REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

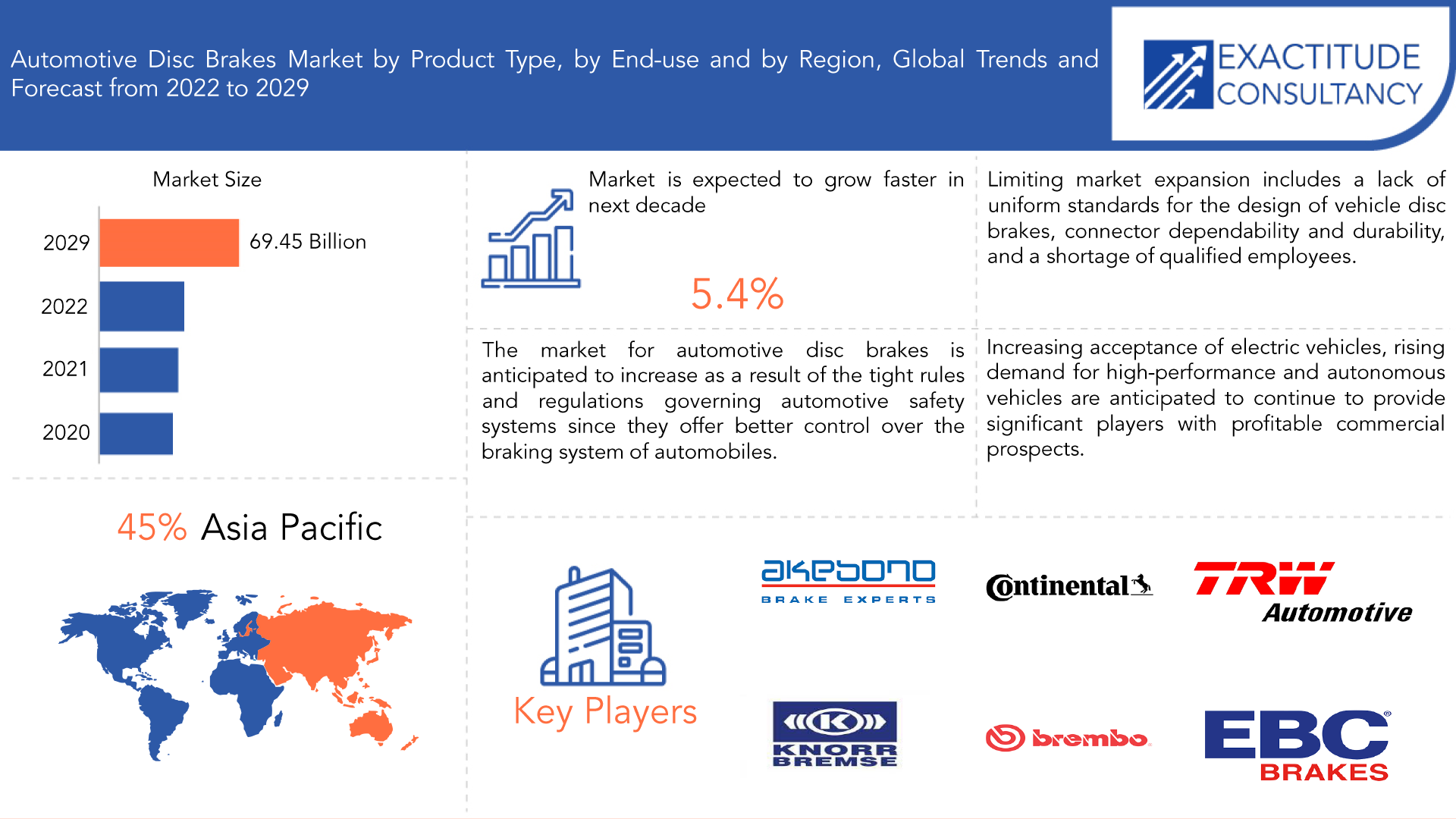

| USD 69.45 billion | 5.4% | Asia Pacific |

| By Product Type | By End-use | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Automotive Disc Brakes Market Overview

