REPORT OUTLOOK

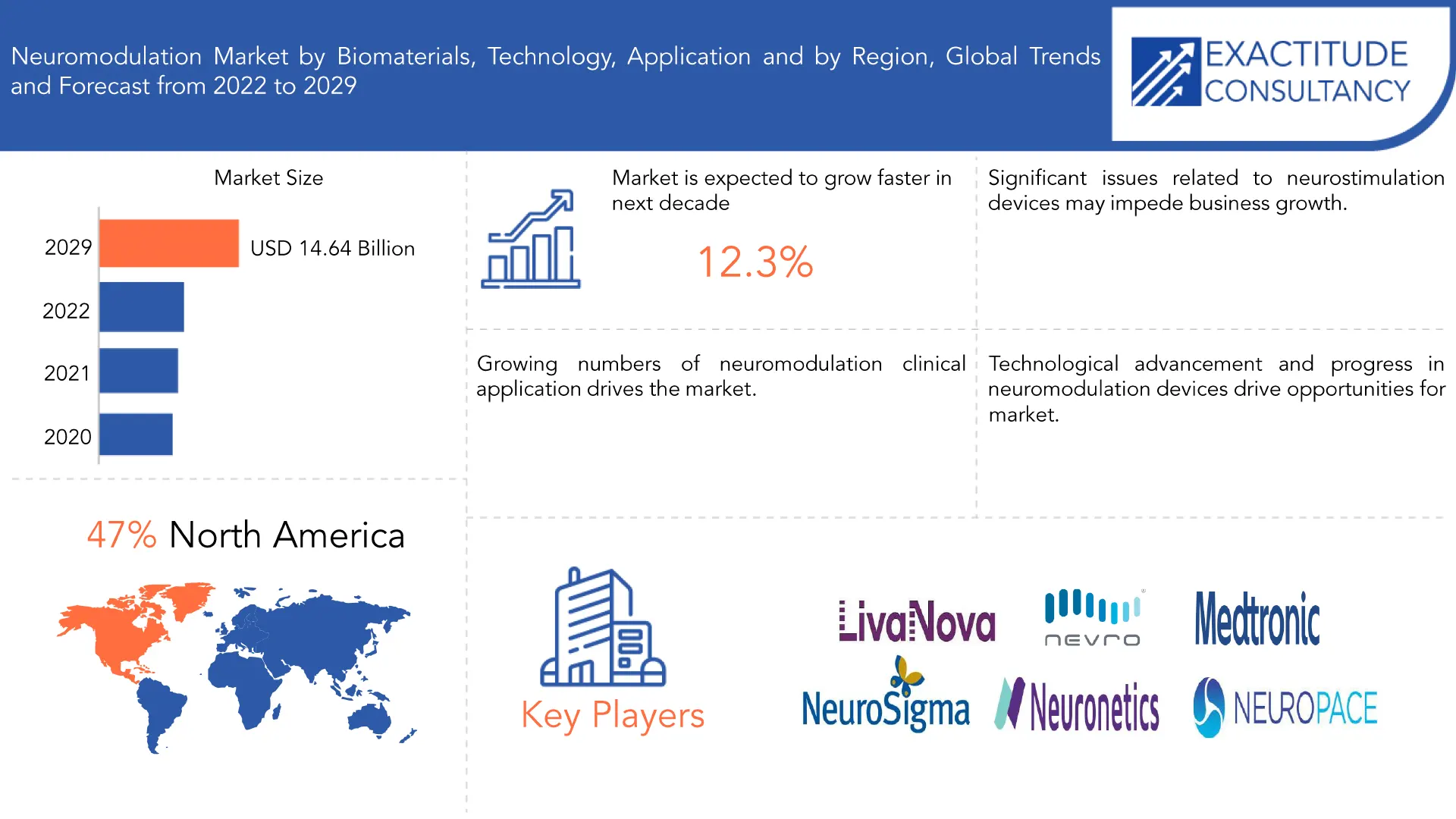

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 5.79 billion in 2021 | 12.3% | North America |

| By Biomaterials | By Technology | By Application | By Regions |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Neuromodulation Market Overview

