REPORT OUTLOOK

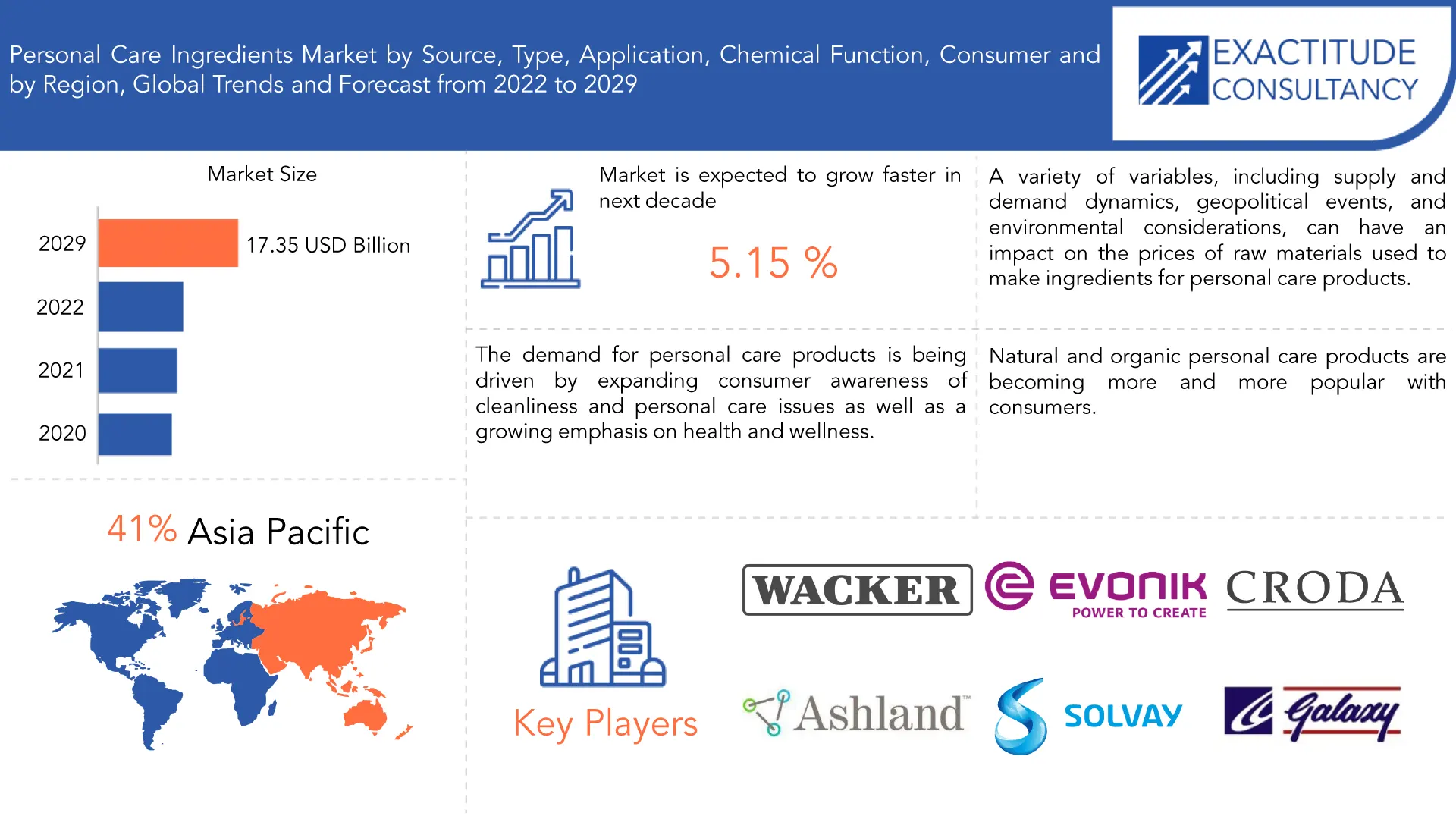

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 17.35 Billion by 2029 | 5.15% | Asia Pacific |

| By Source | By Type | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Personal Care Ingredients Market Overview

