REPORT OUTLOOK

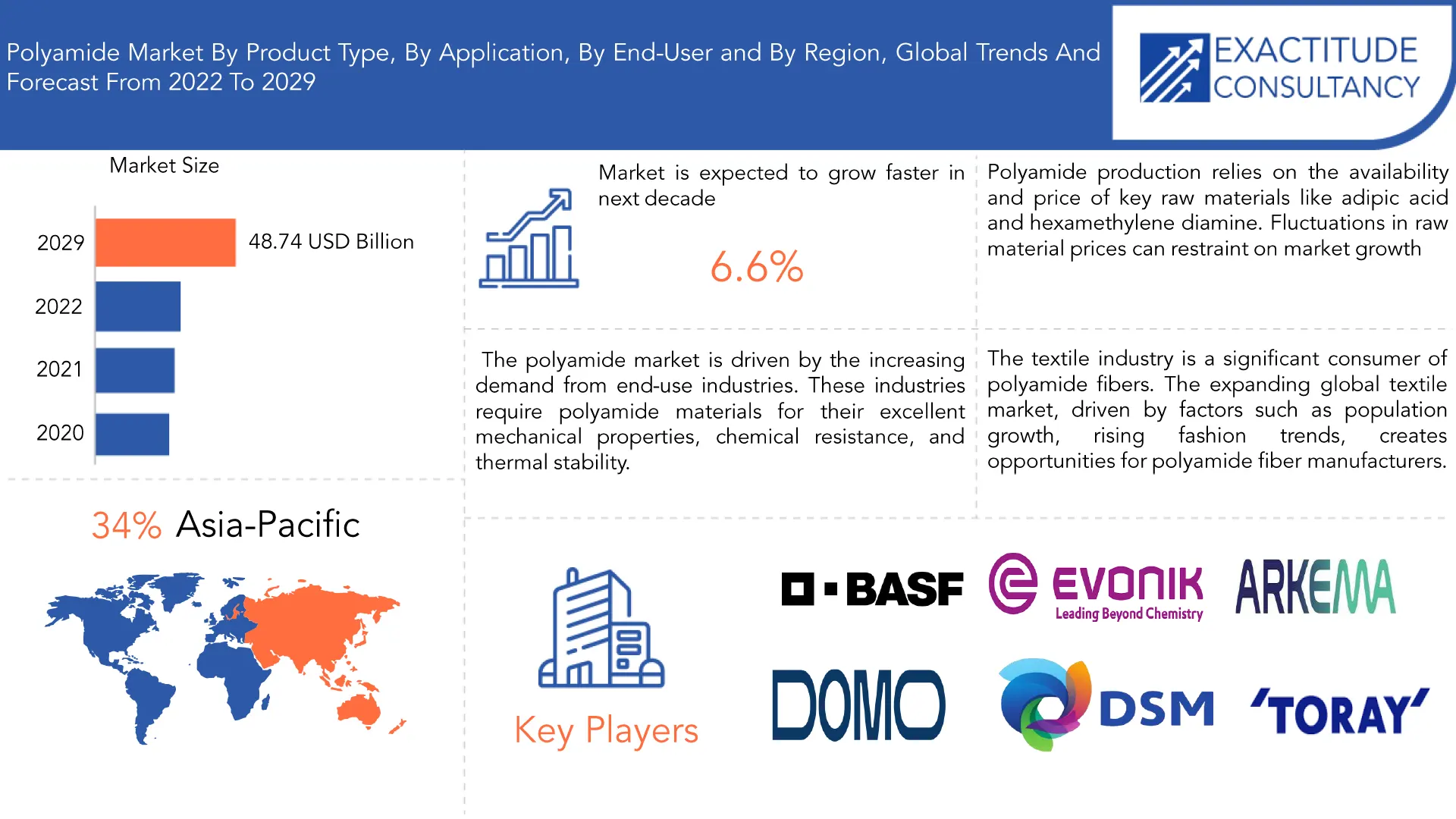

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 48.74 billion by 2029 | 6.6 % | Asia Pacific |

| by Product | by Application | by Regions |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Polyamide Market Overview

