Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.12 Billion by 2029 | 12.7% | North America |

| By Type | By Connectivity | By Applications | By End User |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Blockchain Devices Market Overview

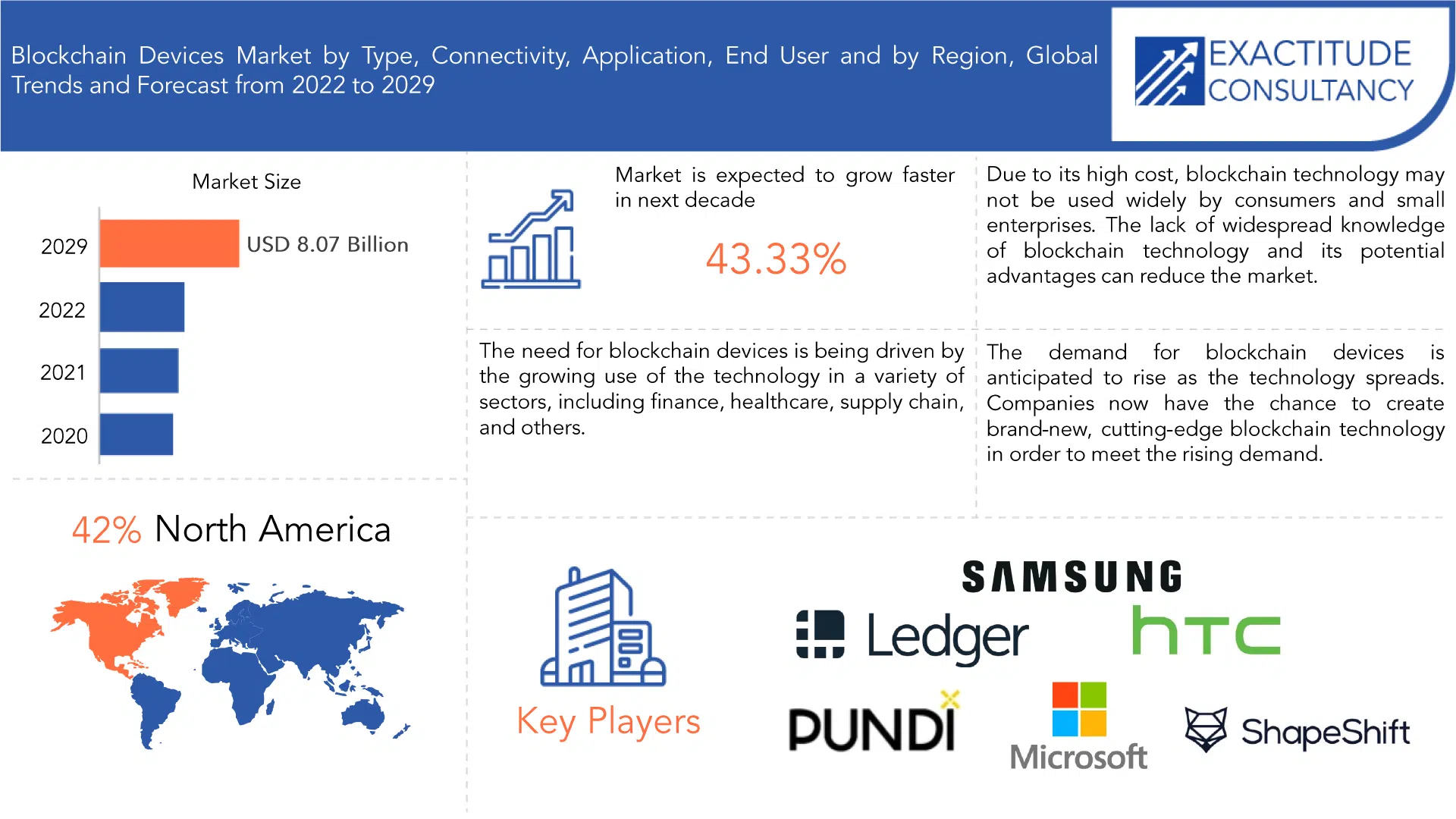

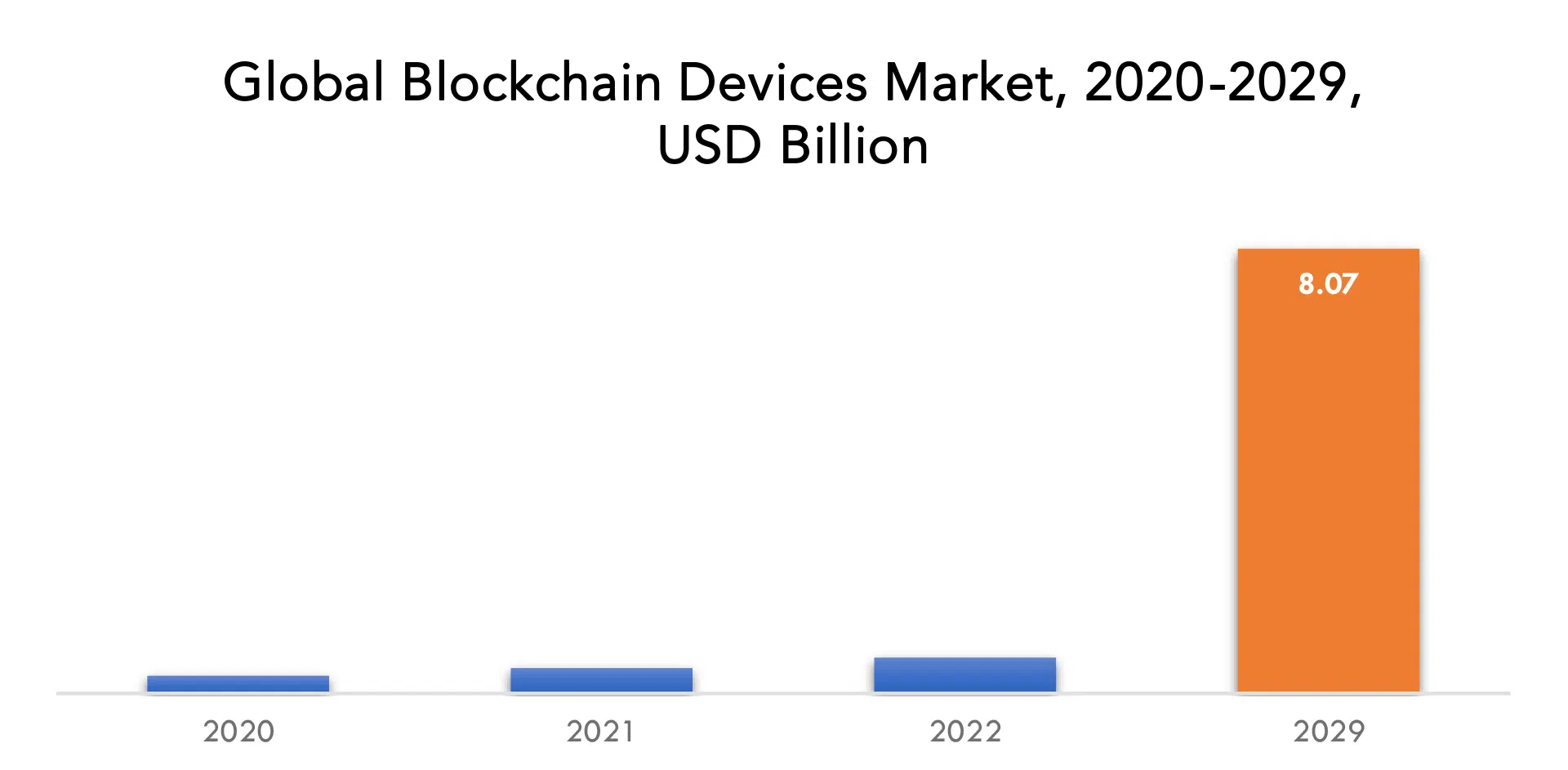

The blockchain devices market is expected to grow at 12.7% CAGR from 2021 to 2029. It is expected to reach above USD 3.12 Billion by 2029 from USD 1.06 Billion in 2020.

