REPORT OUTLOOK

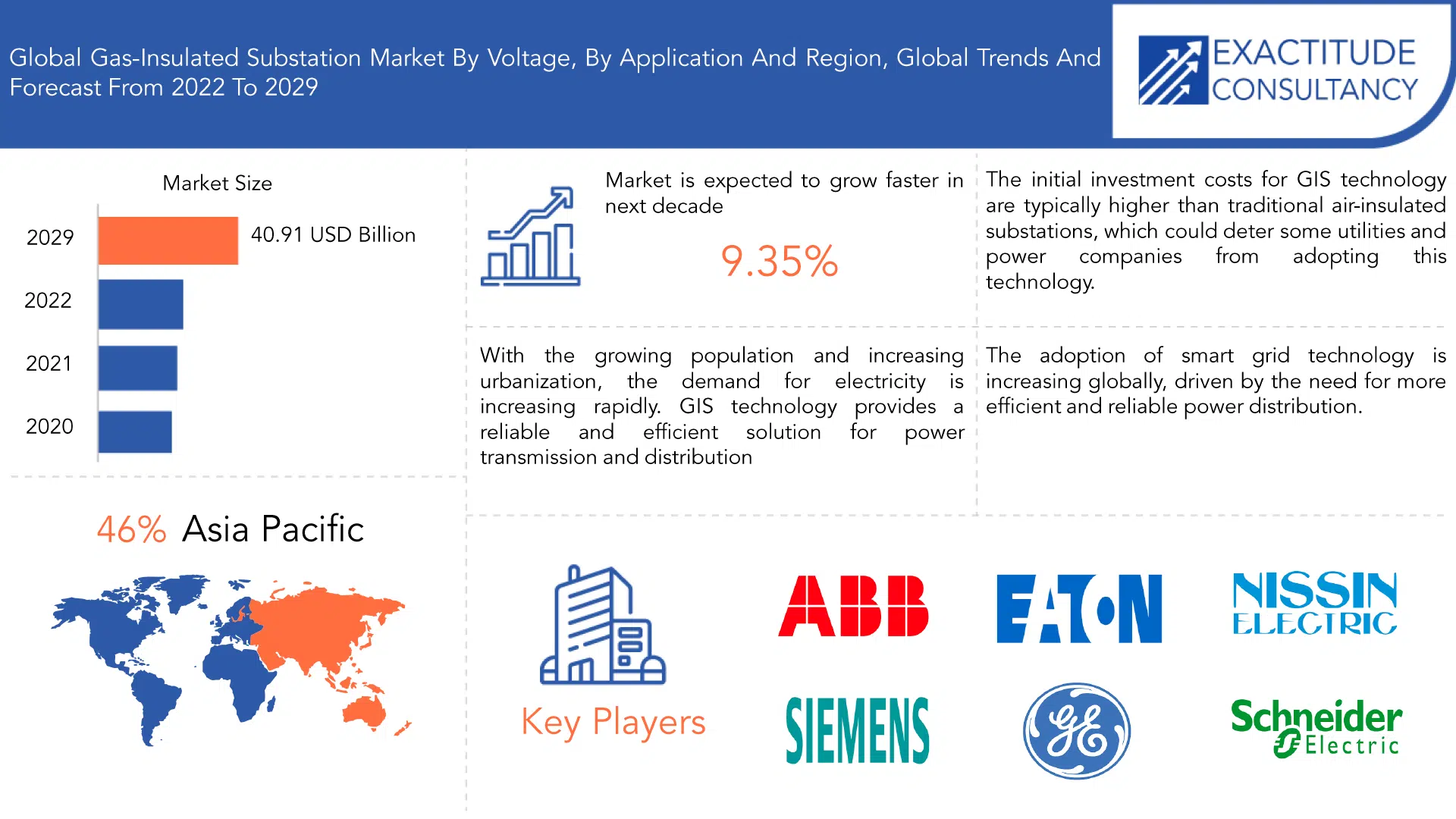

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 40.91 Billion by 2029 | 9.35% | Asia Pacific |

| By Type | By Applications | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Gas-Insulated Substation Market Overview

