REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1.04 billion by 2029 | 5.7% | Asia-pacific |

| By Form | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Melamine Formaldehyde Market Overview

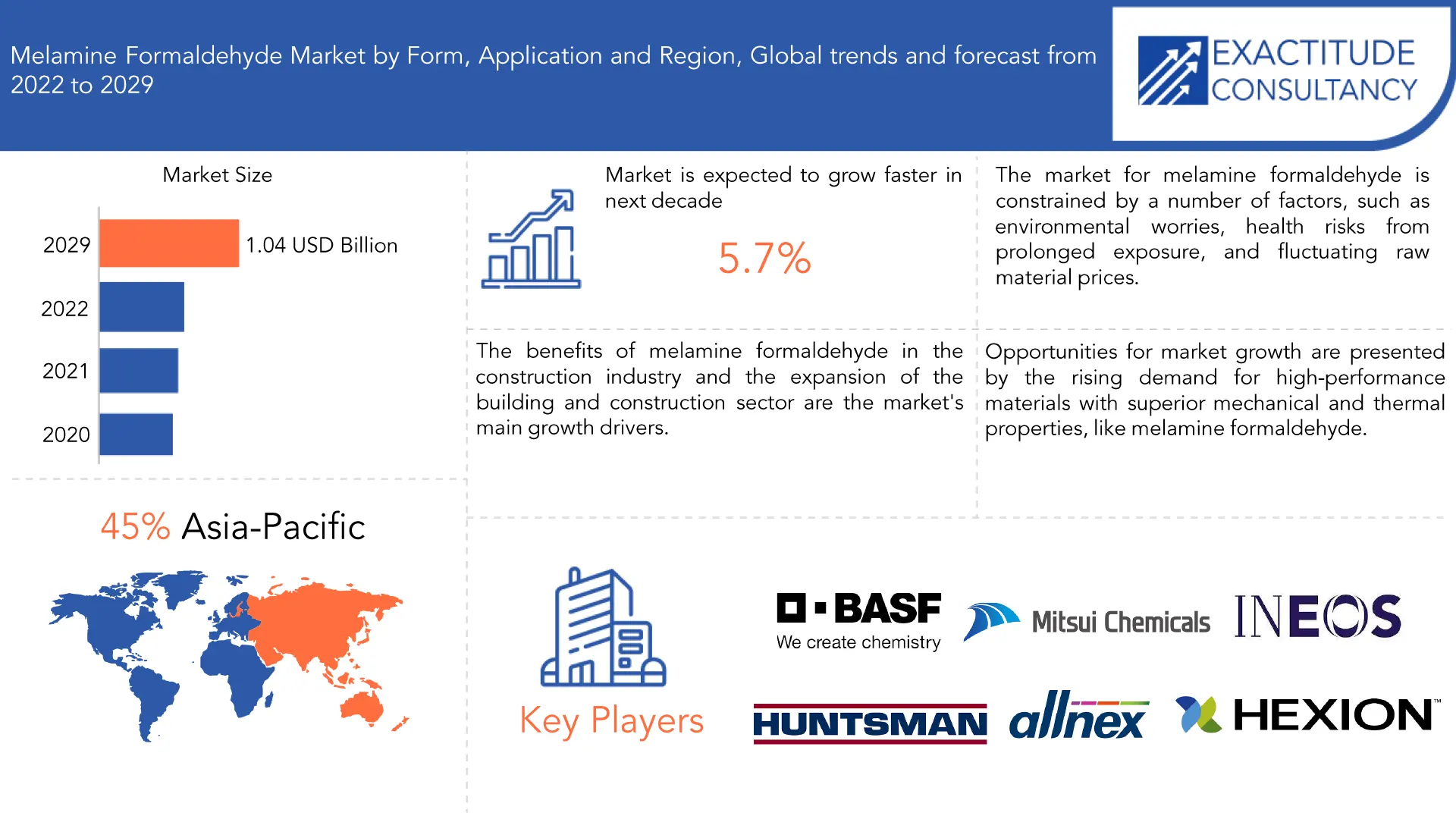

