REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1208.74 million by 2029 | 7.7% | North America |

| By component | By installation | By Application | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Robotic Drilling Market Overview

The robotic drilling market is expected to grow at 7.7% CAGR from 2022 to 2029. It is expected to reach above USD 1208.74 million by 2029 from USD 667.74 million in 2021.

Robotic drilling, which is used in a variety of industries, including mining, oil and gas exploration, and construction, describes the use of autonomous or semi-autonomous robots to carry out drilling tasks. These robots are made to work in risky or challenging environments, increasing drilling operations’ efficiency and safety. Advanced sensors, artificial intelligence, and machine learning algorithms are all incorporated into robotic drilling technology to give the robots the ability to make decisions in real-time and modify their drilling parameters in response to changing conditions. Additionally, with the help of this technology, drilling operations can be remotely monitored and managed, requiring less human involvement and increasing operational effectiveness.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), Value (Thousand Units) |

| Segmentation | By component, by installation, by application, by region |

| By component

|

|

| By installation

|

|

| By Application

|

|

| By Region

|

|

Robotic drilling systems can improve drilling accuracy and precision while significantly reducing drilling time and costs. Additionally, these systems may be used to access resources in previously inaccessible regions, boosting the overall productivity of drilling operations. As a result, the use of robotic drilling technology is expanding quickly across many industries and providing important advantages in terms of safety, effectiveness, and affordability.

The rise in automation in the oil and gas sector is one of the key factors propelling the market for robotic drilling. Since automation saves time and money, the oil and gas industries have become more and more dependent on it. The oil fields are being digitalized by a number of companies. As a result, there has been an increase in funding for facility modernization in an effort to increase productivity and cut costs and lead times.

The adoption of robotic drilling in the oil and gas industry is anticipated to grow significantly due to the industry’s increasing need for automation. Robotic drilling in the oil and gas sector is still required due to factors like improved worker safety, increased precision, high accuracy, improved data collection, and efficiency. Additionally, for oil and gas rigs located in deep ocean regions with unstable weather, automated robotic drilling continues to be the best option. A further factor influencing the growth of the robotic drilling market is the use of robotic drilling systems to extract gas from water and land, which is supported by an increase in the use of LPG and CNG in the automotive industry.

Robots that drill metal need more torque and stiffness. They must exert more force as well. Robots for drilling metal are therefore more expensive than those for drilling wood, fiber, and other relatively soft materials. Used robots are considerably more affordable than brand-new ones. Furthermore, the initial cost of buying robotic drilling equipment is only one factor; it is also important to take into account the costs of designing and creating the equipment. Maintenance and auxiliary costs are the other bases of the robotic drilling equation. All executives and leaders must take maintenance into account as a cost that could impede market expansion.

Numerous growth and development opportunities are presented by the robotic drilling market. The demand for automation and safety in drilling operations is rising, and this demand is being fueled by developments in robotics technology. The mining and oil and gas sectors, where the use of robotic drilling can increase efficiency and cut costs, are predicted to experience significant market growth. Additionally, new opportunities for innovation and market differentiation are being created by the development of autonomous drilling systems and the incorporation of artificial intelligence and machine learning technologies. Overall, the market for robotic drilling is expected to grow significantly over the next few years as more industries adopt automation and safety technologies.

The COVID-19 pandemic has significantly disrupted the global robotic drilling market. The COVID-19 epidemic changed consumer buying habits by slowing economic growth in almost all major nations. The lockdown imposed in many countries has made it difficult for people to travel domestically and internationally, which has seriously disrupted the supply chains of many industries globally and widened the supply-demand gap. As a result, a lack of raw material supply is probably going to cause a significant slowdown in the production rate of robotic drilling equipment. However, as governments all over the world start to loosen their restrictions on resumed business operations, the situation is anticipated to get better.

Robotic Drilling Market Segment Analysis

The robotic drilling market is segmented based on component, installation, application and region. by component market is segmented into hardware and software; by installation market is segmented into retrofit and new builds; by application market is segmented into onshore and offshore; and region.

Businesses are making significant investments in the creation of both hardware and software. During the forecast period, this is anticipated to increase demand for robotic drilling in the oil and gas industry.

In 2021, the retrofit segment of the global robotic drilling market was the most profitable. Given that robotic drilling enhances the efficiency and safety of the current rigs, demand in this market is anticipated to increase significantly. Additionally, it puts more emphasis on minimizing human involvement in drilling.

Over 90% of revenue came from the onshore application segment, which was the largest in the robotic drilling market. Onshore, where there are many wells to drill, robotic drilling is frequently used, along with high-pressure steam or water injection to lubricate and cool the drill bit. Due to the technology’s ability to cut operational costs by as much as 42%, it can also be applied commercially for oil and gas exploration.

