REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

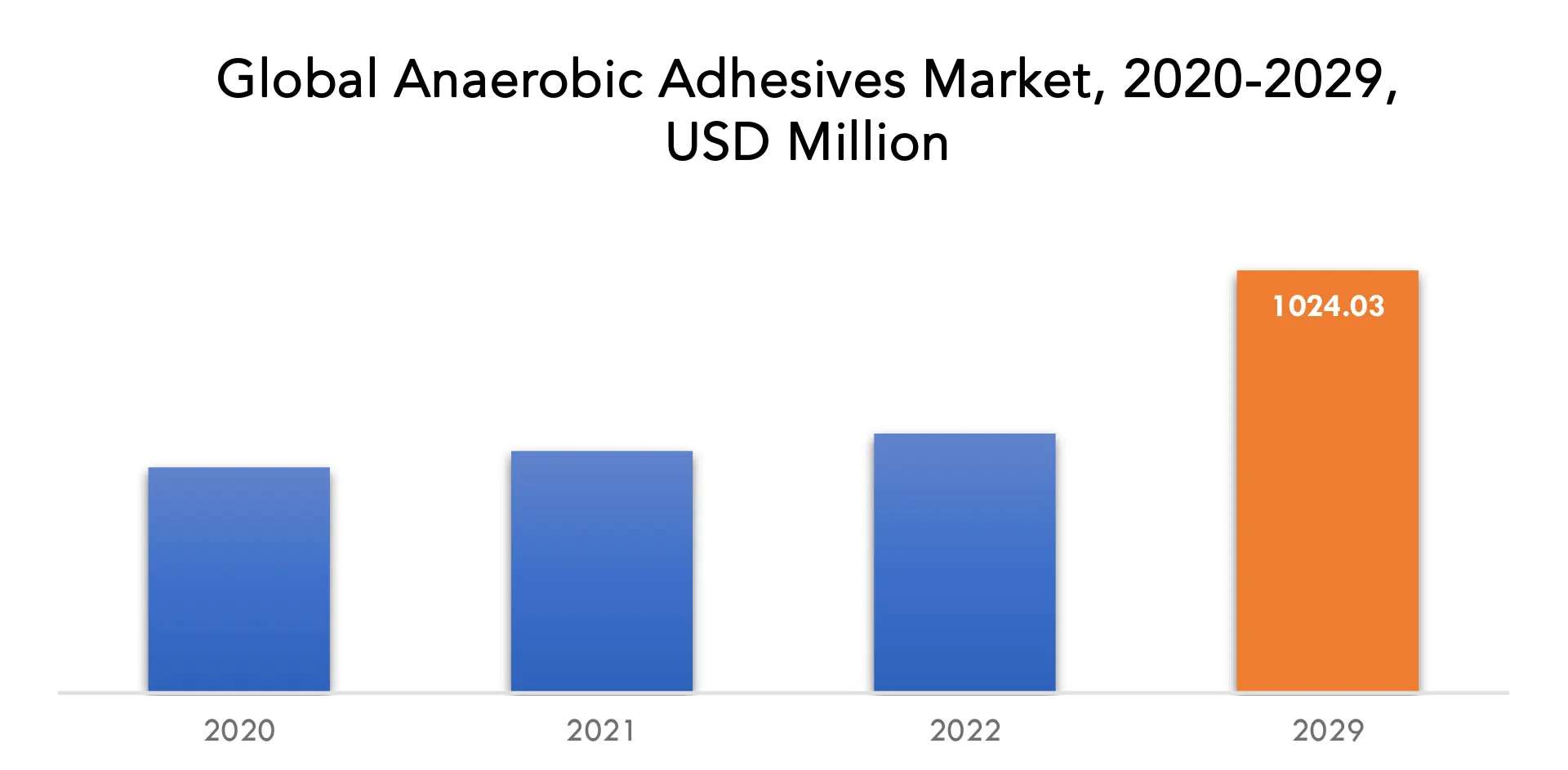

| USD 1024.03 million by 2029 | at 7.22 % CAGR | Asia Pacific |

| By Product | By Substrate | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Anaerobic Adhesives Market Overview

The anaerobic adhesives market is expected to grow at 7.22 % CAGR from 2022 to 2029. It is expected to reach above USD 1024.03 million by 2029 from USD 546.8 million in 2020.