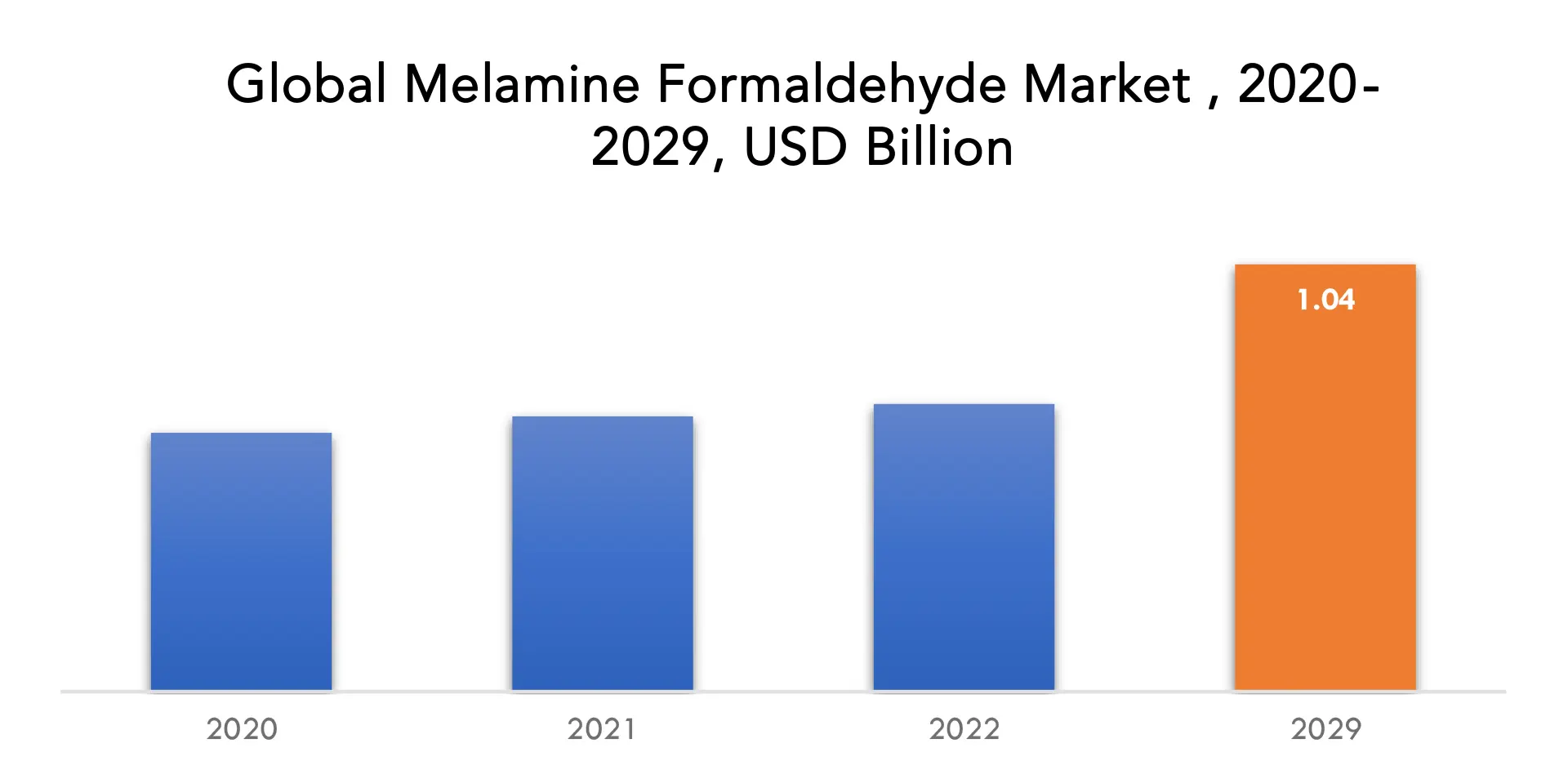

The melamine formaldehyde market is expected to grow at 5.7% CAGR from 2022 to 2029. It is expected to reach above USD 1.04 billion by 2029 from USD 0.63 billion in 2020.