Robotic Drilling Market Players

The robotic drilling market key players include Abraj Energy Services SAOC, Automated Rig Technologies Ltd, Drillform Technical Services Ltd, Drillmec Inc., Ensign Energy Services Inc., Huisman Equipment BV, Nabors Industries Ltd, National-Oilwell Varco Inc., Rigarm Inc., Sekal AS, and others.

Industry Developments:

28 October 2021: Schlumberger and Drillmec collaborated to deliver a drilling automation solution. In another signal that digitalization is transforming the oil and gas industry, the two companies have expressed a joint aim to deliver an automation solution.

17 July 2020: Ensign Energy Services Inc. (“Ensign” or “the Company”) (TSX: ESI) is pleased to announce the acquisition of Halliburton’s 40% ownership in the joint venture operating under the name Trinidad Drilling International (“TDI”) which owns and operates five drilling rigs in Mexico, Kuwait and Bahrain.

Who Should Buy? Or Key stakeholders

- Manufacturers

- Traders and distributors

- End-users companies

- Government organizations

- Research organizations

- Investment research firms

- Others

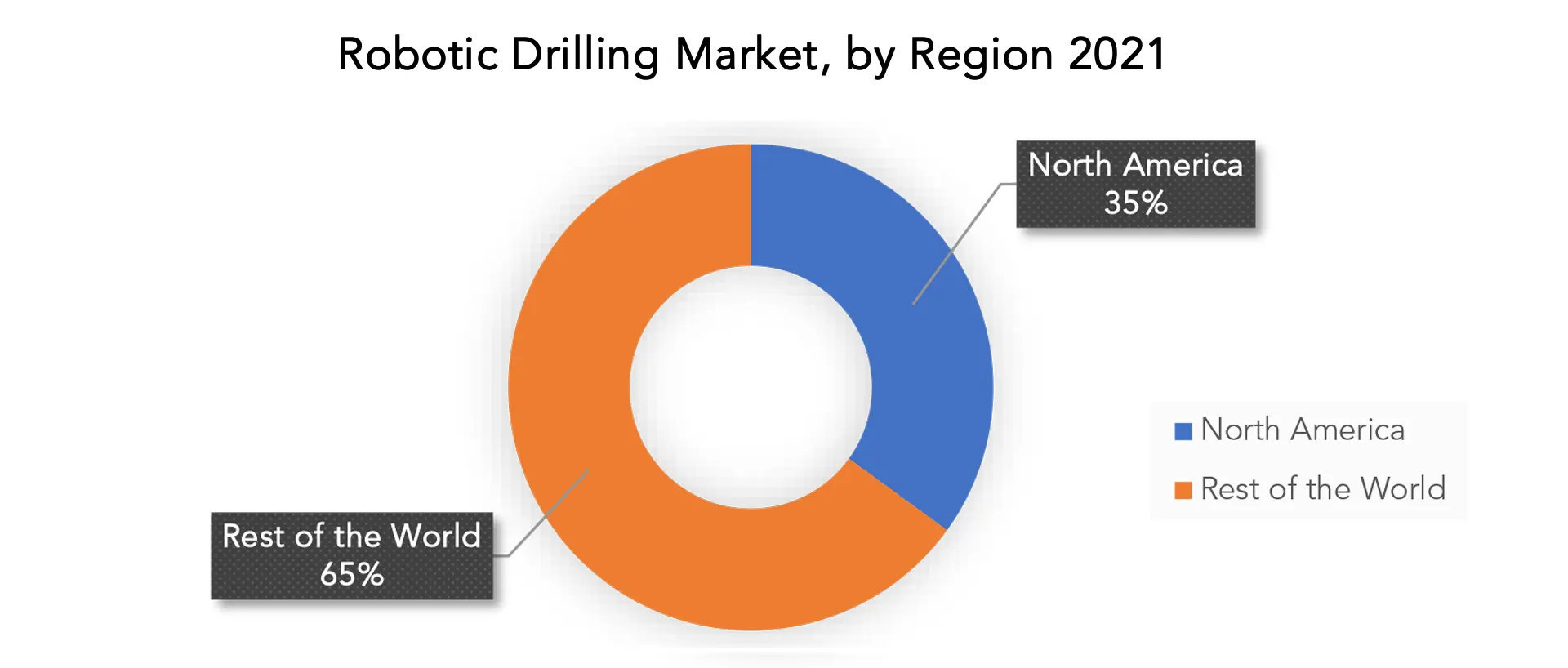

Robotic Drilling Market Regional Analysis

The robotic drilling market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico, Rest of North America

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Russia, Spain, and Rest of Europe

- South America: includes Brazil, Argentina, Colombia and Rest of South America

- Middle East & Africa: includes UAE, Saudi Arabia, South Africa, and Rest of MEA

Due to increased shale gas production and higher standards of safety and efficiency set by drilling contractors, North America is expected to dominate the global market during the anticipated period. The fastest-growing market is also anticipated to be North America, followed by Asia-Pacific. Due to increased drilling for unconventional hydrocarbon resources and the adoption of automation and robotics in oil and gas drilling, it is anticipated that there will be an increase in demand for robotic drilling on a global scale. The high demand for crude oil in India is expected to cause the market in the Asia-Pacific region to grow quickly in the near future.

