REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 8.06 billion by 2029 | 7.8 % | North America |

| By Platform | By Receiver Type | By Technique |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Anti-Jamming Market Overview

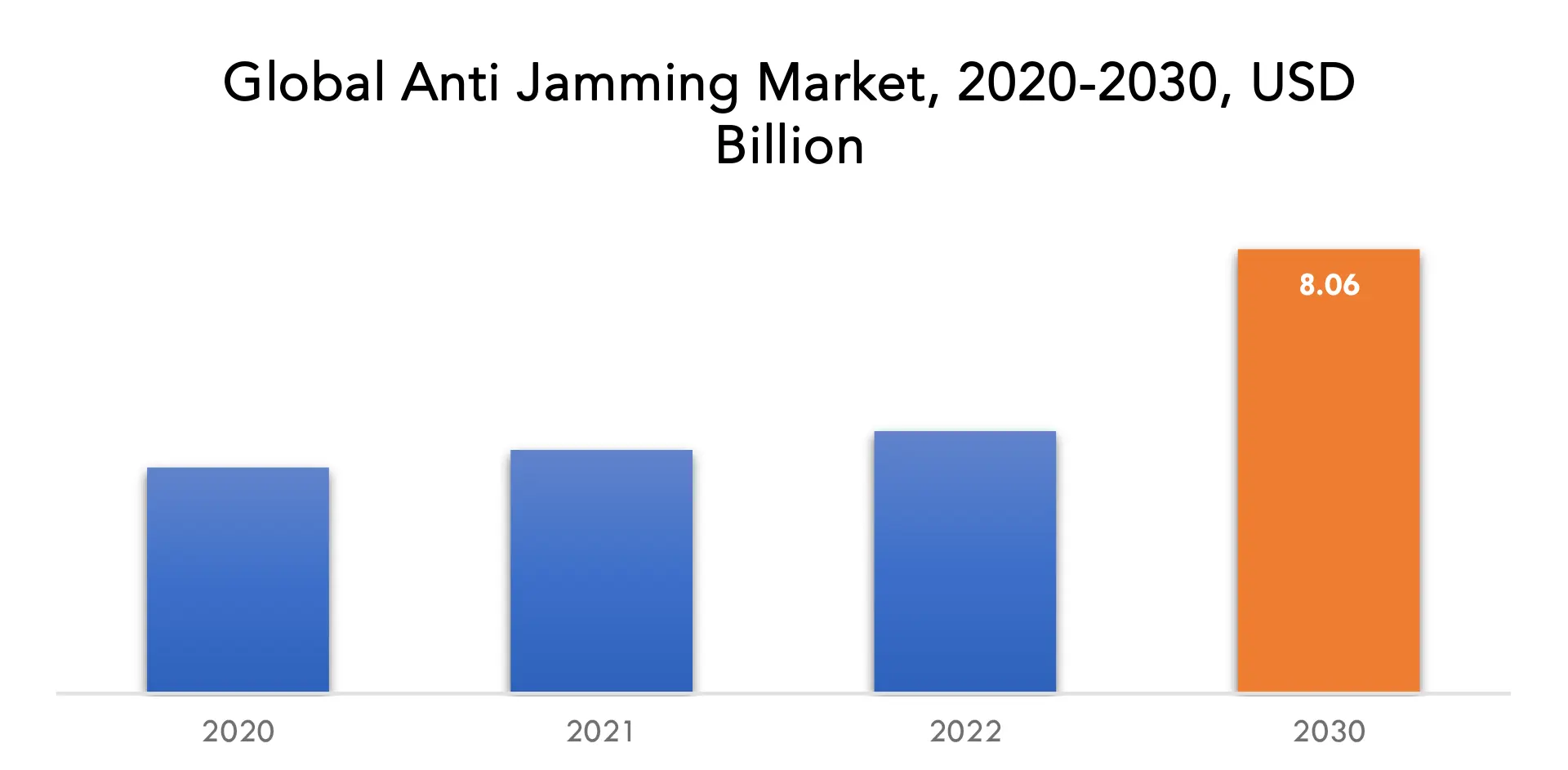

The anti-jamming market is expected to grow at 7.8 % CAGR from 2022 to 2029. It is expected to reach above USD 8.06 billion by 2029 from USD 4.1 billion in 2020.