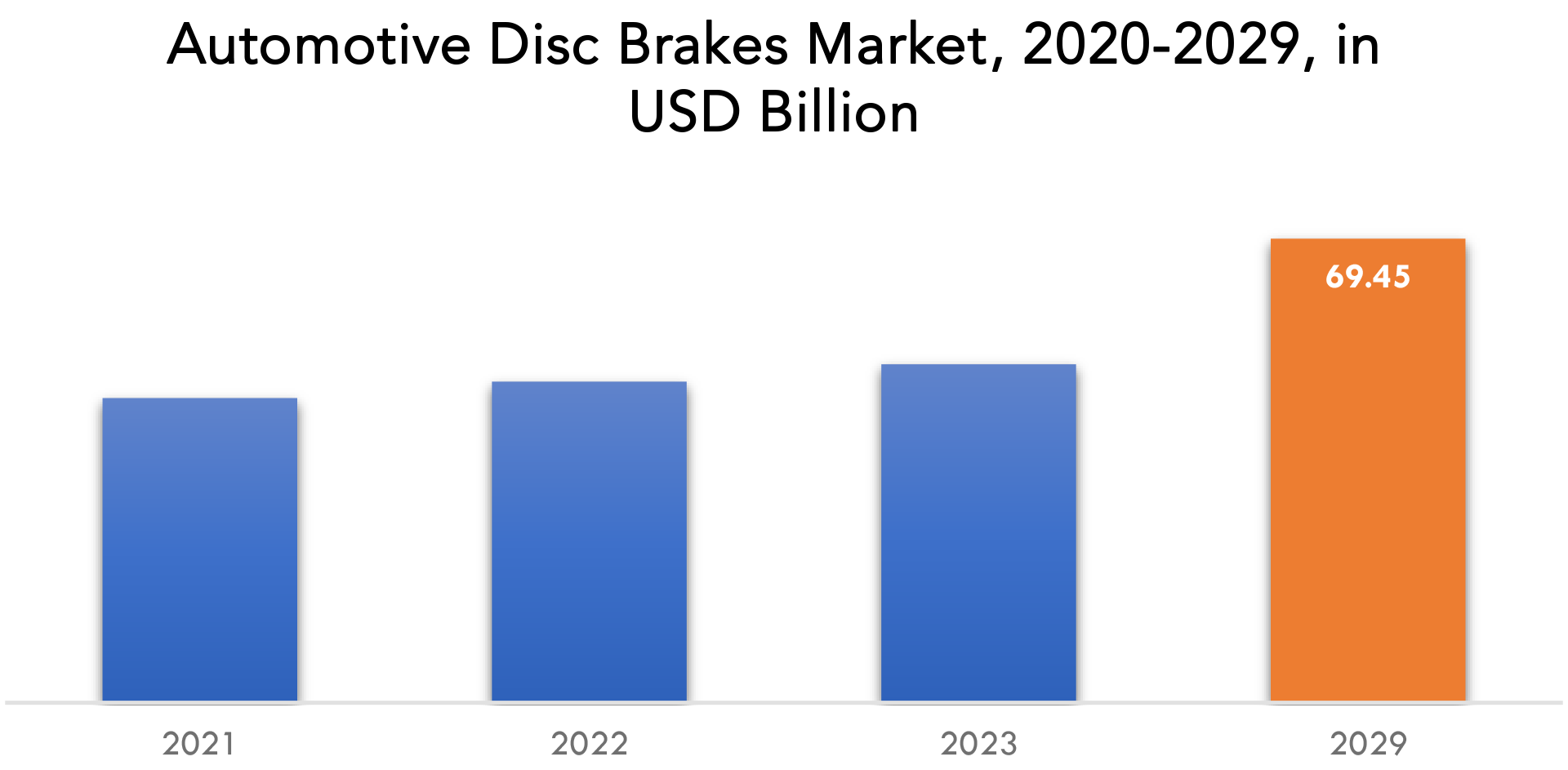

The automotive disc brakes market is expected to grow at 5.4% CAGR from 2022 to 2029. It is expected to reach above USD 69.45 billion by 2029 from USD 43.26 billion in 2020.

The automated disc brake is a type of car brake that works by applying pressure to a disc that is fixed to the wheel using friction from pads. In the auto sector, disc brakes are well-known and frequently utilized on motorbikes and car wheels. A caliper and friction material are applied to the sides of a rotating disc to apply a disc brake, which is a particular form of the brake. With the help of calipers and pairs of pads pressed up against a disc or “rotor,” disc brakes produce friction. They consist of revolving disc rotors that are attached to the wheel and a stationary braking caliper assembly that also includes brake pads. The production of automobiles and trucks is on the rise, as is the use of electric vehicles. Demand for regenerative brakes is also on the rise.

