REPORT OUTLOOK

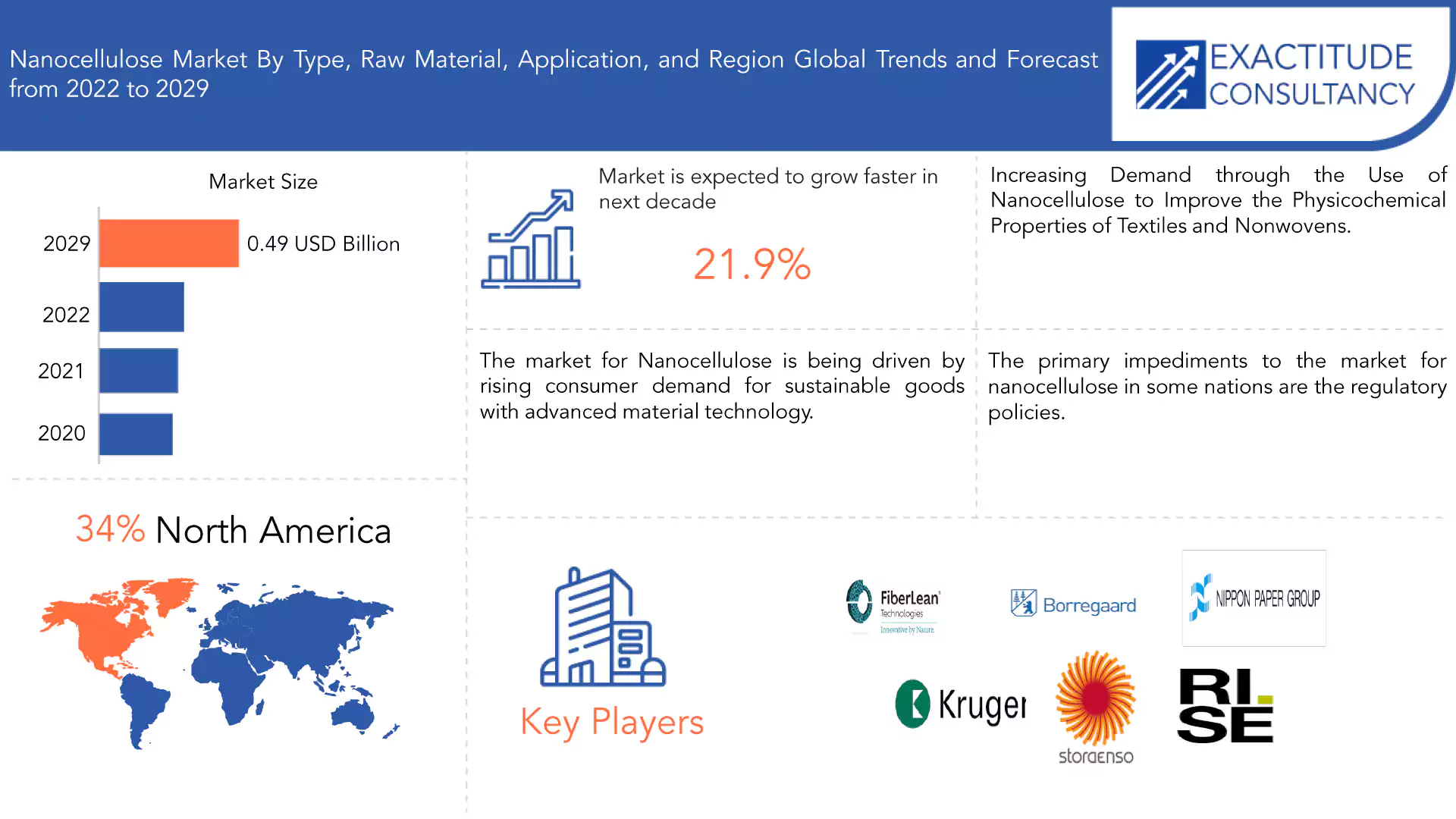

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 0.49 Billion By 2029 | 21.9% | North America |

| by Type | by Raw Material | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Nanocellulose Market Overview