Receiver protection against interference and jamming signals is provided by anti-jamming devices. Several systems, including aeroplane, jets, autonomous weapons, tanks, unmanned aerial vehicles (UAVs), and important government buildings, are equipped with anti-jammers. GPS jammers are increasingly being used worldwide due of the growing number of applications for satellite-assisted navigation systems. When GPS signals are received from satellites by receivers on Earth, they deteriorate and are susceptible to interference from other powerful Radio Frequency (RF) waves.

Growing demand for unnamed airborne vehicles and systems, growing demand for low power anti-jamming systems from missile manufacturers, growing demand for miniaturization of GNSS-based anti-jamming devices, and growing dependence on satellite communication are all factors that are accelerating market growth. Rising ongoing developments to improve the overall GPS infrastructure is also a significant factor. Additionally, during the aforementioned forecast period, the market for GPS anti-jamming solutions will see increased development as well as rising demand for UAVs and systems.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Thousand units. |

| Segmentation | By Platform, By Receiver Type, By Technique, By Application, By Region. |

| By Platform

|

|

| By Receiver Type |

|

| By Technique |

|

| By Application

|

|

| By Region

|

|

The operation of commercial aircraft on the routes has been impeded by the rising use of GPS jammers during joint military exercises or in a conflict zone. Russian military attempts to disrupt satellite navigation were reported by the French Civil Aviation Authority in April 2022, close to the Black Sea region. Numerous commercial aeroplanes operating close to the Black Sea had their navigation systems impacted by this. The Russian military attempted to block satellite navigation in the vicinity of the Black Sea in 2022, impacting the local commercial airlines’ navigation systems.

The most secure data transfer method uses light photons in quantum communication, which operates on the quantum physics premise. A Chinese satellite dubbed Micius, intended to allow quantum communication, was launched in August 2016. Between two ground stations that were 1,200 kilometers apart, Micius created a direct communication. Entanglement-based quantum cryptography was used by Micius to make this connection. The deployment of a multi-orbital satellite constellation equipped with quantum communication technologies for secure data transfer by 2027 was announced by the European Commission in November 2022. Consequently, advances in quantum communication could pose a serious danger to anti-jammers.

Opportunities in the market for anti-jamming equipment are being created by the alarming rise in violent armed conflicts around the world. In addition to the growing need for defense modernization to improve national security and mitigate the effects of signal interference brought on by digital technology, governments and defense organizations, particularly in developing countries, are hastily putting new anti-jamming techniques into practice. The need for more potent Positioning, Navigation, and Timing (PNT) systems and electronic warfare defenses such GNSS anti-jamming systems has grown over the past few years as global conflicts have intensified and defense budgets have expanded.

Global anti-jamming market growth was severely impacted by COVID-19. The COVID-19 epidemic caused countries to alter their purchasing strategies and objectives. Due to COVID-19-related restrictions, OEMs also encountered significant challenges in providing anti-jammers or allied equipment on time. For instance, Israel Aerospace Industries (IAI), after a lengthy delay, finally delivered Heron drones to the Indian army in November 2021. The launch of the GPS III satellite, which has anti-jam capability, was also delayed by approximately six months in the United States.

Anti-Jamming Market Segment Analysis

The anti-jamming market is segmented based on platform, receiver type, technique and application

Airborne, land-based, naval, and space platforms make up the market. In 2021, the airborne category accounted for the biggest market share. Due to the increasing number of satellites held by established and emerging nations, space-based anti-jammers are predicted to see the highest growth during the projection period. Due to increased demand for frigates, jets, and commercial aircraft around the world, it is also projected that the land and naval segments will expand slightly.

The market is segmented into military and government grade and commercial transportation grade based on the kind of receiver. Military and governmental grade anti-jammers are anticipated to experience the quickest growth throughout the projection due to rising demand in the defense industry. Due to modifications or anti-jammer installations in commercial aircraft, commercial transportation grade anti-jammers are also expected to grow significantly between 2022 and 2029.