Melamine and formaldehyde react to create melamine formaldehyde, which is a type of thermosetting resin. It is a very adaptable material with excellent mechanical and thermal characteristics, making a variety of applications possible. Commonly used as a binder in the creation of laminates, particleboard, and other composite materials is melamine formaldehyde. These materials gain strength, durability, and resistance to chemicals and moisture by the addition of melamine formaldehyde. Additionally, it is employed in the production of decorative coatings, adhesives, and molded goods like dinnerware and electrical parts.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Value (Kilotons) |

| Segmentation | By form, By Application, By Region |

| By Form

|

|

| By Application

|

|

| By Region

|

|

Melamine formaldehyde is a common option for commercial and residential applications due to its high resistance to heat, moisture, and chemicals. Due to of its high thermal stability, it can withstand extreme temperatures without deteriorating or changing shape. This makes it suitable for use in the electronics, aerospace, and automotive industries. However, melamine formaldehyde exposure over an extended period of time can be harmful to human health. It can release harmful gases like formaldehyde and ammonia when heated, which can irritate the skin, eyes, and respiratory system. Ingesting it can also result in kidney damage and other health issues. As a result, it’s critical to handle melamine formaldehyde safely, use it as directed, and adhere to all applicable safety precautions.

The benefits of melamine formaldehyde in the construction industry and the expansion of the building and construction sector are the market’s main growth drivers. One of the main factors propelling the growth of the Melamine Formaldehyde Market is the booming expansion of the construction sector. As a concrete plasticizer, it is used in the construction of tall buildings and other robust structures. Additionally, when combined with the common wood waste products used in the construction industry, it makes it easier to comply with green building standards. As a result, the growth of the construction sector is likely to have an impact on the market for melamine formaldehyde.

The market for melamine formaldehyde is constrained by a number of factors, such as environmental worries, health risks from prolonged exposure, and fluctuating raw material prices. Increased scrutiny and regulation have resulted from worries about the negative effects of formaldehyde emissions from products made with melamine formaldehyde. The market may also be affected by the cost and availability of the raw materials used to make melamine formaldehyde. The competition from substitute materials and the efficiency of production methods also have an impact on the market.

The melamine formaldehyde market offers room for growth and expansion, particularly in developing nations where there is a growing need for consumer and industrial goods. Opportunities for market growth are presented by the rising demand for high-performance materials with superior mechanical and thermal properties, like melamine formaldehyde. Given the rising demand for environmentally friendly materials, another area of opportunity is the development of sustainable and eco-friendly melamine formaldehyde products. Additionally, the market can profit from the creation of cutting-edge production methods that boost productivity and cut costs, increasing its ability to compete on the world market.

The market for melamine formaldehyde suffered from the COVID-19 outbreak. Demand for melamine formaldehyde from a variety of industries, including the furniture, paper, and construction industry, fell dramatically on the market. The COVID-19 pandemic resulted in an export and import ban, which disrupted the supply chain and slowed the expansion of the melamine formaldehyde market. Government-imposed lockdowns have had a significant negative impact on the construction industry due to many projects have been put on hold or delayed, which has slowed the growth of the melamine formaldehyde market. The COVID-19 pandemic caused a sizable gap between supply and demand. Melamine price fluctuations during COVID-19 significantly hampered the market.

Melamine Formaldehyde Market Segment Analysis

The melamine formaldehyde market is segmented based on form, application and region. Based on types market is segmented into liquid melamine formaldehyde and powder melamine formaldehyde; by application market is segmented into laminates, wood adhesives, molding powders, coatings, others; and region.

In 2021, the melamine formaldehyde market was dominated by the powder segment, which is predicted to expand at a CAGR of 5.4% from now until 2022. Particleboard laminates, and other composite materials are frequently made using powdered melamine formaldehyde. It is incorporated into the raw materials during the manufacturing process to increase their durability, strength, and resistance to chemicals and moisture. Various industrial and consumer products, such as laminates, coatings, adhesives, and molded goods like tableware and electrical components, are produced using liquid melamine formaldehyde as a binder and adhesive. In the creation of textiles and water-soluble resins, it serves as a cross-linking agent.

