REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 9.28 Billion by 2029 | 6% | Asia Pacific |

| by Type | by End-User |

|---|---|

|

|

SCOPE OF THE REPORT

Flocculant and Coagulant Market Overview

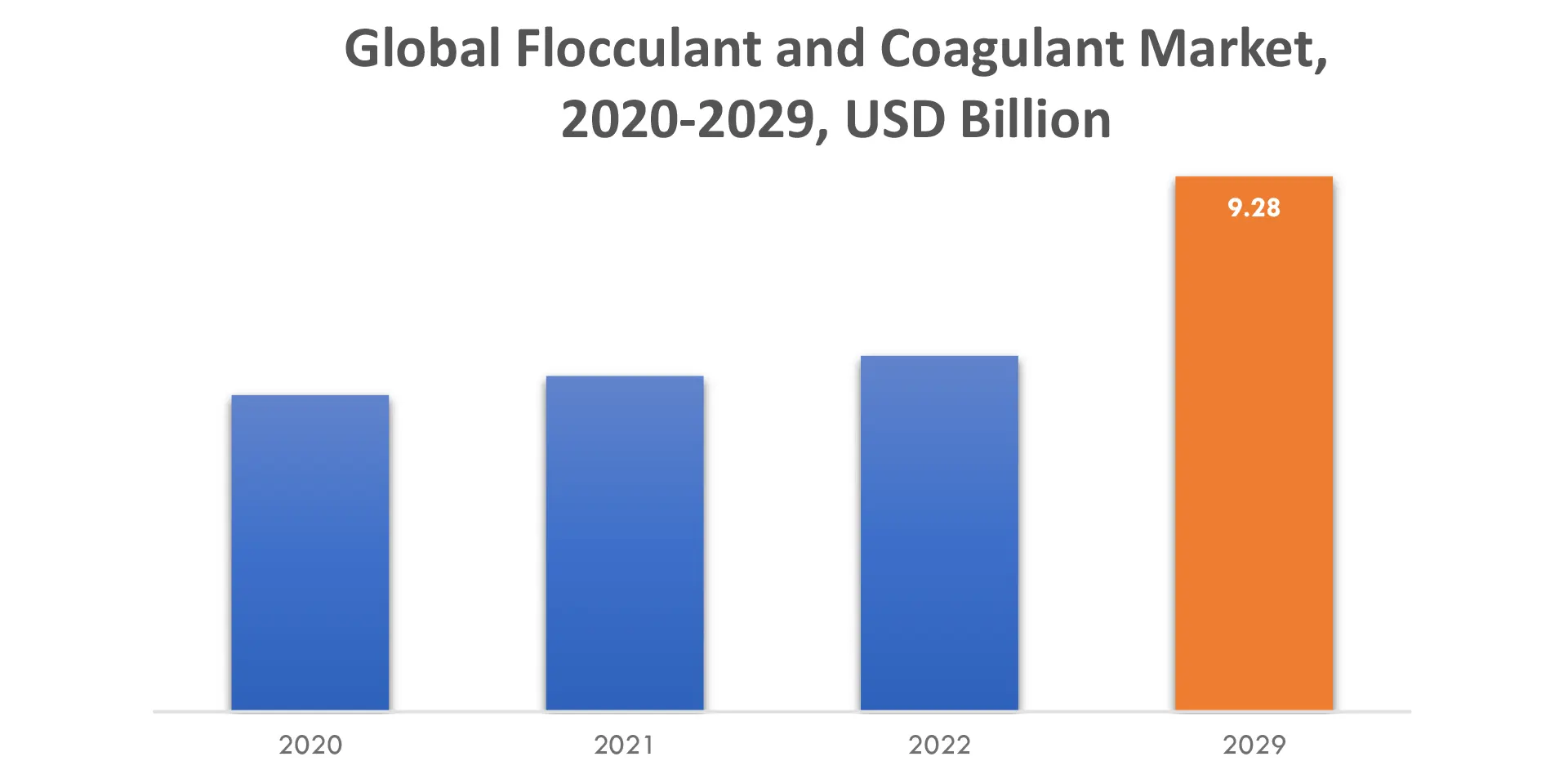

The flocculant and coagulant market are expected to grow at 6% CAGR from 2022 to 2029. It is expected to reach above USD 9.28 Billion by 2029 from USD 5.49 Billion in 2020.