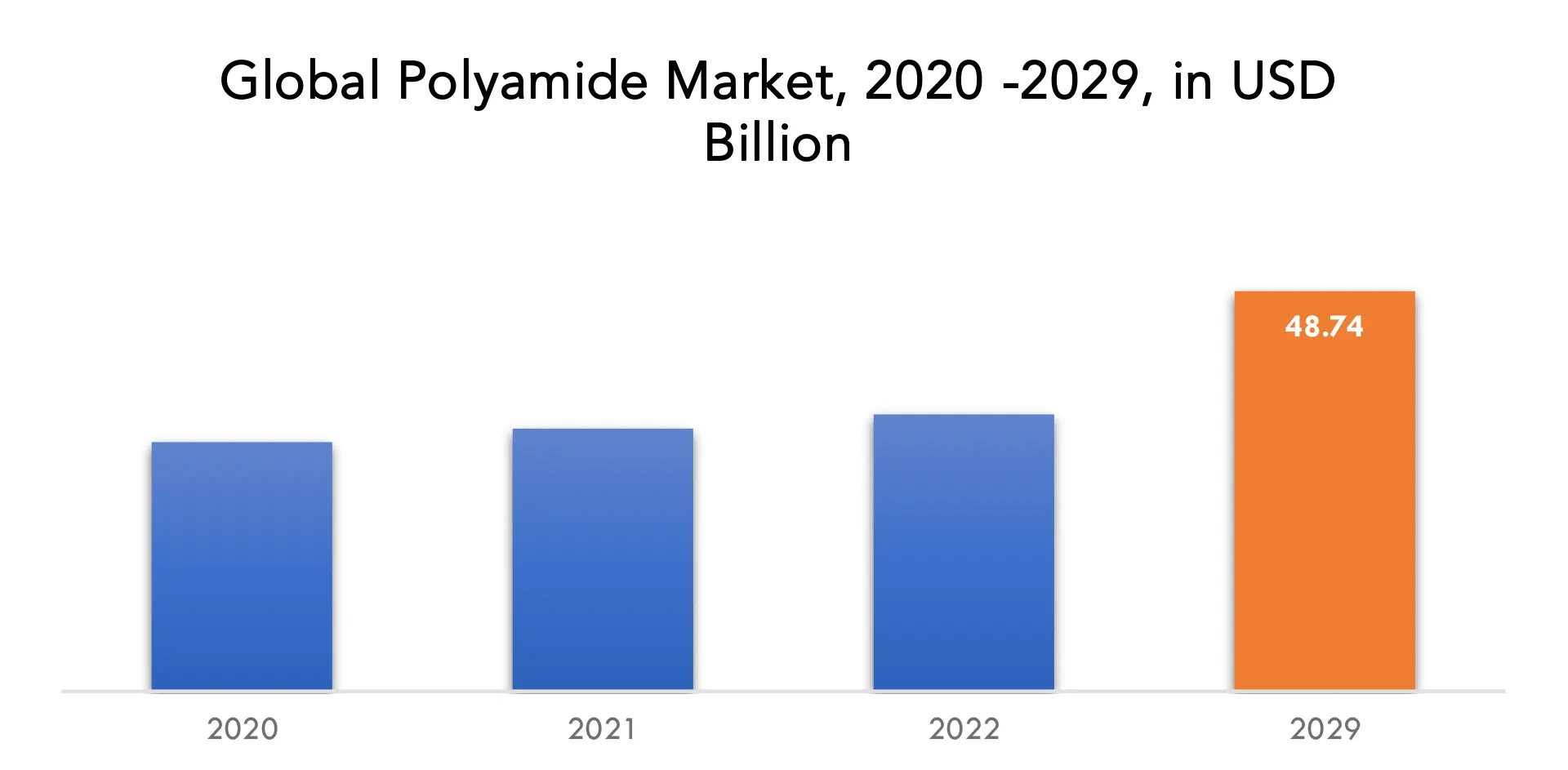

The global polyamide market is projected to reach USD 48.74 billion by 2029 from USD 30.36 billion in 2020, at a CAGR of 6.6 % from 2022 to 2029.