Strict regulations are also being put in place to lower the number of fatalities related to auto accidents. A strong demand for automobiles is being caused by rising urbanization around the world, which has increased the average disposable income of the urban population. Also, these systems offer a shorter and more controlled braking distance in a variety of traffic situations, improving stability and occupant safety as a result and driving greater product utilization in the automobile disc brake industry. Moreover, firms are investing in superior disc brake technology to manufacture lightweight disc brakes, which would further propel market expansion, due to greater awareness of safety precautions and favourable government regulation. The delay in purchasing new vehicles and the high manufacturing costs associated with producing automobile vehicles could further restrain market expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product Type, By End-use, By Region |

|

By Product Type |

|

| By End-use |

|

| By Region |

|

Globally, the rate of urbanization is accelerating, which has raised the average disposable income of the urban population and allowed them to significantly raise their standard of living. Due to changing lifestyles, there is a higher demand for commercial cars, which has prompted manufacturers to boost production in order to better service customers. The production of vehicles has steadily increased in both developed and emerging nations. Lower loan interest rates have also contributed to the growth of the automotive industry. Intercity and intracity transit patronage has undergone a substantial transformation in the previous several years. The market for automobiles is rising globally, which has benefited production and raised the requirement for robust braking systems.

The automotive disc brake market is rapidly regaining its pre-COVID levels, and over the projected period, a healthy growth rate is anticipated, led by the economic recovery in most developing countries. The high contagiousness of the virus and the frequent suspension of public transportation networks drove the need for passenger automobiles, which in turn drove demand for automotive disc brake products. A bleak outlook is being created by exceptional circumstances brought on by the anticipated third and subsequent waves of the pandemic.

Automotive Disc Brakes Market Segment Analysis

Automotive disc brakes market is segmented based on product type, end-use, and region.

Based on product type, a significant portion of the market was made up of floating caliper. This is due to its straightforward and economical design, which makes it simple to produce and maintain. A calliper that moves linearly presses the brake pads against the rotor makes up a floating calliper disc braking system. The calliper can move in reaction to the movement of the brake pads since it is attached on pins or bolts. This motion aids in maintaining brake pad contact with the rotor, resulting in dependable and consistent braking performance. The floating calliper system is extremely small and light, making it perfect for usage in cars and light trucks. It is appropriate for high-performance applications since it also has outstanding heat dissipation and can endure high temperatures.

Based on end-use, a significant portion of the market was made up of passenger vehicles. This is explained by the expanding demand for passenger cars, the increased attention being paid to vehicle safety, and the implementation of stringent laws governing braking systems for automobiles. Due to their greater performance and safety features, disc brakes are often required for passenger vehicles like automobiles and SUVs. Compared to conventional drum brakes, disc brakes have greater stopping power, shorter stopping distances, and a superior brake pedal feel. As a result, they have been widely used in passenger vehicles, which has in turn fueled the market for automobile disc brakes. Additionally, the demand for disc brakes is being fueled by the growing popularity of electric vehicles (EVs) in the passenger vehicle market. For their regenerative braking systems, which transform kinetic energy into electrical energy and store it in the battery for later use, electric vehicles (EVs) need disc brakes. This has increased the demand in the passenger car segment for automotive disc brakes.

Automotive Disc Brakes Market Players

The Market research report covers the analysis of Market players. Key companies profiled in the report include Akebono Brake Corporation, Continental AG, EBC Brakes, Knorr-Bremse AG, Brembo SpA, Wabco, Haldex, TRW Automotive, Hyundai Mobis, Mando Corporation

Recent Developments

On April 2023, Akebono Brake Corporation expanded its ProACT and EURO Ultra-Premium Disc Brake Pad line by ten new part numbers: ACT1965, ACT2032, ACT2065, ACT2186, ACT2223, ACT2229, ACT2371 and EUR1894, EUR1924, EUR2074. Electronic wear sensor and Premium stainless steel abutment hardware is included in the kits that require it.

On June 2021, EBC’s acclaimed two-piece, fully-floating front, and rear rotors now available for ‘Turbo’ and ‘Turbo S’ 991-generation 911s, as well as the 981 Cayman GT4

Who Should Buy? Or Key stakeholders

- Research and Development Institutes

- Regulatory Authorities

- End-use Companies

- Industrial

- Potential Investors

- Automotive Industry

- Others

Automotive Disc Brakes Market Regional Analysis

The automotive disc brakes market by region includes North America, Asia-Pacific (APAC), Europe, South America, And Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