Flocculants and coagulants are chemicals that are widely utilised in many industries, including water and wastewater treatment, mining, oil and gas, and pulp and paper. Flocculants are compounds that stimulate the development of larger particles or flocs by bringing together tiny particles suspended in a liquid, making separation easier. Coagulants, on the other hand, aid in the destabilization of colloidal particles and the formation of bigger, settleable bulk.

In the treatment of water and wastewater, flocculants and coagulants serve an important role in removing suspended solids, organic debris, and pollutants from the water, allowing it to be used for a variety of purposes. These compounds promote the development of bigger particles, which can then be easily removed via sedimentation, filtering, or flotation processes. Flocculants and coagulants are used in mining to separate precious minerals from ore and to clear process water. These compounds are used in the oil and gas sector to separate oil droplets and solids from generated water, increasing the efficiency of separation processes.

The flocculant and coagulant industry is being driven by severe rules and standards for water quality and environmental protection. Water treatment plants are embracing modern technologies to meet regulatory criteria as governments around the world focus on maintaining clean and safe water supply. Flocculants and coagulants are important in water treatment operations as they help remove suspended particles, organic materials, and pollutants.

Emerging economies’ fast industrialization and infrastructure development are fueling demand for flocculants and coagulants. These compounds are used in industries like as mining, oil and gas, pulp and paper, and chemicals to separate and clarify solids and liquids. As these businesses grow, so does the volume of wastewater produced, necessitating adequate treatment and disposal solutions. In these sectors, flocculants and coagulants are used to optimize the separation process, increase water reuse, and reduce environmental effect.

The flocculant and coagulant market present several opportunities for growth. Increasing environmental regulations and the need for efficient water and wastewater treatment solutions drive demand in industries such as municipal water treatment, mining, and oil and gas. Additionally, the expanding industrial sector in emerging economies offers prospects for market expansion. Technological advancements and the development of eco-friendly and cost-effective flocculants and coagulants also create opportunities for innovation and market penetration.

The availability of alternative technology and treatment methods is a major limitation for the flocculant and coagulant business. Water treatment technology advancements such as membrane filtration and ultraviolet (UV) disinfection pose a market challenge by providing more efficient and ecologically friendly alternatives. Furthermore, tight chemical usage and disposal restrictions limit the growth of the flocculant and coagulant market, as enterprises seek alternate means to comply with these regulations.

The flocculant and coagulant market have been impacted by the COVID-19 pandemic. The restrictions imposed to control the spread of the virus have led to disruptions in supply chains and reduced industrial activities, affecting the demand for these chemicals. However, the market has also witnessed a surge in demand for water treatment applications due to increased emphasis on hygiene and sanitation, which partially offset the negative impact of the pandemic.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Type, By End-User, By Region |

| By Type

|

|

| By End-User

|

|

| By Region

|

|

Flocculant and Coagulant Market Segment Analysis

The Flocculant and Coagulant market is segmented based on Type, End-User and region.

Based on type, the flocculant and coagulant market can be segmented based on type into organic and inorganic flocculants and coagulants. Organic types are derived from natural polymers or synthetic materials, while inorganic types are typically metal salts. The choice of type depends on the specific application and desired performance, such as sedimentation or clarification in water treatment processes.

By the end-user, the flocculant and coagulant market can be divided into four segments: water and wastewater treatment, mining, oil and gas, and pulp and paper. These compounds are used to encourage particle aggregation and separation, resulting in more efficient treatment operations and higher product quality. The need for flocculants and coagulants varies throughout different industries due to their unique purifying and separation requirements.