Anaerobic adhesive is a solvent-free glue that cures when there is no air present and when there are metal ions present. When in the presence of metal ions, such as those from iron or steel, this glue remains liquid until it is isolated from oxygen. Three prerequisites—metal contact, adequate temperature, and air isolation are needed for anaerobic adhesive polymerization. One-part liquid or paste forms of anaerobic adhesives are available for purchase. They can withstand a wide range of temperatures and have improved wetting ability. Additionally, they have rapid thermal cycling resistance, shelf stability, and quick cure. When used in applications for preservation, they frequently securely assemble the parts utilizing the press or shrink fit.

Numerous factors are contributing to the expansion of the anaerobic adhesives market globally. Additionally, anaerobic adhesives are employed in the manufacturing of a number of home appliances, such as food processors, dishwashers, dryers, and washing machines. These factors are anticipated to help fuel the growth of the global anaerobic adhesives market. The market won’t be able to expand due to a number of restrictions and challenges. The environment, includes being subjected to extremely high mechanical stress or hot temperatures, etc. This would, it is projected, limit growth during the projection period. Additional potential barriers to the growth of the global business include the lack of room for product differentiation and the sluggish progress of the automobile industry in countries like Russia, Argentina, Brazil, Taiwan, and Japan.

In order to address the increasing demand for anaerobic adhesives worldwide, there has been a rapid expansion in industrialization and urbanization, and this is projected to drive market growth. As anaerobic adhesives provide high shear strength and temperature resistance ideal for the industry, the building and construction sector has also seen an increase in demand. The anaerobic adhesives market is anticipated to be driven by the adhesives’ improved sustainable features. Additionally, there is a significant rise in demand for anaerobic adhesives in end-use sectors including electrical & electronics and automotive & transportation. Research and development (R&D) efforts are carried out by a number of anaerobic adhesive producers with the goal of enhancing renewable adhesives and removing the drawbacks of traditional fastening techniques, which considerably aid in the expansion of the global market.

Although anaerobic adhesives have a variety of uses and benefits, their high cost restrains the market’s expansion. Additionally, they demand specialized primers for inert surfaces, high bond gaps, or passive metals, which adds to the manufacturing cost. Thermoplastics may be harmed occasionally by them. Due to of this, the demand for anaerobic adhesives is constrained, which in turn limits the growth of the global market.

Anaerobic glue use lowers component inventories, lowers manufacturing costs, and improves manufacturing equipment dependability. Anaerobic adhesives are employed in several applications thanks to their characteristics. The market for anaerobic adhesives is expanding due to the rising demand for cars and auto parts worldwide. For a variety of uses, including thread-lockers, oxygen-compatible sealants, retention agents, and form-in-place gaskets, many medical equipment use anaerobic adhesives. It is anticipated that the market will benefit in the future from the global healthcare market’s noteworthy rise.

The global anaerobic adhesives industry is anticipated to slow significantly over the next few years as a result of the COVID-19 pandemic. Many governments throughout the world have enacted lockdown, which has caused factories to close down in a number of towns and provinces, raising concerns about a sudden reduction in production. The recent slowdown in the expansion of building activity is another important issue that is anticipated to have a negative effect on the market for anaerobic adhesives. In addition, while industrial activities are suspended, businesses must deal with lost revenues and damaged supply chains. The anaerobic adhesive market is anticipated to rise as a result of the pandemic’s impact on the healthcare sector.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), (Million Square Meter). |

| Segmentation | By Product, By Substrate, By End User, By Region. |

| By Product

|

|

| By Substrate

|

|

| By End User

|

|

| By Region

|

|

Anaerobic Adhesives Market Segment Analysis

The anaerobic adhesives market is segmented based on product, substrate and end user.

The thread locker, thread sealants, retaining compounds, and gasket sealants segments of the market are based on product. The market segment for thread sealants is anticipated to experience the greatest CAGR over the forecast period. The need for this market is increasing as a result of features including high heat resistance, chemical resistance, great performance on passive metals without activator, and rapid low-pressure seal.