Due to increased oil and gas extraction activities and a quicker adoption of cutting-edge technologies in the region, the North American market is currently expected to dominate the global robotic drilling market during the anticipated period. The development of shale gas resources to boost oil and gas production is the main focus of the North American market in the United States, and it is anticipated that this will increase demand for robotic drilling and lead to regional market expansion during the anticipated period. As a result of the rising demand for crude oil from emerging economies, Asia-Pacific is expected to experience the fastest rate of growth during the anticipated period.

Key Market Segments: Robotic Drilling Market

Robotic Drilling Market By Component, 2020-2029, (USD Million, Thousand Units)

- Hardware

- Software

Robotic Drilling Market By Product Technique , 2020-2029, (USD Million, Thousand Units)

- Retrofit

- New Builds

Robotic Drilling Market By Application, 2020-2029, (USD Million, Thousand Units)

- Onshore

- Offshore

Robotic Drilling Market By Region, 2020-2029, (USD Million, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

IMPORTANT COUNTRIES IN ALL REGIONS ARE COVERED.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the robotic drilling market over the next 7 years?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, Middle East, and Africa?

- How is the economic environment affecting the robotic drilling market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the robotic drilling market?

- What is the current and forecasted size and growth rate of the global robotic drilling market?

- What are the key drivers of growth in the robotic drilling market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the robotic drilling market?

- What are the technological advancements and innovations in the robotic drilling market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the robotic drilling market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the robotic drilling market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of robotic drilling in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ROBOTIC DRILLING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ROBOTIC DRILLING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ROBOTIC DRILLING MARKET OUTLOOK

- GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION, THOUSAND UNITS), 2020-2029

- HARDWARE

- SOFTWARE

- GLOBAL ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION, THOUSAND UNITS),2020-2029

- RETROFIT

- NEW BUILDS

- GLOBAL ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION, THOUSAND UNITS),2020-2029

- ONSHORE

- OFFSHORE

- GLOBAL ROBOTIC DRILLING MARKET BY REGION (USD MILLION, THOUSAND UNITS),2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- REST OF NORTH AMERICA

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ABRAJ ENERGY SERVICES SAOC

- AUTOMATED RIG TECHNOLOGIES LTD

- DRILLFORM TECHNICAL SERVICES LTD

- DRILLMEC INC.

- ENSIGN ENERGY SERVICES INC.

- HUISMAN EQUIPMENT BV

- NABORS INDUSTRIES LTD

- NATIONAL-OILWELL VARCO INC.

- RIGARM INC.

- SEKAL AS

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 2 GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 6 GLOBAL ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL ROBOTIC DRILLING MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL ROBOTIC DRILLING MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 16 NORTH AMERICA ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 17 US ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 18 US ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 19 US ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 20 US ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 21 US ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 22 US ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA ROBOTIC DRILLING MARKET BY COMPONENT (MILLION), 2020-2029

TABLE 24 CANADA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 26 CANADA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 28 CANADA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 30 MEXICO ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 32 MEXICO ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 34 MEXICO ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 REST OF NORTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 36 REST OF NORTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 37 REST OF NORTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 38 REST OF NORTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 39 REST OF NORTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATIONN (USD MILLION), 2020-2029

TABLE 40 REST OF NORTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATIONN (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 42 SOUTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 43 SOUTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 44 SOUTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 45 SOUTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 46 SOUTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 47 SOUTH AMERICA ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 48 SOUTH AMERICA ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 49 BRAZIL ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 50 BRAZIL ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 51 BRAZIL ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 52 BRAZIL ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 53 BRAZIL ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 54 BRAZIL ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 ARGENTINA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 56 ARGENTINA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 57 ARGENTINA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 58 ARGENTINA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 59 ARGENTINA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 60 ARGENTINA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 COLOMBIA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 62 COLOMBIA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 63 COLOMBIA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 64 COLOMBIA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 65 COLOMBIA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 66 COLOMBIA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF SOUTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 68 REST OF SOUTH AMERICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 69 REST OF SOUTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 70 REST OF SOUTH AMERICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 71 REST OF SOUTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATIONN (USD MILLION), 2020-2029