Flocculant and Coagulant Market Players

The Flocculant and Coagulant market key players SNF Group, BASF SE, Kemira Oyj, Ecolab Inc, Solenis LLC, Feralco Group, Kurita Water Industries Ltd, Feralco Group, Aries Chemical Inc, Accepta Ltd, Hawkins Inc, Hychem International, IXOM.

16-05-2023: – Kurita Water Industries Ltd. (Head Office: Nakano-ku, Tokyo; President: Hirohiko Ejiri; hereinafter “Kurita”) developed the Kurita SAMS System, which could perform separation treatment on used diapers and utilize the recovered materials as raw materials and fuel for products.

03-05-2023: Kurita Water Industries Ltd. (Head Office: Nakano-ku, Tokyo; President: Hirohiko Ejiri; hereinafter “Kurita”) announced its decision to acquire European companies manufacturing and selling water treatment facilities, namely, Arcade Engineering GmbH (Head Office: Germany; hereinafter “Arcade Germany”).

Who Should Buy? Or Key stakeholders

- Water and Wastewater Treatment Facilities

- Mining and Mineral Processing Companies

- Oil and Gas Industry

- Pulp and Paper Industry

- Chemical and Manufacturing Industries

- Industrial Cleaning Companies

Flocculant and Coagulant Market Regional Analysis

The Flocculant and Coagulant market by region include North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

