REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

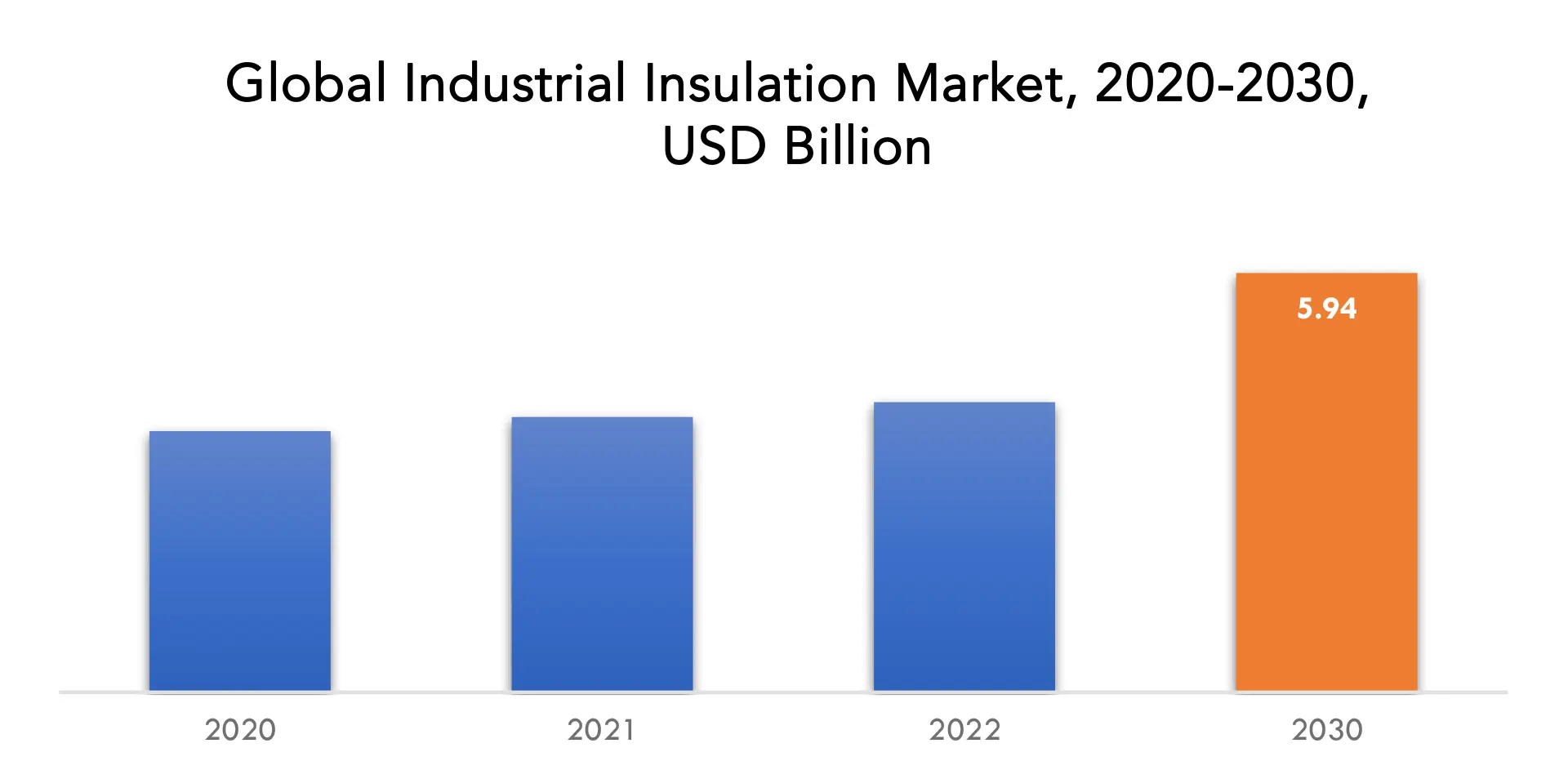

| USD 5.94 Billion By 2029 | 5.40% | Europe |

| By Material | By Product | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Industrial Insulation Market Overview

The Industrial Insulation Market Is Expected to Grow At 5.4 % CAGR From 2022 To 2029. It Is Expected to Reach Above USD 5.94 Billion By 2029 From USD 3.7 Billion In 2020.