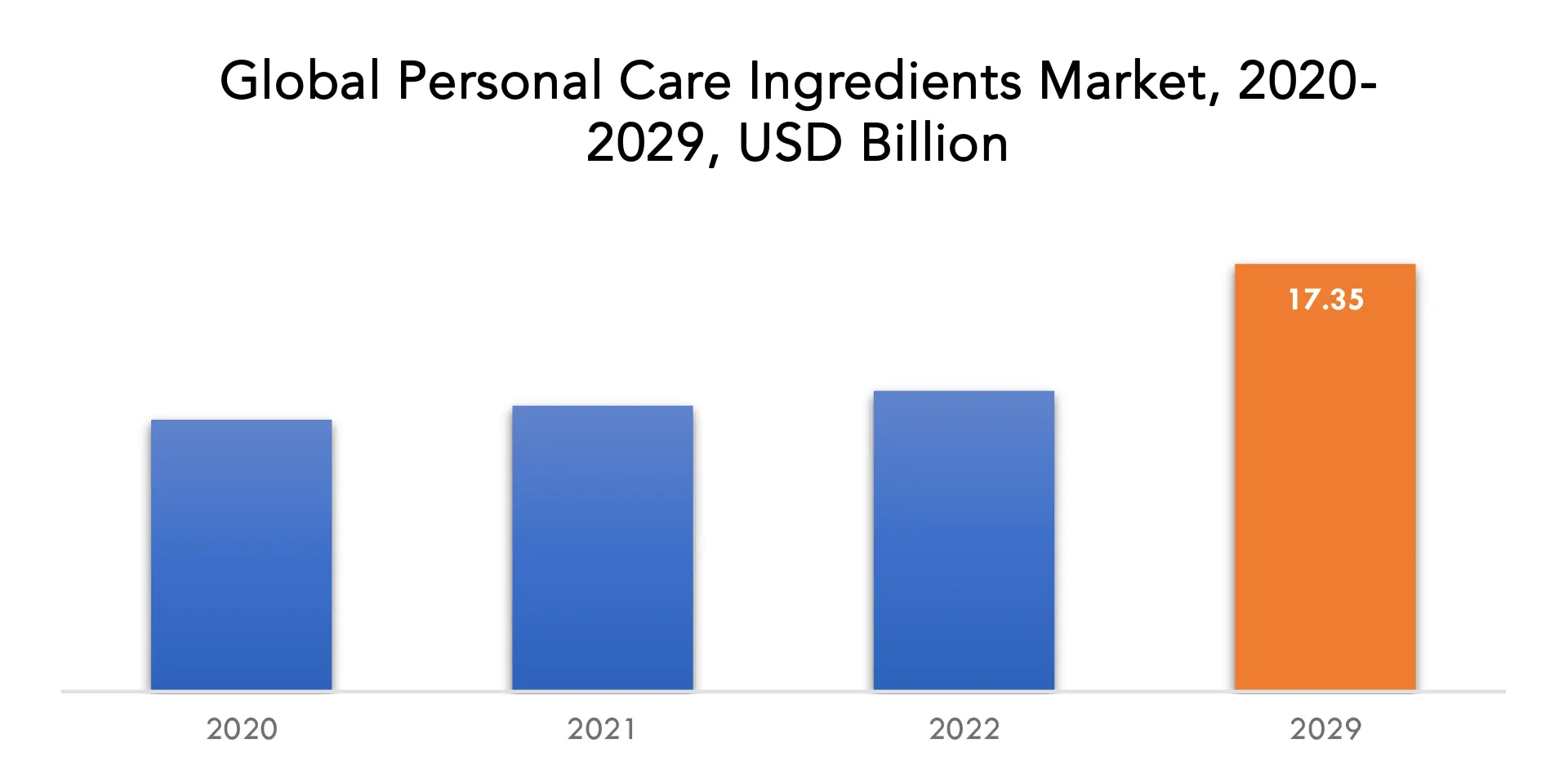

The personal care ingredients market is expected to grow at 5.15% CAGR from 2021 to 2029. It is expected to reach above USD 17.35 Billion by 2029 from USD 11.03 Billion in 2020.

