTOROLA MOBILITY LLC: COMPANY SNAPSHOT

FIGURE 34 TROVAN LTD.: COMPANY SNAPSHOT

FAQ

The pet wearables market size had crossed USD 874.85 million in 2020 and will observe a CAGR of more than 9.8% up to 2029 driven by the increasing demand to preserve agricultural products.

The upcoming trend in pet wearables market is an opportunity in enterprise applications is an opportunity for market growth.

The global pet wearables market registered a CAGR of 9.8% from 2022 to 2029. The application segment was the highest revenue contributor to the market.

The North America dominated the global industry in 2021 and accounted for the maximum share of more than 48% of the overall revenue.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.