Polyamide is a flexible polymer that occurs naturally in the form of wool and silk. The item is artificially produced and is widely utilised in a variety of industries, including automotive, fabric, packaging, electronic parts, machinery, and coatings. Polyamide is well-known for its resistance to water. Polyamides occur naturally in wool and silk and are synthesized as nylon, polyamide 6, and aramid, among other materials. Wear resistance, high mechanical strength, low gas permeability, and chemical stability are all features of synthetic polyamides. Bio-based polyamides are gaining popularity due to their environmental responsibility.

Many industries employ waterproof polyamide textiles in a range of goods. It is mostly employed in the production of sports and outdoor clothes due to its waterproof characteristics. The textile industry benefits significantly from polyamide as well. Its exceptional strength and durability make it an excellent choice for producing fibers used in clothing, carpets, and upholstery. Polyamide fabrics offer superior abrasion resistance and moisture-wicking properties, ensuring longevity and comfort in various applications.

Polyamides also demonstrate good thermal stability, meaning they can maintain their structural integrity even at elevated temperatures. This property allows them to withstand heat without deforming or losing their mechanical properties. Consequently, polyamides find applications in high-temperature environments, such as automotive engine components, electrical connectors, and industrial machinery.

Increased popularity of polyamide as engineering plastics in various end-use sectors such as automotive and industrial/machinery, among others, is expected to boost worldwide market growth. In addition, rising demand for polyamide in the electrical & electronics and packaging sectors is likely to drive global market growth in the coming years. Furthermore, substantial expansion in the consumer goods and appliances industries is likely to fuel potential market growth in the coming years. Increasing demand for these items in both emerging and established economies is another factor expected to boost worldwide market expansion.

The volatility of raw material prices is one of the primary restraints in the polyamide market. Polyamides are generated from petrochemical feedstock, and variations in the pricing of crude oil and other raw materials can have a direct influence on the manufacturing cost of polyamide materials. This volatility presents issues for producers since it might lead to unpredictable profit margins and alter pricing strategies.

Environmental concerns and sustainability issues also present restraints for the polyamide market. Polyamides are typically derived from non-renewable resources and are not easily biodegradable. This raises concerns regarding their long-term environmental impact, particularly in terms of waste management and end-of-life disposal. As sustainability becomes an increasingly important factor for consumers and regulatory bodies, the polyamide industry is actively exploring and developing more sustainable alternatives, such as bio-based polyamides and recycling technologies.

The increasing demand for lightweight materials in the automotive industry, polyamides offer a compelling solution for weight reduction and improved fuel efficiency. The push for sustainability creates opportunities for bio-based polyamides derived from renewable resources. The electrical and electronics sector seeks polyamides with excellent electrical insulation properties.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion) Volume (Kilotons) |

| Segmentation | By Product, By Application, By End-User, By Region |

| By Product |

|

| By Application |

|

| By End-User |

|

| By Region

|

|

Polyamide Market Segment Analysis

The global polyamide market is segmented by product, application, end-user and region.

Based on product, the polyamide market is segmented into Polyamide 6, Polyamide 66, Bio-based Polyamide, Specialty Polyamide. Polyamide 6 segmental growth will account for the majority of market share. Its unique qualities make it a suitable product substitution for steel, bronze, brass, gunmetal, aluminium, and plastics, among others. Electrical protection device producers will also be able to expand into new markets. Furthermore, the incorporation of PA 6 from the luxury carpet sector, fishing nets, and travel accessories would boost polyamide 6 demand throughout the projection period.

Based on application, the polyamide market is segmented into Engineering Plastics, Fibers. The engineering plastics can be further distributed across automotive, electronics and electrical, consumer goods and appliances, packaging, and others, while the fibers segment can be broken down into textile, carpet, and others. Engineering plastics will account for the largest segmental growth. Engineering plastics are a versatile group of materials known for their exceptional mechanical, thermal, and chemical properties. Polyamides, commonly referred to as nylons, are widely used in engineering plastics due to their high strength, toughness, and resistance to wear and abrasion.

Polyamide fibers, commonly known as nylon fibers, are widely used in the textile industry due to their exceptional strength, durability, and abrasion resistance. These fibers find applications in various textile products, including apparel, active wear, hosiery, industrial fabrics, and carpets.