The market is divided into plastic, metal, rubber, and other segments based on the kind of substrate. During the forecast period, the metals section is anticipated to see the largest increase. Strong anaerobic adhesives are based on metal substrates. Anaerobic adhesives benefit from metal substrates’ remarkable tensile strength and tear resistance.

The market is segmented into automotive & transportation, electrical & electronics, industrial, and others based on end-user. During the projected period, the electrical & electronics end-use industry segment is anticipated to experience the greatest CAGR. Critical components including connectors, splice assemblies, and cable closures can be bonded, potted, low-pressure molded, sealed, and encapsulated using anaerobic adhesives.

Anaerobic Adhesives Market Player

The anaerobic adhesives market key players includes 3M Company, Avery Dennison Corporation, Cyberbond L.L.C., DELO-ML, Henkel AG & Co. KGaA, Nitto Denko Corporation, Parson Adhesives India Pvt. Ltd., Permabond LLC, Royal Adhesives & Sealants, L.L.C., Tonsan Adhesive Inc.

18 April 2023: 3M Health Information Systems (HIS) announced a collaboration with Amazon Web Services (AWS) to accelerate the innovation and advancement of 3M M*Modal ambient intelligence. As part of the collaboration, 3M will use AWS Machine Learning (ML) and generative AI services, including Amazon Bedrock, Amazon Comprehend Medical and Amazon Transcribe Medical, to help expedite, refine and scale the delivery of 3M’s ambient clinical documentation and virtual assistant solutions.

02 March 2023: 3M today announced a collaboration with Guardhat, an industry-leading connected safety software company. Given the importance of connectivity as a key ingredient in safety programs, 3M is transferring its Safety Inspection Management (SIM) software to Guardhat. The transition is expected to be completed in mid-2023.

Who Should Buy? Or Key Stakeholders

- Manufacturers of anaerobic adhesives and its raw materials

- automotive & transportation Industry

- electrical & electronics Industry

- industrial Industry

- Traders, distributors, and suppliers of anaerobic adhesives

- Government and regional agencies

- research organizations

- Others

Anaerobic Adhesives Market Regional Analysis

The anaerobic adhesives market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

