REPORT OUTLOOK

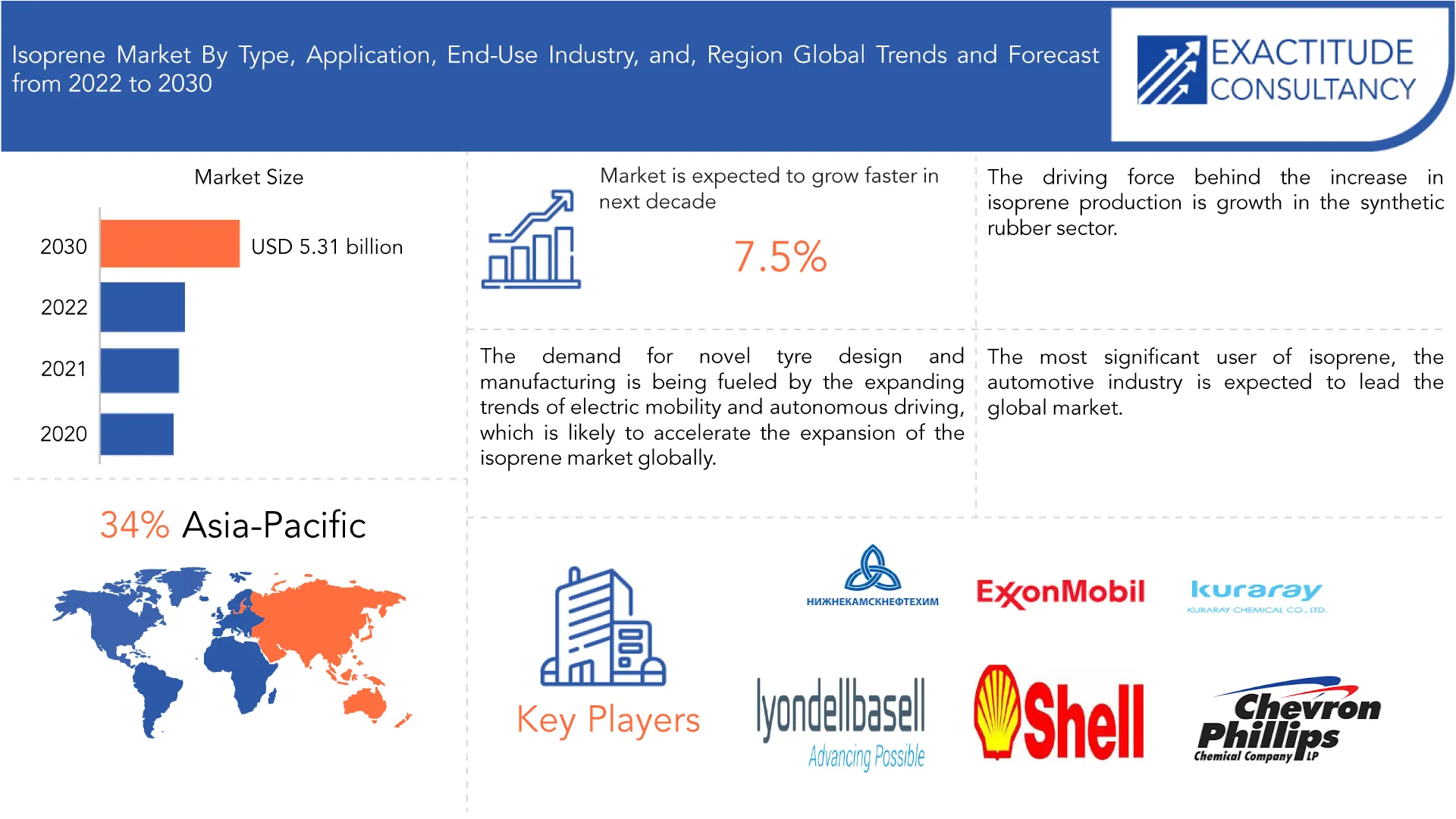

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 5.31 billion by 2029 | 7.5% | Asia Pacific |

| By Type | By Application | By End-Use Industry |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Isoprene Market Overview:

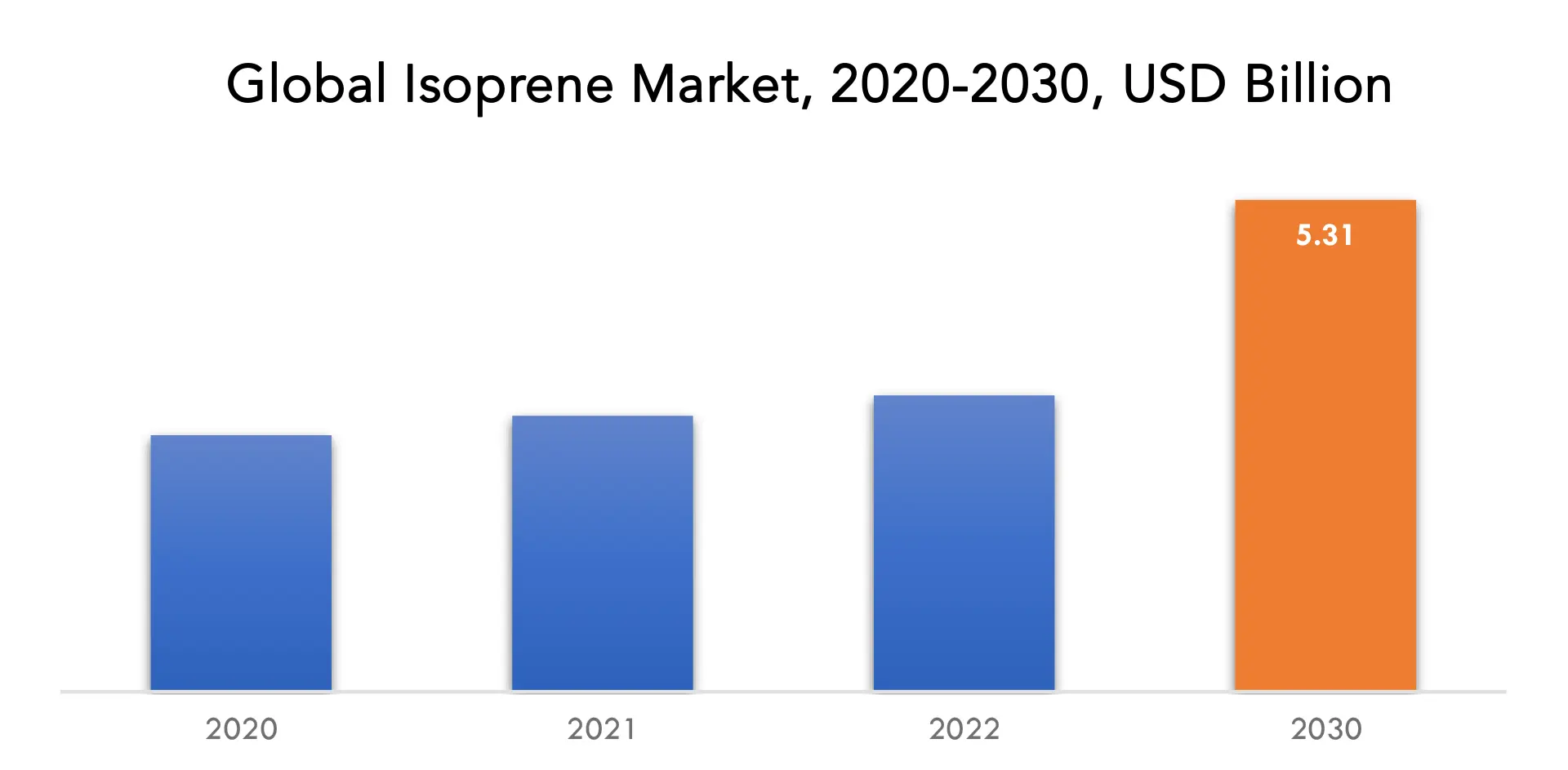

The global isoprene market was valued at 3.2 billion in 2022 and is projected to reach 5.31 billion by 2029, growing at a CAGR of 7.5% from 2022 to 2029.

