REPORT OUTLOOK

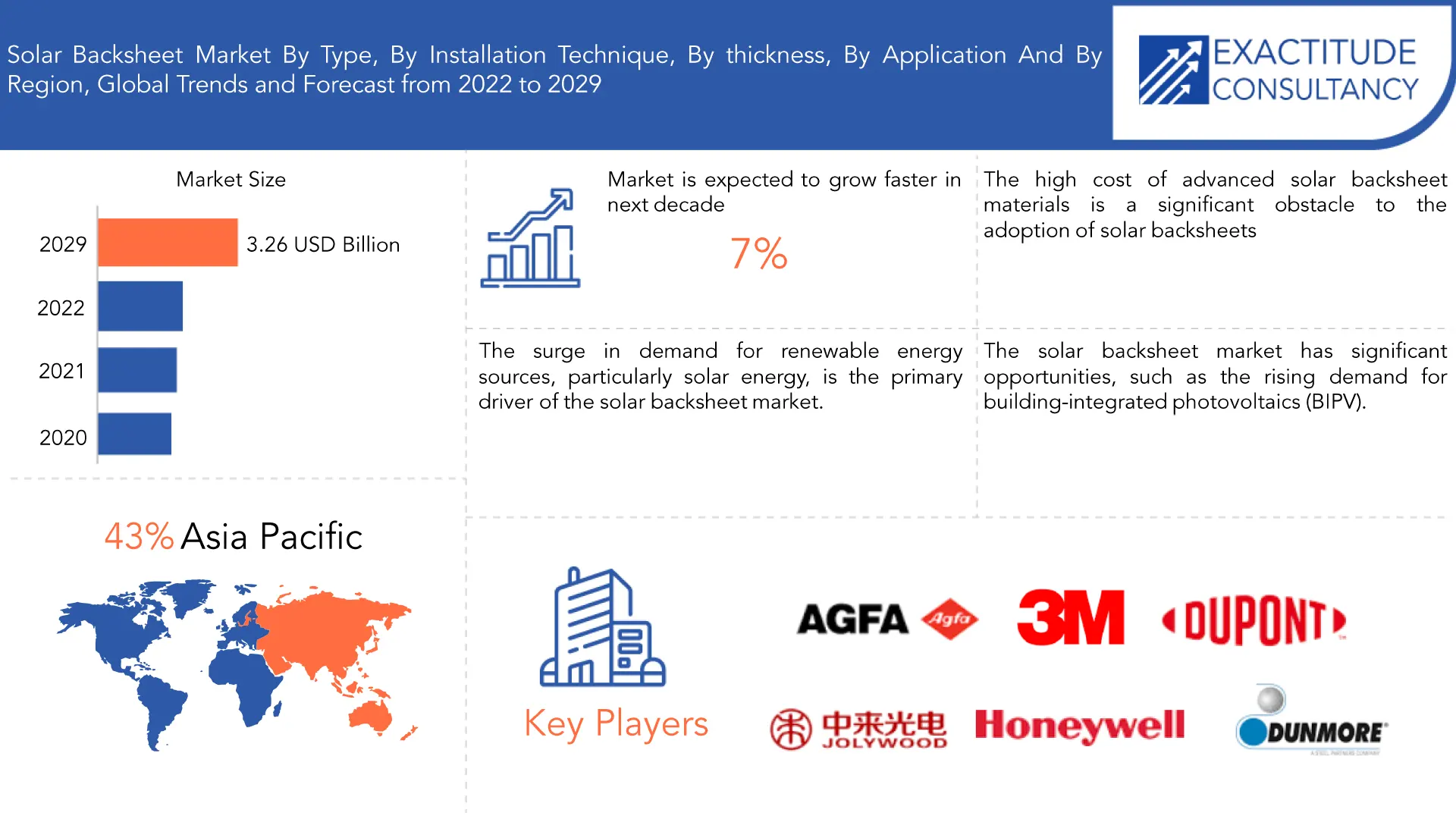

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 3.26 billion by 2029 | 7% | Asia Pacific |

| By Type | By Installation technique | By Thickness |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Solar Backsheet Market Overview