By minimizing heat loss, industrial insulation is a substance or material combination that slows the passage of heat energy. They also make it easier to perform a wide range of tasks, including controlling surface temperatures, preventing water condensation and vapor flow on cold surfaces, improving operational efficiency, and protecting equipment in corrosive environments. Industrial insulations are frequently employed to decrease energy waste and enhance process economics generally.

Market drivers for industrial insulation include rising energy conservation measures, stricter building codes, and rising demand for thermal efficiency and noise reduction. Innovations in insulating materials, technical improvements, and the demand for environmentally friendly and sustainable solutions all have an impact on the industry. The difficulty of retrofitting insulation in older structures and the fluctuating cost of raw materials are major obstacles. The market is anticipated to have consistent expansion as a result of the developing industrial and construction sectors.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Material, By Product, By Application, By Region. |

| By Material |

|

| By Product |

|

| By Application |

|

| By Region |

|

The Industrial Insulation Market is primarily growing as a result of strict regulations requiring the use of insulation materials for energy saving. The market is expanding due to laws requiring energy conservation and the need for insulation materials in end-use industries such oil and gas, chemical and petrochemical, food, and beverages. Additionally, the American Society of Mechanical Engineers (ASME), the American Boiler Manufacturers Association (ABMA), and the American Society for Testing and Materials (ASTM) have established standards for the development, revision, and implementation of industrial equipment. These organizations include ASME, ABMA, and ASTM.

Changes in the price of crude oil and fluctuations in the price of raw materials, which are products based on crude oil, are predicted to impede the expansion of the industrial insulation market. The installation of the material comes at a significant cost, requires different clearances, is subject to regulations, and requires specialized labor, all of which pose obstacles for the sector.

The rising adoption of cutting-edge technologies like machine learning (ML), the internet of things (IoT), and artificial intelligence (AI) has led to a rapid growth in industrial automation. A number of benefits, such as greater traceability, increased productivity, and high adaptability, have fueled the need for automation over the years in the food and beverage sector. The application of automation technology in contemporary industrial sectors is expanding as a result of its success in lowering production costs. In addition to electrical insulation, thermal insulation is a concern for automation experts since it improves machine performance, such as faster operation and longer service life. Electric and electrical components will probably employ automation more often, which will raise the requirement for industrial insulation to maintain them thermally insulated.

Every nation on earth went into some sort of lockdown during the COVID-19 epidemic, which had a major effect on the manufacturing sector of the global economy. The manufacturing and supply chain disruptions have had a detrimental effect on the industrial insulation market. The Asia Pacific region holds a high market share in terms of value for industrial insulation. The majority of their manufacturing hubs remained under lockdowns to stop the spread of the virus due to Asia Pacific nations including China, Japan, and India turned into virus hotspots during the early outbreak of the COVID-19 pandemic. As a result, the area went through a significant social exclusion campaign, which had an impact on its manufacturing sectors.

Industrial Insulation Market Segment Analysis:

The industrial insulation market is segmented based on material, product and application.

In 2022, stone wool dominated the market and generated around 21.6% of the total revenue. Dolomite, diabase, and basalt, which are readily available volcanic rocks, are used to make stone wool. Where high compressive strength is required, stone wool materials are typically employed. It effectively stifles fire and doesn’t release any harmful smoke or toxic fumes. Additionally, it effectively guards against both high and low temperatures.