Isoprene is described as an organic liquid chemical that is colorless and volatile. Synthetic rubber and persecution aluminum chloride catalysts have exceptional solidity to gases and are used in inner tubes. It is typically used to generate compound substances with properties based on the proportion of elements in them.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By Type, Application, End-Use Industry, and Region. |

| By Type

|

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

Isoprene is a prominent class of other naturally occurring chemicals known as isoprenoids and the monomer of natural rubber. It is a hemiterpene with the chemical formula CH2=C(CH3) CH=CH2. For plants, it serves as a metabolite. It smells like petroleum and is a clear, colorless liquid. Isoprene is used as a monomer in the production of synthetic rubber, also referred to as polyisoprene. Polyisoprene is a commonly used and affordably priced commercial rubber. They offer strong fatigue resistance and can be employed dynamically in low- and ambient-temperature applications. Most often, isoprene is used to make copolymers or polymers.

Making isoprene-styrene black polymers requires the usage of isoprene as a key component. The creation of pressure-sensitive adhesives frequently uses these products. The hydrocarbon resin with an isoprene basis, which has exceptional heat stability, is widely used in the manufacture of adhesives.

Isoprene Market Segment Analysis

Based on type, application, end-use industry, and region, the global market for isoprene is divided into these categories.

The Isoprene market is segmented into Polymer grade and Chemical grade according to type. Based on type, the isoprene market is separated into chemical-grade and polymer-grade segments. The isoprene kind that is most frequently utilized is polymer grade. Due to its characteristics resembling those of natural rubber, this kind of isoprene is utilized in a variety of applications. Additionally, it is more uniform than natural rubber in terms of processing, mixing, molding, strength, and cure rate. With the biggest revenue share of 62.0% in 2022, the polymer grade category controlled the market. This is due to it has uses that are comparable to those of natural rubber. Four isomers, including the two most significant isomers, cis- and trans-isoprene, are produced when several isoprene molecules are joined. The market for polymer-grade products is being driven by the growing demand for the product due to its many desirable qualities, including cold resistance, high resilience, and exceptional tensile strength. Isoprene is a liquid that is clear and colorless, contains 99.3% of its concentration, and is frequently utilized in a variety of industries.

The applications of the isoprene market include polyisoprene, styrene isoprene styrene, and isobutyl isoprene rubber. One of the main factors driving the isoprene market is the rising demand for polyisoprene. Its characteristics are similar to those of natural rubber. Greater consistency than natural rubber in terms of strength, mixing, processing, cure rate, and molding is anticipated to boost market expansion. Additionally, an increasing need for isoprene in the production of isobutylene isoprene rubber (IIR) and styrene isoprene styrene (SIS) is anticipated to significantly expand the market. The principal market for isoprene has been the polyisoprene sector, which has grown at a CAGR of 3.2%. The production of tires and other rubber goods uses polyisoprene primarily. Compared to natural rubber, it has a reduced non-polymer component content. In addition to tires, polyisoprene is used in conveyor belts, rubber bands, shoes, cut thread, infant bottle nipples, and hoses. Medical equipment manufacturers frequently employ polyisoprene to make items like surgical gloves, sample covers, and catheters. Isoprene Styrene The least hardness and least viscosity of all the styrene block copolymers are the styrene (SIS) polymers, which are based on styrene and isoprene. Adhesives, agricultural chemicals, fiber optic compounds, ball bladders, O-rings, caulks and sealants, cling film, electrical fluids, lubricants (2-stroke engine oil), paper and pulp, personal care items, pigment concentrates, for rubber and polymer, butyl rubber are all made with polyisobutylene and butyl rubber.