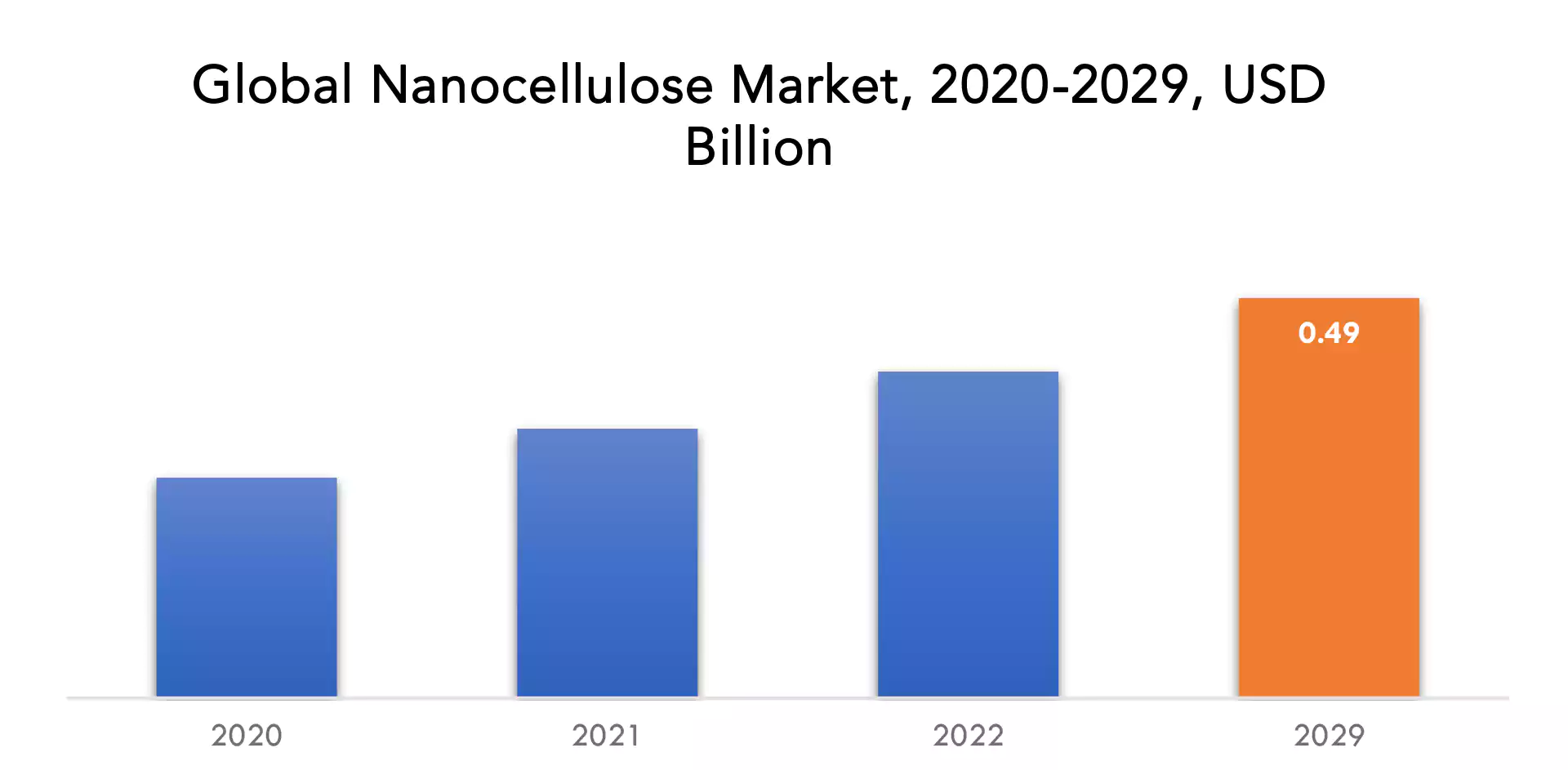

The global nanocellulose market was valued at 0.40 billion in 2022 and is projected to reach 0.49 billion by 2029, growing at a CAGR of 21.9% from 2022 to 2029.

Nanocellulose is a cellulose derivative produced from wood pulp. The material is removed from the wood mechanically by applying high shear forces. Grinders, microfluidizers, high-pressure homogenizers, and ultrasonic homogenizers could all be used to prepare it. These nanoparticles’ excellent strength, light weight, and electrical conductivity make them ideal for application in composite materials. A nanocomposite with a nanocellulose component has the strength to be used in the production of bulletproof products.