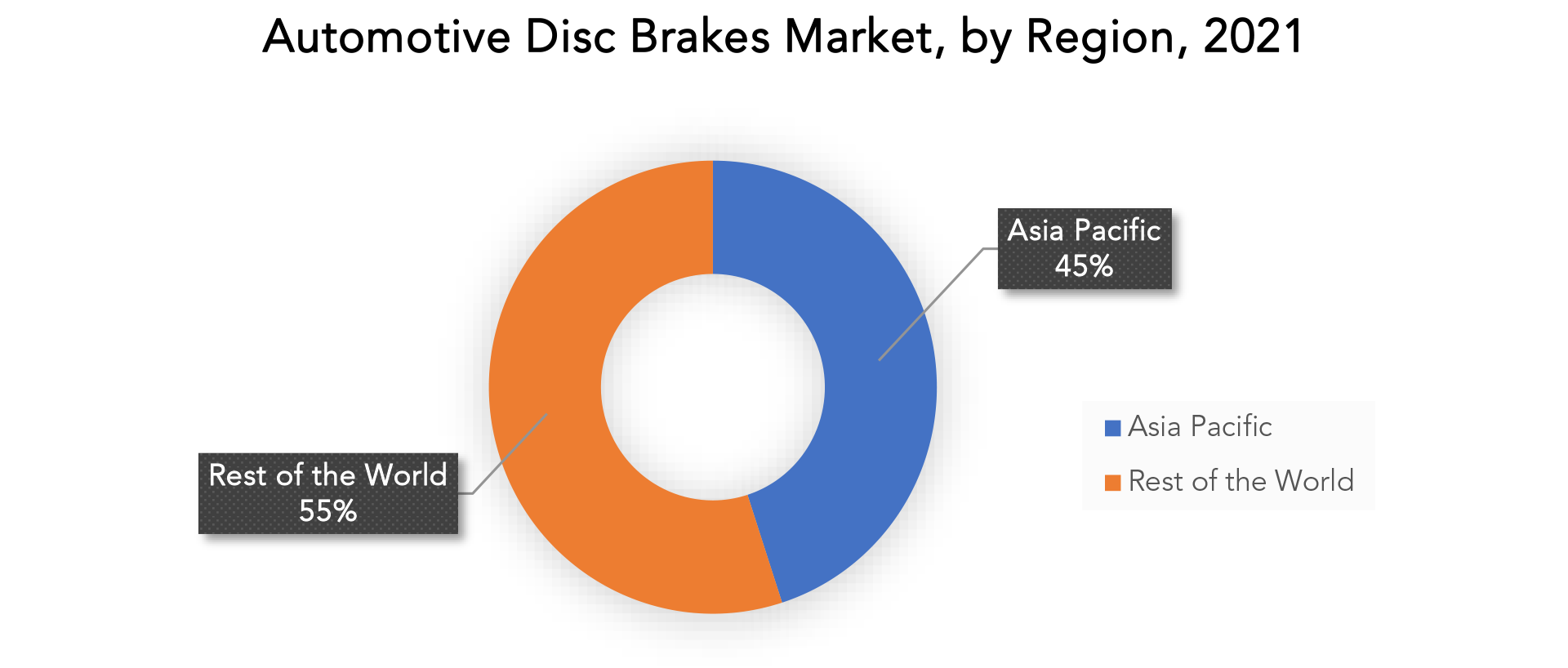

The greatest revenue share in 2021 over 45% was accounted for by Asia Pacific. The region’s dense population, rising automobile demand, and the existence of significant automotive manufacturing hubs in nations like China, Japan, South Korea, and India are just a few of the reasons for this.

Due to the increased emphasis on vehicle safety and the implementation of stringent laws surrounding vehicle braking systems, the demand for automobile disc brakes has been expanding throughout the Asia Pacific area. Another factor in the market’s expansion has been consumers’ growing understanding of the value of disc brakes in guaranteeing safe driving. Disc brake demand is also being fueled by the region’s expanding use of electric cars (EVs). In order for EVs to employ their regenerative braking systems, which turn kinetic energy into electrical energy and store it in the battery for later use, disc brakes are necessary. As a result, demand for vehicle disc brakes in the Asia Pacific region has increased.

Overall, the Asia Pacific region is anticipated to maintain its leadership in the automotive disc brakes market over the next few years due to factors like rising vehicle demand, stricter regulations being put in place, and rising EV usage.

Key Market Segments: Automotive Disc Brakes Market

Automotive Disc Brakes Market by Product Type, (USD Billion), (Thousand Units)

- Opposed Piston

- Floating Caliper

Automotive Disc Brakes Market by End-Use, (USD Billion), (Thousand Units)

- Passenger Vehicles

- Light Commercial Vehicles (LCVS)

- Heavy Commercial Vehicles (HCVS)

- Others

Automotive Disc Brakes Market by Region, (USD Billion), (Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the expected growth rate of the automotive disc brakes market over the next 7 years?

- Who are the major players in the automotive disc brakes market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the automotive disc brakes market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the automotive disc brakes market?