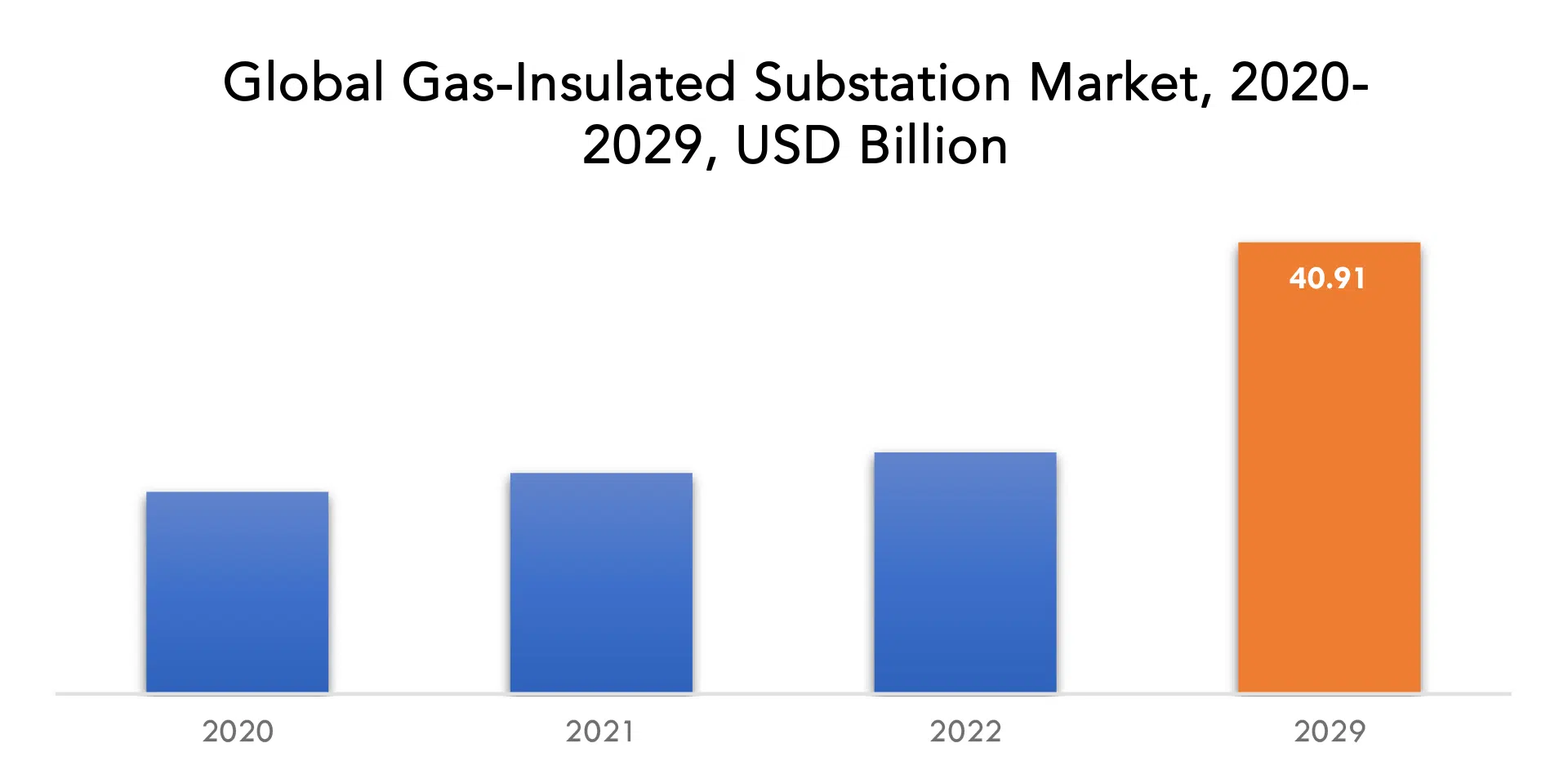

The global Gas-Insulated Substation Market is expected to grow at 9.35 % CAGR from 2020 to 2029. It is expected to reach above USD 40.91 Billion by 2029 from USD 18.30 Billion in 2020.

A gas-insulated substation (GIS) is a type of electrical substation where the components such as circuit breakers, disconnectors, and transformers are enclosed in a sealed metal enclosure filled with sulfur hexafluoride (SF6) gas as the insulating medium. SF6 gas has excellent insulating properties, making it a suitable alternative to traditional air-insulated substations. GIS technology offers several advantages, including smaller footprint, higher reliability, and lower maintenance requirements. GIS are commonly used in high-voltage power transmission and distribution systems, urban areas, and other locations where space is limited.