End products are given nanocellulose as an additive to give them properties such biodegradability, low toxicity, increased strength and stiffness, and low weight. Due to its enhanced properties, nanocellulose can take the place of petroleum-based packaging, metallic components, and other non-renewable materials. The development of bio-based goods is having a positive impact on the market for nanocellulose. This trend will have a significant global impact on firm investments and business decisions. The market for nanocellulose is being driven by rising customer demand for environmentally friendly products made of superior materials. Also, the increase in demand for various applications and the changing popularity of employing products made of biological materials are the elements that are driving product demand. Nanocellulose is excellent to produce a wide variety of products due to its different properties, including greater paper machine efficiency, better filler content, lighter base mass, and higher freeness. Due to its high strength, excellent oxygen barrier performance, low density, mechanical characteristics, and biocompatibility among the available bio-based resources, nanocellulose is used as a significant sustainable nanomaterial additive in the paper industry. The main applications of nanocellulose composite materials include the manufacture of materials, aqueous coating, and others.

Nanocellulose is utilized in the automobile industry. In the automotive industry, replacing heavy steel parts, like set frames, with new reinforced polymers that are equally priced to traditional materials is one of the main goals. The weight of vehicle interior components can be greatly reduced thanks to nanocellulose. Therefore, the market for nanocellulose is expanding due to the possibility of using lighter cars.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Billion Tons) |

| Segmentation | By Type, Raw Material, Application, and Region. |

| By Type |

|

| By Raw Material |

|

| By Application |

|

| By Region |

|

Nanocellulose Market Segment Analysis:

Based on type, raw material, application, and region, the global market for nanocellulose is divided into these categories.

These cellulose-based nanocrystalline biomedical materials are widely used in cardiovascular disease, antimicrobial/antibacterial, tissue engineering, medication delivery, wound healing, and medical implants. In 2022, Cellulose Nanofibers (CNF) had a revenue share of more than 51%, dominating the market. Due to the product’s simple accessibility and enhanced tensile qualities, it has the biggest market share. The bulk cellulose of wood is often processed mechanically and chemically to create MFC and NFC (Nano Fibrillated Cellulose). The production of these goods is made easier by the availability of pulp made of wood. The most cutting-edge biomass material in the world is cellulose nanofiber (CNF), which is created from wood-derived fiber (pulp) that has been micro-refined to the nano level of several hundredths of a micron and smaller. The organic substance (C6H10O5) n known as bacterial cellulose is created by specific species of bacteria. While most plants use cellulose as a fundamental structural component, it is also created by bacteria, primarily those belonging to the genera Acetobacter, Sarina ventriculi, and Agrobacterium. Bacterial, or microbial, cellulose differs from plant cellulose in that it is stronger, more moldable, and capable of storing more water than plant cellulose.

Most bacteria in natural environments create extracellular polysaccharides, such as cellulose, which surround the cells in protective envelopes. Even though bacterial cellulose is created in nature, numerous strategies are currently being researched to speed up the growth of cellulose from cultures on a big scale in laboratories. Small crystalline particles known as cellulose nanocrystals (CNC) range in size from 3 to 40 nm in diameter and 100 to 500 nm in length. Due to its nano-scale dimensions and capacity to create a potent entangled nano porous network, MFC and NFC are in high demand and are growing quickly in both supply and demand. Due to their exceptional reinforcing potential, MFC and NFC are frequently utilized in nanocomposites due to their high yield, high specific surface area, high strength, and stiffness qualities. A cellulose derivative derived from wood pulp is called nanocellulose. By applying strong shear stresses mechanically, the substance is separated from the wood. It may be prepared using grinders, microfluidizers, high-pressure homogenizers, or ultrasonic homogenizers. These nanoparticles are perfect for use in composites due to they are exceptionally strong, light, and electrically conductive. The strength of a nanocomposite with a nanocellulose component makes it suitable for producing bullet-proof items.