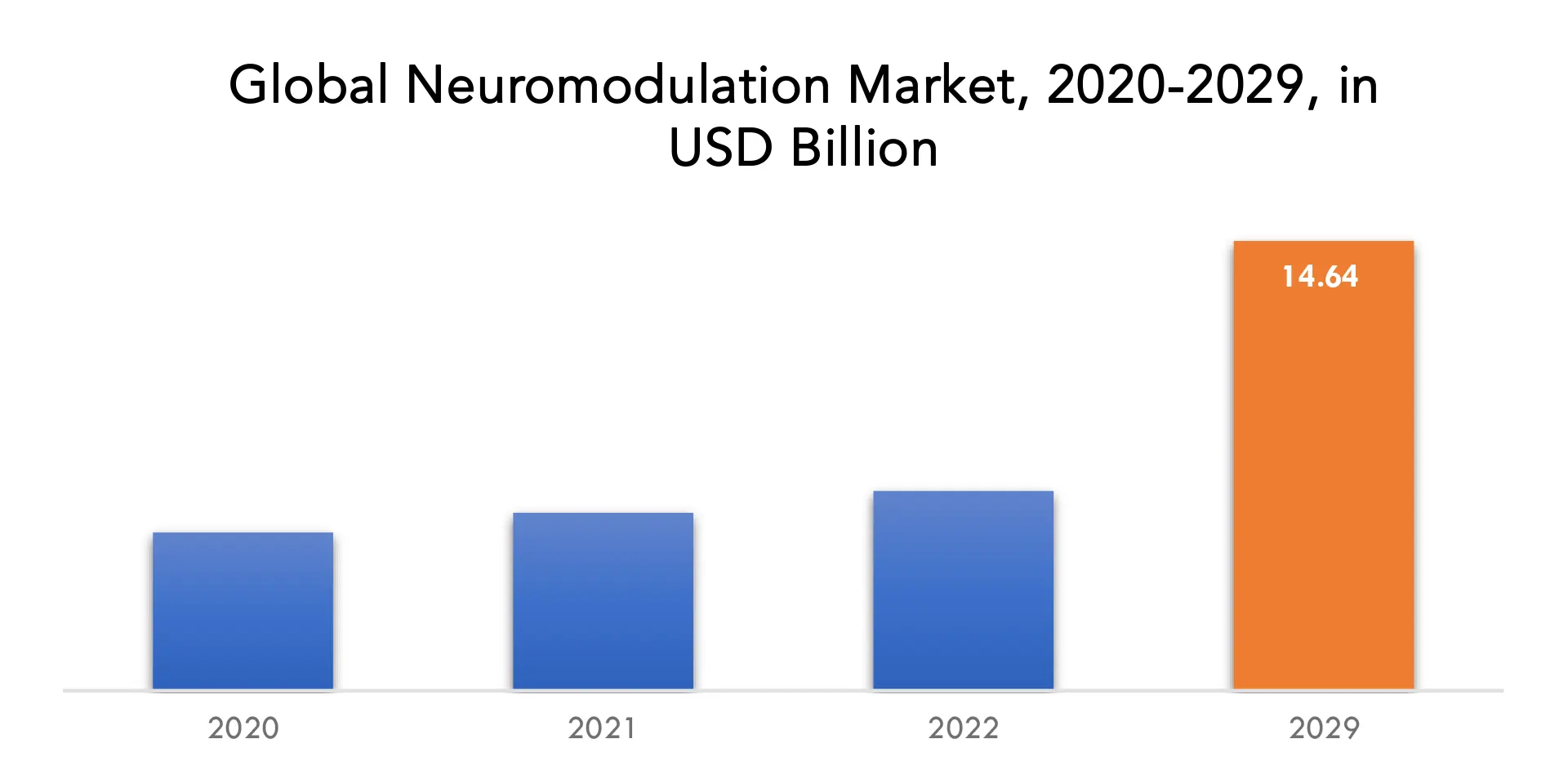

The global neuromodulation market is expected to grow at a 12.3% CAGR from 2022 to 2029, from USD 5.79 billion in 2021.

Globally, neurological disorders like Parkinson’s disease, epilepsy, chronic pain, and incontinence are on the rise. Worldwide, neurological disorders affect about 1 billion people, according to the World Health Organisation. Due to changing lifestyles and an ageing population, this number is anticipated to rise.