In 2022, pipe insulation dominated the market and generated around 47.76% of total revenue. Due to its superior performance and capacity to stabilize the process temperatures, the market is anticipated to have significant demand, growing at a CAGR of 5.5% between 2023 and 2030. It guards against exposure to extremely high temperatures and protects against pipe breakage and freezing damage. The product helps lower operational costs by improving the energy efficiency of the process or plant.

The market was led by LPG/LNG in 2022, which generated about 20.70% of the total revenue. The market is anticipated to maintain its current trend over the course of the projection period, which can be ascribed to the high risk associated with the transportation and storage of LPG and LNG goods, which has resulted in significant product demand.

Industrial Insulation Market Players:

The industrial insulation market key players includes Rockwool Insulation A/S, Poroc Group Oy, Knauf Insulation, TechnoNICOL Corporation, Anco Products, Inc., Aspen Aerogels, Inc., Cabot Corporation, Morgan Advanced Materials plc, Unifrax LLC, RATH Group.

Recent Developments:

May 1, 2023: Cabot Corporation announced the launch of its new ENTERA™ aerogel particles portfolio. ENTERA aerogel particles are a thermal insulation additive designed to enable the development of ultra-thin thermal barriers for electric vehicle (EV) lithium-ion batteries. In this portfolio, Cabot has launched three ENTERA aerogel products that formulators can incorporate into a range of thermal barrier forms including blankets, pads, sheets, films, foams and coatings.

May 14, 2024: Knauf Insulation is pleased to announce a major investment of circa€200 million in a new state-of-the-art rock mineral wool factory to serve the UK market. The large-scale facility, with an annual capacity in excess of 100,000 tonnes, will utilise cutting-edge, low-carbon electric melting technology, demonstrating a strong commitment to meet the growing market demand for sustainable, non-combustible insulation solutions.

May 1, 2024: Knauf Insulation, Inc., a leading, family-owned global manufacturer of fiberglass insulation, today announced the launch of its new HVAC fiberglass insulation product line, Knauf Performance+. This product line is the first of its kind to be CERTIFIED asthma & allergy friendly® and the only HVAC fiberglass insulation line that is formaldehyde-free.

March 2, 2023: Knauf insulation announced €120 million investment in sustainable expansion of Croatia plant.

October 12, 2022: The Knauf Group had announced its plans to increase Mineral Wool production capacity within Central and Eastern Europe by investing close to €135 million in Knauf Insulation’s facility in Târnăveni, Romania. As well as retrofitting the existing plant, which was acquired earlier this year, Knauf Insulation plans to expand its presence by building an additional insulation facility. This investment will allow the company to significantly increase its annual production output, manufacturing more than 75,000 tonnes of Mineral Wool every year to satisfy growing demands in Central and Eastern Europe.

Who Should Buy? Or Key Stakeholders:

- Manufacturers

- Contractors and Installers

- Engineers and Architects.

- Regulatory Authorities and Standards Organizations

- Distributors and Suppliers

- Research and Development Institutions

- Environmental Organizations

- Government and Regulatory Bodies

- Investors and Financial Institutions

- Others

Industrial Insulation Market Regional Analysis:

The industrial insulation market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