In 2021, the melamine formaldehyde market was dominated by the laminates segment, which is anticipated to expand at a CAGR of 6.2%. Widely used in both residential and non-residential construction, as well as for remodeling and furniture applications, are the resulting products. Melamine formaldehyde laminates are widely used in a variety of end-use industries, including the production of flooring tiles and furniture for homes, offices, and hospitals, due to their strong resistance to heat, stains, moisture, and damage.

Melamine Formaldehyde Market Key Players

The melamine formaldehyde market key players include BASF, Huntsman International, Hexion, Mitsui Chemicals, Allnex group, INEOS Melamines, Chemiplastica, Hexza Corporation Berhad, Chemisol Italia, Borealis Agrolinz Melamine., and others.

Recent Developments:

01 June 2021: ASF Japan and Mitsui Chemicals collaborated to promote chemical recycling in Japan. Through cooperation across the value chain, BASF and Mitsui Chemicals will evaluate collaborative business models and various options to commercialize chemical recycling in Japan to address the local challenge of plastic waste recycling.

22 March 2023: BASF introduces a new Ultramid Deep Gloss grade, optimized for highly glossy automotive interior parts, and applied for the first time to the garnish of Toyota‘s new Prius.

Key stakeholders

- Suppliers and Distributors

- Chemicals Industry

- Investors

- End user companies

- Research and development

- Regulatory Authorities

- Others

Melamine Formaldehyde Market Regional Analysis

The melamine formaldehyde market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, South Africa, Saudi Arabia and Rest of MEA