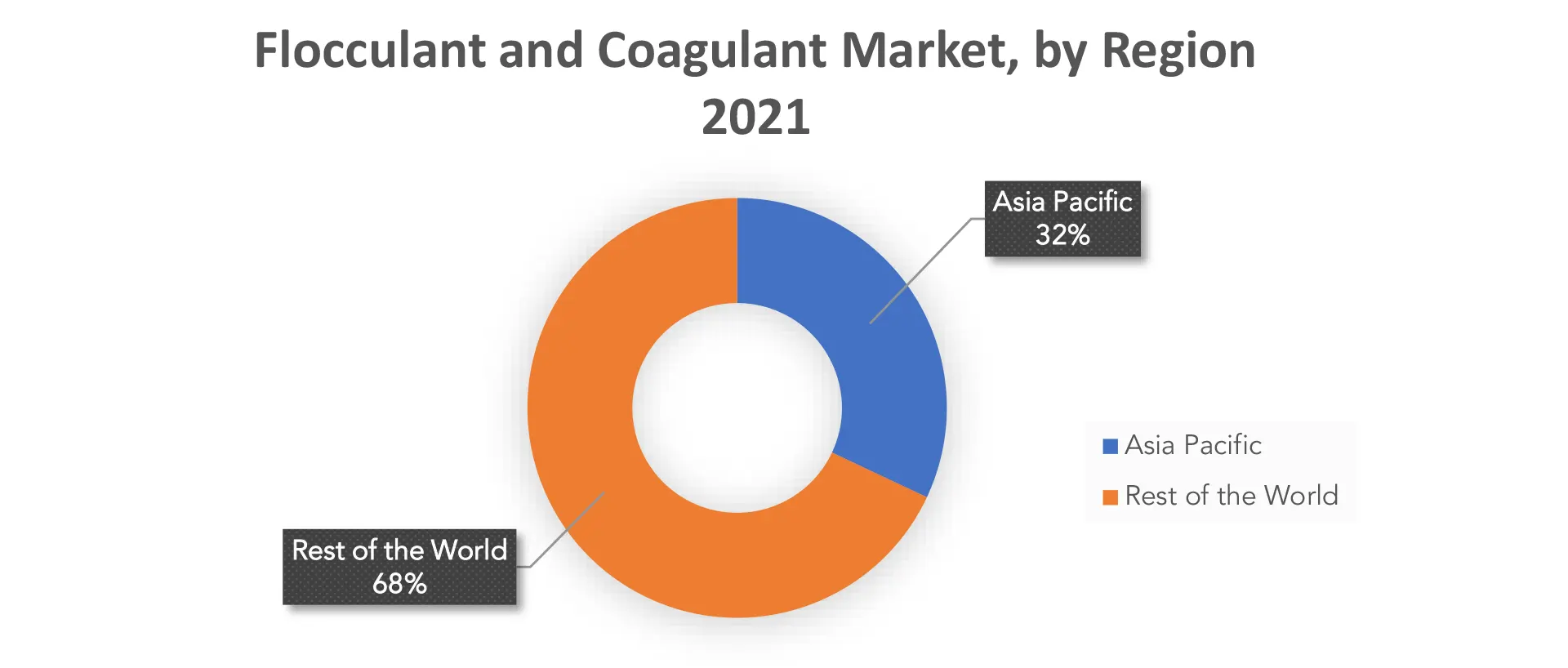

The market for Flocculant and Coagulant in Asia Pacific is sizable and expanding holds 32% of total market size. The flocculant and coagulant market in the Asia Pacific region has witnessed significant growth in recent years. The market is driven by rapid industrialization, population growth, and increasing environmental concerns. Countries like China, India, and Japan are major contributors to the market’s expansion. Factors such as strict water treatment regulations, urbanization, and the need for efficient wastewater management are propelling the demand for flocculants and coagulants in the region. The Asia Pacific market for flocculants and coagulants is expected to continue its growth trajectory in the coming years.

The flocculant and coagulant market in Europe has been steadily growing, driven by stringent environmental regulations and increasing water treatment activities across various industries. The market size in Europe is expected to reach a significant value in the coming years, with a focus on sustainable and efficient water treatment solutions. Factors such as industrial growth, infrastructure development, and environmental concerns continue to drive the demand for flocculants and coagulants in the region.

Key Market Segments: Flocculant and Coagulant Market

Flocculant and Coagulant Market by Type, 2020-2029, (USD Billion), (Kilotons).

- Flocculant

- Anionic

- Cationic

- Organic Coagulant

- Inorganic Coagulant

Flocculant and Coagulant Market by End-User, 2020-2029, (USD Billion), (Kilotons).

- Municipal Water Treatment

- Pulp & Paper

- Textile

- Oil & Gas

- Mining

Flocculant and Coagulant Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new Type

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the flocculant and coagulant market over the next 7 years?

- Who are the major players in the flocculant and coagulant market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the flocculant and coagulant market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the flocculant and coagulant market?

- What is the current and forecasted size and growth rate of the global flocculant and coagulant market?

- What are the key drivers of growth in the flocculant and coagulant market?

- What are the distribution channels and supply chain dynamics in the flocculant and coagulant market?

- What are the technological advancements and innovations in the flocculant and coagulant market and their impact on type development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the flocculant and coagulant market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the flocculant and coagulant market?

- What are the type offerings and specifications of leading players in the market?

- What is the pricing trend of flocculant and coagulant in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL FLOCCULANT AND COAGULANT MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON FLOCCULANT AND COAGULANT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL FLOCCULANT AND COAGULANT MARKET OUTLOOK

- GLOBAL FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION, KILOTONS)

- FLOCCULANT

- ANIONIC

- CATIONIC

- ORGANIC COAGULANT

- INORAGANIC COAGULANT

- FLOCCULANT

- GLOBAL FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION, KILOTONS)