Investments in renewable energy are a significant driver for the gas-insulated substation (GIS) market. As the world shifts towards renewable energy sources such as wind and solar power, new infrastructure is required to transport and distribute electricity. GIS technology is well-suited for renewable energy applications, as it can efficiently handle high-voltage power and is compatible with renewable energy sources. Governments and private companies are investing heavily in renewable energy to reduce carbon emissions and meet sustainability targets. This has resulted in an increasing demand for GIS technology, which provides a reliable and efficient solution for power transmission and distribution. As renewable energy continues to grow, the demand for GIS technology is expected to increase further in the coming years.

The gas-insulated substation (GIS) market is restrained by high initial investment costs. The upfront costs for GIS technology are typically higher than traditional air-insulated substations, which can deter some utilities and power companies from adopting this technology. While GIS technology offers several benefits, including higher reliability and lower maintenance requirements, the initial investment costs can be a significant barrier for some organizations. In addition, the cost of upgrading or replacing existing infrastructure to accommodate GIS technology can also be a challenge. As a result, some utilities and power companies may opt to stick with traditional air-insulated substations, which can be a more cost-effective option in the short term. Efforts are underway to reduce the cost of GIS technology and make it more accessible for a wider range of organizations.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Thousand Units) |

| Segmentation | By Voltage, Application and Region. |

| By Type |

|

| By Applications |

|

| By Region |

|

The development of smart grids presents a significant opportunity for the gas-insulated substation (GIS) market. As the world moves towards more efficient and reliable power distribution, smart grid technology is gaining popularity. GIS technology can play a critical role in the development of smart grids, providing a reliable and efficient solution for power transmission and distribution. GIS technology can be used to build high-voltage substations that can integrate with the smart grid system, enabling real-time monitoring and control of power supply. Additionally, GIS technology can help utilities and power companies manage their power networks more efficiently, reducing the risk of outages and improving overall system reliability. As the demand for smart grid technology continues to grow, the GIS market is expected to experience significant growth in the coming years.

The COVID-19 pandemic had negatively impacted the gas-insulated substation (GIS) market by disrupting global supply chains, resulting in delays and increased costs for GIS equipment manufacturers. Many GIS projects had delayed or put on hold due to restrictions on construction activities and supply chain disruptions. Additionally, the pandemic had resulted in an economic slowdown, which had reduced the demand for power and could impact the funding for GIS projects. Despite these challenges, those increased demand for infrastructure investment and digital solutions is expected to support the growth of the GIS market in the coming years.

Gas-Insulated Substation Market Segment Analysis

The high voltage segment is expected to be the largest contributor in the gas-insulated substation (GIS) market. High voltage GIS equipment is typically used for power transmission applications, and it offers several advantages over traditional air-insulated substations, including higher reliability, lower maintenance requirements, and a smaller footprint. As demand for reliable and efficient power transmission infrastructure continues to grow, the high voltage GIS segment is expected to experience significant growth in the coming years. Additionally, the increasing adoption of renewable energy sources and the development of smart grids are expected to drive demand for high voltage GIS equipment, further supporting the growth of this segment.

The power transmission utility segment is expected to hold the largest market share in the gas-insulated substation (GIS) market. Power transmission utilities are responsible for transmitting power from the generation source to the distribution network, and GIS technology is well-suited for this application due to its high reliability, low maintenance requirements, and smaller footprint. As demand for electricity continues to grow, power transmission utilities are investing in GIS technology to upgrade their existing infrastructure and build new substations. Additionally, government initiatives aimed at improving power infrastructure, increasing electrification rates, and reducing greenhouse gas emissions are expected to drive demand for GIS equipment in the power transmission utility segment. As a result, this segment is expected to continue to hold the largest market share in the GIS market in the coming years.

Gas-Insulated Substation Market Players

The gas-insulated substation market key players include ABB Group, CG Power and Industrial Solutions Ltd., Eaton Corporation PLC, General Electric Company, Hyosung Corporation, Mitsubishi Electric Corporation, Nissin Electric Co. Ltd., Schneider Electric SE, Siemens AG, Toshiba International Corporation.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Recent Developments:

April 2023 ABB invested $170 million in the US.

April 2023 Eaton announced it had completed the acquisition of a 49% stake in Jiangsu Ryan Electrical Co. Ltd. (Ryan), a manufacturer of power distribution and sub-transmission transformers in China with revenues of approximately $100 million in 2022.