Based on end-user, the polyamide market is segmented into automotive, electrical & electronics, textile, construction, packaging, consumer goods, others. Automotive will account for the largest segmental growth. Polyamide integration in hydraulic clutch lines, headlamp bezels, automotive cooling systems, air intake manifolds, and airbag containers will increase the market value of the global polyamide market share. Furthermore, factors such as high mechanical qualities, wear resistance, and the growing need for lightweight automobiles will boost the market forward.

The electrical and electronics industry utilizes polyamides in engineering plastics and fibers. In engineering plastics, polyamides are used for electrical connectors, circuit boards, and other components due to their excellent electrical insulation and heat resistance properties. In the form of fibers, polyamides find applications in wire and cable insulation, protective coatings, and electronic device components.

Polyamide Market Key Players

The global polyamide market key players include BASF SE, DowDuPont Inc., Lanxess AG, Solvay S.A., Avient, Evonik Industries AG, Asahi Kasei Corporation, Arkema SA, Domo Chemical, Honeywell, Royal DSM, Toray Industries Inc., KOLON PLASTIC INC., AdvanSix.

Recent News:

April 27, 2023: Asahi Kasei and Microwave Chemical launched a joint demonstration project in April 2023 with the objective of commercializing a chemical recycling process for polyamide 661 (PA66, also called nylon 66) using microwave technology.

December 12, 2022 – Avient Corporation announced an expansion to its range of polyketone (PK) based materials with new Comple PKE long fiber reinforced engineered thermoplastics. The new formulations broaden options for customers looking for strong mechanical performance to support demanding applications, even in cold environments.