The market is divided into nulling, beam steering, and excision system categories based on technique. Due to growing applications in satellites, the category of beam steering systems is predicted to develop at the highest CAGR between 2022 and 2029. The nulling systems market held the most market share in 2021 and is anticipated to continue to dominate over the next few years due to its wide range of applications and technological capacity.

The market is segmented into flight control, surveillance and reconnaissance, position, navigation and timing, targeting, casualty evacuation, and others based on application. Due to increasing applications in aircraft and UAVs, the flight control segment is expected to develop at the greatest CAGR between 2022 and 2029. Due to its use in commercial aircraft, unmanned aerial vehicles, and other devices, the position, navigation, and timing category had the greatest market share in 2021 and is anticipated to continue to dominate during the forecast.

Anti-Jamming Market Player

The anti jamming market key players includes BAE System, Furuno Electric, Hexagon AB, Cobham, Israel Aerospace Industries, L3Harris Technologies Inc., Lockheed Martin, Raytheon Technologies Corporation, ST Engineering, Thales.

13 June 2023: At the Joint Navigation Conference in San Diego, BAE Systems unveiled NavGuide™, a next-generation Assured-Positioning, Navigation and Timing (A-PNT) device featuring M-Code Global Positioning System (GPS) technology. NavGuide is a field-installable replacement to the Defense Advanced GPS Receiver (DAGR) designed for quick integration into current DAGR mounts and accessories without mission interruption.

31 May 2023: BAE Systems launched Mission Advantage™, a new technology partner program that facilitates collaboration between BAE Systems’ Intelligence & Security sector and companies in the program to deliver cutting-edge technologies to accelerate mission readiness.