Who Should Buy? Or Key stakeholders

- Investors

- Raw Materials Manufacturer

- Energy Companies

- Supplier and Distributor

- Government Organizations

- Research Organizations

- Regulatory Authorities

- Institutional & retail players

- Others

Gas-Insulated Substation Market Regional Analysis

The Gas-Insulated Substation market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

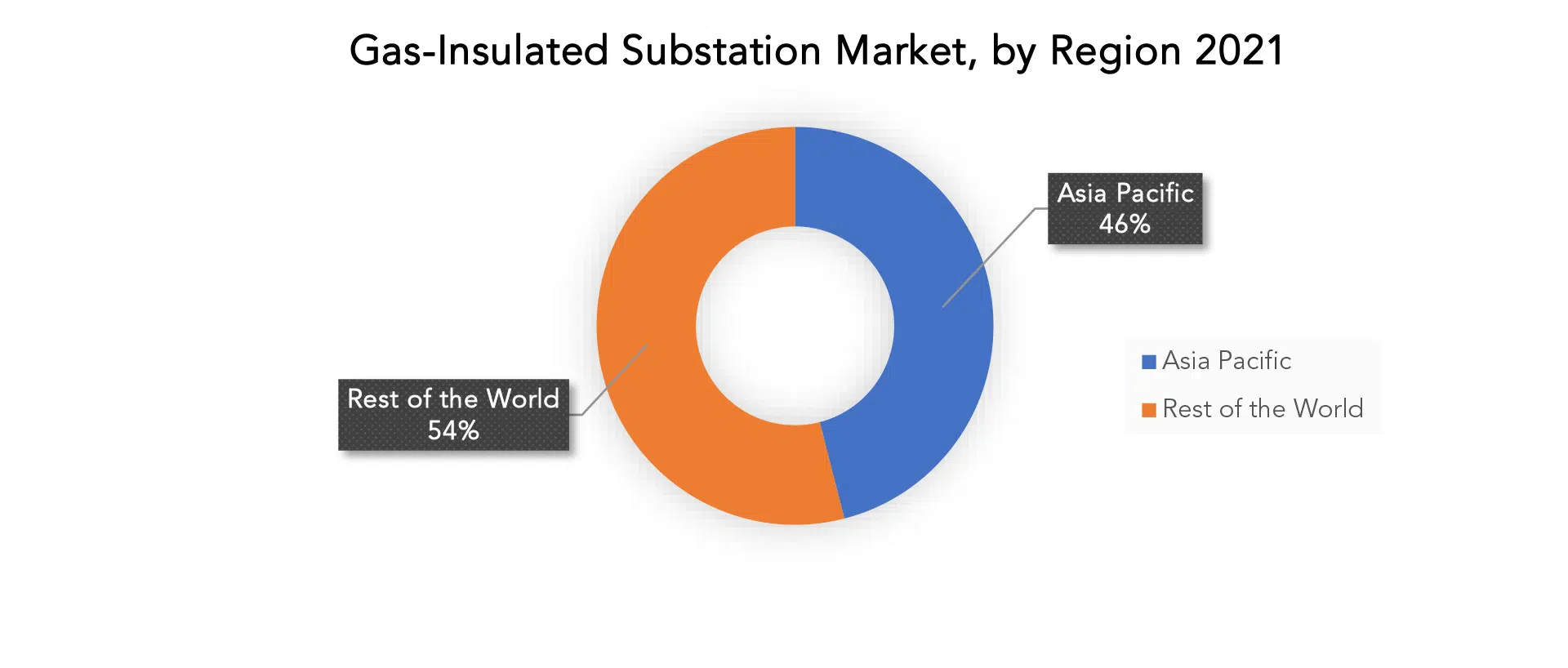

Asia Pacific is expected to be the dominant region in the gas-insulated substation (GIS) market. The region has a large population and rapid urbanization, which is driving the demand for reliable and efficient power supply. Additionally, countries in the region, such as China and India, are investing heavily in power transmission and distribution infrastructure to meet the growing demand for electricity. This is creating significant opportunities for GIS equipment manufacturers to provide high-voltage GIS solutions for power transmission applications. Moreover, government initiatives aimed at improving power infrastructure, increasing electrification rates, and reducing greenhouse gas emissions are expected to drive the growth of the GIS market in the region. As a result, Asia Pacific is expected to continue to be the dominant region in the GIS market in the coming years.

North America is a mature market for gas-insulated substation (GIS) technology, but it is expected to continue to invest in upgrading its existing infrastructure and building new substations to meet the growing demand for electricity. The increasing adoption of renewable energy sources and the development of smart grids are expected to drive demand for GIS equipment in the region. In addition, government initiatives aimed at reducing greenhouse gas emissions and improving the reliability and resiliency of the power grid are expected to create significant opportunities for GIS equipment manufacturers. The United States is the largest market for GIS technology in North America, driven by the increasing demand for electricity and the need to upgrade the aging power infrastructure. Canada is also expected to experience significant growth in the GIS market due to the increasing demand for electricity and the adoption of renewable energy sources.