Polyamide Market Regional Analysis

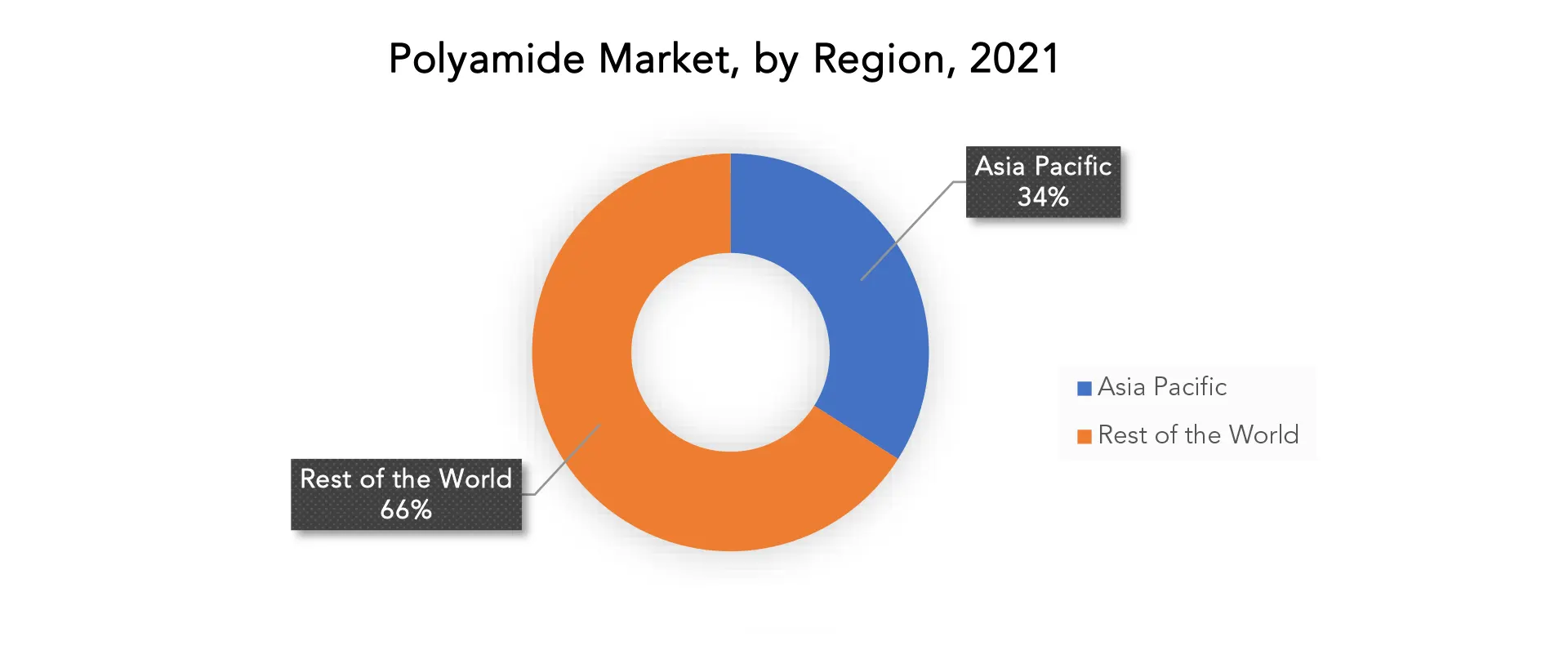

The polyamide market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Asia-Pacific region has seen the most development in the polyamide market, with rising usage in industries like as automotive, consumer products, and electrical and electronics. The region has seen a growth in demand for luxury automobiles as customers’ spending power has improved, resulting in higher polyamide consumption in this area. China, as the major consumer, has considerably contributed to the rise of polyamides in the Asia-Pacific area.

Polyamide demand is increasing in the North and South American regions due to its use in the vehicle and electronics markets. North America is one of the world’s most technologically sophisticated areas, particularly in terms of consumer electronics and other electronic items. Recent advancements have contributed in the expansion of the polyamide market in the electrical and electronics segment in North America.

Europe, the Middle East, and Africa are likely to expand faster in the next years as a result of increasing automotive sales; the government has intensified infrastructure construction operations. In Europe, the increased need for high-quality, long-lasting consumer electronics is driving up demand for polyamides. The electronics industry dominates the European polyamide market, followed by consumer products and appliances.

Key Market Segments: Polyamide Market

Polyamide Market by Product 2022-2029, (USD Billion) (Kilotons)

- Polyamide 6

- Polyamide 66

- Bio-based Polyamide

- Specialty Polyamide

Polyamide Market by Application, 2022-2029, (USD Billion) (Kilotons)

- Engineering Plastics

- Automotive

- Electronic and Electrical

- Consumer Goods and Appliances

- Packaging

- Others

- Fibers

- Textile

- Carpet

- Others

Polyamide Market by End-User, 2022-2029, (USD Billion) (Kilotons)

- Automotive

- Electrical & Electronics

- Textile

- Construction

- Packaging

- Consumer Goods

- Others

Polyamide Market by Regions, 2022-2029, (USD Billion) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- MEA

Important Countries in All Regions Are Covered

Who Should Buy? Or Key stakeholders

- Polyamide Manufacturers

- Polyamide Traders, Suppliers, and Distributors

- Government and Research Organizations

- Material R&D Companies

- Associations and Industrial Bodies

- Feedstock Suppliers and Distributors

- Industry Associations

Key Question Answered

- What is the expected growth rate of the polyamide market over the next 7 years?

- Who are the major players in the polyamide market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the polyamide market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the polyamide market?

- What is the current and forecasted size and growth rate of the global polyamide market?

- What are the key drivers of growth in the polyamide market?

- What are the distribution channels and supply chain dynamics in the polyamide market?

- What are the technological advancements and innovations in the polyamide market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the polyamide market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the polyamide market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of polyamide in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL POLYAMIDE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON POLYAMIDE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL POLYAMIDE MARKET OUTLOOK

- GLOBAL POLYAMIDE MARKET BY PRODUCT TYPE, 2020-2029, (USD BILLION) (KILOTONS)

- POLYAMIDE 6

- POLYAMIDE 66

- BIO-BASED POLYAMIDE

- SPECIALTY POLYAMIDE

- GLOBAL POLYAMIDE MARKET BY APPLICATION, 2020-2029, (USD BILLION) (KILOTONS)

- ENGINEERING PLASTICS

- AUTOMOTIVE

- ELECTRONIC AND ELECTRICAL

- CONSUMER GOODS AND APPLIANCES

- PACKAGING

- OTHERS

- FIBERS

- TEXTILE

- CARPET

- OTHERS

- ENGINEERING PLASTICS

- GLOBAL POLYAMIDE MARKET BY END-USER, 2020-2029, (USD BILLION) (KILOTONS)

- AUTOMOTIVE

- ELECTRICAL & ELECTRONICS

- TEXTILE

- CONSTRUCTION

- PACKAGING

- CONSUMER GOODS

- OTHERS

- GLOBAL POLYAMIDE MARKET BY REGION, 2020-2029, (USD BILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- BASF SE

- SOLVAY SA

- DOWDUPONT INC.