TABLE 72 REST OF SOUTH AMERICA ROBOTIC DRILLING MARKET BY APPLICATIONN (THOUSAND UNITS), 2020-2029

TABLE 73 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 74 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 75 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 76 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 77 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 78 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 80 ASIA -PACIFIC ROBOTIC DRILLING MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 81 INDIA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 82 INDIA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 83 INDIA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 84 INDIA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 85 INDIA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 86 INDIA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 87 CHINA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 88 CHINA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 89 CHINA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 90 CHINA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 91 CHINA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 92 CHINA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 93 JAPAN ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 94 JAPAN ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 95 JAPAN ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 96 JAPAN ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 97 JAPAN ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 98 JAPAN ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 SOUTH KOREA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 100 SOUTH KOREA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 101 SOUTH KOREA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 102 SOUTH KOREA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH KOREA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 104 SOUTH KOREA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 105 AUSTRALIA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 106 AUSTRALIA ROBOTIC DRILLING MARKET BY INSTALLATIONBY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 107 AUSTRALIA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 108 AUSTRALIA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 109 AUSTRALIA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 110 AUSTRALIA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC ROBOTIC DRILLING MARKET BY INSTALLATIONBY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 118 EUROPE ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 120 EUROPE ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 122 EUROPE ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 123 EUROPE ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 124 EUROPE ROBOTIC DRILLING MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 126 GERMANY ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 128 GERMANY ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 129 GERMANY ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 130 GERMANY ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 131 UK ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 132 UK ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 133 UK ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 134 UK ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 135 UK ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 136 UK ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 137 FRANCE ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 138 FRANCE ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 140 FRANCE ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 141 FRANCE ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 142 FRANCE ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 144 ITALY ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 146 ITALY ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 147 ITALY ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 148 ITALY ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 150 SPAIN ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 152 SPAIN ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 153 SPAIN ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 154 SPAIN ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 156 RUSSIA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 158 RUSSIA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 159 RUSSIA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 160 RUSSIA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 162 REST OF EUROPE ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 164 REST OF EUROPE ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF EUROPE ROBOTIC DRILLING MARKET BY APPLICATIONN (USD MILLION), 2020-2029

TABLE 166 REST OF EUROPE ROBOTIC DRILLING MARKET BY APPLICATIONN (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 175 UAE ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 176 UAE ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 177 UAE ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 178 UAE ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 179 UAE ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 180 UAE ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 182 SAUDI ARABIA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 184 SAUDI ARABIA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 185 SAUDI ARABIA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 186 SAUDI ARABIA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 188 SOUTH AFRICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 190 SOUTH AFRICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 191 SOUTH AFRICA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 192 SOUTH AFRICA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY COMPONENT (USD MILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY INSTALLATION (USD MILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY INSTALLATION (THOUSAND UNITS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ROBOTIC DRILLING MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ROBOTIC DRILLING MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ROBOTIC DRILLING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT, USD MILLION, 2021

FIGURE 14 GLOBAL ROBOTIC DRILLING MARKET BY COMPONENT, USD MILLION, 2021

FIGURE 15 GLOBAL ROBOTIC DRILLING MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 16 GLOBAL ROBOTIC DRILLING MARKET BY REGION, USD MILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ABRAJ ENERGY SERVICES SAOC: COMPANY SNAPSHOT

FIGURE 19 AUTOMATED RIG TECHNOLOGIES LTD: COMPANY SNAPSHOT

FIGURE 20 DRILLFORM TECHNICAL SERVICES LTD: COMPANY SNAPSHOT

FIGURE 21 DRILLMEC INC.: COMPANY SNAPSHOT

FIGURE 22 ENSIGN ENERGY SERVICES INC.: COMPANY SNAPSHOT

FIGURE 23 HUISMAN EQUIPMENT BV: COMPANY SNAPSHOT

FIGURE 24 NABORS INDUSTRIES LTD: COMPANY SNAPSHOT

FIGURE 25 NATIONAL-OILWELL VARCO INC.: COMPANY SNAPSHOT

FIGURE 26 RIGARM INC.: COMPANY SNAPSHOT

FIGURE 27 SEKAL AS: COMPANY SNAPSHOT

FAQ

Robotic drilling market was valued at USD 719.16 million in 2022 and is projected to reach USD 1208.74 million by 2029, growing at a CAGR of 7.7% from 2022 to 2029.

Robotic drilling has established itself as a revolutionary robotic technology which has significant applications in unmanned drilling operations. Robotic control systems for drilling help to facilitate seamless operations between drilling machines in a safe manner which also reduces the scope for human error.

The major players are Abraj Energy Services SAOC, Automated Rig Technologies Ltd, Drillform Technical Services Ltd, Drillmec Inc., Ensign Energy Services Inc., Huisman Equipment BV, Nabors Industries Ltd, National-Oilwell Varco Inc., Rigarm Inc., Sekal AS.

The global robotic drilling market is segmented on the basis of component, installation, application, and geography.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.