Who Should Buy? Or Key Stakeholders

- Government and Military Agencies

- Defense Contractors

- Technology Providers

- Communication Equipment Manufacturers

- Satellite Operators

- Telecommunication Service Providers

- Transportation and Aviation Industry

- Research Institutions and Academia

- Industry Associations and Standards Organizations

- Others

Anti-Jamming Market Regional Analysis

The anti-jamming market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

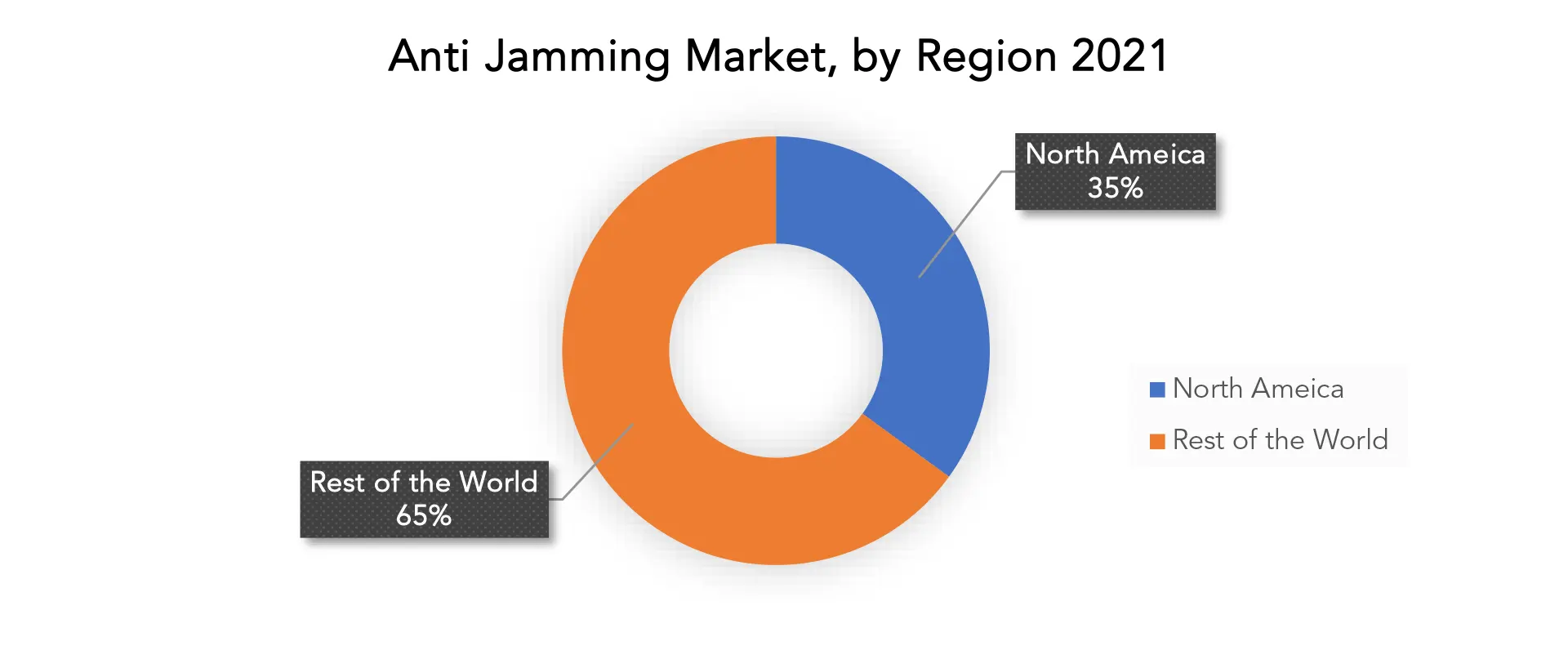

With a CAGR of 11.55% over the forecast period, North America will hold the highest market share. The largest market contributor in the area is the United States. According to SIPRI, the United States spent the most on its military in 2022 ($778 billion), considerably outpacing China, which came in second. The country is increasingly adopting unmanned vehicles for defense. Any interruption in these devices’ communication could endanger the security of the nation, which is why anti-jamming solutions are primarily used. The US places a high priority on its military and defense sector and makes significant investments in the creation of new armament systems.

By 2030, Asia-Pacific is expected to grow at a CAGR of 18.65% and produce USD 2,078 million. Asia-Pacific is home to several developing nations with advanced technology systems. Tensions within the region between several nations, some of which have some of the largest defense expenditures, are driving up demand for anti-jamming equipment. In the area, military spending is dominated by China and India. Due to intensified military attacks in the province, China is expected to contribute primarily. This has led to other countries improving their surveillance and capacities.

Key Market Segments: Anti Jamming Market

Anti-Jamming Market by Platform, 2020-2029, (USD Billion, Thousand Units).

- Airborne

- Land

- Naval

- Space

Anti-Jamming Market By Receiver Type, 2020-2029, (USD Billion, Thousand Units).

- Military & Government Grade

- Commercial Transportation Grade

Anti-Jamming Market By Technique, 2020-2029, (USD Billion, Thousand Units).

- Nulling System

- Beam Steering System

- Excision System

Anti-Jamming Market By Application, 2020-2029, (USD Billion, Thousand Units).

- Flight Control

- Surveillance & Reconnaissance, Position

- Navigation & Timing

- Targeting

- Casualty Evacuation

- Others

Anti-Jamming Market By Region, 2020-2029, (USD Billion, Thousand Units).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the anti-jamming market over the next 7 years?

- Who are the major players in the anti-jamming market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such As Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the anti-jamming market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the anti-jamming market?

- What is the current and forecasted size and growth rate of the global anti jamming market?

- What are the key drivers of growth in the anti-jamming market?

- What are the distribution channels and supply chain dynamics in the anti-jamming market?