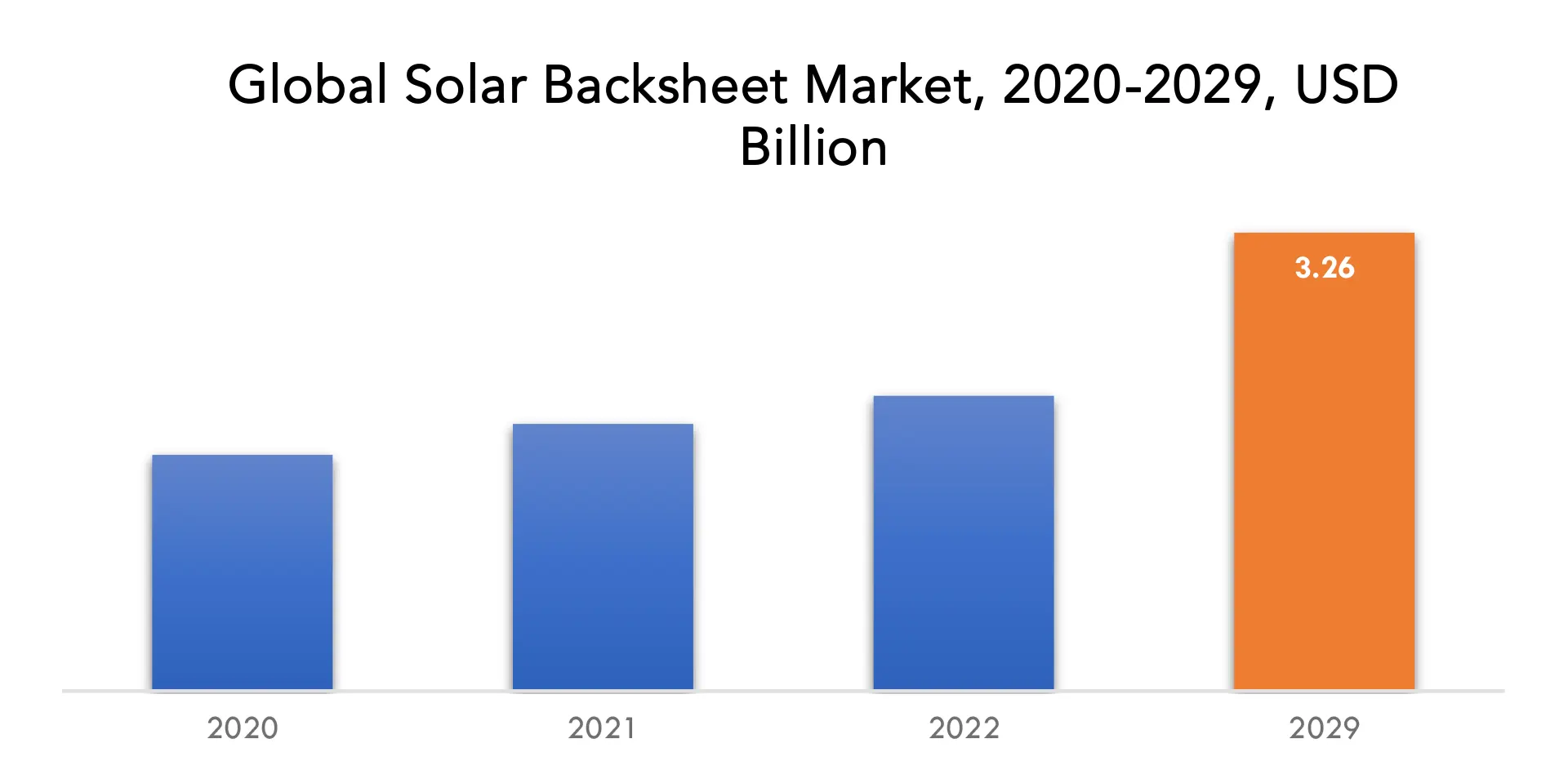

The solar backsheet market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above USD 3.26 billion by 2029 from USD 1.9 billion in 2021.

