REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

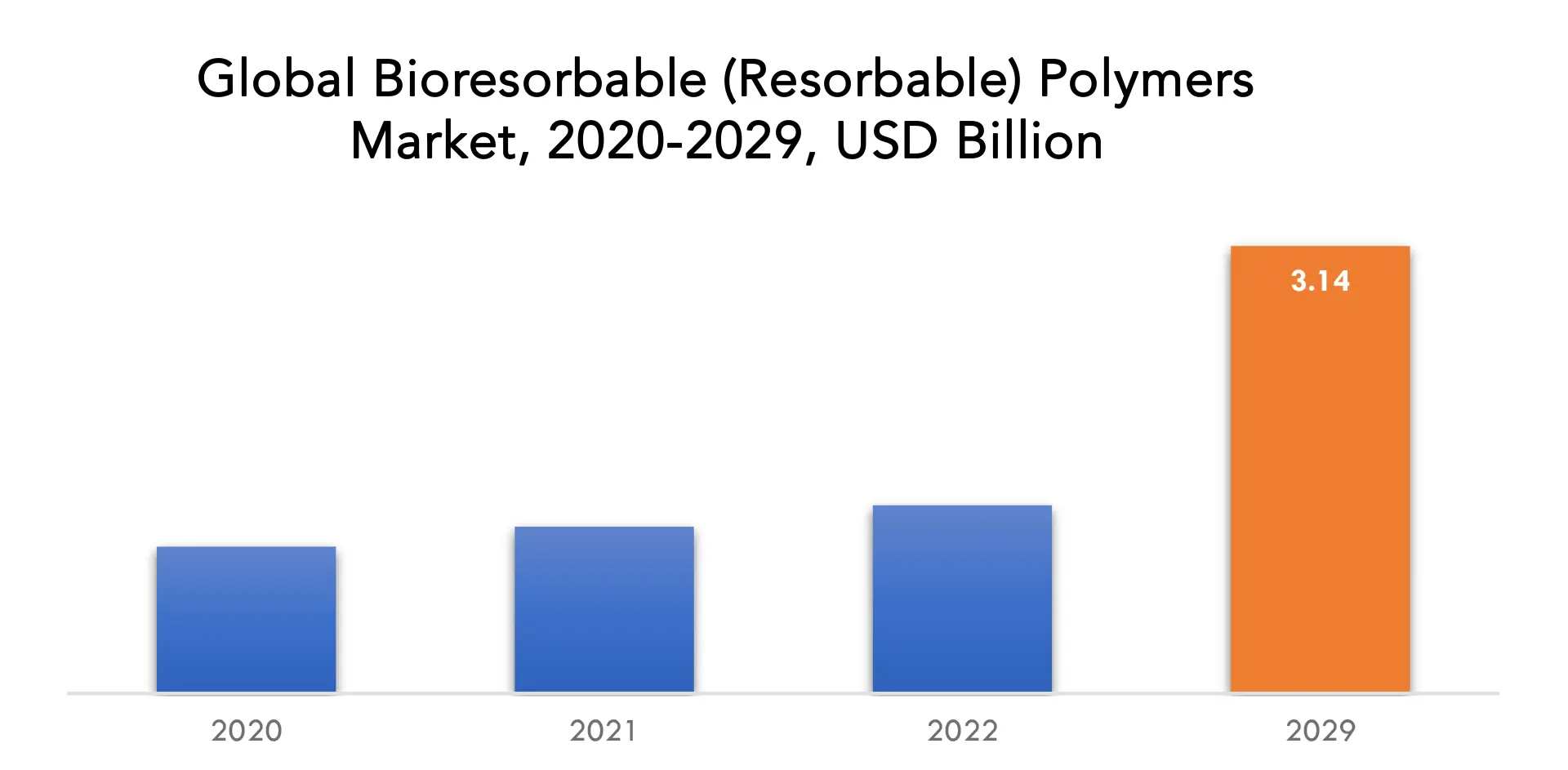

| USD 3.14 Billion by 2029 | 13.2 % CAGR | North America |

| Market by Type | Market by Application | Market by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Bioresorbable (Resorbable) Polymers Market Overview

The bioresorbable (resorbable) polymers market is expected to grow at 13.2 % CAGR from 2022 to 2029. It is expected to reach above USD 3.14 Billion by 2029 from USD 1.03 Billion in 2020.