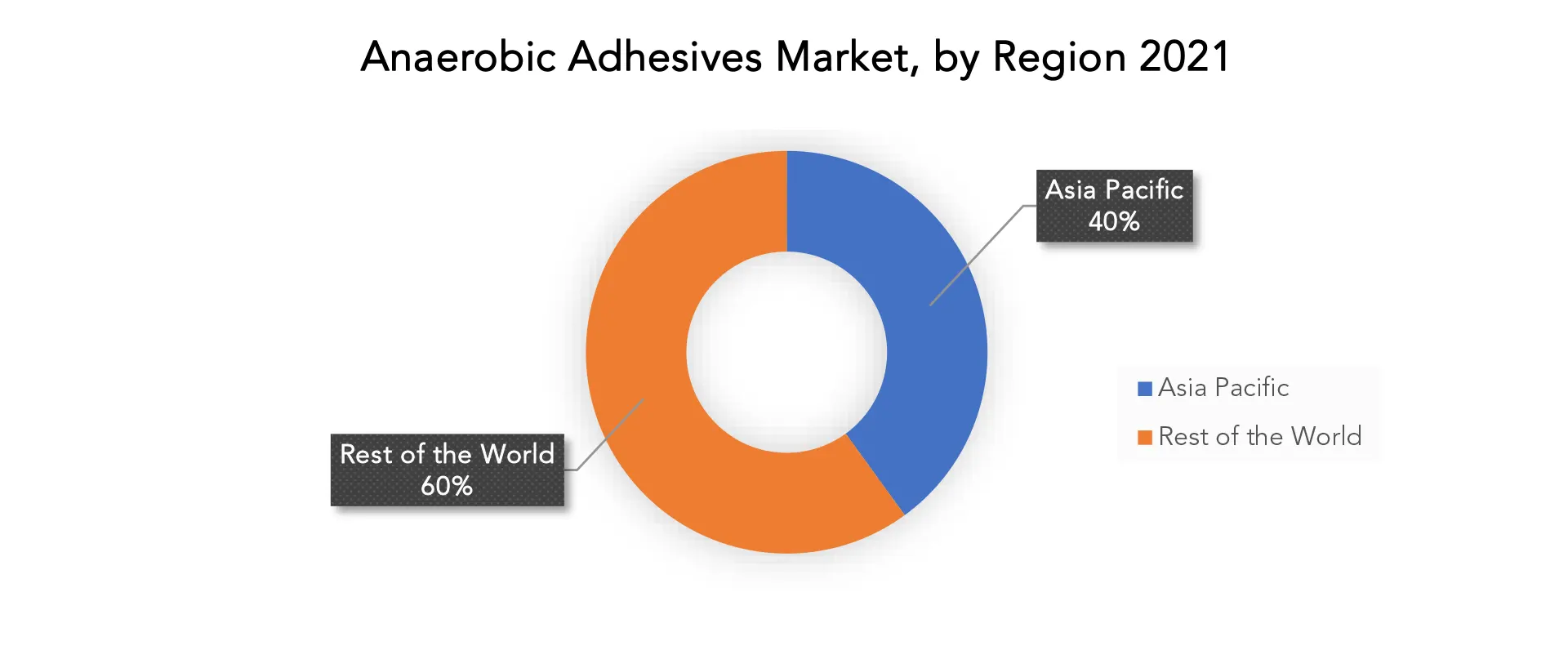

With a market share of 39.99%, the Asia Pacific region led the world market for anaerobic adhesives. During the projected period, the Asia Pacific region is anticipated to lead the market for anaerobic adhesives. The industry has been supported by strong demand from the region’s automotive and transportation sectors, as well as rising demand from the electrical and electronics industries. The largest automaker in the world is China. The number of automobiles produced in the nation in 2021 was 26.08 million, an increase of 3.0% from the 25.23 million vehicles produced in 2020. As consumer desire for battery-powered cars increases, the nation’s automotive industry is observing patterns that are changing.

The American auto industry significantly influences local, national, and international auto markets. The nation is home to significant automobile manufacturers that produce and export vehicles to other economies in the Americas, Europe, and Asia-Pacific. The US automotive and automobile manufacturing market had a total market value of USD 82.6 billion in 2021. Additionally, sales of new light vehicles will increase by 3.4% to 15.4 million units in the United States in 2022. Both the largest aviation market in North America and one of the largest fleet sizes globally are found in the United States.

Key Market Segments: Anaerobic Adhesives Market

Anaerobic Adhesives Market By Product, 2020-2029, (USD Million), (Million Square Meter).

- Thread Locker

- Thread Sealants

- Retaining Compounds

- Gasket Sealants

Anaerobic Adhesives Market By Substrate, 2020-2029, (USD Million), (Million Square Meter).

- Plastic

- Metal

- Rubber

- Others

Anaerobic Adhesives Market By End User, 2020-2029, (USD Million), (Million Square Meter).

- Automotive & Transportation

- Electrical & Electronics

- Industrial

- Others

Anaerobic Adhesives Market By Region, 2020-2029, (USD Million), (Million Square Meter).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

- What is the expected growth rate of the anaerobic adhesives market over the next 7 years?

- Who are the major players in the anaerobic adhesives market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the anaerobic adhesives market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the anaerobic adhesives market?

- What is the current and forecasted size and growth rate of the global anaerobic adhesives market?

- What are the key drivers of growth in the anaerobic adhesives market?

- What are the distribution channels and supply chain dynamics in the anaerobic adhesives market?