The solar backsheet is a vital part of a solar panel’s construction, serving as a protective layer for the panel’s backside and guarding the solar cells against moisture, heat, and UV radiation. Generally, the solar backsheet comprises three layers: a polyester film layer, an ethylene vinyl acetate (EVA) layer, and a fluoropolymer layer. The polyester film layer confers stability and strength to the backsheet, the EVA layer provides a moisture barrier, and it also helps to bond the solar cells to the backsheet. Additionally, the fluoropolymer layer offers extra protection against UV radiation and environmental elements.

The proper selection of the solar backsheet is vital in creating high-performance solar panels. The backsheet’s characteristics, such as low water vapor transmission rate, excellent adhesion properties, high temperature resistance, and UV stability, are essential to ensure the solar panel’s durability and dependability over its expected lifespan. The solar backsheet is a crucial solar panel component, safeguarding solar cells from external factors and guaranteeing the solar panel’s longevity and performance.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion)(Thousand Units) |

| Segmentation | By Type, Installation technique, Thickness, Application |

| By Type |

|

| By Installation technique |

|

| By Thickness |

|

| By Application |

|

| By Region |

|

The surge in demand for renewable energy sources, particularly solar energy, is the primary driver of the solar backsheet market. The adoption of solar panels across different applications, including residential, commercial, and utility-scale projects, is a significant factor driving the demand for solar backsheets. Improved efficiency and durability of solar panels are additional drivers of the growth of the solar backsheet market. To enhance the performance and lifespan of solar panels, the use of advanced materials, such as fluoropolymers, is gaining popularity, leading to an increase in demand for high-quality solar backsheets.

The high cost of advanced solar backsheet materials is a significant obstacle to the adoption of solar backsheets, especially in emerging markets with limited resources. Another restraint is the limited availability of raw materials needed for solar backsheets’ production, such as fluoropolymers and ethylene vinyl acetate (EVA). This scarcity can lead to supply chain disruptions, limiting the availability and production of solar backsheets. Moreover, the stringent regulatory policies and standards for solar panel installation and components, including backsheets, pose a significant challenge for the solar backsheet market.

The solar backsheet market has significant opportunities, such as the rising demand for building-integrated photovoltaics (BIPV). BIPV involves integrating solar panels into building structures like windows and roofs, providing renewable energy while enhancing the building’s aesthetic appeal. Another opportunity is the development of lightweight and flexible backsheets that can enhance solar panels’ efficiency and lower installation costs. This advancement can make solar panels more practical and accessible for various applications, including portable and mobile solar panels.

The pandemic had a mixed impact on the solar backsheet market. On the one hand, the global economic slowdown and disruptions in the supply chain led to reduced demand for solar panels and backsheets. This led to a decline in the market growth rate, particularly in the first half of 2020. On the other hand, the pandemic increased awareness about the importance of renewable energy and sustainability, leading to a growing demand for solar panels and backsheets in the latter half of the year. The pandemic also accelerated the shift towards digitization, resulting in increased investments in research and development activities for innovative and sustainable solar backsheet materials.

Solar Backsheet Market Segment Analysis

The solar backsheet market is segmented based on type, installation technique, thickness and application.

Fluoropolymer is currently the dominant type of solar backsheet in the market owing to its exceptional properties such as high resistance to weather and UV radiation, low water vapor transmission rate, and strong adhesion, which make it a popular choice for high-performance solar panels. Nevertheless, due to concerns regarding the environmental impact and cost-effectiveness of fluoropolymers, there is an emerging trend towards the usage of non-fluoropolymer backsheets.

The largest share for solar backsheet market based on installation technique is ground mount solar. This is due to the suitability of ground-mounted solar panels for large-scale solar projects, which is a growing segment in the solar industry. Ground mount solar systems are generally installed in open areas and have a larger capacity compared to roof-mounted solar systems, making them an ideal choice for utility-scale projects.

The most significant share of the solar backsheet market, based on thickness, falls within the 100-500mm range. This thickness range strikes a balance between strength and flexibility, making it a popular choice for different solar panel applications. It provides ample protection against external elements like moisture, heat, and UV radiation while allowing for easy installation and maintenance. However, the thickness requirements for solar backsheets can vary based on the specific application and environmental conditions.