Growth and expansion of the semiconductor industry, particularly in emerging markets, growing adoption of blockchain technology by small and medium-sized businesses in developing nations, increasing trend of cryptocurrencies, rising venture capital funding, rising modernization of existing infrastructure with cutting-edge systems, and rising infrastructure development activities, particularly in developing nations.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Thousand Units) |

| Segmentation | By Type, By Connectivity, By Applications, By End user, By Region |

| By Type |

|

| By Connectivity |

|

| By Applications |

|

| By End user |

|

| By Region |

|

It is prominent from the name alone that blockchain devices are the collection of hardware and parts that underpin bitcoin technology. In order to mine cryptocurrency and provide stronger security encryption, blockchain devices are employed. The primary market growth driving factors will emerge as increasing demand from the banking, financial services, and insurance industries as well as rise in the digitization of countries, particularly the developing nations. The market value will be further harmed by increasing Wi-Fi, Bluetooth, smartphone, and internet penetration, rising popularity of a variety of cryptocurrencies, increased visibility of blockchain technology benefits in the financial sector, rising acceptance of cryptocurrencies as a form of payment across various industries, and widespread industrialization. Increased investment in research and development, increased knowledge of the advantages of blockchain technology, such as its high level of security and transparency, and ongoing advancements in this field will all contribute to the market’s expansion.

However, the market’s ability to grow will be constrained by the high expenditures associated with research and development capabilities. Additionally, the developing economies’ strict regulatory environments and people’s misgivings about blockchain technology may slow the market’s expansion. The market growth rate will also be hampered by significant technological and infrastructure restrictions, security, privacy, and control-related issues related to blockchain technology, and regulatory ambiguity related to blockchain deployment.

Due to the pandemic, distant work has increased, which has increased the need for secure remote access to data. Due to this, there is now more demand for blockchain-based devices that provide safe and distant data access. Global supply chains have been hampered by the pandemic, which has caused delays and shortages in the manufacture and distribution of blockchain devices. The pandemic has hindered the understanding of and implementation of blockchain technology by diverting focus away from newer technologies like blockchain.

Blockchain devices Market Segment Analysis

The blockchain devices market is segmented based on type, connectivity, applications, end user, and region.

Based on type, the blockchain devices market segmentation has been divided into blockchain smartphones, crypto hardware wallets, crypto software wallets, crypto automated teller machines (ATMs), point of sale (PoS) terminals. During the forecast period, the global blockchain devices market is anticipated to be dominated by blockchain smartphone. In essence, a built-in “hardware wallet” on blockchain gadgets gives bitcoin owners an additional layer of security. Sensitive personal information, including bitcoin keys, are protected and encrypted in this wallet, which serves as an offline digital safe. Crypto ATMs are anticipated to have a sizable market share and experience rapid expansion over the course of the forecast period. Recent advancements in crypto ATM software and compatibility for a number of cryptocurrencies have increased the demand for crypto ATMs. The capacity to buy and sell cryptocurrencies from any place, enhanced income stability in the face of bitcoin volatility, and anti-money laundering (AML) capabilities are some other factors driving business expansion. The rise in the market capitalization of cryptocurrencies and initial coin offers (ICO) is a significant factor in the expected expansion of the category of cryptocurrency ATMs during the projection period. Businesses are starting to employ cryptocurrency ATMs in retail locations as they realize the potential of blockchain technology to provide better customer experiences.

The blockchain devices market has been segmented into wired, wireless. During the forecast period, wired connectivity is anticipated to hold a lion’s share of the global market for blockchain devices. Currently in their infancy, the bulk of first-generation blockchain gadgets are wired. The expanding market for bitcoin ATMs is a significant growth factor for the wired category. Additionally connected are pre-configured devices, such as blockchain computers. Users can carry out secure digital transactions on the blockchain by connecting a connected hardware wallet to a PC. The Global Blockchain Devices Market is anticipated to experience substantial expansion over the course of the forecast period. The global blockchain devices market is anticipated to experience substantial expansion over the course of the forecast period. As blockchain hardware develops, wireless blockchain devices are becoming more and more common and dominant on the market. Wired connectivity is highly sought after in the blockchain device market because it offers a better, more reliable connection than wireless connectivity. The increasing number of cryptocurrency ATMs being installed around the world is expected to significantly fuel the market for this category.

The blockchain devices market is segmented into categories based on type, personal, corporate. When blockchain devices were classified further by application, the personal market accounted for the biggest share. Future predictions indicate that the corporate market would experience the strongest growth in the market for blockchain devices when fragmented out by application, from 2021 to 2026.