These therapies are becoming more widely accepted and used as a result of new neuromodulation technologies like closed-loop systems and wireless devices that make them more usable and accessible. Additionally, as the world’s population ages and the prevalence of chronic diseases like chronic pain and movement disorders rises, neuromodulation therapies are expected to become more and more popular. This is especially true in developing nations, where there may be limited access to conventional drug therapies and a growing demand for cutting-edge, affordable treatment options.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Biomaterials, By Technology, By Application, By Region. |

| By Biomaterials |

|

| By Technology |

|

| By Application |

|

| By Region

|

|

The demand for neuromodulation devices is anticipated to increase, particularly as the prevalence of neurological disorders keeps rising. Neuromodulation therapies continue to be accepted and recognized as effective and secure treatment options. In the upcoming years, the market is anticipated to expand due to the rising demand for neuromodulation treatments

Neuromodulation can be used as an alternative to long-term drug therapy for the symptomatic relief of chronic or persistent conditions when the drugs are ineffective or problematic for the patient. By successfully modifying the abnormal neural pathway behaviour brought on by the disease process, neuromodulation devices stimulate the nerves with electrical signals, pharmaceutical agents, and other forms of energy. Neuromodulation therapies can prevent the negative effects of more systemic or irreversible treatments of nervous system disorders as they are tailored to the individual patient. Since they are easily reversible, they can also provide clinicians and patients with a fundamental level of therapeutic control.

The neuromodulation market has been significantly impacted by the COVID-19 pandemic in the healthcare sector. During the pandemic, many hospitals and clinics delayed non-emergency surgeries and procedures, including those involving neuromodulation. As a result, fewer neuromodulation procedures are being carried out, which has an impact on the market.

Market expansion is expected to be hampered by high costs, governmental restrictions, safety worries, and consumer ignorance. The surgical implantation of neuromodulation devices entails risks like infection, bleeding, or device malfunction. The use of these devices may be restricted due to safety concerns, or regulatory oversight may become more intense. Additionally, as neuromodulation is a young field, patients and medical professionals might not be as familiar with its potential advantages.

Some manufacturers are creating less invasive, more cost-effective neuromodulation devices that are simpler to use, which can help cut costs. Additionally, in order to increase the affordability and accessibility of neuromodulation therapies, some healthcare providers are looking into alternative payment models like value-based pricing. Therefore, despite the fact that access for patients in need of these treatments is currently hindered by the high cost of neuromodulation devices and therapies, efforts are being made to address this problem.

Neuromodulation Market Segment Analysis

Implanting neuromodulation and neurostimulation devices is becoming more common to normalise nervous system activity and treat neurological condition symptoms. An NCBI study found that each year, about 50,000 spinal cord neurostimulators are used to treat patients who suffer from severe and persistent pain brought on by a variety of conditions, including failed back surgery/arachnoiditis, neuropathy, and other neurological disorders. Recent years have seen an increase in the use of spinal cord stimulators, which have a 74% long-term success rate.

The neuromodulation market is segmented into three categories based on biomaterials: metallic, polymeric, and ceramic biomaterials, with metallic biomaterials making up the majority of the market. Metallic biomaterials are frequently used in neuromodulation devices, especially in electrodes and other parts that need to be durable and have high electrical conductivity. Due to their excellent biocompatibility, high strength-to-weight ratio, and resistance to corrosion, titanium and its alloys, in particular, are frequently used in neuromodulation devices.

The neuromodulation market is segmented into internal and external neuromodulation based on technology, with internal neuromodulation making up the majority of the market. In general, internal neuromodulation is thought to be more successful in treating chronic conditions. External neuromodulation, on the other hand, is frequently used as a pain relief or diagnostic tool.

In order to deliver electrical or chemical stimulation to the nervous system, internal neuromodulation involves inserting devices into the patient’s body. Common applications for these devices include the treatment of neurological conditions, movement disorders, and chronic pain. Spinal cord stimulators, deep brain stimulators, and sacral nerve stimulators are a few examples of internal neuromodulation devices.

The neuromodulation market is segmented by application into chronic pain, faecal and urinary incontinence, migraine, failed back syndrome, Parkinson disease, epilepsy, tremor, depression, and other applications, with chronic pain making up the majority of the market. One of the most prevalent chronic diseases, chronic pain, is primarily treated with neuromodulation therapies. The World Health Organisation estimates that chronic diseases like diabetes, heart disease, cancer, chronic respiratory diseases, and stroke cause roughly 71% of all deaths worldwide.

The industry size for pain management was the largest in 2021, at over 67%. The high prevalence of chronic pain disorders (like arthritis) and the rising demand for pain-management products as of their high and rising therapeutic value are expected to fuel the expansion of this market. Approximately 58.5 million people in the US, or 23.8% of the population, have arthritis, according to the CDC.

Neuromodulation therapies are also used to treat Parkinson’s disease, epilepsy, depression, and urinary/faecal incontinence in addition to chronic pain. These conditions may be resistant to conventional treatments and have a significant impact on a patient’s quality of life.