The isoprene market is further split into tires, non-tires, and adhesives based on the end-use industry. In 2018, the isoprene market’s tire category held the biggest market share. Tires are frequently made of isoprene due to their qualities, which include durability, tensile resistance, tear strength, etc. Demand for tires is rising on a global scale. The global demand for tires in 2014 was 2.84 billion. Demand increased from 6.55% in 2014 to around 3.66 billion units in 2018. Around 18 billion USD are sold in the tire and rubber industry globally, primarily from sectors like the automobile and aerospace industries. Manufacturing companies that make tires and rubber are expanding globally. The number of tire manufacturers in the US and Europe respectively increased by about 111 and 4,300 companies. Isoprene is commonly used in the production of rubber goods, including tires. Comparatively fewer non-polymer components are present than in natural rubber. In addition to tires, polyisoprene is used in hoses, conveyor belts, cut thread, infant bottle nipples, rubber bands, and footwear. The hydrocarbon resin with an isoprene basis, which has exceptional heat stability, is widely used in the manufacture of adhesives. Many different industries, including construction, automotive, consumer products, textiles, electronics, and more, heavily rely on adhesives. Adhesives made of isoprene offer greater stability and a solid bind to the objects. Additionally, the substance makes its adhesives resistant to water, giving them a long-lasting effect. In the near future, increasing adhesive applications from end-use industries are anticipated to boost product demand.

Polyisoprene, which is created from polymer-grade isoprene, is used to create tires, mechanically molded products, motor mounts, shock-absorber bushings, and pipe gaskets.

Isoprene Market Players

The major players operating in the global Isoprene industry include the major market players Nizhnekamskneftekhim, SIBUR, The Goodyear Tire & Rubber Company, Royal Dutch Shell Plc, Kuraray Co. Ltd., ZEON Corporation, LyondellBasell Industries N.V., Exxon Mobil Corporation., Holding B.V., Chevron Phillips Chemical Company, Bridgestone Corporation, Michelin, Continental AG and, Sumitomo Rubber Industries Ltd. and others

9 May 2023: Goodyear Launched New All-Season Cooper® Procontrol™.

1 May 2023: Goodyear Launched Two New Kelly Products, Kelly Edge® Touring A/S, and Kelly Edge® Sport.

Who Should Buy? Or Key stakeholders

- Manufacturing

- End-Use Industries

- BFSI

- Automotive

- Manufacturing & Construction

- Regulatory Authorities

- Research Organizations

- Information Technology

- Materials & Chemicals

Isoprene Market Regional Analysis

Geographically, the isoprene market is segmented into North America, South America, Europe, APAC, and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