The raw materials used to manufacture skincare products all around the world are personal care ingredients. Anti-fungal, anti-aging, skin-conditioning, and other ingredients are utilised in skincare products. components for personal care products can be divided into active and inert components. Anti-aging, exfoliating, conditioning, and UV-protecting compounds are examples of active components, while surfactants, preservatives, colorants, and polymer ingredients are examples of inactive ingredients. Consumers’ rising understanding of the components in personal care products is one of the factors behind the market’s expansion.

Innovative product branding aids in quick product recognition by consumers. Product branding is a deliberate fusion of experience and design that distinguishes one product from others in the same category. Globally, the emergence of digital technology has had an impact on consumer purchasing habits in the personal care goods sector. The top personal care companies are expanding their use of digital technologies to give customers a completely new brand experience. Personal care and hygiene products are now more readily available due to technological developments, creative branding, and advertising techniques. Every developed and developing economy depends heavily on the personal care sector. Consumers’ purchasing power was enhanced by an increase in disposable income. Accelerated urbanization, rising urban population, and shifting lifestyle expectations are key factors contributing to the market’s rising need for personal care products. With an increasing global population living in cities, disposable income has increased. This has boosted the urban population’s ability to spend. A sizable portion of the urban population and consumer expenditure is made up of millennials.

Various organic chemicals and synthetic chemicals are used as raw materials in the production of personal care products and products connected to ingredients. To provide most personal care components a shelf life of up to several months, a large number of compounds are used as raw materials. The market faces serious problems related to the presence of poisonous and harmful substances in the product despite the widespread demand and benefits for ingredients used in personal care products.

Price changes for the raw materials required to make ingredients for personal care products were brought on by the pandemic. The dynamics of supply and demand were disrupted, and this, along with currency changes and market turbulence, caused raw material prices to fluctuate. Manufacturers of ingredients had to control cost variations and modify prices as necessary. Consumer spending during the pandemic shifted towards necessary personal care items like soap and hand sanitizers while there was a fall in demand for optional items like cosmetics and scents. The demand for various kinds of personal care ingredient types was impacted by this change in consumer preferences.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By Source, By Type, By Application, By Chemical Function, By Consumer, By Region |

| By Source |

|

| By Type |

|

| By Application |

|

| By Chemical Function |

|

| By Consumer |

|

| By Region |

|

Personal Care Ingredients Market Segment Analysis

The personal care ingredients market is segmented based on source, type, application, chemical function, consumer, and region.

Based on source, the personal care ingredients market is divided into natural ingredients, synthetic ingredients. In 2021, synthetic substances made up a sizable portion. The demand for beauty and cosmetics items has increased as a result of expanding urbanization, disposable income, and population. The increased use of detergents, cleaning supplies, and soaps, particularly during the pandemic, is another factor driving market expansion. Throughout the projected period, there will likely be a rise in the demand for natural components. Users’ growing health consciousness and changing preferences for sustainable and bio-based ingredients are driving this segment’s expansion.

The market for personal care ingredients is divided into emollients, surfactant, conditioning polymer, colour cosmetics ingredient, preservatives boosters, emollients esters, emulsifiers, rheology modifiers, amphoteric based on type. Due to the increased use of these personal care ingredients due to their soothing and skin-smoothing properties, the emollients segment, which had the largest revenue share of the global personal care ingredients market in 2020, is anticipated to dominate the market over the forecast period. Nearly all products, such as cleansers, deodorants, shampoos, antiperspirants, and others, contain them. These elements have a substantial impact on this segment’s growth.

Based on application, the make-up, skin care, hair care, oral care. Due to rising consumer demand for skin care products like sunscreen, body lotions, facial creams, and others, the skin care category had the biggest revenue share of the global market for personal care ingredients. These elements are fueling this market segment’s expansion.

The market is divided into chelating agents, active ingredients, cream bases, protein products, lipid layer enhancers, humectants, shine concentrates, thickeners, waxes and opacifiers based on chemical function. Chelating agents are essential in personal care products as they bind and neutralize metal ions that can reduce the stability and performance of the product. They are used to formulations to increase their potency and shelf life.

The market is divided into manufacturer, consultants in chemical industries and end user industries based on consumer. The end user industries are probably the most important sub-segment. This encompasses different sectors whose goods contain substances used in personal care. Manufacturers of cosmetics, bath and shower products, skincare, haircare, oral care, and other personal care items may fall under this category. The principal consumers of personal care ingredients are end-user businesses since they need these substances to create their goods and satisfy consumer demand.