The blockchain devices market is segmented into the BFSI, government, retail & e-commerce, travel & hospitality, automotive, transportation & logistics, IT & telecommunications. The BFSI segmented is expected to dominate the market in the forecasted period. Moreover, the transportation & logistics segment would also experience a noticeable growth.

Blockchain devices Market Players

Ledger SAS., HTC Corporation, Pundi X Labs Pte. Ltd., GENERAL BYTES S.R.O., RIDDLE&CODE GmbH, Blockchain.com, Inc., Genesis Coin Inc., Lamassu Industries AG, SAMSUNG, ShapeShift, CoolBitX, Bitaccess, Covault, IBM and Microsoft are the major blockchain devices market players.

Industry Development:

06 January, 2021: ShapeShift, an international, non-custodial cryptocurrency leader, announced that it integrated decentralized exchange protocols into its platform. This will protect users while increasing transparency in the digital asset economy.

24 March, 2023: Pundi X registered with FINTRAC as the Money Service Business in Canada that enables Pundi X to conduct virtual currency and payment service provider businesses in the country.

Who Should Buy? Or Key stakeholders

- Hardware Device Manufacturers

- Cryptocurrency Exchanges

- Blockchain Developers

- Research and Development (R&D) Companies

- Government Research Institute

- Investors

- Regulatory Authorities

- Others

Blockchain devices Market Regional Analysis

The Blockchain devices market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