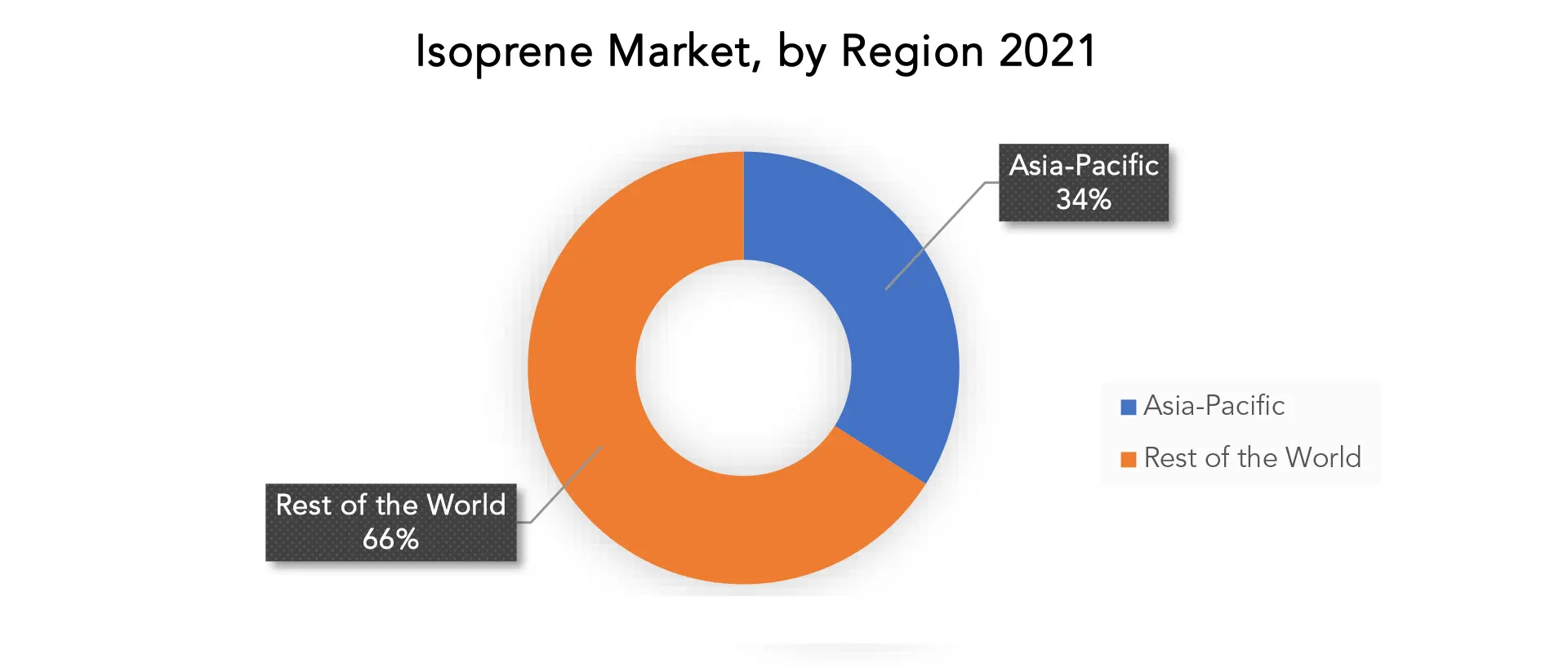

Asia Pacific dominates the largest market for isoprene. In 2022, Asia Pacific had the biggest revenue share (34%) in the product market. This is explained by the expansion of numerous end-use sectors where it is employed as an industrial rubber and a tire adhesive. The demand for large-scale tire production was spurred by an increase in car production in the area, which in turn drove up tire consumption in the Asia Pacific. Due to the existence of numerous rubber producers there, China is a significant producer and consumer of rubber in the Asia Pacific region. In addition, the Government of West Bengal (India) reports that India ranks fourth in the world for rubber consumption, behind China, the United States, and Japan. So, the Asia Pacific dominates the biggest market for Isoprene. The expanding car sales in China and India are anticipated to fuel the need for isoprene in the automotive sector for the production of polyisoprene. The Asia Pacific isoprene market is expanding due to rising consumer demand for tires with increased fuel economy and environmental friendliness. So, the Asia Pacific dominates the isoprene market.

Key Market Segments: Isoprene Market

Isoprene Market by Type, 2020-2029, (USD Billion), (Kilotons)

- Polymer grade

- Chemical grade

Isoprene Market by Application, 2020-2029, (USD Billion), (Kilotons)

- Polyisoprene

- Styrene isoprene styrene

- Isobutyl isoprene rubber

Isoprene Market by End-Use Industry, 2020-2029, (USD Billion), (Kilotons)

- Tires

- Non-tires

- Adhesives

Isoprene Market by Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All-Region Are Covered

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the isoprene market over the next 7 years?

- Who are the major players in the isoprene market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, the middle east, and Africa?

- How is the economic environment affecting the isoprene market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the isoprene market?

- What is the current and forecasted size and growth rate of the global isoprene market?

- What are the key drivers of growth in the isoprene market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the isoprene market?

- What are the technological advancements and innovations in the isoprene market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the isoprene market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the isoprene market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ISOPRENE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE ISOPRENE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ISOPRENE MARKET OUTLOOK

- GLOBAL ISOPRENE MARKET BY TYPE, 2020-2029, (USD BILLION) (KILOTONS)

- POLYMER GRADE

- CHEMICAL GRADE

- GLOBAL ISOPRENE MARKET BY APPLICATION, 2020-2029, (USD BILLION) (KILOTONS)

- POLYISOPRENE

- STYRENE ISOPRENE STYRENE

- ISOBUTYL ISOPRENE RUBBER

- GLOBAL ISOPRENE MARKET BY END-USE INDUSTRY, 2020-2029, (USD BILLION) (KILOTONS)

- TIRES

- NON-TIRES

- ADHESIVES

- GLOBAL ISOPRENE MARKET BY REGION, 2020-2029, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- NIZHNEKAMSKNEFTEKHIM

- SIBUR

- THE GOODYEAR TIRE & RUBBER COMPANY

- ROYAL DUTCH SHELL PLC

- KURARAY CO. LTD.