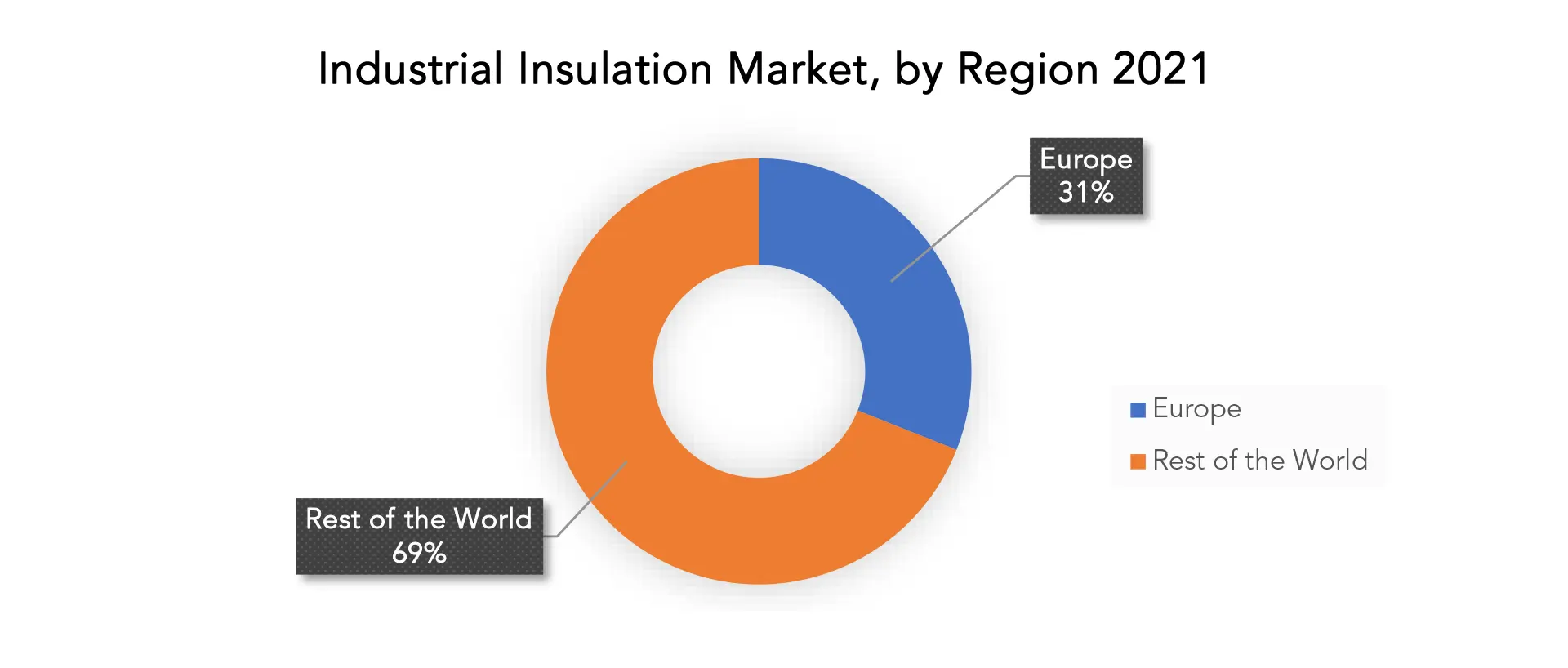

In 2022, Europe controlled the majority of the market and generated roughly 31.0% of the total revenue. By 2030, it is anticipated that the market would still dominate. Strict regulations and legislation implemented by European regulatory bodies have raised awareness of growing energy prices and the need for energy efficiency, which is anticipated to be advantageous for the industry. The market in Europe is concentrated on realising large energy savings and emissions mitigation potential associated to enhanced thermal insulation in EU27 industry, which is anticipated to play a crucial role in expanding the usage of industrial insulation products in various end-use sectors.

Due to the demand being influenced by a highly developed industrial and power generating sector, North America has been dominating the worldwide industrial insulation market for years. The United States has the biggest market share, which is due to its highly developed industrial sector, which consumes the most energy in the world.

Key Market Segments: Industrial Insulation Market

Industrial Insulation Market by Material, 2020-2029, (USD Billion), (Kilotons).

- Stone Wool

- Elastomeric Foam

- Glass Wool

- Composites

- CMS Fibers

- Calcium Silicate

- Cellular Glass

- Others

Industrial Insulation Market by Product, 2020-2029, (USD Billion), (Kilotons).

- Pipe

- Board

- Blanket

Industrial Insulation Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Power Generation

- Petrochemical & Refineries

- EIP Industries

- LNG/LPG

Industrial Insulation Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered:

- What is the expected growth rate of the industrial insulation market over the next 7 years?

- Who are the major players in the industrial insulation market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the industrial insulation market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the industrial insulation market?