Personal Care Ingredients Market Players

The personal care ingredients market key players include Wacker Chemie AG, Evonik Industries AG, Momentive, BASF SE, Clariant, Croda International Plc, Ashland., The Dow Chemical Company, J.M. Huber Corporation, Solvay, Galaxy Surfactants, The Lubrizol Corporation, Oxiteno, Givaudan, Huntsman International LLC, Koninklijke DSM N.V., Merck KGaA, Stepan Company, Innospec, DuPont.

Recent developments:

30 April, 2021: Ashland completed acquisition of personal care business of Schulke & Mayr GmbH a portfolio company of EQT.

15 July, 2020: BASF SE and Isobioinics launched Isobionics Santalol, an alternative to sandalwood oil.

Who Should Buy? Or Key stakeholders

- Personal Care Product Manufacturers

- Ingredient Manufacturers and Suppliers

- Distributors and Retailers

- Consumers

- Trade Associations

- Government Bodies

- Research Organizations

- Investors

- Regulatory Authorities

Personal Care Ingredients Market Regional Analysis

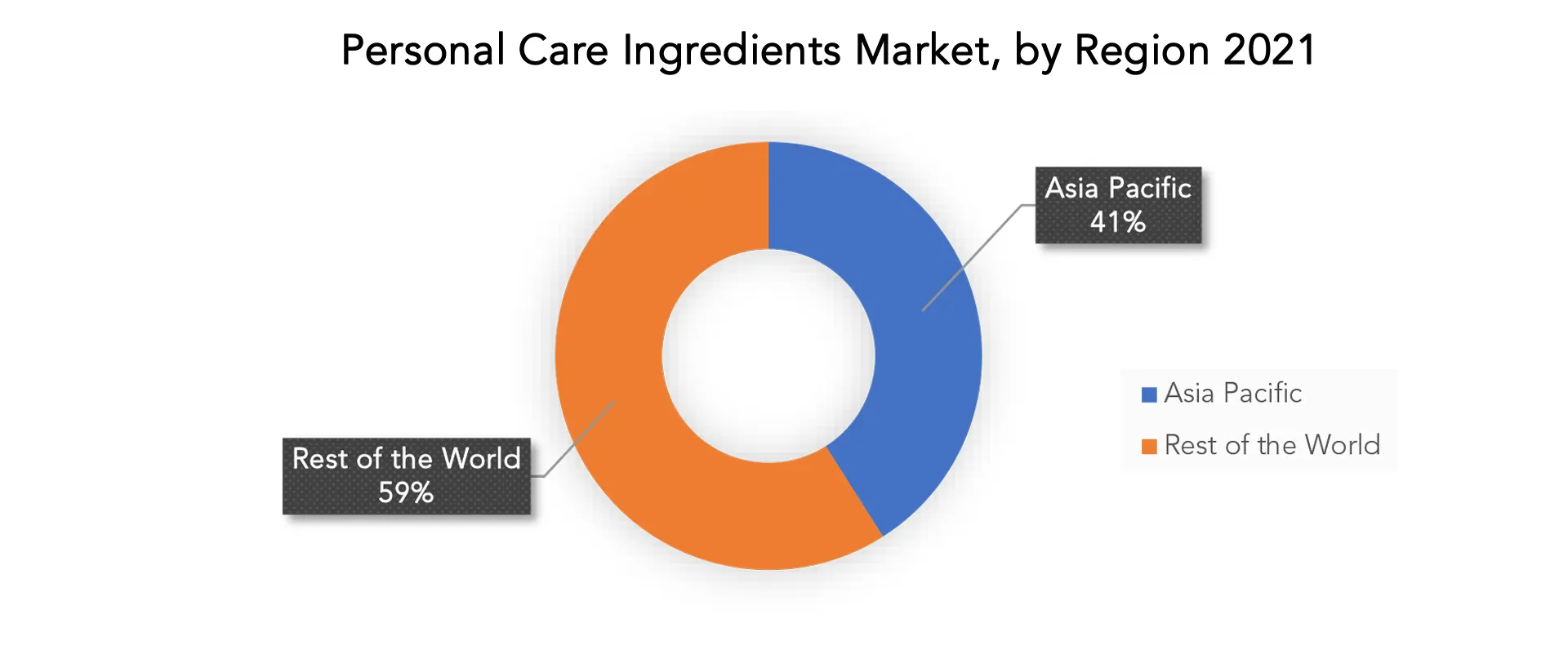

The personal care ingredients market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Asia-Pacific will continue to dominate the global market for personal care ingredients. A sizable and quickly expanding middle class with rising discretionary incomes is present throughout Asia-Pacific. The need for personal care products and, as a result, the demand for personal care ingredients in the area has been spurred by this demographic development. Personal care products with specialized benefits, like skin-brightening, anti-aging, and natural/organic formulas, are becoming more and more popular among consumers in the Asia-Pacific region. This has fueled the region’s desire for specialized components for personal care products. In 2021, Asian beauty fads like K-beauty and J-beauty saw a tremendous increase in popularity. These fashions emphasize multi-step skincare regimens, cutting-edge products, and exclusive ingredients.

North America will have the personal care ingredients market’s strongest growth in 2021. The personal care market in North America is highly established, with a high level of consumer demand and awareness. The demand for products with natural and organic ingredients, as well as those that provide particular advantages and address individual needs, is rising among consumers in this region. This has increased demand for a variety of substances used in personal care products. Natural and independent beauty businesses that place a premium on ingredient quality and transparency have grown in popularity in North America. The demand for regional ingredient producers is increased by the fact that these firms frequently buy components for personal care products from local vendors.

Key Market Segments: Personal Care Ingredients Market

Personal Care Ingredients Market By Source, 2020-2029, (USD Billion, Kilotons)

- Natural Ingredients

- Synthetic Ingredients