Bioresorbable (resorbable) polymers are a class of materials that can degrade and be absorbed by the body over time. These polymers are used in medical and pharmaceutical applications to provide temporary support or controlled drug release. They are designed to eliminate the need for surgical removal and reduce long-term complications. Bioresorbable polymers are typically biocompatible and can be broken down by the body’s natural processes. They find applications in medical devices such as sutures, implants, stents, and drug delivery systems. The global market for bioresorbable polymers has been growing due to increased demand for biodegradable materials in healthcare.

The increasing demand for biodegradable materials is a significant driver in the bioresorbable polymers market. There is a growing need for materials that are both biocompatible and capable of degrading within the body over time. Bioresorbable polymers fulfill this requirement as they can be broken down and absorbed by the body, eliminating the need for surgical removal. This demand stems from various medical and pharmaceutical applications where temporary support or controlled drug release is necessary. The use of biodegradable materials reduces the risk of long-term complications and promotes better patient outcomes. As a result, the market for bioresorbable polymers is expanding to meet the rising demand for biodegradable materials in healthcare.

High manufacturing costs pose a significant restraint in the bioresorbable polymers market. The production of bioresorbable polymers involves complex processes and specialized equipment, leading to elevated manufacturing expenses. These costs can impact the affordability and accessibility of bioresorbable polymer-based products, particularly in regions with limited financial resources. Additionally, the higher production costs may discourage new entrants from entering the market, limiting competition and innovation. The challenge lies in finding cost-effective manufacturing methods without compromising the quality and performance of bioresorbable polymers. Addressing the issue of high manufacturing costs is crucial to ensure wider adoption of bioresorbable polymers and to realize their potential in advancing medical treatments and therapies.

Increasing applications in drug delivery present a significant opportunity in the bioresorbable polymers market. Bioresorbable polymers offer unique advantages in controlled drug delivery systems. The ability to tailor the degradation rate and release profile of drugs within the body opens up opportunities for targeted therapies, personalized medicine, and improved patient compliance. Developing innovative drug delivery systems using bioresorbable polymers can revolutionize the treatment of various diseases. The market has the potential to expand as more pharmaceutical companies and researchers explore the use of bioresorbable polymers for drug delivery. Advancements in this field can lead to safer and more effective treatments, providing new avenues for growth and development in the bioresorbable polymers market.

The COVID-19 pandemic had a positive impact on the bioresorbable polymers market in several ways. Firstly, the pandemic has accelerated the demand for advanced medical materials, including bioresorbable polymers, in the development of medical devices such as ventilator components, face shields, and personal protective equipment (PPE). This increased demand has driven the growth of the market and created new opportunities for bioresorbable polymer manufacturers. Additionally, the focus on infection control and patient safety during the pandemic has highlighted the advantages of bioresorbable polymers, which eliminate the need for surgical removal and reduce the risk of long-term complications. This has further increased the adoption of bioresorbable polymers in various medical applications. Overall, the COVID-19 pandemic had contributed to the growth and recognition of the importance of bioresorbable polymers in the healthcare industry.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Type, By Application, By Region. |

| By Type

|

|

| By Application |

|

| By Region

|

|

Bioresorbable (Resorbable) Polymers Market Segment Analysis

Polylactic Acid (PLA) is estimated to be the largest type in the bioresorbable polymers market. PLA is a biodegradable and bioresorbable polymer derived from renewable resources such as corn starch or sugarcane. It offers excellent biocompatibility and mechanical properties, making it suitable for a wide range of medical applications. PLA is extensively used in sutures, orthopedic implants, drug delivery systems, and tissue engineering. The increasing demand for sustainable and biocompatible materials in the healthcare sector is expected to drive the dominance of PLA in the bioresorbable polymers market.

Orthopedic devices have been the largest application for the bioresorbable polymers market. Bioresorbable polymers find extensive use in orthopedic implants such as screws, plates, and scaffolds, offering temporary support and gradually degrading over time. These polymers provide advantages such as reduced risk of implant removal surgeries, improved healing, and minimized long-term complications. The growing prevalence of orthopedic conditions, advancements in implant technologies, and the increasing adoption of bioresorbable materials in orthopedic surgeries have contributed to the dominance of orthopedic devices as the largest application segment in the bioresorbable polymers market.