- What are the technological advancements and innovations in the anaerobic adhesives market and their impact on substrate development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the anaerobic adhesives market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the anaerobic adhesives market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of anaerobic adhesives in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH SUBSTRATEOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL ANAEROBIC ADHESIVES OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ANAEROBIC ADHESIVES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL ANAEROBIC ADHESIVES OUTLOOK

- GLOBAL ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION) (MILLION SQUARE METER) 2020-2029

- THREAD LOCKER

- THREAD SEALANTS

- RETAINING COMPOUNDS

- GASKET SEALANTS

- GLOBAL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION) (MILLION SQUARE METER) 2020-2029

- PLASTIC

- METAL

- RUBBER

- OTHERS

- GLOBAL ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION) (MILLION SQUARE METER) 2020-2029

- AUTOMOTIVE & TRANSPORTATION

- ELECTRICAL & ELECTRONICS

- INDUSTRIAL

- OTHERS

- GLOBAL ANAEROBIC ADHESIVES MARKET BY REGION (USD MILLION) (MILLION SQUARE METER) 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3M COMPANY

- AVERY DENNISON CORPORATION

- CYBERBOND L.L.C.

- DELO-ML

- HENKEL AG & CO. KGAA

- NITTO DENKO CORPORATION

- PARSON ADHESIVES INDIA PVT. LTD.

- PERMABOND LLC

- ROYAL ADHESIVES & SEALANTS, L.L.C.

- TONSAN ADHESIVE INC.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 2 GLOBAL ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 3 GLOBAL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 4 GLOBAL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 5 GLOBAL ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 6 GLOBAL ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 7 GLOBAL ANAEROBIC ADHESIVES MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL ANAEROBIC ADHESIVES MARKET BY REGION (MILLION SQUARE METER), 2020-2029

TABLE 9 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 11 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 13 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 15 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 16 NORTH AMERICA ANAEROBIC ADHESIVES MARKET BY COUNTRY (MILLION SQUARE METER), 2020-2029

TABLE 17 US ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 18 US ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 19 US ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 20 US ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 21 US ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 22 US ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 23 CANADA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION), 2020-2029

TABLE 24 CANADA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 25 CANADA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 26 CANADA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 27 CANADA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 28 CANADA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 29 MEXICO ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 30 MEXICO ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 31 MEXICO ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 32 MEXICO ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 33 MEXICO ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 34 MEXICO ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 35 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 36 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 37 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 38 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 39 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 40 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 41 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 42 SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY COUNTRY (MILLION SQUARE METER), 2020-2029

TABLE 43 BRAZIL ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 44 BRAZIL ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 45 BRAZIL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 46 BRAZIL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 47 BRAZIL ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 48 BRAZIL ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 49 ARGENTINA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 50 ARGENTINA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 51 ARGENTINA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 52 ARGENTINA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 53 ARGENTINA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 54 ARGENTINA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 55 COLOMBIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 56 COLOMBIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 57 COLOMBIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 58 COLOMBIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 59 COLOMBIA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 60 COLOMBIA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 61 REST OF SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 63 REST OF SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 65 REST OF SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 67 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 68 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 69 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 70 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 71 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 72 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 73 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 74 ASIA-PACIFIC ANAEROBIC ADHESIVES MARKET BY COUNTRY (MILLION SQUARE METER), 2020-2029

TABLE 75 INDIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 76 INDIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 77 INDIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 78 INDIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 79 INDIA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 80 INDIA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 81 CHINA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 82 CHINA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 83 CHINA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 84 CHINA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 85 CHINA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 86 CHINA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 87 JAPAN ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 88 JAPAN ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 89 JAPAN ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 90 JAPAN ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 91 JAPAN ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 92 JAPAN ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 93 SOUTH KOREA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 94 SOUTH KOREA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 95 SOUTH KOREA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 96 SOUTH KOREA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 97 SOUTH KOREA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 98 SOUTH KOREA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 99 AUSTRALIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 100 AUSTRALIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 101 AUSTRALIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 102 AUSTRALIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 103 AUSTRALIA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 104 AUSTRALIA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 105 SOUTH EAST ASIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 107 SOUTH EAST ASIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 109 SOUTH EAST ASIA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 111 REST OF ASIA PACIFIC ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 113 REST OF ASIA PACIFIC ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 115 REST OF ASIA PACIFIC ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 117 EUROPE ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 118 EUROPE ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 119 EUROPE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 120 EUROPE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 121 EUROPE ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 122 EUROPE ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 123 EUROPE ANAEROBIC ADHESIVES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 124 EUROPE ANAEROBIC ADHESIVES MARKET BY COUNTRY (MILLION SQUARE METER), 2020-2029