Paper & Pulp, Composites, Paints & Coatings, Biomedical & Pharmaceuticals, and Electronics & Sensors are the applications of nanocellulose. Nanocellulose is a key constituent in the pulp and paper industry’s production of light, white paper, which further spurs the market’s expansion. It is employed in healthcare applications as biomedicines and personal hygiene products due to of its benign properties. A fascinating free-standing thin film material made from sustainable nanocellulose, cellulose nano paper (CNP) exhibits unique qualities like transparency, haze, thermal stability, mechanical strength, and flexibility. Additionally, composites “nanocellulose” refers to cellulosic materials with well-defined structural dimensions at the nanoscale. They could be bacterial nanocellulose, cellulose nanofibers, or cellulose nanocrystals (CNC or NCC). Nanocellulose has no harmful impacts on human health or the environment and is non-toxic, biodegradable, and biocompatible. A device that detects a physical property of interest (such as heat, light, or sound) and converts it into an electrical signal so that it may be measured and used by an electrical or electronic system is known as an electrical sensor, also known as an electronic sensor.

Nanocellulose Market Key Players:

The major players operating in the global Nanocellulose industry include the major market players are GE Fiberlean Technologies, Borregaard, Nippon Paper Group, Celluforce, Kruger Inc., Stora Enso, RISE Innventia, American Process Inc., FPInnovations, Sappi Ltd, Innventia AB, and others.

Recent News:

In September 2020, Celluforce announced the signing of a multi-million contract with a multinational company operating in cosmetics sector for development and supply of nanocellulose for application in their offerings.

In August 2020, Stora Enso announced the construction of a new pilot plant for production of cellulose foam. The new plant is located at the company’s Fors mill in Sweden and shall be able to produce a lightweight biofiber-based foam material for packaging and cushioning applications and replace fossil-based materials used in the packaging industry.

Who Should Buy? Or Key stakeholders

- Manufacturing

- End-Use Industries

- BFSI

- Automotive

- Manufacturing & Construction

- Regulatory Authorities

- Research Organizations

- Information Technology

- Materials & Chemicals

Nanocellulose Market Regional Analysis:

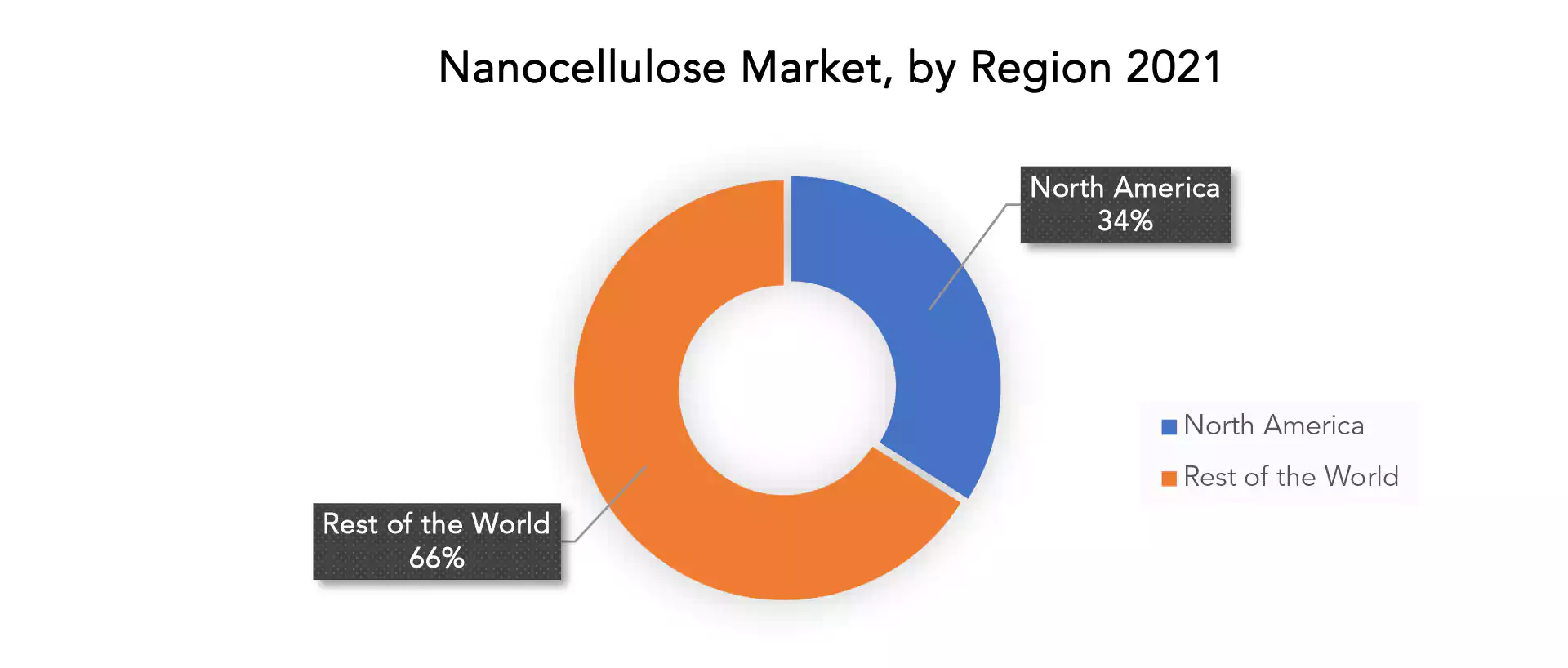

Geographically, the nanocellulose market is segmented into North America, South America, Europe, APAC, and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and the Rest of APAC

- South America: includes Brazil, Argentina, and the Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

North America is also the largest regional market for cellulose. The growth of the regional market is attributed to the rise of North America’s commercial building sector and refurbishing activities. The market for nanocellulose in North America is projected to expand at a CAGR of roughly 21.9% from 2018 to 2032. Nanocellulose is becoming more and more significant in the building and construction sector. Thanks to the material, many products can gain from enhanced strength and environmental advantages. Government-led upgrades to the public infrastructure should encourage regional industry growth. The variety of uses for nanocellulose in North America will also increase as a result of ongoing advancements in a few industries, including paints and coatings, oil and gas, and food and beverage. Also, to produce high-strength cement and construction composites, there is a growing need for Nano fibrillated cellulose nanomaterials in North America. The use of MFC and CNF to produce functional food products has greatly increased in popularity in the region as a result of the people in the area being very worried about their health.

Key Market Segments: Nanocellulose Market

Nanocellulose Market by Type, 2020-2029, (USD Billion) (Billion Tons)

- Nanocrystalline Cellulose

- Cellulose Nanofibers

- Bacterial Cellulose

- Crystalline Nanocellulose

- MFC & NFC

Nanocellulose Market by Raw Material, 2020-2029, (USD Billion) (Billion Tons)

- Wood

- Non Wood

Nanocellulose Market by Application, 2020-2029, (USD Billion) (Billion Tons)

- Paper & Pulp

- Composites

- Paints & Coatings

- Biomedical & Pharmaceuticals

- Electronics & Sensors

Nanocellulose Market by Region, 2020-2029, (USD Billion) (Billion Tons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Region Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered:

- What is the expected growth rate of the nanocellulose market over the next 7 years?

- Who are the major players in the nanocellulose market and what is their market share?

- What are the end-user industries driving demand for the market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the nanocellulose market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the nanocellulose market?

- What is the current and forecasted size and growth rate of the global nanocellulose market?

- What are the key drivers of growth in the nanocellulose market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the nanocellulose market?

- What are the technological advancements and innovations in the nanocellulose market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the nanocellulose market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the nanocellulose market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NANOCELLULOSE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON THE NANOCELLULOSE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NANOCELLULOSE MARKET OUTLOOK

- GLOBAL NANOCELLULOSE MARKET BY TYPE, 2020-2029, (USD BILLION), (BILLION TONS)

- NANOCRYSTALLINE CELLULOSE

- CELLULOSE NANOFIBERS

- BACTERIAL CELLULOSE

- CRYSTALLINE NANOCELLULOSE

- MFC & NFC

- GLOBAL NANOCELLULOSE MARKET BY RAW MATERIAL, 2020-2029, (USD BILLION), (BILLION TONS)

- WOOD

- NON WOOD

- GLOBAL NANOCELLULOSE MARKET BY APPLICATION, 2020-2029, (USD BILLION), (BILLION TONS)

- PAPER & PULP

- COMPOSITES

- PAINTS & COATINGS

- BIOMEDICAL & PHARMACEUTICALS

- ELECTRONICS & SENSORS

- GLOBAL NANOCELLULOSE MARKET BY REGION, 2020-2029, (USD BILLION), (BILLION TONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- FIBERLEAN TECHNOLOGIES

- BORREGAARD

- NIPPON PAPER GROUP

- CELLUFORCE

- KRUGER INC.

- STORA ENSO

- RISE INNVENTIA

- AMERICAN PROCESS INC.