Neuromodulation Market Players

Key players involved in Neuromodulation market are LivaNova PLC, Nevro Corporation, Medtronic, NeuroSigma, Neuronetics, Bioventus Inc., NeuroPace Inc, MicroTransponder, Boston Scientific Corporation and Abbott. Mergers and acquisitions, joint ventures, capacity expansions, significant distribution, and branding decisions by established industry players to boost market share and regional presence. They are also engaged in continuous R&D activities to develop new Product Products and are focused on expanding the Product Biomaterials portfolio. This is expected to increase competition and pose a threat to new market entrants.

March 7, 2023, Nevro announced the full market launch of the revolutionary HFX IQTM spinal cord stimulation system in the United States to personalize chronic pain treatment.

March 1, 2023, NeuroSigma announced a new telehealth option for monarch eTNS for paediatric ADHD patients and carers.

Who Should Buy? Or Key stakeholders

- Research and development

- Hospitals & Specialty Cardiac Centers

- Clinics & Physiotherapy Centers

- Office-Based Labs

- Government

- Healthcare

- Hospitals & Ambulatory Surgery Centers

Neuromodulation Market Regional Analysis

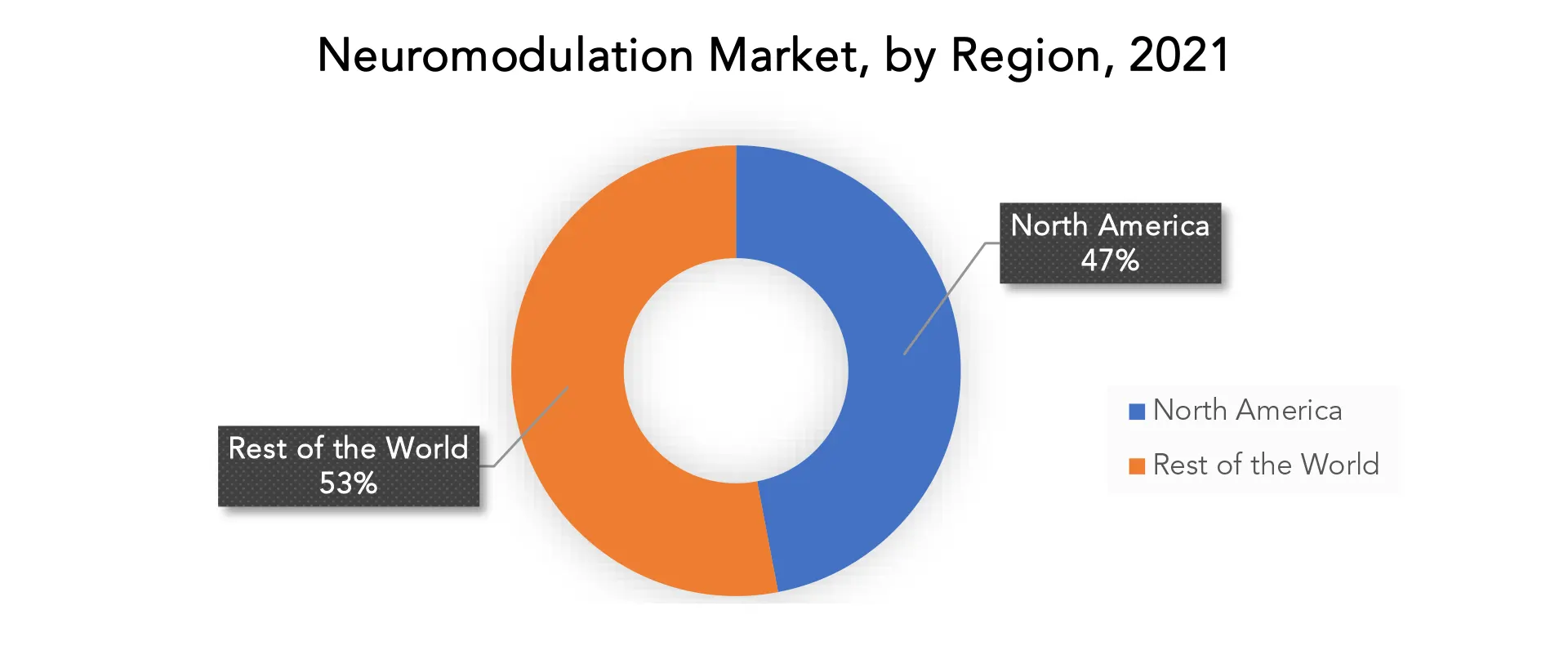

Geographically, the Neuromodulation market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The market is dominated by North America, primarily as of the high prevalence of neurological disorders like Parkinson’s disease and chronic pain, as well as the rising use of neuromodulation therapies by healthcare professionals. The region also has a large number of important market participants for neuromodulation, which supports its dominant position.