- EVONIK INDUSTRIES

- LANXESS AG

- AVIENT

- ASAHI KASEI CORPORATION

- ARKEMA SA

- DOMO CHEMICAL

- HONEYWELL

- ROYAL DSM

- TORAY INDUSTRIES INC.

- KOLON PLASTIC INC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL POLYAMIDE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL POLYAMIDE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA POLYAMIDE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA POLYAMIDE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 17 US POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 18 US POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 19 US POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 US POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 22 US POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 23 CANADA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 CANADA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 28 CANADA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 29 MEXICO POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 34 MEXICO POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA POLYAMIDE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA POLYAMIDE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 43 BRAZIL POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 49 ARGENTINA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 55 COLOMBIA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC POLYAMIDE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC POLYAMIDE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 75 INDIA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 INDIA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 80 INDIA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 81 CHINA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 CHINA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 86 CHINA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 87 JAPAN POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 JAPAN POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 92 JAPAN POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 117 EUROPE POLYAMIDE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE POLYAMIDE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 EUROPE POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 123 EUROPE POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 124 EUROPE POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 125 GERMANY POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 130 GERMANY POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 131 UK POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 132 UK POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 133 UK POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 136 UK POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 137 FRANCE POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 FRANCE POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 142 FRANCE POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 143 ITALY POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 147 ITALY POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 148 ITALY POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 149 SPAIN POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 SPAIN POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 154 SPAIN POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 155 RUSSIA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 175 UAE POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 176 UAE POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 177 UAE POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 UAE POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 180 UAE POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA POLYAMIDE MARKET BY END-USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

FIGURE 9 GLOBAL POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2020-2029

FIGURE 10 GLOBAL POLYAMIDE MARKET BY END-USER (USD BILLION) 2020-2029

FIGURE 11 GLOBAL POLYAMIDE MARKET BY REGION (USD BILLION) 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL POLYAMIDE MARKET BY PRODUCT TYPE (USD BILLION) 2021

FIGURE 14 GLOBAL POLYAMIDE MARKET BY APPLICATION (USD BILLION) 2021

FIGURE 15 GLOBAL POLYAMIDE MARKET BY END-USER (USD BILLION) 2021

FIGURE 16 GLOBAL POLYAMIDE MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BASF SE: COMPANY SNAPSHOT

FIGURE 19 DOWDUPONT INC.: COMPANY SNAPSHOT

FIGURE 20 LANXESS AG: COMPANY SNAPSHOT

FIGURE 21 SOLVAY S.A.: COMPANY SNAPSHOT

FIGURE 22 AVIENT: COMPANY SNAPSHOT

FIGURE 23 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 24 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

FIGURE 25 ARKEMA SA: COMPANY SNAPSHOT

FIGURE 26 DOMO CHEMICAL: COMPANY SNAPSHOT

FIGURE 27 HONEYWELL: COMPANY SNAPSHOT

FIGURE 28 ROYAL DSM: COMPANY SNAPSHOT

FIGURE 29 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 30 KOLON PLASTIC INC: COMPANY SNAPSHOT

FAQ

The global polyamide market is projected to reach USD 48.74 billion by 2029 from USD 30.36 billion in 2020, at a CAGR of 6.6 % from 2022 to 2029.

The global polyamide market registered a CAGR of 6.6 % from 2022 to 2029.

Increasing demand from the automotive sector, expansion in electrical and electronics applications, investments and R&D in bio-based and specialized polyamides, and an increase in disposable income are all projected to fuel polyamide adoption.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.