The largest share for the solar backsheet market based on application is utilities. This is due to the increasing investments in renewable energy infrastructure by governments worldwide, coupled with various incentives and subsidies, which are driving the demand for solar panels and in turn, the solar backsheet market. Additionally, utility-scale solar projects require a high volume of solar panels, which increases the demand for solar backsheets.

Solar Backsheet Market Players

The solar backsheet market key players include Honeywell Corporation, Agfa, DuPont, Jolywood, 3M, Dunmore Corporation, Krempel, Flexcon, and Hangzhou Sunhome Solar Backsheet Co. Ltd.

Industry News:

April 05 , 2022 : Nomex 910, developed by DuPont™, is produced by and sold through Krempel. Since 2015, Krempel have been DuPont’s global partner for the newly developed cellulose paper, supporting DuPont™ by producing Nomex® 910 in one of our paper production facilities – and eventually produced the 3, 5, 7 and 10 mil. papers in the same plant.

September 20, 2022 : 3M expanded research and development into emerging technologies focused on decarbonization and renewable fuels. Through cross-functional global teams, 3M Corporate Research and 3M Ventures, the company’s corporate venturing arm, 3M is investing in and developing innovative materials for green hydrogen and low-carbon intensity energy separations.

Who Should Buy? Or Key stakeholders

- Solar Backsheet Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Greater than 500mm