- ZEON CORPORATION

- LYONDELLBASELL INDUSTRIES N.V.

- EXXON MOBIL CORPORATION.

- HOLDING B.V.

- CHEVRON PHILLIPS CHEMICAL COMPANY

- BRIDGESTONE CORPORATION

- MICHELIN

- CONTINENTAL AG

- SUMITOMO RUBBER INDUSTRIES LTD *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 6 GLOBAL ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 7 GLOBAL ISOPRENE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL ISOPRENE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA ISOPRENE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA ISOPRENE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 17 US ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 US ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 US ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 22 US ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 23 CANADA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 CANADA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 28 CANADA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 29 MEXICO ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 34 MEXICO ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA ISOPRENE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA ISOPRENE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 43 BRAZIL ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 48 BRAZIL ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 49 ARGENTINA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 54 ARGENTINA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 55 COLOMBIA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 60 COLOMBIA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC ISOPRENE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC ISOPRENE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 75 INDIA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 INDIA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 80 INDIA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 81 CHINA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 CHINA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 86 CHINA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 87 JAPAN ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 JAPAN ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 92 JAPAN ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 117 EUROPE ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 118 EUROPE ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 119 EUROPE ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 120 EUROPE ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 121 EUROPE ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 122 EUROPE ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 123 EUROPE ISOPRENE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 124 EUROPE ISOPRENE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 125 GERMANY ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 130 GERMANY ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 131 UK ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 UK ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 136 UK ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 137 FRANCE ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 FRANCE ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 142 FRANCE ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 143 ITALY ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 147 ITALY ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 148 ITALY ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 149 SPAIN ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 SPAIN ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 154 SPAIN ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 155 RUSSIA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 160 RUSSIA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ISOPRENE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 175 UAE ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 177 UAE ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 UAE ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 180 UAE ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ISOPRENE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ISOPRENE MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ISOPRENE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ISOPRENE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ISOPRENE MARKET BY END-USE INDUSTRY (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ISOPRENE MARKET BY END-USE INDUSTRY (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ISOPRENE MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ISOPRENE MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ISOPRENE MARKET BY END-USE INDUSTRY, USD BILLION, 2020-2029

FIGURE 11 GLOBAL ISOPRENE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ISOPRENE MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL ISOPRENE MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL ISOPRENE MARKET BY END-USE INDUSTRY, USD BILLION, 2021

FIGURE 16 GLOBAL ISOPRENE MARKET BY REGION, USD BILLION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 NIZHNEKAMSKNEFTEKHIM: COMPANY SNAPSHOT

FIGURE 19 SIBUR: COMPANY SNAPSHOT

FIGURE 20 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

FIGURE 21 ESAOTE S.P.A: COMPANY SNAPSHOT

FIGURE 22 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

FIGURE 23 KURARAY CO. LTD.: COMPANY SNAPSHOT

FIGURE 24 ZEON CORPORATION: COMPANY SNAPSHOT

FIGURE 25 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

FIGURE 26 EXXON MOBIL CORPORATION.: COMPANY SNAPSHOT

FIGURE 27 HOLDING B.V.: COMPANY SNAPSHOT

FIGURE 28 CHEVRON PHILLIPS CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 29 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

FIGURE 30 MICHELIN: COMPANY SNAPSHOT

FIGURE 31 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 32 SUMITOMO RUBBER INDUSTRIES LTD: COMPANY SNAPSHOT

FAQ

The global isoprene market was valued at 3.2 billion in 2022 and is projected to reach 5.31 billion by 2029, growing at a CAGR of 7.5% from 2022 to 2029.

Based on type, application, end-use industry, and region the isoprene market reports divisions are broken down.

The global isoprene market registered a CAGR of 7.5% from 2022 to 2029. The industry segment was the highest revenue contributor to the market.

Asia Pacific dominates the largest market for isoprene. In 2022, Asia Pacific had the biggest revenue share (34%) in the product market. This is explained by the expansion of numerous end-use sectors where it is employed as an industrial rubber and a tire adhesive.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.