- What is the current and forecasted size and growth rate of the global industrial insulation market?

- What are the key drivers of growth in the industrial insulation market?

- What are the distribution channels and supply chain dynamics in the industrial insulation market?

- What are the technological advancements and innovations in the industrial insulation market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the industrial insulation market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the industrial insulation market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of industrial insulation in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH PRODUCTOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA MATERIALS

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL INDUSTRIAL INSULATION OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON INDUSTRIAL INSULATION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL INDUSTRIAL INSULATION OUTLOOK

- GLOBAL INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION) (KILOTONS) 2020-2029

- STONE WOOL

- ELASTOMERIC FOAM

- GLASS WOOL

- COMPOSITES

- CMS FIBERS

- CALCIUM SILICATE

- CELLULAR GLASS

- OTHERS

- GLOBAL INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION) (KILOTONS) 2020-2029

- PIPE

- BOARD

- BLANKET

- GLOBAL INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION) (KILOTONS) 2020-2029

- POWER GENERATION

- PETROCHEMICAL & REFINERIES

- EIP INDUSTRIES

- LNG/LPG

- GLOBAL INDUSTRIAL INSULATION MARKET BY REGION (USD BILLION) (KILOTONS) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- ROCKWOOL INSULATION A/S

- POROC GROUP OY

- KNAUF INSULATION

- TECHNONICOL CORPORATION

- ANCO PRODUCTS, INC.

- ASPEN AEROGELS, INC.

- CABOT CORPORATION

- MORGAN ADVANCED MATERIALS PLC

- UNIFRAX LLC

- RATH GROUP *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 2 GLOBAL INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 3 GLOBAL INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 4 GLOBAL INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 5 GLOBAL INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 6 GLOBAL INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 7 GLOBAL INDUSTRIAL INSULATION MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL INDUSTRIAL INSULATION MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 15 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA INDUSTRIAL INSULATION MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 17 US INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 18 US INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 19 US INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 20 US INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 21 US INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 22 US INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 23 CANADA INDUSTRIAL INSULATION MARKET BY MATERIAL (BILLION), 2020-2029

TABLE 24 CANADA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 25 CANADA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 26 CANADA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 27 CANADA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 CANADA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 MEXICO INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 30 MEXICO INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 31 MEXICO INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 32 MEXICO INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 33 MEXICO INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 MEXICO INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 39 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 41 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 43 BRAZIL INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 44 BRAZIL INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 45 BRAZIL INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 46 BRAZIL INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 47 BRAZIL INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 48 BRAZIL INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 49 ARGENTINA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 50 ARGENTINA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 51 ARGENTINA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 52 ARGENTINA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 53 ARGENTINA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 ARGENTINA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 COLOMBIA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 56 COLOMBIA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 57 COLOMBIA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 58 COLOMBIA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 59 COLOMBIA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 COLOMBIA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 69 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 71 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC INDUSTRIAL INSULATION MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 75 INDIA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 76 INDIA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 77 INDIA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 78 INDIA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 79 INDIA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 INDIA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 CHINA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 82 CHINA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 83 CHINA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 84 CHINA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 85 CHINA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 86 CHINA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 87 JAPAN INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 88 JAPAN INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 89 JAPAN INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 90 JAPAN INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 91 JAPAN INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 92 JAPAN INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 93 SOUTH KOREA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 95 SOUTH KOREA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 97 SOUTH KOREA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 AUSTRALIA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 101 AUSTRALIA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 103 AUSTRALIA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 105 SOUTH EAST ASIA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 107 SOUTH EAST ASIA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 109 SOUTH EAST ASIA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 117 EUROPE INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 118 EUROPE INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 119 EUROPE INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 120 EUROPE INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 121 EUROPE INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 122 EUROPE INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 123 EUROPE INDUSTRIAL INSULATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE INDUSTRIAL INSULATION MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 125 GERMANY INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 126 GERMANY INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 127 GERMANY INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 128 GERMANY INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 129 GERMANY INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 130 GERMANY INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 131 UK INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 132 UK INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 133 UK INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 134 UK INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 135 UK INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 UK INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 137 FRANCE INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 138 FRANCE INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 139 FRANCE INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 140 FRANCE INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 141 FRANCE INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 142 FRANCE INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 143 ITALY INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 144 ITALY INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 145 ITALY INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 146 ITALY INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 147 ITALY INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 148 ITALY INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 149 SPAIN INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 150 SPAIN INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 151 SPAIN INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 152 SPAIN INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 153 SPAIN INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 154 SPAIN INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 155 RUSSIA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 156 RUSSIA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 157 RUSSIA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 158 RUSSIA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 159 RUSSIA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 160 RUSSIA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 161 REST OF EUROPE INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 163 REST OF EUROPE INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 165 REST OF EUROPE INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 175 UAE INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 176 UAE INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 177 UAE INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 178 UAE INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 179 UAE INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 180 UAE INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 181 SAUDI ARABIA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 183 SAUDI ARABIA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 185 SAUDI ARABIA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 187 SOUTH AFRICA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 189 SOUTH AFRICA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 191 SOUTH AFRICA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY MATERIAL (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY MATERIAL (KILOTONS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY PRODUCT (KILOTONS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL INSULATION MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL INDUSTRIAL INSULATION MARKET BY MATERIAL, USD BILLION, 2020-2029