- FPINNOVATIONS

- SAPPI LTD

- INNVENTIA AB *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 3 GLOBAL NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 4 GLOBAL NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 5 GLOBAL NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 7 GLOBAL NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 8 GLOBAL NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 9 GLOBAL NANOCELLULOSE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 10 GLOBAL NANOCELLULOSE MARKET BY REGION (BILLION TONS) 2020-2029

TABLE 11 NORTH AMERICA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 13 NORTH AMERICA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 15 NORTH AMERICA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 17 NORTH AMERICA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 19 NORTH AMERICA NANOCELLULOSE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA NANOCELLULOSE MARKET BY COUNTRY (BILLION TONS) 2020-2029

TABLE 21 US NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 22 US NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 23 US NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 24 US NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 25 US NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 US NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 27 US NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 28 US NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 29 CANADA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 CANADA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 31 CANADA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 32 CANADA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 33 CANADA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 CANADA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 35 CANADA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 36 CANADA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 37 MEXICO NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 MEXICO NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 39 MEXICO NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 40 MEXICO NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 41 MEXICO NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 MEXICO NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 43 MEXICO NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 44 MEXICO NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 45 SOUTH AMERICA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 46 SOUTH AMERICA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 47 SOUTH AMERICA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 48 SOUTH AMERICA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 49 SOUTH AMERICA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 SOUTH AMERICA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 51 SOUTH AMERICA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 52 SOUTH AMERICA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 53 SOUTH AMERICA NANOCELLULOSE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 54 SOUTH AMERICA NANOCELLULOSE MARKET BY COUNTRY (BILLION TONS) 2020-2029

TABLE 55 BRAZIL NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 BRAZIL NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 57 BRAZIL NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 58 BRAZIL NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 59 BRAZIL NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 BRAZIL NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 61 BRAZIL NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 62 BRAZIL NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 63 ARGENTINA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 64 ARGENTINA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 65 ARGENTINA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 66 ARGENTINA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 67 ARGENTINA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 68 ARGENTINA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 69 ARGENTINA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 70 ARGENTINA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 71 COLOMBIA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 72 COLOMBIA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 73 COLOMBIA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 74 COLOMBIA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 75 COLOMBIA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 76 COLOMBIA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 77 COLOMBIA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 78 COLOMBIA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 87 ASIA-PACIFIC NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 ASIA-PACIFIC NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 89 ASIA-PACIFIC NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 90 ASIA-PACIFIC NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 91 ASIA-PACIFIC NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 92 ASIA-PACIFIC NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 93 ASIA-PACIFIC NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 94 ASIA-PACIFIC NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 95 ASIA-PACIFIC NANOCELLULOSE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 96 ASIA-PACIFIC NANOCELLULOSE MARKET BY COUNTRY (BILLION TONS) 2020-2029

TABLE 97 INDIA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 98 INDIA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 99 INDIA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 100 INDIA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 101 INDIA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 INDIA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 103 INDIA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 104 INDIA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 105 CHINA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 CHINA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 107 CHINA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 108 CHINA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 109 CHINA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 CHINA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 111 CHINA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 112 CHINA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 113 JAPAN NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 114 JAPAN NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 115 JAPAN NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 116 JAPAN NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 117 JAPAN NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 118 JAPAN NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 119 JAPAN NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 120 JAPAN NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 121 SOUTH KOREA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 SOUTH KOREA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 123 SOUTH KOREA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 124 SOUTH KOREA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 125 SOUTH KOREA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 126 SOUTH KOREA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 127 SOUTH KOREA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 128 SOUTH KOREA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 129 AUSTRALIA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 130 AUSTRALIA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 131 AUSTRALIA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 132 AUSTRALIA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 133 AUSTRALIA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 AUSTRALIA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 135 AUSTRALIA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 136 AUSTRALIA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 137 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 139 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 141 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 143 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 153 EUROPE NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 154 EUROPE NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 155 EUROPE NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 156 EUROPE NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 157 EUROPE NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 EUROPE NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 159 EUROPE NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 160 EUROPE NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 161 EUROPE NANOCELLULOSE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 162 EUROPE NANOCELLULOSE MARKET BY COUNTRY (BILLION TONS) 2020-2029