- What are the technological advancements and innovations in the anti-jamming market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the anti-jamming market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the anti-jamming market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of anti-jamming in the market and what is the impact of raw application prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ANTI JAMMING OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ANTI JAMMING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ANTI JAMMING OUTLOOK

- GLOBAL ANTI JAMMING MARKET BY PLATFORM (USD BILLION) (THOUSAND UNITS) 2020-2029

- AIRBORNE

- LAND

- NAVAL

- SPACE

- GLOBAL ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) (THOUSAND UNITS) 2020-2029

- MILITARY & GOVERNMENT GRADE

- COMMERCIAL TRANSPORTATION GRADE

- GLOBAL ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) (THOUSAND UNITS) 2020-2029

- NULLING SYSTEM

- BEAM STEERING SYSTEM

- EXCISION SYSTEM

- GLOBAL ANTI JAMMING MARKET BY APPLICATION (USD BILLION) (THOUSAND UNITS) 2020-2029

- FLIGHT CONTROL

- SURVEILLANCE & RECONNAISSANCE, POSITION

- NAVIGATION & TIMING

- TARGETING

- CASUALTY EVACUATION

- OTHERS

- GLOBAL ANTI JAMMING MARKET BY REGION (USD BILLION) (THOUSAND UNITS) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BAE SYSTEM

- FURUNO ELECTRIC

- HEXAGON AB

- COBHAM

- ISRAEL AEROSPACE INDUSTRIES

- L3HARRIS TECHNOLOGIES INC.

- LOCKHEED MARTIN

- RAYTHEON TECHNOLOGIES CORPORATION

- ST ENGINEERING

- THALES *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 6 GLOBAL ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 7 GLOBAL ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 8 GLOBAL ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 9 GLOBAL ANTI JAMMING MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL ANTI JAMMING MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 11 NORTH AMERICA ANTI JAMMING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA ANTI JAMMING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 13 NORTH AMERICA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 15 NORTH AMERICA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 17 NORTH AMERICA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 19 NORTH AMERICA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 21 US ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 22 US ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 23 US ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 24 US ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 25 US ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 26 US ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 27 US ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 28 US ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 29 CANADA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 31 CANADA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 CANADA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 33 CANADA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 34 CANADA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 35 CANADA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 36 CANADA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 37 MEXICO ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 39 MEXICO ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 MEXICO ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 41 MEXICO ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 42 MEXICO ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 43 MEXICO ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 44 MEXICO ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 45 SOUTH AMERICA ANTI JAMMING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA ANTI JAMMING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH AMERICA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH AMERICA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 51 SOUTH AMERICA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 53 SOUTH AMERICA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 55 BRAZIL ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 BRAZIL ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 BRAZIL ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 59 BRAZIL ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 60 BRAZIL ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 61 BRAZIL ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 62 BRAZIL ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 63 ARGENTINA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 ARGENTINA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 ARGENTINA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 67 ARGENTINA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 68 ARGENTINA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 69 ARGENTINA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 70 ARGENTINA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 71 COLOMBIA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 COLOMBIA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 COLOMBIA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 75 COLOMBIA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 76 COLOMBIA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 77 COLOMBIA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 78 COLOMBIA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 87 ASIA-PACIFIC ANTI JAMMING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC ANTI JAMMING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 89 ASIA-PACIFIC ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 91 ASIA-PACIFIC ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 93 ASIA-PACIFIC ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 95 ASIA-PACIFIC ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 97 INDIA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 99 INDIA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 100 INDIA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 101 INDIA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 102 INDIA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 103 INDIA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 104 INDIA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 105 CHINA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 107 CHINA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 CHINA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 109 CHINA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 110 CHINA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 111 CHINA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 112 CHINA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 113 JAPAN ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 115 JAPAN ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 116 JAPAN ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 117 JAPAN ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 118 JAPAN ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 119 JAPAN ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 120 JAPAN ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 121 SOUTH KOREA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 123 SOUTH KOREA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 125 SOUTH KOREA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 127 SOUTH KOREA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 129 AUSTRALIA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 131 AUSTRALIA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 133 AUSTRALIA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 135 AUSTRALIA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 137 SOUTH-EAST ASIA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 139 SOUTH-EAST ASIA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 141 SOUTH-EAST ASIA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 143 SOUTH-EAST ASIA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 153 EUROPE ANTI JAMMING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 154 EUROPE ANTI JAMMING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 155 EUROPE ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 156 EUROPE ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 157 EUROPE ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 EUROPE ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 159 EUROPE ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 160 EUROPE ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 161 EUROPE ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 162 EUROPE ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 163 GERMANY ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 165 GERMANY ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 166 GERMANY ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 167 GERMANY ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 168 GERMANY ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 169 GERMANY ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 170 GERMANY ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 171 UK ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 172 UK ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 173 UK ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 174 UK ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 175 UK ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 176 UK ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 177 UK ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 178 UK ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 179 FRANCE ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 181 FRANCE ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 182 FRANCE ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 183 FRANCE ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 184 FRANCE ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 185 FRANCE ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 186 FRANCE ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 187 ITALY ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 189 ITALY ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 ITALY ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 191 ITALY ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 192 ITALY ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 193 ITALY ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 194 ITALY ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 195 SPAIN ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 197 SPAIN ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 198 SPAIN ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 199 SPAIN ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 200 SPAIN ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 201 SPAIN ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 202 SPAIN ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 203 RUSSIA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 205 RUSSIA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 206 RUSSIA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 207 RUSSIA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 208 RUSSIA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 209 RUSSIA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 210 RUSSIA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 211 REST OF EUROPE ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 213 REST OF EUROPE ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 215 REST OF EUROPE ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 217 REST OF EUROPE ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY COUNTRY (THOUSAND UNITS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 229 UAE ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 230 UAE ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 231 UAE ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 232 UAE ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 233 UAE ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 234 UAE ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 235 UAE ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 236 UAE ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 237 SAUDI ARABIA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 239 SAUDI ARABIA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 241 SAUDI ARABIA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 243 SAUDI ARABIA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 245 SOUTH AFRICA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 247 SOUTH AFRICA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 249 SOUTH AFRICA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 251 SOUTH AFRICA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY RECEIVER TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY RECEIVER TYPE (THOUSAND UNITS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY PLATFORM (THOUSAND UNITS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY TECHNIQUE (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA ANTI JAMMING MARKET BY TECHNIQUE (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ANTI JAMMING MARKET BY PLATFORM, USD BILLION, 2020-2029