Solar Backsheet Market Regional Analysis

The solar backsheet market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

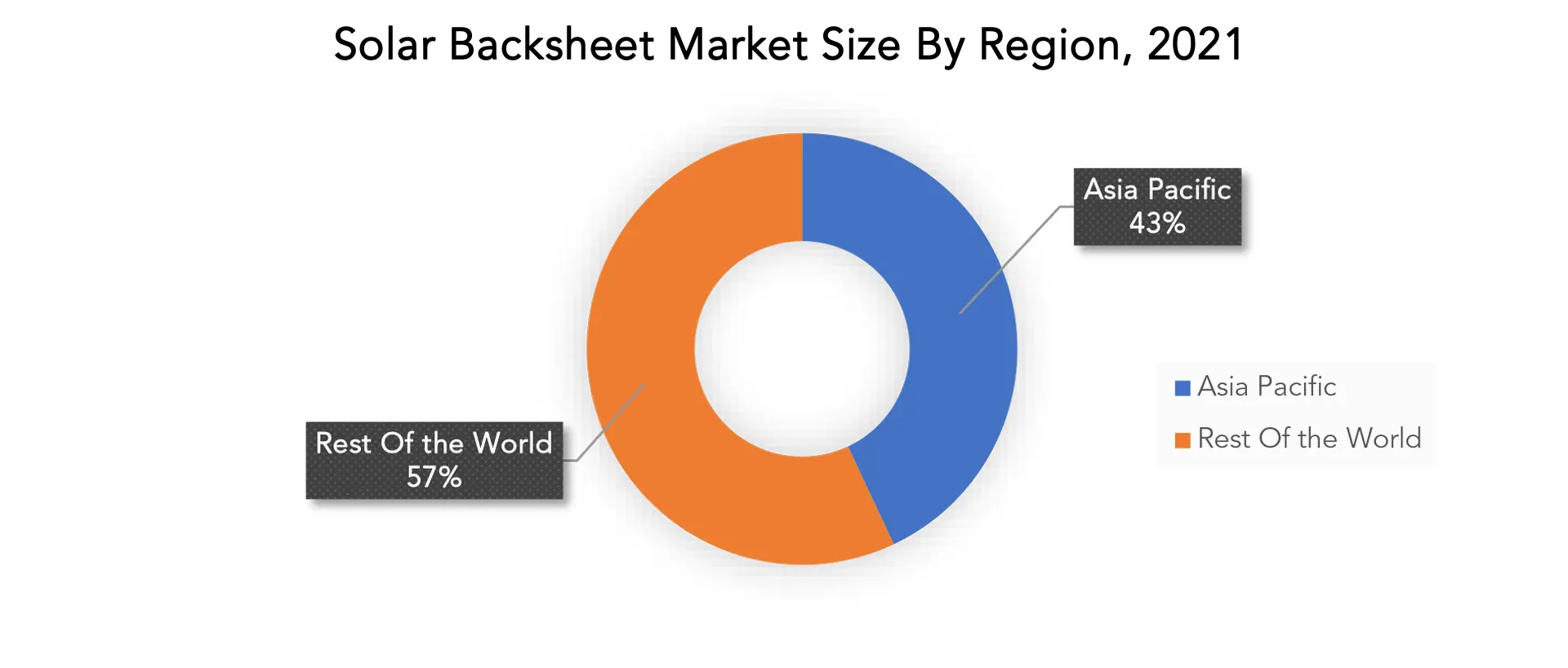

The Asia Pacific region has witnessed significant growth in the solar backsheet market, primarily driven by the increasing adoption of renewable energy sources in the region. The rising demand for solar panels across various applications, including residential, commercial, and utility-scale projects, is driving the demand for solar backsheets. Additionally, the availability of raw materials and low-cost labor in the region has led to the establishment of numerous manufacturing facilities, further contributing to the growth of the market. Moreover, government initiatives and incentives to promote the adoption of renewable energy sources are fueling the growth of the solar backsheet market in the Asia Pacific region.

The North American solar backsheet market is driven by factors such as government policies and incentives promoting the use of solar energy, rising energy costs, and growing awareness of the environmental benefits of renewable energy. The market is dominated by large players such as Dupont, Coveme, Krempel, and Madico, among others. These companies offer a wide range of backsheet materials such as fluoropolymer, polyester, and polyamide, among others, that cater to different types of solar panels and installation environments.

Key Market Segments: Solar Backsheet Market

Solar Backsheet Market By Type, 2020-2029, (USD Billion), (Thousand Units)

- Fluoropolymer

- Non-Fluoropolymer

Solar Backsheet Market By Installation Technique, 2020-2029, (USD Billion), (Thousand Units)

- Flat Roof Solar

- Pitched Roof Solar

- Ground Mount Solar

Solar Backsheet Market By Thickness, 2020-2029, (USD Billion), (Thousand Units)

- Less Than 100mm

- 100-500mm

- Greater Than 500mm

Solar Backsheet Market By Application , 2020-2029, (USD Billion), (Thousand Units)

- Residential

- Commercial

- Industrial

- Utilities

Solar Backsheet Market By Region, 2020-2029, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

IMPORTANT COUNTRIES IN ALL REGIONS ARE COVERED.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered: –

- What is the expected growth rate of the solar backsheet market over the next 7 years?

- Who are the major players in the solar backsheet market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the solar backsheet market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the solar backsheet market?

- What is the current and forecasted size and growth rate of the global solar backsheet market?

- What are the key drivers of growth in the solar backsheet market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the solar backsheet market?

- What are the technological advancements and innovations in the solar backsheet market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the solar backsheet market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the solar backsheet market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of high temperature elastomers in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA INSTALLATION TECHNIQUES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SOLAR BACKSHEET MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SOLAR BACKSHEET MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SOLAR BACKSHEET MARKET OUTLOOK

- GLOBAL SOLAR BACKSHEET MARKET BY TYPE, (USD BILLION) (THOUSAND UNITS) 2020-2029,

- FLUOROPOLYMER

- NON-FLUOROPOLYMER

- GLOBAL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE,2020-2029, (USD BILLION) (THOUSAND UNITS) 2020-2029,

- FLAT ROOF SOLAR

- PITCHED ROOF SOLAR

- GROUND MOUNT SOLAR

- GLOBAL SOLAR BACKSHEET MARKET BY THICKNESS, 2020-2029, (USD BILLION) (THOUSAND UNITS) ,2020-2029

- LESS THAN 100MM

- 100-500MM

- GREATER THAN 500MM

- GLOBAL SOLAR BACKSHEET MARKET BY APPLICATION, 2020-2029, (USD BILLION) (THOUSAND UNITS) ,2020-2029

- RESIDENTIAL

- COMMERCIAL

- INDUSTRIAL

- UTILITIES

- GLOBAL SOLAR BACKSHEET MARKET BY REGION, 2020-2029, (USD BILLION) (THOUSAND UNITS) ,2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- HONEYWELL CORPORATION