- MUNICIAPL WATER TREATMENT

- PULP & PAPER

- TEXTILE

- OIL & GAS

- MINING

- GLOBAL FLOCCULANT AND COAGULANT MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SNF GROUP

- BASF SE

- KEMIRA OYJ

- ECOLAB INC

- SOLENIS LLC

- FERALCO GROUP

- KURITA WATER INDUSTIRES LTD

- ARIES CHEMICAL INC

- ACCEPTA LTD

- HAWKINS INC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 4 GLOBAL FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 5 GLOBAL FLOCCULANT AND COAGULANT MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL FLOCCULANT AND COAGULANT MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA FLOCCULANT AND COAGULANT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA FLOCCULANT AND COAGULANT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 16 US FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 17 CANADA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 20 CANADA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 21 MEXICO FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 24 MEXICO FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 31 BRAZIL FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 34 BRAZIL FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 35 ARGENTINA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 38 ARGENTINA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 39 COLOMBIA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 42 COLOMBIA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC FLOCCULANT AND COAGULANT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC FLOCCULANT AND COAGULANT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 56 INDIA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 57 CHINA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 60 CHINA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 61 JAPAN FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 64 JAPAN FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 81 EUROPE FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 84 EUROPE FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 85 EUROPE FLOCCULANT AND COAGULANT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE FLOCCULANT AND COAGULANT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 90 GERMANY FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 91 UK FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 94 UK FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 95 FRANCE FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 98 FRANCE FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 99 ITALY FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 102 ITALY FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 103 SPAIN FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 106 SPAIN FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 107 RUSSIA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 110 RUSSIA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 124 UAE FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY END-USER (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA FLOCCULANT AND COAGULANT MARKET BY END-USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FLOCCULANT AND COAGULANT MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL FLOCCULANT AND COAGULANT MARKET BY END-USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL FLOCCULANT AND COAGULANT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL FLOCCULANT AND COAGULANT MARKET BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL FLOCCULANT AND COAGULANT MARKET BY END-USER, USD BILLION, 2021

FIGURE 14 GLOBAL FLOCCULANT AND COAGULANT MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 SNF GROUP: COMPANY SNAPSHOT

FIGURE 17 BASF SE: COMPANY SNAPSHOT

FIGURE 18 KEMIRA OYJ: COMPANY SNAPSHOT

FIGURE 19 ECOLAB INC: COMPANY SNAPSHOT

FIGURE 20 SOLENIS LLC: COMPANY SNAPSHOT

FIGURE 21 FERALCO GROUP: COMPANY SNAPSHOT

FIGURE 22 KURITA WATER INDUSTRIES LTD: COMPANY SNAPSHOT

FIGURE 23 ARIES CHEMICAL INC: COMPANY SNAPSHOT

FIGURE 24 ACCEPTA LTD: COMPANY SNAPSHOT

FIGURE 25 HAWKINS INC: COMPANY SNAPSHOT

FAQ

The flocculant and coagulant market are expected to grow at 6% CAGR from 2022 to 2029. It is expected to reach above USD 9.28 Billion by 2029 from USD 5.49 Billion in 2020.

Asia Pacific held more than 32% of the Flocculant and Coagulant market revenue share in 2021 and will witness expansion in the forecast period.

The flocculant and coagulant industry is being driven by severe rules and standards for water quality and environmental protection. Water treatment plants are embracing modern technologies to meet regulatory criteria as governments around the world focus on maintaining clean and safe water supply. Flocculants and coagulants are important in water treatment operations as they help remove suspended particles, organic materials, and pollutants.

Based on type, the flocculant and coagulant market can be segmented based on type into organic and inorganic flocculants and coagulants. Organic types are derived from natural polymers or synthetic materials, while inorganic types are typically metal salts. The choice of type depends on the specific application and desired performance, such as sedimentation or clarification in water treatment processes.

The market for Flocculant and Coagulant in Asia Pacific is sizable and expanding holds 32% of total market size. The flocculant and coagulant market in the Asia Pacific region has witnessed significant growth in recent years. The market is driven by rapid industrialization, population growth, and increasing environmental concerns. Countries like China, India, and Japan are major contributors to the market’s expansion. Factors such as strict water treatment regulations, urbanization, and the need for efficient wastewater management are propelling the demand for flocculants and coagulants in the region. The Asia Pacific market for flocculants and coagulants is expected to continue its growth trajectory in the coming years.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.