FIGURE 9 GLOBAL ANTI JAMMING MARKET BY RECEIVER TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL ANTI JAMMING MARKET BY TECHNIQUE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL ANTI JAMMING MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL ANTI JAMMING MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 GLOBAL ANTI JAMMING MARKET BY PLATFORM, USD BILLION, 2021

FIGURE 14 GLOBAL ANTI JAMMING MARKET BY RECEIVER TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL ANTI JAMMING MARKET BY TECHNIQUE, USD BILLION, 2021

FIGURE 16 GLOBAL ANTI JAMMING MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 17 GLOBAL ANTI JAMMING MARKET BY REGION, USD BILLION, 2021

FIGURE 18 PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 BAE SYSTEM: COMPANY SNAPSHOT

FIGURE 21 FURUNO ELECTRIC: COMPANY SNAPSHOT

FIGURE 22 HEXAGON AB: COMPANY SNAPSHOT

FIGURE 23 COBHAM: COMPANY SNAPSHOT

FIGURE 24 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

FIGURE 25 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 26 LOCKHEED MARTIN: COMPANY SNAPSHOT

FIGURE 27 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FIGURE 28 ST ENGINEERING: COMPANY SNAPSHOT

FIGURE 29 THALES: COMPANY SNAPSHOT

FAQ

The anti-jamming market is expected to grow at 7.8 % CAGR from 2022 to 2029. It is expected to reach above USD 8.06 billion by 2029 from USD 4.1 billion in 2020.

North America held more than 35 % of the anti-jamming market revenue share in 2021 and will witness expansion in the forecast period.

Growing demand for unnamed airborne vehicles and systems, growing demand for low power anti-jamming systems from missile manufacturers, growing demand for miniaturization of GNSS-based anti-jamming devices, and growing dependence on satellite communication are all factors that are accelerating market growth.

Due to increasing applications in aircraft and UAVs, the flight control segment is expected to develop at the greatest CAGR between 2022 and 2029.

North America is the largest regional market for anti jamming market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.