TABLE 125 GERMANY ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 126 GERMANY ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 127 GERMANY ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 128 GERMANY ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 129 GERMANY ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 130 GERMANY ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 131 UK ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 132 UK ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 133 UK ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 134 UK ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 135 UK ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 136 UK ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 137 FRANCE ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 138 FRANCE ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 139 FRANCE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 140 FRANCE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 141 FRANCE ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 142 FRANCE ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 143 ITALY ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 144 ITALY ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 145 ITALY ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 146 ITALY ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 147 ITALY ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 148 ITALY ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 149 SPAIN ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 150 SPAIN ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 151 SPAIN ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 152 SPAIN ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 153 SPAIN ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 154 SPAIN ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 155 RUSSIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 156 RUSSIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 157 RUSSIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 158 RUSSIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 159 RUSSIA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 160 RUSSIA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 161 REST OF EUROPE ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 162 REST OF EUROPE ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 163 REST OF EUROPE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 164 REST OF EUROPE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 165 REST OF EUROPE ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 166 REST OF EUROPE ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY COUNTRY (MILLION SQUARE METER), 2020-2029

TABLE 175 UAE ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 176 UAE ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 177 UAE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 178 UAE ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 179 UAE ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 180 UAE ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 181 SAUDI ARABIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 182 SAUDI ARABIA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 183 SAUDI ARABIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 184 SAUDI ARABIA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 185 SAUDI ARABIA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 186 SAUDI ARABIA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 187 SOUTH AFRICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 188 SOUTH AFRICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 189 SOUTH AFRICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 190 SOUTH AFRICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 191 SOUTH AFRICA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 192 SOUTH AFRICA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (USD MILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY PRODUCT (MILLION SQUARE METER), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (USD MILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY SUBSTRATE (MILLION SQUARE METER), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA ANAEROBIC ADHESIVES MARKET BY END USER (MILLION SQUARE METER), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ANAEROBIC ADHESIVES MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ANAEROBIC ADHESIVES MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ANAEROBIC ADHESIVES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 GLOBAL ANAEROBIC ADHESIVES MARKET BY PRODUCT, USD MILLION, 2021

FIGURE 13 GLOBAL ANAEROBIC ADHESIVES MARKET BY END USER, USD MILLION, 2021

FIGURE 14 GLOBAL ANAEROBIC ADHESIVES MARKET BY SUBSTRATE, USD MILLION, 2021

FIGURE 15 GLOBAL ANAEROBIC ADHESIVES MARKET BY REGION, USD MILLION, 2021

FIGURE 16 PORTER’S FIVE FORCES MODEL

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 3M COMPANY: COMPANY SNAPSHOT

FIGURE 19 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

FIGURE 20 CYBERBOND L.L.C.: COMPANY SNAPSHOT

FIGURE 21 DELO-ML: COMPANY SNAPSHOT

FIGURE 22 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 23 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

FIGURE 24 PARSON ADHESIVES INDIA PVT. LTD.: COMPANY SNAPSHOT

FIGURE 25 PERMABOND LLC: COMPANY SNAPSHOT

FIGURE 26 ROYAL ADHESIVES & SEALANTS, L.L.C.: COMPANY SNAPSHOT

FIGURE 27 TONSAN ADHESIVE INC.: COMPANY SNAPSHOT

FAQ

The anaerobic adhesives market is expected to grow at 7.22 % CAGR from 2022 to 2029. It is expected to reach above USD 1024.03 million by 2029 from USD 546.8 million in 2020.

Asia Pacific held more than 40% of the anaerobic adhesives market revenue share in 2021 and will witness expansion in the forecast period.

Additionally, anaerobic adhesives are employed in the manufacturing of a number of home appliances, such as food processors, dishwashers, dryers, and washing machines. These factors are anticipated to help fuel the growth of the global anaerobic adhesives market.

During the projected period, the electrical & electronics end-use industry segment is anticipated to experience the greatest CAGR.

Asia Pacific is the largest regional market for anaerobic adhesives market

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.