Bioresorbable (Resorbable) Polymers Market Player

The bioresorbable (resorbable) polymers market key players include Corbion NV, Evonik Industries AG, Poly-Med Inc., Foster Corp., Abbott, KLS Martin Group, 3D Biotek LLC., Sunstar Suisse S.A., DSM, Futerro

Dec 2022, Abbott Launched Navitor™, Its Latest-Generation Transcatheter Aortic Valve Implantation (Tavi) System To Treat Aortic Stenosis In India.

June 2023, Evonik launched next-generation peptide for biopharma applications.

Who Should Buy? Or Key Stakeholders

- Chemicals Companies

- Medical Devices Companies

- Raw Material Manufacturer

- Market Research

- Research and Development Institutes

- Consulting Firms

- Venture capitalists

- Investors

- Supplier and Distributor

- Others

Bioresorbable (Resorbable) Polymers Market Regional Analysis

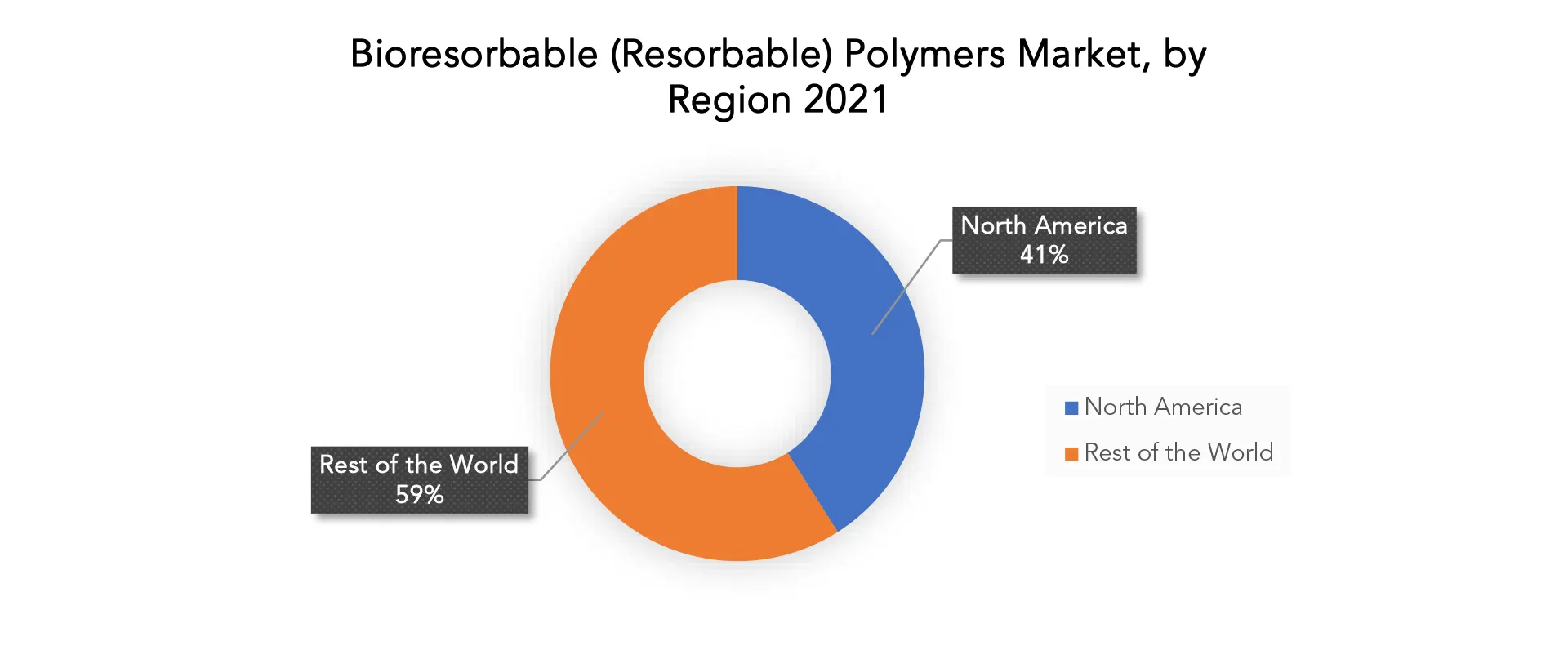

The Bioresorbable (Resorbable) Polymers market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is estimated to be the largest region in the bioresorbable polymers market. The region’s leading position can be attributed to several factors. Firstly, North America has a well-established healthcare infrastructure and advanced medical technology, fostering the adoption of bioresorbable polymers in various medical applications. Additionally, the region has a high healthcare expenditure and favorable reimbursement policies, supporting the growth of the market. North America is also home to several major players in the bioresorbable polymers industry, driving innovation and market development. Furthermore, increasing awareness of the benefits of bioresorbable polymers and their growing utilization in medical devices contribute to the region’s dominance in the market.