FIGURE 9 GLOBAL INDUSTRIAL INSULATION MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL INDUSTRIAL INSULATION MARKET BY PRODUCT, USD BILLION, 2020-2029

FIGURE 11 GLOBAL INDUSTRIAL INSULATION MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL INDUSTRIAL INSULATION MARKET BY MATERIAL, USD BILLION, 2021

FIGURE 13 GLOBAL INDUSTRIAL INSULATION MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL INDUSTRIAL INSULATION MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 15 GLOBAL INDUSTRIAL INSULATION MARKET BY REGION, USD BILLION, 2021

FIGURE 16 PORTER’S FIVE FORCES MODEL

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ROCKWOOL INSULATION A/S: COMPANY SNAPSHOT

FIGURE 19 POROC GROUP OY: COMPANY SNAPSHOT

FIGURE 20 KNAUF INSULATION: COMPANY SNAPSHOT

FIGURE 21 TECHNONICOL CORPORATION: COMPANY SNAPSHOT

FIGURE 22 ANCO PRODUCTS, INC.: COMPANY SNAPSHOT

FIGURE 23 ASPEN AEROGELS, INC.: COMPANY SNAPSHOT

FIGURE 24 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 25 MORGAN ADVANCED MATERIALS PLC: COMPANY SNAPSHOT

FIGURE 26 UNIFRAX LLC: COMPANY SNAPSHOT

FIGURE 27 RATH GROUP: COMPANY SNAPSHOT

FAQ

The industrial insulation market is expected to grow at 5.4 % CAGR from 2022 to 2029. It is expected to reach above USD 5.94 billion by 2029 from USD 3.7 billion in 2020.

Europe held more than 31% of the industrial insulation market revenue share in 2021 and will witness expansion in the forecast period.

Market drivers for industrial insulation include rising energy conservation measures, stricter building codes, and rising demand for thermal efficiency and noise reduction. Innovations in insulating materials, technical improvements, and the demand for environmentally friendly and sustainable solutions all have an impact on the industry.

The market was led by LPG/LNG in 2022, which generated about 20.70% of the total revenue. The market is anticipated to maintain its current trend over the course of the projection period, which can be ascribed to the high risk associated with the transportation and storage of LPG and LNG goods, which has resulted in significant product demand.

Europe is the largest regional market for industrial insulation market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.