- What is the current and forecasted size and growth rate of the global automotive disc brakes market?

- What are the key drivers of growth in the automotive disc brakes market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the automotive disc brakes market?

- What are the technological advancements and innovations in the automotive disc brakes market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the automotive disc brakes market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the automotive disc brakes market?

- What are the products offerings and specifications of leading players in the market?

Exactitude Consultancy Services Key Objectives

- Increasing sales and Market share

- Developing new End-use

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL AUTOMOTIVE DISC BRAKES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AUTOMOTIVE DISC BRAKES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL AUTOMOTIVE DISC BRAKES MARKET OUTLOOK

- GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- OPPOSED PISTON

- FLOATING CALIPER

- GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY END-USE, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- PASSENGER VEHICLES

- LIGHT COMMERCIAL VEHICLES (LCVS)

- HEAVY COMMERCIAL VEHICLES (HCVS)

- OTHERS

- GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY REGION, 2020-2029, (USD BILLION), (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AKEBONO BRAKE CORPORATION

- CONTINENTAL AG

- EBC BRAKES

- KNORR-BREMSE AG

- BREMBO SPA

- WABCO

- HALDEX

- TRW AUTOMOTIVE

- HYUNDAI MOBIS

- MANDO CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 4 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 13 US AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 14 US AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 US AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 16 US AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 20 CANADA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 24 MEXICO AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 34 BRAZIL AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 35 ARGENTINA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 38 ARGENTINA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 39 COLOMBIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 COLOMBIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 42 COLOMBIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 47 ASIA-PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 ASIA-PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 51 ASIA-PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 53 INDIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 INDIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 56 INDIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 57 CHINA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 CHINA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 60 CHINA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 61 JAPAN AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 JAPAN AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 64 JAPAN AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 65 SOUTH KOREA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH KOREA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 69 AUSTRALIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 AUSTRALIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 73 SOUTH EAST ASIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH EAST ASIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 81 EUROPE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 EUROPE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 84 EUROPE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 85 EUROPE AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 87 GERMANY AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 GERMANY AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 90 GERMANY AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 91 UK AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 92 UK AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 UK AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 94 UK AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 95 FRANCE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 FRANCE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 98 FRANCE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 99 ITALY AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 ITALY AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 102 ITALY AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 103 SPAIN AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 SPAIN AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 106 SPAIN AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 107 RUSSIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 RUSSIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 110 RUSSIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF EUROPE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF EUROPE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 121 UAE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 122 UAE AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 123 UAE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 124 UAE AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 125 SAUDI ARABIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 127 SAUDI ARABIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 129 SOUTH AFRICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 SOUTH AFRICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE DISC BRAKES MARKET BY END-USE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY END-USE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY PRODUCT TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY END-USE, USD BILLION, 2021

FIGURE 14 GLOBAL AUTOMOTIVE DISC BRAKES MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AKEBONO BRAKE CORPORATION: COMPANY SNAPSHOT

FIGURE 17 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 18 EBC BRAKES: COMPANY SNAPSHOT

FIGURE 19 KNORR-BREMSE AG: COMPANY SNAPSHOT

FIGURE 20 BREMBO SPA: COMPANY SNAPSHOT

FIGURE 21 WABCO: COMPANY SNAPSHOT

FIGURE 22 HALDEX: COMPANY SNAPSHOT

FIGURE 23 TRW AUTOMOTIVE: COMPANY SNAPSHOT

FIGURE 24 HYUNDAI MOBIS: COMPANY SNAPSHOT

FIGURE 25 MANDO CORPORATION: COMPANY SNAPSHOT

FAQ

The automotive disc brakes market is expected to grow at 5.4% CAGR from 2022 to 2029. It is expected to reach above USD 69.45 billion by 2029 from USD 43.26 billion in 2020.

Asia Pacific held more than 45% of the automotive disc brakes market revenue share in 2021 and will witness expansion in the forecast period.

The adoption of stringent rules for vehicle safety measures by governments throughout the world, as well as the arrival of sophisticated and advanced braking End-use, are other driving factors in the automotive disc brake market. Also, in certain traffic situations, these systems offer a shorter and more controlled braking distance, improving stability and occupant safety in the process and driving up product utilization in the vehicle disc brake market.

Manufacturers in the Asia-Pacific region continue to dominate the industry and provide significant cost savings due to the accessibility of inexpensive labour and raw materials. High-potential countries like China and India are also present in the region. The expanding popularity of active braking systems has helped sales of luxury and premium vehicles. The major objective of the businesses is to develop reliable, long-lasting, and environmentally friendly braking systems.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.