Personal Care Ingredients Market By Type, 2020-2029, (USD Billion, Kilotons)

- Emollients

- Surfactant

- Conditioning Polymer

- Colour Cosmetics Ingredient

- Preservatives Boosters

- Emollients Esters

- Emulsifiers

- Rheology Modifiers

- Amphoteric

Personal Care Ingredients Market By Application, 2020-2029, (USD Billion, Kilotons)

- Make-Up

- Skin Care

- Hair Care

- Oral Care

Personal Care Ingredients Market By Chemical Function, 2020-2029, (USD Billion, Kilotons)

- Chelating Agents

- Cream Bases

- Active Ingredients

- Protein Products

- Lipid Layer Enhancers

- Humectants

- Shine Concentrates

- Thickeners

- Waxes

- Opacifiers

Personal Care Ingredients Market By Consumer, 2020-2029, (USD Billion, Kilotons)

- Manufacturer

- Consultants In Chemical Industries

- End User Industries

Personal Care Ingredients Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new application

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the personal care ingredients market over the next 7 years?

- Who are the major players in the personal care ingredients market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the personal care ingredients market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the personal care ingredients market?

- What is the current and forecasted size and growth rate of the global personal care ingredients market?

- What are the key drivers of growth in the personal care ingredients market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the personal care ingredients market?

- What are the technological advancements and innovations in the personal care ingredients market and their impact on source development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the personal care ingredients market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the personal care ingredients market?

- What are the product offering and specifications of leading players in the market?

- What is the pricing trend of personal care ingredients in the market and what is the impact of raw material price-up on the price-up trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PERSONAL CARE INGREDIENTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PERSONAL CARE INGREDIENTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PERSONAL CARE INGREDIENTS MARKET OUTLOOK

- GLOBAL PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION, KILOTONS), 2020-2029

- NATURAL INGREDIENTS

- SYNTHETIC INGREDIENTS

- GLOBAL PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION, KILOTONS), 2020-2029

- EMOLLIENTS

- SURFACTANT

- CONDITIONING POLYMER

- COLOUR COSMETICS INGREDIENT

- PRESERVATIVES BOOSTERS

- EMOLLIENTS ESTERS

- EMULSIFIERS

- RHEOLOGY MODIFIERS

- AMPHOTERIC

- GLOBAL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION, KILOTONS), 2020-2029

- MAKE-UP

- SKIN CARE

- HAIR CARE

- ORAL CARE

- GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION, KILOTONS), 2020-2029