- AGFA

- DUPONT

- JOLYWOOD

- 3M

- DUNMORE CORPORATION

- KREMPEL

- FLEXCON

- HANGZHOU SUNHOME SOLAR BACKSHEET CO. LTD *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 4 GLOBAL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 6 GLOBAL SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 8 GLOBAL SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL SOLAR BACKSHEET MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL SOLAR BACKSHEET MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA SOLAR BACKSHEET MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA SOLAR BACKSHEET MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 21 US SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 22 US SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 US SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 24 US SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 25 US SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 26 US SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 27 US SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 US SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 32 CANADA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 34 CANADA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 36 CANADA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 40 MEXICO SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 42 MEXICO SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 44 MEXICO SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA SOLAR BACKSHEET MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA SOLAR BACKSHEET MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 58 BRAZIL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 60 BRAZIL SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 BRAZIL SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 66 ARGENTINA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 68 ARGENTINA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 70 ARGENTINA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 74 COLOMBIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 76 COLOMBIA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 COLOMBIA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 100 INDIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 102 INDIA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 104 INDIA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 108 CHINA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 110 CHINA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 112 CHINA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 116 JAPAN SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 118 JAPAN SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 120 JAPAN SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE SOLAR BACKSHEET MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE SOLAR BACKSHEET MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 EUROPE SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 158 EUROPE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 160 EUROPE SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 162 EUROPE SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 166 GERMANY SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 168 GERMANY SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 170 GERMANY SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 171 UK SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 172 UK SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 173 UK SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 174 UK SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 175 UK SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 176 UK SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 177 UK SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UK SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 182 FRANCE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 184 FRANCE SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 186 FRANCE SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 190 ITALY SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 192 ITALY SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 194 ITALY SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 198 SPAIN SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 200 SPAIN SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 202 SPAIN SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 206 RUSSIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 208 RUSSIA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 210 RUSSIA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 229 UAE SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 230 UAE SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 231 UAE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 232 UAE SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 233 UAE SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 234 UAE SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 235 UAE SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 236 UAE SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY TYPE (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY THICKNESS (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY THICKNESS (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA SOLAR BACKSHEET MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SOLAR BACKSHEET MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL SOLAR BACKSHEET MARKET BY THICKNESS, USD BILLION, 2020-2029

FIGURE 11 GLOBAL SOLAR BACKSHEET MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL SOLAR BACKSHEET MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL SOLAR BACKSHEET MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL SOLAR BACKSHEET MARKET BY INSTALLATION TECHNIQUE, USD BILLION, 2021

FIGURE 15 GLOBAL SOLAR BACKSHEET MARKET BY THICKNESS, USD BILLION, 2021

FIGURE 16 GLOBAL SOLAR BACKSHEET MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 17 GLOBAL SOLAR BACKSHEET MARKET BY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 HONEYWELL CORPORATION: COMPANY SNAPSHOT

FIGURE 21 AGFA: COMPANY SNAPSHOT

FIGURE 22 DUPONT: COMPANY SNAPSHOT

FIGURE 23 JOLYWOOD: COMPANY SNAPSHOT

FIGURE 24 3M: COMPANY SNAPSHOT

FIGURE 25 DUNMORE CORPORATION: COMPANY SNAPSHOT

FIGURE 26 KREMPEL: COMPANY SNAPSHOT

FIGURE 27 FLEXCON: COMPANY SNAPSHOT

FIGURE 28 HANGZHOU SUNHOME SOLAR BACKSHEET CO. LTD: COMPANY SNAPSHOT

FAQ

Solar backsheet market was USD 1.9 Billion in the year 2021.

Asia Pacific held more than 40 % of the Solar Backsheet market revenue share in 2021 and will witness expansion in the forecast period.

The surge in demand for renewable energy sources, particularly solar energy, is the primary driver of the solar backsheet market.

Fluoropolymer is currently the dominant type of solar backsheet in the market owing to its exceptional properties.

The Asia Pacific region has witnessed significant growth in the solar backsheet market, primarily driven by the increasing adoption of renewable energy sources in the region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.