Asia Pacific is a rapidly growing region in the bioresorbable polymers market. Factors such as increasing healthcare expenditure, growing population, and advancing healthcare infrastructure contribute to its expansion. The region’s focus on minimally invasive procedures and personalized medicine creates opportunities for the adoption of bioresorbable polymers. Additionally, Asia Pacific benefits from the presence of key manufacturers and suppliers, as well as supportive government initiatives. With rising awareness of the benefits and increasing demand, Asia Pacific holds significant potential for the growth of the bioresorbable polymers market.

Key Market Segments: Bioresorbable (Resorbable) Polymers Market

Bioresorbable (Resorbable) Polymers Market by Type, 2020-2029, (USD Billion), (Kilotons).

- Agro-Polymers

- Proteins

- Polysaccharides

- Bio-Polyesters

- Polylactic Acid

- Polyglycolic Acid

- Polycaprolactone

Bioresorbable (Resorbable) Polymers Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Orthopedics

- Drug Delivery

Bioresorbable (Resorbable) Polymers Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the bioresorbable (resorbable) polymers market over the next 7 years?

- Who are the major players in the bioresorbable (resorbable) polymers market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the bioresorbable (resorbable) polymers market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the bioresorbable (resorbable) polymers market?

- What is the current and forecasted size and growth rate of the global bioresorbable (resorbable) polymers market?

- What are the key drivers of growth in the bioresorbable (resorbable) polymers market?

- What are the distribution channels and supply chain dynamics in the bioresorbable (resorbable) polymers market?

- What are the technological advancements and innovations in the bioresorbable (resorbable) polymers market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the bioresorbable (resorbable) polymers market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the bioresorbable (resorbable) polymers market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of bioresorbable (resorbable) polymers in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON BIORESORBABLE (RESORBABLE) POLYMERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET OUTLOOK

- GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- AGRO-POLYMERS

- PROTEINS

- POLYSACCHARIDES

- BIO-POLYESTERS

- POLYLACTIC ACID

- POLYGLYCOLIC ACID

- POLYCAPROLACTONE

- GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- ORTHOPEDICS

- DRUG DELIVERY

- GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- CORBION NV

- EVONIK INDUSTRIES AG

- POLY-MED INC.

- FOSTER CORP.

- ABBOTT

- KLS MARTIN GROUP

- 3D BIOTEK LLC.

- SUNSTAR SUISSE S.A.

- DSM

- FUTERRO*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 BRAZIL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL BIORESORBABLE (RESORBABLE) POLYMERS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 CORBION NV: COMPANY SNAPSHOT

FIGURE 17 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 18 POLY-MED INC.: COMPANY SNAPSHOT

FIGURE 19 FOSTER CORP.: COMPANY SNAPSHOT

FIGURE 20 ABBOTT: COMPANY SNAPSHOT

FIGURE 21 KLS MARTIN GROUP: COMPANY SNAPSHOT

FIGURE 22 3D BIOTEK LLC.: COMPANY SNAPSHOT

FIGURE 23 SUNSTAR SUISSE S.A.: COMPANY SNAPSHOT

FIGURE 24 DSM: COMPANY SNAPSHOT

FIGURE 25 FUTERRO: COMPANY SNAPSHOT

FAQ

The bioresorbable (resorbable) polymers market is expected to grow at 13.2 % CAGR from 2022 to 2029. It is expected to reach above USD 3.14 Billion by 2029 from USD 1.03 Billion in 2020.

North America held more than 41% of the bioresorbable (resorbable) polymers market revenue share in 2021 and will witness expansion in the forecast period.

There is a growing demand for materials that are biocompatible and biodegradable in the medical field. Bioresorbable polymers provide a solution to this demand as they can be broken down and absorbed by the body, eliminating the need for surgical removal.

The healthcare industry is major sector where the application of bioresorbable (resorbable) polymers has seen more.

The markets largest share is in the North America region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.