- CHELATING AGENTS

- CREAM BASES

- ACTIVE INGREDIENTS

- PROTEIN PRODUCTS

- LIPID LAYER ENHANCERS

- HUMECTANTS

- SHINE CONCENTRATES

- THICKENERS

- WAXES

- OPACIFIERS

- GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION, KILOTONS), 2020-2029

- MANUFACTURER

- CONSULTANTS IN CHEMICAL INDUSTRIES

- END USER INDUSTRIES

- GLOBAL PERSONAL CARE INGREDIENTS MARKET BY REGION (USD BILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, SOURCES OFFERED, RECENT DEVELOPMENTS)

- WACKER CHEMIE AG

- EVONIK INDUSTRIES AG

- MOMENTIVE

- BASF SE

- CLARIANT

- CRODA INTERNATIONAL PLC

- ASHLAND

- THE DOW CHEMICAL COMPANY

- M. HUBER CORPORATION

- SOLVAY

- GALAXY SURFACTANTS

- THE LUBRIZOL CORPORATION

- OXITENO

- GIVAUDAN

- HUNTSMAN INTERNATIONAL LLC

- KONINKLIJKE DSM N.V.

- MERCK KGAA

- STEPAN COMPANY

- INNOSPEC

- DUPONT *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 2 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 3 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 4 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 5 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 7 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 8 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 9 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 10 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 11 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY REGION (USD BILLION) 2020-2029

TABLE 12 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 17 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 22 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 23 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 24 NORTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 25 US PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 26 US PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 27 US PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 28 US PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 29 US PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 30 US PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 US PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 32 US PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 33 US PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 34 US PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 35 CANADA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 36 CANADA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 37 CANADA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 CANADA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 39 CANADA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 CANADA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 CANADA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 42 CANADA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 43 CANADA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 44 CANADA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 45 MEXICO PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 46 MEXICO PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 47 MEXICO PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 48 MEXICO PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 49 MEXICO PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 50 MEXICO PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 51 MEXICO PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 52 MEXICO PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 53 MEXICO PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 54 MEXICO PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 55 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 56 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 57 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 58 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 59 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 60 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 61 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 62 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 64 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 65 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 66 SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 67 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 68 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 69 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 74 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 75 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 76 BRAZIL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 77 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 78 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 79 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 80 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 81 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 82 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 84 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 85 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 86 ARGENTINA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 87 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 88 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 89 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 90 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 91 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 92 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 93 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 94 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 95 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 96 COLOMBIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 97 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 98 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 99 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 104 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 105 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 106 REST OF SOUTH AMERICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 107 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 108 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 109 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 110 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 111 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 116 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 117 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 118 ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 119 INDIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 120 INDIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 121 INDIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 122 INDIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 123 INDIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 INDIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 INDIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 126 INDIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 127 INDIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 128 INDIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 129 CHINA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 130 CHINA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 131 CHINA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 CHINA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 CHINA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 CHINA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 CHINA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 136 CHINA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 137 CHINA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 138 CHINA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 139 JAPAN PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 140 JAPAN PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 141 JAPAN PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 142 JAPAN PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 143 JAPAN PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 144 JAPAN PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 145 JAPAN PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 146 JAPAN PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 147 JAPAN PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 148 JAPAN PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 149 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 150 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 151 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 152 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 153 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 154 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 155 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 156 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 157 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 158 SOUTH KOREA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 159 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 160 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 161 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 163 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 166 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 167 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 168 AUSTRALIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 169 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 170 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 171 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 172 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 173 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 174 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 175 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 176 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 177 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 178 SOUTH-EAST ASIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 179 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 180 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 181 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 183 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 186 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 187 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 188 REST OF ASIA PACIFIC PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 189 EUROPE PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 190 EUROPE PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 191 EUROPE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 192 EUROPE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 193 EUROPE PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 EUROPE PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 195 EUROPE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 EUROPE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 EUROPE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 198 EUROPE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 199 EUROPE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 200 EUROPE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 201 GERMANY PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 202 GERMANY PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 203 GERMANY PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 204 GERMANY PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 205 GERMANY PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 206 GERMANY PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 207 GERMANY PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 208 GERMANY PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 209 GERMANY PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 210 GERMANY PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 211 UK PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 212 UK PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 213 UK PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 214 UK PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 215 UK PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 216 UK PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 217 UK PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 218 UK PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 219 UK PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 220 UK PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 221 FRANCE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 222 FRANCE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 223 FRANCE PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 224 FRANCE PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 225 FRANCE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 226 FRANCE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 227 FRANCE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 228 FRANCE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 229 FRANCE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 230 FRANCE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 231 ITALY PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 232 ITALY PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 233 ITALY PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 234 ITALY PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 235 ITALY PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 236 ITALY PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 237 ITALY PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 238 ITALY PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 239 ITALY PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 240 ITALY PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 241 SPAIN PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 242 SPAIN PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 243 SPAIN PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 244 SPAIN PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 245 SPAIN PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 246 SPAIN PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 247 SPAIN PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 248 SPAIN PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 249 SPAIN PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 250 SPAIN PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 251 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 252 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 253 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 254 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 255 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 256 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 257 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 258 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 259 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 260 RUSSIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 261 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 262 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 263 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 264 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 265 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 266 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 267 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 268 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 269 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 270 REST OF EUROPE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 271 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 272 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 273 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 274 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 275 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 276 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 277 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 278 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 279 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 280 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 281 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 282 MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 283 UAE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 284 UAE PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 285 UAE PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 286 UAE PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 287 UAE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 288 UAE PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 289 UAE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 290 UAE PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 291 UAE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 292 UAE PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 293 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 294 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 295 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 296 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 297 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 298 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 299 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 300 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 301 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 302 SAUDI ARABIA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 303 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 304 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 305 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 306 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 307 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 308 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 309 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 310 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 311 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 312 SOUTH AFRICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