The Asia-Pacific region is predicted to have the highest CAGR as of the high patient population, rising healthcare spending, and growing knowledge of neuromodulation therapies. Significant investments are being made in the region’s research and development of neuromodulation therapies and devices. Due to their large patient populations and rising use of neuromodulation therapies, Japan and China currently have the largest markets in the region. However, the market is also expanding significantly in other nations in the region, including Australia, South Korea, and India.

In developing nations like India, Brazil, and China, the prevalence of neurological conditions like epilepsy, depression, and others is rising. 54 million people in China are depressed, according to the WHO. However, fewer people have access to neuromodulation devices due to lower diagnosis and treatment rates, which restrains market expansion.

The prevalence of neurological, respiratory, and other conditions is currently rising throughout the world. The WHO estimates that 40–50 million people worldwide suffer from epilepsy, while Johns Hopkins Medicine estimates that 12 million people do. According to the Cystic Fibrosis Foundation, more than 30,000 people in America and more than 70,000 people worldwide have cystic fibrosis.

The demand for cooling equipment in a variety of end-user industries is significant in Europe, another significant market for chillers. The market is being driven by the rise in neurological conditions like epilepsy and depression. In the upcoming years, demand for neuromodulation therapies is anticipated to increase due to the region’s sizable ageing population.

Key Market Segments: Neuromodulation Market

Neuromodulation Market By Biomaterials, 2020-2029, (USD Billion)

- Metallic Biomaterials

- Polymeric Biomaterials

- Ceramic Biomaterials

Neuromodulation Market By Technology, 2020-2029, (USD Billion)

- Internal Neuromodulation

- External Neuromodulation

Neuromodulation Market By Application, 2020-2029, (USD Billion)

- Chronic Pain

- Urinary And Fecal Incontinence

- Migraine

- Failed Back Syndrome

- Parkinson Disease

- Epilepsy

- Tremor

- Depression

- Other Applications

Neuromodulation Market By Regions, 2020-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Key Objectives:

- Increasing sales and market share

- Developing new Application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the neuromodulation market over the next 7 years?

- Who are the major players in the neuromodulation market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the neuromodulation market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the neuromodulation market?

- What is the current and forecasted size and growth rate of the global neuromodulation market?

- What are the key drivers of growth in the neuromodulation market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the neuromodulation market?

- What are the technological advancements and innovations in the neuromodulation market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the neuromodulation market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the neuromodulation market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NEUROMODULATION MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NEUROMODULATION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NEUROMODULATION MARKET OUTLOOK

- GLOBAL NEUROMODULATION MARKET BY BIOMATERIAL, 2020-2029, (USD BILLION)

- METALLIC BIOMATERIALS

- POLYMERIC BIOMATERIALS

- CERAMIC BIOMATERIALS

- GLOBAL NEUROMODULATION MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION)

- INTERNAL NEUROMODULATION

- EXTERNAL NEUROMODULATION

- GLOBAL NEUROMODULATION MARKET BY APPLICATION, 2020-2029, (USD BILLION)

- CHRONIC PAIN

- URINARY AND FECAL INCONTINENCE

- MIGRAINE

- FAILED BACK SYNDROME

- PARKINSON DISEASE

- EPILEPSY

- TREMOR

- DEPRESSION

- OTHER APPLICATIONS

- GLOBAL NEUROMODULATION MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRIC