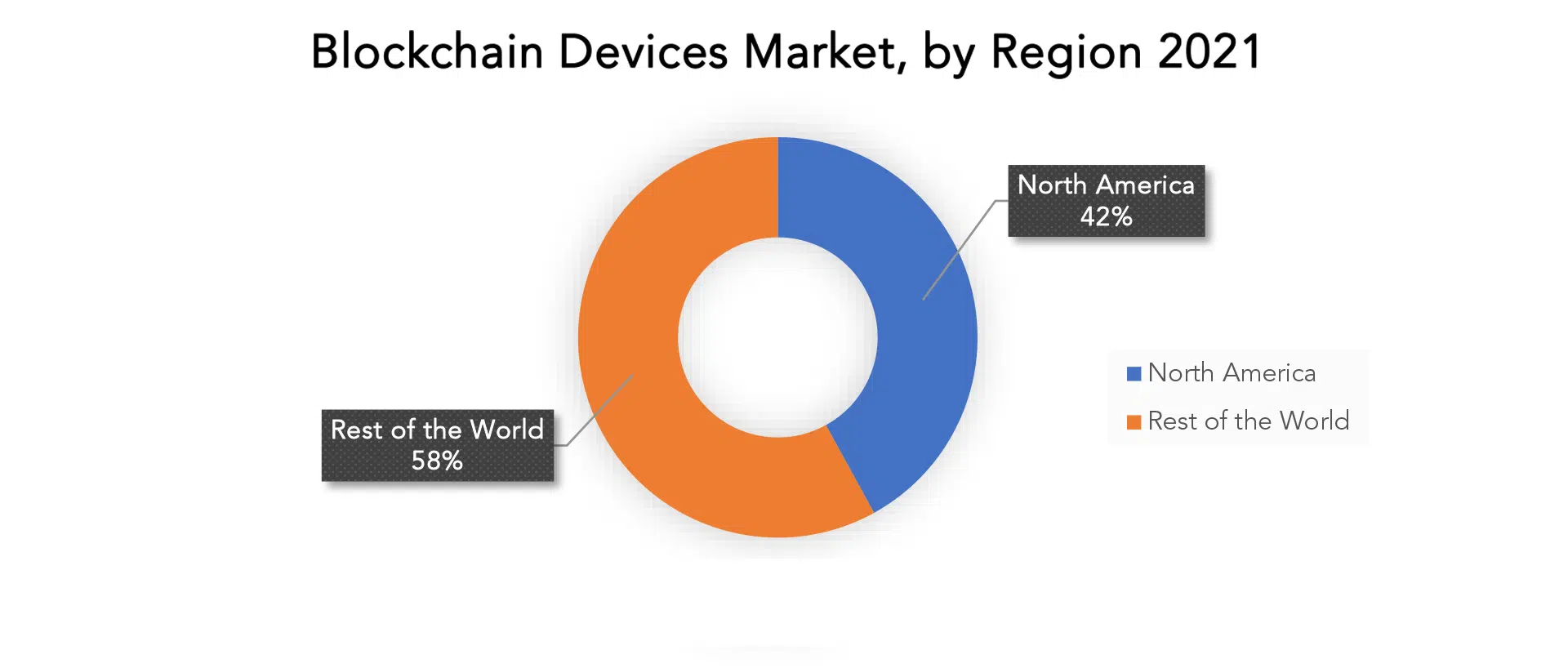

Given its early adoption of blockchain technology, the market’s high potential in the coming four to five years, particularly for chip-level security and the tracking and monitoring of assets, and the accessibility of cutting-edge technologies for implementing and managing data via blockchain networks, North America dominates the market for blockchain devices. Due to accelerating economic digitization, expanding infrastructure building activities, and growing use of blockchain technology, the Asia-Pacific area will have the highest growth rate.

The increased use of blockchain technology across numerous industries and the rise in popularity of cryptocurrencies in the region are driving up demand for blockchain devices. With an increasing number of blockchain startups and well-established technology businesses investing in the creation of blockchain devices, nations including China, India, Singapore, Japan, and South Korea are emerging as significant players in the market for blockchain devices. Furthermore, the region’s Blockchain Devices Market is expanding as a result of supportive governmental policies and regulations as well as rising investment in blockchain technology.

Key Market Segments: Blockchain devices Market

Blockchain Devices Market By Type, 2020-2029, (USD Billion) (Thousand Units)

- Blockchain Smartphones

- Crypto Hardware Wallets

- Crypto Software Wallets

- Crypto Automated Teller Machines (ATMs)

- Point Of Sales (PoS) Terminals

Blockchain Devices Market By Connectivity, 2020-2029, (USD Billion) (Thousand Units)

- Wired

- Wireless

Blockchain Devices Market By Applications, 2020-2029, (USD Billion) (Thousand Units)

- Personal

- Corporate

Blockchain Devices Market By End User, 2020-2029, (USD Billion) (Thousand Units)

- BFSI

- Government

- Retail & E-Commerce

- Travel & Hospitality

- Automotive

- Transportation & Logistics

- It & Telecommunications

Blockchain Devices Market By Region, 2020-2029, (USD Billion) (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new Connectivity

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the blockchain devices market over the next 7 years?

- Who are the major players in the blockchain devices market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the blockchain devices market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the blockchain devices market?

- What is the current and forecasted size and growth rate of the global blockchain devices market?

- What are the key drivers of growth in the blockchain devices market?

- What are the distribution channels and supply chain dynamics in the blockchain devices market?

- What are the technological advancements and innovations in the blockchain devices market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the blockchain devices market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the blockchain devices market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of blockchain devices in the market and what is the impact of raw materials prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BLOCKCHAIN DEVICES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BLOCKCHAIN DEVICES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- END USER VALUE CHAIN ANALYSIS

- GLOBAL BLOCKCHAIN DEVICES MARKET OUTLOOK

- GLOBAL BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- BLOCKCHAIN SMARTPHONES

- CRYPTO HARDWARE WALLETS

- CRYPTO SOFTWARE WALLETS

- CRYPTO AUTOMATED TELLER MACHINES (ATMS)

- POINT OF SALES (POS) TERMINALS

- GLOBAL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION, THOUSAND UNITS), 2020-2029

- WIRED

- WIRELESS

- GLOBAL BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS), 2020-2029

- PERSONAL

- CORPORATE

- GLOBAL BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION, THOUSAND UNITS), 2020-2029

- BFSI

- GOVERNMENT

- RETAIL & E-COMMERCE

- TRAVEL & HOSPITALITY

- AUTOMOTIVE

- TRANSPORTATION & LOGISTICS

- IT & TELECOMMUNICATION

- GLOBAL BLOCKCHAIN DEVICES MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

-

- LEDGER SAS.

- HTC CORPORATION

- PUNDI X LABS PTE. LTD.

- GENERAL BYTES S.R.O.

- RIDDLE&CODE GMBH

- COM, INC.

- GENESIS COIN INC.