TABLE 163 GERMANY NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 164 GERMANY NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 165 GERMANY NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 166 GERMANY NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 167 GERMANY NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 168 GERMANY NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 169 GERMANY NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 170 GERMANY NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 171 UK NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 172 UK NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 173 UK NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 174 UK NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 175 UK NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 176 UK NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 177 UK NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 178 UK NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 179 FRANCE NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 180 FRANCE NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 181 FRANCE NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 182 FRANCE NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 183 FRANCE NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 FRANCE NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 185 FRANCE NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 186 FRANCE NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 187 ITALY NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 ITALY NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 189 ITALY NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 190 ITALY NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 191 ITALY NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 192 ITALY NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 193 ITALY NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 194 ITALY NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 195 SPAIN NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 196 SPAIN NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 197 SPAIN NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 198 SPAIN NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 199 SPAIN NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 200 SPAIN NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 201 SPAIN NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 202 SPAIN NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 203 RUSSIA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 204 RUSSIA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 205 RUSSIA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 206 RUSSIA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 207 RUSSIA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 208 RUSSIA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 209 RUSSIA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 210 RUSSIA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 211 REST OF EUROPE NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 212 REST OF EUROPE NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 213 REST OF EUROPE NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 214 REST OF EUROPE NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 215 REST OF EUROPE NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 216 REST OF EUROPE NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 217 REST OF EUROPE NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 218 REST OF EUROPE NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY COUNTRY (BILLION TONS) 2020-2029

TABLE 229 UAE NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 230 UAE NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 231 UAE NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 232 UAE NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 233 UAE NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 234 UAE NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 235 UAE NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 236 UAE NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 237 SAUDI ARABIA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 238 SAUDI ARABIA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 239 SAUDI ARABIA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 240 SAUDI ARABIA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 241 SAUDI ARABIA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 242 SAUDI ARABIA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 243 SAUDI ARABIA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 244 SAUDI ARABIA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 245 SOUTH AFRICA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 246 SOUTH AFRICA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 247 SOUTH AFRICA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 248 SOUTH AFRICA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 249 SOUTH AFRICA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 250 SOUTH AFRICA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 251 SOUTH AFRICA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 252 SOUTH AFRICA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY TYPE (BILLION TONS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY RAW MATERIAL (USD BILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY RAW MATERIAL (BILLION TONS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY APPLICATION (BILLION TONS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY PLATFORM (USD BILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA NANOCELLULOSE MARKET BY PLATFORM (BILLION TONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NANOCELLULOSE MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL NANOCELLULOSE MARKET BY RAW MATERIAL, USD BILLION, 2020-2029

FIGURE 10 GLOBAL NANOCELLULOSE MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL NANOCELLULOSE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL NANOCELLULOSE MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL NANOCELLULOSE MARKET BY RAW MATERIAL, USD BILLION, 2021

FIGURE 15 GLOBAL NANOCELLULOSE MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL NANOCELLULOSE MARKET BY REGION, USD BILLION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 FIBERLEAN TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 19 BORREGAARD: COMPANY SNAPSHOT

FIGURE 20 NIPPON PAPER GROUP: COMPANY SNAPSHOT

FIGURE 21 CELLUFORCE: COMPANY SNAPSHOT

FIGURE 22 KRUGER INC.: COMPANY SNAPSHOT

FIGURE 23 STORA ENSO: COMPANY SNAPSHOT

FIGURE 24 RISE INNVENTIA: COMPANY SNAPSHOT

FIGURE 25 AMERICAN PROCESS INC.: COMPANY SNAPSHOT

FIGURE 26 FPINNOVATIONS: COMPANY SNAPSHOT

FIGURE 27 SAPPI LTD: COMPANY SNAPSHOT

FIGURE 28 INNVENTIA AB: COMPANY SNAPSHOT

FIGURE 29 DAICEL CORPORATION: COMPANY SNAPSHOT

FAQ

The global nanocellulose market was valued at 0.40 billion in 2022 and is projected to reach 0.49 billion by 2029, growing at a CAGR of 21.9% from 2022 to 2029

Based on type, raw material, application, and region the nanocellulose market reports divisions are broken down.

The global nanocellulose market registered a CAGR of 21.9% from 2022 to 2029. The industry segment was the highest revenue contributor to the market.

North America is also the largest regional market for cellulose. The growth of the regional market is attributed to the rise of North America’s commercial building sector and refurbishing activities. The market for nanocellulose in North America is projected to expand at a CAGR of roughly 21.9% from 2018 to 2032.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.