TABLE 313 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 314 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 315 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 316 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 317 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 318 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 319 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (USD BILLION) 2020-2029

TABLE 320 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION (KILOTONS) 2020-2029

TABLE 321 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (USD BILLION) 2020-2029

TABLE 322 REST OF MIDDLE EAST AND AFRICA PERSONAL CARE INGREDIENTS MARKET BY CONSUMER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY SOURCE, USD BILLION, 2020-2029

FIGURE 6 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 7 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 8 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION, USD BILLION, 2020-2029

FIGURE 9 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER, USD BILLION, 2020-2029

FIGURE 19 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY SOURCE, USD BILLION, 2021

FIGURE 13 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CHEMICAL FUNCTION, USD BILLION, 2021

FIGURE 16 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY CONSUMER, USD BILLION, 2021

FIGURE 17 GLOBAL PERSONAL CARE INGREDIENTS MARKET BY REGION, USD BILLION, 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 WACKER CHEMIE AG: COMPANY SNAPSHOT

FIGURE 20 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 21 MOMENTIVE: COMPANY SNAPSHOT

FIGURE 22 BASF SE: COMPANY SNAPSHOT

FIGURE 23 CLARIANT: COMPANY SNAPSHOT

FIGURE 24 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

FIGURE 25 ASHLAND: COMPANY SNAPSHOT

FIGURE 26 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 27 J.M. HUBER CORPORATION: COMPANY SNAPSHOT

FIGURE 28 SOLVAY: COMPANY SNAPSHOT

FIGURE 29 GALAXY SURFACTANTS: COMPANY SNAPSHOT

FIGURE 30 THE LUBRIZOL CORPORATION: COMPANY SNAPSHOT

FIGURE 31 OXITENO: COMPANY SNAPSHOT

FIGURE 32 GIVAUDAN: COMPANY SNAPSHOT

FIGURE 33 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

FIGURE 34 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

FIGURE 35 MERCK KGAA: COMPANY SNAPSHOT

FIGURE 36 STEPAN COMPANY: COMPANY SNAPSHOT

FIGURE 37 INNOSPEC: COMPANY SNAPSHOT

FIGURE 38 DUPONT: COMPANY SNAPSHOT

FAQ

The personal care ingredients market size had crossed USD 11.03 billion in 2020 and will observe a CAGR of more than 5.15% up to 2029.

The demand for personal care ingredients has increased significantly as a result of changing lifestyles and the rising purchasing power of consumers in developing nations.

The region’s largest share is in Asia Pacific. Product manufactured in nations like India and China that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.