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1 LIVANOVA PLC

9.2. NEVRO CORPORATION

9.3. MEDTRONIC

9.4. NEUROSIGMA

9.5. NEURONETICS

9.6. BIOVENTUS INC.

9.7. NEUROPACE INC

9.8. MICROTRANSPONDER

9.9. BOSTON SCIENTIFIC CORPORATION

9.10. ABBOTT

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 2 GLOBAL NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 3 GLOBAL NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL NEUROMODULATION MARKET BY REGION (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA NEUROMODULATION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 9 US NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 10 US NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 11 US NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 12 CANADA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 13 CANADA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 14 CANADA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 15 MEXICO NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 16 MEXICO NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 17 MEXICO NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 18 SOUTH AMERICA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 19 SOUTH AMERICA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 20 SOUTH AMERICA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA NEUROMODULATION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 22 BRAZIL NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 23 BRAZIL NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 24 BRAZIL NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 25 ARGENTINA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 26 ARGENTINA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 27 ARGENTINA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 COLUMBIA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 29 COLUMBIA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 30 COLUMBIA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 31 REST OF SOUTH AMERICA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 32 REST OF SOUTH AMERICA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 33 REST OF SOUTH AMERICA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 ASIA PACIFIC NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 35 ASIA PACIFIC NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 36 ASIA PACIFIC NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 37 ASIA PACIFIC NEUROMODULATION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 38 INDIA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 39 INDIA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 40 INDIA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 41 CHINA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 42 CHINA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 43 CHINA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 44 JAPAN NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 45 JAPAN NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 46 JAPAN NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 47 SOUTH KOREA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 48 SOUTH KOREA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 49 SOUTH KOREA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 AUSTRALIA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 51 AUSTRALIA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 52 AUSTRALIA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 53 SOUTH EAST ASIA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 54 SOUTH EAST ASIA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 55 SOUTH EAST ASIA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 56 REST OF ASIA PACIFIC NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 57 REST OF ASIA PACIFIC NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 58 REST OF ASIA PACIFIC NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 59 EUROPE NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 60 EUROPE NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 61 EUROPE NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 EUROPE NEUROMODULATION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 63 GERMANY NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 64 GERMANY NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 65 GERMANY NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 UK NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 67 UK NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 68 UK NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 69 FRANCE NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 70 FRANCE NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 71 FRANCE NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ITALY NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 73 ITALY NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 74 ITALY NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 75 SPAIN NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 76 SPAIN NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 77 SPAIN NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 RUSSIA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 79 RUSSIA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 80 RUSSIA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 81 REST OF EUROPE NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 82 REST OF EUROPE NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 83 REST OF EUROPE NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 85 MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 86 MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 87 MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 UAE NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 89 UAE NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 90 UAE NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 91 SAUDI ARABIA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 92 SAUDI ARABIA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 93 SAUDI ARABIA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 94 SOUTH AFRICA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 95 SOUTH AFRICA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 96 SOUTH AFRICA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 97 REST OF MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION) 2020-2029

TABLE 98 REST OF MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 99 REST OF MIDDLE EAST & AFRICA NEUROMODULATION MARKET BY APPLICATION (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NEUROMODULATION MARKET BY BIOMATERIAL, USD BILLION, 2020-2029

FIGURE 9 GLOBAL NEUROMODULATION MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE10 GLOBAL NEUROMODULATION MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL NEUROMODULATION MARKET BY REGION, USD BILLION, 2020-2022

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL NEUROMODULATION MARKET BY BIOMATERIAL (USD BILLION), 2021

FIGURE 14 GLOBAL NEUROMODULATION MARKET BY TECHNOLOGY (USD BILLION), 2021

FIGURE 15 GLOBAL NEUROMODULATION MARKET BY APPLICATION (USD BILLION), 2021

FIGURE 16 GLOBAL NEUROMODULATION MARKET BY REGION (USD BILLION), 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 LIVANOVA PLC: COMPANY SNAPSHOT

FIGURE 19 NEVRO CORPORATION: COMPANY SNAPSHOT

FIGURE 20 MEDTRONIC: COMPANY SNAPSHOT

FIGURE 21 NEUROSIGMA: COMPANY SNAPSHOT

FIGURE 22 NEURONETICS: COMPANY SNAPSHOT

FIGURE 23 BIOVENTUS INC.: COMPANY SNAPSHOT

FIGURE 24 NEUROPACE INC: COMPANY SNAPSHOT

FIGURE 25 MICROTRANSPONDER: COMPANY SNAPSHOT

FIGURE 26 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 27 ABBOTT: COMPANY SNAPSHOT

FAQ

The neuromodulation market reached USD 5.15 billion in 2020 and is expected to grow at a CAGR of more than 12.3% through 2029, owing to the increasing in awareness about health.

The upcoming trend in the neuromodulation market is an opportunity for market growth.

The global neuromodulation market registered a CAGR of 12.3% from 2022 to 2029.

The North America neuromodulation market had largest market share of 47% in 2021. Increased availability of neuromodulation devices, a rising number of diseases (such as migraine), more neuromodulation device manufacturers in the US, and skilled medical professionals resulted in North America’s dominance in the industry.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.