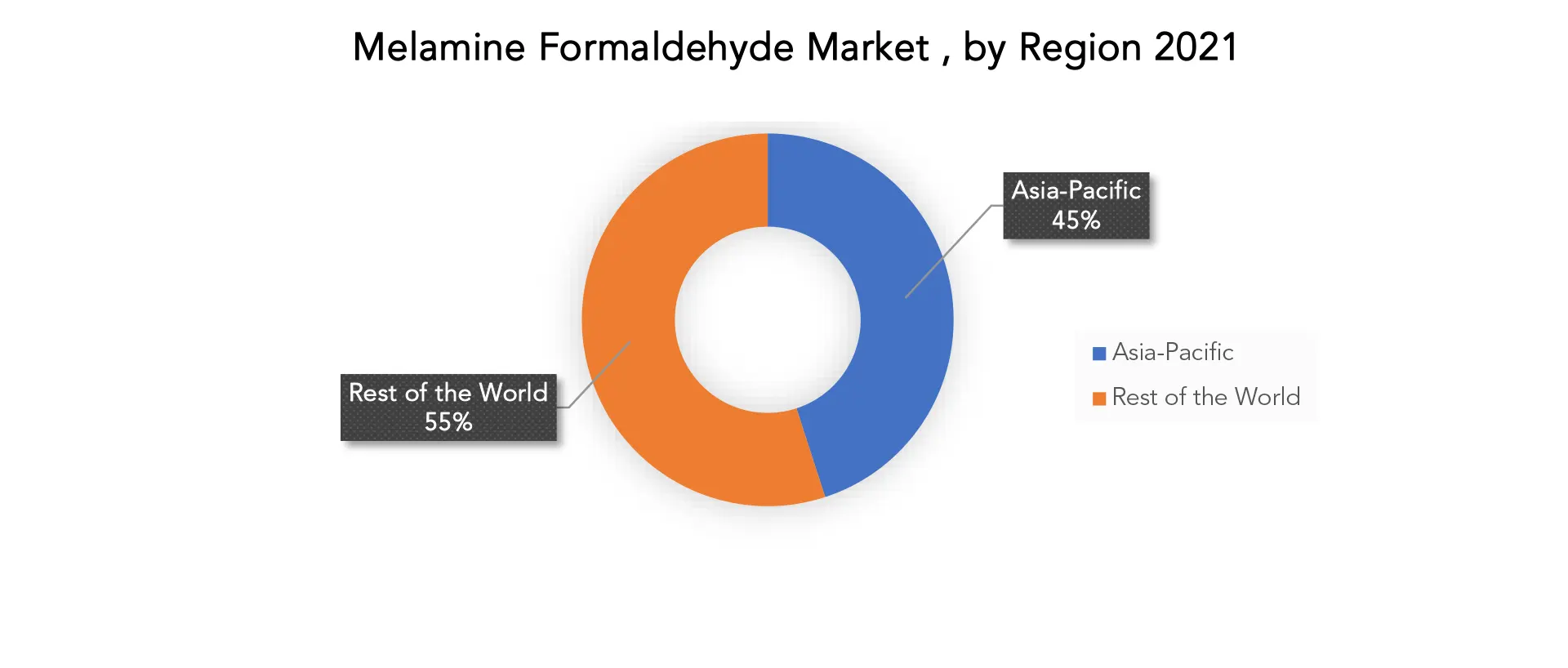

In 2021, Asia Pacific accounted for 45% of the global market for melamine formaldehyde and had the highest demand for it. This can be attributed to the industry’s steadily rising demand for secondary processed products over the ensuing seven years. Due to extremely high demand from the secondary manufacturing sector, China has dominated the local market. However, raw materials like melamine and formaldehyde are necessary for China’s development. Over the next seven years, it is anticipated that the demand for end-use applications will increase, causing rapid growth in nations like India, Vietnam, Korea, Thailand, Malaysia, and Indonesia.

Due to a rise in demand from the construction and coatings industries, North America has closely followed the Asia Pacific. A massive demand for construction in the U.S. has contributed to this trend. The next seven years are expected to see sluggish growth in Europe as well. Africa is expected to experience rapid growth over the next seven years as a result of rising demand from the furniture, coatings, and construction industries. A rise in demand for the automotive sector is anticipated to lead to growth in demand in the Middle East, which will help the region’s market overall.

Key Market Segments: Melamine Formaldehyde Market

Melamine Formaldehyde Market By Form, 2020-2029, (USD Billion, Kilotons)

- Liquid Melamine Formaldehyde

- Powder Melamine Formaldehyde

Melamine Formaldehyde Market By Application, 2020-2029, (USD Billion, Kilotons)

- Laminates

- Wood Adhesives

- Molding Powders

- Coatings

- Others

Melamine Formaldehyde Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the melamine formaldehyde market over the next 7 years?

- Who are the major players in the melamine formaldehyde market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the melamine formaldehyde market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the melamine formaldehyde market?

- What is the current and forecasted size and growth rate of the global melamine formaldehyde market?

- What are the key drivers of growth in the melamine formaldehyde market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the melamine formaldehyde market?

- What are the technological advancements and innovations in the melamine formaldehyde market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the melamine formaldehyde market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the melamine formaldehyde market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of melamine formaldehyde in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MELAMINE FORMALDEHYDE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MELAMINE FORMALDEHYDE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL MELAMINE FORMALDEHYDE MARKET OUTLOOK

- GLOBAL MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION, KILOTONS)

- LIQUID MELAMINE FORMALDEHYDE

- POWDER MELAMINE FORMALDEHYDE

- GLOBAL MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION, KILOTONS)

- LAMINATES

- WOOD ADHESIVES

- MOLDING POWDERS

- COATINGS

- OTHERS

- GLOBAL MELAMINE FORMALDEHYDE MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SOUTH AFRICA

- SAUDI ARABIA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF

- HUNTSMAN INTERNATIONAL

- HEXION

- MITSUI CHEMICALS

- ALLNEX GROUP

- INEOS MELAMINES

- CHEMIPLASTICA

- HEXZA CORPORATION BERHAD

- CHEMISOL ITALIA

- BOREALIS AGROLINZ MELAMINE*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 2 GLOBAL MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 3 GLOBAL MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL MELAMINE FORMALDEHYDE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL MELAMINE FORMALDEHYDE MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 14 US MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 15 US MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA MELAMINE FORMALDEHYDE MARKET BY FORM (BILLION), 2020-2029