Key Market Segments: Gas-Insulated Substation Market

Gas-Insulated Substation Market By Voltage, 2020-2029, (USD Billion), (Thousand Units)

- Medium Voltage

- High Voltage

- Extra High Voltage

Gas-Insulated Substation Market By Application, 2020-2029, (USD Billion), (Thousand Units)

- Power Transmission Utility

- Distribution Utility

- Generation Utility

Gas-Insulated Substation Market By Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the gas-insulated substation market over the next 7 years?

- Who are the major players in the gas-insulated substation market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the gas-insulated substation market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the gas-insulated substation market?

- What is the current and forecasted size and growth rate of the global gas-insulated substation market?

- What are the key drivers of growth in the gas-insulated substation market?

- What are the distribution channels and supply chain dynamics in the gas-insulated substation market?

- What are the technological advancements and innovations in the gas-insulated substation market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the gas-insulated substation market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the gas-insulated substation market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL GAS-INSULATED SUBSTATION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GAS-INSULATED SUBSTATION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL GAS-INSULATED SUBSTATION MARKET OUTLOOK

- GLOBAL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- MEDIUM VOLTAGE

- HIGH VOLTAGE

- EXTRA HIGH VOLTAGE

- GLOBAL GAS-INSULATED SUBSTATION MARKET BY APPLICATION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- POWER TRANSMISSION UTILITY

- DISTRIBUTION UTILITY

- GENERATION UTILITY

- GLOBAL GAS-INSULATED SUBSTATION MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABB GROUP

- CG POWER AND INDUSTRIAL SOLUTIONS LTD.

- EATON CORPORATION PLC

- GENERAL ELECTRIC COMPANY

- HYOSUNG CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- NISSIN ELECTRIC CO. LTD.

- SCHNEIDER ELECTRIC SE

- SIEMENS AG

- TOSHIBA INTERNATIONAL CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 2 GLOBAL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL GAS-INSULATED SUBSTATION MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL GAS-INSULATED SUBSTATION MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA GAS-INSULATED SUBSTATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA GAS-INSULATED SUBSTATION MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 14 US GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 15 US GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 18 CANADA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 22 MEXICO GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 32 BRAZIL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC GAS-INSULATED SUBSTATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC GAS-INSULATED SUBSTATION MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 54 INDIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 58 CHINA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 62 JAPAN GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 82 EUROPE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE GAS-INSULATED SUBSTATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE GAS-INSULATED SUBSTATION MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 88 GERMANY GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 UK GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 92 UK GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 93 UK GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 96 FRANCE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 100 ITALY GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 104 SPAIN GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 108 RUSSIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 122 UAE GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY VOLTAGE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA GAS-INSULATED SUBSTATION MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL GAS-INSULATED SUBSTATION MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL GAS-INSULATED SUBSTATION MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL GAS-INSULATED SUBSTATION MARKET BY VOLTAGE, USD BILLION, 2021

FIGURE 13 GLOBAL GAS-INSULATED SUBSTATION MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL GAS-INSULATED SUBSTATION MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 ABB GROUP: COMPANY SNAPSHOT

FIGURE 17 CG POWER AND INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

FIGURE 18 EATON CORPORATION PLC: COMPANY SNAPSHOT

FIGURE 19 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

FIGURE 20 HYOSUNG CORPORATION: COMPANY SNAPSHOT

FIGURE 21 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 22 NISSIN ELECTRIC CO. LTD.: COMPANY SNAPSHOT

FIGURE 23 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

FIGURE 24 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 25 TOSHIBA INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

FAQ

The global gas-insulated substation market is expected to grow at 9.35 % CAGR from 2020 to 2029. It is expected to reach above USD 40.91 Billion by 2029 from USD 18.30 Billion in 2020.

Asia Pacific held more than 46% of the gas-insulated substation market revenue share in 2020 and will witness tremendous expansion during the forecast period.

With the growing population and increasing urbanization, the demand for electricity is increasing rapidly. GIS technology provides a reliable and efficient solution for power transmission and distribution, making it an attractive option for utilities and power companies.

The energy and power sector are where the application of market has seen more.

The markets largest share is in the Asia Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.