- LAMASSU INDUSTRIES AG

- SAMSUNG

- SHAPESHIFT

- COOLBITX

- BITACCESS

- COVAULT

- IBM

- MICROSOFT *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 4 GLOBAL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 8 GLOBAL BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL BLOCKCHAIN DEVICES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL BLOCKCHAIN DEVICES MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 21 US BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 22 US BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 US BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 24 US BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 25 US BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 US BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 US BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 US BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 32 CANADA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 CANADA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 36 CANADA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 40 MEXICO BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 MEXICO BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 44 MEXICO BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 58 BRAZIL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 BRAZIL BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 62 BRAZIL BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 66 ARGENTINA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 ARGENTINA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 70 ARGENTINA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 74 COLOMBIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 COLOMBIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 78 COLOMBIA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 100 INDIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 INDIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 INDIA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 108 CHINA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 CHINA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 112 CHINA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 116 JAPAN BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 JAPAN BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 120 JAPAN BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE BLOCKCHAIN DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE BLOCKCHAIN DEVICES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 EUROPE BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 158 EUROPE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 EUROPE BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 162 EUROPE BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 166 GERMANY BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 168 GERMANY BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 170 GERMANY BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 171 UK BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 172 UK BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 173 UK BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 174 UK BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 175 UK BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 176 UK BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 177 UK BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 178 UK BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 182 FRANCE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 FRANCE BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 FRANCE BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 190 ITALY BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 192 ITALY BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 194 ITALY BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 198 SPAIN BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 200 SPAIN BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 202 SPAIN BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 206 RUSSIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 208 RUSSIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 210 RUSSIA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 229 UAE BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 230 UAE BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 231 UAE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 232 UAE BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 233 UAE BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 234 UAE BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 235 UAE BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 236 UAE BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY END USER (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA BLOCKCHAIN DEVICES MARKET BY END USER (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL BLOCKCHAIN DEVICES MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 6 GLOBAL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY, USD BILLION, 2020-2029

FIGURE 7 GLOBAL BLOCKCHAIN DEVICES MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 8 GLOBAL BLOCKCHAIN DEVICES MARKET BY END USER, USD BILLION, 2020-2029

FIGURE 9 GLOBAL BLOCKCHAIN DEVICES MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 10 PORTER’S FIVE FORCES MODEL

FIGURE 11 GLOBAL BLOCKCHAIN DEVICES MARKET BY TYPE, USD BILLION, 2021

FIGURE 12 GLOBAL BLOCKCHAIN DEVICES MARKET BY CONNECTIVITY, USD BILLION, 2021

FIGURE 13 GLOBAL BLOCKCHAIN DEVICES MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL BLOCKCHAIN DEVICES MARKET BY END USER, USD BILLION, 2021

FIGURE 15 GLOBAL BLOCKCHAIN DEVICES MARKET BY REGION, USD BILLION, 2021

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 LEDGER SAS.: COMPANY SNAPSHOT

FIGURE 18 HTC CORPORATION: COMPANY SNAPSHOT

FIGURE 19 PUNDI X LABS PTE. LTD.: COMPANY SNAPSHOT

FIGURE 20 GENERAL BYTES S.R.O.: COMPANY SNAPSHOT

FIGURE 21 RIDDLE&CODE GMBH: COMPANY SNAPSHOT

FIGURE 22 BLOCKCHAIN.COM, INC.: COMPANY SNAPSHOT

FIGURE 23 GENESIS COIN INC.: COMPANY SNAPSHOT

FIGURE 24 LAMASSU INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 25 SAMSUNG: COMPANY SNAPSHOT

FIGURE 26 SHAPESHIFT: COMPANY SNAPSHOT

FIGURE 27 COOLBITX: COMPANY SNAPSHOT

FIGURE 28 BITACCESS: COMPANY SNAPSHOT

FIGURE 29 COVAULT: COMPANY SNAPSHOT

FIGURE 30 IBM: COMPANY SNAPSHOT

FIGURE 31 MICROSOFT: COMPANY SNAPSHOT

FAQ

The blockchain devices market size had crossed USD 0.32 Billion in 2020 and will observe a CAGR of more than 43.33% up to 2029.

Growing visibility of benefits of blockchain technology in financial sector is one of the main factor that drives the growth of blockchain devices market.

The region’s largest share is in North America. Type that is manufactured in nations like US and Canada that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal. Also, the key players such as Analog Devices, Inc., Belden Inc. play important roles.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.