TABLE 18 CANADA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 19 CANADA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 22 MEXICO MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 23 MEXICO MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 REST OF NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 26 REST OF NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 27 REST OF NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 REST OF NORTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 31 SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 33 SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 35 BRAZIL MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 36 BRAZIL MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 37 BRAZIL MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 BRAZIL MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 ARGENTINA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 40 ARGENTINA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 41 ARGENTINA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 ARGENTINA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 COLOMBIA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 44 COLOMBIA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 45 COLOMBIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 COLOMBIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 REST OF SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 48 REST OF SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA -PACIFIC MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 52 ASIA -PACIFIC MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 53 ASIA -PACIFIC MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 ASIA -PACIFIC MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 ASIA -PACIFIC MELAMINE FORMALDEHYDE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 56 ASIA -PACIFIC MELAMINE FORMALDEHYDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 57 INDIA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 58 INDIA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 59 INDIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 INDIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 CHINA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 62 CHINA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 63 CHINA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 CHINA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 JAPAN MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 66 JAPAN MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 67 JAPAN MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 JAPAN MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 SOUTH KOREA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 70 SOUTH KOREA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 71 SOUTH KOREA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 SOUTH KOREA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 AUSTRALIA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 74 AUSTRALIA HYBRID APPLICATIONBY FORMS (KILOTONS), 2020-2029

TABLE 75 AUSTRALIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 AUSTRALIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC HYBRID APPLICATIONBY FORMS (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 82 EUROPE MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 83 EUROPE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE MELAMINE FORMALDEHYDE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE MELAMINE FORMALDEHYDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 88 GERMANY MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 89 GERMANY MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 92 UK MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 93 UK MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 96 FRANCE MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 97 FRANCE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 100 ITALY MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 101 ITALY MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 104 SPAIN MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 105 SPAIN MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 108 RUSSIA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 109 RUSSIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST ABD AFRICA MELAMINE FORMALDEHYDE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST ABD AFRICA MELAMINE FORMALDEHYDE MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 122 UAE MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 123 UAE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY FORM (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY FORM (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA MELAMINE FORMALDEHYDE MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MELAMINE FORMALDEHYDE MARKET BY FORM, USD BILLION, 2020-2029

FIGURE 9 GLOBAL MELAMINE FORMALDEHYDE MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL MELAMINE FORMALDEHYDE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 MELAMINE FORMALDEHYDE MARKET BY FORM, USD BILLION, 2021

FIGURE 13 MELAMINE FORMALDEHYDE MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 MELAMINE FORMALDEHYDE MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BASF: COMPANY SNAPSHOT

FIGURE 17 HUNTSMAN INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 18 HEXION: COMPANY SNAPSHOT

FIGURE 19 MITSUI CHEMICALS: COMPANY SNAPSHOT

FIGURE 20 ALLNEX GROUP: COMPANY SNAPSHOT

FIGURE 21 INEOS MELAMINES: COMPANY SNAPSHOT

FIGURE 22 CHEMIPLASTICA: COMPANY SNAPSHOT

FIGURE 23 HEXZA CORPORATION BERHAD: COMPANY SNAPSHOT

FIGURE 24 CHEMISOL ITALIA: COMPANY SNAPSHOT

FIGURE 25 BOREALIS AGROLINZ MELAMINE: COMPANY SNAPSHOT

FAQ

The global melamine formaldehyde market size was valued at 0.63 billion in 2020.

The melamine formaldehyde market key players include BASF, Huntsman International, Hexion, Mitsui Chemicals, Allnex group, INEOS Melamines, Chemiplastica, Hexza Corporation Berhad, Chemisol Italia, Borealis Agrolinz Melamine.

Asia-pacific is the largest regional market for melamine formaldehyde market.

The melamine formaldehyde market is segmented into form, application and region.

The market is anticipated to be driven by the rising demand and applications for melamine formaldehyde, the rising consumption in the packaging industry, and technological advancements in this segment.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.